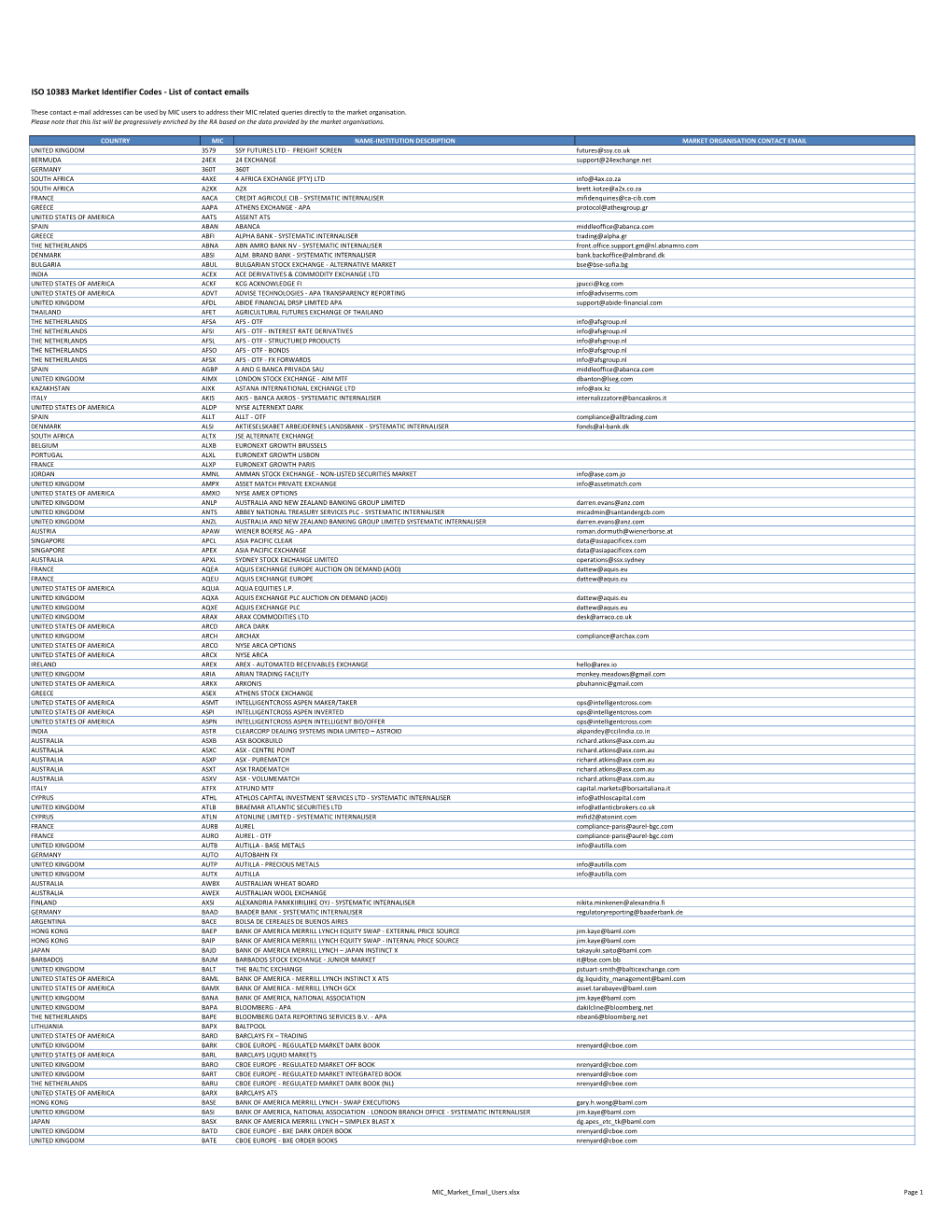

ISO 10383 Market Identifier Codes - List of Contact Emails

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Evaluation of Factors Contributing to the Stock Market Liquidity Constraints Or Companies Listed on the Namibian Stock Exchange

