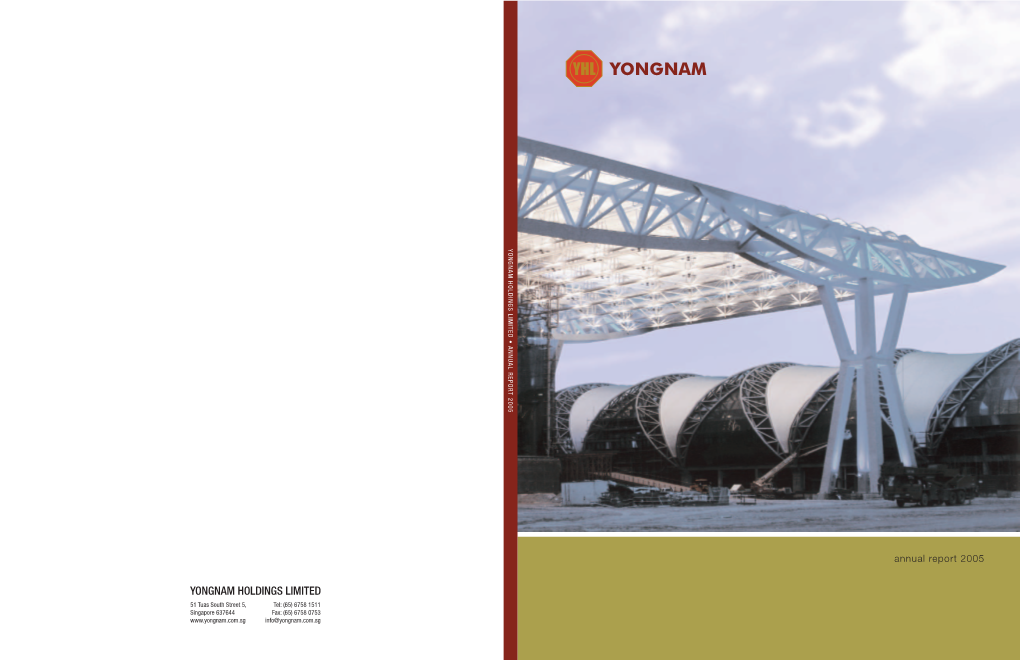

Yongnam Holdings Limited • Annual Report 2005

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NCE Nicoll Highway Collpase

Extracted from New Civil Engineer May 2005 Design and construction failures caused Singapore tunnel INADEQUATE highway was also destroyed. collapse'TEMPORARY The disaster was triggered by works and design the failure of a connection and construction between horizontal struts and waling beams, which between errors led to the them supported the diaphragm fatal collapse of walls, the inquiry heard last Singapore's week. deepest ever cut The explanation was given and cover tunnel, the public as part of a summary of inquiry into the disaster heard evidence submitted to the last week. Committee of Inquiry in The collapse hit a 110m section Singapore. of tunnel being con structed for The general causes of the Singapore Mass Rapid Transit's col lapse were agreed last month new Circle Line, adjacent to the by client the Land Transport six lane Nicoll Highway. Authority (LTA), main con tractor Four workers died when steel Nishimatsu-Lum Chang joint struts supporting the excava- venture (NLC), NLC's designer tion's diaphragm walls failed, Maunsell Asia, NLC project causing the tunnel to cave in on engineer Paul Broome, base slab subcontractor L&M, 20 April last year. Part of the strutting subcontractor Kori, persisted in using it and refused had S$25M (£83M) against it in to change." claims for late delivery against Combined with further errors schedule. Nishimatsu-Lum Chang for undrained soils, Shanmugam in temporary works design, this "If LTA knew that NLC's (NLC) was negligent, stated. led to strut-water connections design had serious defects, and reckless and dishonest "Use of Method A was being under-strength by a factor that NLC was concerned and during design and grossly erroneous. -

