The Mineral Industry of Tanzania in 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Acacia Mining: Human Rights Violations and the Company’S Grievance Mechanism in North Mara, Tanzania

Questions & Answers Acacia Mining: Human rights violations and the company’s grievance mechanism in North Mara, Tanzania Click on the question to jump to the answer. 1. What is an operational-level grievance mechanism? 2. Why are they important? 3. What do grievance mechanisms have to do with human rights? 4. Why do businesses like company-based grievance mechanisms? 5. Do companies themselves investigate and decide grievances? 6. Who is Acacia Mining and where is its North Mara Gold Mine? 7. How is Acacia Mining linked to Barrick Gold? 8. What are the human rights problems at North Mara mine? 9. Who are these ‘intruders’ who come into the mine? 10. How does the Mine deal with ‘intruders’? 11. Is it necessary to use force against the ‘intruders’? 12. Is the company’s private security also involved in violations? 13. Does Acacia Mining have similar problems at its other mine sites? 14. Why does Acacia use the Tanzanian police to provide security? 15. Intruders have decreased so aren’t violations only a historical problem? 16. Are ‘intruders’ still being killed at North Mara mine? 17. Does Acacia report on how many ‘intruders’ are injured? 18. Has Acacia been questioned about its reporting on deaths/injuries? 19. Is Acacia right to say that RAID has made 'sweeping claims' and misrepresented the human rights situation? 20. If the Tanzanian police are shooting people, why is this the company’s responsibility? 21. How many police officers have been charged with criminal offences? 22. Has Acacia raised the issue of police violations with government officials? 23. -

De Gouvernance À

UNIVERSITÉ DU QUÉBEC À MONTRÉAL DE GOUVERNANCE À RSE: LE GRI EST-IL UN OUTIL DE REDDITION DE COMPTES EFFICACE POUR L'IMPACT SUR LES ENJEUX DU DÉVELOPPEMENT DURABLE DES PRINCIPALES MINIÈRES CANADIENNES À L'ÉTRANGER? MÉMOIRE PRÉSENTÉ COMME EXIGENCE PARTIELLE DE LA MAÎTRISE ÈS SCIENCES DE LA GESTION PAR DAISY TIBURCIO CARNEIRO OCTOBRE 2018 UNIVERSITÉ DU QUÉBEC À MONTRÉAL Service des bibliothèques Avertissement La diffusion de ce mémoire se fait dans le respect des droits de son auteur, qui a signé le formulaire Autorisation de reproduire et de diffuser un travail de recherche de cycles supérieurs (SDU-522 – Rév.07-2011). Cette autorisation stipule que «conformément à l’article 11 du Règlement no 8 des études de cycles supérieurs, [l’auteur] concède à l’Université du Québec à Montréal une licence non exclusive d’utilisation et de publication de la totalité ou d’une partie importante de [son] travail de recherche pour des fins pédagogiques et non commerciales. Plus précisément, [l’auteur] autorise l’Université du Québec à Montréal à reproduire, diffuser, prêter, distribuer ou vendre des copies de [son] travail de recherche à des fins non commerciales sur quelque support que ce soit, y compris l’Internet. Cette licence et cette autorisation n’entraînent pas une renonciation de [la] part [de l’auteur] à [ses] droits moraux ni à [ses] droits de propriété intellectuelle. Sauf entente contraire, [l’auteur] conserve la liberté de diffuser et de commercialiser ou non ce travail dont [il] possède un exemplaire.» REMERCIEMENTS L'exercice d'un mémoire est certainement un défi qui nous tire hors de notre zone de confort. -

