View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reporting Marks

Lettres d'appellation / Reporting Marks AA Ann Arbor Railroad AALX Advanced Aromatics LP AAMX ACFA Arrendadora de Carros de Ferrocarril S.A. AAPV American Association of Private RR Car Owners Inc. AAR Association of American Railroads AATX Ampacet Corporation AB Akron and Barberton Cluster Railway Company ABB Akron and Barberton Belt Railroad Company ABBX Abbott Labs ABIX Anheuser-Busch Incorporated ABL Alameda Belt Line ABOX TTX Company ABRX AB Rail Investments Incorporated ABWX Asea Brown Boveri Incorporated AC Algoma Central Railway Incorporated ACAX Honeywell International Incorporated ACBL American Commercial Barge Lines ACCX Consolidation Coal Company ACDX Honeywell International Incorporated ACEX Ace Cogeneration Company ACFX General Electric Rail Services Corporation ACGX Suburban Propane LP ACHX American Cyanamid Company ACIS Algoma Central Railway Incorporated ACIX Great Lakes Chemical Corporation ACJR Ashtabula Carson Jefferson Railroad Company ACJU American Coastal Lines Joint Venture Incorporated ACL CSX Transportation Incorporated ACLU Atlantic Container Line Limited ACLX American Car Line Company ACMX Voith Hydro Incorporated ACNU AKZO Chemie B V ACOU Associated Octel Company Limited ACPX Amoco Oil Company ACPZ American Concrete Products Company ACRX American Chrome and Chemicals Incorporated ACSU Atlantic Cargo Services AB ACSX Honeywell International Incorporated ACSZ American Carrier Equipment ACTU Associated Container Transport (Australia) Limited ACTX Honeywell International Incorporated ACUU Acugreen Limited ACWR -

Class III / Short Line System Inventory to Determine 286,000 Lb (129,844 Kg) Railcar Operational Status in Kansas

Report No. K-TRAN: KSU-16-5 ▪ FINAL REPORT▪ August 2017 Class III / Short Line System Inventory to Determine 286,000 lb (129,844 kg) Railcar Operational Status in Kansas Eric J. Fitzsimmons, Ph.D. Stacey Tucker-Kulesza, Ph.D. Lisa Shofstall Kansas State University Transportation Center 1 Report No. 2 Government Accession No. 3 Recipient Catalog No. K-TRAN: KSU-16-5 4 Title and Subtitle 5 Report Date Class III / Short Line System Inventory to Determine 286,000 lb (129,844 kg) August 2017 Railcar Operational Status in Kansas 6 Performing Organization Code 7 Author(s) 7 Performing Organization Report Eric J. Fitzsimmons, Ph.D., Stacey Tucker-Kulesza, Ph.D., Lisa Shofstall No. 9 Performing Organization Name and Address 10 Work Unit No. (TRAIS) Kansas State University Transportation Center Department of Civil Engineering 11 Contract or Grant No. 2109 Fiedler Hall C2069 Manhattan, Kansas 66506 12 Sponsoring Agency Name and Address 13 Type of Report and Period Kansas Department of Transportation Covered Bureau of Research Final Report 2300 SW Van Buren October 2015–December 2016 Topeka, Kansas 66611-1195 14 Sponsoring Agency Code RE-0691-01 15 Supplementary Notes For more information write to address in block 9. The rail industry’s recent shift towards larger and heavier railcars has influenced Class III/short line railroad operation and track maintenance costs. Class III railroads earn less than $38.1 million in annual revenue and generally operate first and last leg shipping for their customers. In Kansas, Class III railroads operate approximately 40 percent of the roughly 2,800 miles (4,500 km) of rail; however, due to the current Class III track condition, they move lighter railcars at lower speeds than Class I railroads. -

