New York State Thruway Financial Requirements and Proposed Toll Adjustments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New NY Bridge Buffalo and a Licensed Professional Manager As Well As Highway/Transit Project

Representatives of the New York State Thruway Authority will present and discuss the delivery of the largest single contract in state history and its current progress. Topics will include the planning, procurement, design, construction, and contract management of the $3.98-billion Governor Mario M. Cuomo Bridge over the Hudson River. The westbound bridge of the twin-spanning crossing recently opened to traffic and the second span is on schedule to open next year. Craig Teepell is the New John Kowalski is the NY Bridge project’s Commercial Manager for the NYS Deputy Construc-tion Manager. He has David R. Capobianco is the Design Thruway Authority on the New NY been a part of the bridge replacement Compliance Engineer and Project Bridge project. He is a 1983 civil effort since 2007, having previously Manager for Delivery for the NYS engineering graduate of the SUNY served as NNYB Project Controls Thruway Authority’s New NY Bridge Buffalo and a licensed professional Manager as well as Highway/Transit Project. Dave managed the concurrent engineering New York. John formerly Engineering Manager for the Tappan development of the Environmental was employed by the NYS Department Zee Bridge/I-287 Corridor Project. Prior Impact Statement and the Design-Build of Transportation for 30 years where he to joining the NYS Thruway Authority, procurement documents including the held a number of positions in bridge Craig was part of the NYS Department of technical evaluation of proposals and design and construction in the Buffalo Transportation Major Projects group. selection process. Prior to his region, and served as Deputy Project Craig also con-tributed to the involvement in the Tappan Zee Bridge Director for the Route 9A Reconstruc- reconstruction of Lower Manhattan as replacement, Dave held positions as the tion project in Lower Manhattan Engineering Coordinator for the Route Director of Structural Design and following the 9/11 attacks. -

Erie Canalway Map & Guide

National Park Service Erie Canalway National Heritage Corridor U.S. Department of the Interior Erie Canalway Map & Guide Pittsford, Frank Forte Pittsford, The New York State Canal System—which includes the Erie, Champlain, Cayuga-Seneca, and Oswego Canals—is the centerpiece of the Erie Canalway National Heritage Corridor. Experience the enduring legacy of this National Historic Landmark by boat, bike, car, or on foot. Discover New York’s Dubbed the “Mother of Cities” the canal fueled the growth of industries, opened the nation to settlement, and made New York the Empire State. (Clinton Square, Syracuse, 1905, courtesy Library of Congress, Prints & Photographs Division, Detroit Publishing Extraordinary Canals Company Collection.) pened in 1825, New York’s canals are a waterway link from the Atlantic Ocean to the Great Lakes through the heart of upstate New York. Through wars and peacetime, prosperity and This guide presents exciting Orecession, flood and drought, this exceptional waterway has provided a living connection things to do, places to go, to a proud past and a vibrant future. Built with leadership, ingenuity, determination, and hard work, and exceptional activities to the canals continue to remind us of the qualities that make our state and nation great. They offer us enjoy. Welcome! inspiration to weather storms and time-tested knowledge that we will prevail. Come to New York’s canals this year. Touch the building stones CONTENTS laid by immigrants and farmers 200 years ago. See century-old locks, lift Canals and COVID-19 bridges, and movable dams constructed during the canal’s 20th century Enjoy Boats and Boating Please refer to current guidelines and enlargement and still in use today. -

