Myanmar National Airline

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Useful Information for Trips to Myanmar

USEFUL INFORMATION FOR TRIPS TO MYANMAR www.exotravel.com/trade 1 AIRLINES (DOMESTIC) We use the following 9 domestic airlines: , Air Mandalay, Air KBZ, Asian Wings, FMI, Mann Yadanarpon, Golden Myanmar, Myanmar National, Apex, and Yangon Airways. All nine airlines fly French-Italian ATR turboprop planes (Avions de Transports Régionaux), a type of plane well suited for the local conditions, airports and distances. The configuration is either 40 seats (ATR-42) or 70-seats (ATR 72) in rows of 4 seats with a middle aisle. Entry-exit is at the back of the plane. Standard One-class configuration. AIRLINES (INTERNATIONAL) The following airlines currently fly into Myanmar: Thai Airways, Bangkok Airways, Air Asia, Nok Air, Myanmar Airways International, Malaysia Airlines, Silk Air/ Singapore Airline, Air China, China Eastern, China Airlines, Air India, China Southern Airlines, Qatar Airways, Vietnam Airlines, Emirates Airline, Tiger Air, Jet Star Airline, Thai Lion, Thai Smile, Viet Jet, Dragon Air, Hong Kong Express, Myanmar National Airline. ARRIVAL FORMALITIES Queue up at the immigration counters with a filled out arrival card and your passport with your visa stamped inside. If you are arriving with an e-visa, just hand your print out confirmation to the officer with your passport. After passing immigration, collect your luggage from the luggage belt and proceed to the customs counter. Hand over your filled-out customs form. Note that items of value and currency in excess of 10,000 USD are supposed to be declared and taken again on departure, but in practice things are made quite easy for tourists. CLOTHING Comfortable lightweight clothing in natural fabrics such as cotton is most suitable for traveling in Myanmar. -

2.2 Myanmar Aviation Myanmar Aviation

2.2 Myanmar Aviation Myanmar Aviation Page 1 4.5 Myanmar Airport Company Contact List Key airport information may also be found at: World Aero Data information on Myanmar Overview This logistics capacity assessment does not include review of military airports. Myanmar has three international airports: Yangon, Mandalay and Naypyitaw, of which Yangon has most handling capacity for passengers and cargo. Mandalay and Naypyitaw airport normally don’t handle cargo (except luggage) and have few international flights. There is a limited number of helicopter companies available, who mainly operate for the natural gas and oil industry and avoid to fly cargo at high altitudes in the mountains. Obtaining permission, registration and certification for foreign registered aircraft to operate inside Myanmar for emergencies can be a lengthy and complicated process. Airports assessed for this LCA include the following Location Region Type Status Yangon Yangon International Operational Mandalay Mandalay International Operational Naypyitaw Naypyitaw International Operational Mawlamyine Mon state Domestic 1x/Week use Dawei Tanintharyi Domestic Operational KawThaung Tanintharyi Domestic Operational Myeik Tanintharyi Domestic Operational Nyaung-U Mandalay Domestic Operational Pyay Bago Domestic Not in use Magway Magway Domestic Not in use Pakokku Magway Domestic Not in use Mandalay Chanmyathazi Mandalay Domestic 2x/Week use Kale Sagaing Domestic Operational Monywa Sagaing Domestic Operational Loikaw Kayah State Domestic Operational Heho Shan State Domestic Operational -

Business Conglomerates in the Context of Myanmar's Economic

Chapter 6 Business Conglomerates in the Context of Myanmar’s Economic Reform Aung Min and Toshihiro Kudo Abstract The purpose of this paper is to identify the role of conglomerates in the context of Myanmar’s economic reform process. The paper addresses the research question of the role of business conglomerates and the Myanmar economy, such as are they growth engines or just political cronies? We select some of the top conglomerates in Myanmar and assess their profile, performance, and strategies and examine the sources of growth and limitations for future growth and prospects. The top groups chosen for this paper are Htoo, Kanbawza, Max, Asia World, IGE, Shwe Taung, Serge Pun Associates (SPA)/First Myanmar Investment Group of Companies (FMI), Loi Hein, IBTC, Myanmar Economic Corporation (MEC), and Union of Myanmar Economic Holdings Ltd. (UMEHL). There are other local conglomerates that this paper does not address and they include Shwe Than Lwin Group, Eden Group, Capital and Dagon International etc., which are suggested for further research about Myanmar’s conglomerates in the future. Sources of growth and key success factors of the top business groups are their connection with government, contact with foreign partners, and their competency in the past and present. In the context of the economic reform, previously favored business people appear to recognize that the risks of challenging economic reform could outweigh the likely benefits. In addition, some of the founders and top management of the conglomerates are still subject to US sanctions. Market openness, media monitoring, competition by local and foreign players, sanctions, and the changing trends of policy and the economy limit the growth of conglomerates. -