2.0 Current Freight Rail System and Services in Florida

Investment Element of the 2010 Florida Rail System Plan 2.0 Current Freight Rail System and Services in Florida 2.1 Overview The Florida rail system is comprised of 2,786 miles of mainline track, which are owned by 15 operating line-haul railroads and terminal or switching companies, as well as 81 miles owned by the State of Florida. Florida’s rail system includes 2 Class I Railroads (CSX Transportation and Norfolk Southern Corporation), 1 Class II (Florida East Coast Railway), 11 Class III (Alabama and Gulf Coast Railway AN Railway, Bay Line Railroad, First Coast Railroad, Florida West Coast Railroad, Florida Central Railroad, Florida Midland Railroad, Florida Northern Railroad, Georgia and Florida Railway, Seminole Gulf Railway, and South Central Florida Express) and 1 railroad specializing in switching and terminals (Talleyrand Terminal).9 The largest operator in the State is CSX Transportation, which owns more than 53 percent of the statewide track mileage. In 2008, Florida’s railroads carried nearly 1.6 million carloads – 19 percent less than in 2006 – and approximately 83 million tons of freight, representing a 25 million ton (23 percent) decrease from 2006.10 During that year, railroads handled freight equivalent to roughly 5.0 million heavy trucks.11 Nonetheless, railroads continue to support thousands of jobs throughout the State and assist Florida’s industries to remain competitive with international and domestic markets for fertilizer, construction rock, consumer goods, paper products, processed 9 U.S. Class I Railroads are line-haul freight railroads with 2007 operating revenue in excess of $359.6 million (2006 operating revenues exceeding $346.7 million). -

UTU News. June2008

Volume 4 0 June 2008 N u m b e r 6 www.utuia.org www.utu.org The Official Publication of the United Transportation Union News and Notes U.S. rail members ratify Accidents take members Three UTU members – Eli A. Locklear, James Wilson, and David C. Goolsby – have U T U national agre e m e n t been killed in separate incidents. By overwhelming margins within each craft, “ A d d i t i o n a l l y,” said Futhey, “the UTU was L o c k l e a r, 46, a CSX conductor and member of Local 1011 at Hamlet, N.C., was killed May members of the United Transportation Union the only union to gain continuation of a COLA, 26 when he was crushed by tons of coal while have ratified a new national rail agreement beginning in 2010, while a new agreement is unloading a train. He was part of a two-person covering wages, rules and being negotiated. The COLA put crew that was unloading a 97-car train at working conditions. some $7 more per day in members’ Progress Energ y ’s Weatherspoon Plant when he The ratified agreement is pockets while we were at the nego- either fell or was pulled down into the coal. retroactive to Jan. 1, 2005, tiating table this round. Wilson, 35, a UP conductor and member and remains in force through “ We also retained, undis- of Local 923 in Dalhart, Texas, was riding on Dec. 31, 2009. turbed, our locally negotiat- top of a train car that was being pushed in an Amarillo, Texas, yard when he fell and was “In the face of recurring ed crew-consist agreements, hit by the train. -

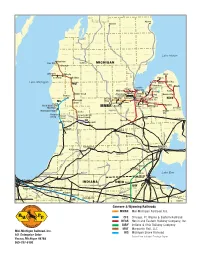

Michigan Railroads Association

Michigan Railroads Association Local Surface Grade Crossing Railroad Contact list Mark Dobronski, President Tyler Delvaux, Assistant, SLE and Adrian & Blissfield Rail Road Trainmaster 734.641.2300 o Escanaba & Lake Superior Railroad [email protected] 906.786.0693 c [email protected] Steven M. Ayala, Roadmaster Ann Arbor Railroad Bob Anderson, SLE & Operations Manager 419.206.8172 c Escanaba & Lake Superior Railroad [email protected] 906.280.2513 o 906.542.3214 c Mark Dobronski, President [email protected] Charlotte Southern Railroad Company 734.641.2300 o Adam Robillard, Roadmaster [email protected] Grand Elk Railroad 269.762.9069 c Thomas Brasseur, Manager of Public Works [email protected] CN 248.452.4854 c Toby Tobias, AVP Engineering [email protected] Grand Rapids Eastern Railroad 855.793.7900 o Kevin T. Voss, Director – Track [email protected] Maintenance Conrail Mark Russell, Chief Engineer 856.231.2055 c Great Lakes Central [email protected] 231.775.2182 o 989.666.2706 c Amanda DeCesare, CSX Engineering [email protected] CSX Transportation 859.372.6124 o Luke Ziesemer, Roadmaster [email protected] Huron & Eastern Railroad 989.797.5129 c Mark Dobronski, President [email protected] Detroit Connecting Railroad Company 734.641.2300 o Scott Sandoval, AVP Engineering [email protected] Indiana & Ohio Railway 614.479.1863 o 231.233.9084 c [email protected] Mark Dobronski, President Toby Tobias, AVP Engineering Jackson & Lansing Railroad Company Michigan Shore Railroad 734.641.2300 o 855.793.7900 o [email protected] [email protected] Mark Pennell, Superintendent MOW Toby Tobias, AVP Engineering Lake State Railway Mid Michigan Railroad 989.393.9820 o 855.793.7900 o 989.529.6640 c [email protected] [email protected] Brent Emerson – Ft. -

