M:(7/95):Thruway Defined for Highway Use Tax Purposes:Tsbm956m

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New NY Bridge Buffalo and a Licensed Professional Manager As Well As Highway/Transit Project

Representatives of the New York State Thruway Authority will present and discuss the delivery of the largest single contract in state history and its current progress. Topics will include the planning, procurement, design, construction, and contract management of the $3.98-billion Governor Mario M. Cuomo Bridge over the Hudson River. The westbound bridge of the twin-spanning crossing recently opened to traffic and the second span is on schedule to open next year. Craig Teepell is the New John Kowalski is the NY Bridge project’s Commercial Manager for the NYS Deputy Construc-tion Manager. He has David R. Capobianco is the Design Thruway Authority on the New NY been a part of the bridge replacement Compliance Engineer and Project Bridge project. He is a 1983 civil effort since 2007, having previously Manager for Delivery for the NYS engineering graduate of the SUNY served as NNYB Project Controls Thruway Authority’s New NY Bridge Buffalo and a licensed professional Manager as well as Highway/Transit Project. Dave managed the concurrent engineering New York. John formerly Engineering Manager for the Tappan development of the Environmental was employed by the NYS Department Zee Bridge/I-287 Corridor Project. Prior Impact Statement and the Design-Build of Transportation for 30 years where he to joining the NYS Thruway Authority, procurement documents including the held a number of positions in bridge Craig was part of the NYS Department of technical evaluation of proposals and design and construction in the Buffalo Transportation Major Projects group. selection process. Prior to his region, and served as Deputy Project Craig also con-tributed to the involvement in the Tappan Zee Bridge Director for the Route 9A Reconstruc- reconstruction of Lower Manhattan as replacement, Dave held positions as the tion project in Lower Manhattan Engineering Coordinator for the Route Director of Structural Design and following the 9/11 attacks. -

Erie Canalway Map & Guide

National Park Service Erie Canalway National Heritage Corridor U.S. Department of the Interior Erie Canalway Map & Guide Pittsford, Frank Forte Pittsford, The New York State Canal System—which includes the Erie, Champlain, Cayuga-Seneca, and Oswego Canals—is the centerpiece of the Erie Canalway National Heritage Corridor. Experience the enduring legacy of this National Historic Landmark by boat, bike, car, or on foot. Discover New York’s Dubbed the “Mother of Cities” the canal fueled the growth of industries, opened the nation to settlement, and made New York the Empire State. (Clinton Square, Syracuse, 1905, courtesy Library of Congress, Prints & Photographs Division, Detroit Publishing Extraordinary Canals Company Collection.) pened in 1825, New York’s canals are a waterway link from the Atlantic Ocean to the Great Lakes through the heart of upstate New York. Through wars and peacetime, prosperity and This guide presents exciting Orecession, flood and drought, this exceptional waterway has provided a living connection things to do, places to go, to a proud past and a vibrant future. Built with leadership, ingenuity, determination, and hard work, and exceptional activities to the canals continue to remind us of the qualities that make our state and nation great. They offer us enjoy. Welcome! inspiration to weather storms and time-tested knowledge that we will prevail. Come to New York’s canals this year. Touch the building stones CONTENTS laid by immigrants and farmers 200 years ago. See century-old locks, lift Canals and COVID-19 bridges, and movable dams constructed during the canal’s 20th century Enjoy Boats and Boating Please refer to current guidelines and enlargement and still in use today. -

