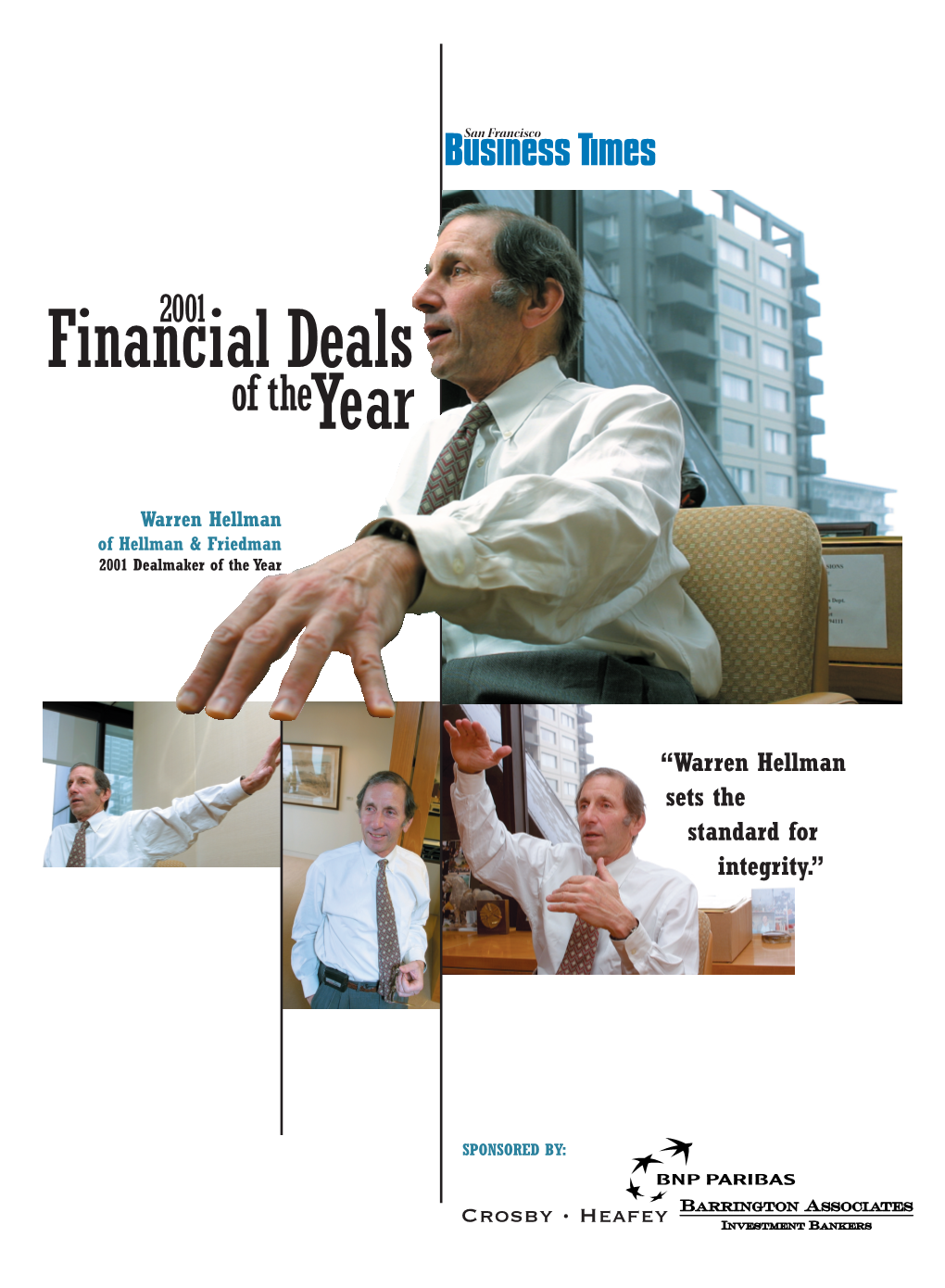

Of Hellman & Friedman

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

COUNCIL ON FOREIGN RELATIONS ANNUAL REPORT July 1,1996-June 30,1997 Main Office Washington Office The Harold Pratt House 1779 Massachusetts Avenue, N.W. 58 East 68th Street, New York, NY 10021 Washington, DC 20036 Tel. (212) 434-9400; Fax (212) 861-1789 Tel. (202) 518-3400; Fax (202) 986-2984 Website www. foreignrela tions. org e-mail publicaffairs@email. cfr. org OFFICERS AND DIRECTORS, 1997-98 Officers Directors Charlayne Hunter-Gault Peter G. Peterson Term Expiring 1998 Frank Savage* Chairman of the Board Peggy Dulany Laura D'Andrea Tyson Maurice R. Greenberg Robert F Erburu Leslie H. Gelb Vice Chairman Karen Elliott House ex officio Leslie H. Gelb Joshua Lederberg President Vincent A. Mai Honorary Officers Michael P Peters Garrick Utley and Directors Emeriti Senior Vice President Term Expiring 1999 Douglas Dillon and Chief Operating Officer Carla A. Hills Caryl R Haskins Alton Frye Robert D. Hormats Grayson Kirk Senior Vice President William J. McDonough Charles McC. Mathias, Jr. Paula J. Dobriansky Theodore C. Sorensen James A. Perkins Vice President, Washington Program George Soros David Rockefeller Gary C. Hufbauer Paul A. Volcker Honorary Chairman Vice President, Director of Studies Robert A. Scalapino Term Expiring 2000 David Kellogg Cyrus R. Vance Jessica R Einhorn Vice President, Communications Glenn E. Watts and Corporate Affairs Louis V Gerstner, Jr. Abraham F. Lowenthal Hanna Holborn Gray Vice President and Maurice R. Greenberg Deputy National Director George J. Mitchell Janice L. Murray Warren B. Rudman Vice President and Treasurer Term Expiring 2001 Karen M. Sughrue Lee Cullum Vice President, Programs Mario L. Baeza and Media Projects Thomas R. -

1 DICKSON LEW LOUIE Office: 510-352-8885 Mobile: 510-384-4229 [email protected] [email protected] May 4, 2020

