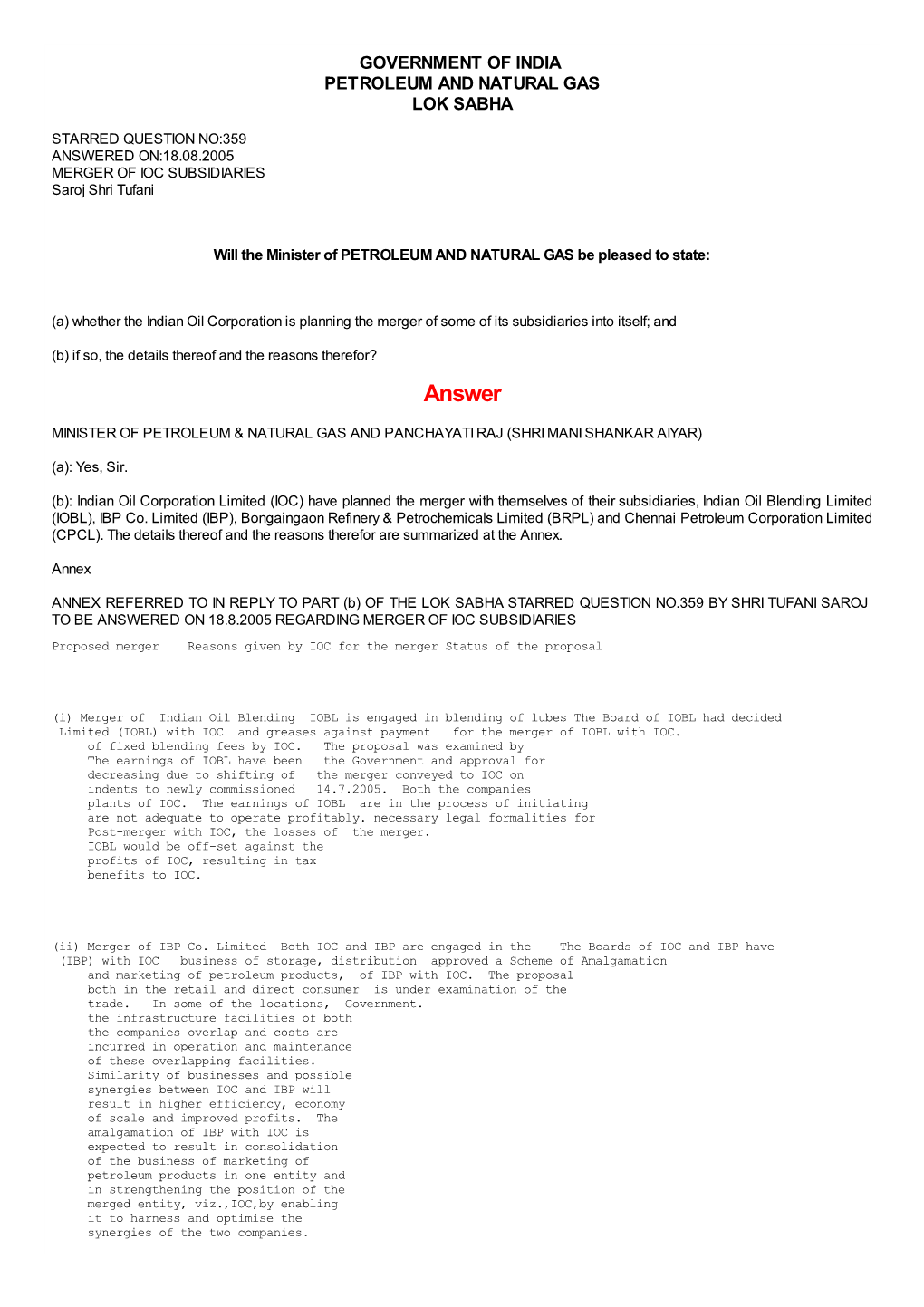

ANSWERED ON:18.08.2005 MERGER of IOC SUBSIDIARIES Saroj Shri Tufani

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

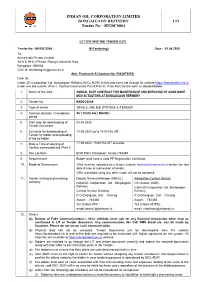

INDIAN OIL CORPORATION LIMITED BONGAIGAON REFINERY Tender No

INDIAN OIL CORPORATION LIMITED BONGAIGAON REFINERY LIT Tender No – BN20CS004 LETTER INVITING TENDER (LIT) Tender No : BN20CS004 (E-Tendering) Date : 01.08.2020 To, Auma India Private Limited. 38-A & 39-B,II Phase, Peenya Industrial Area, Bangalore -560058 DSC Id: [email protected] Attn. Prashanth S (Contact No: 9342679053) Dear Sir, Indian Oil Corporation Ltd, Bongaigaon Refinery (IOCL-BGR) invites electronic bid through its website https://iocletenders.nic.in under one bid system, (Part-I : Techno-Commercial Part & Part-II : Price Part) for the work as detailed below: 1. Name of the work ANNUAL RATE CONTRACT FOR MAINTENANCE AND SERVICING OF AUMA MAKE MOV ACTUATORS AT BONGAIGAON REFINERY 2. Tender No BN20CS004 3. Type of tender SINGLE ONE BID SYSTEM, E-TENDER 4. Contract duration / Completion 36 ( Thirty-Six ) Months period 5. Start date for downloading of 03.08.2020 Tender Document 6. Last date for downloading of 10.08.2020 up to 14.00 Hrs IST Tender by bidder and uploading of bid by bidder 7. Date & Time of opening of 11.08.2020, 15.00 Hrs IST onwards. Techno-commercial bid (Part-I) 8. Site Location BGR Plant Dhaligaon, Assam-783385 9. Requirement Bidder shall have a valid PF Registration Certificate 10. Mode of Submission Offer must be uploaded on e-tender website www.iocletenders.nic.in before the last date & time of submission of tender. Offer submitted using any other mode will not be accepted. 11. Tender inviting and receiving Deputy General Manager (MN-EL) Alternative Contact Details: authority IndianOil Corporation Ltd, Bongaigaon CS Charan, AMEL Refinery IndianOil Corporation Ltd, Bongaigaon Central Service Building Refinery P.O-Dhaligaon, Dist – Chirang P.O-Dhaligaon, Dist – Chirang Assam – 783385 Assam – 783385 Tel: 03664-3741 ; Tel: 03664-253758; email: [email protected] ; email: [email protected]; 12. -

