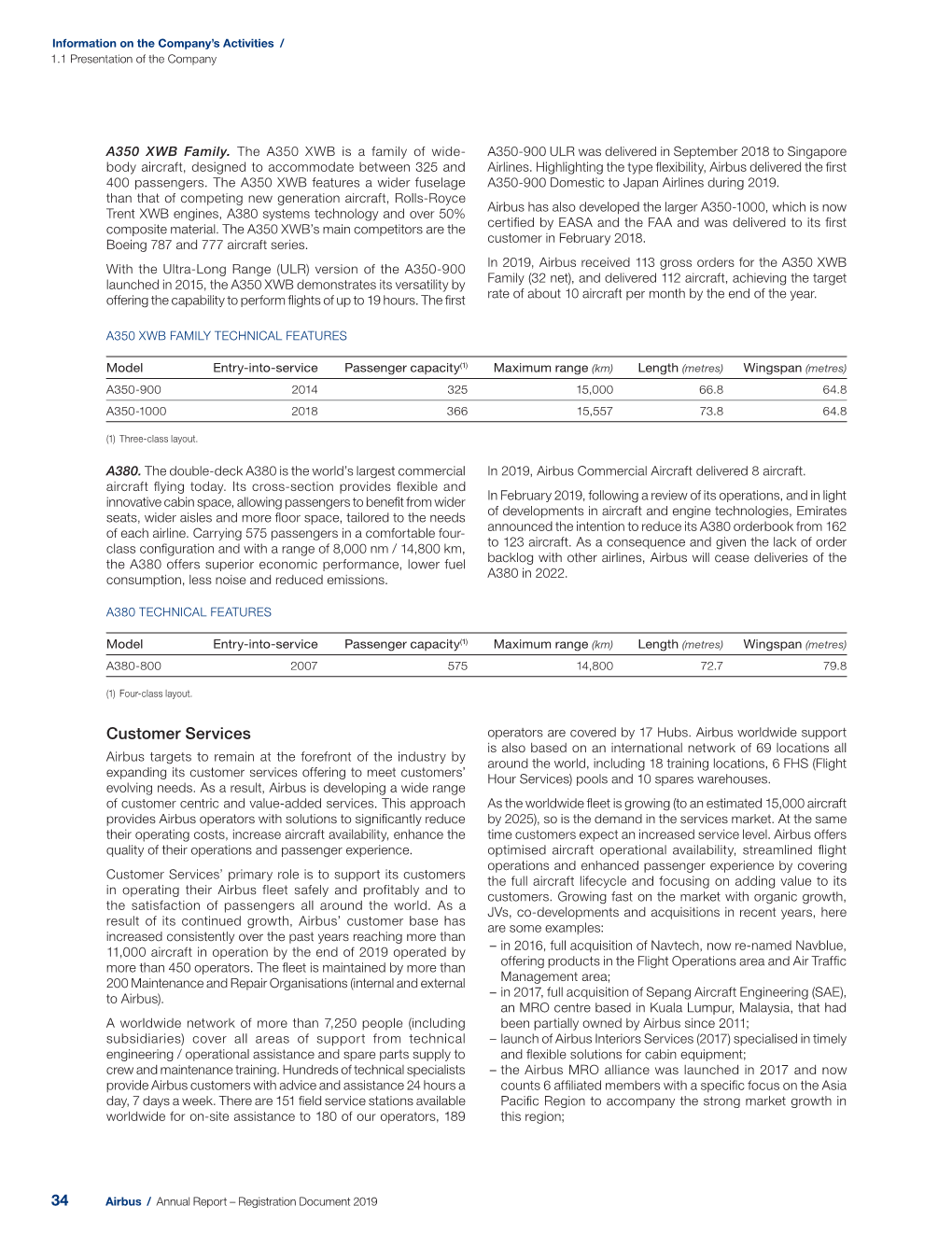

A350 Xwb Family Technical Features

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2016, Registration Document 2016 and Financial