1. ROUTE 84-GOING EAST OR WEST If Traveling on Route 84-East Or

1. ROUTE 84-GOING EAST OR WEST If traveling on Route 84-East or West-take Exit 10S to Route 9W SOUTH. Once on 9W South, travel south through the city of Newburgh. You will pass several traffic lights until you come to the traffic light located at Broadway, which is the main street passing through the city of Newburgh. At the intersection with Broadway, go straight to the next light and continue straight past Sacred Heart Church on your left and Sacred Heart School on your right. At the second light (beyond Broadway, at the corner of Sacred Heart Church) make a right at the traffic light onto Washington Street. Proceed down Washington Street to the next traffic light Turn left at the light and make an immediate right into the parking lot at Independent Living, Inc., which is on the corner beyond the light. There are green awnings on the store fronts of the building. BE VERY CAREFUL MAKING THIS RIGHT HAND TURN. People do not expect you to turn suddenly. 2. NEW YORK STATE THRU-WAY (ROUTE 87-NORTH OR SOUTH) Traveling on the New York State Thruway (ROUTE 87-North or South), get off at Exit 17-which is Newburgh/Route 300 After paying toll, follow signs for Route 300 South. (Make a right at the light onto Route 300.) At third light (See a Nissan Dealer ahead), make a left on to Route 17K. Proceed down Route 17K through the city of Newburgh. (Route 17K becomes Broadway.) At the seventh traffic light on Route 17K/Broadway, make a right turn on to Lake Street (Route 32 South). -

Barge Canal” Is No Longer an Accurate Description of the New York State Canals Marine Activity on New York’S Canals

The Story of the Afterword Today, the name “Barge Canal” is no longer an accurate description of the New York State Canals marine activity on New York’s canals. Trains and trucks have taken over the transport of most cargo that once moved on barges along the canals, but the canals remain a viable waterway for navigation. Now, pleasure boats, tour Historical and Commercial Information boats, cruise ships, canoes and kayaks comprise the majority of vessels that ply the waters of the legendary Erie and the Champlain, Oswego and Cayuga- Seneca canals, which now constitute the 524-mile New York State Canal ROY G. FINCH System. State Engineer and Surveyor While the barges now are few, this network of inland waterways is a popular tourism destination each year for thousands of pleasure boaters as well as visitors by land, who follow the historic trade route that made New York the “Empire State.” Across the canal corridor, dozens of historic sites, museums and community festivals in charming port towns and bustling cities invite visitors to step back in time and re-live the early canal days when “hoggees” guided mule-drawn packet boats along the narrow towpaths. Today, many of the towpaths have been transformed into Canalway Trail segments, extending over 220 miles for the enjoyment of outdoor enthusiasts from near and far who walk, bike and hike through scenic and historic canal areas. In 1992, legislation was enacted in New York State which changed the name of the Barge Canal to the “New York State Canal System” and transferred responsibility for operation and maintenance of the Canal System from the New York State Department of Transportation to the New York State Canal Corporation, a newly created subsidiary of the New York State Thruway Authority. -

New York State Canal Corporation: Infrastructure Inspection And

New York State Office of the State Comptroller Thomas P. DiNapoli Division of State Government Accountability Infrastructure Inspection and Maintenance New York State Canal Corporation Report 2014-S-45 May 2015 2014-S-45 Executive Summary Purpose To determine whether the New York State Canal Corporation’s (Corporation) inspection scheduling procedures ensure that all high- and intermediate-importance structures are periodically inspected and whether inspection results are considered when maintenance activities are prioritized. The audit covers the period January 2012 through October 2014. Background The Corporation, a subsidiary of the New York State Thruway Authority (Thruway Authority), was created in 1992 to operate and maintain the New York State Canal System (Canal System). The Canal Law requires the Corporation to maintain the Canal System in good condition. The Corporation’s Canal Structure Inspection Manual-95 has established inspection requirements and frequency standards, including in-depth inspections (Inspections) – both above and below water – of structural safety and integrity on a 2-year cycle. Of the 2,065 structures the Corporation is required to inspect, 747 are deemed “critical” (e.g., dams and locks). Key Findings • While the Corporation does perform routine operational and reliability checks of the Canal System’s critical structures, it has not performed the two-year Inspections of a significant number of these structures. In fact, some structures that the Corporation’s infrastructure management system identifies as critical have not had an Inspection in many years – and some not at all. • The Corporation’s process for determining Inspection and maintenance priorities is inconsistent, and the basis for decisions is sometimes unclear. -

