Automotive in South Asia from Fringe to Global

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Agreements That Have Undermined Venezuelan Democracy Xxxxxxxxxxxxxxxxxxxxxxthe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements That Have Undermined Venezuelan Democracy

THE CHINA DEALS Agreements that have undermined Venezuelan democracy xxxxxxxxxxxxxxxxxxxxxxThe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements that have undermined Venezuelan democracy August 2020 1 I Transparencia Venezuela THE CHINA DEALS Agreements that have undermined Venezuelan democracy Credits Transparencia Venezuela Mercedes De Freitas Executive management Editorial management Christi Rangel Research Coordinator Drafting of the document María Fernanda Sojo Editorial Coordinator María Alejandra Domínguez Design and layout With the collaboration of: Antonella Del Vecchio Javier Molina Jarmi Indriago Sonielys Rojas 2 I Transparencia Venezuela Introduction 4 1 Political and institutional context 7 1.1 Rules of exchange in the bilateral relations between 12 Venezuela and China 2 Cash flows from China to Venezuela 16 2.1 Cash flows through loans 17 2.1.1 China-Venezuela Joint Fund and Large 17 Volume Long Term Fund 2.1.2 Miscellaneous loans from China 21 2.2 Foreign Direct Investment 23 3 Experience of joint ventures and failed projects 26 3.1 Sinovensa, S.A. 26 3.2 Yutong Venezuela bus assembly plant 30 3.3 Failed projects 32 4 Governance gaps 37 5 Lessons from experience 40 5.1 Assessment of results, profits and losses 43 of parties involved 6 Policy recommendations 47 Annex 1 52 List of Venezuelan institutions and officials in charge of negotiations with China Table of Contents Table Annex 2 60 List of unavailable public information Annex 3 61 List of companies and agencies from China in Venezuela linked to the agreements since 1999 THE CHINA DEALS Agreements that have undermined Venezuelan democracy The People’s Republic of China was regarded by the Chávez and Maduro administrations as Venezuela’s great partner with common interests, co-signatory of more than 500 agreements in the past 20 years, and provider of multimillion-dollar loans that have brought about huge debts to the South American country. -

Competing in the Global Truck Industry Emerging Markets Spotlight

KPMG INTERNATIONAL Competing in the Global Truck Industry Emerging Markets Spotlight Challenges and future winning strategies September 2011 kpmg.com ii | Competing in the Global Truck Industry – Emerging Markets Spotlight Acknowledgements We would like to express our special thanks to the Institut für Automobilwirtschaft (Institute for Automotive Research) under the lead of Prof. Dr. Willi Diez for its longstanding cooperation and valuable contribution to this study. Prof. Dr. Willi Diez Director Institut für Automobilwirtschaft (IfA) [Institute for Automotive Research] [email protected] www.ifa-info.de We would also like to thank deeply the following senior executives who participated in in-depth interviews to provide further insight: (Listed alphabetically by organization name) Shen Yang Senior Director of Strategy and Development Beiqi Foton Motor Co., Ltd. (China) Andreas Renschler Member of the Board and Head of Daimler Trucks Division Daimler AG (Germany) Ashot Aroutunyan Director of Marketing and Advertising KAMAZ OAO (Russia) Prof. Dr.-Ing. Heinz Junker Chairman of the Management Board MAHLE Group (Germany) Dee Kapur President of the Truck Group Navistar International Corporation (USA) Jack Allen President of the North American Truck Group Navistar International Corporation (USA) George Kapitelli Vice President SAIC GM Wuling Automobile Co., Ltd. (SGMW) (China) Ravi Pisharody President (Commercial Vehicle Business Unit) Tata Motors Ltd. (India) © 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved. Competing in the Global Truck Industry – Emerging Markets Spotlight | iii Editorial Commercial vehicle sales are spurred by far exceeded the most optimistic on by economic growth going in hand expectations – how can we foresee the with the rising demand for the transport potentials and importance of issues of goods. -

