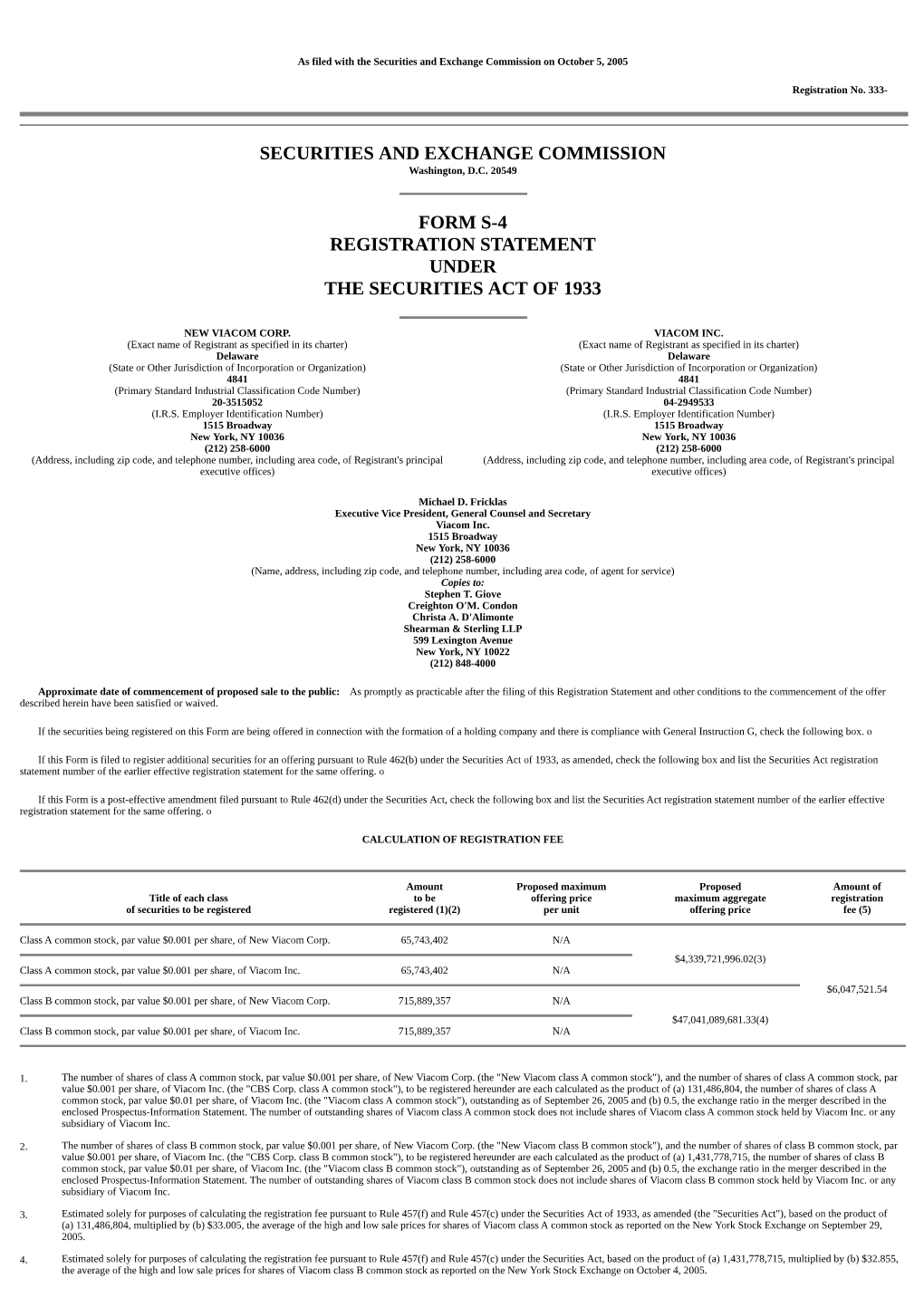

Securities and Exchange Commission Form S-4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KMPS KZOK KJAQ Money Maker 2012-FINAL