1. ROUTE 84-GOING EAST OR WEST If Traveling on Route 84-East Or

1. ROUTE 84-GOING EAST OR WEST If traveling on Route 84-East or West-take Exit 10S to Route 9W SOUTH. Once on 9W South, travel south through the city of Newburgh. You will pass several traffic lights until you come to the traffic light located at Broadway, which is the main street passing through the city of Newburgh. At the intersection with Broadway, go straight to the next light and continue straight past Sacred Heart Church on your left and Sacred Heart School on your right. At the second light (beyond Broadway, at the corner of Sacred Heart Church) make a right at the traffic light onto Washington Street. Proceed down Washington Street to the next traffic light Turn left at the light and make an immediate right into the parking lot at Independent Living, Inc., which is on the corner beyond the light. There are green awnings on the store fronts of the building. BE VERY CAREFUL MAKING THIS RIGHT HAND TURN. People do not expect you to turn suddenly. 2. NEW YORK STATE THRU-WAY (ROUTE 87-NORTH OR SOUTH) Traveling on the New York State Thruway (ROUTE 87-North or South), get off at Exit 17-which is Newburgh/Route 300 After paying toll, follow signs for Route 300 South. (Make a right at the light onto Route 300.) At third light (See a Nissan Dealer ahead), make a left on to Route 17K. Proceed down Route 17K through the city of Newburgh. (Route 17K becomes Broadway.) At the seventh traffic light on Route 17K/Broadway, make a right turn on to Lake Street (Route 32 South). -

Barge Canal” Is No Longer an Accurate Description of the New York State Canals Marine Activity on New York’S Canals

The Story of the Afterword Today, the name “Barge Canal” is no longer an accurate description of the New York State Canals marine activity on New York’s canals. Trains and trucks have taken over the transport of most cargo that once moved on barges along the canals, but the canals remain a viable waterway for navigation. Now, pleasure boats, tour Historical and Commercial Information boats, cruise ships, canoes and kayaks comprise the majority of vessels that ply the waters of the legendary Erie and the Champlain, Oswego and Cayuga- Seneca canals, which now constitute the 524-mile New York State Canal ROY G. FINCH System. State Engineer and Surveyor While the barges now are few, this network of inland waterways is a popular tourism destination each year for thousands of pleasure boaters as well as visitors by land, who follow the historic trade route that made New York the “Empire State.” Across the canal corridor, dozens of historic sites, museums and community festivals in charming port towns and bustling cities invite visitors to step back in time and re-live the early canal days when “hoggees” guided mule-drawn packet boats along the narrow towpaths. Today, many of the towpaths have been transformed into Canalway Trail segments, extending over 220 miles for the enjoyment of outdoor enthusiasts from near and far who walk, bike and hike through scenic and historic canal areas. In 1992, legislation was enacted in New York State which changed the name of the Barge Canal to the “New York State Canal System” and transferred responsibility for operation and maintenance of the Canal System from the New York State Department of Transportation to the New York State Canal Corporation, a newly created subsidiary of the New York State Thruway Authority. -

New York State Canal Corporation: Infrastructure Inspection And

New York State Office of the State Comptroller Thomas P. DiNapoli Division of State Government Accountability Infrastructure Inspection and Maintenance New York State Canal Corporation Report 2014-S-45 May 2015 2014-S-45 Executive Summary Purpose To determine whether the New York State Canal Corporation’s (Corporation) inspection scheduling procedures ensure that all high- and intermediate-importance structures are periodically inspected and whether inspection results are considered when maintenance activities are prioritized. The audit covers the period January 2012 through October 2014. Background The Corporation, a subsidiary of the New York State Thruway Authority (Thruway Authority), was created in 1992 to operate and maintain the New York State Canal System (Canal System). The Canal Law requires the Corporation to maintain the Canal System in good condition. The Corporation’s Canal Structure Inspection Manual-95 has established inspection requirements and frequency standards, including in-depth inspections (Inspections) – both above and below water – of structural safety and integrity on a 2-year cycle. Of the 2,065 structures the Corporation is required to inspect, 747 are deemed “critical” (e.g., dams and locks). Key Findings • While the Corporation does perform routine operational and reliability checks of the Canal System’s critical structures, it has not performed the two-year Inspections of a significant number of these structures. In fact, some structures that the Corporation’s infrastructure management system identifies as critical have not had an Inspection in many years – and some not at all. • The Corporation’s process for determining Inspection and maintenance priorities is inconsistent, and the basis for decisions is sometimes unclear. -

