Airline Industry 10 Ii

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

669419-1 EFFICIENCY of AIRLINES in INDIA ABSTRACT This Paper Measures the Technical Efficiency of Various Airlines Operating In

Natarajan and Jain Efficiency of Airlines in India EFFICIENCY OF AIRLINES IN INDIA Ramachandran Natarajan, College of Business, Tennessee Technological University, Cookeville TN, 38505, U.S.A. E-Mail: [email protected] , Tel: 931-372-3001 and Ravi Kumar Jain, Icfai Business School, IFHE University, Hyderabad-501203 (AP) India. E-Mail: [email protected] , Mobile: 91+94405-71846 ABSTRACT This paper measures the technical efficiency of various airlines operating in India over a ten-year period, 2001-2010. For this, the Input Efficiency Profiling model of DEA along with the standard Data Envelopment Analysis (DEA) is used to gain additional insights. The study period is divided into two sub-periods, 2001-2005 and 2006-2010, to assess if there is any impact on the efficiency of airlines due to the significant entry of private operators. The study includes all airlines, private and publicly owned, both budget and full service, operating in the country offering scheduled services on domestic and international routes. While several studies on efficiency of airlines have been conducted globally, a research gap exists as to similar studies concerning airlines in India. This paper addresses that gap and thus contributes to the literature. Key Words: Airlines in India, DEA analysis, Input efficiency profiling, Productivity analysis, Technical efficiency. Introduction The civil aviation industry in India has come a long way since the Air Corporation Act was repealed in the year 1994 allowing private players to operate in scheduled services category. Several private players showed interest and were granted the status of scheduled carriers in the year 1995. However, many of those private airlines soon shut down. -

Recent Trend in Indian Air Transport with Reference to Transport Economics and Logistic

© 2019 JETIR June 2019, Volume 6, Issue 6 www.jetir.org (ISSN-2349-5162) Recent Trend in Indian Air Transport with Reference to Transport Economics and Logistic Dr Vijay Kumar Mishra, Lecturer (Applied Economics), S.J.N.P.G College, Lucknow Air transport is the most modern means of transport which is unmatched by its speed, time- saving and long- distance operation. Air transport is the fastest mode of transport which has reduced distances and converted the world into one unit. But it is also the costliest mode of transport beyond the reach of many people. It is essential for a vast country like India where distances are large and the terrain and climatic conditions so diverse. Through it one can easily reach to remote and inaccessible areas like mountains, forests, deserts etc. It is very useful during the times of war and natural calamities like floods, earthquakes, famines, epidemics, hostility and collapse of law and order. The beginning of the air transport was made in 1911 with a 10 km air mail service between Allahabad and Naini. The real progress was achieved in 1920 when some aerodromes were constructed and the Tata Sons Ltd. started operating internal air services (1922). In 1927 Civil Aviation Department was set up on the recommendation of Air Transport Council. Flying clubs were opened in Delhi, Karachi, Calcutta (now Kolkata) and Bombay (now Mumbai) in 1928. In 1932 Tata Airways Limited introduced air services between Karachi and Lahore. In 1932, Air India began its journey under the aegis of Tata Airlines, a division of Tata Sons Ltd. -

A 21St Century Powerhouse Dick Forsberg Head of Strategy, Avolon

An in-depth analysis of the Indian air travel market Dick Forsberg | July 2018India A 21st Century Powerhouse Dick Forsberg Head of Strategy, Avolon ACKNOWLEDGEMENTS The author would like to acknowledge FlightGlobal Ascend as the source of the fleet data and OAG, through their Traffic Analyser and Schedules Analyser products, as the source of the airline traffic and capacity data used in this paper. DISCLAIMER This document and any other materials contained in or accompanying this document (collectively, the ‘Materials’) are provided for general information purposes only. The Materials are provided without any guarantee, condition, representation or warranty (express or implied) as to their adequacy, correctness or completeness. Any opinions, estimates, commentary or conclusions contained in the Materials represent the judgement of Avolon as at the date of the Materials and are subject to change without notice. The Materials are not intended to amount to advice on which any reliance should be placed and Avolon disclaims all liability and responsibility arising from any reliance placed on the Materials. Dick Forsberg has over 45 years’ aviation industry experience, working in a variety of roles with airlines, operating lessors, arrangers and capital providers in the disciplines of business strategy, industry analysis and forecasting, asset valuation, portfolio risk management and airline credit assessment. As a founding executive and Head of Strategy at Avolon, his responsibilities include defining the trading cycle of the business, primary interface with the aircraft appraisal and valuation community, industry analysis and forecasting, driving thought leadership initiatives, setting portfolio risk management criteria and determining capital allocation targets. Prior to Avolon, Dick was a founding executive at RBS (now SMBC) Aviation Capital and previously worked with IAMG, GECAS and GPA following a 20-year career in the UK airline industry. -