KMPS-FM 94.1 / KZOK-FM 102.5 / KJAQ-FM 96.5 KMPS / KZOK / KJAQ- MONEY MAKER OFFICIAL RULES NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCE OF WINNING. 1. HOW TO ENTER a. These rules govern the Money Maker promotion (the “Promotion”) being conducted by KMPS-FM, KZOK-FM, and KJAQ-FM (collectively the “Station”) beginning on July 14, 2012 at 10:00am Pacific Time (“PT”) and ending on Tuesday November 13, 2012 at 10:59pm PT. b. To participate in the Promotion, you must listen to either KMPS-FM, KZOK-FM, or KJAQ-FM each Monday beginning on July 14, 2012 and ending on Tuesday November 13, 2012 between the hours of 6:00am PT to 11:59pm PT each Monday for the announcement of the location of the “Money Maker” vehicle which displays the “key word of the week”. Upon finding the “Money Maker” vehicle, listeners must text the “key word of the week” to the KMPS short code, 54994. Upon texting in the “key word of the week” one (1) winner will be chosen on the following Tuesday to win a Qualifying Prize upon confirmation of eligibility. At the time of notification for qualifying, the potential prize winner will be required to provide all information requested including their full name, complete address (including zip code), day and evening phone numbers and date of birth in order to be eligible to win. In the event that the selected caller is disconnected or is found to be ineligible, the next eligible text will be a winner. -

Media Ownership Chart

In 1983, 50 corporations controlled the vast majority of all news media in the U.S. At the time, Ben Bagdikian was called "alarmist" for pointing this out in his book, The Media Monopoly . In his 4th edition, published in 1992, he wrote "in the U.S., fewer than two dozen of these extraordinary creatures own and operate 90% of the mass media" -- controlling almost all of America's newspapers, magazines, TV and radio stations, books, records, movies, videos, wire services and photo agencies. He predicted then that eventually this number would fall to about half a dozen companies. This was greeted with skepticism at the time. When the 6th edition of The Media Monopoly was published in 2000, the number had fallen to six. Since then, there have been more mergers and the scope has expanded to include new media like the Internet market. More than 1 in 4 Internet users in the U.S. now log in with AOL Time-Warner, the world's largest media corporation. In 2004, Bagdikian's revised and expanded book, The New Media Monopoly , shows that only 5 huge corporations -- Time Warner, Disney, Murdoch's News Corporation, Bertelsmann of Germany, and Viacom (formerly CBS) -- now control most of the media industry in the U.S. General Electric's NBC is a close sixth. Who Controls the Media? Parent General Electric Time Warner The Walt Viacom News Company Disney Co. Corporation $100.5 billion $26.8 billion $18.9 billion 1998 revenues 1998 revenues $23 billion 1998 revenues $13 billion 1998 revenues 1998 revenues Background GE/NBC's ranks No. -

TEXAS Library JOURNAL

TexasLibraryJournal VOLUME 88, NUMBER 1 • SPRING 2012 INCLUDES THE BUYERS GUIDE to TLA 2012 Exhibitors TLA MOBILE APP Also in this issue: Conference Overview, D-I-Y Remodeling, and Branding Your Professional Image new from texas Welcome to Utopia Notes from a Small Town By Karen Valby Last Launch Originally published by Spiegel Discovery, Endeavour, Atlantis and Grau and now available in By Dan Winters paperback with a new afterword Powerfully evoking the and reading group guide, this unquenchable American spirit highly acclaimed book takes us of exploration, award-winning into the richly complex life of a photographer Dan Winters small Texas town. chronicles the $15.00 paperback final launches of Discovery, Endeavour, and Atlantis in this stunning photographic tribute to America’s space Displaced Life in the Katrina Diaspora shuttle program. Edited by Lynn Weber and Lori Peek 85 color photos This moving ethnographic ac- $50.00 hardcover count of Hurricane Katrina sur- vivors rebuilding their lives away from the Gulf Coast inaugurates The Katrina Bookshelf, a new series of books that will probe the long-term consequences of Inequity in the Friedrichsburg America’s worst disaster. A Novel The Katrina Bookshelf, Kai Technopolis By Friedrich Armand Strubberg Race, Class, Gender, and the Digital Erikson, Series Editor Translated, annotated, and $24.95 paperback Divide in Austin illustrated by James C. Kearney $55.00 hardcover Edited by Joseph Straubhaar, First published in Jeremiah Germany in 1867, Spence, this fascinating Zeynep autobiographical Tufekci, and novel of German Iranians in Texas Roberta G. immigrants on Migration, Politics, and Ethnic Identity Lentz the antebellum By Mohsen M. -