Tanzania-BHR Mission North Mara

The International Commission of Jurists concludes visit to North Mara mine in Tanzania On Friday 1 September, a delegation from the International Commission of Jurists (ICJ) concluded a learning and assessment mission to the North Mara region and the North Mara Gold Mine Ltd, a subsidiary of Acacia Mining plc located in north-west Tanzania in the Tarime district of the Mara region. The visit took place between 27 August and 1 September. The objective of the ICJ Mission was to learn about the operation with a view to assessing the effectiveness of the North Mara Gold Mine’s operational grievance mechanism (OGM) in addressing complaints over alleged human rights concerns and abuses committed in connection with the mine’s operations. The mission noted the progress that the mine has made in developing its OGM and will be continuing to gather information with a view to more fully understanding its operation. The North Mara mine is by far the largest investment and economic engine for the region, and a major attraction for people migrating into the immediate area, whose population has grown exponentially since the mine was initiated in 1998. The prospect of gold predictably created a strong economic magnet that was bound to attract people in search of economic opportunities. As company officials themselves acknowledged, the company was slow in putting in place the necessary physical security and measures to avoid human rights abuses and to redress those which occurred. The delegation is grateful to the NGO Legal and Human Rights Centre (LHRC) of Tanzania for its facilitation of the visit and especially the meetings with a number of people who have grievances pending against the company. -

Annual Information Form for the Year Ended December 31, 2018 Dated As of March 22, 2019 BARRICK GOLD CORPORATION

Barrick Gold Corporation Brookfield Place, TD Canada Trust Tower Suite 3700, 161 Bay Street, P.O. Box 212 Toronto, ON M5J 2S1 Annual Information Form For the year ended December 31, 2018 Dated as of March 22, 2019 BARRICK GOLD CORPORATION ANNUAL INFORMATION FORM TABLE OF CONTENTS GLOSSARY OF TECHNICAL AND BUSINESS TERMS 4 REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION 10 FORWARD-LOOKING INFORMATION 11 SCIENTIFIC AND TECHNICAL INFORMATION 14 THIRD PARTY DATA 15 GENERAL INFORMATION 15 Organizational Structure 15 Subsidiaries 16 Areas of Interest 18 General Development of the Business 18 History 18 Significant Acquisitions 18 Strategy 19 Recent Developments 21 Results of Operations in 2018 22 NARRATIVE DESCRIPTION OF THE BUSINESS 26 Production and Guidance 26 Reportable Operating Segments 26 Barrick Nevada 27 Pueblo Viejo (60% basis) 28 Lagunas Norte 29 Veladero (50% basis) 29 Turquoise Ridge (75% basis) 30 Acacia Mining plc (63.9% basis) 31 Pascua-Lama Project 32 Mineral Reserves and Mineral Resources 33 Marketing and Distribution 46 Employees and Labor Relations 47 Competition 48 Sustainability 48 Operations in Emerging Markets: Corporate Governance and Internal Controls 49 Board and Management Experience and Oversight 50 Communications 51 - i - Internal Controls and Cash Management Practices 51 Managing Cultural Differences 52 Books and Records 52 MATERIAL PROPERTIES 52 Cortez Property 52 Goldstrike Property 58 Turquoise Ridge Mine 63 Pueblo Viejo Mine 69 Veladero Mine 76 Kibali Mine 86 Loulo-Gounkoto Mine Complex 93 EXPLORATION -