CHAPTER - I Through International Competitive Biddings in a 1

CHAPTER - I through international competitive biddings in a 1. INTRODUCTION deregulated scenario. Appraisal of 35% of the total sedimentary basins is targeted together with 1.1 The Ministry of Petroleum & Natural Gas acquisition of acreages abroad and induction of (MOP&NG) is concerned with exploration & advanced technology. The results of the initiatives production of oil & natural gas (including import taken since 1999 have begun to unfold. of Liquefied Natural Gas), refining, distribution & 1.8 ONGC-Videsh Limited (OVL) a wholly owned marketing, import, export and conservation of subsidiary of ONGC is pursing to acquire petroleum products. The work allocated to the exploration acreage and oil/gas producing Ministry is given in Appendix-I. The names of the properties abroad. OVL has already acquired Public Sector Oil Undertakings and other discovered/producing properties in Vietnam (gas organisations under the ministry are listed in field-45% share), Russia (oil & gas field – 20% Appendix-II. share) and Sudan (oil field-25% share). The 1.2 Shri Ram Naik continued to hold the charge as production from Vietnam and Sudan is around Minister of Petroleum & Natural Gas during the 7.54 Million Metric Standard Cubic meters per financial year 2003-04. Smt. Sumitra Mahajan day (MMSCMD) of gas and 2,50,000 barrels of assumed the charge of Minister of State for oil per day (BOPD) respectively. The first Petroleum & Natural Gas w.e.f 24.05.2003. consignment of crude oil from Sudan project of OVL was received in May, 2003 by MRPL 1.3 Shri B.K. Chaturvedi continued to hold the charge (Mangalore Refinery Petrochemicals Limited) in as Secretary, Ministry of Petroleum & Natural Gas. -