San Linn (EMPA

YANGON UNIVERSITY OF ECONOMICS MASTER OF PUBLIC ADMINISTRATION PROGRAMME ANALYSIS ON IMPROVEMENT OF AIRPORT SERVICE AFTER LIBERALIZATION IN AVIATION INDUSTRY OF MYANMAR (Case Study: Customer Perspective at Yangon International Airport) SAN LINN EMPA - 52 (16th Batch) JUNE, 2019 YANGON UNIVERSITY OF ECONOMICS MASTER OF PUBLIC ADMINISTRATION PROGRAMME ANALYSIS ON IMPROVEMENT OF AIRPORT SERVICE AFTER LIBERALIZATION IN AVIATION INDUSTRY OF MYANMAR (Case Study: Customer Perspective at Yangon International Airport) A thesis submitted in partial fulfillment of the requirements for the Master of Public Administration (MPA) Degree Supervised by Submitted by Dr. Pwint Phyu Aung San Linn Lecturer Roll Number- 52 Department of Applied Economics EMPA 16thBatch Yangon University of Economics (2017 – 2019) JUNE, 2019 YANGON UNIVERSITY OF ECONOMICS MASTER OF PUBLIC ADMINISTRATION PROGRAMME This is to certify that this thesis entitled “ANALYSIS ON IMPROVEMENT OF AIRPORT SERVICE AFTER LIBERALIZATION IN AVIATION INDUSTRY OF MYANMAR (Case Study: Customer Perspective at Yangon International Airport)” submitted as a partial fulfillment in the requirements for the degree of Master of Public Administration (MPA) has been accepted by the Board of Examiners. BOARD OF EXAMINERS 1. Professor Dr. Tin Win Rector Yangon University of Economics (Chief Examiner) 2. Professor Dr. Ni Lar Myint Htoo Pro-Rector Yangon University of Economics (Examiner) 3. Professor Dr. Kyaw Min Htun Pro-Rector (Retd.) Yangon University of Economics (Examiner) 4. Professor Dr. Phyu Phyu Ei Programme Director and Head of Department Department of Applied Economics Yangon University of Economics (Examiner) 5. Dr. Zin Zin Naing Associate Professor Department of Applied Economics Yangon University of Economics (Examiner) JUNE, 2019 ABSTRACT Transportation has vitally important role for the economic development and regarding important development in the liberalization of air transport services was the emergence and subsequent expansion of bilateral agreements. -

RASG-PA ESC/29 — WP/04 14/11/17 Twenty

RASG‐PA ESC/29 — WP/04 14/11/17 Twenty ‐ Ninth Regional Aviation Safety Group — Pan America Executive Steering Committee Meeting (RASG‐PA ESC/29) ICAO NACC Regional Office, Mexico City, Mexico, 29‐30 November 2017 Agenda Item 3: Items/Briefings of interest to the RASG‐PA ESC PROPOSAL TO AMEND ICAO FLIGHT DATA ANALYSIS PROGRAMME (FDAP) RECOMMENDATION AND STANDARD TO EXPAND AEROPLANES´ WEIGHT THRESHOLD (Presented by Flight Safety Foundation and supported by Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP) EXECUTIVE SUMMARY The Flight Data Analysis Program (FDAP) working group comprised by representatives of Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP, is in the process of preparing a proposal to expand the number of functional flight data analysis programs. It is anticipated that a greater number of Flight Data Analysis Programs will lead to significantly greater safety levels through analysis of critical event sets and incidents. Action: The FDAP working group is requesting support for greater implementation of FDAP/FDMP throughout the Pan American Regions and consideration of new ICAO standards through the actions outlined in Section 4 of this working paper. Strategic Safety Objectives: References: Annex 6 ‐ Operation of Aircraft, Part 1 sections as mentioned in this working paper RASG‐PA ESC/28 ‐ WP/09 presented at the ICAO SAM Regional Office, 4 to 5 May 2017. 1. Introduction 1.1 Flight Data Recorders have long been used as one of the most important tools for accident investigations such that the term “black box” and its recovery is well known beyond the aviation industry. -

