Sinotrans Container Line- Corporate Reporting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New Port Development and Global City Making: Emergence of the Shanghai-Yangshan Multilayered Gateway Hub Chengjin Wang, César Ducruet

New port development and global city making: Emergence of the Shanghai-Yangshan multilayered gateway hub Chengjin Wang, César Ducruet To cite this version: Chengjin Wang, César Ducruet. New port development and global city making: Emergence of the Shanghai-Yangshan multilayered gateway hub. Journal of Transport Geography, Elsevier, 2012, 25, pp.58-69. halshs-00717879 HAL Id: halshs-00717879 https://halshs.archives-ouvertes.fr/halshs-00717879 Submitted on 13 Nov 2012 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. New port development and global city making: Emergence of the Shanghai-Yangshan multilayered gateway hub Chengjin WANG Key Laboratory of Regional Sustainable Development Modeling Institute of Geographical Sciences and Natural Resources Research (IGSNRR) Chinese Academy of Sciences (CAS) Beijing 100101, China [email protected] César DUCRUET French National Centre for Scientific Research (CNRS) UMR 8504 Géographie-cités F-75006 Paris, France [email protected] Abstract Planned as Shanghai's new port, Yangshan is currently expanding its roles as transhipment hub and integrated logistics/industrial center in the Asia-Pacific region. This paper examines the impact of the emergence of Yangshan on the spatial pattern of the Yangtze River Delta since the 1970s, with reference to existing port system spatial evolutionary models. -

Polar Seaways? Maritime Transport in the Arctic: an Analysis of Shipowners’ Intentions II

1 Polar Seaways? Maritime Transport in the Arctic: An Analysis of Shipowners’ Intentions II. Frédéric Lasserre Corresponding author Professor, Laval University [email protected] Leah Beveridge Research Assistant, Dalhousie University [email protected] Mélanie Fournier Post-doctoral Fellow, Dalhousie University [email protected] Pierre-Louis Têtu PhD student, Laval University [email protected] Linyan Huang PhD student, Laval University [email protected] Abstract Climate change in the Arctic is leading to the fast recession of the sea ice extent in the summer. This evolution leads several observers, scientists, media and government officials, to consider the possibility of developing new shipping routes along Arctic routes, as these routes are much shorter between Europe and Asia. The literature displays a strong interest for these potential shipping routes while the media often assume shipping companies nurture a sustained attraction for Arctic routes. This paper tackles with this idea and examines to what extent shipping companies, the ultimate economic agents, are really interested in Arctic shipping routes. The image the research portrayed is that only a minority of shipping companies are indeed interested, and those that are interested stress the destinational dimension of Arctic shipping, not transit shipping. Keywords: Arctic shipping; NSR; NWP; transit; destinational traffic; business strategy. Lasserre, F.; Beveridge, L. ; Fournier, M.; Têtu, P-L, Huang, L. (2016). Polar seaways? Maritime transport in the Arctic: An analysis of shipowners' intentions II. Journal of Transport Geography, 57(2016) 105-114, http://dx.doi.org/10.1016/j.jtrangeo.2016.10.004 2 Acknowledgements This research was funded by ArcticNet Research Network (Canada); the Social Sciences and Humanities Research Council of Canada (SSHRC); the Natural Sciences and Engineering Research Council of Canada (NSERC). -

Privatization Amid Ongoing Recovery, Maintain "Accumulate"

股 票 Research 研 [Table_Title] Company Report: Sinotrans Shipping (00368 HK) Spencer Fan 范明 究 (86755) 2397 6686 Equity 公司报告: 中外运航运 (00368 HK) [email protected] 21 September 2018 Privatization[Table_Summary] amid Ongoing Recovery, Maintain "Accumulate" 复苏在途,计划私有化,维持“收集” Privatization planned: In accordance with SASAC rules and the Company’s [Table_Rank] valuation in recent years, we estimate 0.9x-1.0x acquisition PBR for the Rating: Accumulate Maintained privatization of Sinotrans Shipping, which corresponds to approx. 100% 公 upward price potential. We await further disclosure of details. 司 评级: 收集 (维持) Operating strategy in 1H18 was unexpectedly cautious. The Company’s 报 1H18 revenue declined 0.7% YoY to US$497 mn due to less dry bulk 6[Table_Price-18m TP目标价] : HK$2.22 告 shipping capacity in control, yet shareholders' profit surged 399.85% YoY to Revised from 原目标价: HK$2.36 US$40.018 mn amid effective cost control. The price of 70% of self-owned Company Report vessels will be locked in in 2H18 to secure stable margins. Sino-U.S trade Share price 股价: HK$1.810 tension will have limited impact on dry bulk profitability. Improving capacity structure with possible higher-than-expected Stock performance demand in 2H18. Projected supply/ demand growth has been revised to 股价表现 1.7%/ 3.2% for 2018. Average grain shipping distance might rise. Iron ore [Table_QuotePic] import is expected to stay robust amid heating housing construction; we % of return 30.0 estimate 2018 dry bulk revenue to slightly decline by 2.2% YoY. 20.0 Container business gradually forming into good shape. -