DICKSON LEW LOUIE Office: 510-352-8885 Mobile: 510-384-4229 [email protected] [email protected] May 4, 2020 PROFESSIONAL/ACADEMIC POSITIONS University of California, Davis (2012- present] - Lecturer/Visiting Assistant Professor of Management San Francisco State University (2015-present) - Lecturer, Executive MBA Program, College of Business Time Capsule Press, LLC (2008-present) - President and CEO Louie & Associates (1999-present) - Principal The ClearLake Group (2012-18) - Colleague San Francisco Chronicle (2002-2006) - Strategic Planning Director (newsroom) (2003-06) - Advertising Business Manager (2002-03) San Jose Mercury News (1998-1999) - Business Development and Planning Manager (1998-99) - Advertising Business Manager (1998) Harvard Business School, Harvard University (1996-98) - Research Associate Los Angeles Times/Times Mirror Company (1983-95) - Corporate Financial Planning Manager, Times Mirror Newspaper Group, (1994-95) - Circulation Planning Manager, Los Angeles Times (1989-1994) - Senior Financial Planning Analyst, Los Angeles Times (1988-1999) - Financial Planning Analyst, Los Angeles Times (1984-88) - Financial Planning Intern, Los Angeles Times (1983) California State University, Hayward (Summer 1984) - Lecturer, Department of Accounting 1 Arthur Young & Company, CPAs (1980-82- Staff auditor and tax accountant, San Francisco Office (1980-82) EDUCATION University of Chicago, MBA, Marketing, Finance, and Statistics, 1984. California State University, Hayward, BS, Business Administration (Accounting option), minor, Mass Communications (Journalism), with high honors, 1980. EXECUTIVE EDUCATION Building and Leveraging Brand Equity, Wharton School of Commerce, University of Pennsylvania, May 1996. Leading Product Development, Harvard Business School, Harvard University, June 1997. Executive Leadership Program, Media Management Institute, Kellogg School of Management and Medill School of Journalism, Northwestern University, Spring 2002. Disney Institute, Disney’s Approach to Leadership Excellence, Disneyland, Anaheim, California, July 2017. -

