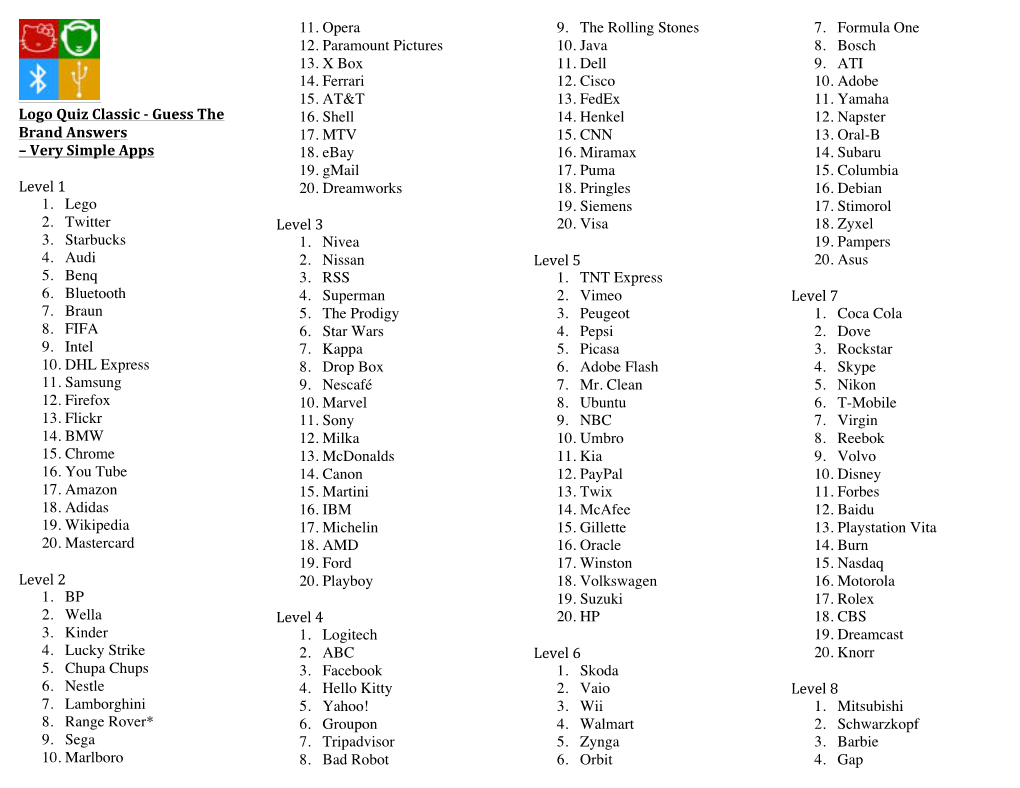

Logo Quiz Classic - Guess the 16

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consumer & Retail M&A Report

HYDE PARK CAPITAL Integrity | Expertise | Results Investment Banking | Mergers & Acquisitions | Capital Raising John Hill Senior Managing Director [email protected] (813) 383‐0205 John McDonald Senior Managing Director [email protected] (813) 383‐0206 Consumer & Retail Keith Hodgdon Managing Director M&A Report [email protected] (813) 383‐0208 Q2 2017 Greg Bosl Vice President [email protected] (813) 597‐2649 Jami Gold Vice President [email protected] (813) 383‐0203 Charlie Hendrick Vice President [email protected] (813) 383‐0207 Jeffrey Hendricks Vice President [email protected] (678) 523‐3073 Hyde Park Capital Advisors, LLC 701 N. Franklin Street Tampa, FL 33602 Tel: 813‐383‐0202 www.hydeparkcapital.com Member FINRA/SIPC Capital Markets Overview –Consumer & Retail Commentary Select Public Offerings – Consumer & Retail (Q2 2017) Transaction Offer Date Issuer Industry Sector Transaction Type Value ($mm) The S&P 500 and S&P 500 Retailing Index increased 15.2% and 13.7%, respectively, while the S&P 500 Consumer Durables & 05/09/17 Costco Wholesale Corp. Retail Fixed‐Income $3,783 Apparel Index increased 4.2% for the twelve month period ended 04/27/17 Pepsico, Inc. Food and Beverages Fixed‐Income $3,544 June 30, 2017. 04/19/17 Lowe's Co., Inc. Retail Fixed‐Income $2,988 The table on the right illustrates select public offerings completed 06/29/17 Albertsons Co., LLC Food and Beverages Fixed‐Income $2,500 in Q2 2017. Blue Apron Holdings, Inc. (NYSE:APRN), which 04/26/17 Netflix, Inc. Retail Fixed‐Income $1,414 operates an e‐commerce marketplace for home delivery of original recipes and pre‐portioned ingredients, raised $300 million in the 06/21/17 Taylor Morrison Home Corp. -