S&P Summary Sales

Friday 31 October 2014 S&P Summary Sales by Buyers Location Sales by Type Europe, 7.6 Unknown, 40.65 China 98.5 Tankers, 100.30 Greece 49.7 Bulkers, 148.85 Hong Kong, 52.7 Sales DRY Name Type DWT Yard Built USD mill Comments VesselsValue.com Buyer Seller ER Beilun Capesize 179,400 Hyundai HI 2010 49.25 TCB to sellers 43.7 Sinotrans Shipping ER Schiffahrt ER Brazil Capesize 179,400 Hyundai HI 2010 49.25 TCB to sellers 43.7 Sinotrans Shipping ER Schiffahrt Mandarin Wisdom Ultramax 64,000 Hantong 2015 28.7 Resale 26.9 Erasmus Shipinvest Dasin Holdings Pte Darya Bhakti Supramax 56,000 Mitsui 2005 16.8 16.7 Unknown Chellaram Shipping Nestor Handysize 28,600 Hudong 1997 4.85 At auction in Piraeus 5.6 Unknown Tsangaris Bros WET Name Type DWT Yard Built USD mill Comments VesselsValue.com Buyer Seller Amin 2 Suezmax 158,000 Hyundai Samho 2009 52.7 At auction in Xiamen, after being laid up 1 year 56.0 HK based Irano Hind Shipping Risanger MR 46,300 Daedong 2000 10.5 En bloc 10.6 IMS Westfal Larsen Ravnanger MR 46,300 Daedong 2000 10.5 En bloc 10.6 IMS Westfal Larsen Nord Star MR 46,000 Shin Kurushima 2009 19 22.2 Unknown Torm Clipper Leander Small Clean 10,100 Yardimci Deniz 2006 7.6 9.3 European Nordic Tankers CONTAINER Name Type TEU Yard Built USD mill Comments VesselsValue.com Buyer Seller SCI Nhava Sheva Panamax 5,042 Hyundai HI 2005 17.5 En bloc 16.5 Lomar Shipping Offen Claus-Peter Santa Priscilla Panamax 5,042 Hyundai HI 2005 17.5 En bloc 16.5 Lomar Shipping Offen Claus-Peter HS Livingstone Panamax 4,990 Hanjin HI 2004 15.5 En bloc 14.5 -

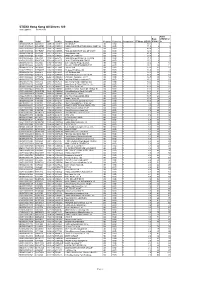

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 83.1 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 71.5 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 49.4 3 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 42.9 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 41.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 33.3 6 7 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 31.0 7 6 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 27.1 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.2 9 10 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 20.1 10 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 11 12 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 18.8 12 9 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.2 14 15 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 16.7 15 14 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.1 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

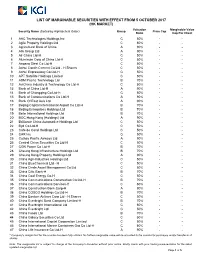

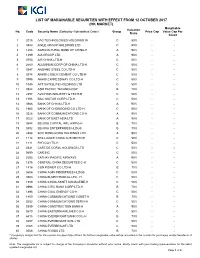

List of Marginable Securities with Effect from 5 October 2017 (Hk Market)