Ningbo Tuopu Group Co., Ltd. Annual Report 2020

Stock Code: 601689 Abbr.: Tuopu Group Ningbo Tuopu Group Co., Ltd. Annual Report 2020 April 2021 Ningbo Tuopu Group Co., Ltd. Annual Report 2020 Important Notes I. The Board of Directors, Board of Supervisors, Directors, Supervisors and Senior Management of Ningbo Tuopu Group Co., Ltd. hereby guarantee that the information presented in this report shall be authentic, accurate and complete and free of any false records, misleading statements or material omissions, and they will bear joint and several liability for such information. II. All directors attended the meeting of the Board of Directors. III. BDO China Shu Lun Pan Certified Public Accountants LLP (Special General Partnership) issued a standard and unqualified audit report for the Company. IV. Wu Jianshu, a person in charge of the Company, Hong Tieyang, an officer in charge of accounting work and accounting institution (Accounting Officer) hereby declare and warrant that the financial statements in the annual report are authentic, accurate, and complete. V. The profit distribution plan for the reporting period or the plan for converting public reserve funds into additional share capital after consideration by the Board of Directors As audited by BDO China Shu Lun Pan Certified Public Accountants LLP (Special General Partnership), Ningbo Tuopu Group Co., Ltd. (“The Parent Company”) realized a net profit at RMB 620,890,219.47 in 2020, after a statutory surplus reserve at RMB 62,089,021.95 is withdrawn at 10% of the realized net profit, the profit available for distribution in the year is RMB 558,801,197.52; with the undistributed profit at the beginning of the year at RMB 2,539,788,223.59 added, and the cash dividends at RMB 200,447,672.31 distributed in 2020 deducted, the cumulative profit available for distribution at the end of 2020 is RMB 2,898,141,748.80. -

L'expérience De Valeo

Séminaire Management de l’innovation n n n Séance du 21 novembre 2018 Comment un équipementier français organise ses activités en Chine : l’expérience de Valeo par n Édouard de Pirey n Vice-président du groupe de produits Systèmes d’électrification, Valeo En bref La Chine va vite, très vite. Usine du monde il y a deux décennies, elle est désormais une source majeure d’innovation, en particulier en matière d’intelligence artificielle, et elle bénéficie d’un marché intérieur en pleine expansion. Pour Valeo, équipementier mondialement reconnu pour ses technologies et présent en Chine depuis plus de vingt ans, le challenge est dorénavant de répondre aux exigences croissantes des constructeurs automobiles locaux, tout en s’intégrant aux nouvelles ambitions globales de l’empire du Milieu. Être chinois en Chine tout en restant un groupe international, développer localement des produits répondant aux exigences internationales les plus élevées, faire confiance et développer les compétences locales, tels sont les défis relevés aujourd’hui avec succès par Valeo Chine et ses équipes. Compte rendu rédigé par Pascal Lefebvre L’Association des Amis de l’École de Paris du management organise des débats et en diffuse les comptes rendus, les idées restant de la seule responsabilité de leurs auteurs. Elle peut également diffuser les commentaires que suscitent ces documents. Le séminaire Management de l’innovation est organisé avec le soutien de la Direction générale des entreprises (ministère de l’Économie et des Finances) et grâce aux parrains de l’École de Paris du management : Algoé 1 • Carewan 1 • Conseil régional d’Île-de-France • Danone • EDF • Else & Bang • ENGIE • FABERNOVEL • Fondation Roger Godino • Groupe BPCE • Groupe Caisse des Dépôts • Groupe OCP • GRTgaz • HRA Pharma 2 • IdVectoR 2 • IPAG Business School • L’Oréal • La Fabrique de l’industrie • MINES ParisTech • Ministère de l’Économie et des Finances – DGE • RATP • Renault-Nissan Consulting • SNCF • Thales • UIMM • Ylios 1 1. -