Nicholl Highway Collapse

INTERNATIONAL SOCIETY FOR SOIL MECHANICS AND GEOTECHNICAL ENGINEERING This paper was downloaded from the Online Library of the International Society for Soil Mechanics and Geotechnical Engineering (ISSMGE). The library is available here: https://www.issmge.org/publications/online-library This is an open-access database that archives thousands of papers published under the Auspices of the ISSMGE and maintained by the Innovation and Development Committee of ISSMGE. Design and Construction of Excavations in an Urban Setting – Lessons Learnt from Failures L. J. Endicott AECOM Asia Co Ltd, Hong Kong Department of Civil and Structural Engineering, University of Hong Kong Department of Civil and Structural Engineering, Hong Kong University of Science and Technology ABSTRACT: Safety is fundamental in Civil Engineering, yet failures happen. There are detailed Codes of Practice and various levels of checking, often detailed checking by Third parties. Failures should not occur; but they do. This paper makes reference to some catastrophic failures of deep excavations. It sets out some of the causative factors and explores what lessons have been learned from those cases. The main example is the collapse with fatalities of a 30m deep excavation alongside the Nicoll Highway in Singapore in 2004. This example is unusual in that the failed section happened to be at the location of an instrumented section and data is available from monitoring up to, and during, the collapse. Also many factors were disclosed during the official inquiry. The Inquiry and its findings are well documented. Subsequently remedial measures were put in place these measures relate to design standards, design methods, instrumentation, monitoring, supervision. -

The Circle Line Does Relieve Some of the Rush Hour Crush “It’S a Really Beautiful Line

01 “I think the Circle Line does relieve some of the rush hour crush “It’s a really beautiful line. I’d even consider it and sometimes, I can even get a seat!” a tourist attraction!” Donna Lim, shop manager Reuben Sim, student “My family, my neighbours – we’ve been waiting a long time for the Circle “I think the art makes each station special. I really like the artwork for Dakota Line. Now we won’t have to travel all the way downtown to get on the – it really reflects the history of our area. I feel like I can say it’s ‘my’ station.” East-West Line.” Chan Pei Cheng, Dakota resident Goh Jin Qiang, Yishun resident “When I’m away, one of the things I miss is the ease, convenience and sheer predictability of our MRT system. “It’s not just the time-savings. The Circle Line’s seamless transitions in a very The Circle Line has just raised my expectations further. comfortable and sheltered environment make using the MRT not just quick, I’m spoilt.” but also pleasant.” Jack See, underwriter Daphne Khong, senior planning officer “When the first MRT lines were being built, my grandfather said he wanted to live long enough to ride the trains. He did – for 14 years. He would have really loved the Circle Line.” Zhang Wei Min, school teacher 02 CIRCLELINE 03 “I wanted to be a train driver when I grew up, but that’s not needed now. I think I will be an engineer and build tunnels. Are you building more lines?” Nur Insyirah Ahmad Thaha, student, age 7 THE CIRCLE LINE LINKING ALL LINES “After all those years of digging and diversions and dust, the Circle Line is finally here and I must say it’s been worth it. -

Engineered for Growth Annual Report 2006

ENGINEERED FOR GROWTH ANNUAL REPORT 2006 Contents 1 Corporate Profile 2 CEO’s Message 4 Board of Directors 7 Corporate Information 8 Operations Review 12 5-Year Financial Profile 13 Financial Contents Profile Corporate Shaping the city skyline, adding structural and aesthetic value to buildings, laying solid foundations that give people the confidence to build upon – Yongnam aspires to be the name synonymous with such ideals. Steel is increasingly the material of choice for the construction of buildings and temporary support for deep excavations. The advantages of using steel over conventional material such as concrete for building construction are numerous. The higher speed of construction, superior material strength to volume ratio, flexibility in design and aesthetics are just some of the benefits of using steel. Yongnam excels in adding value Yongnam is an ISO-9001:2000, to steel. Its steel fabrication IQNet qualified company and experience has spanned more than accredited SI classification from 30 years. Together with production Singapore Structural Steel Society facilities in Malaysia, the Group (“SSSS”). Its Quality Management has a total production capacity of System takes a planned approach 45,000 tons of steel fabrication. Its towards continuous improvement of Singapore operations are housed our products, processes and services at its mega-site in Tuas. The Group to meet or exceed our customer’s utilizes latest steel technologies expectations at all times. to exploit innovative designs and methods. Yongnam’s technical The most cost-effective methods of and value engineering solutions for design, fabrication and installation are steel fabrication and erection have adopted in close consultation with resulted in increased productivity, our clients’ specific project needs, improved yield and lower costs. -

Final Report of the Construction Industry Institute, Hong Kong Research Project On