Race Program

RACE PROGRAM 2018 - 2019 RACE FIS Racing has been a way of life for Rossignol since 1907. Over a century of iconic history and innovation. Over a century of victories, medals, and glory. Today, Rossignol’s commitment and passion for racing is more visible than ever. Whether a World Cup champion or a race league competitor, the all-new HERO race collection exemplifies the spirit of competition, the excitement at the start, the need for speed, and the ultimate thrill of victory. The apex of premium technology, athlete-approved innovation, and competitive racing performance, HERO invites every skier to share in the rush of adrenaline as you cross the finish, capture the podium, and raise your skis triumphantly into the air for Another Best Day. Join the Band of Heroes HERO ATHLETE FIS SL HERO ATHLETE FIS GS FACTORY HERO ATHLETE FIS GS DLC FACTORY HERO ATHLETE FIS GS HERO ATHLETE FIS GS DLC SYSTEM R22 SYSTEM R22 SYSTEM R22 DLC - R22 RECTANGULAR SIDEWALL RECTANGULAR SIDEWALL RECTANGULAR SIDEWALL ASH WOOD CORE ASH WOOD CORE ASH WOOD CORE TITANAL CONSTRUCTION TITANAL CONSTRUCTION TITANAL CONSTRUCTION SIDECUT 115/66/101 116/66/102 116/67/103 SIDECUT 102/65/84 101/65/81 103/65/85 103/63/85 102/65/85 104/65/87 106/65/87 DYNAMIC LINE CONTROL SYSTEM (DLC) RADIUS 11 m 12 m 13 m RADIUS 30 m 30 m 27 m 25 m 23 m 20 m 19 m SIDECUT 102/65/84 101/65/81 SIZES 150 157 165 SIZES 193 188 185 182 175 170 165 RADIUS 30 m 30 m WEIGHT (+/- 5 %) 4,2 kg/PAIR WEIGHT (+/- 5 %) 5,2 kg/PAIR SIZES 193 188 WEIGHT (+/- 5 %) 6,0 kg/PAIR RRH01GA 193 RAHGA01 HERO ATHLETE FIS -

Orange County Business Journal

CONEJO VALLEY SIMI VALLEY SAN FERNANDO CALABASAS AGOURA HILLS ANTELOPE VALLEY CONEJO VALLEY SIMI VALLEY SAN FERNANDO CALABASAS AGOURA HILLS ANTELOPE VALLEY 4.7.14 front_Layout 1 4/4/14 12:09 PM Page 1 ocbj.com ORANGE COUNTY BUSINESS JOURNAL TM $1.50 VOL. 37 NO. 14 THE COMMUNITY OF BUSINESS APRIL 7-13, 2014 EXECUTIVE DINING Restrained View on Q2 Top Public Cos. Total $134B OC Business Expectations (50 or higher indicates positive expectations) on 18.7% Gain in Market Cap 93.9 91.6 ECONOMY: 88.8 88.1 Allergan No. 1 85.2 again; Western Digital adds $9.6B 75 By MARK MUELLER 72.8 70.5 Orange County’s largest publicly traded companies com - bined for a cool $20 billion boost to their market valuations over the past year, thanks to strong gains by Allergan Inc. Q3/12 Q4/12 Q1/13 Q2/13 Q3/13 Q4/13 Q1/14 Q2/14 and Western Digital Corp. , the largest representatives of the local healthcare and technology sectors. Provenance: pEasgtbelu 2ff 2 The 100 largest public companies based here account for CSUF Index: Outlook $134 billion in market value overall, according to the Busi - 100 for 2014: Ł Public Cos. 13 list starts on page 10 About Flat for Q2 LUXURY HOMES ECONOMY: Continues to ease off all-time high notched last year Pyott’s Place: Not Big Pharma By JANE YU CEO: Cash-Pay Lines, Less Bureaucracy Set Allergan Apart Orange County business owners and executives enter the second quarter with a virtually un - By VITA REED T changed outlook on the economy, according to the latest quarterly index of business expectations Call Allergan Inc. -