International Journal of Accounting Research (IJAR) Vol. 2, No. 8, 2015 Publisher: ZARSMI, UAE, and Regent Business School, South Africa AN EVALUATION OF FACTORS CONTRIBUTING TO THE STOCK MARKET LIQUIDITY CONSTRAINTS OR COMPANIES LISTED ON THE NAMIBIAN STOCK EXCHANGE Albert Mutonga Matongela Graduate of the Regent Business School, Durban Republic of South Africa External Supervisor Attached to the Regent Business School, Durban, Republic of South Africa Anis Mahomed Karodia akarodia@regent,ac.za Professor, Senior Academic and Researcher, Regent Business School, Durban, Republic of South Africa Abstract In 1992, the Namibian Stock Exchange (NSX) was established, amongst others, to facilitate investment in capital markets. Stakeholders have raised concerns that liquidity is low on the NSX. The African Economic Outlook has pointed out that the NSX faces the challenge of few locally issued securities and low liquidity. On its part, the Ministry of Finance is of the view that the NSX is characterized by low levels of liquidity. The aim of this research was to evaluate factors contributing to the stock market liquidity constraints for companies listed on the NSX. Key Words: Evaluation, Factors, Stock Exchange, Liquidity, Regulatory, Corporate Governance, Capital Markets Introduction Stock market liquidity is linked to savings mobilization, long-term capital investment, risk diversification, stock market development and economic growth (Ahmed, Shahbaz and Ali, 2008: 191; Antonios, 2010: 8; Omet, 2011: 4). Lack of liquidity is a serious impediment to the efficient functioning of stock markets and impacts stock prices adversely (Bokpin (2013: 2143). Liquidity is the ability to trade financial securities easily and at a low cost (Yartey, 2008: 16). -

External Borkers List

NORDEA INVESTMENT MANAGEMENT AB Approved broker list 2018 Global Head of Trading, Erling Skorstad 15/10/2018 Legal Name City of Domicile Country of Domicile LEI ABG Sundal Collier ASA Oslo Norway 2138005DRCU66B8BNY04 ABN Amro Group NV Amsterdam The Netherlands BFXS5XCH7N0Y05NIXW11 Arctic Securities AS Oslo Norway 5967007LIEEXZX4RVS72 Aurel BGC SAS Paris France 5RJTDGZG4559ESIYLD31 Australia and New Zealand Banking Group Limited Melbourne Australia JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP London UK 213800LBM6PT85IGM996 Banca IMI S.p.A Milan Italy QV4Q8OGJ7OA6PA8SCM14 Banco Bilbao Vizcaya Argentaria S.A Bilbao Spain K8MS7FD7N5Z2WQ51AZ71 Banco Português de Investimento, S.A. (BPI) Porto Portugal 213800NGLJLXOSRPK774 BANCO SANTANDER S.A Madrid Spain 5493006QMFDDMYWIAM13 Bank Vontobel AG Zurich Switzerland 549300L7V4MGECYRM576 Barclays Bank PLC London UK G5GSEF7VJP5I7OUK5573 Barclays Capital Securities Limited London UK K9WDOH4D2PYBSLSOB484 Bayerische Landesbank Munich Germany VDYMYTQGZZ6DU0912C88 BCS Prime Brokerage Limited London UK 213800UU8AHE2B6QUI26 BGC Brokers LP London UK ZWNFQ48RUL8VJZ2AIC12 BNP Paribas SA Paris France R0MUWSFPU8MPRO8K5P83 Carnegie AS Norway Oslo Norway 5967007LIEEXZX57BC18 Carnegie Investment Bank AB (publ) Stockholm Sweden 529900BR5NZNQZEVQ417 China International Capital Corporation (UK) Limited London UK 213800STG3UV87MDGA96 Citigroup Global Markets Limited London UK XKZZ2JZF41MRHTR1V493 Clarksons Platou Securities AS Oslo Norway 5967007LIEEXZXA40G44 CLSA (UK) London UK 213800VZMAGVIU2IJA72 Commerzbank AG Frankfurt -