` Final Report of the Construction Industry Institute, Hong Kong Research Project on Reinventing the Hong Kong Construction Industry for its Sustainable Development THE UNIVERSITY OF HONG KONG AND THE HONG KONG POLYTECHNIC UNIVERSITY Research Team: Project Team Leaders: Research Manager Professor Chack-fan Lee Dr. James M.W. Wong Professor Andrew N. Baldwin Project Coordinators: Research Assistants Dr. S. Thomas Ng Ms. Joyce W.S. Cheung Professor Albert P.C. Chan Ms. Joanne W.S. Ng Mr. Ryan Y.C. Fan Team Members: Dr. Y.H. Chiang Professor Mohan M. Kumaraswamy Dr. Patrick T.I. Lam Ir Peter K.K. Lee November 2008 ACKNOWLEDGEMENT The Research Team would like to thank the Construction Industry Institute, Hong Kong; The University of Hong Kong; and the Faculty of Construction and Land Use, The Hong Kong Polytechnic University for their financial support to this research. In addition, throughout the research period, unreserved support, enduring guidance and constructive comments have been provided by the Research Task Force of the Construction Industry Institute – Hong Kong. They have made this study possible and their generosity is hereby gratefully acknowledged. Task Force Member Position Organisation Ir Raymond T.K. CHEUNG Chairman of Executive Construction Industry Institute, (Task Force Chairman) Board Hong Kong Mr. Kam-ling CHAN Chief Executive Officer, NWS Holdings Ltd. Director Mr. Lawrence Y.K. CHOI Vice Chairman Shui On Construction & Materials Ltd. Mr. Thomas O.S. HO Chief Executive Gammon Construction Ltd. Mr. M.L. KU Consultant Davis Langdon & Seah HK Ltd. Ir Henry H.C. LAM General Manager – MTR Corporation Project Mr. Wo-hei LAM Director Wong & Ouyang (HK) Ltd. -

Singapore 2020

Construction Cost Handbook SINGAPORE 2020 Arcadis Singapore Pte Ltd Artist’s Impression Arcadis Singapore Pte Ltd would like to acknowledge the following projects featured on our cover page: 1. 18 Robinson 2 Tuan Sing Holdings Limited (Project visual courtesy of Tuan Sing Holdings Limited) 1 2. The Avenir Hong Leong Holdings Limited 3 (Project visual courtesy of Hong Leong Holdings Limited) 3. JTC Defu Industrial City JTC Corporation (Project visual courtesy of JTC) 2 Twenty-sixth Edition 2020 © Arcadis Singapore Pte Ltd All rights reserved. No part of this publication may be reproduced, copied, stored or transmitted in any form without prior written permission from Arcadis Singapore Pte Ltd. The information contained herein should be regarded as indicative and for general guidance only. Arcadis Singapore Pte Ltd makes no representation, expressed or implied, with regard to the accuracy of the information herein and cannot accept any responsibility or liability for any errors or omissions that may be made. Unless otherwise stated, costs reflected in this handbook are current as at 4th Quarter 2019. Business Registration No: 199508550H 3 TABLE OF CONTENTS Page No. Table of Contents 4 Introduction 7 Calendars 8 1. CONSTRUCTION TRENDS Construction Outlook 14 Construction Cost Trends: a. Tender Price Indices 20 b. Material Price Indices 22 2. CONSTRUCTION COST DATA Preambles 26 Construction Costs For: a. Singapore 28 b. Selected Asian Cities 30 Construction Cost Specification 36 Cost Breakdown For Different Building Types 40 Major Rates For Selected Asian Cities 42 M&E Costs For: a. Singapore 48 b. Selected Asian Cities 50 Office M&E Cost Components 56 M&E Cost Charts 58 Utility Costs For Selected Asian Cities 62 3. -

IPO Prospectus

PROSPECTUS DATED 7 APRIL 2010 (registered by the Monetary Authority of Singapore on 7 April 2010) TIONG SENG H Corporate Profile We are principally engaged in building construction and civil engineering in Singapore, as well as property development in the PRC. O LD Established since 1959, we are one of the leading ING building construction and civil engineering contractors S L in Singapore. We hold the highest BCA grading of A1 for both general building and civil engineering* which I M qualifies us to undertake public sector construction I T E projects with unlimited contract value. D Through the use of pre-casting and advanced formwork systems, we are able to shorten the construction time and reduce our reliance on human labour, resulting in higher productivity and cost efficiencies. Our property development business focuses on developing residential and commercial projects in various second- and third-tier cities in the PRC. We have successfully developed properties in Tianjin, Suzhou and Yangzhou. Currently, we have four on- going projects in the Bohai Economic Rim, which is THIS DOCUMENT IS IMPORTANT. IF YOU ARE IN ANY DOUBT AS TO THE one of the main economic zones in the PRC. ACTION YOU SHOULD TAKE, YOU SHOULD CONSULT YOUR LEGAL, FINANCIAL, TAX, OR OTHER PROFESSIONAL ADVISER. TIONG SENG HOLDINGS LIMITED ESTABLISHED SINCE 1959. SINGAPORE We have applied to the Singapore Exchange Securities Trading Limited (the (Incorporated in the Republic of Singapore on 15 April 2008) * As of 9 February 2010, only 48 out of 1,573 contractors registered “SGX-ST”) for permission to deal in and for quotation of all the ordinary shares (Company Registration No. -