One Rail Australia Submission to ESCOSA

One Rail Australia Submission to ESCOSA One Rail Australia welcomes the invitation from ESCOSA to respond to the South Australian Rail Access Regime Review Issues Paper (February 2020). The review is timely given recent developments in the rail industry in South Australia, which are set out in detail below. Overall, our position is: • There is no compelling case to change the current regime significantly. • Whilst volumes on intrastate main lines continue to reduce, this has been driven by increased competition from road transport, rather than deficiencies in the access regime. • Other than lower volumes, there has been no significant change in the operation of the market since 2015, such that ESCOSA’s conclusions at the time supporting the continuation of the existing regime should have altered; • The current regime is a cost-effective way to provide protection to both access seekers and access providers in South Australia and provides certainty for all parties through the negotiation and arbitration framework; • ESCOSA reflects a fit-for-purpose regulator for the South Australian rail market given its size relative to the national regulated market which allows for efficient communication and resolution of issues; and • Changing to a national regime would be a costly process during transition and would raise regulatory compliance costs of all parties in the long run. It would also generate risks around the process of transition and there may be opportunity for other parties, such as national transport carriers, to exert market power. The rest of this submission sets out some information about One Rail Australia, an update on the South Australian freight transport industry, an overview of our perceptions of strengths and weaknesses of the current regime. -