LIST OF MARGINABLE SECURITIES WITH EFFECT FROM 5 OCTOBER 2017 (HK MARKET) Valuation Marginable Value Security Name (Sorted by Alphabetical Order) Group Price Cap Ratio Cap Per Client 1 AAC Technologies Holdings Inc C 50% - - 2 Agile Property Holdings Ltd C 50% - - 3 Agricultural Bank of China A 90% - - 4 AIA Group Ltd A 90% - - 5 Air China Ltd-H C 50% - - 6 Aluminum Corp of China Ltd-H C 50% - - 7 Angang Steel Co Ltd-H C 50% - - 8 Anhui Conch Cement Co Ltd - H Shares C 50% - - 9 Anhui Expressway Co Ltd-H C 50% - - 10 APT Satellite Holdings Limited C 50% - - 11 ASM Pacific Technology Ltd B 70% - - 12 AviChina Industry & Technology Co Ltd-H C 50% - - 13 Bank of China Ltd-H A 90% - - 14 Bank of Chongqing Co Ltd-H C 50% - - 15 Bank of Communications Co Ltd-H A 90% - - 16 Bank Of East Asia Ltd A 90% - - 17 Beijing Capital International Airport Co Ltd-H B 70% - - 18 Beijing Enterprises Holdings Ltd B 70% - - 19 Belle International Holdings Ltd B 70% - - 20 BOC Hong Kong (Holdings) Ltd A 90% - - 21 Brilliance China Automotive Holdings Ltd C 50% - - 22 Byd Co Ltd-H C 50% - - 23 Cafe de Coral Holdings Ltd C 50% - - 24 CAR Inc C 50% - - 25 Cathay Pacific Airways Ltd A 90% - - 26 Central China Securities Co Ltd-H C 50% - - 27 CGN Power Co Ltd-H B 70% - - 28 Cheung Kong Infrastructure Holdings Ltd B 70% - - 29 Cheung Kong Property Holdings Ltd A 90% - - 30 China Agri-Industries Holdings Ltd C 50% - - 31 China BlueChemical Ltd - H C 50% - - 32 China Cinda Asset Management Co Ltd C 50% - - 33 China Citic Bank-H B 70% - - 34 China Coal Energy Co-H C -

Can Now Offer You Shipbuilding and Fleet Forecasting

POR 0002 13JO AN REV CONTAINERISATION INGLES 210x297MM.pdf 1 16/11/15 10:19 CONTENTS THE RANKINGS TOP LISTS 04 Introduction 26 Top 10 box port operators 08 Numbers 1-10 45 Top 50 beneficial owners 28 Numbers 11-20 60 Top 10 brokers 44 Numbers 21-30 61 Top 50 owners by country 57 Numbers 31-40 71 Top 50 flags 69 Numbers 41-50 72 Top 10 insurers 84 Numbers 51-60 79 Top 10 regulators 94 Numbers 61-70 104 Top 10 classification societies 101 Numbers 71-80 115 Top 10 ship finance 111 Numbers 81-90 119 Top 10 lawyers 120 Numbers 91-100 Top 100 Editor Chief executive Printing Lloyd’s List is available online in every country Nicola Good Michael Dell St Ives plc in the world by placing a subscription with the publishers in London, Informa UK Ltd. Please Lloyd’s List Managing Editor Head of Marketing Services Editoral, advertising and place your order with the Lloyd’s List marketing Richard Meade Fergus Gregory sponsorship inquiries team at Informa. This special supplement is Lloyd’s List, Christchurch Court, 10-15 Lloyd’s List Asia Editor-in-Chief Head of Sales – Marketing Services issued free to subscribers. Newgate Street, London, EC1A 7AZ Tom Leander David O’Neill Tel: +44 (0)20 7017 5000 For further information please email: Lloyd’s List Deputy Editor Marketing Services Sales Fax: +44 (0)20 7017 4782 [email protected] Craig Eason Janet Wood (Greece & Cyprus) Email: [email protected] or telephone: +44 (0)20 3377 3792 Linsey Dinesan-Rajan (The Americas) Lloyd’s Digital Content Manager Published by Informa UK Ltd. -

M&A in the Transport & Logistics Industry

M&A in the Transport & Logistics Industry January–December 2018 Highlights Results M&A activity 2018: strong first half- Analysis of M&A activity by sector Table of year, weak second half and investor type China: still acting locally, some Outlook for 2019 contents with a global vision Europe: Brexit with mixed Methodology repercussions Contacts 1 Highlights – Highlights M&A activity 2018: strong first half-year, weak second half: The first half-year of 2018 was a record period for the T&L industry in terms of deal value ($74.3 billion), while a slight slowdown in the number of deals (127) in comparison with previous half-years could be observed. However, in the second half of 2018 only 92 deals were announced, which is the lowest number in five years. The total deal value also nearly halved in comparison with the first half-year ($41.0 billion). Deal value is mainly driven by megadeals. Intense competition for target properties in combination with investment pressure, especially from institutional investors, has led to a surge in prices for fewer T&L deals in 2018 companies or equity interests in the area of infrastructure, railways and airlines, with the result that various 23% than the year before transactions were initially discontinued. Furthermore, global factors, such as uncertainty surrounding the China-US trade dispute – an example of increasing protectionism – weighed on both the logistics and the general transaction markets. Measured by the number of deals announced, 2018 showed a slowdown in deal activity across all industries, but the decline in T&L is particularly strong at –22.6% compared with 2017. -