Package Africa*

Best automotive diagnostic tool on market! Date: 2021.09.28 Package Africa* List of supported car models *In case of programming of mileage or motohours, the software may be used only for repair purposes. However, in certain countries, the change of a value of an odometer (counter) or interference in correctness of his indications is prohibited under the threat of the penalties. In accordance with article 306a of the polish penal code, that is: “who changes the indica tion of the odometer of a motor vehicle or interferes in the correctness of its measurement is subject to imprisonment from 3 months to 5 years. The same penalty shall apply to anyone who commits another person to perform an act referred above.” CARS\ACURA\93C46 CARS\ACURA\93C56 V1 CARS\ACURA\93C56 V2 CARS\ACURA\ILX 93C66 CARS\ACURA\INTEGRA 93C66 CARS\ACURA\MDX\2000-2006 93C56 V1 CARS\ACURA\MDX\2000-2006 93C56 V2 CARS\ACURA\MDX\2007-2013 93C76 CARS\ACURA\MDX\2014... 93C66 CARS\ACURA\RDX\2008 93C66 CARS\ACURA\RDX\2013 93C66 CARS\ACURA\RDX\2019 93C86 CARS\ACURA\RDX\93C56 CARS\ACURA\RDX\93C66 CARS\ACURA\RL 93C66 CARS\ACURA\RSX\93C46 CARS\ACURA\RSX\93C66 CARS\ACURA\TL\93C46 CARS\ACURA\TL\93C66 CARS\ACURA\TL\93C86 CARS\ACURA\TSX\93C46 CARS\ACURA\TSX\93C66 CARS\ACURA\TSX\93C86 CARS\ALFA\147\147 93C86 CARS\ALFA\159\159 93C86 CARS\ALFA\166\166 2002... 93C56 CARS\ALFA\BRERA\BRERA 93C86 CARS\ALFA\ECU\EDC15 24C02 V1 CARS\ALFA\ECU\EDC15 SP08 CARS\ALFA\ECU\EDC16 95160 CARS\ALFA\ECU\EDC16 95640 CARS\ALFA\MITO\MITO 24C16 CARS\AUDI\A2 Page 1 Best automotive diagnostic tool on market! Date: 2021.09.28 CARS\AUDI\A3\(8L0) 6/1999...\Directly MM HC12 CARS\AUDI\A3\(8L0) 6/1999...\MAGNETI MARELLI CARS\AUDI\A3\(8L0) 6/1999...\VDO CARS\AUDI\A3\(8L0) 1996-5/1999\UK-NSI 93C56 CARS\AUDI\A3\(8L0) 1996-5/1999\VDO CARS\AUDI\A3\(8P0) 2003.. -

Guangzhou Automobile Group

China / Hong Kong Company Guide Guangzhou Automobile Group Version 6 | Bloomberg: 2238 HK Equity | 601238 CH Equity | Reuters: 2238.HK | 601238.SS Refer to important disclosures at the end of this report DBS Group Research . Equity 7 May 2019 Japanese JCEs leading growth H: BUY Last Traded Price (H) ( 7 May 2019):HK$8.14(HSI : 29,363) More clarity on JVs future strategy. Guangzhou Auto (GAC) and its Price Target 12-mth (H):HK$9.60 (17.9% upside) (Prev HK$17.86) Japanese JCE partners have agreed on key priorities to grow the business. The medium-term plans include capacity expansion and new A: HOLD model development (both traditional and new energy vehicles). Last Traded Price (A) ( 7 May 2019):RMB11.61(CSI300 Index : 3,721) Price Target 12-mth (A):RMB11.30 (2.7% downside) (Prev RMB21.71) Another key factor is that both partners have agreed to maintain the current shareholding structure, hence removing uncertainties. The Analyst Rachel MIU+852 36684191 [email protected] Japanese auto brands have gained market share from 15.6% in December 2016 to 19% in February 2019 aided by their product What’s New range, pricing, and proactive business strategy. Despite the tough • More clarity on development of Japanese JCEs, key 1Q19 auto market, GAC’s Japanese JCEs managed to chalk up strong earnings driver in the future volume sales growth and decent profit contributions to the group. • Self-brand going through short-term adjustment and Where we differ? We expect normalisation of Trumpchi sales to have should start to normalise in 2H19 a meaningful impact on earnings, on anticipation of a recovery in • Maintain BUY, TP revised down slightly to HK$9.60 the PV market in 2H19. -