The Impact of Lack Financial Services on the Growth of Libyan Small Businesses

4th International Conference on Humanities, Geography and Economics (ICHGE'2013) Oct. 6-7, 2013 Dubai (UAE) The Impact of Lack Financial Services on the Growth of Libyan Small Businesses Mukhtar E. Eltaweel, and Robin Bown finance more prominent. There is often a tendency to use Abstract—This article is about the impact of lack financial informal methods of finance where the access to formal services on the growth of Libyan small businesses. It is worth noting methods is constrained. The issue of time is important in the from the outset that the situation in Libya has changed as a result of provision of finance, and it may be that this is what the uprising. There are number of aspects of research that will lead to distinguishes the formal sector. The importance of time seems conclusions about the Libyan economic development. In this study, the findings have illustrated that small businesses in Libya face to focus around the issue of responsiveness; the speed at which problems in raising equity capital, due to government policy and also finance can be provided. due to small businesses themselves. The Libyan financial market is It has been proposed that SMEs in Libya, and have poor relatively small and is dependent on just the banking sector and a managerial, financial and marketing capabilities [6]. The same number of insurance companies. The Libyan stock market has been source notes that SMEs also lack economies of scale probably recently established and only lists a small number of large companies. due to the dominance of the petrochemical sector which It is reasonable to say that Libyan small businesses suffer from a lack of external sources of equity finance. -

Modernizing the Public Equity Market in Nepal

Framing the Issues: Modernizing the Public Equity Market in Nepal JOHN SCHELLHASE, STACI WARDEN ABOUT THE MILKEN INSTITUTE CONTENTS The Milken Institute is a nonprofit, nonpartisan think tank. 2 INTRODUCTION AND OVERVIEW For the past three decades, the Milken Institute has served as a catalyst for practical, scalable solutions to global challenges by connecting human, financial, and 5 PART I FOUNDATIONS FOR CAPITAL MARKET DEVELOPMENT: educational resources to those who need them. Guided by a conviction that the POLITICAL AND MACROECONOMIC STABILITY AND A STRONG, STABLE BANKING SECTOR best ideas, under-resourced, cannot succeed, we conduct research and analysis and convene top experts, innovators, and influencers from different backgrounds and 7 Political and Macroeconomic Stability competing viewpoints. We leverage this expertise and insight to construct programs 8 The Banking Sector and policy initiatives. 13 PART II DEVELOPING THE NEPSE: ATTRACTING ISSUERS, These activities are designed to help people build meaningful lives in which EXPANDING THE INVESTMENT BASE, AND IMPROVING THE they can experience health and well-being, pursue effective education and TRADING ENVIRONMENT gainful employment, and access the resources required to create ever-expanding 14 Attracting Issuers opportunities for themselves and their broader communities. 25 Attracting Investors 31 Improving the Trading Environment and Increasing Liquidity ABOUT THE GLOBAL MARKET DEVELOPMENT PRACTICE 37 PART III OWNERSHIP, GOVERNANCE, AND REGULATION The Milken Institute’s Global -

Apêndice a País Código MIC Identificação Do Mercado/MTF

Apêndice A Código País MIC Identificação do Mercado/MTF ALBANIA XTIR TIRANA STOCK EXCHANGE ALGERIA XALG ALGIERS STOCK EXCHANGE ARGENTINA XBUE BUENOS AIRES STOCK EXCHANGE ARGENTINA XMAB MERCADO ABIERTO ELECTRONICO S.A. ARGENTINA XMEV MERCADO DE VALORES DE BUENOS AIRES S.A. ARGENTINA XMTB MERCADO A TERMINO DE BUENOS AIRES S.A. ARGENTINA XBCM BOLSA DE COMMERCIO DE MENDOZA S.A. ARGENTINA XROS BOLSA DE COMERCIO ROSARIO ARMENIA XARM ARMENIAN STOCK EXCHANGE AUSTRALIA XNEC STOCK EXCHANGE OF NEWCASTLE LTD AUSTRALIA XASX ASX OPERATIONS PTY LIMITED AUSTRALIA XSFE SYDNEY FUTURES EXCHANGE LIMITED AUSTRALIA XYIE YIELDBROKER PTY LTD AUSTRIA XNEW NEWEX OESTERREICHISCHE TERMIN- UND AUSTRIA XOTB OPTIONENBOERSE, CLEARING BANK AG AUSTRIA XWBO WIENER BOERSE AG AZERBAIJAN XIBE BAKU INTERBANK CURRENCY EXCHANGE BAHAMAS XBAA BAHAMAS INTERNATIONAL STOCK EXCHANGE BAHRAIN XBAH BAHRAIN STOCK EXCHANGE BANGLADESH XCHG CHITTAGONG STOCK EXCHANGE LTD. BANGLADESH XDHA DHAKA STOCK EXCHANGE LTD BARBADOS XBAB SECURITIES EXCHANGE OF BARBADOS BELGIUM XBRU EURONEXT BRUSSELS BELGIUM XEAS NASDAQ EUROPE BERMUDA XBDA BERMUDA STOCK EXCHANGE LTD, THE BOLIVIA XBOL BOLSA BOLIVIANA DE VALORES S.A. BOTSWANA XBOT BOTSWANA STOCK EXCHANGE BRAZIL XBVP BOLSA DE VALORES DO PARANA BRAZIL XBBF BOLSA BRASILIERA DE FUTUROS BRAZIL XRIO BOLSA DE VALORES DO RIO DE JANEIRO SOCIEDADE OPERADORA DO MERCADO DE BRAZIL XSOM ATIVOS S.A. BRAZIL XBMF BOLSA DE MERCADORIAS E FUTUROS BRAZIL XBSP BOLSA DE VALORES DE SAO PAULO BULGARIA XBUL BULGARIAN STOCK EXCHANGE MONTREAL EXCHANGE THE / BOURSE DE CANADA XMOD MONTREAL -