OELMA Web.Version 11.08.Pmd

Fall 2007 Vol. 59, No. 1 1 Contents NCLB & The SKILLS ACT .............................................................................................4 NCLB & The No Child Left Inside Act ........................................................................5 Media Literacy by Frank Baker ................................................................................6 The Marantz Picture Book Collection Moves to Kent State University ...................8 The Story Box Project .............................................................................................10 The Big Read: an urban middle school “Big Read” Project illustrates the power of story .....................................................................................................................13 Bringing science concepts to life with literature ...................................................17 Got Rocks? The U.S. Polar Rock Repository does! Read about a unique educa- tional resource...................................................................................................21 The International Baccalaureate Programme and the School Librarian .............23 Call for Articles ........................................................................................................28 School Librarians Rock! Librarians’ powerful impact on literacy develop- ment....................................................................................................................29 Interactive Whiteboards and Clickers in the Classroom .......................................37 -

EM3 LIT Cross Cur Links Format 09-21-09 Sap

4th Grade Everyday Mathematics Cross-Curricular Literature Links EVERYDAY MATHEMATICS TITLE AUTHOR PUBLISHER, YEAR LESSON(S) Math Curse Scieszka, John Viking Children's, 2007 1.1 When a Line Ends…A Shape Begins Greene, Rhonda Gowler Sandpiper, 2001 1.2 Gregory and the Magic Line* Piggot, Dawn Orion, 2004 1.2 Shape Up! Adler, David A. Holiday House, 2000 1.3 The Greedy Triangle Burns, Marily Scholastic, 1995 1.5 Ed Emberley's Picture Pie: A Cut and Paste Drawing Book Emberley, Ed Little Brown, 2006 1.6 How Tall, How Short, How Far Away? Adler, David A. Holiday House, 2000 2.1 12 Ways to Get to 11 Merriam, Eve Aladdin Paperbacks, 1996 2.2 The History of Counting Schmandt-Besserat, Denise HarperCollins, 1999 2.3 If You Made a Million Schwartz, David M. HarperTrophy, 1994 2.3, 5.8 My Full Moon is Square Pinczes, Elinor J. Houghton Mifflin, 2002 3.2 Sea Squares Hulme, Joy N. Hyperion Books for Children, 1999 3.2 Count Your Way through the Arab World Jim Haskins Lerener Publishing Group, 1988 3.6 Each Orange Had Eight Slices: A Counting Book Giganti, Paul Jr. Greenwillow Books, 1999 3.2, 12.2 Safari Park Murphy, Stuart J. HarperCollins Publishers, 2002 3.5 Nine O'Clock Lullaby Singer, Marilyn HarperCollins, 1993 3.6 Kids' Funniest Jokes Barry, Shelia Anne Sterling Publishing Co., 1994 4.3 The Everything Kids' Joke Book: Side-Splitting, Rib-Tickling Fun Dahl, Michael Adams Media Corporation, 2001 4.3 Inchworm and a Half Pinczes, Elinor J. Houghton Mifflin Harcourt, 2003 4.8 Millions to Measure Schwartz, David M. -

Paramount Pictures and Dreamworks Pictures' "GHOST in the SHELL" Is in Production in New Zealand

