May 2016 — CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

L'arte Armena. Storia Critica E Nuove Prospettive Studies in Armenian

e-ISSN 2610-9433 THE ARMENIAN ART ARMENIAN THE Eurasiatica ISSN 2610-8879 Quaderni di studi su Balcani, Anatolia, Iran, Caucaso e Asia Centrale 16 — L’arte armena. Storia critica RUFFILLI, SPAMPINATO RUFFILLI, FERRARI, RICCIONI, e nuove prospettive Studies in Armenian and Eastern Christian Art 2020 a cura di Edizioni Aldo Ferrari, Stefano Riccioni, Ca’Foscari Marco Ruffilli, Beatrice Spampinato L’arte armena. Storia critica e nuove prospettive Eurasiatica Serie diretta da Aldo Ferrari, Stefano Riccioni 16 Eurasiatica Quaderni di studi su Balcani, Anatolia, Iran, Caucaso e Asia Centrale Direzione scientifica Aldo Ferrari (Università Ca’ Foscari Venezia, Italia) Stefano Riccioni (Università Ca’ Foscari Venezia, Italia) Comitato scientifico Michele Bacci (Universität Freiburg, Schweiz) Giampiero Bellingeri (Università Ca’ Foscari Venezia, Italia) Levon Chookaszian (Yerevan State University, Armenia) Patrick Donabédian (Université d’Aix-Marseille, CNRS UMR 7298, France) Valeria Fiorani Piacentini (Università Cattolica del Sa- cro Cuore, Milano, Italia) Ivan Foletti (Masarikova Univerzita, Brno, Česká republika) Gianfranco Giraudo (Università Ca’ Foscari Venezia, Italia) Annette Hoffmann (Kunsthistorisches Institut in Florenz, Deutschland) Christina Maranci (Tuft University, Medford, MA, USA) Aleksander Nau- mow (Università Ca’ Foscari Venezia, Italia) Antonio Panaino (Alma Mater Studiorum, Università di Bologna, Italia) Antonio Rigo (Università Ca’ Foscari Venezia, Italia) Adriano Rossi (Università degli Studi di Napoli «L’Orientale», Italia) -

Greek Debt Crisis

July 3 - 9, 2015 WEEKLY PUBLISHED EVERY FRIDAY www.georgiatoday.ge Price: GEL 2.50 Georgia Today 24 p. ISSUE No.773 GrGreekeek DeDebtbt Crisis:Crisis: Why it Matters for Georgia IN THIS WEEK’S ISSUE Why Armenia Is Not (Yet) Ukraine P.4 BUSINESS HEADLINES Georgia’s Aversi Georgia Shifts to Now Selling Riga Virus Cancer Digital Broadcasting P.11 Treatment The Partnership Fund It comes with a hefty price Photo: AP tag, but the worth of the new Opens Panex Plant P.11 As Eurozone finance ministers reject the Greek government’s easy-to-use cancer killer is request for a bailout extension, remittances to Georgia are Minsk: A Platform for being proven throughout the expected to be reduced by up to 5 million euros per month. world. P.17 Dialogue between the P.6 EU and EEU P.12 New EU Program for Culture and Creativity The Launched for Eastern Partnership Region Transcaucasian Turkey and Russia Bridging the gap: Trail – Two Discuss Gas British Council and EU Americans, One Discount P.13 launch a program to Vision show Georgia how a FLIGHT SCHEDULE “We have a vision to walk good cultural industry and map the Transcaucasian can be created and Trail, to write a guide book sustained through and bring this scenic trek international dialogue P.4 through a variety of cultures and capacity building. P.23 P.17 to the world’s attention.” 2 JULY 3 - 9 NEWS IN BRIEF USS Laboon Missile Destroyer Visits Georgia ISISISIS DecDeclarlareses CaliphaCaliphatete inin thethe CaucasusCaucasus By Zviad Adzinbaia “The two countries have decided to deepen cooperation in all areas includ- On June 27-29, the USS Laboon ing the military field. -

