Telecom Italia S.P.A. 2007 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enel Green Power, Sharp and Stmicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy

Enel Green Power, Sharp and STMicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy January 4, 2010 3:04 AM ET Enel Green Power, Sharp and STMicroelectronics join forces to produce innovative thin-film photovoltaic panels. The plant, located in Catania, Italy, is expected to have initial production capacity of 160 MW per year and is targeted to grow to 480 MW over the next years. In addition, Enel Green Power and Sharp will jointly develop solar farms focusing on the Mediterranean area, with a total installed capacity at a level of 500 MW, by the end of 2016. Geneva, January 4, 2010 – Today, Enel Green Power, Sharp and STMicroelectronics signed an agreement for the manufacture of triple-junction thin-film photovoltaic panels in Italy. At the same time, Enel Green Power and Sharp signed a further agreement to jointly develop solar farms. Today's agreement regarding the photovoltaic panel factory follows the Memorandum of Understanding signed in May 2008 by Enel Green Power and Sharp. STMicroelectronics has joined this strategic partnership. This agreement marks the first time that three global technology and industrial powerhouses have joined together in an equal partnership to contribute their unique value-add to the solar industry. It brings together Enel Green Power, with its international market development and project management know-how; Sharp, and its exclusive triple-junction thin-film technology, which will be operational in the mother plant in Sakai, Japan as of spring 2010; and STMicroelectronics, with its manufacturing capacity, skills and resources in highly advanced, hi-tech sectors such as microelectronics. -

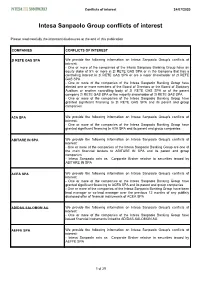

Intesa Sanpaolo Group Conflicts of Interest

Conflicts of interest 24/07/2020 Intesa Sanpaolo Group conflicts of interest Please read carefully the important disclosures at the end of this publication COMPANIES CONFLICTS OF INTEREST 2I RETE GAS SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have an equity stake of 5% or more in 2I RETE GAS SPA or in the Company that has a controlling interest in 2I RETE GAS SPA or are a major shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have elected one or more members of the Board of Directors or the Board of Statutory Auditors or another controlling body of 2I RETE GAS SPA or of the parent company 2I RETE GAS SPA or the majority shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to 2I RETE GAS SPA and its parent and group companies A2A SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to A2A SPA and its parent and group companies ABITARE IN SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group are one of the main financial lenders to ABITARE IN SPA and its parent and group companies - Intesa Sanpaolo acts as Corporate Broker relative to securities issued -

Exprivia – Italtel with Cisco

Company Presentation Borsa Italiana – Star Conference Milano, 27/28 Marzo 2018 Index • Exprivia today • Italtel today • 2017 Exprivia Financial Data • 2017 Italtel Financial Data • The New Group • Business Plan 2015-2020 update Index • Exprivia today • Italtel today • 2017 Exprivia Financial Data • 2017 Italtel Financial Data • The New Group • Business Plan 2015-2020 update Exprivia Today – Born in 2005 through the merge between Abaco Software (1987) and AISoftw@re (1983) – Group revenue 2017 of € 161.2 mln – About 2000 professionals – Listed on Italian Stock Exchange since 2000 – Presence in Europe, America and Asia An international ICT specialist, the Exprivia group leverages digital technologies to steer the business drivers of change for its customers 4 Exprivia Today Exprivia is specialized in Information and Communication Technology (ICT) , able to direct drivers of change for the business of its customers, thanks to digital technologies. Exprivia's offer covers the entire range of digital transformation processes thanks to the plurality of skills and the wealth of experience on the various reference markets: Banking, Finance & Insurance , Telco & Media, Energy & Utilities, Aerospace & Defense, Manufacturing & Distribution, Healthcare and Public Sector. Exprivia supports its customers in defining new business models through the conception, development and integration of solutions based on consolidated and emerging technologies. 5 Exprivia Today Capital Market Credit & Risk Management IT Governance & Infrastructure Big Data & Analytics -

