COE Submission 2021.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vodafone: Expanding Access to Financial Services

Vodafone: Expanding Access to Financial Services Initiative Description In 2008, Vodafone joined the Business Call to Action (BCtA) with its pledge to increase access to financial services, drive small-scale enterprise, and stimulate economic growth in key emerging markets through its Vodafone Money Transfer platform known locally in Kenya, Tanzania, Fiji, Afghanistan, and South Africa as M-PESA or M-Paisa. Vodafone’s goal: • Expand access of Money Transfer platform in Kenya, Tanzania, South Africa, Fiji, and Afghanistan so that people can securely receive or transfer money Business Model Across the developing world, lack of access to basic financial services hinders economic growth and development. Informal, cash-based economies leave citizens vulnerable to risks and without a secure means of saving or transferring money. Experts estimate that roughly three billion people worldwide are unbanked.1 For the vast majority of this population, paying bills, saving money, or sending cash to family members in another village, is a dangerous, time consuming, and expensive prospect. With roughly two billion mobile phone users in developing countries, mobile money transfer and payment services provide a potential solution to connect the millions of people who do not have access to formal financial services. In 2005, Vodafone won a grant from the UK Department of International Development to develop a new application that specifically targeted the unbanked in Africa. Vodafone chose to pilot the project in Kenya, where over 70 percent of households did not have bank accounts, but many had access to a mobile phone.2 The goal was to provide a mobile application which offered a valuable service for an underserved market group of low-income consumers that had use of a mobile phone yet lacked access to financial services. -

What Makes a Successful Mobile Money Implementation

Becoming a member There are three types of GSMA membership: Full, Associate and Rapporteur. Full Membership Full Membership is open to licensed GSM mobile network operators. Associate Membership Associate Membership is open to designers, manufacturers and suppliers of GSM technology platforms. These might include anything from software and infrastructure, equipment and accessories, to billing, data, finance or security. Rapporteur Membership Rapporteur Membership is open to non-GSM licensed operators moving to LTE/HSPA or those wishing to roam on GSM. To find out how GSMA membership can benefit your business, or to apply today, visit www.gsmworld.com/membership or email [email protected] Mobile Money for the Unbanked For further information please contact [email protected] GSMA London Office 1st Floor, Mid City Place, 71 High Holborn, London WC1V 6EA, United Kingdom T +44 (0) 20 7759 2300 www.gsmworld.com/membership What Makes a Successful Mobile Money Implementation? Learnings from M-PESA in Kenya and Tanzania What makes a Successful Mobile Money Implementation? Learnings from M-PESA in Kenya and Tanzania Table of Contents Foreword 2 Introduction 3 Kenya and Tanzania 3 Urbanization 4 Economic Development 4 Access to Finance 4 Previous Methods of Money Transfer 5 The Service Providers – Safaricom and Vodacom 6 Ownership and Positioning 6 Market Share 6 Agent Network 7 Advertising 8 Fee Structure 9 Technology 9 Conclusions 10 Authors and References 11 01 What makes a Successful Mobile Money Implementation? Learnings from M-PESA in Kenya and Tanzania Foreword Contributed By: Paul Leishman, GSMA The mobile money community has watched (and 3. Product compared) the adoption of M-PESA in Kenya and Within the last three months, Vodacom introduced Tanzania with great interest. -

Swisscom Sustainability Report 2018

Sustainability Report 2018 Annual Report publications Annual Report 2018 Sustainability Report 2018 2018 at a glance The Annual Report, Sustainability Report and 2018 at a glance together make up Swisscom’s reporting on 2018. The three publications are available online at: swisscom.ch/report2018 “Inspiring people” concept The networked world offers countless opportunities that we canbegin to shape today. Top quality, groundbreaking innovation, deep-rooted commitment – we feel lucky to be able to inspire people and to lead them to embrace the opportunities that a networked future offers. The images used in our reporting show how and where we inspired people in 2018: from high in the Alps to people’s homes, in business and in our Swisscom Shops. A big thank-you to all who took the time to pose for these photographs: Pius and Jeanette Jöhl with their kids at the Oberchäseren alp, a houseshare with friends in Zurich (Seraina Cadonau, Anna Spiess, Linard Baer and Johannes Schutz), Ypsomed AG in Burgdorf, Stefan Mauron, our customer Jeannette Furter, and the entire crew at House of Swisscom in Basel. Corporate Responsibility Fulfilling the expectations of our stakeholder groups in a responsible manner. Introduction Stakeholders’ letter ............................................4 Sustainable environment ......................................5 Material issues ...............................................11 Corporate Priorities and objectives up until 2020 .........................13 Responsibility strategy Priorities and objectives up until -