April 14, 2016 Paramount Pictures and DreamWorks Pictures' "GHOST IN THE SHELL" is in Production in New Zealand HOLLYWOOD, Calif.--(BUSINESS WIRE)-- Paramount Pictures and DreamWorks Pictures have announced that production is underway on "GHOST IN THE SHELL," starring Scarlett Johansson ("AVENGERS: AGE OF ULTRON," "LUCY") and directed by Rupert Sanders ("SNOW WHITE AND THE HUNTSMAN"). The film is shooting in Wellington, New Zealand. This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160414005815/en/ Paramount Pictures will release the film in the U.S. on March 31, 2017. The film, which is based on the famous Kodansha Comics manga series of the same name, written and illustrated by Masamune Shirow, is produced by Avi Arad ("THE AMAZING SPIDER-MAN 1 & 2," "IRON MAN"), Ari Arad ("GHOST RIDER: SPIRIT OF VENGEANCE"), and Steven Paul ("GHOST RIDER: SPIRIT OF VENGEANCE"). Michael Costigan ("PROMETHEUS"), Tetsu Fujimura ("TEKKEN"), Mitsuhisa Ishikawa, whose animation studio Production I.G produced the Japanese "GHOST IN THE SHELL" film and television series, and Jeffrey Silver ("EDGE OF TOMORROW," "300") will executive produce. Scarlett Johansson plays the Major in Ghost in the Shell from Paramount Pictures Based on the internationally-acclaimed sci-fi and DreamWorks Pictures in Theaters March 31, 2017. (Photo: Business Wire) property, "GHOST IN THE SHELL" follows the Major, a special ops, one-of-a-kind human-cyborg hybrid, who leads the elite task force Section 9. Devoted to stopping the most dangerous criminals and extremists, Section 9 is faced with an enemy whose singular goal is to wipe out Hanka Robotic's advancements in cyber technology. -

Gabriel Mann

GABRIEL MANN FEATURE FILMS HUMOR ME Danielle Renfrew Behrens, Ruth Pomerance, Emily Blavatnik, Fugitive Films Courtney Potts. Jamie Gordon, prods. Sam Hoffman, dir. TELEVISION SERIES THE MAYOR Jeremy Bronson, Dylan Clark, Daveed Diggs, Scott Stuber, ABC Jamie Tarses, exec prods. Score & Theme Jeremy Bronson, showrunner James Griffiths, dir. ROSEWOOD Marty Bowen, Wyck Godfrey, Todd Harthan, exec. prods. FBC / 20th Century Fox TV Todd Harthan, showrunner Score & Theme Richard Shepard, dir. RECTIFY Melissa Bernstein, Ray McKinnon, Mark Johnson, exec. prods. Sundance Channel / Gran Via Productions Ray McKinnon, showrunner Score Keith Gordon, dir. MODERN FAMILY Steven Levitan, Christopher Lloyd, exec. prods. ABC/ 20th Century Fox Television Jason Winer/Reggie Hudlin, dir. Score 3 CABALLEROS Sarah Finn, dir. Disney Online Co-Score ANGEL FROM HELL Tad Quill, exec. prod. CBS / CBS TV Studios Tad Quill, showrunner Score Don Scardino, dir. DR. KEN Jared Stern, John Davis, John Fox, ABC / Sony Pictures TV Mike Sikowitz, exec. prods. Score Mike Sikowitz, showrunner Scott Ellis, dir. SCHOOL OF ROCK Richard Linklater, Scott Rudin, Jim Armogida, Steve Nickelodeon / Paramount TV Armogida, exec. prods. Score THE CROODS Netflix / Dreamworks Animation Score THE KICKS Elizabeth Allen Rosenbaum, prod /dir. Amazon Studios / Picrow Prods Andrew Orenstein, showrunner Score THE MCCARTHYS Will Gluck, Brian Gallivan, Mike Sikowitz, exec. prods. CBS / Sony Pictures TV Mike Sikowitz, showrunner Score Andy Ackerman, dir. The Gorfaine/Schwartz Agency, Inc. (818) 260-8500 1 GABRIEL MANN MARRY ME David Caspe, Seth Gordon, Jamie Tarses, exec. prod. NBC / Sony Pictures TV David Caspe, showrunners Score Seth Gordon, dir. FRIENDS WITH BETTER LIVES Aaron Kaplan, exec. prod. CBS / 20th Century Fox Television Dana Klein, David Hemingson, showrunners Score & Theme TROPHY WIFE Lee Eisenberg, Emily Halpern, Sarah Haskins, exec. -

Communications Status Report for Areas Impacted by California Public Safety Power Shutoffs October 26, 2019