Oral History with Paul J. Ferri

Oral History with Paul J. Ferri NVCA-Venture Forward Oral History Collection This oral history is part of NVCA-Forward Oral History Collection at the Computer History Museum and was recorded under the auspieces of the National Venture Capital Association (NVCA). In October 2018, the NVCA transferred the copyright of this oral history to the Computer History Museum to ensure that it is freely accessible to the public and preserved for future generations CHM Reference number: X8628.2018 © 2021 Computer History Museum National Venture Capital Association Venture Capital Oral History Project PAUL J. FERRI Interview Conducted by Carole Kolker, PhD November 28, 2012 December 6, 2012 This collection of interviews, Venture Capital Greats, recognizes the contributions of individuals who have followed in the footsteps of early venture capital pioneers such as Andrew Mellon and Laurance Rockefeller, J. H. Whitney and Georges Doriot, and the mid-century associations of Draper, Gaither & Anderson and Davis & Rock — families and firms who financed advanced technologies and built iconic US companies. Each interviewee was asked to reflect on his formative years, his career path, and the subsequent challenges faced as a venture capitalist. Their stories reveal passion and judgment, risk and rewards, and suggest in a variety of ways what the small venture capital industry has contributed to the American economy. As the venture capital industry prepares for a new market reality in the early years of the 21st century, the National Venture Capital Association reports (2008) that venture capital investments represented 21 percent of US GDP and were responsible for 12.1 million American jobs and 2.9 trillion in sales. -

LACERS Los Angeles City Employees’ Retirement System

LACERS Los Angeles City Employees’ Retirement System Report to Board of Administration Agenda of: AUGUST 3, 2009 From: Daniel P. Gallagher, Chief Investment Officer ITEM: V−A SUBJECT: NOTIFICATION OF UP TO $20 MILLION INVESTMENT IN HELLMAN & FRIEDMAN CAPITAL PARTNERS VII, L.P. Recommendation: That the Board receive and file this notice. Discussion: Attached is an investment abstract for Hellman & Friedman Capital Partners VII, L.P. (H&F VII) prepared by Hamilton Lane, LACERS’ traditional alternative investments consultant. Background H&F VII (Fund) is projected to be a $7 billion, hard cap $10 billion, middle-market to large cap buyout fund focusing on a variety of industries, including financial services, media, software/data services, business services, healthcare, internet/digital media, and energy/industrials. Investments will be pursued both in the U.S. and Western Europe with a small percentage that can be invested in Eastern Europe, Asia and Australia. LACERS has invested $31 million in H&F Funds with $11 million in H&F V (vintage 2004), and $20 million in H&F VI (vintage 2007). The General Partner (GP), founded in 1987 by Warren Hellman and Tully Friedman, has an experienced team. The majority of team members have worked and invested successfully together over many years and through several economic and private equity market cycles. H&F VII will be managed by senior partners Warren Hellman, Brian Powers, Philip Hammarskjold, Patrick Healy, and Thomas Steyer. The principals average over twenty-three years private equity experience and seventeen years tenure with the GP. They will be supported by thirty-one additional investment professionals and forty-one support staff. -

NASDAQ Shareholders Elect Six New Board Members, Re-Elect Three Members at Annual Meeting

