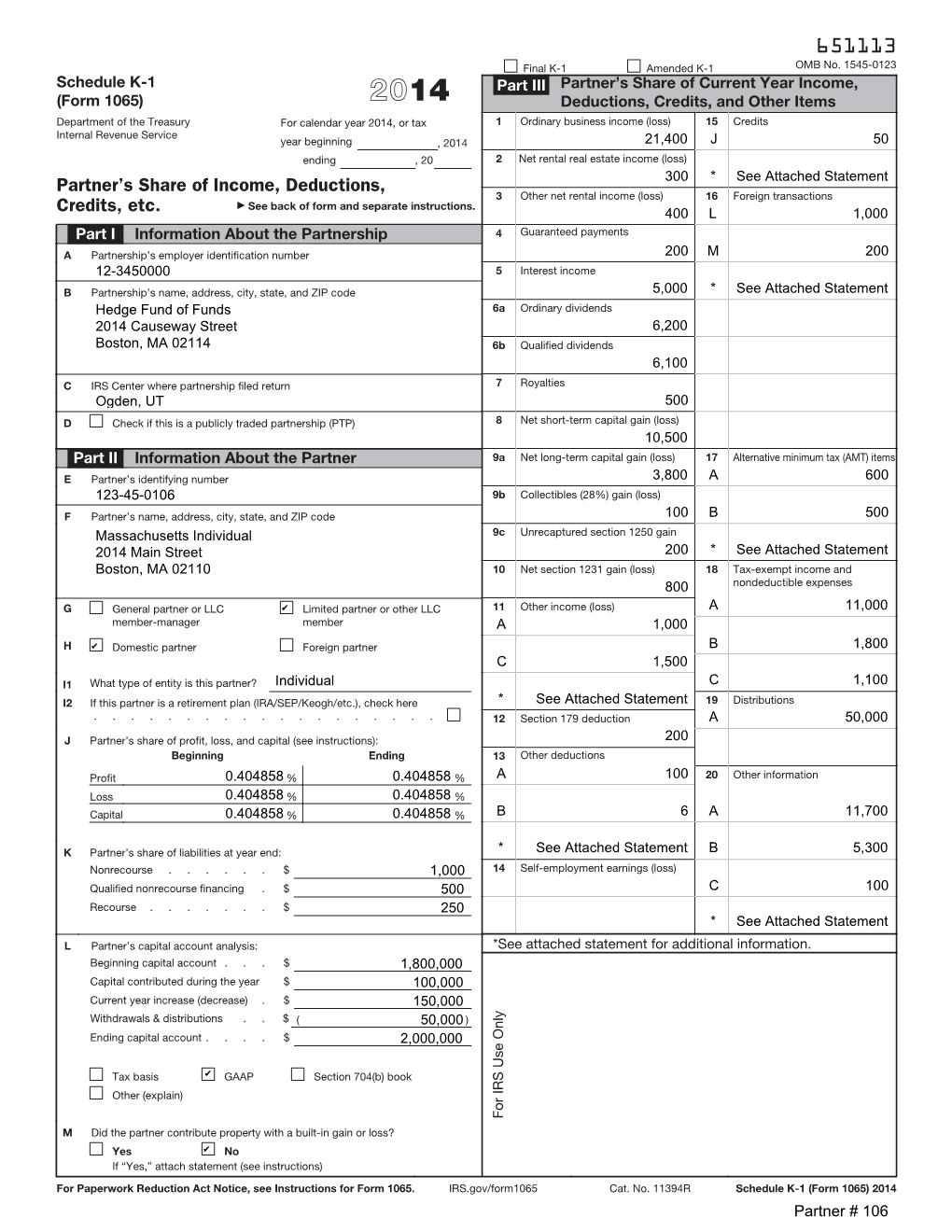

Partner's Share of Income, Deductions, Credits, Etc. 651113

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shanghai Lumina Shanghai (100% Owned)