Mobile Data Consumption Continues to Grow – a Majority of Operators Now Rewarded with ARPU

Industry analysis #3 2019 Mobile data – first half 2019 Mobile data consumption continues to grow – a majority of operators now rewarded with ARPU Taiwan: Unlimited is so last year – Korea: 5G boosts usage Tefficient’s 24th public analysis on the development and drivers of mobile data ranks 115 operators based on average data usage per SIM, total data traffic and revenue per gigabyte in the first half of 2019. tefficient AB www.tefficient.com 5 September 2019 1 The data usage per SIM grew for all; everybody climbed our Christmas tree. More than half of the operators could turn that data usage growth into ARPU growth – for the first time a majority is in green. Read on to see who delivered on “more for more” – and who didn’t. Speaking of which, we take a closer look at the development of one of the unlimited powerhouses – Taiwan. Are people getting tired of mobile data? We also provide insight into South Korea – the world’s leading 5G market. Just how much effect did 5G have on the data usage? tefficient AB www.tefficient.com 5 September 2019 2 Fifteen operators now above 10 GB per SIM per month Figure 1 shows the average mobile data usage for 115 reporting or reported1 mobile operators globally with values for the first half of 2019 or for the full year of 2018. DNA, FI 3, AT Zain, KW Elisa, FI LMT, LV Taiwan Mobile, TW 1) FarEasTone, TW 1) Zain, BH Zain, SA Chunghwa, TW 1) *Telia, FI Jio, IN Nova, IS **Maxis, MY Tele2, LV 3, DK Celcom, MY **Digi, MY **LG Uplus, KR 1) Telenor, SE Zain, JO 3, SE Telia, DK China Unicom, CN (handset) Bite, -

M-PESA: Mobile Money for the “Unbanked” Turning Cellphones Into 24-Hour Tellers in Kenya

Nick Hughes and Susie Lonie M-PESA: Mobile Money for the “Unbanked” Turning Cellphones into 24-Hour Tellers in Kenya In March 2007, Kenya’s largest mobile network operator, Safaricom (part of the Vodafone Group) launched M-PESA, an innovative payment service for the unbanked. “Pesa” is the Swahili word for cash; the “M” is for mobile. Within the first month Safaricom had registered over 20,000 M-PESA customers, well ahead of the targeted business plan. This rapid take-up is a clear sign that M-PESA fills a gap in the market. The product concept is very simple: an M-PESA customer can use his or her mobile phone to move money quickly, securely, and across great dis- tances, directly to another mobile phone user. The customer does not need to have a bank account, but registers with Safaricom for an M-PESA account. Customers turn cash into e-money at Safaricom dealers, and then follow simple instructions on their phones to make payments through their M-PESA accounts; the system provides money transfers as banks do in the developed world. The account is very secure, PIN-protected, and supported with a 24/7 service provided by Safaricom and Vodafone Group. The project faced formidable financial, social, cultural, political, technological, and regulatory hurtles. A public-sector challenge grant helped subsidize the invest- ment risk. To implement, Vodafone had to marry the incredibly divergent cultures of global telecommunications companies, banks, and microfinance institutions –and cope with their massive and often contradictory regulatory requirements. Finally, the project had to quickly train, support, and accommodate the needs of Two authors have written this case study, each taking up one part of the story. -