ITB 2020 4 - 8 March 2020 List of Exhibitors

ITB 2020 4 - 8 March 2020 List of Exhibitors Exhibitor Postal code City Country/Region 1001 Nights Tours 19199 Tehran Iran 123 COMPARE.ME 08006 Barcelona Spain 1AVista Reisen GmbH 50679 Köln Germany 2 Travel 2 Egypt 11391 Cairo Egypt - Prime Hospitality Management Group 33-North Baabdath el Metn Lebanon 360-up Virtual Tour Marketing 40476 Düsseldorf Germany 365 Travel 10000 Hanoi Vietnam 3FullSteps 1060 Nicosia Cyprus 3Sixty Luxury Marketing RG9 2BP Henley on Thames United Kingdom 4Travel Incoming Tour Operator 31-072 Kraków Poland 4X4 Safarirentals GmbH 04229 Leipzig Germany 500 Rai Resort & Tours 84230 Surat Thani Thailand 506 On The River, Woodstock 05091 Woodstock United States of America 5stelle* native clouds pms 43019 Soragna Italy 5vorFlug GmbH 80339 München Germany 7 Degrees South Victoria Seychelles 7/24 Transfer Alanya/Antalya Turkey 7Pines Kempinski Ibiza 07830 Ibiza Spain 9 cities + 2 in Lower Saxony c/o Hannover Marketing & Tourismus GmbH 30165 Hannover Germany A & E Marketing Durbanville, Cape Town South Africa A Dong Villas Company Limited 56380 Hoi An City Vietnam A la Carte Travel Greece 63200 Nea Moudania Greece A Star Mongolia LLC 14250 Ulaanbaatar Mongolia a&o hostels Marketing GmbH 10179 Berlin Germany A-ROSA Flussschiff GmbH 18055 Rostock Germany A-SONO Riga Latvia A. Tsokkos Hotels Public Ltd 5341 Ayia Napa Cyprus A.T.S. Pacific Fiji Nadi Airport Fiji A1 Excursion Adventure Tours and Travel Pvt. Ltd. 44600 Kathmandu Nepal A2 Forum Management GmbH 33378 Rheda-Wiedenbrück Germany A3M Mobile Personal Protection GmbH 72070 Tübingen Germany AA Recreation Tours & Travels Pvt. Ltd. 110058 New Delhi India AAA Hotels & Resorts Pvt Ltd 20040 Male Maldives AAA Travel 7806 Cape Town South Africa AAA-Bahia-Brasil 41810-001 Salvador Brazil AAB - All About Belgium Incoming DMC for the Benelux 9340 Lede Belgium aachen tourist service e.v. -

Accorhotels and Rixos Hotels Announce a Strategic Partnership

Press release - March 6, 2017 AccorHotels and Rixos Hotels announce a strategic partnership AccorHotels and Rixos Hotels announce today a strategic partnership illustrating AccorHotels’ strategy to expand its presence in the Upper Upscale/Luxury market, with a primary focus on developing global activities in the resort segment. Under a long-term joint venture, both parties intend to collaborate, develop and manage Rixos branded resorts & hotels worldwide. Upon closing, AccorHotels will own a 50% interest in the joint venture management company. Through this joint venture, AccorHotels will integrate in its network 15 iconic hotels that are ideally located in premium resort markets in Turkey, UAE, Egypt, Russia and Europe and which benefit from strong room rate performance. As part of this transaction, Rixos plans to reflag five city-centre hotels to AccorHotels brands which will also be managed by AccorHotels. To this portfolio, Rixos will add a second iconic hotel in Dubai in the very short term as well as two other properties by the end of 2018 in Abu Dhabi and the Maldives highlighting the expansion of the Rixos brand into this key resort market. WorldReginfo - fe7ad744-9212-4c3a-9da0-b21390404e8d Rixos is one of only a handful iconic resort brands in the region that caters to both high- end transient and group customers. It is recognized as one of the leading luxury destination brands in Turkey and the Middle East due to its best-in-class facilities, dining options and entertainment venues. Each unique property is able to capture the traditions of its surrounding while providing signature experiences, unforgettable sensory offerings, and unparalleled level of tailored services. -

