Strong Business Fundamentals to Accelerate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Using Net-Software in Design Education

INTERNATIONAL ENGINEERING AND PRODUCT DESIGN EDUCATION CONFERENCE 2-3 SEPTEMBER 2004 DELFT THE NETHERLANDS USING NET-SOFTWARE IN DESIGN EDUCATION Chris Baelus and Guido De Grande ABSTRACT In the early stages of the design process three major activities are involved: designing the concept, resolving the observed critical aspects and modifying the concept as a result of the previous step. This is a circular and iterative process until the final concept is ready for the detailed design phase. It is the purpose of every design method to minimize the total design time and produce well elaborated design concepts. The use of specialized software is of invaluable help in this attempt to reduce design time. A lot of different software is available on the Internet as downloadable freeware, shareware or demo versions. Most of this software has reduced capabilities; however, many software is excellent for educational purposes. We will call this software “Internet Software” or “net-software”. In this presentation two topics with respect to net-software will be discussed: 1. criteria for choosing net-software for educational purposes, and 2. the implementation of net-software in the new bachelor-master curriculum at the Higher Institute of Integrated Product Development (HIIPO) in Antwerp. A major activity in designing products is the early verification of the product concept with respect to structural, thermal and geometrical integrity. This typical verification net-software can be found in different flavours: for different applications, in different levels and with different user interfaces. Finding easy-to-use and efficient net-software is a rather straightforward task, integrating the software in the curriculum is a more difficult task. -

Aras Innovator - Connectors Support Matrix

Aras Innovator - Connectors Support Matrix MCAD Tools Autocad Autodesk Inventor CATIA V5 Dassault CATIA V6 SolidWorks Creo PTC Creo Direct NX Siemens Solid Edge PDM/PLM Autodesk Vault Altium Vault Enovia Dassault SmarTeam SolidWorks PDM Pro Oracle Agile PTC Windchill SAP PLM Siemens Teamcenter SAP PLM ERP IBM DOORS ORACLE ERP ERP SAP ERP V6 ERP HANNA QAD QAD/Mfg Dynamics NAV Microsoft Dynamics GP Dynamics AX Oracle Netsuite BIM Tools Revit AutoDesk 1 January 2021 Aras Innovator - Connectors Support Matrix ECAD Tools AutoCAD Electrical (Autodesk) Electrical CAD AutoDesk AutoCAD Electrical (Autodesk) Electrical Librarian SolidWorks (Dassault) Electrical Dassault SolidWorks (Dassault) Electrical Librarian Designer Electronic Board Layout CAD Designer Electronic Schematic CAD Designer Electronic Librarian Altium Nexus Server Agent Nexus Electronic Librarian Concord Electronic Librarian Concord PCB Electronic Librarian Xpedition Capture (Mentor Graphic) Electronic Schematic CAD PADS Standard Electronic Schematic CAD Xpedition Electronic Board Layout CAD PADS Standard Electronic Board Layout CAD Xpedition & PADS Professional Electronic Librarian PADS Standard Electronic Librarian Mentor PADS Professional Electronic Schematic CAD PADS Professional Electronic Board Layout CAD Capital Electrical Capital Electrical Librarian EDM Server Agent EDM Librarian Allegro HDL Electronic Schematic CAD OrCAD Capture CIS Electronic Schematic CAD Cadence Allegro & OrCAD Electronic Board Layout CAD Allegro HDL Electronic Librarian OrCAD Electronic Librarian Zuken E3.series (Zuken) Electrical Wiring Layout CAD Elcad Electrical CAD Elcad Electrical Librarian Aucotec Engineering Base Electrical CAD Engineering Base Electrical Librarian EPLAN Electric Electrical CAD EPLAN EPLAN Electric Electrical Librarian Pulsonix Electronic Board Layout CAD Pulsonix Pulsonix Electronic Schematic Layout CAD Pulsonix Electronic Librarian 2 January 2021. -

LH1546ADF Datasheet (PDF)