NASDAQ Shareholders Elect Six New Board Members, Re-elect Three Members at Annual Meeting New York, N.Y.—The Nasdaq Stock Market, Inc., today announced the approval of its shareholders to appoint the following new members to its Board of Directors: Lon Gorman, Vice Chairman of The Charles Schwab Corporation, Head of Schwab Institutional and Asset Management and President of Schwab Capital Markets; John P. Havens, Global Head of Morgan Stanley's Institutional Equity Division; Thomas M. Joyce, Chief Executive Officer and President of Knight Trading Group, Inc.; Thomas F. O'Neill, a founding partner of Sandler O'Neill & Partners L.P.; James S. Riepe, Chairman of the T. Rowe Price Mutual Funds and Vice Chairman of the Board of Directors of T. Rowe Price Group, Inc.; and Arshad Zakaria, Executive Vice President of Merrill Lynch & Co., Inc. and President of the Global Markets and Investment Banking Group. In addition, Michael Casey, Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Starbucks Corporation; John D. Markese, President of the American Association of Individual Investors; and Arthur Rock, Principal of Arthur Rock & Co. were re-elected to NASDAQ's Board of Directors. The nominations were voted on by shareholders at NASDAQ's annual meeting held earlier today at the NASDAQ MarketSite in New York City. The new additions bring NASDAQ's board to a total of 21 members, with eight industry members, 11 non-industry members and two NASDAQ executives. "Adding the skills of these talented individuals to our Board will complement and diversify the abilities of our current directors and speaks to NASDAQ's commitment to continually build investors' confidence in the equity markets," said Wick Simmons, chairman and chief executive officer, NASDAQ. -

As Filed with the Securities and Exchange Commission on May 14, 2001 File No

As filed with the Securities and Exchange Commission on May 14, 2001 File No. 000-32651 ------------------------------------------------------------------------------- UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Amendment No. 1 To Form 10 GENERAL FORM FOR REGISTRATION OF SECURITIES PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 The Nasdaq Stock Market, Inc. (Exact Name of Registrant as Specified in Its Charter) Delaware 52-1165937 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) One Liberty Plaza New York, New York 10006 (Address of Principal (Zip Code) Executive Offices) Registrant's telephone number, including area code: 212-858-4750 Copies to: Edward S. Knight, Esq. Matthew J. Mallow, Esq. The Nasdaq Stock Market, Inc. Eric J. Friedman, Esq. One Liberty Plaza Skadden, Arps, Slate, Meagher & Flom LLP New York, New York 10006 Four Times Square New York, New York 10036 Securities to be registered pursuant to Section 12(b) of the Act: Not Applicable Title of each class Name of each exchange on which to be so registered each class to be registered Securities to be registered pursuant to Section 12(g) of the Act: Common Stock, par value $.01 per share (Title of class) ------------------------------------------------------------------------------- TABLE OF CONTENTS Item 1. Business.............................................................. Item 2. Financial Information................................................. Item 3. Properties........................................................... -

Fellows Program 2011 Annual Report Introduction the 2011 Hellman Fellows Annual Report Highlights the Program’S Significant Accomplishments and Grantmaking Activities

Fellows Program 2011 Annual Report Introduction The 2011 Hellman Fellows Annual Report highlights the program’s significant accomplishments and grantmaking activities. The report reflects the continued growth of the Hellman Fellows program, which now provides annual fellowship awards at thirteen colleges, universities and academic institutions (see list on page 13). This annual report also pays tribute to the program’s founders, Chris and Warren Hellman. In the early 1990’s, the Hellmans identified a need for funding to support junior faculty at colleges and universities. While young faculty were well-funded when first hired, there was little support available to further their research after these initial funds were expended. Many faculty would struggle at this point in their career, with few external funders ready to take a chance on their research. The Hellman Fellows program was designed to bridge this funding gap and smooth the trajectory for promising academic research careers. The scope of the Hellman Fellows program has grown since its launch in 1995, but the program’s goals have remained unchanged. In 2011, the Hellman Fellows program provided 130 fellowships to faculty representing a broad range of academic disciplines, including the arts, humanities, and social sciences, sciences and engineering. Please visit our website for more information about the program: www.hellmanfellows.org. “The Hellman Fellows program is one of the best things we have done with our giving.” – Warren Hellman 2 Table of Contents American Academy of Arts -