Annual Report 2015 Registration Document 2015 Financial Statements 2015 Q Financial Statements 2015 122334455 1 Information on Airbus Activities 1.1 Presentation of the Company Relationship between Airbus Group SE and Airbus In line with the previous organisational structure, Airbus management service agreements have been put in place with Group SE itself does not engage in the core aerospace, defence the subsidiaries and services are invoiced on a cost plus basis. or space business of Airbus but coordinates related businesses, For management purposes, Airbus Group SE acts through its sets and controls objectives and approves major decisions for Board of Directors, Group Executive Committee, and Chief Airbus. As the parent company, Airbus Group SE conducts Executive Offi cer in accordance with its corporate rules and activities which are essential to Airbus’ activities and which procedures as described below under “Corporate Governance”. are an integral part of the overall management of Airbus. In particular, fi nance activities pursued by Airbus Group SE are Within the framework defi ned by Airbus Group SE, each Division, in support of the business activities and strategy of Airbus. In Business Unit and subsidiary is vested with full entrepreneurial connection therewith, Airbus Group SE provides or procures responsibility. the provision of services to the subsidiaries of Airbus. General 1.1.2 Commercial Aircraft Airbus Commercial Aircraft is one of the world’s leading aircraft over the long-term and expanding its customer services offering. manufacturers of passenger airliners. Airbus Commercial To achieve these goals, Airbus Commercial Aircraft is actively: Aircraft helps to shape the future of air transportation and drive steady growth around the world. -

Eurofighter World Editorial 2016 • Eurofighter World 3

PROGRAMME NEWS & FEATURES DECEMBER 2016 GROSSETO EXCLUSIVE BALTIC AIR POLICING A CHANGING AIR FORCE FIT FOR THE FUTURE 2 2016 • EUROFIGHTER WORLD EDITORIAL 2016 • EUROFIGHTER WORLD 3 CONTENTS EUROFIGHTER WORLD PROGRAMME NEWS & FEATURES DECEMBER 2016 05 Editorial 24 Baltic policing role 42 Dardo 03 Welcome from Volker Paltzo, Germany took over NATO’s Journalist David Cenciotti was lucky enough to CEO of Eurofighter Jagdflugzeug GmbH. Baltic Air Policing (BAP) mis - get a back seat ride during an Italian Air Force sion in September with five training mission. Read his eye-opening first hand Eurofighters from the Tactical account of what life onboard the Eurofighter Title: Eurofighter Typoon with 06 At the heart of the mix Air Wing 74 in Neuburg, Typhoon is really like. P3E weapons fit. With the UK RAF evolving to meet new demands we speak to Bavaria deployed to Estonia. Typhoon Force Commander Air Commodore Ian Duguid about the Picture: Jamie Hunter changing shape of the Air Force and what it means for Typhoon. 26 Meet Sina Hinteregger By day Austrian Sina Hinteregger is an aircraft mechanic working on Typhoon, outside work she is one of the country’s best Eurofighter World is published by triathletes. We spoke to her Eurofighter Jagdflugzeug GmbH about her twin passions. 46 Power base PR & Communications Am Söldnermoos 17, 85399 Hallbergmoos Find out how Eurofighter Typhoon wowed the Tel: +49 (0) 811-80 1587 crowds at AIRPOWER16, Austria’s biggest Air [email protected] 12 Master of QRA Show. Editorial Team Discover why Eurofighter Typhoon’s outstanding performance and 28 Flying visit: GROSSETO Theodor Benien ability make it the perfect aircraft for Quick Reaction Alert. -