LH1546ADF, LH1546ADFTR www.vishay.com Vishay Semiconductors 1 Form A Solid-State Relay (Normally Open) FEATURES • Isolation test voltage 5300 VRMS • Typical RON 22 Ω A 1 4 S1 • Load voltage 350 V • Load current 120 mA C 2 3 S2 • Clean bounce free switching • Current limit protection • Low power consumption • Material categorization: for definitions of compliance please see www.vishay.com/doc?99912 DESCRIPTION APPLICATIONS The LH1546AD is a single channel solid state relay in a • General telecom switching 4 pin SMD package. It is a SPST normally open switch (1 Form A) that replaces electromechanical relays in many • Metering applications. It is constructed using a GaAlAs LED for • Security equipment actuation control and MOSFET switches for the output. • Instrumentation In addition, it employs current-limiting circuitry to provide • Industrial controls overvoltage protection. • Battery management systems • Automatic test equipment AGENCY APPROVALS • UL1577, file no. E52744 ORDERING INFORMATION SMD LH1546A##TR PART NUMBER ELECTR. PACKAGE TAPE AND VARIATION CONFIG. REEL > 0.1 mm PACKAGE UL SMD-4, tubes LH1546ADF SMD-4, tape and reel LH1546ADFTR Rev. 1.8, 05-Jul-2018 1 Document Number: 83836 For technical questions, contact: [email protected] THIS DOCUMENT IS SUBJECT TO CHANGE WITHOUT NOTICE. THE PRODUCTS DESCRIBED HEREIN AND THIS DOCUMENT ARE SUBJECT TO SPECIFIC DISCLAIMERS, SET FORTH AT www.vishay.com/doc?91000 LH1546ADF, LH1546ADFTR www.vishay.com Vishay Semiconductors ABSOLUTE MAXIMUM RATINGS (Tamb = 25 °C, unless otherwise specified) PARAMETER CONDITION SYMBOL VALUE UNIT INPUT IRED continuous forward current IF 50 mA IRED reverse voltage VR 5V Input power dissipation Pdiss 80 mW OUTPUT DC or peak AC load voltage VL 350 V Continuous DC load current at 25 °C, I 120 mA bidirectional L SSR output power dissipation Pdiss 550 mW SSR Ambient temperature range Tamb -40 to +85 °C Storage temperature range Tstg -40 to +150 °C Soldering temperature t = 10 s max. -

Metadefender Core V4.12.2

MetaDefender Core v4.12.2 © 2018 OPSWAT, Inc. All rights reserved. OPSWAT®, MetadefenderTM and the OPSWAT logo are trademarks of OPSWAT, Inc. All other trademarks, trade names, service marks, service names, and images mentioned and/or used herein belong to their respective owners. Table of Contents About This Guide 13 Key Features of Metadefender Core 14 1. Quick Start with Metadefender Core 15 1.1. Installation 15 Operating system invariant initial steps 15 Basic setup 16 1.1.1. Configuration wizard 16 1.2. License Activation 21 1.3. Scan Files with Metadefender Core 21 2. Installing or Upgrading Metadefender Core 22 2.1. Recommended System Requirements 22 System Requirements For Server 22 Browser Requirements for the Metadefender Core Management Console 24 2.2. Installing Metadefender 25 Installation 25 Installation notes 25 2.2.1. Installing Metadefender Core using command line 26 2.2.2. Installing Metadefender Core using the Install Wizard 27 2.3. Upgrading MetaDefender Core 27 Upgrading from MetaDefender Core 3.x 27 Upgrading from MetaDefender Core 4.x 28 2.4. Metadefender Core Licensing 28 2.4.1. Activating Metadefender Licenses 28 2.4.2. Checking Your Metadefender Core License 35 2.5. Performance and Load Estimation 36 What to know before reading the results: Some factors that affect performance 36 How test results are calculated 37 Test Reports 37 Performance Report - Multi-Scanning On Linux 37 Performance Report - Multi-Scanning On Windows 41 2.6. Special installation options 46 Use RAMDISK for the tempdirectory 46 3. Configuring Metadefender Core 50 3.1. Management Console 50 3.2. -