Cyta's Telecommunications Hub in the Eastern Mediterranean

CARRIER SERVICES Cyta’s Telecommunications Hub in the Eastern Mediterranean – a Telecommunications Corridor between Europe and the Middle East By Mr Christos Limnatitis, Manager, National and International Wholesale Market antennas, providing connectivity with major satellite systems such as Intelsat, Eutelsat, SES, Hylas, Thor, AsiaSat and Arabsat. Services offered range from satellite television on a permanent and occasional basis to international telephony, monitoring services, data and internet connectivity. The teleports also offer VSAT services, hosting services to third parties and serve as a video head-end for Cyta’s IPTV offering in the Cyprus market. Cytaglobal is particularly active in the area of international undersea fibre optic cables, providing wholesale products and services on a global basis. Taking advantage of the island’s strategic geographical position, Cytaglobal has developed an extensive undersea fibre optic cable network, which connects Cyprus with its neighbouring countries of Greece, Italy, Israel, Syria, Lebanon and Egypt and thereafter with the rest of the world. This cable network, uses state-of-the-art technology By Mr Christos Limnatitis, and full restoration and diversity and includes the following Manager, National and International Wholesale Market submarine fibre optic cable systems that land in Cyprus, at three separate Cytaglobal cable landing stations, namely yta, the leading telecommunications operator Ayia Napa, Pentaskhinos and Yeroskipos: in Cyprus, provides the full spectrum of ARIEL – a private cable subsystem consisting of a fibre Cadvanced telecommunication products and pair between Cyprus and Israel providing connectivity to services, covering fixed and mobile voice and data Israel and extending beyond to Western Europe through communications, Internet, IPTV, broadband and other existing networks. -

Italian Guidelines About Wind Turbine Sound: How to Improve Them And

Italian guidelines about wind turbine sound: PO. ID How to improve them and make them work better C001 Martina Repossi Alerion Clean Power S.p.A. – Milan (Italy) Abstract Critical topics about Italian landscape Wind turbines can produce unwanted sound (referred to as noise) during operation. The nature of sound As a matter of facts, Italian population density, at 197 inhabitants per square kilometre (ISTAT Report, 2013), depends on wind turbine design. Propagation of the sound is primarily a function of distance, but it can also be is higher than that of most Western European countries. However, the distribution of the population is widely affected by turbine placement, surrounding terrain, and atmospheric conditions. uneven. The most densely populated areas are the Po Valley (that accounts for almost a half of the national In Italy, unlike other European countries, we don’t have specific legislation about windmills sound population) and the metropolitan areas of Rome and Naples, while vast regions such as the Alps and measurement and noise limits from Law no.447 are not functional for noise verifical for wind farms. Public Apenins highlands, the island of Sardinia and the plateaus of Basilicata are very sparsely populated. health is an essential Constitutional right (art.32 from Italian Constitution: "la Repubblica tutela la salute come Besides that, Italian landscape is full of protected areas in order to guarantee environmental conservation. The fondamentale diritto dell'individuo e interesse della collettività”) and disagreements related to wind farms noise consequence is that designers need to adapt wind farms layouts to these constraints, also because most are actually recurring. -