We Make It Fly Airbus in the Pacific 03

AIRBUS IN THE PACIFIC WE MAKE IT FLY AIRBUS IN THE PACIFIC 03 AIRBUS GROUP ROPPONGI HILLS MORI TOWER WE MAKE IT FLY A Global Pioneer Airbus is a global leader in aeronautics, space and related services. In 2016, it generated revenues of €67 billion and employed a workforce of around 134,000. The company offers the most comprehensive range of passenger airliners from 100 to more than 600 seats. We are also a leader in tanker, combat, transport and mission aircraft, as well as Europe’s number one space enterprise and the world’s second largest space business. In helicopters, Airbus provides the most efficient civil and military rotorcraft solutions worldwide. Setting the Standard for the Aviation Industry We are the leading global manufacturer of the most innovative commercial aircraft. Our comprehensive product line comprises highly successful families of aircraft from the best-selling single aisle A320 Family to the double-deck A380. Europe’s No. 1 Defence and Space Company In Defence and Space, Airbus develops and manufactures world-class products such as the strategic airlifter A400M and the A330 Multi-Role Tanker Transport (MRTT) aircraft, versatile light aircraft like the C295 that can be deployed on various missions including transport, maritime patrol and surveillance, the world’s most advanced swing-role fighter the Eurofighter Typhoon, and satellites for missions ranging from telecommunications to earth observation and science. The World’s Leading Helicopter Manufacturer The company is the world’s No. 1 helicopter manufacturer, with a 47% share of the global civil and para-public fleet. Its civil helicopter range extends from the H120 light helicopter to the H225 Super Puma, and its military range from the H125M Fennec to the Tiger. -

The Economic Case for Investing in Europe’S Defence Industry

Error! No text of specified style in document. The Economic Case for Investing in Europe’s Defence Industry September 2013 - 1 - Europe Economics is registered in England No. 3477100. Registered offices at Chancery House, 53-64 Chancery Lane, London WC2A 1QU. Whilst every effort has been made to ensure the accuracy of the information/material contained in this report, Europe Economics assumes no responsibility for and gives no guarantees, undertakings or warranties concerning the accuracy, completeness or up to date nature of the information/analysis provided in the report and does not accept any liability whatsoever arising from any errors or omissions © Europe Economics. Contents 1 Executive Summary .............................................................................................................................................. 1 1.1 Broad macroeconomic impacts of defence investment ...................................................................... 1 1.2 Unpacking the mechanisms by which defence spending affects the broader economy .............. 5 2 Introduction ........................................................................................................................................................... 8 3 Macroeconomic Impacts................................................................................................................................... 10 3.1 GDP.............................................................................................................................................................. -

Planned Acquisition of the F-35 Lightning II

Chapter 4 Acquisition timeline and potential alternatives Introduction 4.1 This chapter considers the F-35A acquisition schedule, the risk of the creation of a capability gap should there be further delays to the acquisition timeline, and potential alternatives to the F-35A. Acquisition schedule 4.2 Defence advised the committee that the 'F-35 Program schedule is structured to address the resources required to deliver a highly technical and complex program' and that, as a result, the System Development and Demonstration phase is 'characterised by a concurrent design and production model'. Defence explained that 'this level of concurrency has introduced some risk' to the Program, demonstrated by the Program re-baselining and issues that have become evident during test and evaluation. 1 Defence noted that software development is 'effectively complete' and is now the 'main focus of the ongoing test and evaluation program'. Defence advised that, as at January 2016, the final software build had completed 50 per cent of baseline test points, but that 'significant test points are yet to be undertaken and issues found will need to be rectified'.2 4.3 Defence advised that the F-35 Program schedule has 'stabilised' since the re- baselining in 2012, with 'any movements being managed through schedule margins built into the Program'. However, 'completion of the test and evaluation program and ensuring the required warfighting capability at the completion of the System Development and Demonstration phase carries schedule risk that will need to be carefully -