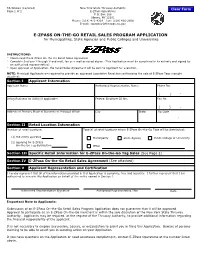

TA-W6333: E-Zpass On-The-Go Retail Sales Program Application For

TA-W6333 (12/2014) New York State Thruway Authority Page 1 of 2 E-ZPass Operations P.O. Box 189 Albany, NY 12201 Phone: (518) 471-4218 Fax: (518) 436-2808 E-mail: [email protected] E-ZPASS ON-THE-GO RETAIL SALES PROGRAM APPLICATION for Municipalities, State Agencies and Public Colleges and Universities ® INSTRUCTIONS: • Please read the E-ZPass On-the-Go Retail Sales Agreement. • Complete Sections I through V and mail, fax or e-mail as noted above. (This Application must be completed in its entirety and signed by an authorized representative). • Upon approval of Application, the Retail Sales Agreement will be sent to Applicant for execution. NOTE: Municipal Applicants are required to provide an approved Legislative Resolution authorizing the sale of E-ZPass Tags (sample attached). Section I Applicant Information Applicant Name Authorized Representative Name Phone No. ( ) - Doing Business As (DBA)(if applicable) Federal Employer ID No. Fax No. ( ) - Address of Primary Place of Business or Principal Office City State Zip Code - Section II Retail Location Information Number of retail locations: Type(s) of retail locations where E-ZPass On-the-Go Tags will be distributed: (1) the entity operates Municipality State Agency Public College or University (2) applying for E-ZPass On-the-Go Tag distribution Other Section III Specific Retail Information for E-ZPass On-the-Go Tag Sales (See Page 2) Section IV E-ZPass On-the-Go Retail Sales Agreement (See attached) Section V Applicant Representation and Certification I hereby represent that all of the information provided in this Application is complete, true and accurate. -

Driving Directions to Westchester Medical Center

Driving Directions to Westchester Medical Center By Car Taconic Parkway SOUTH to Sprain Brook Parkway to Medical Center exit (just past New York State Police Headquarters). Make right at top of exit onto Route 100 (south). Follow to entrance to Medical Center grounds on right. Route 684 SOUTH to Saw Mill River Parkway to Sprain Brook Parkway to Medical Center exit (just past New York State Police Headquarters). Make right at top of exit onto Route 100 (south). Follow to entrance to Medical Center grounds on right. Saw Mill River Parkway SOUTH to Sprain Brook Parkway to Medical Center exit (just past New York State Police Headquarters). Make right at top of exit onto Route 100 (south). Follow to entrance to Medical Center grounds on right. Saw Mill River Parkway NORTH to 1-287 east to Exit 4 (Route 100A north, which becomes Route 100 north). 3.2 miles from exit to entrance to Medical Center grounds on left. I-87 (New York State Thruway) SOUTH to Tappan Zee Bridge. I-287 east to Exit 4 (Route 100A north, which becomes Route 100 north). 3.2 miles from exit to entrance to Medical Center grounds on left. I-87 (New York State Thruway) NORTH to 1-287 east to Exit 4 (Route 100A north, which becomes Route 100 north). 3.2 miles from exit to entrance to Medical Center grounds on left. Sprain Brook Parkway NORTH to Medical Center exit. Make left onto Medical Center grounds. I-95 (New England Thruway) NORTH or SOUTH to 1-287 west (Cross Westchester Expressway). -