INSTITUTION Congress of the US, Washington, DC. House Committee

DOCUMENT RESUME ED 303 136 IR 013 589 TITLE Commercialization of Children's Television. Hearings on H.R. 3288, H.R. 3966, and H.R. 4125: Bills To Require the FCC To Reinstate Restrictions on Advertising during Children's Television, To Enforce the Obligation of Broadcasters To Meet the Educational Needs of the Child Audience, and for Other Purposes, before the Subcommittee on Telecommunications and Finance of the Committee on Energy and Commerce, House of Representatives, One Hundredth Congress (September 15, 1987 and March 17, 1988). INSTITUTION Congress of the U.S., Washington, DC. House Committee on Energy and Commerce. PUB DATE 88 NOTE 354p.; Serial No. 100-93. Portions contain small print. AVAILABLE FROM Superintendent of Documents, Congressional Sales Office, U.S. Government Printing Office, Washington, DC 20402. PUB TYPE Legal/Legislative/Regulatory Materials (090) -- Viewpoints (120) -- Reports - Evaluative/Feasibility (142) EDRS PRICE MFO1 /PC15 Plus Postage. DESCRIPTORS *Advertising; *Childrens Television; *Commercial Television; *Federal Legislation; Hearings; Policy Formation; *Programing (Broadcast); *Television Commercials; Television Research; Toys IDENTIFIERS Congress 100th; Federal Communications Commission ABSTRACT This report provides transcripts of two hearings held 6 months apart before a subcommittee of the House of Representatives on three bills which would require the Federal Communications Commission to reinstate restrictions on advertising on children's television programs. The texts of the bills under consideration, H.R. 3288, H.R. 3966, and H.R. 4125 are also provided. Testimony and statements were presented by:(1) Representative Terry L. Bruce of Illinois; (2) Peggy Charren, Action for Children's Television; (3) Robert Chase, National Education Association; (4) John Claster, Claster Television; (5) William Dietz, Tufts New England Medical Center; (6) Wallace Jorgenson, National Association of Broadcasters; (7) Dale L. -

An Introduction to Toys and Childhood in 2006, the US Toy Industry Earned

1 Chapter One Toys Make a Nation: An Introduction to Toys and Childhood In 2006, the US toy industry earned a whopping $22.3 billion in domestic retail sales, with nearly half those sales earned during the fourth quarter – the all important Christmas toy shopping season.1 Despite this seemingly impressive sales figure, not everyone in the industry was pleased with their annual sales. Mattel, the world’s largest toy manufacturer, continued to see sales of its iconic Barbie doll falter, a trend that was in part blamed on the introduction of a series of rival dolls called Bratz in 2001. To add insult to injury, the Bratz dolls were designed by a former Mattel employee, Carter Bryant. He reportedly developed the idea for Bratz in between stints at Mattel, while he observed teenagers in his hometown of Springfield, Missouri. His idea was a line of fashion dolls that dress like contemporary teenagers, including a heavy dose of teenage attitude.2 Bryant never shared his idea with Mattel, and instead sold the concept to MGA Entertainment, a small family-owned toy company in California. Make no mistake, the toy business is not just fun and games. Indeed, it is a hypercompetitive industry, striking for its secretive product development practices and the occasional accusations of corporate espionage that seem more fitting for military contractors than toymakers. Thus, it was no surprise when Mattel filed lawsuits against Bryant in 2004 and MGA in 2006 primarily based on the claim that any of Bryant’s designs developed while he worked for Mattel are legally theirs. -