R&T Activities on Composite Structures

PUBLIC RELEASE R&T activities on composite structures for existing and future military A/C platforms at Airbus DS, Military Aircraft Mircea Calomfirescu, Rainer Neumaier, Thomas Körwien, Kay Dittrich Airbus Defence and Space GmbH Rechliner Str. 1 85077 Manching GERMANY [email protected] ABSTRACT This paper gives a short overview on the state of the art in composite aerostructures for civil and military aircraft. Major challenges are highlighted in this context and the requirements from military aircraft point of view are illustrated, derived from existing and future military aircraft perspectives. The main objective of the paper is to present the R&T activities in the aerostructure research program called FFS, advanced aerostructures. The activities range here from structural bonding, advanced radomes, new thermoplastic composite technologies and new materials and structures for low observability purposes. A brief insight is given to each of the topic highlighting the challenges and approaches, finishing with a summary of future trends and emerging technologies. 1.0 INTRODUCTION Composites offer several advantages over metallic aerostructures in civil as well as in military aircraft industry including reduced weight, less maintenance effort and costs due to “corrosion-free” composites and a superior fatigue behaviour compared to aluminium. The thermal expansion is much less and the material waste (“buy to fly ratio”) is more advantageous compared to aluminium structures. However, these advantages come along with higher material and manufacturing costs. For the prepreg technology for example the material has to be stored at -18°C, energy and investment intensive autoclaves are necessary and for quality assurance 100% non-destructive testing (NDT) is required in contrast to aluminium structures. -

Weapon System of Choice 38 New Eurofighter Typhoon Aircraft for the Luftwaffe 2021 · EUROFIGHTER WORLD 2021 · EUROFIGHTER WORLD 3

PROGRAMME NEWS & FEATURES JANUARY 2021 Chain Reaction Pilot Brief: Interoperability Eurofighter and FCAS Weapon System of Choice 38 new Eurofighter Typhoon aircraft for the Luftwaffe 2021 · EUROFIGHTER WORLD 2021 · EUROFIGHTER WORLD 3 Contents Programme News & Features January 2021 Welcome 4 Weapon System of Choice Airbus’ Head of Combat Aircraft Systems Kurt Rossner discusses the full implications of Germany’s decision to replace its existing Tranche 1 aircraft under the Quadriga programme. Cover: © Picture: images.art.design. GmbH, 12 Chain Reaction Lucas Westphal We speak to four businesses across Europe about the importance of the Eurofighter Typhoon programme for the Looking back, 2020 was a year few of us will ever The Eurofighter programme supports over 400 business- defence industry and the enriched technology capabilities forget. Because of the impact of the Covid-19 es across Europe, sustaining more than 100,000 jobs. it has helped bring about. pandemic we all faced huge professional and personal That’s why in this edition we shine the spotlight on some Eurofighter World is published by challenges. What stood out for me was the way every- of those supply chain businesses. Eurofighter Jagdflugzeug GmbH 18 Mission Future: Eurofighter and FCAS one involved in the Eurofighter project worked closer PR & Communications In the first of series of exclusive articles our experts exam- together than ever before to deliver. Elsewhere in the magazine we examine Eurofighter’s Am Söldnermoos 17, 85399 Hallbergmoos [email protected] ine Eurofighter’s place alongside a next generation fighter place alongside a next gen- in the future operating environment. Germany’s decision to replace eration fighter in the future Editorial Team Tony Garner its existing Tranche 1 aircraft battlespace. -