M:(7/95):Thruway Defined for Highway Use Tax Purposes:Tsbm956m

New York State Department of Taxation and Finance TSB-M-95 (6)M Taxpayer Services Division Highway Use Tax Technical Services Bureau July 15, 1995 (This replaces TSB-M 95(6)M with a print date of June 1, 1995, which should be destroyed) Thruway Defined for Highway Use Tax Purposes The Highway Use Tax Law (Article 21 of the New York State Tax Law) imposes a weight-distance tax on miles traveled on New York State public highways by certain motor vehicles. In imposing the tax it provides different tax treatment for toll-paid Thruway mileage than for other New York travel. This memorandum defines the portion of the New York State public highway system comprising The Governor Thomas E. Dewey New York State Thruway (Thruway). It also describes the portion of the system considered toll-paid Thruway for purposes of the Highway Use Tax Law. The toll-paid portion of the Thruway consists of parts of several interstate highways running through New York State. This portion of the Thruway includes: • Interstate Route 95 (I-95) from the Bruckner Expressway interchange in the Bronx north to the Connecticut state line, • 1-87 from the New York City/Yonkers city line north to exit 24 at Albany, • The connection from exit 21-A of 1-87 at Selkirk east to exit B- 1 of 1-90, then on to the Massachusetts state line (Berkshire Section) (I-90 from exit 24 at Albany east to exit B-1 of the Berkshire Section is not part of the Thruway system.), • 1-90 from exit 24 at Albany west to the Pennsylvania state line, • 1-190 from exit 53 of 1-90 north to the Robert Moses Parkway, and • The Garden State Parkway Connection from exit 14-A of 1-87 at Spring Valley south to the New Jersey state line. -

New York State Thruway Authority

PRELIMINARY OFFICIAL STATEMENT DATED OCTOBER 7, 2019 NEW ISSUE BOOK ENTRY - ONLY In the opinion of Hawkins Delafield & Wood LLP, Bond Counsel to the Authority, under existing statutes and court decisions and assuming continuing compliance with certain tax covenants described herein, (i) interest on the Series 2019B Junior Indebtedness Obligations ch such is excluded from gross income for federal income tax purposes pursuant to Section 103 of the Internal Revenue Code of 1986, as amended (the “Code”) and (ii) interest on the Series 2019B Junior Indebtedness Obligations is not treated as a preference item in calculating the alternative minimum tax under the Code. In addition, in the opinion of Bond Counsel to the Authority, under existing statutes, interest on the Series 2019B Junior Indebtedness Obligations is exempt from personal income taxes imposed by the State of New York and any political subdivision thereof. See “TAX MATTERS” for further information. nces nces will this Preliminary $1,700,000,000* New York State Thruway Authority General Revenue Junior Indebtedness Obligations Series 2019B Dated: Date of Delivery Due: January 1, as shown on the inside cover Interest is payable each January 1 and July 1, commencing July 1, 2020. The New York State Thruway Authority General Revenue Junior Indebtedness Obligations, Series 2019B (the “Series 2019B Junior Indebtedness Obligations”) are issuable only as fully registered bonds without coupons, in denominations of $5,000 or any integral multiple thereof. The Series 2019B Junior Indebtedness t notice. Under no circumsta Obligations will be issued initially under a book-entry only system and will be registered in the name of Cede & Co., as nominee of The Depository Trust Company, New York, New York (“DTC”), which will act as securities depository for the Series 2019B Junior Indebtedness Obligations. -

Working Group B (Expressway Systems Options)

Working Group B Report Expressway System Options April 2007 SUMMARY The Capital District Transportation Committee is in the midst of an update to its official New Visions regional transportation plan. The update will extend the horizon to 2030 and address emerging issues. In January 2004, CDTC established five “working groups” to help the staff analyze in parallel the subjects requiring further study (as identified by the Quality Region Task Force) and to guide the documentation of the analysis. Working Group B was charged with investigating and documenting “Expressway System Issues The “expressway system” is and Options”. Working Group B was made up of defined as the entire interstate representatives from CDTC staff, NYSDOT Region 1, system, Alternate Route 7, NY NYSDOT Main Office, CDTA, the New York State 85 from I-90 to the NYS Thruway Authority (NYSTA), and one Quality Region Thruway, the I-90 Phase I Task Force member. This report summarizes the research, Connector and the South Mall analysis and findings by Working Group B. Expressway/Dunn Memorial Bridge. The 2004 report has been modified slightly to acknowledge that the New Visions 2030 Finance Plan overall budget is consistent with the Working Group B bridge needs estimates, pavement and bridge maintenance estimates, and most of the section-specific reconstruction estimates. The cost estimates for the Thruway bridges have been more clearly defined as part of the Finance Task Force work. Consequently, the Finance Task Force numbers will be used in the New Visions 2030 Plan. Working group members representing the “Expressway” System in the Capital District New York State Department of Transportation and the New York State Thruway Authority were asked for detailed data regarding current infrastructure needs and attendant costs. -

