Barrick-Q4-2020-Report.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Information Form for the Year Ended December 31, 2018 Dated As of March 22, 2019 BARRICK GOLD CORPORATION

Barrick Gold Corporation Brookfield Place, TD Canada Trust Tower Suite 3700, 161 Bay Street, P.O. Box 212 Toronto, ON M5J 2S1 Annual Information Form For the year ended December 31, 2018 Dated as of March 22, 2019 BARRICK GOLD CORPORATION ANNUAL INFORMATION FORM TABLE OF CONTENTS GLOSSARY OF TECHNICAL AND BUSINESS TERMS 4 REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION 10 FORWARD-LOOKING INFORMATION 11 SCIENTIFIC AND TECHNICAL INFORMATION 14 THIRD PARTY DATA 15 GENERAL INFORMATION 15 Organizational Structure 15 Subsidiaries 16 Areas of Interest 18 General Development of the Business 18 History 18 Significant Acquisitions 18 Strategy 19 Recent Developments 21 Results of Operations in 2018 22 NARRATIVE DESCRIPTION OF THE BUSINESS 26 Production and Guidance 26 Reportable Operating Segments 26 Barrick Nevada 27 Pueblo Viejo (60% basis) 28 Lagunas Norte 29 Veladero (50% basis) 29 Turquoise Ridge (75% basis) 30 Acacia Mining plc (63.9% basis) 31 Pascua-Lama Project 32 Mineral Reserves and Mineral Resources 33 Marketing and Distribution 46 Employees and Labor Relations 47 Competition 48 Sustainability 48 Operations in Emerging Markets: Corporate Governance and Internal Controls 49 Board and Management Experience and Oversight 50 Communications 51 - i - Internal Controls and Cash Management Practices 51 Managing Cultural Differences 52 Books and Records 52 MATERIAL PROPERTIES 52 Cortez Property 52 Goldstrike Property 58 Turquoise Ridge Mine 63 Pueblo Viejo Mine 69 Veladero Mine 76 Kibali Mine 86 Loulo-Gounkoto Mine Complex 93 EXPLORATION -

Auditor Credentials Form 2012

Auditor Credentials Form Facility Audited: African Barrick Gold Bulyanhulu Gold Mine, South Africa Date:- 9th – 13th February 2012 Lead Auditor Credentials Lead Auditor: Arend Hoogervorst EagleEnvironmental Tel:-+27317670244 PrivateBagX06 Fax:-+27317670295 KLOOF3640,SouthAfrica Email:[email protected] CertifyingOrganization:Name:RABQSA AuditorCertificationNumber:12529 Telephone Number: - +61 2 4728 4600 Address: P O Box 347, Penrith BC, NSW 2751, Australia Web Site Address: - www.rabqsa.com Minimum experience: 3 audits in past 7 years as Lead Auditor Year TypeofFacility,TypeofAuditLed Country&State/Province 1991 to 2007 – 111 Chemicals, manufacturing, oil and gas, South Africa, Botswana, audits (Audit logs mining (gold, coal, chrome), foods, and Mozambique, Mali, Namibia, Ghana held by RABQSA & heavy industry sectors. EMS, ICMI) Compliance, Environmental Due Diligence, HSEC, SHE audits. Lead Auditor in 81 audits. 2006 ICMI Cyanide Code Compliance Audits: Lead Auditor *Sasol Polymers Cyanide Plants 1 & 2 South Africa and Storage Areas (Production) *Sasol SiLog (Transportation) South Africa 2007 ICMI Cyanide Code Compliance Audits: Lead Auditor *AngloGold Ashanti West Gold Plant South Africa *AngloGold Ashanti East Gold Acid South Africa Float Plant *AngloGold Ashanti Noligwa Gold South Africa Plant *AngloGold Ashanti Kopanang Gold South Africa Plant *AngloGold Ashanti Savuka Gold Plant South Africa *AngloGold Ashanti Mponeng Gold South Africa Plant 2007 ICMI Cyanide Code Gap Analyses: Lead Auditor *Goldfields Tarkwa Gold Mine Ghana -