There's No Business Like Snow Business PAGE2B DAILY NEXUS THURSDAY

There's No Business Like Snow Business PAGE2B DAILY NEXUS THURSDAY. NOVEMBER20. 1980 Haute Couture ■ Slope fashions Revealed . The era of the super-hot,$ clusive Nexus interview. LeBlanc: Oh, }oui. They super-fashionable, super-e Nexus: What makes you have been creating quite a xpensive ski outfit was think that American skiers sensation at all of the finest thought to have passed us are ready f°r high-fashion European ski resorts. by. These past few years, the ski clothes? Nexus: Which retail best skiers on the slopes LeBlanc: Well, as you chains have you negotiated were more likely to be know, I began my clothing w i^ to carry your fine? wearing a faded pair of empire by designing high- LeBlanc: None what Levi’s bellbottoms and a fashion jeans.' It was for soever. My line of ski wear is ■ m windbreaker than a form- midable. The more we far too exclusive to be sold fitting, meticulously changed, the more we sold- over ‘ the counter. Qur detailed, eye-catching en Naturally, we assume that designers and construction semble. However, thanks to skiers have tbe same sen people accept personal the efforts of noted French sibilities as jeans wearers, orders only; my un designer Jean-Claude Remy but a lot more money. It’s derstanding is that, at this LeFIeur LeBlanc, the well- just good business logic, no? time. there is a waiting list of dressed skiier n»ay be Nexus: Haye the approximately six years per making 3 comeback. prototypes of your new line item. LeBlanc discussed his new of clothes already made Nexus: I see. -

Finding Aid to the Sid Sackson Collection, 1867-2003

Brian Sutton-Smith Library and Archives of Play Sid Sackson Collection Finding Aid to the Sid Sackson Collection, 1867-2003 Summary Information Title: Sid Sackson collection Creator: Sid Sackson (primary) ID: 2016.sackson Date: 1867-2003 (inclusive); 1960-1995 (bulk) Extent: 36 linear feet Language: The materials in this collection are primarily in English. There are some instances of additional languages, including German, French, Dutch, Italian, and Spanish; these are denoted in the Contents List section of this finding aid. Abstract: The Sid Sackson collection is a compilation of diaries, correspondence, notes, game descriptions, and publications created or used by Sid Sackson during his lengthy career in the toy and game industry. The bulk of the materials are from between 1960 and 1995. Repository: Brian Sutton-Smith Library and Archives of Play at The Strong One Manhattan Square Rochester, New York 14607 585.263.2700 [email protected] Administrative Information Conditions Governing Use: This collection is open to research use by staff of The Strong and by users of its library and archives. Intellectual property rights to the donated materials are held by the Sackson heirs or assignees. Anyone who would like to develop and publish a game using the ideas found in the papers should contact Ms. Dale Friedman (624 Birch Avenue, River Vale, New Jersey, 07675) for permission. Custodial History: The Strong received the Sid Sackson collection in three separate donations: the first (Object ID 106.604) from Dale Friedman, Sid Sackson’s daughter, in May 2006; the second (Object ID 106.1637) from the Association of Game and Puzzle Collectors (AGPC) in August 2006; and the third (Object ID 115.2647) from Phil and Dale Friedman in October 2015. -