Competition Issues in the Air Transport Sector in India

2009 StudyStudy on on ImpactCompetition of Trade Issues in Liberalisationthe Domestic in the Information Technology SectorSegment on Development of the Air Draft ReportTransport Sector in Administrative Staff College of India HyderabadIndia Revised Final Report 2007 Administrative Staff College of India, Hyderabad Competition Issues in the Air Transport Sector in India Table of Contents Sl.No Chapter Page No. 1. Introduction 1 2. ToR I 4 3. ToR II & III 15 4. ToR IV 29 5. ToR V 30 6. ToR VI & VII 43 7. ToR VIII 91 8. ToR IX 99 9. ToR X 120 10. ToR XI 121 11. Conclusions and Recommendations 126 12. References 129 ____________________________________________________asci research and consultancy ii Competition Issues in the Air Transport Sector in India List of Tables Table Title Page No. No. I.1 Calculation of HHI 12 I.2 Fleet Size of All Scheduled Airlines 12 I.3 Order for Airplanes 13 I.4 Net Profit/Loss incurred by Different Airlines 16 II.1 City Pair-wise Herfindahl index of Pax. Carried in 2006-07 28 17 II.2 Passenger Load Factor for Indian 22 II.3 Passenger Load Factor for Indian 25 II.4 Slots on Delhi-Mumbai Route 28 II.5 Average Age of Fleet 28 II.6 Fleet Size of All Scheduled Airlines 29 IV.1 Descriptive Statistics for Price Data: Delhi – Mumbai 30 IV.2 Taxes and Surcharges on Route : Delhi – Mumbai 32 IV.3 Taxes and Surcharges on Route : Mumbai – Delhi 32 IV.4 Pre merger (2006/07)-Delhi-Mumbai (passenger wise) 36 IV.5 Post Merger(2008) -Delhi Mumbai (slot wise) 36 IV.6 Pre merger (2006/07)-Delhi-Chennai (passenger wise) 37 IV.7 Post Merger(2008) -Delhi Chennai(slot wise) 37 IV.8 Pre merger (2006/07)-Bangalore-Chennai (passenger wise) 37 IV.9 Post Merger(2008) -Bangalore- Chennai(slot wise) 38 ____________________________________________________asci research and consultancy iii Competition Issues in the Air Transport Sector in India List of Figures Figure Title Page No. -

Management Discussion & Analysis Report

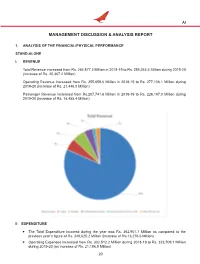

AI MANAGEMENT DISCUSSION & ANALYSIS REPORT 1. ANALYSIS OF THE FINANCIAL/PHYSICAL PERFORMANCE STAND-ALONE I. REVENUE Total Revenue increased from Rs. 264,877.2 Million in 2018-19 to Rs. 285,244.4 Million during 2019-20 (increase of Rs. 20,367.2 Million) Operating Revenue increased from Rs. 255,659.6 Million in 2018-19 to Rs. 277,106.1 Million during 2019-20 (increase of Rs. 21,446.5 Million) Passenger Revenue increased from Rs.207,741.6 Million in 2018-19 to Rs. 226,197.0 Million during 2019-20 (increase of Rs. 18,455.4 Million) II EXPENDITURE The Total Expenditure incurred during the year was Rs. 362,901.7 Million as compared to the previous year’s figure of Rs. 349,625.2 Million (increase of Rs.13,276.5 Million) Operating Expenses increased from Rs. 302,512.2 Million during 2018-19 to Rs. 323,709.1 Million during 2019-20 (an increase of Rs. 21,196.9 Million) 20 AI There was an increase in staff cost by 7% from Rs.30,052.3 Million in 2018-19 to Rs. 32,253.7 Million during 2019-20. Fuel cost decreased by 6% from Rs.100,344.6 Million in 2018-19 to Rs. 93,992.7 Million during 2019-20. Net impact of Rs 20,130.5 Million, due to applicability of “IND AS 116 – LEASES”. CONSOLIDATED I. REVENUE Total Revenue increased from Rs.298,111.5 Million in 2018-19 to Rs.328,306.2 Million during 2019-20, an increase of 10.1%. -