Chinese Carmakers Slash Sales Targets

16 | MOTORING Monday, March 23, 2020 HONG KONG EDITION | CHINA DAILY Nio bullish about its Short Torque BYD transforms lines business performance to support masks Many companies in China have transformed their businesses to despite coronavirus cater to the rising demand for masks amid the coronavirus epi- demic, and leading new energy By LI FUSHENG vehicle manufacturer BYD has [email protected] joined them. On Feb 17, BYD pro- duced its first batch of masks. Chinese electric car startup We are pleased to Each of its production lines can Nio is confident about its see encouraging make 50,000 masks a day, and in prospects this year despite the total five million masks and coronavirus outbreak, expecting results to date, and 300,000 bottles of disinfectant its gross profit margin to become expect around 35 can be made on a daily basis, positive in the second quarter. making the company one of the “Based on the current trend, percent expense biggest mask manufacturers in we would hope the daily new reduction compared the world. The company plans to order rate to return to the level of expand its production lines to a last December in April,” said to the prior quarter daily capacity of up to 10 million William Li, founder and chair- even under the masks. The masks will also be man of Nio, on an earnings call pressure of the provided to other countries hit last week. hard by the virus, after meeting He expected production, outbreak.” GAC showcases its Aion LX model in Shenzhen, Guangdong province last July. -

Poland Regional Cities-Comfort-Vehicle-List

Make Model Year Oldsmobile 19 Oldsmobile Alero Oldsmobile Aurora Oldsmobile Bravada Oldsmobile Cutlass Supreme Oldsmobile Intrigue Oldsmobile Silhouette Dodge Attitude Dodge Avenger 2013 Dodge Caliber Dodge Caravan 2015 Dodge Challenger Dodge Charger 2013 Dodge Dakota Dodge Dart 2015 Dodge Durango 2013 Dodge Grand Caravan 2015 Dodge Intrepid Dodge JCUV Dodge Journey 2013 Dodge Magnum 2013 Dodge Neon 2015 Dodge Nitro 2013 Dodge Ram 1500 Dodge Ram 2500 Dodge Ram 3500 Dodge Ram 4500 Dodge Ram 700 Dodge Ram Van 2015 Dodge Sprinter Dodge Stratus 2015 Dodge Stretch Limo Dodge Viper Dodge Vision Dodge i10 Land Rover Defender 2013 Land Rover Discovery 2013 Land Rover Freelander 2013 Land Rover Freelander 2 Land Rover LR2 Land Rover LR3 Land Rover LR4 Land Rover Range Rover 2013 Land Rover Range Rover Evoque 2013 Land Rover Range Rover Sport 2013 Land Rover Range Rover Velar 2013 Land Rover Range Rover Vogue 2013 Chevrolet Agile Chevrolet Astra 2015 Chevrolet Astro Chevrolet Avalanche 2013 Chevrolet Aveo Chevrolet Aveo5 Chevrolet Beat Chevrolet Blazer Chevrolet Bolt Chevrolet CMV Chevrolet Camaro Chevrolet Caprice Chevrolet Captiva 2013 Chevrolet Cavalier Chevrolet Celta Chevrolet Chevy Chevrolet City Express Chevrolet Classic Chevrolet Cobalt 2015 Chevrolet Colorado Chevrolet Corsa Chevrolet Corsa Sedan Chevrolet Corsa Wagon Chevrolet Corvette Chevrolet Corvette ZR1 Chevrolet Cruze 2015 Chevrolet Cruze Sport6 Chevrolet Dmax Chevrolet Enjoy Chevrolet Epica 2013 Chevrolet Equinox 2013 Chevrolet Esteem Chevrolet Evanda 2013 Chevrolet Exclusive Chevrolet -