Danmarks Nationalbank 2 Thedanmarks Response of Householdnationalbank Customers to Negative Deposit Rates Analyses

ANALYSIS DANMARKS NATIONALBANK 27 APRIL 2021 — NO. 9 The response of house- hold customers to negative deposit rates Negative deposit Reduction in Announcement rates more deposits following increases demand widespread announcements for investments Negative deposit rates There are indications Household customers for household custom that household cus appear to increase their ers are now being tomers reduce their de demand for investment applied by most banks posits when their bank fund shares and switch in Denmark. Further announces negative their deposits to pool more, the banks have interest rates. However, schemes when faced gradually reduced the household customers’ with prospects of nega thresholds for when total deposits have tive deposit rates. negative interest rates increased during the are imposed. period of negative deposit rates. Read more Read more Read more ANALYSIS — DANMARKS NATIONALBANK 2 THEDANMARKS RESPONSE OF HOUSEHOLDNATIONALBANK CUSTOMERS TO NEGATIVE DEPOSIT RATES ANALYSES Low for long Denmark was the first country to introduce negative ABOUT THIS ANALYSIS monetary policy rates in 2012. Since then, Switzer- land, Sweden, Japan and the euro area have followed Most banks in Denmark have now in suit. troduced negative deposit rates for household customers. Furthermore, Very low and in some cases negative interest rates the banks have gradually reduced the thresholds for when negative have characterised the past decade across the ad- interest rates are payable. vanced economies. There are several reasons why interest rates have fallen to the current low levels. Low There are indications that household interest rates reflect the fact that inflation has been customers reduce their deposits subdued in many countries, but structural changes when their bank announces negative in household and corporate savings and investment interest rates. -

Contribution of Pension Funds in the Development Of

CONTRIBUTION OF PENSION FUNDS IN THE DEVELOPMENT OF CAPITAL MARKETS INTANZANIA BENITHO WILLIAM KYANDO A DISSERTATION SUBMITTED IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION OF THE OPEN UNIVERSITY OF TANZANIA 2014 ii CERTIFICATION The undersigned certifies that he has read and now recommends for acceptance, by the Open University of Tanzania, the dissertation entitled “Contribution of pension funds in the development of capital markets in Tanzania” ..................................................... Dr. Proches K. Ngatuni Supervisor Date: .................................................. iii DECLARATION I, Benitho William Kyando, do hereby declare that this dissertation is my own original work and that it has not been submitted for a similar degree award in any other university. _________________________________ Signature ________________________________________ Date iv COPYRIGHT No part of this dissertation may be reproduced, stored in any retrieval system or transmitted in any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the author or the Open University of Tanzania in that behalf. v DEDICATION This work is dedicated to my father William Yoram Kyando and mother Rahel Sigalla who laid a strong foundation for me to climb the ladder of education. vi ACKNOWLEDGEMENTS Conducting research is a difficult task that one cannot do alone without assistance from others. A number of people have contributed in one way or another in accomplishing the task of writing this dissertation. To them all I say thank you. My sincere gratitude should first be directed to my supervisor Dr. P. Ngatuni of the Open University of Tanzania (OUT) for devoting a lot of his time to offer counselling, scholarly criticism, encouragement, comments and reading drafts from initial stage up to this final version. -