Gold-Mining Multinationals and Community Interaction in Tanzania

Gold-mining Multinationals and Community Interaction in Tanzania Towards Localised Social Accountability Mary Mohamed Rutenge This dissertation is part of the Research Programme of CERES, Research School for Resource Studies for Devel- opment. Funded by the Netherlands Fellowship Programme (NFP). © Mary Mohamed Rutenge 2016 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the author. ISBN 978-90-6490-069-3 GOLD-MINING MULTINATIONALS AND COMMUNITY INTERACTION IN TANZANIA Towards Localised Social Accountability MULTINATIONALS IN DE GOUDMIJNBOUW EN HUN INTERACTIE MET DE LOKALE GEMEENSCHAP IN TANZANIA Op weg naar gelokaliseerde sociale verant- woording Thesis to obtain the degree of Doctor from the Erasmus University Rotterdam by command of the Rector Magnificus Professor dr H.A.P Pols and in accordance with the decision of the Doc- torate Board The public defence shall be held on Tuesday 20 December 2016 at 16.00 hrs by Mary Mohamed Rutenge born in Dar Es Salaam, Tanzania Doctoral committee Doctoral dissertation supervisors Prof. P. Knorringa Em. Prof. A.H.J. Helmsing Other members Prof. M.J. Spierenburg, Radboud University Nijmegen Prof. K. Arts, LLM Dr. K. Biekart Dedication To my husband Ernest and my sons Brian and Dennis Contents Dedication vi List of Tables, Figures, Maps and Appendices xi Acronyms xiii Acknowledgements xiv Abstract xvi Samenvatting -

ACACIA-Operational Update.Pdf

9 May 2019 Acacia Mining plc (“Acacia”, “Group” or the “Company”) Operational Update “I am pleased to announce a rebound in gold production and performance at the start of Q2 to 47,805 ounces for the month. This follows the successful implementation of a revised mining plan at the North Mara mine which saw April gold production at the mine increase to 33,941 ounces, 54% above the monthly average production during Q1. Although still early in the second quarter, I am pleased with the improved production levels now being achieved and remain confident of delivering against our full year production guidance of 500,000 to 550,000 ounces,” said Peter Geleta, Interim Chief Executive Officer, who added, “As we maintain our focus on what we can control, our operating performance during the month, together with public recognition for each of our mines at the National Safety Awards in Mbeya, are testament to the resilience and ongoing commitment of our people and businesses. In the meantime, a negotiated resolution remains our preferred outcome to the Company’s ongoing disputes with the Government of Tanzania. The Company continues to provide support to Barrick Gold Corporation (“Barrick”) in its direct discussions with the Government and, once these discussions have been successfully concluded, we look forward to receiving and reviewing a proposal for a resolution of Acacia’s disputes agreed in principle between Barrick and the Government.” Total gold production in April was 47,805 ounces, 37% higher than the monthly average during Q1 2019. This reflects a significant improvement in North Mara production performance through delivery against the revised mining plan announced in the Q1 production update and results releases. -

Mining in Tanzania

Mining in Tanzania Africa’s Golden Child. TABLE OF CONTENTS Tanzania: an overview.......................................p2 This report was researched and prepared by The Reformed Mining Code................................p3 Global Business Reports (www.gbreports.com) for Mining in Tanzania..........................................p5 Engineering & Mining Journal. An Evolving Market Place................................p8 The Support and Service Sector.........................p10 Editorial researched and written by Andrea Stucchi, Corporate Social Responsibility..........................p14 Jolanta Ksiezniak and Sarah Hussaini. Conclusion..................................................p15 For more details, please contact [email protected]. Cover photo courtesy of AngloGold Ashanti. A REPORT BY GBR FOR E&MJ DECEMBER 2012 MINING IN TANZANIA mean that, in terms of economy and infrastructure, companies still face enormous challenges. In fact, following Nyerere’s socialist ex- periment, Tanzania was left as one of the poorest, least developed Tanzania: and most foreign aid dependent countries in Africa. Later, in 1992, the Africa Strategy for Mining Technical Paper an Overview developed by the World Bank and the International Monetary Fund were instrumental in financing and developing a blueprint for the mining sector in Tanzania through a mineral sector development pro- Tanzania’s political gram. The aim of this was to oversee the privatization and liberal- ization of the state-controlled mining sector to facilitate the entry of stability -