Hellman Warren 2014.Pdf

Regional Oral History Office University of California The Bancroft Library Berkeley, California Warren Hellman: Financier, Philanthropist, Civic Patron, Mensch including supplemental interviews with: Philip Hammarskjold and Susan Hirsch Interviews conducted by Lisa Rubens in 2011 Copyright © 2014 by The Regents of the University of California ii Since 1954 the Regional Oral History Office has been interviewing leading participants in or well-placed witnesses to major events in the development of Northern California, the West, and the nation. Oral History is a method of collecting historical information through tape-recorded interviews between a narrator with firsthand knowledge of historically significant events and a well-informed interviewer, with the goal of preserving substantive additions to the historical record. The tape recording is transcribed, lightly edited for continuity and clarity, and reviewed by the interviewee. The corrected manuscript is bound with photographs and illustrative materials and placed in The Bancroft Library at the University of California, Berkeley, and in other research collections for scholarly use. Because it is primary material, oral history is not intended to present the final, verified, or complete narrative of events. It is a spoken account, offered by the interviewee in response to questioning, and as such it is reflective, partisan, deeply involved, and irreplaceable. ********************************* All uses of this manuscript are covered by a legal agreement between The Regents of the University of California and Warren Hellman dated October 1, 2012; Philip Hammarskjold dated August 22, 2014; and Susan Hirsch dated September 6, 2014. The manuscript is thereby made available for research purposes. All literary rights in the manuscript, including the right to publish, are reserved to The Bancroft Library of the University of California, Berkeley. -

Warrem Hellman News Release C

News Release SAN FRANCISCO, December 18, 2011 F. Warren Hellman, Beloved Founder, Passes Away at 77 Business innovator, private equity pioneer, dedicated philanthropist, civic champion, keen sportsman, devoted husband, father and grandfather, San Francisco icon, a true Renaissance man The partners at Hellman & Friedman announce with great sadness today the passing oF our Founder Warren Hellman, 77, due to complications associated with leukemia. “Warren was a great mentor, partner and Friend, and above all, a great man,” said Brian Powers, Chairman of Hellman & Friedman. “He will be deeply missed. His commitment to civic and philanthropic activities and his extraordinary generosity to the many causes he supported will have a lasting impact on our community.” “We have been blessed with an amazing Founder. Warren has been an inspiration to all oF us and set the standard by which we strive to live our personal and proFessional lives,” said Philip Hammarskjold, ChieF Executive OFFicer. “Warren taught us not only to be better investors, but to be better people. He always set his own course and did things in his own way. He wanted to build an investment Firm dedicated to serving its limited partners and the businesses in which we invest. We have all beneFited greatly From his vision, generosity and leadership.” Mick Hellman, one oF Warren's Four children said on behalF oF his Family, "Dad believed in people and their power to accomplish incredible things. In that vein, he helped start several really successful businesses over the years, and he considered Hellman & Friedman his highest proFessional achievement. He was an incredible problem-solver, and was great at bringing groups together that had naturally opposing interests and nudging them to a solution. -

CONGRESSIONAL RECORD—SENATE, Vol. 158, Pt. 1

156 CONGRESSIONAL RECORD—SENATE, Vol. 158, Pt. 1 January 23, 2012 Vallejo Police Department on Novem- sacrifices she made while serving the Chamber of Commerce and the Bay ber 17, 2011. He was 45 years old. community and the people she loved. Area Council; and chairman of Voice of Jim Capoot was originally from Lit- She will be dearly missed.∑ Dance. tle Rock, AR, and served in the U.S. f Warren also led many efforts to sup- Marine Corps and as a California High- port civic initiatives in San Francisco, way Patrol Officer before joining the REMEMBERING WARREN HELLMAN from the underground parking garage Vallejo Police Department in 1992. Offi- ∑ Mrs. BOXER. Mr. President, today I that saved two major museums in cer Capoot was a highly decorated offi- ask my colleagues to join me in hon- Golden Gate Park to the broad-based cer having received the Vallejo Police oring the life and legacy of Warren campaign to reform San Francisco’s Department Officer of the Year award, Hellman, a San Francisco financier, city employee pension system. the Medal of Merit, the Life Saving philanthropist, and community leader On behalf of the people of California, Medal, and twice awarded the Medal of who died last month at age 77 from who have benefitted so much from War- Courage. In addition to his work with complications of leukemia. ren Hellman’s great generosity and the Police Department, Officer Capoot In addition to its spectacular beauty, public sprit, I send my deepest grati- was the volunteer coach of the Vallejo the City of San Francisco is known tude and condolences to his wife, Patri- High School girls’ basketball team and around the world for its great heart cia Christina ‘‘Chris’’ Hellman; son led the team to a section championship and free spirit, its celebration of diver- Marco ‘‘Mick’’ Hellman; daughters in 2010. -