Artist’s impression LUMINA GUANGZHOU GUANGZHOU Artist’s impression Review of Operations – Business in Mainland China Progress of Major Development Projects Beijing Lakeside Mansion (24.5% owned) Branch of Beijing High School No. 4 Hou Sha Yu Primary School An Fu Street Shun Yi District Airport Hospital Hou Sha Yu Hou Sha Yu Station Town Hall Tianbei Road Tianbei Shuang Yu Street Luoma Huosha Road Lake Jing Mi Expressway Yuan Road Yuan Lakeside Mansion, Beijing (artist’s impression) Hua Li Kan Station Beijing Subway Line No.15 Located in the central villa area of Houshayu town, Shunyi District, “Lakeside Mansion” is adjacent to the Luoma Lake wetland park and various educational and medical institutions. The site of about 700,000 square feet will be developed into low-rise country-yard townhouses and high-rise apartments, complemented by commercial and community facilities. It is scheduled for completion in the third quarter of 2020, providing a total gross floor area of about 1,290,000 square feet for 979 households. Beijing Residential project at Chaoyang District (100% owned) Shunhuang Road Beijing Road No.7 of Sunhe Blocks Sunhe of Road No.6 Road of Sunhe Blocks of Sunhe Blocks Sunhe of Road No.4 Road of Sunhe Blocks Road No.10 Jingping Highway Jingmi Road Residential project at Chaoyang District, Beijing (artist’s impression) Huangkang Road Sunhe Station Subway Line No.15 Located in the villa area of Sunhe, Chaoyang District, this project is adjacent to the Wenyu River wetland park, Sunhe subway station and an array of educational and medical institutions. -

Beijing Subway Map

Beijing Subway Map Ming Tombs North Changping Line Changping Xishankou 十三陵景区 昌平西山口 Changping Beishaowa 昌平 北邵洼 Changping Dongguan 昌平东关 Nanshao南邵 Daoxianghulu Yongfeng Shahe University Park Line 5 稻香湖路 永丰 沙河高教园 Bei'anhe Tiantongyuan North Nanfaxin Shimen Shunyi Line 16 北安河 Tundian Shahe沙河 天通苑北 南法信 石门 顺义 Wenyanglu Yongfeng South Fengbo 温阳路 屯佃 俸伯 Line 15 永丰南 Gonghuacheng Line 8 巩华城 Houshayu后沙峪 Xibeiwang西北旺 Yuzhilu Pingxifu Tiantongyuan 育知路 平西府 天通苑 Zhuxinzhuang Hualikan花梨坎 马连洼 朱辛庄 Malianwa Huilongguan Dongdajie Tiantongyuan South Life Science Park 回龙观东大街 China International Exhibition Center Huilongguan 天通苑南 Nongda'nanlu农大南路 生命科学园 Longze Line 13 Line 14 国展 龙泽 回龙观 Lishuiqiao Sunhe Huoying霍营 立水桥 Shan’gezhuang Terminal 2 Terminal 3 Xi’erqi西二旗 善各庄 孙河 T2航站楼 T3航站楼 Anheqiao North Line 4 Yuxin育新 Lishuiqiao South 安河桥北 Qinghe 立水桥南 Maquanying Beigongmen Yuanmingyuan Park Beiyuan Xiyuan 清河 Xixiaokou西小口 Beiyuanlu North 马泉营 北宫门 西苑 圆明园 South Gate of 北苑 Laiguangying来广营 Zhiwuyuan Shangdi Yongtaizhuang永泰庄 Forest Park 北苑路北 Cuigezhuang 植物园 上地 Lincuiqiao林萃桥 森林公园南门 Datunlu East Xiangshan East Gate of Peking University Qinghuadongluxikou Wangjing West Donghuqu东湖渠 崔各庄 香山 北京大学东门 清华东路西口 Anlilu安立路 大屯路东 Chapeng 望京西 Wan’an 茶棚 Western Suburban Line 万安 Zhongguancun Wudaokou Liudaokou Beishatan Olympic Green Guanzhuang Wangjing Wangjing East 中关村 五道口 六道口 北沙滩 奥林匹克公园 关庄 望京 望京东 Yiheyuanximen Line 15 Huixinxijie Beikou Olympic Sports Center 惠新西街北口 Futong阜通 颐和园西门 Haidian Huangzhuang Zhichunlu 奥体中心 Huixinxijie Nankou Shaoyaoju 海淀黄庄 知春路 惠新西街南口 芍药居 Beitucheng Wangjing South望京南 北土城 -