A Stronger Future Together ACACIA MINING PLC ANNUAL REPORT & ACCOUNTS 2018 Acacia Mining Plc Annual Report & Accounts 2018

A stronger future together ACACIA MINING PLC ANNUAL REPORT & ACCOUNTS 2018 Acacia Mining plc Annual Report & Accounts 2018 Strategic report Governance Group at a glance 1 Governance overview 70 Our lasting legacy 4 Board of Directors 72 CEO statement 10 Executive Leadership Team 74 Q&A with the Independent Interim Chair 16 Corporate governance report 75 Market overview 18 Committee reports 80 Our business model 22 Remuneration report 87 Our strategy 24 Other information 102 Key performance indicators 26 Directors’ responsibilities statement 106 Risk management 30 Reserves and resources 107 Principal risks and uncertainties 32 Financial statements Performance review Independent Auditors’ report to the Operating review 36 members of Acacia Mining plc 112 Financial review 50 Consolidated financial statements 119 Sustainability review 56 Notes to the consolidated financial statements 124 Parent company financial statements 164 Notes to the parent company financial statements 168 Shareholder information Glossary of terms 179 Shareholder enquiries 185 STRATEGIC REPORT STRATEGIC At the core of Acacia are excellent assets and great people and, while we continue to work through the uncertain operating environment, we maintain a strong focus over what we can control. We have demonstrated our commitment Acacia is one of the to manage the business, develop our largest gold producers in Africa. We have three people and build long-term partnerships mines, all located in north-west Tanzania, and with our local communities, governments a portfolio of exploration projects across the and other key stakeholders. continent. Operating performance Exploration and development SEE PAGE 36 SEE PAGE 44 Strong cost discipline Sustainability and partnerships SEE PAGE 50 SEE PAGE 56 ACACIA MINING PLC ANNUAL REPORT & ACCOUNTS 2018 1 Highlights Over the past year Acacia has successfully stabilised the business with a focus on optimising operational performance. -

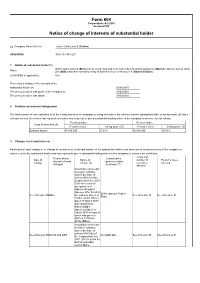

Form 604 Notice of Change of Interests of Substantial Holder

Form 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To Company Name/Scheme Tusker Gold Limited (Tusker) ACN/ARSN ACN 131 945 527 1. Details of substantial holder (1) BUK Holdco Limited (Bidco) on its own behalf and on behalf of Barrick Gold Corporation (Barrick), African Barrick Gold Name plc (ABG) and each controlled entity of Barrick set out in Annexure A (Barrick Entities) ACN/ARSN (if applicable) N/A There was a change in the interests of the substantial holder on 06/04/2010 The previous notice was given to the company on 31/03/2010 The previous notice was dated 31/03/2010 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate (2) had a relevant interest (3) in when last required, and when now required, to give a substantial holding notice to the company or scheme, are as follows: Previous notice Present notice Class of securities (4) Person’s votes Voting power (5) Person’s votes Voting power (5) Ordinary shares 27,910,895 27.91% 30,528,920 30.53% 3. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Class and Person whose Consideration Date of Nature of number of Person’s votes relevant -

The Extractive Resource Industry in Tanzania

The Extractive Resource Industry in Tanzania: Resource The Extractive The Extractive Resource Industry in Tanzania: Status and challenges of the mining sector The existing mineral wealth in a country should be a blessing. However the experience in some countries shows that this can prove to be very problematic instead. This publication is inspired by the increasing discovery of minerals in East Africa and the concern about their impact on the future of the region. It argues that if timely investments are made in promoting and implementing good practices in this sector, the problems that have plagued other resource-rich countries can be avoided in Status and challenges of the mining sector East Africa. This report, a product of a process that has engaged various industry stakeholders focuses on Tanzania, which is a relatively late arrival to large-scale mining. It maps out the performance of the mining sector as one component of Tanzania’s extractive resource industry (ERI) and analyses the interactions of the different stakeholders over time. It argues that although there are a number of challenges faced by the ERI sector, Tanzania could yet become one of the best performers in her class. However this will require hard work and investments by all stakeholders. By providing information on the challenges and implications of the current state of the ERI in Tanzania, this report wishes to contribute to the on going discourse and efforts to improve the performance of the ERI in Tanzania in a way that incorporates public accountability and transparency as well as increased participation and benefit to the Tanzanian population. -