Leveraging Mobile Phones to Enable Basic Banking, Payments, and Economic Growth

DELIVERY NOTE April 2017 Leveraging Mobile Phones to Enable Basic Banking, Payments, and Economic Growth Context PROJECT DATA In the developed world, one barrier hindering the switch to mobile cash is SECTOR: the costly banking infrastructure—cash machines and bank branches. But in Financial Kenya, bank branches and ATMs are few. Before 2007, Kenyans had difficulty DEVELOPMENT CHALLENGE: transferring money, as there was no well-established, non-cash method for Lack of non-cash payment financial transactions. However, 83 percent of the population 15 years and older methods to support economic transactions had mobile phones with embedded SIM cards, a technology that can facilitate DELIVERY CHALLENGES: many things, including payment transactions. Stakeholder roles and responsibilities, business Development Challenge environment: technology and market, banking regulations Lack of a well-established, trusted, robust method other than cash for carrying COUNTRY: out financial transactions was limiting economic activity and job creation in Kenya Kenya. For the many Kenyans who work long distances from their places of PROJECT DURATION: 2005–2017 birth, the lack of an easy, cost-effective way to send money hampered work REGION: mobility and the ability for workers to send remittances back home. The lack Sub-Saharan Africa of easy access to basic banking account services hampered accumulation of This note was produced by Aldo savings for investment and payments. Morri at the World Bank, from an original case study published by the Centre for Public Impact The Intervention (CPI). To access the original case study, please click here: M-PESA, a mobile-payment scheme run by Vodafone, and Safaricom, Kenya’s largest operator (40 percent owned by Vodafone), created an alternative to banks. -

Safaricom Case Study

IBM Institute for Business Value Case Study The Essential Insights from the Global Chief Information CIO Officer Study Safaricom Making money mobile Safaricom is one of Kenya’s leading mobile network operators.1 It’s also 13.5 million transformed the way money moves around Kenya and made a big customers difference to millions of people’s lives with its mobile banking service, 2 and over 24,000 agent outlets since 2007 M-PESA (m is for mobile and pesa is the Swahili word for money). Most Kenyans don’t have bank accounts – and even when they do, they often have to travel miles to find a branch, since there are only 750 banking outlets in the entire country. But carrying cash is risky. M-PESA solves all these problems. It lets people without a bank account transfer funds quickly and easily via their mobile phones. Customers register with an M-PESA agent – usually a cell phone dealer, gas station, chemist, supermarket or shop – and buy electronic value (e-value), which they can then send, via secure text messages, to any other mobile phone user in Kenya. The recipient collects the cash by going to any M-PESA agent, entering a secret code and showing an ID. M-PESA has been hugely successful. It now has 13.5 million customers and has over 24,000 agent outlets since its launch in 2007.3 The service has also been extended to Tanzania, Afghanistan and South Africa, with trials underway in India. Safaricom itself has deservedly won numerous accolades for its pioneering vision – including, most recently, the Mobile Money for the Unbanked Award at this year’s Global Mobile Awards 2011.4 © Copyright IBM Corporation 2011 IBM Global Services Route 100 Somers, NY 10589 U.S.A. -

M-Pesa's Failure in India: Why Couldn't Vodafone Replicate Its Kenyan

The Kennesaw Journal of Undergraduate Research Volume 6 Issue 2 Article 2 Winter 2019 M-Pesa’s Failure in India: Why Couldn’t Vodafone Replicate its Kenyan Success? An International Marketing Case Study (Addendum by Former and Current Executives at the Vodafone Group) Jackson Lott Kennesaw State University, [email protected] Mona Sinha Kennesaw State University, [email protected] Follow this and additional works at: https://digitalcommons.kennesaw.edu/kjur Part of the E-Commerce Commons, International Business Commons, Marketing Commons, and the Technology and Innovation Commons Recommended Citation Lott, Jackson and Sinha, Mona (2019) "M-Pesa’s Failure in India: Why Couldn’t Vodafone Replicate its Kenyan Success? An International Marketing Case Study (Addendum by Former and Current Executives at the Vodafone Group)," The Kennesaw Journal of Undergraduate Research: Vol. 6 : Iss. 2 , Article 2. Available at: https://digitalcommons.kennesaw.edu/kjur/vol6/iss2/2 This Article is brought to you for free and open access by the Office of Undergraduate Research at DigitalCommons@Kennesaw State University. It has been accepted for inclusion in The Kennesaw Journal of Undergraduate Research by an authorized editor of DigitalCommons@Kennesaw State University. For more information, please contact [email protected]. M-Pesa’s Failure in India: Why Couldn’t Vodafone Replicate its Kenyan Success? An International Marketing Case Study (Addendum by Former and Current Executives at the Vodafone Group) Cover Page Footnote This case study has been prepared under the guidance of Dr. Mona Sinha in Spring 2018, as part of the coursework for the International Marketing (MKTG 4820) class at Kennesaw State University. -