Nicoll Highway Collapse, Singapore

Missouri University of Science and Technology Scholars' Mine International Conference on Case Histories in (2013) - Seventh International Conference on Geotechnical Engineering Case Histories in Geotechnical Engineering 02 May 2013, 4:00 pm - 6:00 pm Case Histories of Failure of Deep Excavation. Examination of Where Things Went Wrong: Nicoll Highway Collapse, Singapore John Endicott AECOM, Hong Kong, China Follow this and additional works at: https://scholarsmine.mst.edu/icchge Part of the Geotechnical Engineering Commons Recommended Citation Endicott, John, "Case Histories of Failure of Deep Excavation. Examination of Where Things Went Wrong: Nicoll Highway Collapse, Singapore" (2013). International Conference on Case Histories in Geotechnical Engineering. 7. https://scholarsmine.mst.edu/icchge/7icchge/session03/7 This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License. This Article - Conference proceedings is brought to you for free and open access by Scholars' Mine. It has been accepted for inclusion in International Conference on Case Histories in Geotechnical Engineering by an authorized administrator of Scholars' Mine. This work is protected by U. S. Copyright Law. Unauthorized use including reproduction for redistribution requires the permission of the copyright holder. For more information, please contact [email protected]. CASE HISTORIES OF FAILURE OF DEEP EXCAVATION EXAMINATION OF WHERE THINGS WENT WRONG: NICOLL HIGHWAY COLLAPSE, SINGAPORE Professor John Endicott Fellow, AECOM Hong Kong ABSTRACT During the construction of Contract C824 of the Circle Line in Singapore, on 20th April 2004 an 80 m long section of excavation, 30 m deep, totally collapsed. The resulting crater was as deep as 15 metres and was more than 100 m in diameter. -

BUILDING FOUNDATION, ENSURING SUCCESS Tailored to Their Needs and Demands Managers with Substantial Experience

CORPORATE PROFILE Kori Holdings Limited, through its wholly-owned subsidiaries, Kori Construction (S) Pte. Ltd., Ming Shin KORI HOLDINGS LIMITED KORI HOLDINGS LIMITED Construction (S) Pte. Ltd. and Kori Construction (M) Sdn. (Company Registration No.: 201212407R) Bhd., (collectively, the “Group”) is principally engaged in (Incorporated in the Republic of Singapore on 18 May 2012) providing civil/structural engineering and infrastructural construction services as a sub-contractor for commercial, industrial and public infrastructural construction projects. Its customers include local and overseas developers in the engineering construction industry. The Group’s businesses can be categorised into two main segments, namely, structural steelworks services and tunnelling services. COMPETITIVE STRENGTHS ESTABLISHED TRACK RECORD • Strict quality control procedures at each stage of the • Over 30 years of experience in the areas of structural steel fabrication and erection process all the way to fi nal delivery and civil/structural engineering • Good reputation in the industry as a competent Building EXPERIENCED AND DEDICATED MANAGEMENT TEAM and Construction Authority (“BCA”) licensed and registered • Chairman and Executive Director, Mr. Kori Nobuaki, and Chief builder Executive Offi cer and Managing Director, Mr. Hooi Yu Koh, • Has won numerous infrastructural construction projects both have more than 40 and 17 years of experience, respectively, locally and overseas in structural steel and civil/structural engineering industries • Established a reputation -

Risk Assessment in Deep Excavations and Their Effect on Surrounding Structures : a Review

Risk Assessment in Deep Excavations and their Effect on Surrounding Structures : A review Syed Uzairuddin 3rd Year UG, Civil Engineering Dept. National Institute of Technology, Raipur [email protected] Abstract—Construction is crucial to a country's overall The amount and direction of the generated deformations are economic growth, particularly in developing countries, in dependent on the building's closeness to the excavations, as the current era of globalization. If construction operations shown schematically in Fig. 1. Ground movement prediction are not carried out strictly according to a local or national and management around these construction pits are critical building code, they might result in large-scale failures during the planning and construction phases of these endangering human lives, personnel property, and the excavations to protect surrounding structures from current and economic balance. It is vital to handle the construction future activities as the project progresses(El-Nahhas 2013). process's risk elements. The self weight of soil behind the retaining line is the driving force and shear strength of soil is the resisting force as a result, deep excavations invariably cause lateral and vertical ground deformations. As a result of the produced ground deformations, nearby buildings and utilities become kinetically loaded. Risks associated with ground movement cannot be calculated solely using mathematical predicting models and engineering simulations as it needs to address the uncertainty of soil properties, Geo-materials, ground constitutive nature, building stage modelling, three- dimensional impacts of deep excavations, time-dependent natures of ground deformations, and the critical necessity to include human variables such as craftsmanship into prediction models are all important considerations.This article provides an overview of risk assessment and management technologies and approaches that have been adapted for use in deep excavations. -