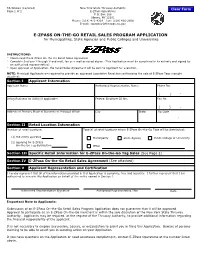

TA-W6333: E-Zpass On-The-Go Retail Sales Program Application For

TA-W6333 (12/2014) New York State Thruway Authority Page 1 of 2 E-ZPass Operations P.O. Box 189 Albany, NY 12201 Phone: (518) 471-4218 Fax: (518) 436-2808 E-mail: [email protected] E-ZPASS ON-THE-GO RETAIL SALES PROGRAM APPLICATION for Municipalities, State Agencies and Public Colleges and Universities ® INSTRUCTIONS: • Please read the E-ZPass On-the-Go Retail Sales Agreement. • Complete Sections I through V and mail, fax or e-mail as noted above. (This Application must be completed in its entirety and signed by an authorized representative). • Upon approval of Application, the Retail Sales Agreement will be sent to Applicant for execution. NOTE: Municipal Applicants are required to provide an approved Legislative Resolution authorizing the sale of E-ZPass Tags (sample attached). Section I Applicant Information Applicant Name Authorized Representative Name Phone No. ( ) - Doing Business As (DBA)(if applicable) Federal Employer ID No. Fax No. ( ) - Address of Primary Place of Business or Principal Office City State Zip Code - Section II Retail Location Information Number of retail locations: Type(s) of retail locations where E-ZPass On-the-Go Tags will be distributed: (1) the entity operates Municipality State Agency Public College or University (2) applying for E-ZPass On-the-Go Tag distribution Other Section III Specific Retail Information for E-ZPass On-the-Go Tag Sales (See Page 2) Section IV E-ZPass On-the-Go Retail Sales Agreement (See attached) Section V Applicant Representation and Certification I hereby represent that all of the information provided in this Application is complete, true and accurate. -

Driving Directions to Westchester Medical Center

Driving Directions to Westchester Medical Center By Car Taconic Parkway SOUTH to Sprain Brook Parkway to Medical Center exit (just past New York State Police Headquarters). Make right at top of exit onto Route 100 (south). Follow to entrance to Medical Center grounds on right. Route 684 SOUTH to Saw Mill River Parkway to Sprain Brook Parkway to Medical Center exit (just past New York State Police Headquarters). Make right at top of exit onto Route 100 (south). Follow to entrance to Medical Center grounds on right. Saw Mill River Parkway SOUTH to Sprain Brook Parkway to Medical Center exit (just past New York State Police Headquarters). Make right at top of exit onto Route 100 (south). Follow to entrance to Medical Center grounds on right. Saw Mill River Parkway NORTH to 1-287 east to Exit 4 (Route 100A north, which becomes Route 100 north). 3.2 miles from exit to entrance to Medical Center grounds on left. I-87 (New York State Thruway) SOUTH to Tappan Zee Bridge. I-287 east to Exit 4 (Route 100A north, which becomes Route 100 north). 3.2 miles from exit to entrance to Medical Center grounds on left. I-87 (New York State Thruway) NORTH to 1-287 east to Exit 4 (Route 100A north, which becomes Route 100 north). 3.2 miles from exit to entrance to Medical Center grounds on left. Sprain Brook Parkway NORTH to Medical Center exit. Make left onto Medical Center grounds. I-95 (New England Thruway) NORTH or SOUTH to 1-287 west (Cross Westchester Expressway). -