Beijing Railway Station 北京站 / 13 Maojiangwan Hutong Dongcheng District Beijing 北京市东城区毛家湾胡同 13 号

Beijing Railway Station 北京站 / 13 Maojiangwan Hutong Dongcheng District Beijing 北京市东城区毛家湾胡同 13 号 (86-010-51831812) Quick Guide General Information Board the Train / Leave the Station Transportation Station Details Station Map Useful Sentences General Information Beijing Railway Station (北京站) is located southeast of center of Beijing, inside the Second Ring. It used to be the largest railway station during the time of 1950s – 1980s. Subway Line 2 runs directly to the station and over 30 buses have stops here. Domestic trains and some international lines depart from this station, notably the lines linking Beijing to Moscow, Russia and Pyongyang, South Korea (DPRK). The station now operates normal trains and some high speed railways bounding south to Shanghai, Nanjing, Suzhou, Hangzhou, Zhengzhou, Fuzhou and Changsha etc, bounding north to Harbin, Tianjin, Changchun, Dalian, Hohhot, Urumqi, Shijiazhuang, and Yinchuan etc. Beijing Railway Station is a vast station with nonstop crowds every day. Ground floor and second floor are open to passengers for ticketing, waiting, check-in and other services. If your train departs from this station, we suggest you be here at least 2 hours ahead of the departure time. Board the Train / Leave the Station Boarding progress at Beijing Railway Station: Station square Entrance and security check Ground floor Ticket Hall (售票大厅) Security check (also with tickets and travel documents) Enter waiting hall TOP Pick up tickets Buy tickets (with your travel documents) (with your travel documents and booking number) Find your own waiting room (some might be on the second floor) Wait for check-in Have tickets checked and take your luggage Walk through the passage and find your boarding platform Board the train and find your seat Leaving Beijing Railway Station: When you get off the train station, follow the crowds to the exit passage that links to the exit hall. -

IC-27255; File No

SECURITIES AND EXCHANGE COMMISSION 17 CFR Part 270 [Release No. IC-27255; File No. S7-06-06; File No. 4-512] RIN 3235-AJ51 Mutual Fund Redemption Fees AGENCY: Securities and Exchange Commission. ACTION: Proposed rule. SUMMARY: The Securities and Exchange Commission (“Commission” or “SEC”) is proposing amendments to the redemption fee rule we recently adopted. The rule, among other things, requires most open-end investment companies (“funds”) to enter into agreements with intermediaries, such as broker-dealers, that hold shares on behalf of other investors in so called “omnibus accounts.” These agreements must provide funds access to information about transactions in these accounts to enable the funds to enforce restrictions on market timing and similar abusive transactions. The Commission is proposing to amend the rule to clarify the operation of the rule and reduce the number of intermediaries with which funds must negotiate information-sharing agreements. The amendments are designed to address issues that came to our attention after we had adopted the rule, and are designed to reduce the costs to funds (and fund shareholders) while still achieving the goals of the rulemaking. DATES: Comments must be received on or before April 10, 2006. ADDRESSES: Comments may be submitted by any of the following methods: Electronic Comments: • Use the Commission’s Internet comment form (http://www.sec.gov/rules/proposed.shtml); or 2 • Send an e-mail to [email protected]. Please include File Number S7-06-06 on the subject line; or • Use the Federal eRulemaking Portal (http://www.regulations.gov). Follow the instructions for submitting comments. -