An Overview of Corporate Governance Practice in Companies Listed on the Libyan Stock Market

Athens Journal of Business & Economics – Volume 7, Issue 3, July 2021 –Pages 287-304 An Overview of Corporate Governance Practice in Companies Listed on the Libyan Stock Market By Salem Amara The corporate governance concept has recently become a major issue in the corporate practices of both developed and developing countries alike. Corporate governance is considered to be a tremendously important topic in many countries around the world; specifically within the emerging stock markets in order to protect the minority of shareholders. The aim of this research is to investigate corporate governance practices in companies listed on the Libyan stock exchange. In particular, to investigate whether corporate governance practices in these companies meet international standards of corporate governance and to identify the main obstacles to implementing them. The concept of corporate governance, corporate governance practices in developing countries, the Libyan stock market and OECD principles of corporate governance were discussed. A close-ended questionnaire was the main method for data collection. 100 questionnaires were distributed to the participants of the study, and only 76 questionnaires usable for analysis were received. Several issues related to corporate governance, depending on OCED principles, were investigated. The results revealed that corporate governance practice in the companies under investigation fit with OCED principles of corporate governance in some aspects and do not fit in others. Furthermore, the most important obstacles were perceived impeding corporate governance practice in companies listed in the Libyan stock market are "lack of compliance with the laws governing the work of companies" and "high cost of applying corporate governance rules". (JEL G30) Keywords: Corporate governance, the Libyan stock exchange, developing countries, OCED principles of corporate governance Introduction Corporate governance is not merely the governing of a certain form of organization "a corporation", but also has a broader meaning. -

Relationship Between Risk and Return of Stocks Listed at the Nairobi Securities Exchange

RELATIONSHIP BETWEEN RISK AND RETURN OF STOCKS LISTED AT THE NAIROBI SECURITIES EXCHANGE DANIEL MWANGI MWANIKI D61/84153/2012 A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION, UNIVERSITY OF NAIROBI NOVEMBER, 2015 DECLARATION This Research Project is my original work and has not been presented for an award of a degree in any other university or learning institution. Signature: …………………………………….. Date: ……………………………. Daniel Mwangi Mwaniki D61/84153/2012 This Research Project has been submitted for examination with my approval as the University supervisor. Signature: …………………………………………….. Date: ……………………………. Prof. Josiah Aduda The Dean, School of Business, University of Nairobi II ACKNOWLEDGEMENT I express my sincere gratitude to my supervisor, Prof. Josiah Aduda, for his guidance; scholarly assistance and inspiration in making this research a reality. His devotion and encouragement towards the progress of this study from the initial stages to completion is highly appreciated. I would also like to take this opportunity to sincerely thank the Chairman of the Department of Finance and Accounting, Mr. Herick O. Ondigo. A special thanks to my family; Carmel, the love of my life and our children Andrew, Stephanie and Mary. Thanks also to my parents, my brothers and sisters, my classmates; David Mwangi, and George Maina. Sincere gratitude goes to my friends who supported me and those who we studied together. Finally, while I may not be able to mention and recognize the effort of others who contributed in one way or the other, I avail myself of this opportunity to thank you all. III DEDICATION I dedicate this project to my wife, Carmel Mwangi, for her unconditional support and help. -

General Background on Nigerian Financial System and Stock Market (Nsm)

Stochastic modelling in Financial markets: case study of the Nigerian Stock Market OMAR, Mahmoud Abdulsalam Taib Available from the Sheffield Hallam University Research Archive (SHURA) at: http://shura.shu.ac.uk/16847/ A Sheffield Hallam University thesis This thesis is protected by copyright which belongs to the author. The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the author. When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given. Please visit http://shura.shu.ac.uk/16847/ and http://shura.shu.ac.uk/information.html for further details about copyright and re-use permissions. Sheffield Haiiam University Learning and Information Services Adsetts Centre, City Campus Sheffield S1 1WO 102 078 532 2 •'laid Hallam University ,-,g and Information Services Adsetts Centre, City Campus Sheffield SI 1WD REFERENCE Stochastic Modelling in Financial Markets: Case Study of the Nigerian Stock Market Mahmoud Abdulsalam Taib Omar A thesis submitted in partial fulfilment of the requirements of Sheffield Hallam University For the degree of Doctor of Philosophy August 2012 DECLARATION I certify that the substance of this thesis has not been already submitted for any degree and is not currently being submitted for any other degree. I also certify that to the best of my knowledge any assistance received in preparing this thesis, and all sources used, have been acknowledged and referenced in this -