NYSCS Recreational Pass Information

Table of Contents www.canals.ny.gov WELCOME TO THE NEW YORK STATE CANAL SYSTEM _________________________________________ 1 New York State Canal System OPERATIONAL SCHEDULE________________________ 2 ERIE CHAMPLAIN OSWEGO CAYUGA-SENECA RECREATIONAL PASS FEE SCHEDULE ____________ 2 SEASONAL PASSES _______________________________ 3 PURCHASE OF A SEASONAL PASS __________________ 3 RECREATIONAL PASS Eligibility______________________________________________ 3 Purchase_______________________________________________ 3 Payment _______________________________________________ 4 Refund ________________________________________________ 4 INFORMATION USE OF A SEASONAL PASS _________________________ 5 Conditions _____________________________________________ 5 Valid Time Period _______________________________________ 5 REPLACEMENT OF PASS DECALS __________________ 5 Eligibility for Replacement ________________________________ 5 Instructions for Replacement_______________________________ 6 TRANSFER OF A SEASONAL PASS___________________ 7 Eligibility for Transfer____________________________________ 7 Instructions for Transfer __________________________________ 7 TEN-DAY AND TWO-DAY PASSES __________________ 8 PURCHASE OF TEN-DAY AND TWO-DAY PASSES ____ 8 Eligibility______________________________________________ 8 Purchase_______________________________________________ 8 Payment _______________________________________________ 9 Refund/Transfer/Replacement_____________________________ 10 USE OF TEN-DAY AND TWO-DAY PASSES __________ 10 Conditions ____________________________________________ -

TAP-421A: General Design and Construction Requirements For

New York State Thruway Authority General Design and Construction Requirements for Occupancies Office of Real Property Management TAP-421A (1/2010) SUBMIT PERMIT APPLICATIONS TO THE APPROPRIATE THRUWAY AUTHORITY DIVISION PERMIT COORDINATOR DIVISION HIGHWAY SECTIONS DIVISION MILEPOST LIMITS New York New York (Main Line) 0.00 - 76.50 - Garden State Parkway G.S. 0.00 - G.S. 2.40 Connection - New England Section N.E. 0.17 - N.E. 15.01 - I-287 Cross Westchester C.W.E. 0.00 - C.W.E. 10.90 Albany Albany (Main Line) 76.50 - 197.90 - Berkshire Section B. 0.00 – B. 24.28 Syracuse Syracuse (Main Line) 197.90 - 350.60 Buffalo Buffalo (Main Line) 350.60 - 496.00 - Niagara Section N. 0.00 - N. 21.50 TELEPHONE NUMBERS AND ADDRESSES TELEPHONE ADDRESS Occupancy and Work Permit Program Mgr. 200 Southern Boulevard Office of Real Property Management P.O. Box 189 Administrative Headquarters Albany, NY 12201-0189 (518) 436-2797, Fax (518) 471-4442 NY Division Permit Coordinator 4 Executive Boulevard (845) 918-2510, Fax (845) 918-2596 Suffern, NY 10901 Albany Division Permit Coordinator 9W, Interchange No. 23 (518) 436-2710, Fax (518) 436-0233 P.O. Box 861 Albany, NY 12201-0861 Syracuse Division Permit Coordinator Suite 250, 2nd floor (315) 437-2741, Fax (315) 461-0765 290 Elwood Davis Road Syracuse, NY 13088-2103 Buffalo Division Permit Coordinator 455 Cayuga Road, Suite 800 (716) 631-9017, Fax (716) 626-5362 Cheektowaga, NY 14225 NOTE: For the Cross Westchester Expressway (I-287), Occupancy Permits are issued by the New York State Department of Transportation and Work Permits are issued by the New York State Thruway Authority. -

TA-W5181 (11/2004) New York State Thruway Authority

TA-W5181 (11/2004) New York State Thruway Authority BOND BOND NUMBER KNOW ALL PERSONS BY THESE PRESENTS, that we of as principal, and a bond issuing company whose principal place of business is at a corporation of the State of , authorized to do business in the State of New York, as Surety, are held and firmly bound unto New York State Thruway Authority, with its principal office in Albany, New York, hereinafter called the Obligee, in the full just sum of , lawful money of the United States, for the payment of which sum well and truly to be made, we bind ourselves, our heirs, administrators, executors, successors, and assigns jointly and severally, firmly to these presents. WHEREAS said Principal has entered into a Credit Agreement with the New York State Thruway Authority providing for the establishment of credit in its name and the issue of E-ZPass tags or special hauling permits valid for travel on the New York State Thruway Authority, which said Credit Agreement is hereby incorporated herein and made a part hereof; and WHEREAS said Principal has requested the extension of credit in accordance with the terms of said Credit Agreement, and the Obligee is willing to extend credit to said Principal as requested, provided a bond with good and sufficient corporate surety, securing the payment for the use of the New York State Thruway Authority, is deposited with said Obligee; NOW, THEREFORE, the condition of this obligation is such that Surety shall, no more than thirty (30) days following its receipt of a written request from Obligee, pay the Obligee the amount of any outstanding invoice for commercial E-ZPass usage by the Principal on Obligee's roads and highways, unless such invoice has been duly paid by the Principal within thirty (30) days after the date of such invoice, and this Bond securing commercial E-ZPass payment to Obligee on behalf of the Principal shall remain in full force and effect during the period that the Principal utilizes commercial E-ZPass and Obligee's roads and highways. -