ANSWERED ON:26.08.2004 FARMERS` LAND ACQUIRED by IOC/GAIL/ONGC Thummar Shri Virjibhai;Varma Shri Ratilal Kalidas

GOVERNMENT OF INDIA PETROLEUM AND NATURAL GAS LOK SABHA STARRED QUESTION NO:446 ANSWERED ON:26.08.2004 FARMERS` LAND ACQUIRED BY IOC/GAIL/ONGC Thummar Shri Virjibhai;Varma Shri Ratilal Kalidas Will the Minister of PETROLEUM AND NATURAL GAS be pleased to state: (a) the total number of refineries in the country run by the IOC/GAIL/ONGC and other PSUs under Ministry of Petroleum and how much land of the farmers has been acquired by them; (b) whether all such landless farmers have been provided any employment or rehabilitated: (c) if so, the details thereof State-wise; (d) if not, the reasons therefor; and (e) the steps taken to rehabilitate remaining farmers? Answer MINISTER OF PETROLEUM & NATURAL GAS AND PANCHAYATI RAJ (SHRI MANI SHANKAR AIYAR) (a) to (e): A statement is laid on the Table of the House. STATEMENT REFERED TO IN REPLY TO PARTS (a) TO (e) OF THE LOK SABHA STARRED QUESTION NO.446 BY SHRI V.K. THUMMAR AND SHRI RATILAL KALIDAS VARMA TO BE ANSWERED ON 26TH AUGUST, 2004 REGARDING FARMERS' LAND ACQUIRED BY IOC/GAIL/ONGC. (a)to(e): There are 17 Public Sector refineries operating in the country. Approximately 16097 acres of land have been acquired for setting up these refineries, as per details given in the Annex. All land owners, including farmers, were provided compensation as per the Land Acquisition Act,1894. In addition, as a rehabilitation measure, rehabilitation grants, training, self-employment, employment in the project etc. were also considered by the Public Sector Refineries for different projects. ANNEX REFERED TO IN REPLY TO PARTS (a) TO (e) OF THE LOK SABHA STARRED QUESTION NO.446 BY SHRI V.K. -

Environmental Impact Assessment (EIA)

INDIAN OIL CORPORATION LIMITED EXECUTIVE SUMMARY of Environmental Impact Assessment (EIA) For Implementation of BGR INDMAX project associated with BGR crude processing capacity enhancement from 2.35 to 2.7 MMTPA, DHDT capacity enhancement from 1.2 to 1.8 MMTPA, CRU-MSQ revamp & Implementation of SDS unit At Tehsil Sidli (PT-II), PO.Dhaligaon, District: Chirang, Assam . ABC TECHNO LABS INDIA PVT. LTD. AN ISO ISO 9001:2008, ISO14001:2004 & OHSAS 18001:2007 certified Environmental Engineering and Consultancy Organization (NABL Accredited & MoEF Recognised Environment Laboratory) QCI NABET Accredited for Sector 5F (Certificate No. NABET / EIA / 1316 / RA001) Corporate Office: No.2, 2 nd Street, Thangam Colony, Anna Nagar West, Chennai – 600040. Tamil Nadu, India. Tel: 044 – 26161123 / 24 / 25 Mumbai Office: A-355, Balaji Bhavan, Plot No. 42 A, Sector 11, CBD Belapur, Navi Mumbai – 400614. Maharashtra, India Tel: 022 27580044 Executive Summary of EIA Report for Implementation of INDMAX project associated with crude processing capacity enhancement from 2.35 to 2.7 MMTPA, DHDT capacity enhancement from 1.2 to 1.8 MMTPA, CRU-MSQ revamp & implementation of SDS unit by M/s IOCL, Bongaigaon Refinery at Dhaligaon, Dist: Chirang (BTAD), Assam EXECUTIVE SUMMARY 1. INTRODUCTION Bongaigaon Refinery (BGR) is the eighth operating refinery of IOCL, formed upon the amalgamation of Bongaigaon Refinery & Petrochemicals Limited (BRPL) with Indian Oil Corporation Ltd. (IOCL) on March 25, 2009. Bongaigaon refinery is situated at Dhaligaon in Chirang district of Assam, 200 km west of Guwahati. Bongaigaon Refinery (erstwhile BRPL) was commissioned in year 1979 with crude processing capacity of 1.00 Million Metric Ton Per Annum (MMTPA). -