Auditor Credentials Form 2012

Auditor Credentials Form Facility Audited: African Barrick Gold Bulyanhulu Gold Mine, South Africa Date:- 9th – 13th February 2012 Lead Auditor Credentials Lead Auditor: Arend Hoogervorst EagleEnvironmental Tel:-+27317670244 PrivateBagX06 Fax:-+27317670295 KLOOF3640,SouthAfrica Email:[email protected] CertifyingOrganization:Name:RABQSA AuditorCertificationNumber:12529 Telephone Number: - +61 2 4728 4600 Address: P O Box 347, Penrith BC, NSW 2751, Australia Web Site Address: - www.rabqsa.com Minimum experience: 3 audits in past 7 years as Lead Auditor Year TypeofFacility,TypeofAuditLed Country&State/Province 1991 to 2007 – 111 Chemicals, manufacturing, oil and gas, South Africa, Botswana, audits (Audit logs mining (gold, coal, chrome), foods, and Mozambique, Mali, Namibia, Ghana held by RABQSA & heavy industry sectors. EMS, ICMI) Compliance, Environmental Due Diligence, HSEC, SHE audits. Lead Auditor in 81 audits. 2006 ICMI Cyanide Code Compliance Audits: Lead Auditor *Sasol Polymers Cyanide Plants 1 & 2 South Africa and Storage Areas (Production) *Sasol SiLog (Transportation) South Africa 2007 ICMI Cyanide Code Compliance Audits: Lead Auditor *AngloGold Ashanti West Gold Plant South Africa *AngloGold Ashanti East Gold Acid South Africa Float Plant *AngloGold Ashanti Noligwa Gold South Africa Plant *AngloGold Ashanti Kopanang Gold South Africa Plant *AngloGold Ashanti Savuka Gold Plant South Africa *AngloGold Ashanti Mponeng Gold South Africa Plant 2007 ICMI Cyanide Code Gap Analyses: Lead Auditor *Goldfields Tarkwa Gold Mine Ghana -

Gold-Mining Multinationals and Community Interaction in Tanzania

Gold-mining Multinationals and Community Interaction in Tanzania Towards Localised Social Accountability Mary Mohamed Rutenge This dissertation is part of the Research Programme of CERES, Research School for Resource Studies for Devel- opment. Funded by the Netherlands Fellowship Programme (NFP). © Mary Mohamed Rutenge 2016 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the author. ISBN 978-90-6490-069-3 GOLD-MINING MULTINATIONALS AND COMMUNITY INTERACTION IN TANZANIA Towards Localised Social Accountability MULTINATIONALS IN DE GOUDMIJNBOUW EN HUN INTERACTIE MET DE LOKALE GEMEENSCHAP IN TANZANIA Op weg naar gelokaliseerde sociale verant- woording Thesis to obtain the degree of Doctor from the Erasmus University Rotterdam by command of the Rector Magnificus Professor dr H.A.P Pols and in accordance with the decision of the Doc- torate Board The public defence shall be held on Tuesday 20 December 2016 at 16.00 hrs by Mary Mohamed Rutenge born in Dar Es Salaam, Tanzania Doctoral committee Doctoral dissertation supervisors Prof. P. Knorringa Em. Prof. A.H.J. Helmsing Other members Prof. M.J. Spierenburg, Radboud University Nijmegen Prof. K. Arts, LLM Dr. K. Biekart Dedication To my husband Ernest and my sons Brian and Dennis Contents Dedication vi List of Tables, Figures, Maps and Appendices xi Acronyms xiii Acknowledgements xiv Abstract xvi Samenvatting -

For Personal Use Only Use Personal for RIFT VALLEY RESOURCES LIMITED CHAIRMAN’S ADDRESS: 2011 ANNUAL GENERAL MEETING

17 November 2011 RIFT VALLEY RESOURCES LIMITED (ASX: RFV) CHAIRMAN’S ADDRESS TO AGM Rift Valley Resources Limited is pleased to provide a copy of today’s Chairman’s Address to the Annual General Meeting of Shareholders. For personal use only RIFT VALLEY RESOURCES LIMITED CHAIRMAN’S ADDRESS: 2011 ANNUAL GENERAL MEETING Good afternoon Ladies and Gentlemen: I am very pleased to welcome you to Rift Valley’s 2011 Annual General Meeting and to make some brief introductory comments on what has been a very active and successful year for the Company. Rift Valley listed on the Australian Stock Exchange in May this year with a clear strategy to explore the richly mineralised areas of Tanzania, which hold tremendous potential for world class gold and nickel discoveries. Why Tanzania? Quite simply because Tanzania holds all the necessary ingredients for the discovery and development of major world class mining projects. Since inviting foreign investment in the late 1990s, Tanzania has grown from having no modern gold mines to becoming the third largest producer of gold in Africa. Tanzania is politically stable, has an established system of law, an existing mining culture and service industry, and, most importantly, is rich in its mineral potential. The past six months have been a very busy and productive period for Rift Valley. Since listing on the ASX in May, Rift Valley has used its extensive African knowledge base to establish a first class exploration team in Tanzania. This team, led by Bartholomew Mkinga will stand Rift Valley in good stead during the 2012 financial year as we ramp up exploration on our lead projects. -