Beijing Office Development Pipeline, 2021-2023 Onwards

Leasing market recovers more quickly Beijing Grade-A Office Market Report knightfrank.com.cn Q1 2021 BEIJING GRADE-A OFFICE MARKET REPORT Q1 2021 OVERVIEW AND OUTLOOK In the first quarter of 2021 (Q1 2021), the tripled that in 2020. The average Grade-A Amongst, more than 400,000-sqm new office market recovered more quickly office rent continued its downward trend, office space will be completed in the with increasing leasing activity. The fell by 0.6% QoQ to RMB326.6 per sqm second quarter (Q2), thus the vacancy average vacancy rate decreased by 1.8 per month. Looking forward to 2021, it is rate is expected to rise slightly, and the percentage points QoQ to 16.4% and the expected that a total of 1.2 million sqm rebound of office rents are facing certain net absorption reached 209,000 sqm, of new office space will be completed. resistance. FIGURE1: Beijing Grade-A office market indicators[1] 2021 Q1 2021 Q1 2021 Q1 New supply Rent Vacancy rate - 326.6 16.4% sqm RMB/sqm/month pps QoQ change: QoQ change: 0.6% QoQ change: 1.8 Q2 2021: Q2 2021: Q2 2021: Source: Knight Frank Research [1] Rent refers to average effective rent FIGURE 2: Beijing office development pipeline, 2021-2023 onwards '000 sqm CBD 1,500 Lufthansa Financial Street 1,000 East 2nd Ring Road Zhongguancun 500 OGV Wangjing-Jiuxianqiao 0 Lize 2021 2022 2023 onwards Others Source: Knight Frank Research 2 BEIJING GRADE-A OFFICE MARKET REPORT Q1 2021 SUPPLY AND DEMAND In Q1, there was no new office space in Beijing’s Grade-A office market. -

5G for Trains

5G for Trains Bharat Bhatia Chair, ITU-R WP5D SWG on PPDR Chair, APT-AWG Task Group on PPDR President, ITU-APT foundation of India Head of International Spectrum, Motorola Solutions Inc. Slide 1 Operations • Train operations, monitoring and control GSM-R • Real-time telemetry • Fleet/track maintenance • Increasing track capacity • Unattended Train Operations • Mobile workforce applications • Sensors – big data analytics • Mass Rescue Operation • Supply chain Safety Customer services GSM-R • Remote diagnostics • Travel information • Remote control in case of • Advertisements emergency • Location based services • Passenger emergency • Infotainment - Multimedia communications Passenger information display • Platform-to-driver video • Personal multimedia • In-train CCTV surveillance - train-to- entertainment station/OCC video • In-train wi-fi – broadband • Security internet access • Video analytics What is GSM-R? GSM-R, Global System for Mobile Communications – Railway or GSM-Railway is an international wireless communications standard for railway communication and applications. A sub-system of European Rail Traffic Management System (ERTMS), it is used for communication between train and railway regulation control centres GSM-R is an adaptation of GSM to provide mission critical features for railway operation and can work at speeds up to 500 km/hour. It is based on EIRENE – MORANE specifications. (EUROPEAN INTEGRATED RAILWAY RADIO ENHANCED NETWORK and Mobile radio for Railway Networks in Europe) GSM-R Stanadardisation UIC the International -

Quarterly Newsletter of GEF China Sustainable Cities Integrated Approach Pilot Project

Quarterly Newsletter of GEF China Sustainable Cities Integrated Approach Pilot Project issue 8 June 2020 Project Progress (As of June 15, 2020) GEBJ-2: The evaluation for the technical proposal was completed on May 19, 2020. Ministry of Housing and Urban-Rural The bid opening for the financial proposal and Development of P.R.C. contract negotiation were held on June 11, 2020. The PMO intends to partially adjust the The contract of the National TOD Platform tasks in the TOR. A written request of specific was officially signed on April 20, 2020. The changes will be submitted to the World Bank Project Management Office (PMO) held the task team by the end of June 2020. kick-off meeting for the hired consultant to GEBJ-3: Request of Expression of present the inception report and work plans on Interest (REOI) was posted on April 28, May 29, 2020. The inception report and work 2020. The shortlist of qualified bidders was plans were reviewed by a panel of experts on evaluated on June 10, 2020. RFP is currently June 15. It will be finalized and submitted to under preparation and will be sent to the the World Bank task team by the end of June qualified bidders by the end of June 2020. 2020. Tianjin GETJ-1: The first draft for Task 5: The Contextualized TOD Guidebook and Toolkit for Tianjin was completed at the beginning of May 2020. The final draft will be completed at the end of June 2020. The disbursement of grant submitted to the World Bank task team after the evaluation for the final draft is completed. -

Form 7 F Trust Treated As Private Foundation 201 7 Do Not Enter Social Security Numbers on This Form It Public