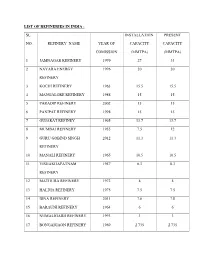

List of Refineries in India

LIST OF REFINERIES IN INDIA : SL INSTALLATION PRESENT NO. REFINERY NAME YEAR OF CAPACITY CAPACITY COMISSION (MMTPA) (MMTPA) 1 JAMNAGAR REFINERY 1999 27 33 2 NAYARA ENERGY 1996 20 20 REFINERY 3 KOCHI REFINERY 1963 15.5 15.5 4 MANGALORE REFINERY 1988 15 15 5 PARADIP REFINERY 2002 15 15 6 PANIPAT REFINERY 1998 15 15 7 GUJARAT REFINEY 1965 13.7 13.7 8 MUMBAI REFINERY 1955 7.5 12 9 GURU GOBIND SINGH 2012 11.3 11.3 REFINERY 10 MANALI REFINERY 1965 10.5 10.5 11 VISHAKHAPATNAM 1957 8.3 8.3 REFINERY 12 MATHURA REFINERY 1972 8 8 13 HALDIA REFINERY 1975 7.5 7.5 14 BINA REFINERY 2011 7.8 7.8 15 BARAUNI REFINERY 1964 6 6 16 NUMALIGARH REFINERY 1993 3 3 17 BONGAIGAON REFINERY 1969 2.735 2.735 18 GUWAHATI REFINERY 1962 1 1 19 NAGAPATTNAM 1993 0.5 1 REFINERY 20 DIGBOI REFINERY 1901 0.65 0.65 21 TATIPAKA REFINERY 2001 0.07 0.07 22 BARMER REFINERY 2013 9 9 Jamnagar Refinery: Jamnagar refinery is a private sector crude oil refinery owned by reliance. The refinery was commissioned in 14 July 1999 with an installed capacity of 27MMTPA. The present capacity of this refinery is 33MMTPA.It is currently the largest refinery in the world. Oil Field of Assam:- In Assam up to the cost of Myanmar, the presence of oil is very common .In the air 1825 itself seepage of oil was discovered in makum .In the year 1867 under the guidance of sir Madly Colt ,the first oil well was dug at makum .But after a very short production, it was abandoned as it was not economically viable. -

INDIAN OIL CORPORATION LIMITED (Refinery Division) Bongaigaon Refinery Advertisement No. BGR/T&D/01/Appr-2016 Date

INDIAN OIL CORPORATION LIMITED (Refinery Division) Bongaigaon Refinery Advertisement No. BGR/T&D/01/Appr-2016 Date: 08.02.2016 Notification for Engagement of Apprentices Indian Oil Corporation Limited, the largest commercial undertaking in India and a Fortune “Global 500” Company, as a measure of Skill Building Initiative for the Nation, proposes to engage apprentices at its Bongaigaon Refinery at Dhaligaon, Assam. Applications are invited from candidates meeting the following qualification & other parameters for engagement as Apprentices under Apprentices Act, 1961 / 1973 (as amended from time to time) in the Trade / Disciplines mentioned below: Educational Qualification, Provisional Number of seats in apprentice category including likely reservation shall be as follows. The consolidated stipend payable shall be as mentioned below or as revised (under the Act) from time to time (whichever is higher), Reservation will be applicable as per the prescribed percentage for recruitment applicable to the state of Assam. Code Trade / Discipline Qualification Period of No of GEN SC ST OB Consolidated stipend per Apprentice vacancy C month -ship (NC (months) L) A1 Trade Apprentice / 3 Years Full time 18 25 15 1 3 6 1st 70% of Minimum Attendant Operator B Sc (Physics, Maths, Year Wage for semi (Chemical Plant) Chemistry/ Industrial skilled worker Discipline - Chemical Chemistry). (applicable to BGR) + Rs 2500.00 A2 Trade Apprentice Matric with 2 (two) 12 for 10 7 0 1 2 2nd (Fitter) Discipline- year ITI (Fitter) NCVT & Year 80% of Minimum Mechanical course. 24 for Wage for semi SCVT skilled worker (applicable to BGR) + Rs 2500.00 A3 Trade Apprentice 3 Years Full time 36 5 4 0 0 1 3rd year 90% of Minimum (Boiler) Discipline- B Sc (Physics, Maths, Wage for semi skilled Mechanical Chemistry /Industrial worker Chemistry). -