Comissão Parlamentar De Inquérito - Cpi Da Telefonia

Assembléia Legislativa do Estado do Tocantins Coordenação de Assistência às Comissões COMISSÃO PARLAMENTAR DE INQUÉRITO - CPI DA TELEFONIA 7ª LEGISLATURA - 3ª SESSÃO LEGISLATIVA ATA DA QUARTA REUNIÃO EXTRAORDINÁRIA EM 13 DE DEZEMBRO DE 2013 Às noves horas, do dia treze de dezembro de dois mil e treze, reuniu-se a Comissão Parlamentar de Inquérito - CPI da Telefonia, no Plenarinho da Assembléia Legislativa, nesta Capital. A Senhora Presidente, Deputada Josi Nunes, sob a proteção de Deus, havendo número legal e em nome do povo tocantinense, declaro aberta a presente reunião da Comissão Parlamentar de Inquérito, com a presença dos Srs. Deputados Marcello Leis, Eli Borges, Carlão da Saneatins e eu, Josi Nunes, que presido a Comissão Parlamentar de Inquérito da Telefonia do Estado do Tocantins. Eu quero agradecer cada um por sua presença. Eu quero agradecer também a presença aos representantes das operadoras de telefonia: Da operadora Tim: agradeço ao assessor de comunicação da operadora Tim, Rafael Guimarães; executivo de relações institucionais da operadora Tim, Roger Monteiro; gerente executivo de relações institucionais norte-nordeste da Tim, Luiz Fortes; e a advogada da operadora Tim, Márcia Bonito. Da operadora Vivo: o assessor executivo da Diretoria de Relações Institucionais da operadora, Eduardo Leal Macedo, e gerente de vendas da operadora Vivo no Tocantins, Orlan Alves Cardoso. Da operadora Claro: Quero aqui agradecer a presença à advogada da operadora Claro no Tocantins, Luma Mayara, e ao gerente da filial da Claro, Rainer Oliveira da Cruz. Da operadora Oi: agradeço a presença ao diretor re relações institucionais no Distrito Federal, da Diretoria de Planejamento Executivo, João Antônio Monteiro Tavares; representante de relações institucionais da referida operadora no Estado do Tocantins, Cláudio Roberto; e o advogado da operadora Oi, Alexandre Nunes Cachoeira. -

A Situação Do Serviço De Telefonia Na Amazônia Ção Do Serviço De Telefoni a N Am Zôni a Si T U a Ção Do Serviço

Biblioteca Digital da Câmara dos Deputados Centro de Documentação e Informação Coordenação de Biblioteca http://bd.camara.gov.br "Dissemina os documentos digitais de interesse da atividade legislativa e da sociedade.” Câmara dos Deputados ação parlamentar A Situação do Serviço de Telefonia na Amazônia A SI T U A ÇÃO DO SERVIÇO DE TELEFONI A N A AM A ZÔNI A Comissão da Amazônia, Integração Nacional e de Desenvolvimento Regional Brasília ı 2010 Mesa da Câmara dos Deputados 53ª Legislatura – 4ª Sessão Legislativa 2010 Presidente Michel Temer 1O Vice-Presidente Marco Maia 2O Vice-Presidente Antônio Carlos Magalhães Neto 1O Secretário Rafael Guerra 2O Secretário Inocêncio Oliveira 3O Secretário Odair Cunha 4O Secretário Nelson Marquezelli Suplentes de Secretário 1O Suplente Marcelo Ortiz 2O Suplente Giovanni Queiroz 3O Suplente Leandro Sampaio 4O Suplente Manoel Junior Diretor-Geral Sérgio Sampaio Contreiras de Almeida Secretário-Geral da Mesa Mozart Vianna de Paiva ação parlamentar Câmara dos Deputados Comissão da Amazônia, Integração Nacional e de Desenvolvimento Regional A Situação do Serviço de Telefonia na Amazônia Audiência pública realizada pela Comissão da Amazônia, Integração Nacional e de De- senvolvimento Regional so- bre a “A Situação do Serviço de Telefonia na Amazônia”, em 5 de maio de 2009, na Câmara dos Deputados. Centro de Documentação e Informação Edições Câmara Brasília | 2010 CÂMARA DOS DEPUTADOS DIRETORIA LEGISLATIVA Diretor Afrísio Vieira Lima Filho CENTRO DE DOCUMENTAÇÃO E INFORMAÇÃO Diretor Adolfo C. A. R. Furtado COORDENAÇÃO -