中遠海運發展股份有限公司 COSCO SHIPPING Development Co., Ltd.*

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult a licensed securities dealer and other registered institution in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in COSCO SHIPPING Development Co., Ltd., you should at once hand this circular, the form of proxy and reply slip to the purchaser or the transferee or to licensed securities dealer or registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. 中遠海運發展股份有限公司 COSCO SHIPPING Development Co., Ltd.* (A joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 02866) (1) 2016 REPORT OF THE BOARD (2) 2016 REPORT OF THE SUPERVISORY COMMITTEE (3) 2016 WORK REPORT OF INDEPENDENT DIRECTORS (4) 2016 FINANCIAL STATEMENTS AND AUDITORS’ REPORT (5) 2016 ANNUAL REPORT (6) 2016 PROFIT DISTRIBUTION PLAN (7) REMUNERATION OF DIRECTORS AND SUPERVISORS FOR THE YEAR 2017 (8) RE-APPOINTMENT OF PRC AUDITOR, INTERNAL CONTROL AUDITOR AND INTERNATIONAL AUDITOR FOR THE YEAR 2017 (9) DISCLOSEABLE AND CONNECTED TRANSACTION – ASSIGNMENT AND NOVATION OF SHIPBUILDING CONTRACTS (10) CAPITAL CONTRIBUTION TO CHINA BOHAI BANK (11) PROVISIONS OF GUARANTEES AND (12) SUPPLEMENTAL NOTICE OF AGM Independent Financial Adviser to the Independent Board Committee and Independent Shareholders Capitalised terms used in this cover shall have the same meanings as those defined in this circular. -

List of Marginable Securities with Effect from 12 October 2017 (Hk Market)

LIST OF MARGINABLE SECURITIES WITH EFFECT FROM 12 OCTOBER 2017 (HK MARKET) Marginable Valuation No. Code Security Name (Sorted by Alphabetical Order) Group Price Cap Value Cap Per Ratio Client 1 2018 AAC TECHNOLOGIES HOLDINGS IN C 50% - - 2 3383 AGILE GROUP HOLDINGS LTD C 50% - - 3 1288 AGRICULTURAL BANK OF CHINA-H A 90% - - 4 1299 AIA GROUP LTD A 90% - - 5 0753 AIR CHINA LTD-H C 50% - - 6 2600 ALUMINUM CORP OF CHINA LTD-H C 50% - - 7 0347 ANGANG STEEL CO LTD-H C 50% - - 8 0914 ANHUI CONCH CEMENT CO LTD-H C 50% - - 9 0995 ANHUI EXPRESSWAY CO LTD-H C 50% - - 10 1045 APT SATELLITE HOLDINGS LTD C 50% - - 11 0522 ASM PACIFIC TECHNOLOGY B 70% - - 12 2357 AVICHINA INDUSTRY & TECH-H C 50% - - 13 1958 BAIC MOTOR CORP LTD-H C 50% - - 14 3988 BANK OF CHINA LTD-H A 90% - - 15 1963 BANK OF CHONGQING CO LTD-H C 50% - - 16 3328 BANK OF COMMUNICATIONS CO-H A 90% - - 17 0023 BANK OF EAST ASIA LTD A 90% - - 18 0694 BEIJING CAPITAL INTL AIRPO-H B 70% - - 19 0392 BEIJING ENTERPRISES HLDGS B 70% - - 20 2388 BOC HONG KONG HOLDINGS LTD A 90% - - 21 1114 BRILLIANCE CHINA AUTOMOTIVE C 50% - - 22 1211 BYD CO LTD-H C 50% - - 23 0341 CAFE DE CORAL HOLDINGS LTD C 50% - - 24 0699 CAR INC C 50% - - 25 0293 CATHAY PACIFIC AIRWAYS A 90% - - 26 1375 CENTRAL CHINA SECURITIES C-H C 50% - - 27 1816 CGN POWER CO LTD-H B 70% - - 28 0606 CHINA AGRI-INDUSTRIES HLDGS C 50% - - 29 3983 CHINA BLUECHEMICAL LTD - H C 50% - - 30 1359 CHINA CINDA ASSET MANAGEME-H C 50% - - 31 0998 CHINA CITIC BANK CORP LTD-H B 70% - - 32 1898 CHINA COAL ENERGY CO-H C 50% - - 33 1800 CHINA COMMUNICATIONS CONST-H B 70% - - 34 0552 CHINA COMMUNICATIONS SERVI-H C 50% - - 35 0939 CHINA CONSTRUCTION BANK-H A 90% - - 36 0670 CHINA EASTERN AIRLINES CO-H C 50% - - 37 6818 CHINA EVERBRIGHT BANK CO L-H B 70% - - 38 0257 CHINA EVERBRIGHT INTL LTD C 50% - - 39 0165 CHINA EVERBRIGHT LTD C 50% - - 40 0506 CHINA FOODS LTD B 70% - - * Company's margin limit for the counter has been fully utilized. -