Talent Development @ Hospitality Industry

Talent Development @ Hospitality Industry Hüseyin KÜCÜ HR Manager @ CHQ [email protected] 1 • Rixos Hotels, established in 2000, is one of the world’s fastest growing, luxury hotel brand. Rixos At a Glance • The World’s largest Turkish hotel brand. • Market Leader at All Inclusive concept in Turkey. • One of the most well known hotel brand in Turkey & CIS Countries • Member of a Global Hotel Alliance, a collection of 22 upscale and luxury regional hotel brands from across the world 2 • We are giving luxury services with more than 8000 employees from 50 different nationalities Rixos: A Global Company • 700.000 guests from 200 different nationalities, stayed Rixos Hotels at 2013. • Annually Guest satisfaction score of Rixos is 85%. • 8out of 10 of satisfied guests were recommending Rixos to others • More than 80 international awards during 14 years. • Winner of the award of Europe’s Leading Hotel Brand, known as Oscar of Hospitality Industry, at 2010 3 Rixos Worlwide 2009 –Rixos Lares 2010 –Rixos Al Nasr Tripoli 2000– Rixos Tekirova 2011 –Rixos Downtown Antalya 2014 – Naftalan Hotel By Rixos 2003 –Rixos Premium Bodrum 2012 –Rixos The Palm Dubai 2014 – Samaxi Palace Platinum By Rixos 2005 –Rixos Premium Belek 2013 – Rixos Pera İstanbul 2014 – Rixos Krasnaya Polyana Sochi 2005 –Rixos President Astana 2013 –Rixos Sharm El Sheikh 2014 – Rixos Quba Azerbaijan 2005 –Rixos Konya 2014 – Rixos Premium Göcek Suites&Villas 2014 – Rixos Flüela Davos 2007 –Rixos Libertas Dubrovnik 2014 – Rixos Beldibi 2014 – Rixos Alamein 2009 –Rixos Grand Ankara 2014 –Rixos Eskişehir 2014 – Rixos Bab Al Bahr 2009 –Rixos Sungate 2014 –Rixos Khadisha Shymkent 2014 –Rixos Mriya, Yalta 2009 –Rixos Almaty 2014 –Rixos Borovoe 2014 –Rixos Duhok • We have 29 hotels in 10 countries at Worlwide. -

Europe Nominee List Updated 26 Aug 2010

Europe Europe Europe's Leading Airline Air France Alitalia British Airways Iberia KLM Lufthansa SAS Scandinavian Airlines Swiss International Air Lines TAP Portugal Turkish Airlines Europe's Leading Airport Amsterdam Airport Schiphol, Netherlands Barcelona International Airport, Spain Copenhagen Airport, Denmark Domodedovo International Airport, Russia Hamburg Airport, Germany Heathrow Airport, London, England HelsinkiVantaa, Finland Leonardo da Vinci International Airport, Italy Lisbon Airport, Portugal Madrid Barajas International Airport, Spain Munich International Airport, Germany Zurich Airport, Switzerland Europe's Leading Airport Hotel Hilton Copenhagen Airport Hotel, Denmark Hilton London Heathrow Airport Hotel, England Kempinski Airport Hotel Munich, Germany Radisson SAS Hotel London Stansted Airport, England Renaissance Barcelona Airport Hotel, Spain Sheraton Amsterdam Airport Hotel and Conference Center, Netherlands Sheraton Paris Airport Hotel & Conference Centre, France Europe's Leading All-inclusive Resort Aldemar Rhodos Paradise Village, Greece Aska Costa Holiday Club, Turkey Club Hotel Riu Chiclana, Spain Club Hotel Riu Gran Canaria, Spain Club Hotel Riu Paraiso Lanzarote Resort, Spain Club Hotel Riu Vista Mar, Spain Concorde De Luxe Resort,Turkey Da Balaia Club Med, Portugal Kemer Resort Hotel, Turkey Rixos Premium Belek, Turkey Titanic Hotel Antalya, Turkey Europe's Leading Beach Cannes, France Corfu, Greece Costa de la Luz, Spain Costa Smeralda, Sardinia, Italy Dona Ana, Lagos, Portugal Formentera Island, Ibiza Marbella, -