Safaricom-Sdg-Case-Study.Pdf

KPMG Case Study Safaricom Limited Integrating the Sustainable Development Goals into Safaricom’s Corporate Strategy Transforming Lives Safaricom exists to ‘Transform Lives’. This purpose statement permeates every decision made by the company, and drives it to push the traditional boundaries of doing business in order to create value for society. Safaricom believes that the role of business extends far beyond making profits, which is why the company sees mobile telecommunications and its related products and services as a unique opportunity to improve the quality of life and contribute to sustainable livelihoods for people throughout Kenya. The assessment carried “I wanted us to ‘walk the talk’, ABOUT SAFARICOM out by KPMG in 2015 using integrating sustainability in a way KPMG’s True Value methodology that enhances our strategy and demonstrated the significant helps our business to deliver Safaricom Limited is the impact Safaricom has on the against our targets and mission. I largest mobile operator in the Kenyan economy, society wanted every employee, from my Kenyan market. It serves over and environment. The report Senior Leadership team to our shop 23 million customers: more concluded that the ‘true floor colleagues to understand and than two thirds of the Kenyan earnings’ of Safaricom were embrace sustainability.” market. Safaricom’s services more than ten times the value include mobile and fixed of the company’s financial Bob Collymore, CEO, Safaricom voice, SMS, data, internet earnings. and M-PESA, a mobile phone-based money transfer The findings from the True Value service with over 25 million Report were encouraging, but subscribers. as a company which takes its commitment to sustainability Over the past 3 years, seriously, Safaricom wanted to Safaricom has contributed an do more. -

Vodafone Revolutionises Roaming Rules

VODAFONE REVOLUTIONISES ROAMING RULES VODAFONE ALLOWS CUSTOMERS TO MAKE OVERSEAS CALLS AT DOMESTIC RATES Milan, May 17, 2005 – The Vodafone Group is about to revolutionise roaming prices, responding to customers’ demands for greater transparency and clarity when making or receiving calls whilst abroad. June 1 is to see the launch of Vodafone Passport, the first price plan forming part of the Group’s new Vodafone Travel Promise package. Vodafone Passport enables Vodafone customers who access the Group’s networks to make calls at domestic rates, paying just € 1.00 at the start of each call. The new offering provides Vodafone customers with greater transparency, giving better value for money and eliminating any doubts about cost effectiveness. When overseas Vodafone customers will thus be able to: • Call Italy: at the same prices charged for domestic calls, paying an additional €1.00 per call. • Receive calls: talking free of charge having paid a connection fee of just €1.00. “The nature of the Vodafone Group enables us to offer a veritable revolution in roaming services,” claimed Pietro Guindani, CEO of Vodafone Italia. “Vodafone Passport will make the customer feel at home in any country with a Vodafone network.” The new service will be available in Germany, Greece, Italy, the Netherlands, Spain, Sweden, Fiji and Japan from June 1. Hungary, Malta, Portugal, Ireland, the UK, Albania, Australia and New Zealand will introduce the price plan during the summer. Customers who use the SFR (France), Swisscom (Switzerland) and Proximus (Belgium) networks will also subsequently gain access. Vodafone Passport is the latest innovation created by the Vodafone Group with the aim of making it easier to make mobile calls when abroad and thus increase the use of roaming services. -