Altium's Journey and Its Vision of Industry Transformation

A Winning Strategy for Value-Creation ALTIUM’S JOURNEY AND ITS VISION OF INDUSTRY TRANSFORMATION 18 June 2021 Agenda 1 Altium’s Journey of Transformation 2 Uniqueness of Altium in the Engineering Software Ecosystem 3 Altium’s Confidence in its Ability to Execute 4 Our Flight Path to Dominance Outstanding Value-Creation Track-Record Over Time ALU Set in 2019 and confident of achieving $500M * Stock Price Revenue Target Set in 2016 and fell short with COVID, $189M ** Delivering Value for our Shareholders $200M is a Hallmark of Altium… Revenue Target • A history of setting and over-achieving Set in 2014 and overachieved, $110M $100M aggressive long-term financial targets Revenue Target • Eight consecutive years of double-digit revenue growth & expanding margin ? • Focused execution with the “ingenuity of and” A$41.60 delivering strong operating leverage A$10.15 • Transparency for stakeholders and all-in reporting (no capitalization of R&D expenses) A$4.36 • Value creation at every stage from leadership to dominance to industry transformation A$0.76 Performing Leading Dominating Transforming 2012 2015 2017 2020 2025 * The target revenue of $500M may include 10-20% from future acquisitions. 3 ** Three months out analysts’ consensus pointed to a revenue target of $208M for FY2020 Pursuing Dominance and Transformation from a Position of Strength Financial Altium Designer Altium 365 Performance Dominance Adoption Altium is the fastest growing EDA company Altium Designer is the most widespread The world’s first digital platform for with 8 consecutive -

Circuitmaker 2000 (The Symbol Will Be Replaced by a Rectangle)

CircuitMaker® 2000 the virtual electronics lab™ CircuitMaker User Manual advanced schematic capture mixed analog/digital simulation Revision A Software, documentation and related materials: Copyright © 1988-2000 Protel International Limited. All Rights Reserved. Unauthorized duplication of the software, manual or related materials by any means, mechanical or electronic, including translation into another language, except for brief excerpts in published reviews, is prohibited without the express written permission of Protel International Limited. Unauthorized duplication of this work may also be prohibited by local statute. Violators may be subject to both criminal and civil penalties, including fines and/or imprisonment. CircuitMaker, TraxMaker, Protel and Tango are registered trademarks of Protel International Limited. SimCode, SmartWires and The Virtual Electronics Lab are trademarks of Protel International Limited. Microsoft and Microsoft Windows are registered trademarks of Microsoft Corporation. Orcad is a registered trademark of Cadence Design Systems. PADS is a registered trademark of PADS Software. All other trademarks are the property of their respective owners. Printed by Star Printery Pty Ltd ii Table of Contents Chapter 1: Welcome to CircuitMaker Introduction............................................................................................1-1 Required User Background..............................................................1-1 Required Hardware/Software...........................................................1-1 -

Electronic Design Automation Tools Part 2 by Christopher Henderson This Article Provides an Overview of the Electronic Design Automation (EDA) Design Tools

Issue 126 December 2019 Electronic Design Automation Tools Part 2 By Christopher Henderson This article provides an overview of the Electronic Design Automation (EDA) design tools. The EDA industry is an interesting ecosystem and bears discussing, so that the design engineer can Page 1 Electronic Design understand the environment. Automation Tools In last month’s feature article we discussed the three major EDA Part 2 tool suppliers: Cadence Design Systems, Synopsys, and Mentor Graphics, which is now owned by Siemens. Here in Part II we will Page 5 Technical Tidbit briefly discuss interoperability issues between the three major platforms. We’ll also discuss other suppliers developing tools in this area. Finally, we’ll discuss the use case and the strengths and Page 8 Ask the Experts weaknesses of the tool suites. Each of the three major EDA firms creates products that work well within their own portfolio, but what about across the three major Page 10 Spotlight providers? What if you want to create designs using tools from across two or more of the providers? This is a major challenge because it requires that one work with different formats for different files, which Page 13 Upcoming Courses requires translators, scripts and additional programs. What would be most useful is a good interoperability standard, and the good news is that there is one. It is called OpenAccess and is supported and promoted by the Silicon Integration Initiative. OpenAccess actually had its start as the result of a lawsuit against Cadence. Users sued Cadence, claiming that their internal format gave them a controlling monopoly in the design area, and a judge agreed with them. -

233-203 PCB Terminal Block; Push-Button; 0.5 Mm²; Pin Spacing 2.5 Mm; 3-Pole; CAGE CLAMP®; 0,50 Mm²; Gray