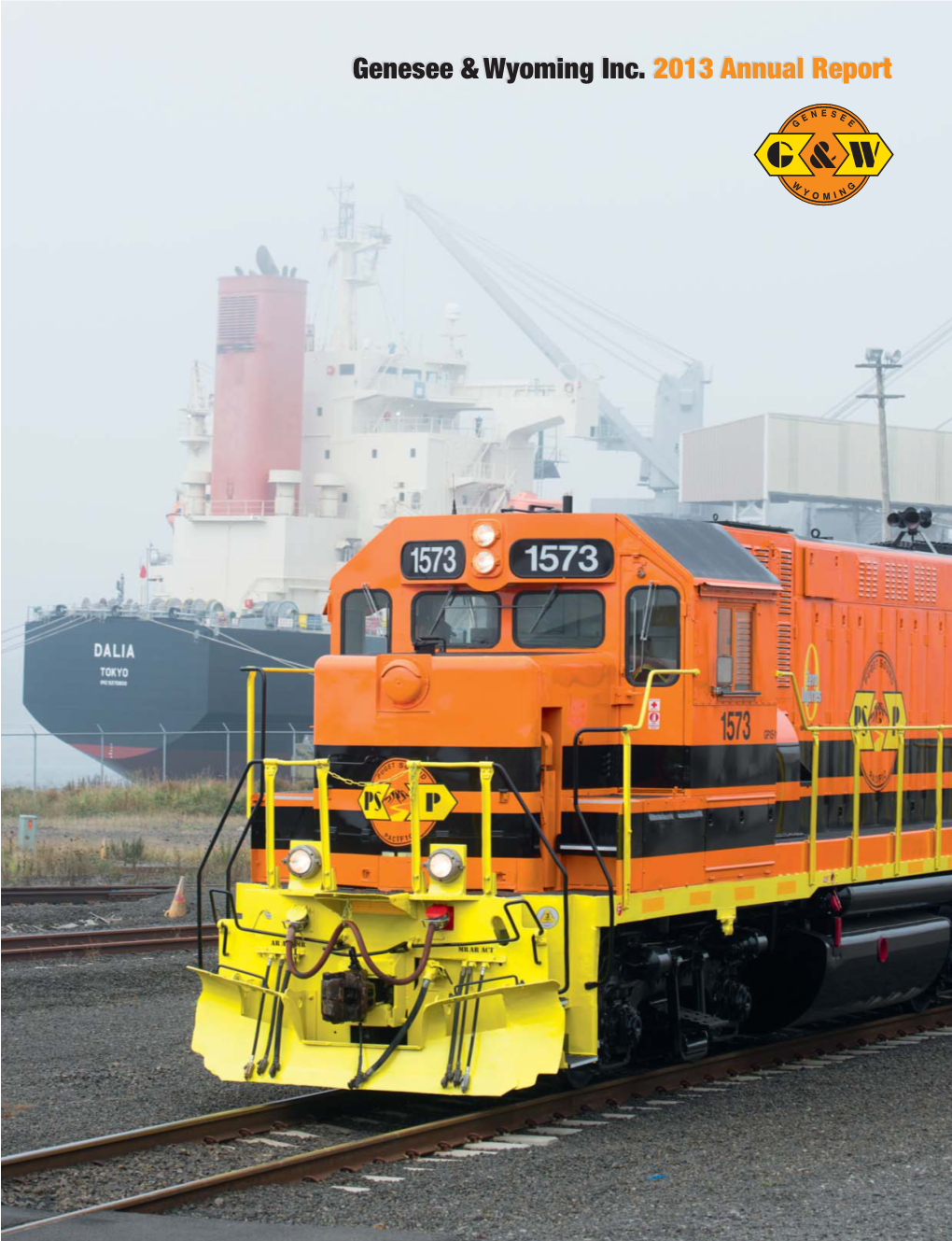

Genesee & Wyoming Inc. 2016 Annual Report

Genesee & Wyoming Inc. 2016 Annual Report Genesee & Wyoming Inc.*owns or leases 122 freight railroads worldwide that are organized into 10 operating regions with approximately 7,300 employees and 3,000 customers. * The terms “Genesee & Wyoming,” “G&W,” “the company,” “we,” “our,” and “us” refer collectively to Genesee & Wyoming Inc. and its subsidiaries and affiliated companies. Financial Highlights Years Ended December 31 (In thousands, except per share amounts) 2012 2013 2014 2015 2016 Statement of Operations Data Operating revenues $874,916 $1,568,643 $1,639,012 $2,000,401 $2,001,527 Operating income 190,322 380,188 421,571 384,261 289,612 Net income 52,433 271,296 261,006 225,037 141,096 Net income attributable to Genesee & Wyoming Inc. 48,058 269,157 260,755 225,037 141,137 Diluted earnings per common share attributable to Genesee & Wyoming Inc. common stockholders: Diluted earnings per common share (EPS) $1.02 $4.79 $4.58 $3.89 $2.42 Weighted average shares - Diluted 51,316 56,679 56,972 57,848 58,256 Balance Sheet Data as of Period End Total assets $5,226,115 $5,319,821 $5,595,753 $6,703,082 $7,634,958 Total debt 1,858,135 1,624,712 1,615,449 2,281,751 2,359,453 Total equity 1,500,462 2,149,070 2,357,980 2,519,461 3,187,121 Operating Revenues Operating Income Net Income Diluted Earnings ($ In Millions) ($ In Millions) ($ In Millions) 421.61,2 Per Common Share 2 2,001.5 401.6 1 $2,000 2,000.4 $400 394.12 $275 271.3 $5.00 1 2 4.79 1 374.3 1 380.21 384.3 261.0 4.581 1,800 250 4.50 350 1,639.0 225.01 225 2 1 1,600 233.5 4.00 2 3.89 1,568.6 4.10 2 300 2 200 213.9 213.3 2 3.78 2 1,400 1 3.50 3.69 289.6 183.32 3.142 250 175 1,200 3.00 211. -

Quarterly Rail Cost Adjustment Factor 70% Ownership Interest in Transrail 2 on February 3, 2012, in Docket No

Federal Register / Vol. 77, No. 57 / Friday, March 23, 2012 / Notices 17121 Issued in Washington, DC, on March 20, The MG Principals will retain the Class RailAmerica et al. states that: (1) W&C 2012. B Common Units of TransRail, thereby does not connect with any of Jeffrey D. Wiese, retaining a 30% interest in TransRail, RailAmerica’s subsidiary railroads; (2) Associate Administrator for Pipeline Safety. though they will not retain control or the proposed transaction is not part of [FR Doc. 2012–7080 Filed 3–22–12; 8:45 am] the power to control W&C. a series of anticipated transactions to BILLING CODE 4910–60–P Fortress’ noncarrier affiliate, RR connect W&C and any of RailAmerica’s Acquisition, currently owns about 60% subsidiary railroads; and (3) the of the publicly traded shares and proposed transaction does not involve a DEPARTMENT OF TRANSPORTATION controls the noncarrier RailAmerica, Class I rail carrier. The proposed which directly controls the noncarrier transaction is therefore exempt from the Surface Transportation Board Palm Beach, which directly controls the prior approval requirements of 49 U.S.C. [Docket No. FD 35605] noncarrier RTC. 11323 pursuant to 49 CFR 1180.2(d)(2). RailAmerica states that it controls the Under 49 U.S.C. 10502(g), the Board RailAmerica, Inc., Palm Beach Rail following Class III rail carriers: (1) may not use its exemption authority to Holding, Inc., RailAmerica Alabama & Gulf Coast Railway LLC; (2) relieve a rail carrier of its statutory Transportation Corp., RailTex, Inc., Arizona & California Railroad Company; obligation to protect the interests of its Fortress Investment Group, LLC, and (3) Bauxite & Northern Railway employees. -