Smes and Public Equity Financing: a New Dataset of SME Boards in Emerging-Market and Developing Economies

SMEs and Public Equity Financing: A New Dataset of SME Boards in Emerging-Market and Developing Economies John Schellhase and Jim Woodsome August 2017 Introduction In recent years, a number of stock exchanges in emerging-market and developing economies have established dedicated market segments for small and medium-sized enterprises (SMEs). The main purpose of these SME boards, as they are often called, is to expand access to equity finance for relatively small but growing firms with the potential, as a group, to significantly contribute to economic growth and employment. In some cases, SME boards also serve as feeder exchanges, incubating firms for later graduation to a stock exchange’s main board. Today, there around 30 dedicated SME boards in emerging-market and developing economies, the majority of which have been established in the last decade or so. Due to the role these firms can play in creating jobs and diversifying economies, improving access to finance for SMEs is a long-standing policy goal in developed and developing countries alike. As banks have curbed their lending to SMEs in the wake of the global financial crisis, policymakers and industry bodies are now increasingly emphasizing non-bank financing alternatives for SMEs. Public equity financing is one option that may be suitable for fast-growing SMEs with the capacity to meet the listing requirements. SME boards may contribute to expanding financial access for SMEs both directly, by facilitating access to public equity financing, and indirectly, by incentivizing listing firms to improve their financial reporting and corporate governance practices, which may, in turn, make them more appealing to credit-based lenders. -

Approved Broker List 2016

NORDEA INVESTMENT MANAGEMENT AB Approved broker list 2016 Head of Trading, Miles Kumaresan 07/04/2016 NORDEA INVESTMENT MANAGEMENT AB Legal Name City name Country name LEI ABG Sundal Collier ASA Oslo Norway 2138005DRCU66B8BNY04 ABNAMRO Bank N.V Amsterdam The Netherlands BFXS5XCH7N0Y05NIXW11 Ak Yatirim Menkul Degerler A.S Istanbul Turkey 789000ZSYXQD4Y7YRG72 Arctic Securities AS Oslo Norway 5967007LIEEXZX4RVS72 Aurel BGC SAS Paris France 5RJTDGZG4559ESIYLD31 Australia and New Zealand Banking Group Limited Melbourne Australia JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP London UK 213800LBM6PT85IGM996 Banca IMI S.p.A Milan Italy QV4Q8OGJ7OA6PA8SCM14 Banco Bilbao Vizcaya Argentaria S.A Bilbao Spain K8MS7FD7N5Z2WQ51AZ71 Banco Português de Investimento, S.A. (BPI) Porto Portugal 213800NGLJLXOSRPK774 BANCO SANTANDER S.A Madrid Spain 5493006QMFDDMYWIAM13 Bank Vontobel AG Zurich Switzerland 549300L7V4MGECYRM576 Barclays Bank PLC London UK G5GSEF7VJP5I7OUK5573 Barclays Capital Securities Limited London UK K9WDOH4D2PYBSLSOB484 Bayerische Landesbank Munich Germany VDYMYTQGZZ6DU0912C88 BMO Capital Markets Limited London UK L64HM9LHPDOS1B9HJC68 BNP Paribas SA Paris France R0MUWSFPU8MPRO8K5P83 Canaccord Genuity Limited London UK ZBU7VFV5NIMN4ILRFC23 Carnegie Holding AB Stockholm Sweden 529900BR5NZNQZEVQ417 China International Capital Corporation (UK) Limited London UK 213800STG3UV87MDGA96 Citigroup Global Markets Europe Limited London UK 5493004FUULDQTMX0W20 Citigroup Global Markets Limited London UK XKZZ2JZF41MRHTR1V493 Clarksons Platou Securities