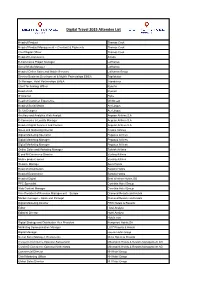

Digital Travel 2015 Attendee List

Digital Travel 2015 Attendee List Head of Product Thomas Cook Head of Product Management – Checkout & Payments Thomas Cook Chief Digital Officer Thomas Cook Head of E-Commerce Alitalia E-Commerce Project Manager Lufthansa Social Media Manager Lufthansa Head of Online Sales and Mobile Services Lufthansa Group Director Business Development & Mobile Partnerships EMEA TripAdvisor Sr Manager, Hotel Partnerships EMEA Tripadvisor Chief Technology Officer RyanAir Head of QA Ryanair IT Director Flybe Head of Customer Experience Whitbread Head of Social Media Aer Lingus Sr. Ux Designer Aer Lingus Ancillary and Analytics Web Analyst Aegean Airlines S.A E-Commerce & Loyalty Manager Aegean Airlines S.A Head of Digital Services and Content Aegean Airlines S.A Sales and Marketing Director Croatia Airlines Digital Marketing Specialist Pegasus Airlines Digital Marketing Manager Pegasus Airlines Digital Marketing Manager Pegasus Airlines Online Sales and Marketing Manager Turkish Airlines E and M-Commerce Director Vueling Airlines Mobile product owner Vueling Airlines Website Manager Apex Hotels Head of eDistribution Barcelo Hotels Head of Ecommerce Barcelo Hotels Head of Digital Best Western Hotels GB PPC Specialist Corinthia Hotel Group Web Content Manager Corinthia Hotel Group Vice President of Revenue Management – Europe Diamond Resorts and Hotels Market manager – Spain and Portugal Diamond Resorts and Hotels Digital Marketing Director FRHI Hotels & Resorts Editor Hotel Analyst Editorial Director Hotel Analyst Hotels.com Digital Strategy and Distribution -

Recent M&A Activity in the European Hospitality Industry

Recent M&A Activity in the European Hospitality Industry: A story of OpCos and PropCos September 2018 By Andrew Harrington Partner AHV Associates LLP Strictly Private and Confidential An Introduction Founded in 2001 by Andrew Harrington and Hanif Virji, AHV Associates LLP (AHV) is an award winning boutique investment bank focused on advising private companies across a range of M&A and advisory assignments AHV Associates AHV Corporate Finance AHV Financial Markets Therium AHV Financial Mergers & Acquisitions Board Advisory Raising Finance Advisory Markets ▪ M&A ▪ Strategic Options ▪ Real Estate Finance ▪ Derivatives ▪ £200 million Litigation ▪ Company Sales & JVs Assessment ▪ Debt & Equity ▪ Loans & Currencies Funding ▪ MBO ▪ Acquisition Finance ▪ Interest Rate Hedging ▪ Transaction Structuring ▪ Dev/Exp Capital ▪ Buy Out AHV specializes in hospitality and has worked with companies who owns hotels, apart-hotels, serviced apartments, hostels and mixed-use resorts AHV Associates LLP is authorized and regulated by the Financial Conduct Authority Recent M&A Activity in the European Hospitality Industry: Opcos and Propcos Executive Summary There has been a lot of M&A activity in the European hospitality industry during the last 12 months, either by European companies investing globally or by non European companies acquiring or investing in the European market We have reviewed the deals that have occurred and have identified a few key themes that could underpin activity in the future: ❑ Many hotel groups have chosen to solely focus on the operational -

European Hotel Transactions 2004

European Hotel Transactions 2004 This issue has been published by the London Office of HVS International 2005 Edition Philippa Bock and Bernard Forster good covenants, together with the availability of a buyer and the offer Introduction exceptional level of private equity and matching the vendor’s expectations. institutional capital becoming available. During 2004, HVS recorded a total of he European hotel industry staged 137 single asset hotel transactions of a good recovery in 2004, having more than €7.5 million, the minimum experienced significant instability T amount set for a transaction to qualify in recent times as a result of numerous European Single for inclusion in our survey. The total unprecedented events worldwide. The volume of single asset transactions was resilience of the hotel market, as proven Asset Transaction particularly impressive, resulting in a over the last three years, has resulted in Activity record level of investment; this hotel real estate now being considered a investment, at approximately €4 billion, mainstream asset class. Moreover, the ith no unprecedented events was 21% higher than it was the previous upside of hotels in a recovering market occurring in Europe during year. Single asset transactions accounted is very appealing, with the positive 2004 to send the industry into W for approximately 45% of the total leverage resulting from improved turmoil, the signs in late 2003 that many investment activity, less than the profitability creating a very attractive European markets were at the bottom of previous year; however, this was environment for investors. their cycles proved correct, with a understandable considering the strong In 2004, the European hotel number of European markets enjoying increase in portfolio activity following investment market shifted into top gear RevPAR growth in 2004. -

International Students Guide

INTERNATIONAL STUDENTS GUIDE Caucasus University CAUCASUS UNIVERSITY 1 CONTENTS W E L C O M E ............................................................................................................................. 3 Facts and Figures About Caucasus University (CU) ...................................................................... 6 Campus History And Location .......................................................................................................8 Accommodations ........................................................................................................................... 9 Your First Few Days .................................................................................................................... 10 Practical Information .................................................................................................................... 10 Visa ........................................................................................................................................... 10 Residence Permit .......................................................................................................................11 Traveling Options ...................................................................................................................... 11 Budgeting .................................................................................................................................. 12 Health & Insurance ......................................................................................................................13 -