CP's North American Rail

2020_CP_NetworkMap_Large_Front_1.6_Final_LowRes.pdf 1 6/5/2020 8:24:47 AM 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Lake CP Railway Mileage Between Cities Rail Industry Index Legend Athabasca AGR Alabama & Gulf Coast Railway ETR Essex Terminal Railway MNRR Minnesota Commercial Railway TCWR Twin Cities & Western Railroad CP Average scale y y y a AMTK Amtrak EXO EXO MRL Montana Rail Link Inc TPLC Toronto Port Lands Company t t y i i er e C on C r v APD Albany Port Railroad FEC Florida East Coast Railway NBR Northern & Bergen Railroad TPW Toledo, Peoria & Western Railway t oon y o ork éal t y t r 0 100 200 300 km r er Y a n t APM Montreal Port Authority FLR Fife Lake Railway NBSR New Brunswick Southern Railway TRR Torch River Rail CP trackage, haulage and commercial rights oit ago r k tland c ding on xico w r r r uébec innipeg Fort Nelson é APNC Appanoose County Community Railroad FMR Forty Mile Railroad NCR Nipissing Central Railway UP Union Pacic e ansas hi alga ancou egina as o dmon hunder B o o Q Det E F K M Minneapolis Mon Mont N Alba Buffalo C C P R Saint John S T T V W APR Alberta Prairie Railway Excursions GEXR Goderich-Exeter Railway NECR New England Central Railroad VAEX Vale Railway CP principal shortline connections Albany 689 2622 1092 792 2636 2702 1574 3518 1517 2965 234 147 3528 412 2150 691 2272 1373 552 3253 1792 BCR The British Columbia Railway Company GFR Grand Forks Railway NJT New Jersey Transit Rail Operations VIA Via Rail A BCRY Barrie-Collingwood Railway GJR Guelph Junction Railway NLR Northern Light Rail VTR -

Midville Mahrt

Rochester Buffalo Silver Springs Erie Mt. Jewett PENNSYLVANIA Driftwood New Castle Peoria Homer City Pittsburg Havana ILLINOIS York Springfield ILLINOIS MISSOURI KENTUCKY Murray Elizabethton Paris Johnson City Dresden Henry ETRY Bruceton McKenzie Cumnock Sanford ARKANSAS ATW Chattanooga TENNESSEE NORTH CAROLINA Danville Chickamauga East Greenville Little Rock Hedges Rock CCKY CPDR HR Laurens T Berryton Hartsville RR Darlington GN SCRF Florence Bishopville Amory Fordyce Atlanta Fordyce ABR R FC WR GR Banks Greenwood West Point Belk RC GW Eupora LXVR Hermitage Fernbank Talladega Columbus SCS EARY Greenville Sylacauga Crosset Crossett Gantts Quarry SA N AGR LW SOUTH Midville CAROLINA Bastrop GEORGIA Macon NS GM R Operated by Pioneer Demopolis GC GM Selma Columbus R Nunez Meridian Montgomery Dublin Linden CCH GSWR Monroe MNBR Nuckols GMR ALABAMA Garden City GC SAPT Mahrt Helena Vidalia Savannah NS Americus Kimbrough Cordele White Preston CSX GeorgetownGITW Oak Genesee & Wyoming Railroads Troy Smithville Richmond Hill Hybart Eufaula HOG HOG Heart of Georgia Railroad COEH GSWR Dawson CSX Goshen BAYL The Bay Line Railroad, L.L.C. Cuthbert CCH Columbus & Chattahoochee Railroad, Inc. RSOR GC Georgia Central Railway, L.P. MISSISSIPPI Georgiana Riceboro Abbeville Albany GSWR Georgia Southwestern Railroad, Inc. HAL Hilton & Albany Railroad, Inc. LOUISIANA HAL GFRR Dashed line indicates Trackage Rights. Waterford BAYL Gray line indicates Out of Service. Arlington TNHR WGCR 07/2017 Andalusia Enterprise Grime s Hilton SMWR R CIRR FR Dothan G GFRR Saffold G F Atmore RR GITM Lynn Bainbridge Seals Cottondale CS Valdosta X Chattahoochee CS X Kingsland SM Mobile VR Clyattville Cantonment FCRD Fernandina Yulee GFRR Jacksonville Pensacola FLORIDA Lake Charles Lafayette TTR New Iberia AN FE Panama C City Port St. -