Effects of Mining Activities at Bulyanhulu Gold Mine (Bgm) on the Water Quality of Bulyanhulu River: Shinyanga - Tanzania

University of Zimbabwe Faculty of Engineering Department of Civil Engineering EFFECTS OF MINING ACTIVITIES AT BULYANHULU GOLD MINE (BGM) ON THE WATER QUALITY OF BULYANHULU RIVER: SHINYANGA - TANZANIA By GRACE NKULI A Thesis Submitted in Partial Fulfilment of the Requirements for the Degree of Master of Science Intergrated Water Resources Management June 2008 Effects of gold mining activities on the water quality of Bulyanhulu River: The case of Bulyanhulu Gold Mine in Shinyanga - Tanzania CERTIFICATION The undersigned certifies that they have read and hereby recommend for accepta nce by the University of Zimbabwe a thesis entitled : Effects of Gold mining activities on the water quality of Bulyanhulu River : The case of Bulyanhulu Gold Mine in Shinyanga, Tanzania in fulfillment of the requirements for the degree of Master of Science (Integrated Water Resources Management) of the University of Zimbabwe. ……………………………………….. S. Misi. (Dr) ………………………………………. Z. Hoko. (Eng) Date ……………………………………… MSc. (IWRM) Thesis by Grace Nkuli June 2008 i Effects of gold mining activities on the water quality of Bulyanhulu River: The case of Bulyanhulu Gold Mine in Shinyanga - Tanzania DECLARATION I, Grace Michael Nkuli, declare that this thesis is my o wn original work (except where acknowledged) and that it has not been presented and will not be presented to any other University for any other degree award. Signature……………………………… Date…………………………………. MSc. (IWRM) Thesis by Grace Nkuli June 2008 ii Effects of gold mining activities on the water quality of Bulyanhulu River: The case of Bulyanhulu Gold Mine in Shinyanga - Tanzania ACKNOWLEDGEMENTS Usually it is not easy for anyone to write a thesis of this length and importance in the given time without some external assistance. -