Configurazione

PROCEDURA CREAZIONE NUOVO APN (Access Point Name) per Tablet Hamlet XZPAD412LTE Nel caso la vostra SIM non dovesse effettuare correttamente l’accesso ad Internet, potrebbe essere necessario l’inserimento manuale dell’APN del vostro operatore. Nella guida qui di seguito riportata sono indicati i passaggi per creare un nuovo APN, nel nostro caso verrà configurata una SIM FASTWEB. 1. Accedere al menù impostazioni e selezionare l’opzione “RETE E INTERNET”. 2. Selezionare l’opzione “RETE MOBILE”. 3. Selezionare la voce “NOMI PUNTI DI ACCESSO”. 4. Toccare l’icona “+” in alto a destra per creare il nuovo APN. 5. Inserire nei vari campi le impostazioni del proprio operatore (far riferimento al punto 12 della presente guida). 6. Per salvare la corrente impostazione selezionare “…” in alto sulla destra e selezionare “SALVA”. 7. Nella schermata principale degli APN compatirà l’APN appena creato, premere la freccia in alto a sinistra per ritornare nel menù “RETE ED INTERNET”. 8. Selezionare “UTILIZZO DATI”. 9. Attivare l’opzione “DATI MOBILI”. 10. Confermare l’utilizzo dei dati mobili della nostra SIM premendo “OK”. 11. A questo punto la procedura di creazione e selezione dell’APN di connessione a Internet è completata. Per verificare che la connessione sia attiva verificare che in alto a destra vicino al segnale di ricezione del 4G/3G, appaia una seconda icona del segnale come da immagine qui sotto riportata. 12. Di seguito sono riportate le impostazioni degli APN di alcuni operatori, per maggiori dettagli è consigliato visitare il sito web del proprio operatore o contattare il servizio clienti per ottenere le informazioni aggiornate relative al corretto APN da utilizzare con la propria SIM. -

*** CONCLUSION of the OPTION PERIOD of AUTOGRILL S.P.A.'S

This announcement is not being made in and copies of it may not be released, published, distributed or sent, directly or indirectly, into the United States, the United Kingdom, Canada, Australia or Japan or in any other jurisdiction in which offers or sales would be prohibited by applicable law. This announcement does not constitute an offer of securities for sale or a solicitation of an offer to purchase or subscribe securities of Autogrill S.p.A. in the United States or any other jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such offer or solicitation. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended. Autogrill S.p.A. does not intend to register any of the securities in the United States or to conduct a public offering of the securities in the United States. Any public offering of securities to be made in the United States will be made by means of a prospectus that may be obtained from Autogrill S.p.A. and that will contain detailed information about the Company and management, as well as financial statements. There is no intention to register any securities referred to herein in the United States or to make a public offering of such securities in the United States. This communication does not constitute an offer of the Securities to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the Securities. -

Telecom Italia S.P.A. Relazione Primo Semestre 2007 0 2 E R T S E M E S O M I R P E N O I Z a L E R

Telecom Italia S.p.A. Relazione primo semestre 2007 Telecom ItaliaS.p.A.Telecom Relazioneprimosemestre2007 Relazione Gestione Governo SocietarioBilancio Consolidato Informazioni Contabili Capogruppo Altre informazioni Sommario Relazione Organi Sociali al 30 giugno 2007 2 sulla gestione Macrostruttura organizzativa del Gruppo Telecom Italia al 30 giugno 2007 5 Quadro regolatorio 7 Informazioni per gli investitori 10 Principali dati economico - finanziari del Gruppo Telecom Italia 12 Indicatori alternativi di performance 14 Commento ai principali dati economico - finanziari del Gruppo Telecom Italia 15 Riconciliazione del patrimonio netto consolidato e dell’utile netto consolidato con le corrispondenti voci della Capogruppo 30 Rapporti con parti correlate 31 Eventi successivi al 30 giugno 2007 31 Evoluzione della gestione: prospettive per l’esercizio in corso 31 Le Business Unit del Gruppo Telecom Italia 32 Domestic 34 European BroadBand 43 Mobile Brasile 47 Media 50 Olivetti 53 Altre attività 55 Sezione di Sostenibilità 57 Introduzione 57 Clienti 58 Fornitori 60 Concorrenti 62 Istituzioni 64 Ambiente 67 Comunità 69 – Attività di ricerca e sviluppo 71 Risorse Umane 74 Azionisti 79 RELAZIONE SUL GOVERNO SOCIETARIO - AGGIORNAMENTO SEMESTRALE 81 Bilancio Indice 88 Consolidato Stato patrimoniale Consolidato 89 infrannuale al Conto economico Consolidato 91 30 giugno 2007 del Gruppo Prospetto dei movimenti di Patrimonio Netto Consolidato 92 Telecom Italia Rendiconto finanziario Consolidato 94 Note al Bilancio Consolidato 96 Informazioni Indice -