Bongaigaon Refinery & Petrochemicals Limited

SANSCO SERVICES - Annual Reports Library Services - www.sansco.net Bongaigaon Refinery & Petrochemicals Limited (A group company of IndianOil) T 34th ANNUAL REPORT 2007-2008 Growing through consistent performance www.reportjunction.com SANSCO SERVICES - Annual Reports Library Services - www.sansco.net BOARD OF DIRECTORS Shri Sarthak Behuria Chairman Shri A.K. Sarmah Managing Director Shri A. Saran Shri T.V. John Director (Operations) Director (Finance) Bowman Riflmn> > PrtoHtmJciH umlM 34th AKNUAL RBPORT 2007-2008 Shri P.C. Sharma Shri B.M. Bansal Shri Maninder Singh Director Director Director We believe that growth of an organization depends on its aspiration to achieve new heights of performance through constant efforts and dedication. Our physical and financial performance during the year 2007-08 is a testimony to the Shri J.L Raina Dr. D.N. Buragohain ShriP.K. Goyal Shri G. Bhanumurthy above belief. Director Director Director Director www.reportjunction.com SANSCO SERVICES - Annual Reports Library Services - www.sansco.net CONTENTS Notice 2 Board of Directors 5 Performance at a Glance 6 Directors' Report 8 Management Discussion & Analysis 24 Report on Corporate Governance 29 Auditors' Report 43 Comments of Comptroller and Auditor General of India 46 Balance Sheet 48 Profit & Loss Account 49 Schedules 50 Statement of Significant Accounting Policies 61 Income & Expenditure on Social Overheads 70 Cash Flow Statement ° 75 Business Segments Report ' 76 www.reportjunction.com " SERVICES rAnriuaTRoport NOTICE NOTICE IS HEREBY GIVEN THAT the Thirty-fourth Annual General of India in terms of Section 619 of the General Meeting of the Shareholders of Bongaigaon Refinery Companies Act, 1956. & Petrochemicals Limited will be held on Wednesday, the 2. -

Brief Summary

BRIEF SUMMARY Project: Augmentation of PHBPL by Laying of new 30" OD Crude Oil Pipeline in Haldia- Barauni section of PHBPL and Conversion of existing 18" OD Haldia-Barauni section (Mainline and Loop line) to Product & Gas Service Introduction Out of total eleven refineries in the country (Own plus two refineries of subsidiary), IOCL has two refineries located at Haldia and Barauni in the Eastern part of the country and three refineries at Digboi, Guwahati and Bongaigaon in the North Eastern part of the country. The total crude oil requirement of Haldia and Barauni refineries and part requirement of Bongaigaon Refinery is met from the Paradip and Haldia ports, located on the east coast of India. The crude oil received through tankers at Paradip port is transported to these three refineries through Paradip-Haldia- Barauni crude oil Pipeline (PHBPL) of IOCL. Minor crude oil volume is also handled at Haldia for pumping in Haldia-Barauni section of PHBPL (18” Mainline and 18” loop line sections). Barauni- Bongaigaon section of Oil India Limited’s (OIL) Pipeline is utilized for transporting crude oil further from Barauni to Bongaigaon. The present name plate capacity of Haldia, Barauni and Bongaigaon refineries is 7.5 MMTPA, 6.0 MMTPA and 2.35 MMTPA, respectively. These refineries are getting augmented and the total requirement of these refineries will be 20.4 with peak-processing capacity at 22 MMTPA. Whereas, the present capacity of Paradip-Haldia section of PHBPL is 15.2 MMTPA and that of Haldia-Barauni section is 9.2 MMTPA. In view of the projected future crude oil supply requirements of Haldia Barauni and Bongaigaon refineries, capacity augmentation of PHBPL is envisaged as under: a) Augmentation of capacity of Paradip-Haldia (P-H) section from 15.2 to 20.4 MMTPA, which can be increased to 22 MMTPA, when crude oil of lesser viscosity is pumped or through the use of DRA. -