Kingfisher Airlines, Spice Jet, Air Deccan and Many More

SUMMER TRAINING REPORT ON Aviation Sector in India “Submitted in the Partial Fulfillment for the Requirement of Post Graduate Diploma in Management” (PGDM) Submitted to: Submitted by: Mr. Sandeep Ranjan Pattnaik Biswanath Panigrahi Marketing and Sales Manager Roll No: 121 At Air Uddan Pvt.ltd (2011-2013) Jagannath International Management School Kalkaji, New Delhi. 1 | P a g e Acknowledgment I have made this project report on “Aviation Sector in India” under the supervision and guidance of Miss Palak Gupta (Internal Mentor) and Mr.Sandeep Ranjan Pattnaik (External Mentor). The special thanks go to my helpful mentors, Miss Palak Gupta and Mr.Sandeep Ranjan Pattnaik. The supervision and support that they gave truly helped the progression and smoothness of the project I have made. The co-operation is much indeed appreciated and enjoyable. Besides, this project report making duration made me realize the value of team work. Name: Biswanath Panigrahi STUDENT’S UNDERTAKING 2 | P a g e I hereby undertake that this is my original work and have never been submitted elsewhere. Project Guide: (By:Biswanath Panigrahi) Mr. Sandeep Ranjan Pattnaik Marketing and Sales Manager Air Uddan Pvt.ltd (EXTERNAL GUIDE) Ms. Palak Gupta (Astt. Professor JIMS) S.NO. CHAPTERS PAGE NO. 01. CHAPTER 1 5 3 | P a g e EXECUTIVE SUMMARY 02. CHAPTER 2 8 COMPANY PROFILE 03. CHAPTER 3 33 Brief history of Indian Aviation sector 04. CHAPTER 4 40 OBJECTIVE OF THE PROJECT 05. CHAPTER 5 43 RESEARCH METHODOLOGY 06. CHAPTER 6 46 ANALYSIS AND INTERPRETATION 07. CHAPTER 7 57 FINDINGS AND INTERFERENCES 08. CHAPTER 8 60 RECOMMENDATION 09. -

IMPACT of CIVIL AVIATION STRATEGIES on TOURISM in INDIA Shivam Shukla1, Dr

IMPACT OF CIVIL AVIATION STRATEGIES ON TOURISM IN INDIA Shivam Shukla1, Dr. Mini Amit Arrawatia2 1Research Scholar, 2Research Supervisor, Department of Management and Humanities, Jayoti Vidyapeeth Women’s University, Jaipur, (India) I. INTRODUCTION This study provides to aviation industry stakeholders and tourism authorities with the necessary information regarding priority areas for the development of civil aviation in India and identifies appropriate actions that need to be taken going forward. The study has been initiated by the Department of Tourism Government of India II. OBJECTIVES The objective of the study is to aid industry stakeholders in resolving issues presently facing the aviation or tourism transport industry and guide in improving policies investment and business decision making within and related to these sectors. This document deals specifically with issues regarding air seat capacity and strategies for air services negotiations. The overall aim of this report is to present a case to secure adequate seat additional capacity with a focus on India‘s key source and destination markets. The Consulting Team defines adequate seat capacity to be the extent to which supply matches current and anticipated demand and need in the most cost-effective way. This report also presents and evaluates via an econometric model the direct, indirect and induced impacts of India‘s international aviation arrangements on the market for air travel to and from India. Specifically the consulting team has modelled the competitive effects of incremental seat capacity on prices employment and net tourism. Finally it examines the issues surrounding the proposed liberalisation of India‘s policy for civil aviation and provides a suggested policy option plan for the continued development of the Indian civil aviation industry and including the pace and extent to which the policy should be liberalized and the potential effect of that liberalisation on the Indian economy, airline and tourism sectors. -