ATR-42/72 Rev 6

U.S. Department of Transportation Federal Aviation Administration Washington, DC Flight Standardization Board (FSB) Report Revision: 6 Date: 10/14/2016 Manufacturer ATR – GIE Avions de Transport Régional Type Certification Data Sheet (TCDS) A53EU TCDS Identifiers ATR-42 ATR-72 ATR-42-200-300-320-500-600 ATR-72-101-102-201-202-211-212A-212 Pilot Type Rating ATR42 ATR72 Timothy C. Hayward, Chair Flight Standardization Board Federal Aviation Administration Flight Standards Division Seattle Aircraft Evaluation Group 1601 Lind Avenue SW Renton, WA 98057-3356 Telephone: (425) 917-6600 Fax: (425) 917-6638 Revision 6 10/14/2016 ATR-42/ATR-72 FSB Report RECORD OF REVISIONS REVISION SECTION PAGES DATE 1 9.2.4 17–27 01/10/1994 2 ALL ALL 02/01/1996 3 VARIOUS VARIOUS 07/01/1997 4 VARIOUS VARIOUS 7/15/2002 5 ALL ALL 12/05/2014 6 ALL ALL 10/14/2016 HIGHLIGHTS OF CHANGE All Sections All Pages: This revision contains minor editorial changes on every page for clarity, consistency, standardization, updated terminology, acronyms, and United States Workforce Rehabilitation Act Section 508 compliancy. Added Clarity for Training for Seat-Dependent Tasks (6.1.7 and 6.1.7). Added Clarity for Second-in-Command (SIC) Training Tasks (6.1.8). Added Clarity for Unique Training Provisions (6.2.6.1). Page 2 of 26 Revision 6 10/14/2016 ATR-42/ATR-72 FSB Report CONTENTS SECTION PAGE RECORD OF REVISIONS .......................................................................................................2 HIGHLIGHTS OF CHANGE ...................................................................................................2 1. PURPOSE AND APPLICABILITY .........................................................................................4 2. PILOT “TYPE RATING” REQUIREMENTS ..........................................................................7 3. “MASTER COMMON REQUIREMENTS” (MCRs) ..............................................................7 4. -

TAC Register Rev 6 22 Feb 2017

2/22/2017 Aircraft TAC TAC Register Rev 6 22 Feb 2017 THE REPOSITORY (SPREADSHEET): This data presented in this repository is a list of approved SACAA TACs as conferred to current foreign TC holders. Aircraft Type/Model File No. Conditions Category TAC Issue Issue Date Reissue Date Common Name 328 Support Services GmbH Dornier 328-100 & Dornier 328-300 J15/12/529 As per Type Certficate Data Sheet EASA.A.096 Standard Original 11 April 2007 - 328JET (328-300) Agusta S.p.A. (Now Leonardo Helicopter) A109E, A109K2, A109S, AW109SP and A109C J15/12/395 This certificate is issued as per EASA Type Certificate number EASA.R.005 Standard Reissue 15 September 1996 01 August 2013 AB139 J15/12/493 This certificate is issued as per EASA Type Certificate number EASA.R.006 Standard Original 21 April 2006 - AB139, AW139 AW189 J15/12/625 This certificate is issued as per EASA Type Certificate number EASA.R.510 Standard Original 24 November 2016 AW189 Air Tractor Inc. AT-402, AT-402B, AT-502, AT-502A, AT-502B & AT-504, AT-402A J15/12/327 This certificate is issued as per FAA Type Certificate number A17SW Restricted Original 15 October 2013 28 July 2016 AT-602, AT-802 and AT-802A J15/12/380 This certificate is issued as per FAA Type Certificate number A19SW Restricted Original 15 October 2013 - Airbus SAS A300B4-622R J15/12/565 This certificate is issued as per DGAC Type Certificate number 72. Standard Original 23 December 2009 - A320-232, A320-233 J15/12/593 This certificate is issued as per EASA Type Certificate number EASA.A.064 Standard Original 23 December 2011 - A330-301, A330-321, A330-322, A330- 341, A330-342, A330-202, A330-223, A330-243, A330-323, A330-343, A330- 203, A330-201, A330-302, A330-303, A330-223F and A330-243F J15/12/584 This certificate is issued as per EASA Type Certificate number EASA.A.004 Standard Original 08 December 2010 10 November 2016 A340-200, A340-300 and A340-600 series J15/12/382 As per DGAC Type Certficate number 183. -