View Detailed

C H A R L E V O I X Alpena Gaylord A N T R I M O T S E G O M O N T M O R E N C Y A L P E N A L E E L A N A U GLC G R A N D K A L K A S K A C R AW F O R D O S C O D A A L C O N A B E N Z I E T R AV E R S E L S R C M A N I S T E E W E X F O R D M I S S A U K E E O G E M AW L O S C O Lake Huron R O S C O M M O N Manistee Filer City Cadillac MICHIGAN Stronach C G R L A R E N A C S C L M A S O N L A K E O S C E O L A C L A R E G L A D W I N Ludington Walhalla Kinde Scottville Baldwin Pigeon H U R O N L Bad Axe Lake Michigan S Quarry R Elkton MQT C M I D L A N D B AY Ubly Sebewaing Ruth Essexville Auburn Akron O C E A N A N E WAY G O M E C O S TA I S A B E L L A Midland Bay City Palms Gilford Colling Monitor White Cloud Zilwaukee Munger Fairgrove Deckerville Fremont Carrollton T U S C O L A Buena Caro St Louis Wheeler Saginaw Vista Reese HESR Newaygo Denmark Jct MS Alma Gera S A N I L A C Grant M O N T C A L M Breckenridge Paines Vassar Berry Richville Marlette North Muskegon Hemlock S A G I N AW Arthur Millington Muskegon MMRR Croswell M U S K E G O N G R AT I O T K E N T L C GLC L S Muskegon Heights G R L A P E E R Brown Sparta C City G E N E S E E Fruitport C S T. -

Rail Plan 2005 - 2006

Kansas Department of Transportation Rail Plan 2005 - 2006 Kathleen Sebelius, Governor Debra L. Miller, Secretary of Transportation Kansas Department of Transportation Division of Planning and Development Bureau of Transportation Planning – Office of Rail Affairs Kansas Rail Plan Update 2005 - 2006 Kansas Department of Transportation Division of Planning and Development Bureau of Transportation Planning Office of Rail Affairs Dwight D. Eisenhower State Office Building 700 SW Harrison Street, Second Floor Tower Topeka, Kansas 66603-3754 Telephone: (785) 296-3841 Fax: (785) 296-0963 Debra L. Miller, Secretary of Transportation Terry Heidner, Division of Planning and Development Director Chris Herrick, Chief of Transportation Planning Bureau John Jay Rosacker, Assistant Chief Transportation Planning Bureau ACKNOWLEDGEMENT Prepared by CONTRIBUTORS Office of Rail Affairs Staff John W. Maddox, CPM, Rail Affairs Program Manager Darlene K. Osterhaus, Rail Affairs Research Analyst Edward Dawson, Rail Affairs Research Analyst Paul Ahlenius, P.E., Rail Affairs Engineer Bureau of Transportation Planning Staff John Jay Rosacker, Assistant Chief Transportation Planning Bureau Carl Gile, Decision Mapping Technician Specialist OFFICE OF RAIL AFFAIRS WEB SITE http://www.ksdot.org/burRail/Rail/default.asp Pictures provided by railroads or taken by Office of Rail Affairs staff Railroad data and statistics provided by railroads 1 Executive Summary The Kansas Rail Plan Update 2005 - 2006 has Transportation Act (49 U.S.C. 1654 et seg). Financial been prepared in accordance with requirements of the assistance in the form of Federal Rail Administration Federal Railroad Administration (FRA) U.S. Department (FRA) grants has been used to fund rehabilitation of Transportation (USDOT), as set forth in federal projects throughout Kansas.