Aviation Industry in India

Aviation BUSINESS ANAYISIS AND PRESENTAION TOPIC: - AVIATION INDUSTRY IN INDIA SUBMITED TO: - Prof. S K Biswal Date of Presentation:-15thMarch, 2014 SUBMITTED BY:-Group no – 20 Amit Kumar Singh - 1306260035 Pooja Singh - 1306260020 Rourkela Institute of Management Studies, Rourkela 0 Aviation MBA 1st year (2nd SEM) Rourkela Institute of Management Studies, Rourkela 1 Aviation ACKNOWLEDGEMENT I have made lot of efforts to make this project. However, it would not have been possible without the kind support and help of many individuals who helped me in completing this project report i would like to extend my sincere thanks to all of them. I would like to thank our faculty Prof: S.K BISWAL for his guidance and help to complete my project. I would also like to thank my friends and family for their co-operation and encouragement which help me in completing this project. Rourkela Institute of Management Studies, Rourkela 2 Aviation Executive Summary India is one of the fastest growing aviation markets in the world. With the liberalization of the Indian aviation sector, the industry had witnessed a transformation with the entry of the privately owned full service airlines and low cost carriers. The sector has seen a significant increase in number of domestic air travel passengers. Some of the factors that have resulted in higher demand for air transport in India include the growing middle class and its purchasing power, low airfares offered by low cost carriers, the growth of the tourism industry in India, increasing outbound travel from India, and the overall economic growth of india. Rourkela Institute of Management Studies, Rourkela 3 Aviation CONTENTS Chapters Page no. -

Handbook on Civil Aviation Statistics

HHAANNDDBBOOOOKK OONN CCIIVVIILL 2017-18 AAVVIIAATTIIOONN SSTTAATTIISSTTIICCSS a glimpse of aviation statistics….. DIRECTORATE GENERAL OF CIVIL AVIATION OVERVIEW Directorate General of Civil Aviation is the regulatory body governing the safety aspects of civil aviation in India. It is responsible for regulation of air transport services to/from/within India and for enforcement of civil air regulations, air safety and airworthiness standards. It also interfaces with all the regulatory functions of International Civil Aviation Organization. DGCA’s Vision Statement: “Endeavour to promote safe and efficient Air Transportation through regulation and proactive safety oversight system.” REGIONAL AND SUB-REGIONAL OFFICES OF DGCA. DGCA Head Quarters Western Region Northern Region Eastern Region Sothern Region Bengaluru Mumbai Delhi Kolkata Chennai RO RO RO RO RO Bhopal Lucknow Patna Hyderabad Kochi SRO SRO SRO SRO SRO Kanpur Bhubaneswar SRO SRO Patiala Guwahati SRO SRO RO: Regional office SRO: Sub-Regional office S DGCA has several directorates and divisions under its purview to carry out its functions. DIRECTORATE GENERAL OF CIVIL AVIATION AIR TRANSPORT LEGAL AFFAIRS STATE SAFETY PERSONNEL LICENSING PROGRAMME FLIGHT TRAINING AND INTERNATIONAL SPORTS COOPERATION INVESTIGATION AND AIRCRAFT CERTIFICATION PREVENTION CONTINUING SURVEILLANCE AND AIRWORTHINESS ENFORCEMENT INFORMATION AIRCRAFT OPERATIONS TECHNOLOGY AERODROMES AND ADMINISTRATION GROUND AIDS AIR NAVIGATION TRAINING SERVICES Sl. No. CONTENTS PAGE No. 1. PASSENGER TRAFFIC STATISTICS 1-5 2. CARGO TRAFFIC STATISTICS 6-7 3. AIRCRAFT STATISTICS 8-10 4. NSOP STATISTICS 11-12 5. OPERATING ECONOMICS STATISTICS 13-15 6. HUMAN RESOURCE STATISTICS 16-19 7. AIR SAFETY STATISTICS 20 8. OTHER AVIATION RELATED STATISTICS 21-24 PASSENGER TRAFFIC Air Passenger Traffic in India, both domestic and international witnessed a positive growth in the year 2017-18 compared to the previous year. -

The Impacts of Globalisation on International Air Transport Activity

Global Forum on Transport and Environment in a Globalising World 10-12 November 2008, Guadalajara, Mexico The Impacts of Globalisation on International Air Transport A ctivity Past trends and future perspectives Ken Button, School of George Mason University, USA NOTE FROM THE SECRETARIAT This paper was prepared by Prof. Ken Button of School of George Mason University, USA, as a contribution to the OECD/ITF Global Forum on Transport and Environment in a Globalising World that will be held 10-12 November 2008 in Guadalajara, Mexico. The paper discusses the impacts of increased globalisation on international air traffic activity – past trends and future perspectives. 2 TABLE OF CONTENTS NOTE FROM THE SECRETARIAT ............................................................................................................. 2 THE IMPACT OF GLOBALIZATION ON INTERNATIONAL AIR TRANSPORT ACTIVITY - PAST TRENDS AND FUTURE PERSPECTIVE .................................................................................................... 5 1. Introduction .......................................................................................................................................... 5 2. Globalization and internationalization .................................................................................................. 5 3. The Basic Features of International Air Transportation ....................................................................... 6 3.1 Historical perspective ................................................................................................................. -