BLUECROSS01 11/14/2018920 AM ZZ/^ ^^V 2949132805105 8 A ^ Return of Private Foundation OMB No 1545-0052 9O or Section 4947 (a)(1) Form 7 F Trust Treated as Private Foundation 201 7 Do not enter social security numbers on this form it public . ^r^s^r ^^i Department of the Treasury ► as may be made Internal Revenue Service to www.irs.gov/Form99OPF for instructions and the latest information . pen to Public Inspection For calendar year 2017 or tax year beginning and ending Name of foundation A Employer identification number BLUE CROSS & BLUE SHIELD OF LOUISIANA FOUNDATION 72-1232379 Number and street (or P 0 box number if mail is not delivered to street address) Room/suite B Telephone number (see instructions) P.O. BOX 98022 225 - 295-3307 City or town, state or province , country, and ZIP or foreign postal code C If exemption application is pending , check here BATON ROUGE LA 7 0 8 9 8 - 9 0 2 2 ► G Check all that apply Initial return Initial return of a former public charity o 1 Foreign organizations , check here ► Final return Amended return 2 Foreign organizations meeting the Address change Name change 85% test , check here and attach computation P. H Check type of organization XX Section 501 (c)( 3) exempt private foundation If private foundation status was terminated under Section 4947 (a )( 1 ) nonexem pt charitable trust Other taxable p rivate foundation section 507 (b)(1((A), check here ► El Fair market value of all assets at J Accounting method [] Cash XX Accrual F If the foundation is in a 60-month termination end of year (from -

Campus Life Guide for International Students

CAMPUS LIFE GUIDE FOR INTERNATIONAL STUDENTS International Students & Scholars Center 4 Life at Tsinghua Contents Food and Drink 13 Shopping 15 Postal and Delivery Services 16 Transportation 16 Sports and Leisure 18 Student Associations 19 Important Dates and Holidays 20 5 Academics and Related Resources Teaching Buildings and Self-Study Rooms 21 Learning Chinese 21 Libraries 22 Important University Websites 22 Center for Psychological Development 23 Center for Student Learning and Development 23 Career Development Center 24 1 Welcome to Tsinghua Center for Global Competence Development 24 Welcome Message 01 About Tsinghua 02 6 Health and Safety Hospitals 25 Before You Leave Home Health Insurance 26 2 Campus Safety Tips 27 Important Documents 03 Visa 03 Physical Examination 05 Beijing and Surrounds Converting Money 05 7 What to Bring 06 Climate 29 Accommodation 06 Transportation 29 Wudaokou and Surrounds 30 Travel 30 3 Settling In Beijing Life Web Resources 30 Getting to Tsinghua 08 Housing Arrangements 08 Useful Information and Contacts University Registration 09 8 Local Sim Card 09 Emergency Contacts 31 Bank Card 10 On-Campus Important Contacts 31 Student IC Card 10 Off-Campus Important Contacts 31 Internet 11 Campus Map 32 Student Email Account 12 International Students & Scholars Center 33 Physical Examination Authentication 12 Orientation 12 Appendix Additional Information 12 Welcome to Tsinghua 欢迎来到清华 About Tsinghua Founded in 1911, Tsinghua University is a unique comprehensive university bridging China and the world, connecting ancient and modern society, and encompassing the arts and sciences. As one of China's most prestigious and influential universities, Tsinghua is committed to cultivating globally competent students who will thrive in today's world and become tomorrow's leaders. -

Beijing 2022 Press Accommodation Guide

Beijing 2022 Press Accommodation Guide Beijing Organising Committee for the 2022 Olympic and Paralympic Winter Games September, 2020 Beijing 2022 Press Content Accommodation Guide Introduction Policies and Procedures 1 Accreditation Requirement 1 Beijing 2022 Accommodation Booking Period 1 Accommodation Facility Classification System 1 Room Types 2 Room Rates 3 Room Reservation 3 Accommodation Allocation Agreement(AAA) 3 Accommodation Management System (AMS) 4 Reservation Procedure 4 Cancellation Policy 5 Reservation Changes 6 Re-sale 6 Payment 7 Check-in/Check-out Time 8 Deposit 8 Incidental Charges 8 Function Rooms 8 Parking Spaces 8 Accommodation Timeline and Key Dates 8 Press Hotel List 9 Press Hotel Map 10 Hotel Information Sheet 15 Appendix: Beijing 2022 Press Accommodation Request Form 51 Beijing 2022 Press Introduction Accommodation Guide Welcome to the Press Accommodation Guide presented by the Beijing Organising Committee for the 2022 Olympic and Paralympic Winter Games (Beijing 2022). This Guide is intended to assist press to secure accommodation for the Beijing 2022 Olympic Winter Games, please read this guide thoroughly to be able to secure sufficient price-controlled accommodation and assist us to offer the best possible accommodation allocation. To date, Beijing 2022 has contracted around 100 accommodation facilities based on location, transportation, star-rating and service levels. Beijing 2022 provides 18 accommodation facilities with 2,446 rooms for press in Beijing, Yanqing and Zhangjiakou zones. To find more information about the press accommodation facilities, please read the Press Hotel Information Sheet and view the Press Hotels Map. Designating an Accommodation Management System (AMS) authorised person and providing his/her information is the first step to your room reservation. -