View Annual Report

The toPower Entertain 1998 Hasbro, Inc. Annual Report Financial Highlights (Thousands of Dollars and Shares Except Per Share Data) 1998 1997 1996 1995 1994 FOR THE YEAR Net revenues $3,304,454 3,188,559 3,002,370 2,858,210 2,670,262 Operating profit $ 324,882 235,108 332,267 273,572 295,677 Earnings before income taxes $ 303,478 204,525 306,893 252,550 291,569 Net earnings $ 206,365 134,986 199,912 155,571 175,033 Cash provided by operating activities $ 126,587 543,841 279,993 227,400 283,785 Cash utilized by investing activities $ 792,700 269,277 127,286 209,331 244,178 Weighted average number of common shares outstanding (1) Basic 197,927 193,089 195,061 197,272 197,554 Diluted 205,420 206,353 209,283 210,075 212,501 EBITDA (2) $ 514,081 541,692 470,532 434,580 430,448 PER COMMON SHARE (1) Net earnings Basic $ 1.04 .70 1.02 .79 .89 Diluted $ 1.00 .68 .98 .77 .85 Cash dividends declared (3) $ .21 .21 .18 .14 .12 Shareholders’ equity $ 9.91 9.18 8.55 7.76 7.09 AT YEAR END Shareholders’ equity $1,944,795 1,838,117 1,652,046 1,525,612 1,395,417 Total assets $3,793,845 2,899,717 2,701,509 2,616,388 2,378,375 Long-term debt $ 407,180 — 149,382 149,991 150,000 Debt to capitalization ratio .29 .06 .14 .15 .14 NET REVENUES EARNINGS 3,304 3,189 3,002 227 2,858 220 2,670 200 183 206 175 175 156 135 Special Charges (4) Reported Earnings 1994 1995 1996 1997 1998 1994 1995 1996 1997 1998 (1) Adjusted to reflect the three-for-two stock split declared on February 19, 1999 and paid on March 15, 1999. -

Extrait Du Extrait Du Supplement Formateur Ment Formateur Ment

Conseil et Relation Annonceur BTS Communication Extrait du SuppleSupplementment formateur Table des applications complémentairescomplémentaires,, exercices et points pratiques. Table des applications complémentairescomplémentaires,, exercices et points pratiques. Réaliser un diagnostic basé sur l’étude documentaire ................................................................ ................................ La stratégie du groupe Rossignol en regardant 5 ans après ................................................................ ............................ Application : Choisir un support de presse avec les échelles… ................................................................ ....................... Correction, choisir un support de presse avec les échelles… ................................................................ .......................... Travailler une zone de chalandise et une opération promotionnelle ................................................................ ............... Correction : Travailler une zone de chalandise et une opération promotionnelle ................................ ........................... Quelques significations acquises ................................................................................................ ................................ Correction : quelques significations acquises ................................................................................................ .................. Communication et stratégie relationnelle ............................................................................................... -

Footwear Fw21 Another Best Day

FOOTWEAR FW21 ANOTHER BEST DAY A KEY PIECE FOR ALL MEN’S AND WOMEN’S WARDROBE, THE ROSSIGNOL SHOES ARE THE MUST-HAVE OF THE SEASON. The new Rossignol fall-winter 2122 footwear collection is versatile, designed to adapt to ongoing transfers between different scenarios,in the mountains as well as in the city. 3 PRODUCT LINES AUCKLAND ICONIC CHAMONIX Designed to wear on snowy trails or icy streets, the men’s Chamonix boots and the women’s Megève and Courchevel ones combine mountain-ready technical fea- tures and refined good looks. The line is completed by the new Buf- falo boots. They’re made of full grain leather with a breathable waterproof membrane and lightweight insu- lation, so feet stay warm and dry. BUFFALO The rugged rubber outsole provides reliable traction on ice and snow. Emblematic boots, from the slopes to the streets. MEGÈVE AUCKLAND BOOTS TECHNOLOGIES WATERPROOF INSULATION The Hdry® membrane is thermally bonded on the entire Wintherm® technology enables active thermal insulation. inner surface of the shoe to create a waterproof and brea- The fibers that make up the linings prevent the dispersion thable barrier. The possible entry points of the water are of the heat while an aluminium microfilm reflects the heat therefore eliminated. towards its source, that is to say its user. SOLE & GRIP ACCUPRESSURE The camber sole like a ski profile allows a good apprehen- Relaxing sole with 3 pressure points to reduce the pain, sion of the grounds and a perfect grip on snow, ice and relax your foot and re-activate blood circulation. -