Jl Engeneuring, Pc K

JJ CIVIL/STRUCTURAL LL ENGENEURING, P.C. ARCHITECTURAL KK INGENUITY IN ENGINEERING TRANSPORTATION PUBLIC WORKS COMMERCIAL RESIDENTIAL 5788 STONE ROAD LOCKPORT, NEW YORK 14094 PHONE/FAX: (716) 433-7485 E-Mail GODBRIDGE@ AOL.COM MOBILE: (716) 860-9200 JAMES L. KLINO, P.E. PRESIDENT OF JLK ENGENEURING, P.C. RELATED WORK EXPERIENCE: JLK Engeneuring, P.C. 5788 Stone Road Lockport, New York 14094 Detailed Structural analysis, and design, inspection, condition assessment, & load rating of bridge structures of all types. Bridge jacking analysis & design to replace bearings and repair concrete pedestals and piers. Structural analysis & design of scaffold systems & cable suspended metal deck Platform systems including but not limited to cables, metal decking, post clamping plates intermediate hangers, cable tie ups and all other component design peculiar to each type of structure. Custom design of scaffold & containment systems (rolling, modular, stationary, vertical and horizontal opening and closing, etc.) for steel, concrete and masonry structures (bridges, buildings, water tanks, chemical process towers, etc.) with difficult and varying geometric configurations of steel, traffic restrictions, waterway restrictions, and paint removal methods. Design of containment systems in conformance with SSPS Guidelines and all levels of containment types including designs required to resist and sustain hurricane wind speeds. Design in conformance with all applicable codes and industry standards (IE: AISC, ACI, OSHA, SSPC, Etc.) Staad analysis used extensively in modeling Bridges, Scaffolds, & Platform systems, analysis of existing structures to verify adequacy of supporting imposed construction loads. Detailed Structural analysis, and design, inspection, condition assessment, & load rating of bridge structures Contract Documents (Plans and Calculations prepared and submitted for Agency approval on each project. -

New York State Thruway Traffic and Revenue Report Including a Review of the Physical Condition of the Thruway System

New York State Thruway Traffic and Revenue Report Including a Review of the Physical Condition of the Thruway System October 7, 2019 Prepared for: New York State Thruway Authority Prepared by: Stantec Consulting Services, Inc. Table of Contents 1.0 INTRODUCTION AND EXECUTIVE SUMMARY ............................................................. 1 2.0 THE NEW YORK STATE THRUWAY SYSTEM .............................................................. 2 2.1 BACKGROUND ................................................................................................................ 2 2.2 ROADWAYS ..................................................................................................................... 4 2.3 BRIDGES .......................................................................................................................... 5 2.4 SERVICE AREAS AND BUILDINGS ................................................................................ 6 2.5 SAFETY, INCIDENT RESPONSE AND TRAVELER INFORMATION SYSTEMS ........... 7 2.6 ANNUAL ROUTINE MAINTENANCE ACTIVITIES ........................................................... 8 2.7 PHYSICAL CONDITION OF THE THRUWAY’S INFRASTRUCTURE ............................. 9 2.7.1 New York Division ........................................................................................... 9 2.7.2 Albany Division .............................................................................................. 10 2.7.3 Syracuse Division .........................................................................................