Fondo Archivio Storico Italtel

Fondo Archivio storico Italtel Estremi cronologici: 1930 - 2000 Consistenza: Buste 155; fascicoli 852 Notizie sulla società La Siemens Società anonima nacque a Milano nel 1921 con capitali delle società tedesche Siemens & Halske Ag e Siemens Schuckertwerke Ag. Negli anni successivi alla rappresentanza commerciale per l'Italia dei prodotti della casa madre Siemens vengono affiancate attività di carattere industriale come la produzione di apparecchiature telefoniche, di motori elettrici e contatori. Nel 1943 l'azienda, assunto il nome di Siemens Società per azioni, acquisisce le fabbriche Olap (Officine lombarde apparecchi di precisione) e Isaria. Al termine del conflitto mondiale la Siemens Spa viene affidata in gestione, da parte del Comitato internazionale per la liquidazione dei beni tedeschi, al Ministero del Tesoro. Dopo cinque anni di amministrazione sequestrataria, nel 1950, la società passa sotto il controllo della Stet. Nel corso degli anni cinquanta la Siemens Spa viene rilanciata nella produzione di apparecchiature per le telecomunicazioni, macchinari elettrici, apparecchi radiofonici e elettrodomestici. Nel 1960 l'azienda assume la nuova denominazione sociale di Società italiana telecomunicazioni Siemens Spa (Sit-Siemens Spa) specializzandosi nel settore delle telecomunicazioni e dell'elettronica, trasferendo le altre produzioni alla Siemens Elettra Spa. Gli anni sessanta sono caratterizzati da un'espansione dell'azienda con la costruzione dello stabilimento di Santa Maria Capua Vetere e l'acquisizione degli stabilimenti di Palermo, L'Aquila e Catania. Nel 1965 è costituita la società controllata Italtel con la qualifica di "commissionaria per l'estero" della Sit-Siemens Spa. Agli inizi degli anni settanta l'azienda ha superato il numero di trentamila dipendenti, sono in funzione gli stabilimenti di: Milano San Siro, Milano Castelletto, L'Aquila via Pile, L'Aquila Boschetto, Terni, Santa Maria Capua Vetere, Palermo Villagrazia, Palermo Carini. -

The World of Autogrill 16

15 The world of Autogrill 16 (G4-4; G4-6; G4-7; G4-8; G4-9; G4-17; G4-56; G4-DMA) A-company The world of Autogrill Autogrill is the world leader in catering and retail services for travelers, with a consolidated leadership in the United States and Italy. Autogrill is present in 29 countries with approximately 54,000 workers and about Revenue by geographical area 2,800 points of sale in over 1,000 locations. It mainly operates through concession contracts in airports, railway stations, highways, city centers, malls, trade fairgrounds and cultural sites. 18.1% The Group offers consumers a comprehensive range, including both proprietary products and concepts (like Ciao, Bistrot, Bubbles, Beaudevin, La Tapenade) and third 7.1% 2014 47.0% party concepts and brands. The latter include both local and international brands (like Starbucks Coffee, Burger King, Brioche Dorée). The Group manages a portfolio of over 250 brands either directly or under licensing agreements. 27.8% Autogrill S.p.A. is listed on the Milan Stock Exchange and is controlled by North America Schematrentaquattro S.r.l. (50.1%), a company entirely owned by Edizione S.r.l., the Italy holding company controlled by the Benetton family. International Other European countries 17.5% 6.0% 2013 46.8% 29.7% Australia New Zealand Austria Poland Belgium Russia Canada Singapore Czech Republic Slovenia Denmark Spain Finland Sweden France Switzerland Germany The Netherlands Greece Turkey India United Arab Emirates Indonesia United Kingdom Ireland USA Italy Vietnam Malaysia Autogrill Group 17 Highlights euro 3,930.2 million revenues in 2014 euro 316.2 million EBITDA 8% on revenues euro 118.6 million EBIT euro 196.4 million net investments euro 693.3 million net financial position The world of Autogrill 54,408 employees 61% women, 88% of the Group personnel have a permanent labor contract 1 30% of employees are aged 21-30 “Feel good?” over 42,000 customer satisfaction interviews in 2014 “Do you Feel good?” 1.