Psychologists, Psychotherapists and Social Workers

International Appeal to Stop 5G on Earth and in Space PSYCHOLOGISTS, PSYCHOTHERAPISTS AND SOCIAL WORKERS AFGHANISTAN Hamza Abdurrahim, Dr. Psych., Psychologist, Kabul Mir Abdullah Burhani, Kabul, Takhar ALBANIA Rita Strakosha, Msc. in Law, MPS in Clinical Psychology, Tirana, Albania ANDORRA Marta Boix, Barcelona, Andorra ARGENTINA María Altuna, caba, Buenos Aires Luz belén BERARDO Manero, Carlos Paz, Córdoba Cecilia Biedermann, Licenciada universitaria, Necochea, Buenos Aires Maria Bonano, Psychologist, Buenos Aires, Buenos Aires Melina Bronfman, Musictherspist, Buenos Aires, Ciudad de Buenos Aires Maria florencia Cardená, Capital federal, Buenos aires Marta Chemes, Dra.en Psicología, BsAs, CABA Karina Collia, Quilmes, Buenos Aires Silvana Degasperi, Psychology, Buenos Aires, Buenos Aires Isabel Lucía Diaz, Almafuerte, Córdoba Josefina Filosa, Licenciada en Psicologia, Psicoterapeuta, Godoy Cruz, Mendoza Sandra Gioia, Quilmes, Buenos aires vanesa Lilian guerra, licenciada en psicologia, caba, buenos aires lilia mabel labiano, Dra. en Psicología, Licenciada en Psicología. Profesora en Enseñanza Normal y Especial en Psicología, psicóloga, jubilada como docente-investigadora de la Universidad Nacional de San Luis, San Luis, SAN LUIS Julieta Liverotti, La Plata, Buenos Aires Dania Lucas, Lic. en Psicología, Psychologiest, member of the board of the AAPsiA Argentine Association of Anthroposophic Psychologists, Buenos Aires, Buenos Aires Franco Luciani, Buenos Aires, Buenos Aires Patricia Ana Martínez Fletcher, Licenciatura en Fonoaudiología -

Everyday Guardians, Captures a Brief History and the Key Highlights of NS in the Five Everyday Decades Since

14mm SINCE 1967, NATIONAL SERVICE (NS) OFFICERS OF THE SINGAPORE POLICE FORCE AND SINGAPORE CIVIL DEFENCE FORCE HAVE MORE THAN STEPPED UP TO THE CALL TO SERVE ALONGSIDE REGULAR OFFICERS – on THE GROUND AND IN SENIOR APPOINTMENTS AT ALL LEVELS. THIS BOOK, EVERYDAY GUARDIANS, CAPTURES A BRIEF HISTORY AND THE KEY HIGHLIGHTS OF NS IN THE FIVE EVERYDAY DECADES SINCE. Duty to the country is being performed ever more effectively in the Home Team. NS officers are equipped with more effective hardware, from Unmanned Aerial Vehicles to body-worn cameras, and more sophisticated skillsets in emergency medical service. But what qualifies EV GUARDIANS them best is their deep sense of responsibility and dedication to keep 50 YEARS OF NATIONAL SERVICE Singapore safe and secure. E RYDAY GUARDIANS RYDAY IN SINGAPORE’S HOME TEAM Devotion to family and community remain primary motivations. These men in blue remain warmly-supported by “the other home team” of family and loved ones, as well as bosses and colleagues, neighbours and fellow citizens. It takes a village to make an NS officer, and in return, these citizen guardians give their all back – not only at home, but also in overseas missions far away, representing their country and serving humanity. Daring is evident in all that these NS officers do, wherever the need arises. Whether in a major disaster or neighbourhood incident, the courage is unquestioned, and the commitment untiring – to combat crime, preserve order and save lives. It has been 50 years, but Singaporeans know they can rely on their NS officers even for 50 more, as the core values of the Home Team are passed on from one generation to the next.