Toll Chart 2021

New York State Thruway Toll Schedule 2021 Class 2L New York E-ZPass PROPOSED No. Interchange 15 16 17 Newburgh I-84 1.33 0.67 17 Class 2L 18 New Paltz 2.04 1.38 0.71 18 19 Kingston 2.72 2.06 1.40 0.69 19 Vehicles are those with two axles and a 20 Saugerties 3.17 2.51 1.84 1.13 0.44 20 height of less than 7'6" 21 Catskill 3.73 3.07 2.40 1.69 1.01 0.57 21 21B Coxsackie 4.21 3.55 2.88 2.17 1.48 1.04 0.48 21B Berkshire spur B1 Hudson-Renss. I-90 5.53 4.87 4.20 3.49 2.80 2.36 1.80 1.32 B1 B2 Taconic Parkway 5.91 5.25 4.58 3.87 3.18 2.74 2.18 1.70 0.38 B2 B3 Canaan 6.32 5.66 4.99 4.28 3.59 3.15 2.59 2.11 0.79 0.41 B3 22 Selkirk 4.67 4.01 3.34 2.63 1.95 1.51 0.94 0.46 0.97 1.35 1.76 22 23 Albany (Downtown) 4.98 4.32 3.66 2.95 2.26 1.82 1.25 0.78 1.29 1.67 2.08 0.31 23 GANTRY - Fixed toll 0.27 24 Albany GANTRY - Fixed toll 0.27 0.00 If get on or off at 25A Toll credit will be applied. 25 Schenectady E. -

2940 Grand Concourse Bronx, NY 10458 718-684-2516

2940 Grand Concourse Bronx, NY 10458 718-684-2516 (Phone) 718-684-2518 (Fax) Directions From the North I-87 S/New York State Thruway S toward Saw Mill Pkwy South/New York City/ RT-119/Saw Mill Pkwy North/ Elmsford • Merge onto Saw Mill River Pky S/ Saw Mill Pky S via Exit 7 • Saw Mill River Pky S becomes Henry Hudson Pky • Keep left to take Mosholu Pky S via Exit 24 toward I-87 S/Deegan Expwy • Slight Right onto Grand Concourse • Left at Fork to continue on Grand Concourse • Left onto E 198th St. Take first left onto Grand Concourse. From the South I-278 E/Bruckner Expy towards Throgs Neck Br/New England • Merge onto I-895 N/Sheridan Expy via Exit 49 toward E 177 St. • Merge onto I-95 S/Cross Bronx Expy toward G Washington Br/Trenton • Take Exit 3 toward Third Ave. • Turn slight left onto E 175th St. • Take 1st right onto 3rd Ave. • Left onto E Fordham Rd/US-1. • Continue to follow E Fordham Rd. • Slight right onto E Kingsbridge Rd. • Take 1st right onto Grand Concourse. From the East I-495 W/Long Island Expy. • Take the Cross Is Pkwy North exit, Exit 31, toward Whitestone Br. • Merge onto Cross Island Pky. N. • Merge onto I-295 N via Exit 33 toward Bronx/New England • I-295 N become I-95 S/Cross Bronx Exp. • Take Exit 4B towards Rosedale Ave/Bronx River Pkwy. • Stay straight to go onto Cross Bronx Expy. • Merge onto Bronx River Pky N toward White Plains • Take Exit 8W toward Mosholu Pkwy.