Anger Boils Over at North Mara Mine – Barrick/Acacia Leave Human Rights Abuses Unaddressed

Anger Boils Over at North Mara Mine – Barrick/Acacia Leave Human Rights Abuses Unaddressed Field Assessment Brief Catherine Coumans July 2017 June proved to be a hot month for Canada’s Barrick Gold Corp. (Barrick) and its London-based 63.9%- owned subsidiary Acacia Mining plc. (Acacia). Both in Tanzania’s capital Dar es Salaam and at the North Mara Gold Mine ltd.1 (North Mara) problems escalated for the companies. On June 12th, the Tanzanian Government released a second report by a Presidential Committee of experts2 examining the economic and legal activities of Acacia’s operations. This report followed the release of an explosive Presidential Committee report in May3 that accused Acacia of underreporting gold and copper percentages in mineral sand concentrates slated for export and smelting overseas, leading to an export ban on these concentrates from two of the company’s three operating mines and costing Acacia an estimated $1 million (US) a day.4 The June report reviews data back to 1998 and accuses Acacia of under-reporting revenues and under-payment of taxes and royalties worth tens of billions of dollars.5 It also recommends re-negotiation of the contracts between the Tanzanian government and Acacia and a continuation of the export ban on concentrates from Acacia’s Buzwagi and Bulyanhulu mines. On June 14, Barrick’s Executive Chairman, John Thornton, flew into Dar es Salaam to meet with President Magufuli, reportedly6 to negotiate a solution to the financial impacts of Magufuli’s decisions on Barrick and Acacia’s Tanzanian operations. 1 North Mara Gold Mine ltd. -

ACACIA-Operational Update.Pdf

9 May 2019 Acacia Mining plc (“Acacia”, “Group” or the “Company”) Operational Update “I am pleased to announce a rebound in gold production and performance at the start of Q2 to 47,805 ounces for the month. This follows the successful implementation of a revised mining plan at the North Mara mine which saw April gold production at the mine increase to 33,941 ounces, 54% above the monthly average production during Q1. Although still early in the second quarter, I am pleased with the improved production levels now being achieved and remain confident of delivering against our full year production guidance of 500,000 to 550,000 ounces,” said Peter Geleta, Interim Chief Executive Officer, who added, “As we maintain our focus on what we can control, our operating performance during the month, together with public recognition for each of our mines at the National Safety Awards in Mbeya, are testament to the resilience and ongoing commitment of our people and businesses. In the meantime, a negotiated resolution remains our preferred outcome to the Company’s ongoing disputes with the Government of Tanzania. The Company continues to provide support to Barrick Gold Corporation (“Barrick”) in its direct discussions with the Government and, once these discussions have been successfully concluded, we look forward to receiving and reviewing a proposal for a resolution of Acacia’s disputes agreed in principle between Barrick and the Government.” Total gold production in April was 47,805 ounces, 37% higher than the monthly average during Q1 2019. This reflects a significant improvement in North Mara production performance through delivery against the revised mining plan announced in the Q1 production update and results releases. -