Project Department of Automotive and Aeronautical

Project Department of Automotive and Aeronautical Engineering Aircraft Design Studies Based on the ATR 72 Author: Mihaela Florentina Niţă Examiner: Prof. Dr.-Ing. Dieter Scholz, MSME Delivered: 13.06.2008 Abstract This project gives a practical description of a preliminary aircraft design sequence. The sequence starts with a preliminary sizing method. The design sequence is illustrated with a redesign study of the ATR 72 turboprop aircraft. The requirements for the redesign aircraft are those of the ATR 72. The ATR 72 serves also as the reference during the redesign. The Preliminary sizing method was available (at the university) only for jet-powered aircraft. Therefore the method was adapted to work also with propeller driven aircrafts. The sizing method ensures that all requirements are met: take-off and landing field length, 2nd segment and missed approach gradients as well as cruise Mach number. The sizing method yields the best (low) power/weight ratio and the best wing loading. The redesign process covers all the aircraft components: fuselage, wing, empennage and landing gear. The aircraft design sequence defines the cabin layout, the wing parameters, the type of high lift system, the configuration and surface of the empennage. A mass distribution analysis is made, the position of the CG is calculated and the wing position determined. Finally the Direct Operating Costs (DOC) are calculated. DOCs are calculated applying the method from the Association of European Airlines (AEA). The DOCs serve for an aircraft evaluation. In order to meet requirements, the redesigned ATR 72 had to be slightly modified compared to the original ATR. -

Avation Increases to 35 Its Fleet of ATR 72S

Avation increases to 35 its fleet of ATR 72s ATR and the Singapore-based lessor announce 5 additional ATR 72-600s Singapore, February 16, 2016 – The world’s leading turboprop manufacturer ATR and the Singapore-based commercial aircraft lessor Avation PLC announced an agreement for the purchase of five new ATR 72-600 aircraft. At list prices the acquisition is valued at about US $130 million and brings to 35 the total number of firm ATR 72s ordered by Avation PLC since their first ATR purchase in 2011. As of today, Avation has already taken delivery of over 20 ATR 72s, mostly ATR 72-600s, which currently fly in the liveries of Virgin Australia, Flybe (for Scandinavian Airlines), UNI Air (Taiwan), Air India and Fiji Airways. Deliveries of the remaining ATR 72-600s on order extend out to 2018. ATR aircraft are the best-selling regional aircraft for below-90-seats size since 2010, representing 77% of global orders for turboprops. ATR is also experiencing an outstanding success among leasing firms in the same period, booking 87% of all their orders for below-90-seat regional aircraft. Avation is the second largest lessor by number of new ATRs ordered. According to Jeff Chatfield, Avation’s Executive Chairman, “We believe the ATR 72 is the most efficient aircraft type for regional routes. It provides the lowest fuel burn and the most reduced operating costs among all regional aircraft of its category. ATRs are superb assets for lessors, they offer great returns and also allow portfolio diversification. Avation raises equity and debt with the London and New York markets and we are proud to promote the ATR in these essential forums”. -

E N a C / Eetac Atr

E N A C / EETAC ATR FAA regulation analysis for ATR ETOPS validation Jordi CLARAMUNT SEGURA IENAC14 - Erasmus End of studies report / Treball Final de Grau 11/08/2017 FAA regulation analysis for ATR ETOPS validation 2 3 FAA regulation analysis for ATR ETOPS validation Acknowledgements With deepest gratitude and appreciation, I humbly give thanks to the people who helped me in making this end of studies project a possible one. First of all, I would like to offer my special thanks to Souhir Charfeddine, my internship tutor in ATR, for choosing me among the other candidates and giving me the possibility to perform this internship. Thanks for her valuable and constructive help during the planning and development of this internship. I really appreciate all the time she has dedicated to me with all the different meetings we have had inside the company. I have learnt a lot at her side, she has been an amazing tutor. Thank you. I am also grateful to all of those with whom I have had the pleasure to work with during this project. Each of the members I have worked with have provided me extensive and professional guidance and taught me a great deal about certification aspects, as well as other domains. Those include Antonio Paradies, Didier Cailhol, Eric Bédessem, Ciro Manco, Fabien Vançon, Jean-Paul Delpont, Nadège Gualina and Lucille Mitchell. Also, I would like to offer my gratitude to ENAC for first, giving me the possibility to join their Erasmus programme in its great university and then, for allowing me having the chance to do the internship, which has been the best election of my life so far.