Data sheet | Item number: 233-203 PCB terminal block; push-button; 0.5 mm²; Pin spacing 2.5 mm; 3-pole; CAGE CLAMP®; 0,50 mm²; gray www.wago.com/233-203 Color: L = (pole no. x pin spacing) + 2.3 mm SubjectItem description to changes. Please also observe the further product documentation! WAGO Kontakttechnik GmbH & Co. KG Do you have any questions about our products? Hansastr. 27 We are always happy to take your call at +49 (571) 887-44222. 32423 Minden Phone: +49571 887-0 | Fax: +49571 887-169 Email: [email protected] | Web: www.wago.com 03.07.2020 Page 1/8 Data sheet | Item number: 233-203 www.wago.com/233-203 Item description Compact PCB terminal strips with CAGE CLAMP® connection and screwdriver actuation parallel or perpendicular to conductor entry Double solder pins for high mechanical Custom color combinations Data Electrical data Ratings per IEC/EN 60664-1 Ratings per IEC/EN 60664-1 Nominal voltage (III/3) 63 V Rated surge voltage (III/3) 2.5 kV Rated voltage (III/2) 160 V Rated surge voltage (III/2) 2.5 kV Nominal voltage (II/2) 320 V Rated surge voltage (II/2) 2.5 kV Rated current 6 A Legend (ratings) (III / 2) ≙ Overvoltage category III / Pollution degree 2 Approvals per UL 1059 Rated voltage UL (Use Group B) 150 V Rated current UL (Use Group B) 4 A Approvals per CSA Rated voltage CSA (Use Group B) 150 V Rated current CSA (Use Group B) 4 A Connection data Connection technology CAGE CLAMP® Actuation type Push-button Solid conductor 0,08 … 0,5 mm² / 28 … 20 AWG Fine-stranded conductor 0,08 … 0,5 mm² / 28 … 20 AWG Fine-stranded conductor; with insulated ferrule 0,25 mm² Fine-stranded conductor; with uninsulated ferrule 0,25 mm² SubjectStrip length to changes. -

Kretskorsdesign

Kretskorsdesign Schema Nätlista Nätlista Layout Simulering Schema ● Beskriver grafiskt vilka komponenter som finns i kretsen och hur de är sammankopplade. ● Behöver inte ha någon koppling till hur kretsen ser ut fysiskt. Nätlista ● Länken mellan den grafiska beskrivningen i schemat och layout eller simulering. ● Mer eller mindre automatiskt genererad textfil med anslutningarna mellan komponenters pinnar. ● Nät kan ges beskrivande namn i schemat, tex ”GND” ● Nät med samma namn är sammankopplade. Kan användas för att få ett tydligare schema. Layout ● Fysisk beskrivning av kretsen. ● Får information om vilka komponenter(och vilken fysisk kapsel) samt anslutningar mellan dessa från nätlistan. ● Hur komponenterna placeras på kortet och hur de fysiska ledningarna ser ut är upp till den som gör layouten. Vilka program finns det? ● Det finns många alternativ... ● Eagle – Historiskt väldigt populärt. – Gratisversion upp till 2 lager och 80x100mm. – Större kort och/eller kommersiellt bruk numera endast via abonnemang. ● Diptrace – Begränsningar på antalet pinnar, 300 eller 500 för ”non-profit”. – 1000 pinnar för 125$ ”non-profit”, 395$ för motsvarande kommersiella version. Open source ● KiCad – Har utvecklats mycket senaste åren. – Fokus har varit på att förbättra layout-delen. – Nästa version kommer att innehålla b.l.a simulering(ngspice) och förbättringar i schema-delen. ● gEDA/PCB – Lite mer löst sammanhållna verktyg. – PCB är förmodligen det äldsta open-source layoutprogrammet som är aktivt, första versionen kom 1990 för Atari Online ● Easyeda – Schema/layout/simulering. – Tillverkar kort, men genererar även gerberfiler. ● Upverter ● Circuitmaker – Från Altium. – Installeras lokalt, men kräver att man är uppkopplad. Tillverkning Layout Gerber, borr-fil Gerber ● En fil per lager. – Filändelsen brukar indikera vilket lager det ska vara ● En eller två borrfiler(pläterade/opläterade hål). -