Mining in Tanzania

Mining in Tanzania Africa’s Golden Child. TABLE OF CONTENTS Tanzania: an overview.......................................p2 This report was researched and prepared by The Reformed Mining Code................................p3 Global Business Reports (www.gbreports.com) for Mining in Tanzania..........................................p5 Engineering & Mining Journal. An Evolving Market Place................................p8 The Support and Service Sector.........................p10 Editorial researched and written by Andrea Stucchi, Corporate Social Responsibility..........................p14 Jolanta Ksiezniak and Sarah Hussaini. Conclusion..................................................p15 For more details, please contact [email protected]. Cover photo courtesy of AngloGold Ashanti. A REPORT BY GBR FOR E&MJ DECEMBER 2012 MINING IN TANZANIA mean that, in terms of economy and infrastructure, companies still face enormous challenges. In fact, following Nyerere’s socialist ex- periment, Tanzania was left as one of the poorest, least developed Tanzania: and most foreign aid dependent countries in Africa. Later, in 1992, the Africa Strategy for Mining Technical Paper an Overview developed by the World Bank and the International Monetary Fund were instrumental in financing and developing a blueprint for the mining sector in Tanzania through a mineral sector development pro- Tanzania’s political gram. The aim of this was to oversee the privatization and liberal- ization of the state-controlled mining sector to facilitate the entry of stability -

A Stronger Future Together ACACIA MINING PLC ANNUAL REPORT & ACCOUNTS 2018 Acacia Mining Plc Annual Report & Accounts 2018

A stronger future together ACACIA MINING PLC ANNUAL REPORT & ACCOUNTS 2018 Acacia Mining plc Annual Report & Accounts 2018 Strategic report Governance Group at a glance 1 Governance overview 70 Our lasting legacy 4 Board of Directors 72 CEO statement 10 Executive Leadership Team 74 Q&A with the Independent Interim Chair 16 Corporate governance report 75 Market overview 18 Committee reports 80 Our business model 22 Remuneration report 87 Our strategy 24 Other information 102 Key performance indicators 26 Directors’ responsibilities statement 106 Risk management 30 Reserves and resources 107 Principal risks and uncertainties 32 Financial statements Performance review Independent Auditors’ report to the Operating review 36 members of Acacia Mining plc 112 Financial review 50 Consolidated financial statements 119 Sustainability review 56 Notes to the consolidated financial statements 124 Parent company financial statements 164 Notes to the parent company financial statements 168 Shareholder information Glossary of terms 179 Shareholder enquiries 185 STRATEGIC REPORT STRATEGIC At the core of Acacia are excellent assets and great people and, while we continue to work through the uncertain operating environment, we maintain a strong focus over what we can control. We have demonstrated our commitment Acacia is one of the to manage the business, develop our largest gold producers in Africa. We have three people and build long-term partnerships mines, all located in north-west Tanzania, and with our local communities, governments a portfolio of exploration projects across the and other key stakeholders. continent. Operating performance Exploration and development SEE PAGE 36 SEE PAGE 44 Strong cost discipline Sustainability and partnerships SEE PAGE 50 SEE PAGE 56 ACACIA MINING PLC ANNUAL REPORT & ACCOUNTS 2018 1 Highlights Over the past year Acacia has successfully stabilised the business with a focus on optimising operational performance. -

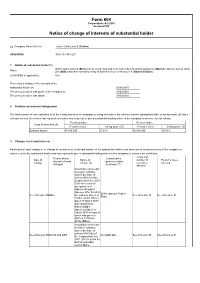

Form 604 Notice of Change of Interests of Substantial Holder

Form 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To Company Name/Scheme Tusker Gold Limited (Tusker) ACN/ARSN ACN 131 945 527 1. Details of substantial holder (1) BUK Holdco Limited (Bidco) on its own behalf and on behalf of Barrick Gold Corporation (Barrick), African Barrick Gold Name plc (ABG) and each controlled entity of Barrick set out in Annexure A (Barrick Entities) ACN/ARSN (if applicable) N/A There was a change in the interests of the substantial holder on 06/04/2010 The previous notice was given to the company on 31/03/2010 The previous notice was dated 31/03/2010 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate (2) had a relevant interest (3) in when last required, and when now required, to give a substantial holding notice to the company or scheme, are as follows: Previous notice Present notice Class of securities (4) Person’s votes Voting power (5) Person’s votes Voting power (5) Ordinary shares 27,910,895 27.91% 30,528,920 30.53% 3. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Class and Person whose Consideration Date of Nature of number of Person’s votes relevant