Markham Concepts, Inc. V. Hasbro, Inc., 355

United States Court of Appeals For the First Circuit No. 19-1927 MARKHAM CONCEPTS, INC.; LORRAINE MARKHAM, individually and in her capacity as trustee of the Bill and Lorraine Markham Exemption Trust and the Lorraine Markham Family Trust; SUSAN GARRETSON, Plaintiffs, Appellants, v. HASBRO, INC.; REUBEN KLAMER; DAWN LINKLETTER GRIFFIN; SHARON LINKLETTER; MICHAEL LINKLETTER; LAURA LINKLETTER RICH; DENNIS LINKLETTER; THOMAS FEIMAN, in his capacity as co-trustee of the Irvin S. and Ida Mae Atkins Family Trust; ROBERT MILLER, in his capacity as co-trustee of the Irvin S. and Ida Mae Atkins Family Trust; MAX CANDIOTTY, in his capacity as co-trustee of the Irvin S. and Ida Mae Atkins Family Trust, Defendants, Appellees, IDA MAE ATKINS, Defendant. APPEAL FROM THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF RHODE ISLAND [Hon. William E. Smith, U.S. District Judge] Before Thompson, Lipez, and Kayatta, Circuit Judges. Robert M. Pollaro, with whom David Cole, John T. Moehringer, and Cadwalader, Wickersham & Taft LLP were on brief, for appellants. Joshua C. Krumholz, with whom Courtney L. Batliner, Mark T. Goracke, Patricia K. Rocha, Holland & Knight LLP, and Adler Pollock & Sheehan P.C. were on brief, for appellee Hasbro, Inc. Patricia L. Glaser, with whom Erica J. Van Loon, Joshua J. Pollack, Thomas P. Burke Jr., Lathrop GPM LLP, and Glaser Weil Fink Howard Avchen & Shapiro LLP were on brief, for appellee Reuben Klamer. Christine K. Bush, Ryan M. Gainor, David B. Jinkins, Hinckley, Allen, & Snyder LLP, and Thompson Coburn LLP on brief for appellees Max Candiotty, Thomas Feiman, Dawn Linkletter Griffin, Laura Linkletter Rich, Dennis Linkletter, Michael Linkletter, Sharon Linkletter, and Robert Miller. -

THEY CAME to PLAY 100 Years of the Toy Industry Association

THEY CAME TO PLAY 100 Years of the Toy Industry Association By Christopher Byrne The Hotel McAlpin in New York was the site of the Association’s inaugural meeting in 1916. Contents 4 6 Foreword Introduction 8 100 Years of the Toy Industry Association Graphic Timeline 30 12 Chapter 2: Policy and Politics Chapter 1: Beginnings • Shirley Temple: The Bright Spot 32 and Early Days in the Great Depression • World War II and the Korean War: 33 • A Vision Realized, An Association Formed 12 Preserving an Industry • Early Years, Early Efforts 20 • Mr. Potato Head: Unlikely Cold War Hero 38 • Playing Safe: The Evolution of Safety Standards 39 • Creepy Crawlers: Rethinking a Classic 46 • TV Transforms the Industry 47 • Tickle Me Elmo and His TV Moment 51 2 64 Chapter 4: A Century of Growth and Evolution • A Century of Expansion: From TMUSA to TIA 65 • Supporting the Business of Toys 68 • Educating an Industry 73 • Creating Future Toy Designers 74 82 • Rewarding the Industry 75 Conclusion: • Worldwide Reach and Global Impact 76 Looking to the Future • Government Affairs 78 • Philanthropy 80 52 Chapter 3: Promoting Play– 84 A Consistent Message Appendix I: For 100 Years Toy Industry Hall 12 2 of Fame Inductees Appendix II: Toy Industry Association Chairmen 3 Foreword In the spring of 1916, a small group of toy manufacturers gathered in the heart of New York City to discuss the need to form an association. Their vision was to establish an organization that would serve to promote American-made products, encourage year-round sales of toys, and protect the general interests of the burgeoning U.S.