Oil & Gas in India: the Milestones (1825-2012)

SEPTEMBER 2014 ISSUE # 6 Oil & Gas in India: The Milestones (1825-2012) ONGC platform at Bombay High Source: http://en.wikipedia.org/wiki/Bombay High#mediaviewer/ file:ONGCoilplatform.jpg (accessed on 17.06.2014) Compiled by Dinesh Kumar Madhrey Upstream 1825: Lieutenant R. Wilcox of the 46th Regiment Native Infantry, who with his small survey party was on a military mission to maintain law and order, spotted oil seepages in the north-eastern corner of Assam in September. 1866: Hydrocarbon exploration began in India when Mr. Goodenough of the Calcutta-based McKillop Stewart Co. drilled a well near Jaypore in Upper Assam and struck oil. He, however, failed to establish satisfactory production. Observer Research Foundation is a public policy think-tank that aims to influence formulation of policies for building a strong and prosperous India. ORF pursues these goals by providing informed and productive inputs, in-depth research and stimulating discussions. The Foundation is supported in its mission by a cross-section of India’s leading public figures, academics and business leaders. 1 | www.orfonline.org | September 2014 Oil & Gas in India: The Milestones (1825-2012) 1867: H. B. Medicott of the Geological Survey of India (GSI) first started oil exploration in India in the Makum area of Assam. The most astounding Indian oil history was made on 26 March by Mr. Goodenough when he struck oil at 35.97 metres at Makum (with a total production of 1135.62 litres). It was Asia's first mechanically drilled well. Before this discovery, three wells had been drilled in Jaypore which encountered some gas but little oil. -

Investor Presentation June 2017

Investor Presentation June 2017 Strictly Private and Confidential Indian Oil Corporation: The Future of India Energy ● Maharatna Company; GoI Control: 57.34% Strong Support from the ● Government nominated Directors on IOC Board Government of India ● Contribution to exchequer of INR 1,79,014 Cr in FY17 ● 11 refineries with 80.7 MMTPA Capacity Largest Refiner in the Country ● 35% of Domestic Refining Capacity ● 12,700+ km pipelines for crude oil and products with a total capacity of 93.7 MMTPA Pan-India Pipeline Infrastructure ● 48% share in crude and product pipeline (by length) Leading Market Share ● 45.1% petroleum market share in FY17 with over Across Portfolio 46,500 touch points Integrated Operations Across the ● 2nd largest domestic player in Petrochemicals entire Energy Value Chain ● E&P: 8 domestic and 9 overseas blocks ● Overall 554 patents as on 31.03.2017 Strong Focus on Innovation Through R&D and Alternate Energy Sources ● New focus on Alternate and Renewable Energy (Wind, Solar, Biofuels, Nuclear) ● Consistent growth and profitability Driven by a Management Team That o FY11-FY17 Revenue CAGR: 6.59% has Delivered Results o Debt / Equity of 0.55x (as on Mar 31, 2017) Note: Company Filings and Petroleum Planning and Analysis Cell (http://ppac.org.in/). 2 Our Journey at a Glance From a humble beginning to an Oil Giant FY17 31-Mar-17 500000 4,45,373 120000.00 99729 Turnover 100000.00 400000 (INR/Cr) Net Worth 80000.00 (INR/Cr) 300000 60000.00 200000 40000.00 78 100000 20000.00 0 0.00 1965 1975 1985 1995 2005 2015 1965 1975 1985 1995 2005 2015 Net Worth Source: Company Filings Refining Capacity Pipeline Network Turnover MMT Kms (‘000) US$ in Billion 11.6x 81 13 6.5x 68.7 7 36 5 24 4 14.5 12 2 7 0.1 0.7 2.7 1970 1980 1990 2000 2017 1970 1980 1990 2000 2017 1970 1980 1990 2000 2017 Contribution Fortune Moody’s : Baa3 Platts Energy to Exchequer: Global 500 Fitch: BBB- “Maharatna” Ranking: 14 US$ 28 Bn Ranking : status (2016) (FY17) 161 (2016) Note: IOC is ranked 14th as per Platt Global Energy Company Rankings 2016. -