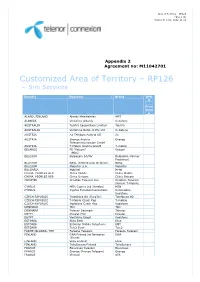

Customized Area of Territory – RP126 – Sim Services

Area of Territory – RP126 Page 1 (3) Version D rel01, 2012-11-21 Appendix 2 Agreement no: M11042701 Customized Area of Territory – RP126 – Sim Services Country Operator Brand GPR S Price Grou p ALAND, FINLAND Alands Mobiltelefon AMT ALBANIA Vodafone Albania Vodafone AUSTRALIA Telstra Corporation Limited Telstra AUSTRALIA Vodafone Network Pty Ltd Vodafone AUSTRIA A1 Telekom Austria AG A1 AUSTRIA Orange Austria Orange Telecommunication GmbH AUSTRIA T-Mobile Austria GmbH T-mobile BELARUS FE “Velcom” Velcom (MDC) BELGIUM Belgacom SA/NV Belgacom (former Proximus) BELGIUM BASE (KPN Orange Belgium) BASE BELGIUM Mobistar S.A. Mobistar BULGARIA Mobiltel M-tel CHINA, PEOPLES REP. China Mobile China Mobile CHINA, PEOPLES REP. China Unicom China Unicom CROATIA Croatian Telecom Inc. Croatian Telecom (former T-Mobile) CYPRUS MTN Cyprus Ltd (Areeba) MTN CYPRUS Cyprus Telecommunications Cytamobile- Vodafone CZECH REPUBLIC Telefónica O2 (EuroTel) Telefónica O2 CZECH REPUBLIC T-Mobile Czech Rep T-mobile CZECH REPUBLIC Vodafone Czech Rep Vodafone DENMARK TDC TDC DENMARK Telenor Denmark Telenor EGYPT Etisalat Misr Etisalat EGYPT Vodafone Egypt Vodafone ESTONIA Elisa Eesti Elisa ESTONIA Estonian Mobile Telephone EMT ESTONIA Tele2 Eesti Tele2 FAROE ISLANDS, THE Faroese Telecom Faroese Telecom FINLAND DNA Finland (fd Networks DNA (Finnet) FINLAND Elisa Finland Elisa FINLAND TeliaSonera Finland TeliaSonera FRANCE Bouygues Telecom Bouygues FRANCE Orange (France Telecom) Orange FRANCE Vivendi SFR Area of Territory – RP126 Page 2 (3) Version D rel01, 2012-11-21 GERMANY E-Plus Mobilfunk E-plus GERMANY Telefonica O2 Germany O2 GERMANY Telekom Deutschland GmbH Telekom (former T-mobile) Deutschland GERMANY Vodafone D2 Vodafone GREECE Vodafone Greece (Panafon) Vodafone GREECE Wind Hellas Wind Telecommunications HUNGARY Pannon GSM Távközlési Pannon HUNGARY Vodafone Hungary Ltd. -

European Telecoms the Digital Telco

European Telecoms The Digital Telco - a Big Data ‘re-rater’? Industry Overview Equity | 04 September 2017 New opportunities for Telco in a Digital World Europe Telecommunications So far Telco has been the facilitator of the digital revolution. But telco too must adapt as customer demands change, digital applications proliferate and new disruptive technologies and companies threaten traditional profits. However telco is well positioned to do so, in our view, thanks to its Big Data commodity. New processes, tools and techniques could see telco exploit Big Data to defend and upsell existing revenue streams, driving cost and capex efficiencies. Analysis suggests up to 30% value upside to Euro telco as a potential mid-term re-rating catalyst. Big Data questionnaire indicates Euro Telco progress We asked questions of 13 Euro Telcos on the subject of Big Data. Responses indicate to David Wright >> Research Analyst us that progress could already be significant; the majority of telcos who answered our MLI (UK) +44 20 7995 6355 questions shifted over the past 12m from inconclusive projects to NPV +ve results. Most [email protected] focus at this stage is on Customer Care and Sales & Marketing. However there is still a Haim Israel >> long way to go with most projects still regional and not yet coordinated at Group level. Research Analyst Merrill Lynch (Israel) [email protected] Boosting revenues through data growth and new avenues Frederic Boulan, CFA >> Digitalisation fuelled by Big Data analytics provides telco with a means to better offset Research Analyst MLI (UK) legacy revenue decline and upsell existing customer relationships, while exploring new [email protected] growth opportunities.