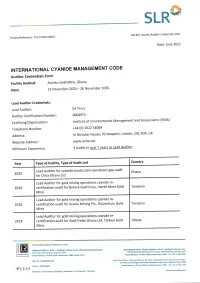

Auditors Credential Form 2021

5LR File Ref. Asanko Auditor Credentials 2021 Project Reference: 710.15025'00001 Date: June 2021 INTERNATIoNALGYANIDEMANAGEMENTcoDE Auditor Credentials Form Facility Audited: Asanko Gold Mine, Ghana November 2020 Date: 23 November 2020 - 26 Lead Auditor Credentials: Lead Auditor: Ed Perry Auditor Certification Number: 0004973 EnvironmentaI Management and Assessment tIEMA) Certifyi ng 0 rganization : tnstitute of Telephone Number: +aa (0) L52254Aag 70 Newport, Lincoln, LN13DP, UK Address: 5t Nicholas House, Website Address: www.iema.net past Lead Auditor Minimum ExPerience: 3 Audits in 7 vears as Country Year Type of Facility, TYPe of Audit Led Lead Auditor for cyanide production operations gap audit 7024 Ghana for Orica Ghana Ltd. Lead Auditor for gold mining operations cyanide re- 2019 certification audit for Barrick Gold Corp', North Mara Gold Tanzania Mine Lead Auditor for gold mining operations cyanide re- 201.8 certification audit for Acacia Mining Plc., Bulyanhulu Gold Tanzania Mine Lead Auditor for gold mining operations cyanide re- 2018 certification audit for Gold Fields Ghana Ltd, Tarkwa Gold Ghana Mine. ttft CstruE re (Afrrel trropraer3rY Umited addrffi: Suite 1 asiHir6 D. Monie Circie, ft€giet€rcd &ddress: Saite 1 - Brilding D, Mffite Cirde, 1?8 MEfftc(atim Boulsard, ,ghaffest*rg Sffiei ?tlyli€l ' SautB*a, ?19? FsBays, J6ll6me&55 Gailk*g" 2X91 1?B *xbnMin6 *aiddard, F8*?s,loha*Bbls& P6tal PO Btx 1596, cnmeroies',65$ Tel' +27 114s7 @45 P*stal*dd.etsi PO 8or 1596, CramwieB, :060, XoulA Att*c Addtss: (rFe7ffi$ta@: Fhy5aalr16drc55: i4rtiffi,lette.ttedtllose,it3wlEtNiseoiela;a, fteg. tlo: it66,/0t51?t/6; car Mal4 and CamPgrgu.d Roads, t @!aRds, Cap€ lom, i't'stern Cape' 776S Sclarq TSOS Tet: +27 11 661 t1j3 Yd t{or 4;@14594, Pa*l Addr6: PO sox 10r.45, Cal€dt s f, EI_$ w,slronsuhing.om Sirectort: Q Hosffi€, fi Feehnll, P Mac(ellar, F var ll*rden, s Doman page z Project Reference: 7xx.xxxxx.xxxxx1S025.00001 File ftef. -

Barrick Gold Corporation Annual Information Form

Barrick Gold Corporation Brookfield Place, TD Canada Trust Tower Suite 3700, 161 Bay Street, P.O. Box 212 Toronto, ON M5J 2S1 Annual Information Form For the year ended December 31, 2017 Dated as of March 23, 2018 BARRICK GOLD CORPORATION ANNUAL INFORMATION FORM TABLE OF CONTENTS GLOSSARY OF TECHNICAL TERMS .................................................................................................. 4 REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION ................................ 10 FORWARD-LOOKING INFORMATION ............................................................................................ 10 SCIENTIFIC AND TECHNICAL INFORMATION ............................................................................ 13 GENERAL INFORMATION .................................................................................................................. 13 Organizational Structure ................................................................................................................ 13 Subsidiaries .................................................................................................................................... 14 Areas of Interest ............................................................................................................................. 16 General Development of the Business ........................................................................................... 16 History ............................................................................................................................. -

The Mineral Industry of Tanzania in 2006

2006 Minerals Yearbook TANZANIA U.S. Department of the Interior April 2009 U.S. Geological Survey THE MINERAL INDUS T RY OF TANZANIA by Thomas R. Yager In 2006, Tanzania was the world’s only producer of tanzanite. to nearly $1.15 billion in 2006 from $847 million in 2005. The country also played a significant role in the global Petroleum products accounted for 27% of the value of total production of gold, accounting for nearly 2% of the world’s gold imports, and fertilizers, 1% (Bank of Tanzania, 2007b, p. 22-23). mine output. Other domestically significant mining and mineral processing operations included cement and diamond. Tanzania Commodity Review was not a globally significant consumer of minerals or mineral fuels (George, 2007). Metals Minerals in the National Economy Cobalt, Copper, and Nickel.—Barrick Gold Corp. of Canada produced copper as a coproduct at the Bulyanhulu gold mine. The manufacturing sector accounted for 6.5% of the gross Reserves at Bulyanhulu were estimated to be nearly 160,000 domestic product, and mining and quarrying, 3.5%. The value metric tons (t) of contained copper (Barrick Gold Corp., 2007a, of output in the mining sector grew by 16.4% in 2006 after p. 133). rising by 15.7% in 2005. Formal employment in the mining Barrick and Falconbridge Ltd. of Canada (50% each) had sector amounted to about 8,000; an estimated 550,000 artisanal a joint venture for the exploration and development of the miners produced colored gemstones, diamond, gold, and other Kabanga nickel sulfide deposit in northwestern Tanzania. In commodities (Mwamunyange, 2006; Bank of Tanzania, 2007a, 2006, Xstrata plc of Switzerland purchased Falconbridge.