Metro Vehicles– Global Market Trends

Annexe C2017 METRO VEHICLES– GLOBAL MARKET TRENDS Forecast, Installed Base, Suppliers, Infrastructure and Rolling Stock Projects Extract from the study METRO VEHICLES – GLOBAL MARKET TRENDS Forecast, Installed Base, Suppliers, Infrastructure and Rolling Stock Projects This study entitled “Metro Vehicles – Global Market Trends” provides comprehensive insight into the structure, fleets, volumes and development trends of the worldwide market for metro vehicles. Urbanisation, the increasing mobility of people and climate change are resulting in an increased demand for efficient and modern public transport systems. Metro transport represents such an environmentally friendly mode which has become increasingly important in the last few years. Based on current developments, this Multi Client Study delivers an analysis and well-founded estimate of the market for metro vehicles and network development. This is the sixth, updated edition of SCI Verkehr’s study analysing the global market for metro vehicles. All in all, the study provides a well-founded analysis of the worldwide market for metro vehicles. This study further provides complete, crucial and differentiated information on this vehicle segment which is important for the operational and strategic planning of players in the transport and railway industry. In concrete terms, this market study of metro vehicles includes: . A regionally differentiated look at the worldwide market for metro vehicles including an in-depth analysis of all important markets of the individual countries. Network length, installed base and average vehicle age in 2016 of all cities operating a metro system are provided . An overview of the most important drivers behind the procurement and refurbishment of metro vehicles in the individual regions . -

SEC Proposed Rule: Mutual Fund Redemption Fees; Release No. IC

Federal Register / Vol. 71, No. 44 / Tuesday, March 7, 2006 / Proposed Rules 11351 Issued in Renton, Washington, on February Paper Comments Investment Company Act.4 We adopted 22, 2006. • the rule to help address abuses Michael J. Kaszycki, Send paper comments in triplicate associated with short-term trading of Acting Manager, Transport Airplane to Nancy M. Morris, Secretary, fund shares. Rule 22c–2 provides that if Directorate, Aircraft Certification Service. Securities and Exchange Commission, a fund redeems its shares within seven [FR Doc. E6–3227 Filed 3–6–06; 8:45 am] 100 F Street, NE., Washington, DC days,5 its board must consider whether 20549–9303. BILLING CODE 4910–13–P to impose a fee of up to two percent of All submissions should refer to File the value of shares redeemed shortly Number S7–06–06. This file number after their purchase (‘‘redemption fee’’).6 SECURITIES AND EXCHANGE should be included on the subject line The rule also requires such a fund to COMMISSION if e-mail is used. To help us process and enter into agreements with its review your comments more efficiently, intermediaries that provide fund 17 CFR Part 270 please use only one method. The management the ability to identify Commission will post all comments on investors whose trading violates fund [Release No. IC–27255; File No. S7–06–06; the Commission’s Internet Web site restrictions on short-term trading.7 File No. 4–512] (http://www.sec.gov/rules/ When we adopted rule 22c–2 last RIN 3235–AJ51 proposed.shtml). Comments are also March, we asked for additional available for public inspection and comment on (i) whether the rule should Mutual Fund Redemption Fees copying in the Commission’s Public include uniform standards for 8 AGENCY: Securities and Exchange Reference Room, 100 F Street, NE., redemption fees, and (ii) any problems Commission.