2.2.16 Myanmar Heho Airport

2.2.16 Myanmar Heho Airport The airport is located 3.7 Km North West of Heho town. Condition of the runway is good and it runs from South to North. The airport is busy all year round. There are nine airlines; Myanmar National Airlines, Air KBZ, Asia Wings, Yangon airway, Apex Airline, Mann Yadanarpon airlines, Golden Myanmar Airlines, FMI Air and Yangon Airways operates in the Heho airport. There are no international airlines except tour charter and ambulance. There are regular flights, everyday, 32 to 38 times per day in high season (October to February). The routes of the flight runs from Heho to Yangon, Mandalay, Lashio, Kengtung, Tarchileik, Monghsat and Bangan. There is no designated helipad in place. However, it can be arranged on apron for VIP flight. No cargo handling equipment facilities in this airport as it is mainly used for tourism. The largest plane that can be handled are medium-sized 100-seat planes such as EMB-190 / B-717. The run way is made of asphalt concrete and strength (PCN) is approximately 68 Metric ton. Airfield Details Country Myanmar Latitude 20°44'49.36"N Province / District Shan State/ Taunggyi Longitude 96°47' 31.28"E Airfield Name Heho Elevation (ft) 1199.1m / 3933ft IATA & ICAO codes HEH / VYHH Surface Asphalt /concrete 68,039 Kg Town or City (closest) Taunggyi 33.1km Runway Condition Good NGO / UN (on ground) No Passenger / Cargo Security Yes Screening (Yes / No) Runway Dimension 2591 (m) x 45 (m) Ground Handling (Yes / No) Yes, luggage trolleys manual only Refuelling Capacity National Energy Puma Aviation Service (a Joint Venture company of MPPE). -

Myanmar Aviation Sector

Myanmar Aviation Sector- Market Snapshot Myanmar Headlines Myanmar has 69 airports: three international, 30 domestic airports, and 36 dormant.1 Three international airports have now been built, though there are 66 remaining airports require further upgrades across the country. The aviation market in Myanmar is competitive, especially among local airlines. There are currently 11 local licensed airlines in Myanmar and 28 international airlines operating in Myanmar. Flag-carrier Myanmar National Airlines – which rebranded from Myanma Airways in 2014 – has the largest domestic fleet with 13 planes, followed by Air KBZ with eight aircraft as of April 2014.2 The eight other domestic carriers including Air Mandalay, Yangon Airways and Mann Yadanarbon have a total of 16 aircraft. International airlines such as Emirates, Qatar, Dragon air, Air China and KLM were launched flights to Myanmar in late 2016. According to the Myanmar Department of Civil Aviation (DCA), the number of passengers in 2013 increased to 4.2 million from 3.6 million in 2012. By 2030, that number is expected to rise to 30 million. Air flight traffic remains small at only 3,289 fright ton-miles in 2014-15. It is expected to grow significantly when infrastructure develops.3 Market Situation Myanmar Department of Civil Aviation (DCA) has a strategic plan to further expand the aviation sector with four objectives: pursue the liberalisation of economic regulations in the aviation sector strengthen air linkages promote airline businesses improve infrastructure The opportunities for all types of carriers in the market are vast as it is currently the most underserved region in ASEAN and perhaps all of Asia. -

Government's Policy Trade and Investment

Weekly Business News 1‐14 November 2013 Government’s Policy 1/ Myanmar to draft national energy plan Myanmar Business Today, 31 October-6 November 2013 Myanmar Government has begun drafting a national energy policy to meet the international norms and standards. The drafting is in cooperation with development partnership organizations as well as experts in this field. Trade and Investment 2/ MPT invites Tenders for Nationwide WiFi services Myanmar Business Today, 31 October-6 November 2013 The state-run Myanmar Post and Telecommunications (MPT) has invited local and overseas companies to implement broadband wireless (WiFi) service in Myanmar. Interested companies are to be submit the relevant documents to MPT by 30 November 2013. 3/ ChinaMyanmar gas pipeline becomes fully operational Myanmar Business Today, 31 October-6 November 2013 China-Myanmar gas pipeline has gone into full operation after its completed the section connecting the cities of Lufeng and Guigenc in southwest China. The pipeline send 12 billion cbm of natural gas annually to southwest China, which will reduce China’s coal consumption by 30.72 million tonnes per year. 4/ Yoma to run Volkswagen’s first service centre in Myanmar Myanmar Business Today, 31 October-6 November 2013 Singapore-based Yoma Strategic Holdings’ 70-percent-held subsidiary German Car Industries Company (GCI) has enter into a service partner agreement with German automaker Volkswagen AG (VW) to operate VW’s first service centre in Yangon. 5/ Foreign investment in Myanmar increases: DICA http://elevenmyanmar.com/business/4035-foreign-investment-in-myanmar-increases-dica Foreign investment in Myanmar has exceeded 43 billion USD, as nine countries including Britain and France have made mew investments in the past month. -