Communications Status Report for Areas Impacted by California Public Safety Power Shutoffs October 26, 2019 The following is a report on the status of communications services in geographic areas impacted by the power shutoffs as of October 26, 2019 at 11:30 a.m. EDT. This report incorporates network outage data submitted by communications providers to the Federal Communications Commission’s Disaster Information Reporting System (DIRS). DIRS is currently activated for 14 affected counties in California. Note that the operational status of communications services during the power shutoffs may evolve rapidly, and this report represents a snapshot in time. The following counties are in the current geographic area that is part of DIRS. California: Alpine, Amador, Butte, Calaveras, El Dorado, Napa, Nevada, Orange, Placer, San Diego, San Mateo, Sierra, Sonoma and Tehama As prepared by the Federal Communications Commission: October 26, 2019 11:30 a.m. EDT 911 Services The Public Safety and Homeland Security Bureau (PSHSB) learns the status of each Public Safety Answering Point (PSAP) through the filings of 911 Service Providers in DIRS, reporting to the FCC’s Public Safety Support Center, coordination with state 911 Administrators and, if necessary, direct contact with individual PSAPs. There are no outages affecting PSAPs in the disaster area. Wireless Services The following section describes the status of wireless communications services and restoration in the affected area, including the percentage of cell sites out of service for each county. The following tables provide cell sites out of service by county. The information shown was provided by the signatories to the Wireless Network Resiliency Framework Cooperative Agreement. -

Broadcasting Decision CRTC 2010-820

Broadcasting Decision CRTC 2010-820 PDF version Route reference: 2010-497 Additional references: 2010-497-1, 2010-497-2 Ottawa, 5 November 2010 Shaw Cablesystems Limited Various locations in British Columbia, Alberta, Saskatchewan and Manitoba Videon Cablesystems Inc. Edmonton, Alberta and Winnipeg, Manitoba The application numbers and locations are in the decision. Public Hearing in Calgary, Alberta 20 September 2010 Various Class 1 terrestrial broadcasting distribution undertakings in western Canada – Licence renewals and amendments The Commission renews the licensees’ broadcasting licences for their Class 1 terrestrial broadcasting distribution undertakings serving various locations in British Columbia, Alberta, Saskatchewan and Manitoba from 1 December 2010 to 31 August 2015. These short-term renewals will permit the Commission to review at an earlier date the licensees’ compliance with the Broadcasting Distribution Regulations and their conditions of licence. Additional considerations of the hearing Panel on alternative ways of dealing with non-compliance are attached. Introduction 1. The Commission received applications by Shaw Cablesystems Limited (Shaw) and Videon Cablesystems Inc. (Videon) (collectively, Shaw) to renew the broadcasting licences for their Class 1 terrestrial broadcasting distribution undertakings (BDUs) serving various locations in British Columbia, Alberta, Saskatchewan and Manitoba. The current licences expire 30 November 2010.1 2. As part of its applications, Shaw requested the deletion of the condition of licence imposed by the Commission at its last licence renewal requiring it to file monthly reports confirming that the sponsorship messages distributed on its community 1 The licences were renewed from 31 August to 30 November 2010 in Administrative renewals, Broadcasting Decision CRTC 2010-500, 22 July 2010. -

Insideradio.Com

800.275.2840 MORE NEWS» insideradio.com THE MOST TRUSTED NEWS IN RADIO THURSDAY, MARCH 5, 2015 Infinite Dial 2015: Radio’s Money Demo is driving online radio growth. Online radio gained ground in 2015 as listeners aged 25-54 tuned to the medium in record numbers. No longer just a habit for 12-24 year-olds, half of Americans aged 25- 54 listen weekly to AM/FM radio stations online or to streamed audio content available only on the internet, according to new findings from Edison Research and Triton Digital. Weekly listening among 25-54 year-olds increased by over a third during the past year. Online radio is now a majority activity and the gap between monthly and weekly listening is closing. Over half of the U.S. population (53%) now listens to online radio monthly and 44% tune in weekly. In fact, the percent that listen weekly has doubled during the past four years. As the medium matures, the impact of a new crop of older, more casual listeners may be impacting average time spent with it. For the first time since 2008, Edison reports a slight decrease in weekly time spent listening to online radio, from 13 hours, 19 minutes in 2014 to 12 hours, 53 minutes in 2015. However the total time consumed continues to rise. Usage is continuing to shift from desktops and laptops to smartphones. Nearly three quarters of weekly online radio listeners tune in on a smartphone, up from 66% last year. As listening on desktops (61%) and tablets (32%) declined slightly, streaming audio consumption on internet-connected TVs rose sharply, from 12% to 18% during the past year. -