INDIAN OIL CORPORATION LIMITED BONGAIGAON REFINERY Tender No

INDIAN OIL CORPORATION LIMITED BONGAIGAON REFINERY Part I Tender No – BN20AK075R HIRING AND OPERATION OF GULLY SUCKER AT IOCL BONGAIGAON REFINERY NOTICE INVITING TENDER (NIT) Tender No : BN20AK075R (E-Tendering) Date : 14.08.2020 Indian Oil Corporation Ltd, Bongaigaon Refinery (IOCL-BGR) invites electronic bids through its website https://iocletenders.nic.in under two bid system, (Part-I : Techno-Commercial Part & Part-II : Price Part) for the subject work, from experienced Contractors fulfilling the qualifying requirements stated hereunder: Brief Details of Tender: 1. Name of the work HIRING AND OPERATION OF GULLY SUCKER AT IOCL BONGAIGAON REFINERY 2. Tender No BN20AK075R 3. Type of tender OPEN TWO BID SYSTEM, DOMESTIC COMPETITIVE BIDDING 4. Contract duration / Completion period 24 (Twenty four) Months 5. Start date for downloading of Tender 14.08.2020 Document 6. Date of pre-bid meeting Not Required 7. Last date for downloading of Tender 24.08.2020, up to 14.00 Hrs IST. IOCL (BGR) at its discretion may by bidder and uploading of bid by extend the deadline for submission of the bids. bidder 8. Date & Time of opening of Techno- 25.08.2020, 15.00 Hrs IST onwards. commercial bid (Part-I) 9. Site Location Plant Area/ Township Area, Dhaligaon, Assam-783385 10. Earnest Money Deposit (EMD) Rs. 52,600.00 (Rupees Fifty two thousand six hundred only). Mode of payment of Earnest Money: Earnest Money shall be paid only through online mode like Netbanking/NEFT/RTGS/Bank Guarantee (BG) as per the details mentioned in Special Instructions to bidders for E-tendering. No offline instruments like Demand Draft/Pay Order/Banker’s cheque etc. -

Tender Document As a Token of Acceptance of the Terms and Conditions Herein

Balmer Lawrie & Co. Ltd. Refinery & Oilfield Services TENDER ENQUIRY ROFS/2K13/05/ENQ/02 24 th July, 2013 DUE DATE – 06.08.2013 upto 15:00 Hours M/s Balmer Lawrie & Co. Ltd. invite sealed tenders from the empanelled transporters of SBU:ROFS for Transportation of materials from Indian Oil Corporation Limited (IOCL), Bongaigaon Refinery, Assam to Indian Oil Corporation Ltd., Haldia as per the following details and terms & conditions 1.0 Description of Work Sl. Description Dimension Appro x. Proposed No. Wight Type of (MT) Vehicle 1.1 Module – I 20’(L) x 8’ (W) x 9.5’ (H) 1.2 Stores Container 20’ x 8’(W) x 8.5’(H) 20 Trailer 1.3 Module - III 20’(L) x 8’ (W) x 9.5’ (H) 1.4 Office Module 20’ x 8’(W) x 9.5’(H) 16 Trailer 1.5 Module V 20’ x 8’(W) x 3.5’(H) 1.6 Module - VII 20’ x 8’(W) x 2.5’(H) 10 Trailer 1.7 Air Compressor 6’(L) x 1.5’(W) x 4.5’(H) Note : Transporters must mention the types and no. of vehicles in the Priced Schedule. 2.0 Scope of Work / Responsibilities 2.1 Transportation of the above materials from starting point to destination at the addresses noted in page no. 3 & 4. 2.2 The above materials are to be loaded at IOCL Bongaigaon by the bidder to the satisfaction of Balmer Lawrie's Site-in-charge. Suitable crane for loading of materials will be provided by Balmer Lawrie fee of cost .