Pulsonix Users Guide Pulsonix Users Guide 3

Pulsonix Design System Users Guide 2 Pulsonix Users Guide Pulsonix Users Guide 3 Copyright Notice Copyright ã WestDev Ltd. 2001-2018 Pulsonix is a Trademark of WestDev Ltd. All rights reserved. E&OE Copyright in the whole and every part of this software and manual belongs to WestDev Ltd. and may not be used, sold, transferred, copied or reproduced in whole or in part in any manner or in any media to any person, without the prior written consent of WestDev Ltd. If you use this manual you do so at your own risk and on the understanding that neither WestDev Ltd. nor associated companies shall be liable for any loss or damage of any kind. WestDev Ltd. does not warrant that the software package will function properly in every hardware software environment. Although WestDev Ltd. has tested the software and reviewed the documentation, WestDev Ltd. makes no warranty or representation, either express or implied, with respect to this software or documentation, their quality, performance, merchantability, or fitness for a particular purpose. This software and documentation are licensed 'as is', and you the licensee, by making use thereof, are assuming the entire risk as to their quality and performance. In no event will WestDev Ltd. be liable for direct, indirect, special, incidental, or consequential damage arising out of the use or inability to use the software or documentation, even if advised of the possibility of such damages. WestDev Ltd. reserves the right to alter, modify, correct and upgrade our software programs and publications without notice and without incurring liability. Microsoft, Windows, Windows NT and Intellimouse are either registered trademarks or trademarks of Microsoft Corporation. -

Tutorial and Design of Printed Circuit Board ”Big Blinky”

Paper ID #31292 An Electronics Lab Project—Tutorial and Design of Printed Circuit Board ”big blinky” Dr. Rod Blaine Foist, California Baptist University Rod Foist Professor (and IEEE student club advisor), Electrical and Computer Engineering, Gordon & Jill Bourns College of Engineering, California Baptist University, [email protected]. Dr. Foist received his B.S. and M.S. degrees in Electrical Engineering from the University of Washington in 1982 and 1989, respectively. He earned his Ph.D. degree in Electrical and Computer Engineering from the University of British Columbia in 2011, specializing in signal processing of spectroscopy data with secondary emphasis in system-on-chip implementation. His on-going research interests involve embedded processing using FPGAs and hardware acceleration of algorithms. In the fall of 2011, Dr. Foist joined the College of Engineering at California Baptist University. He is a U.S. Navy veteran who still strives to serve God and country. He has been happily married for 42 years and has four adult children and two grandchildren. Dr. John Butler, California Baptist University Dr. John Butler is currently an Assistant Professor in the department of Electrical and Computer En- gineering at California Baptist University. He received his B.S., M.S., and Ph.D. degrees in Electrical Engineering from the University of California, Riverside, in 2009, 2011, and 2014, respectively. In the fall of 2018 Dr. Butler joined the Gordon and Jill Bourns College of Engineering at California Baptist University as an Assistant Professor. Prior to this, he served as an Adjunct Professor since 2014. His re- search background includes nanoscale fabrication and characterization, particularly of magnetic thin films for data storage and logic devices. -

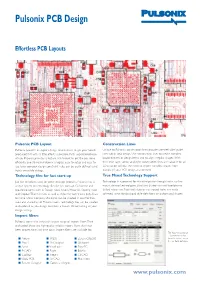

Pulsonix PCB Design

Pulsonix PCB Design Effortless PCB Layouts Pulsonix PCB Layout Construction Lines Pulsonix provides an expert design environment to get your boards Unique to Pulsonix, construction lines provide user-definable 'guide' produced fast with as little effort as possible.With unparalleled ease lines within your design. Use construction lines to create complex of use, Pulsonix provides a feature-rich toolset to get the job done board outlines or design items and to align irregular shapes.With efficiently. Everything in Pulsonix is logical, easy to setup and easy to their own layer, colour and style, construction lines are valuable for all use. Even complex design constraint rules can be easily defined using 2D creation without the need to import complex shapes from highly accessible dialogs. outside of your PCB design environment. Technology files for fast start-up True Mixed Technology Support Just like templates used for other desktop products, Pulsonix has a Technology is supported for standard plated through holes, surface unique system of technology files for fast start-up. Customise and mount devices/technologies, blind and buried vias and laser/plasma pre-define items such as Design rules, Layers, Materials, Spacing rules drilled micro-vias. Pads with slots or non-round holes are easily and Copper/Thermal rules as well as styles for text, tracks, pads, lines achieved using standard pad style definitions or custom pad shapes. to name a few. Company standards can be created in one file then used and shared by all Pulsonix users.Technology files can be created and updated as you design to create a master file containing all your design settings.