Inside Tv Pg 7 01-03

The Goodland Daily News / Friday, January 3, 2003 7 Channel guide Legal Notice Prime time 2 PBS; 3 TBS; 4 ABC; 5 HBO; 6 CNN; 7 CBS; 8 NBC (KS); 11 TVLND; 12 Pursuant to K.S.A. 82a-1030, the board of directors of ESPN; 13 FOX; 15 MAX; 16 TNN; 18 the Northwest Kansas Ground water Management LIFE; 20 USA; 21 SHOW; 22 TMC; 23 Mammograms can District No. 4 will conduct on February 19, 2003 a TV MTV; 24 DISC; 27 VH1; 28 TNT; 30 public hearing in order to hear testimony regarding FSN; 31 CMT; 32 FAM; 33 NBC (CO); save your life. 34 NICK; 36 A&E; 38 SCI; 39 TLC; 40 If you are between 50-64 revisions to the 2003 operating budget. Said revisions FX; 45 FMC; 49 E!; 51 TRAV; 53 WB; you may qualify for a FREE consist of incorporating all 2002 unexpended funds 54 ESPN2; 55 ESPN News; 58 HIST; mammogram. into the previously approved 2003 operating budget. schedule 62 HGTV; 99 WGN. The hearing will begin at 11:30 a.m. central standard For more information time at the Comfort Inn, 2225 S. Range, Colby, Kan- regarding this program Friday Evening January 3, 2003 contact: sas. Copies of the proposed revised 2003 budget will 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 11:30 KLBY/ABC Tostitos Fiesta Bowl Local Local Local Dorendo Harrel be made available at the hearing site. Attest: Robin Deeds, GMD 4 Secretary KBSL/CBS Hack 48 Hours Local Late Show Late Late Show Local (785) 899-4888 KSNW/NBC Dateline NBC Local Tonight Show Conan Local KUSA/NBC Dateline NBC Law & Order: SVU Local Tonight Show Conan KDVR/FOX The Nutty Professor Local Local Local Local Local Local Cable Channels A&E No Mercy Third Watch Biography No Mercy AMC Smokey and the Bandit II Tales from Empire of the Ants Tales from CMT Living Proof: The Hank Williams, Jr. -

Off the Record

About the Center for Public Integrity The CENTER FOR PUBLIC INTEGRITY, founded in 1989 by a group of concerned Americans, is a nonprofit, nonpartisan, tax-exempt educational organization created so that important national issues can be investigated and analyzed over a period of months without the normal time or space limitations. Since its inception, the Center has investigated and disseminated a wide array of information in more than sixty Center reports. The Center's books and studies are resources for journalists, academics, and the general public, with databases, backup files, government documents, and other information available as well. The Center is funded by foundations, individuals, revenue from the sale of publications and editorial consulting with news organizations. The Joyce Foundation and the Town Creek Foundation provided financial support for this project. The Center gratefully acknowledges the support provided by: Carnegie Corporation of New York The Florence & John Schumann Foundation The John D. & Catherine T. MacArthur Foundation The New York Community Trust This report, and the views expressed herein, do not necessarily reflect the views of the individual members of the Center for Public Integrity's Board of Directors or Advisory Board. THE CENTER FOR PUBLIC INTEGRITY 910 17th Street, N.W. Seventh Floor Washington, D.C. 20006 Telephone: (202) 466-1300 Facsimile: (202)466-1101 E-mail: [email protected] Copyright © 2000 The Center for Public Integrity All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information and retrieval system, without permission in writing from The Center for Public Integrity.