APRIL 2014 Contents the Golden Flight - Air Mandalay Inflight Magazine | April 2014 30

APRIL 2014 contents The Golden Flight - Air Mandalay Inflight Magazine | April 2014 30 46 management Chief Executive Officer Gary Villiard editorial Editor Thomas Kean Advertising Thinn Sanda Su Hlaing Cho Tun 24 Ei Mon Htin Publishing License Than Thar Htoo Photographers Thomas Kean, Sophia Hyden, Bosco, Aung Htay Hlaing Features Design & Layout Prodigy 12 At the heart of Team Air Mandalay 36 Printing Shwe Zin Printing 16 Thingyan: Washing away the old (0368) 24 Mrauk Oo: The royal capital of Distribution Regulars Air Mandalay Rakhine 60 Destinations 30 A magical moment All rights reserved. No part of this publication may be reproduced or transmitted in any form 66 Offices by any means including electronic or mechanical, Sunset from the temples of Bagan including photocopying, recording or otherwise, 36 Thingaha Ngapali: A new level in luxury 67 Route map without the prior written consent of the publisher. 68 Travel tips 42 Getting to La Source AIR MANDALAY LIMITED 71 Passenger sales agents No. 34, Shwe Taung Gone Avenue, 46 Savour the flavour: Shan Traditional Food Bahan Township, Yangon, Myanmar. 74 Useful numbers Tel: +95-1 525 488, 501 520 54 Your horoscope Fax: +95-1 525 937 16 E-mail: [email protected] Website: www.airmandalay.com A MESSAGE FROM OUR NEW CEO I would like to be the first of the Air Mandalay management to welcome you on board our domestic air service and also to tell you a little bit about our future plans. As you may already know, Air Mandalay Ltd – at the ripe old age of 20 – is the oldest domestic private airline in Myanmar, with a staff of more than 300. -