SP's Aviation

SP’s AN SP GUIDE PUBLICATION ED BUYER ONLY) ED BUYER AS -B A NDI I 100.00 ( ` Aviation Sharp Content for Sharp Audience www.sps-aviation.com vol 19 ISSUE 12 • DEcEmbEr • 2016 MILITARY CIVIL • CarTER REAFFIRMS ROAD FORUM FOR REDRESSAL: MAP FOR THE NEXT US AIRSEWA LAUNCH DEFENSE SECRETARY • BOEING ENTERS TaNKER RACE WITH FMS OFFER reGiOnAl AviAtiOn: • exclusive interview JOHN SLATTERY, LAST WORD: EMBRAER COMMERCIAL INDIAN NAVY REJECTS TEJAS (LCA) • TIANJIN AIRLINES-EMBRAER, PERFECT FIT FOR CHINA’S REGIONAL EXPANSION MEBAA 2016 • REPORT: • WORRISOME SCENARIO AERO EXPO INDIA 2016 • exclusive interview: WIELAND TIMM, Business AviAtiOn: LUFTHANSA TECHNIK • BAOA REPORT RELEASE • exclusive interview: JAYANT NADKARNI, EXCLUSIVE PRESIDENT, BAOA • MIDDLE EAST IN IRELAND & INDIA THE MIDDLE PAT BREEN, IRELAND MINISTER OF STATE FOR EMPLOYMENT AND SMALL OF A CRISIS BUSINESS +++ GOVERNMENT SUPPORT TO ENTREPRENEURSHIP IS RNI NUMBER: DELENG/2008/24199 EXTREMELY IMPORTANT PAGE 8 SIMPLY THE LARGEST MEDIA FOR (IN ASIA) AERO INDIA 2017 WE AT SP’S, SP GUIDE PUBLICATIONS FOUNDED IN 1964 HENCE A BACKGROUND OF OVER 52 YEARS, BRING THE COLLECTION OF THE LARGEST NUMBER OF PUBLICATIONS (NINE IN TOTAL) AT UPCOMING AERO INDIA 2017 PUBLISHED DAILY ON DAY 1, DAY 2, DAY 3 EMAIL US AT: ADVERTISING@ SPGUIDEPUBLICATIONS.COM SHOW SPECIAL CALL US: SHOW SPECIAL +91 11 24644763 +91 11 24644693 +91 11 24620130 SHOW SPECIAL +91 11 24658322 SHOW SPECIAL CONTACT US: ROHIT GOEL +91 99999 19071 SHOW SPECIAL NEETU DHULIA +91 98107 00864 RAJEEV CHUGH +91 93128 36347 SHOW SPECIAL SIMPLY -

Leakproof Form-Work Gives Long Lasting Concrete

REGIONAL DEVELOPMENTS THROUGH AVIATION IN INDIA—CREATION OF NEW REGIONAL AIRPORTS AND REGIONAL AIRLINES —CreationRegionalCurrent Developments in Air and SpaceDevelopments Lawof new Regional through airports aviation and Regionalin India airlines Debabrat Mishra* Introduction One of the fastest growing aviation industries in the world is Indian Aviation Industry. With the liberalization of the Indian aviation sector, a rapid revolution has undergone in Indian aviation industry. Primarily it was a government-owned industry, but now it is dominated by privately owned full service airlines and low cost carriers. Around 75% share of the domestic aviation market is shared by private airlines. Earlier only few people could afford air travel, but now it can be afforded by a large number of people as it has become much cheaper because of stiff competition. The civil aviation traffic has seen an unprecedented traffic in the past few years on account of booming Indian economy, growing tourism industry, and entry of low cost carriers in the private sector, liberalization of international bi-lateral agreements and liberalization of civil aviation policy. In future also the civil aviation traffic is expected to grow at the same pace despite current slowdown due to global recession. But airport infrastructure has not kept pace with the growth of the civil aviation traffic. This has resulted in congestion and inefficient services in major airports, limited landing slots, inadequate parking bays and congestion during peak hours for airlines. Development of quality infrastructure will have an impact on international competitiveness and economic growth. This requires faster development of civil aviation infrastructure on public private partnership mode.