Corporate Social Responsibility Report CUSTOMERS’ SUCCESS OUR ACHIEVEMENT SUCCESS CUSTOMERS’ Corporate Social Responsibility Report

Stock Code: 0598HKStock Code: 601598SH 0598HK 601598SH CorporateCorporate Social SocialResponsibility Responsibility Report Report ( ESG Report( ESG ) Report ) CUSTOMERS’CUSTOMERS’ SUCCESS SUCCESS OUR ACHIEVEMENT OUR ACHIEVEMENT 2019 2019 2019 CORPORATE SOCIAL RESPONSIBILITY REPORT (ESG REPORT) SOCIAL (ESG RESPONSIBILITY REPORT CORPORATE REPORT) SOCIAL (ESG RESPONSIBILITY REPORT CORPORATE Address: SinotransAddress: Building Sinotrans Tower Building B, Building Tower 10, B, Building 10, No. 5 AndingNo. Road, 5 Anding Chaoyang Road, District, Chaoyang Beijing, District, China Beijing, China Postcode: Postcode:100029 100029 Fax: 8610 52296519Fax: 8610 52296519 Email: [email protected]: [email protected] Company website:Company http://www.sinotrans.com website: http://www.sinotrans.com Contents GENERAL PREPARATION INFORMATION GENERAL PREPARATION 25 CUSTOMER FOCUS, WIN- INFORMATION WIN COOPERATION AND Thank you for reading the 2019 Social Responsibility and ESG (Environmental, Social and Governance) Report (the 2 CHAIRMAN’S STATEMENT NEW ACHIEVEMENT OF “Report”) of Sinotrans Limited (the “Company”, together with its subsidiaries, collectively “the Group”, “Sinotrans”, EMPOWERMENT “we” or “us”). This Report is the sixth annual ESG Report published by Sinotrans, for the purpose of disclosing the 4 ABOUT US 25 Customer Service and Management Company’s management methods, major practices and achievements in fulfilling social responsibility (including 14 GUIDED BY STRATEGIES, environmental, social and governance) while providing integrated logistics services. GOVERNANCE OPTIMIZATION 25 Customer Service AND NEW STAGE OF 25 Customer Management The board of directors of the Company and all directors thereof guarantee that the information contained in this Report EMPOWERMENT 26 Supply Chain Management does not contain any false representations, misleading statements or material omissions, and jointly and severally 14 Social Responsibility Management accept responsibility for the truthfulness, accuracy and completeness of the content of this Report. -

Japanese Shipping Sector Research Analysts INITIATION

17 June 2013 Asia Pacific/Japan Equity Research Transportation (Marine Transportation (Japan)) / OVERWEIGHT Japanese shipping sector Research Analysts INITIATION Davin Wu 852 2101 6917 [email protected] Shipping profits rise as yen sinks Timothy Ross Figure 1: Japan shipping P/B vs. ROE* 65 6212 3337 [email protected] 3.5x 30% Stock Rating TP Upside 25% 3.0x MOL OP 490 39% 20% 2.5x NYK OP 340 39% K-Line UP 180 -1% 15% 2.0x 10% 1.5x 5% 0% 1.0x -5% 0.5x -10% 0.0x -15% 2009 2007 2008 2010 2011 2012 2013 2014 PB (left) ROE (Right) Source: Company data, Credit Suisse estimates *Average of MOL, NYK and K-Line ■ Rising returns to lift valuations: Despite a strong rally, the shipping sector is trading at one standard deviation (STD) below its long-term mean P/B and 27% below its economic value. We believe a recovery in the dry bulk market driven by scrapping and yen weakness should support higher valuations. We see the fleet market value as a more appropriate valuation base, as we expect fluctuations in the yen to cause fleet value to deviate from book values. We base our target prices on a combination of ROE–P/B and economic values of business portfolios. ■ Long USD, short JPY: The Japanese shipping companies generate much more USD revenues than costs, having net long USD positions. We expect the yen’s depreciation to magnify a dry bulk market recovery; every ¥1 depreciation against the USD should lift the sector’s profit by 4.4% and stock valuations by 1.3%.