Georgia's Convention Center

SAN DIEGO STATE THE BREATHTAKING CROWDFUNDING, UNIVERSITY OPENS IN BEAUTY OF GEORGIA’S GEORGIA’S NEWEST TBILISI MOUNTAINS ANGEL INVESTOR Investor.ge A Magazine Of The American Chamber Of Commerce In Georgia ISSUE 47 OCT.-NOV. 2015 Fashion, Festivals and Forums: Georgia’s Convention Center OCTOBER-NOVEMBER/2015 • Investor.ge | 3 Investor.ge CONTENT 6 Explainer: The National Bank of Georgia’s Financial Supervisory Council 8 A Foreign Education At Home: San Diego State University Opens its Doors for Business 12 Georgian Mountains: Breathtaking Beauty Attracts a Growing Number of Tourists 12 17 Svaneti Prepares for Over 4,000 Skiers at Tetnuldi Resort 18 Georgia’s Economy Running on MICE and FDI 20 KPMG: Chemical Industry Ripe for Investment 22 Chinese Investment in Georgia: The Start of a Beautiful Friendship? 24 Meet Crowdfunding, Georgia’s Newest Angel Investor 28 Tapping into the Business End of Tourism: Georgia plans for a Convention Bureau 34 Checking on the Road Map for Reform of 18 Georgia’s Money Markets 38 Rhea’s Squirrels: Breaking Bread and Breaking Stereotypes 41 Building an inclusive Georgia 17 NEWS ...... 42 4 | Investor.ge • OCTOBER-NOVEMBER/2015 OCTOBER-NOVEMBER/2015 • Investor.ge | 5 WHAT IS THE FINANCIAL made more accountable. EXPLAINER: SUPERVISORY COUNCIL, AND One of the authors of the initiative, WHY WAS IT INITIATED? MP Tamaz Mechiauri, said the new The National he Financial Supervisory Coun- Council will increase public “confi- cil is a council made up of seven dence” in the NBG. Speaking at Parlia- Tmembers that are in charge of ment debates before the bill was adopted, Bank of monitoring and providing oversight for Mechiauri said the new Council would the banking sector. -

Serdar Ali Abet

turizmYEAR:15 • NUMBER: 2014/4 • MAY 2014 • YIL:15 • SAYI: 2014/4 • MAYIS 2014 • ISSN: 1301 - 4587 • FİYATI:aktüel 8 TL THE LEADER OF THE MIDDLE EAST MARKET ALWAYS HUNGRY FOR SUCCESS SERDAR ALİ ABET 5 HOTELS WITH CONVENTION 5 STARS IN 5 YEARS TOURISM BOOMING IN FOOD STEPS OF TURKEY THERMAL TOURISM IN CAPPADOCIA 31 INVESTORS IN TOURISM IN 3 YEARS EDITOR turizm aktüel Year:15 - Number: 2014/4 - MAY 2014 Yıl:15 - Sayı: 2014/4 - MAYIS 2014 ISSN: 1301 - 4587 Publishing Center Yayın Merkezi Kent Turizm Araştırmaları ve Yayıncılık Yerebatan Cad. No: 43 Hüdaverdi İş Merkezi K. 3/8 Cağaloglu İSTANBUL The stage is yours Turkey Tel: +90 212 511 25 61 Fax: +90 212 513 63 59 ello to all from the Turizm Aktuel with its special edition of “ATM e-mail: [email protected] Dubai Tourism Fair”. www.turizmaktuel.com Turkey started in the 2014 tourism fairs marathon with the Owner and Managing Editor WTM London Tourism Fair last November. The marathon Sahibi ve Sorumlu Yazı İşleri Müdürü Hasan Arslan Hcontinued on with Utrecht, Netherlands in January, FITUR, Spain in February, ITB Berlin and MITT Moscow Tourism Fairs in March. Academic Tourism Consultants These fairs are the most important tourism fairs of the world. Turkey, as last Akademik Turizm Danışmanları year, made its appearance before the eyes on the world stage with its renewed Prof. Dr. Muzaffer Uysal image. We made a total show of power ITB Berlin by showing our quality to Virginia Polytechnic University [email protected] competing countries and reclaimed our position. Prof.