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

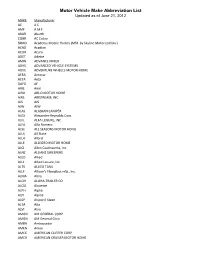

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

Chinese Investment in Europe: Corporate Strategies and Labour Relations

European Trade Union Institute Bd du Roi Albert II, 5 1210 Brussels Belgium +32 (0)2 224 04 70 [email protected] www.etui.org Chinese investment in Europe: corporate strategies and labour relations Edited by Jan Drahokoupil Chinese investment in Europe: China’s global outward foreign direct investment (FDI) has increased substantially over the corporate strategies last decade, with Europe as a key destination. The upsurge in Chinese outward FDI indicates a rebalancing of global political-economic relations, with China and its companies acquiring new and labour relations roles and gaining economic power. — Bringing together research on the rise of Chinese multinational companies and their activities in Europe, this book focuses on the business strategies of Chinese investors and on employment Edited by relations in Chinese-owned companies in Europe. It addresses the topic on three levels: it Jan Drahokoupil analyses the emergence of major ‘challenger multinationals’ that have risen from a peripheral position to become global market leaders, maps the patterns of Chinese investment in Europe, and includes case studies that show the diversity of these investments. The book aims to provide a holistic overview of Chinese activities in Europe, with individual chapters focusing on key sectors and covering the dierent types of investment across the continent. Chinese investment in Europe: in Europe: Chinese investment relations and labour strategies corporate by Jan Drahokoupil Edited D/2017/10.574/16 ISBN: 978-2-87452-454-7 Chinese investment in Europe: corporate strategies and labour relations Chinese investment in Europe: corporate strategies and labour relations — Edited by Jan Drahokoupil Brussels, 2017 © Publisher: ETUI aisbl, Brussels All rights reserved Print: ETUI Printshop, Brussels D/2017/10.574/16 ISBN: 978-2-87452-454-7 (print version) ISBN: 978-2-87452-455-4 (electronic version) The ETUI is financially supported by the European Union. -

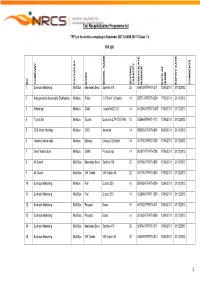

TRP Programme List July Revision 64

- 1 -Last saved by nthitemd - 1 -19 Taxi Recapitalization Programme list TRP List for vehicles complying to September 2007 & SANS 20107 Clause 7.6 TRP 2009 ISSUE DATE EXPIRY COMMENTS NO COMPANY CATEGORY NAME MODEL NAME SEATING CAPACITY CERTIFICATE NUMBER OF DATE 1 Bustruck Marketing Midi Bus Mercedes Benz Sprinter 518 22 556739-TRP07-0311 13/06/2011 31/12/2013 2 Amalgamated Automobile Distributors Minibus Foton 2.2 Petrol 13 Seater 14 550713-TRP07-0309 17/06/2011 31/12/2013 3 Whallinger Minibus CAM Inyathi XGD 2.2i 14 541394-TRPO7-0609 17/06/2011 31/12/2013 4 Toyota SA Minibus Toyota Quantum 2.7P 15S TAXI 15 555664-TRP07-1110 17/06/2011 31/12/2013 5 CCE Motor Holdings Minibus CMC Amandla 14 550826-TRP07-0609 20/06/2011 31/12/2013 6 Nanfeng Automobile Minibus Ekhaya Ekhaya 2.2i Hatch 14 551700-TRP07-0709 17/06/2011 31/12/2013 7 Great Wall motors Minibus GWM Proteus Mpi 14 551517-TRP07-0709 17/06/2011 31/12/2013 8 Mr Coach Midi Bus Mercedes Benz Sprinter 518 22 551798-TRP07-0809 17/06/2011 31/12/2013 9 Mr Coach Midi Bus VW Crafter VW Crafter 50 22 551799-TRP07-0809 17/06/2011 31/12/2013 10 Bustruck Marketing Minibus Fiat Ducato 250 16 551958-TRP07-0809 13/06/2011 31/12/2013 11 Bustruck Marketing Midi Bus Fiat Ducato 250 19 552898-TRP07-1209 13/06/2011 31/12/2013 12 Bustruck Marketing Midi Bus Peugeot Boxer 19 557082-TRP07-0411 13/06/2011 31/12/2013 13 Bustruck Marketing Midi Bus Peugeot Boxer 16 551959-TRP07-0809 13/06/2011 31/12/2013 14 Bustruck Marketing Midi Bus Mercedes Benz Sprinter 416 22 556740-TRP07-0311 13/06/2011 31/12/2013 15