Annual Report

COUNCIL ON FOREIGN RELATIONS ANNUAL REPORT July 1,1997 -June 30,1998 Main Office Washington Office The Harold Pratt House 1779 Massachusetts Avenue, N.W. 58 East 68th Street, New York, NY 10021 Washington, DC 20036 Tel. (212) 434-9400; Fax (212) 861-1789 Tel. (202) 518-3400; Fax (202) 986-2984 Web Site www.foreignrelations.org E-mail [email protected] OFFICERS AND DIRECTORS, 1998-99 Officers Directors Term Expiring 2003 Peter G. Peterson Term Expiring 1999 Peggy Dulany* Chairman of the Board Carla A. Hills Martin S. Feldstein Maurice R. Greenberg Robert D. Hormats Bette Bao Lord Vice Chairman William J. McDonough Vincent A. Mai* Leslie H. Gelb Theodore C. Sorensen Michael H. Moskow* President George Soros Garrick Utley Michael P. Peters Senior Vice President, Chief Operating PaulA.Volcker Leslie H. Gelb Officer, and National Director ex officio Term Expiring 2000 Paula J. Dobriansky Vice President, Washington Program Jessica P. Einhorn Honorary Officers David Kellogg Louis V. Gerstner Jr. and Directors Emeriti Vice President, Corporate Affairs, Maurice R. Greenberg Douglas Dillon and Publisher George J. Mitchell Caryl P. Haskins Lawrence J. Korb Warren B. Rudman Charles McC. Mathias Jr. Vice President, Studies Diane Sawyer* James A. Perkins Abraham F. Lowenthal David Rockefeller Vice President Term Expiring 2001 and Deputy National Director Honorary Chairman Lee Cullum Anne R. Luzzatto Robert A. Scalapino Mario L. Baeza Vice President, Programs Cyrus R.Vance and Media Projects Thomas R. Donahue Glenn E. Watts Janice L. Murray Richard C. Holbrooke Vice President and Treasurer Peter G. Petersont Judith Gustafson Robert B. Zoellick Secretary Term Expiring 2002 Paul A. -

LACERS Los Angeles City Employees’ Retirement System

LACERS Los Angeles City Employees’ Retirement System Report to Board of Administration Agenda of: AUGUST 3, 2009 From: Daniel P. Gallagher, Chief Investment Officer ITEM: V−A SUBJECT: NOTIFICATION OF UP TO $20 MILLION INVESTMENT IN HELLMAN & FRIEDMAN CAPITAL PARTNERS VII, L.P. Recommendation: That the Board receive and file this notice. Discussion: Attached is an investment abstract for Hellman & Friedman Capital Partners VII, L.P. (H&F VII) prepared by Hamilton Lane, LACERS’ traditional alternative investments consultant. Background H&F VII (Fund) is projected to be a $7 billion, hard cap $10 billion, middle-market to large cap buyout fund focusing on a variety of industries, including financial services, media, software/data services, business services, healthcare, internet/digital media, and energy/industrials. Investments will be pursued both in the U.S. and Western Europe with a small percentage that can be invested in Eastern Europe, Asia and Australia. LACERS has invested $31 million in H&F Funds with $11 million in H&F V (vintage 2004), and $20 million in H&F VI (vintage 2007). The General Partner (GP), founded in 1987 by Warren Hellman and Tully Friedman, has an experienced team. The majority of team members have worked and invested successfully together over many years and through several economic and private equity market cycles. H&F VII will be managed by senior partners Warren Hellman, Brian Powers, Philip Hammarskjold, Patrick Healy, and Thomas Steyer. The principals average over twenty-three years private equity experience and seventeen years tenure with the GP. They will be supported by thirty-one additional investment professionals and forty-one support staff.