Treasures of Myanmar

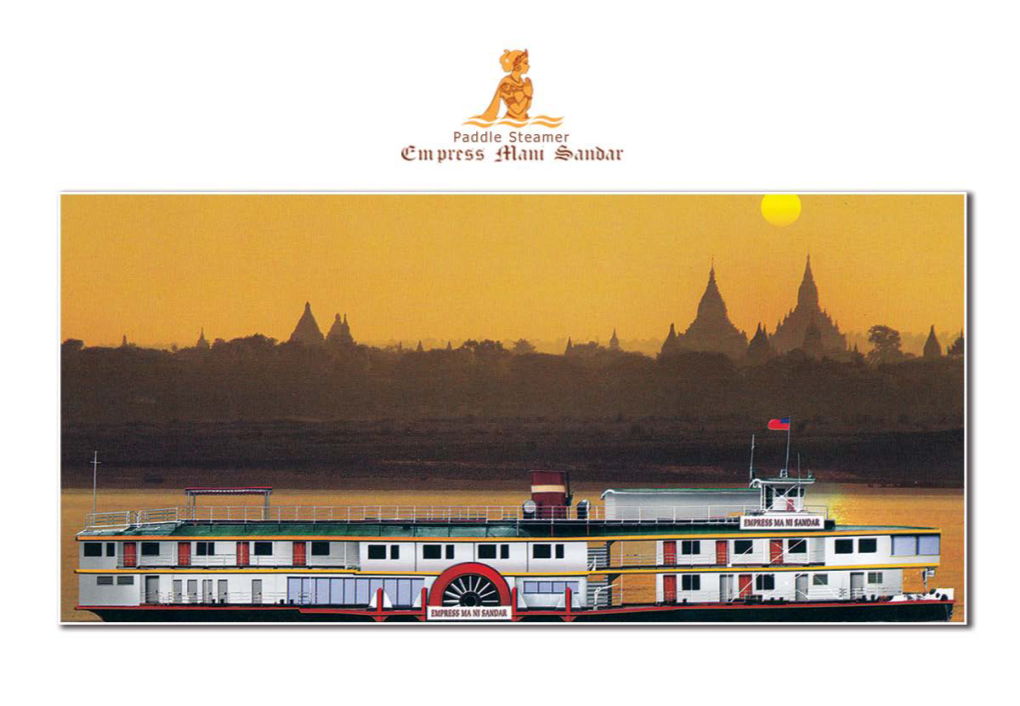

E-Travel Myanmar Co.,Ltd Add: No. 2,#006, Ground Floor, Kyitaw Housing, Mingalar Taung Nyunt Township, Yangon Tel/fax: 95 1 295144; Mobile: (95-9) 5092552 Treasures of Myanmar Yangon - Golden Rock - Bagan - Mt Popa - Mandalay – Sagain – Mingun - Kalaw - Pindaya - Inle Lake - Yangon ****** Itinerary Overview Day Destinations/Activities Meals Day 1 Yangon Arrival - Day 2 Yangon – Bago – Golden Rock B Day 3 Golden Rock – Yangon B Day 4 Yangon – Bagan Sightseeing B Day 5 Bagan – Mt Popa – Mandalay B Day 6 Mandalay – Mingum – City Tour – Mandalay B Day 7 Mandalay – Sagain – Mandalay B Day 8 Mandalay – Heho – Kalaw B Day 9 Kalaw – Pindaya – Nyaung Shwe – Inle B Day 10 Inle – Indein – Inle Lake B Day 11 Inle - Yangon B Day 12 Yangon departure B Note*: B: Breakfast Detailed Itinerary Day 1 Yangon arrival Arrive in Yangon where you will be welcomed by your local tour guide and transferred to your E-Travel Myanmar Co.,Ltd Add: No. 2,#006, Ground Floor, Kyitaw Housing, Mingalar Taung Nyunt Township, Yangon Tel/fax: 95 1 295144; Mobile: (95-9) 5092552 hotel to drop off you luggage. In the afternoon, a walk through "downtown" Yangon, a diverse mix of faded colonial architecture from the British times, and high-rises built by more recent investors; Sule Pagoda, built in the early 3rd century is a landmark in the city centre. Late afternoon visit the magnificent Shwedagon Pagoda of Rudyard Kipling fame and one of Myanmar's most sacred places. The massive bell shaped stupa is plated with gold and the tip of the stupa is set with diamonds and rubies, sapphires and topaz - a stunning sight as the sun sets and a most fitting place to begin our trip in this "Golden Land". -

Myanmar Hotel & Tourism Review 2012

MMRD BUSINESS INSIGHT MYANMAR HOTEL & TOURISM REVIEW 2012 ● ● ● T J Tan [Pick the date] Page | 2 Contents Country Facts ● ● ● .......................................................................................................................... 5 Executive Summary ● ● ● ................................................................................................................ 6 Overview ● ● ● ................................................................................................................................ 7 Infrastructure ............................................................................................................................... 7 There has been much progress in infrastructure development particularly in the past 2 years. This would include: ....................................................................................................................... 7 Banking, Payment & Foreign Exchange ........................................................................................ 8 Investments .................................................................................................................................. 8 Tax .............................................................................................................................................. 11 Communications ......................................................................................................................... 11 Tourism Sector ● ● ● .................................................................................................................... -

Investment Opportunities in Myanmar's Tourism Industry

Investment Opportunities In Myanmar’s Tourism Industry Presentation by: Ms. Thida Aung Assistant Director Directorate of Hotels and Tourism Ministry of Hotels & Tourism, Building No.33, Nay Pyi Taw, The Republic of the Union of Myanmar. Tel and Fax: 95 67 406249, 406104 E-mail: [email protected] Website: www.tourism.gov.mm 1. Background of Myanmar 2. Tourism Situation in Myanmar 3. Law, Rules and Notifications 4. Foreign Investment in Hotels and Commercial Complexes 5. Procedures and the Salient Points for the investment in Hotel and Commercial Building Projects 6. Conclusion 2 Background of Myanmar LET THE JOURNY BEGIN . Situates in Indochina . Area 676,577km2 peninsula . Population: 51.46 . Second largest country million in ASEAN . Density: 76/ sq km . Border with five . Capital: Nay Pyi Taw countries, . Religion: Buddhism . Bay of Bengal & Adman . Hot, Rain & Cold Sea seasons . Easily access by Air, Sea . 135 National races and Land A Country With Diverse National Races MYANMAR Major Destinations in LET THE JOURNY Myanmar BEGIN Yangon Major Destinations in LET THE JOURNY Myanmar BEGIN Mandalay Major Destinations in LET THE JOURNY Myanmar BEGIN Bagan Major Destinations in LET THE JOURNY Myanmar BEGIN Inlay Lake International Air Routes to Myanmar 1 Air Asia 2 Air China 3 Air India 4 Air KBZ 5 All Nippon Airways 6 Bangkok Airways 7 Biman Bangladesh Airlines 8 Cathy Dragon Air 9 China Airlines 10 China Eastern Airlines 11 China Southern Airlines 12 Emirates Air 13 Himalaya Airlines(H9) Hong Kong Express 14 Airways 15 Jet Star Air