In the Shadow of the Corporate Veil: James Hardie and Asbestos Compensation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What Will a Labor Government Mean for Defence Industry in Australia?

What will a Labor Government mean for Defence Industry in Australia? Hon Greg Combet AM Opinion polls suggest a change of government in the Australian Federal election in (expected) May 2019. An incoming Labor Government led by Bill Shorten will likely feature Richard Marles as Minister for Defence and Mike Kelly as Assisting Minister for Defence Industry and Support. Jason Clare, a former Minister for Defence Matériel, would likely have influence upon the defence industry portfolio in his potential role as Minister for Trade and Investment. Under a Labor Government, it is possible Shorten would appoint a new Minister for Defence Matériel (as has been an established practice for many years) given the magnitude of expenditure and complexity of the portfolio. Shorten and Marles have been associates since university and have been closely aligned during their trade union and political careers. With extensive practical experience of the Australian industry, Shorten and Marles have a record of working constructively with business leadership. Both have a sound understanding of the role and the significance of defence industry in Australia. Marles, in particular, has a greater interest in national security and strategic issues and would likely concentrate on these in the portfolio and delegate aspects of defence industry to a ministerial colleague. Labor’s defence industry policy was reviewed and adopted during the December 2018 Party National Conference. The policy is consistent with Labor’s approach when it was last in government, reiterating support for: • an Australian defence industry that provides the Australian Defence Force with the necessary capabilities; • sovereign industrial capability where required, specifically identifying naval shipbuilding; • an export focus; • the maximisation of the participation of small-to-medium enterprises (SMEs) in defence projects; and • initiatives to develop workforce skills. -

Hansart Interpreting Hansard Records

HansART Interpreting Hansard Records THE ENVIRONMENT The following excerpts are taken directly from the Parliament of Australia Hansard records and have not been altered. In using Hansard, please be aware that the standardised style may have changed over time. 1 JOHN HOWARD MP, 1997 MINISTERIAL STATEMENT ON CLIMATE CHANGE Source: Parliament of Australia Since its election the government has addressed the critical issue of global warming in a way that effectively promotes Australia’s national interests. Those interests lie in both protecting Australian jobs and Australian industry whilst ensuring that Australia plays her part in the worldwide effort needed to reduce greenhouse gas emissions. From the start, we have made it plain that Australia would not accept an unfair share of the burden. We have rejected and will continue to reject mandatory uniform targets which advantage many developed countries to the distinct disadvantage of Australia. We have also made it plain that we are not prepared to see Australian jobs sacrificed and efficient Australian industries, particularly in the resources sector, robbed of their hard-earned, competitive advantage. Moreover, we have persistently stressed the need to involve developing countries as their participation is crucial to any lasting solution to the global warming problem. These principles have guided our approach to the greenhouse gas issue. 2 PETER MCGAURAN MP, 1997, RESPONSE TO A QUESTION ON CLIMATE CHANGE Source: Parliament of Australia I thank the member for Hinkler for his question. Representing, as he does, the city of Gladstone, he has a vital interest in all matters greenhouse. There is a great deal of misinformation and at times hysteria, often deliberately manufactured, about the issue of climate change. -

The Foreign Minister Who Never Was

The foreign minister who never was BY:DENNIS SHANAHAN, POLITICAL EDITOR The Australian March 02, 2012 12:00AM Cartoon by Peter Nicholson. Source: The Australian JULIA Gillard's ability to turn good news - a brilliant political strategy, a poignant moment, or an opportunity to become strong, credible and assertive - into bad news and dumb politics appears to be boundless. And, when the Prime Minister has a brain snap, makes an error of judgment or gets into trouble for a reflexive and ill-considered denial the finger is pointed towards staff, speech writers, the hate media, Tony Abbott, or most of all, Kevin Rudd. The mistakes she's admitted are those where she neglected to publicly apportion blame to Rudd as a dysfunctional, pathological leader, and this being the reason for her taking over as prime minister in June 2010. On Monday morning, after three politically debilitating months of unforced errors, media disasters and a destabilising campaign to gather support for a Rudd leadership challenge, Gillard was finally in the clear. After a brilliant political strategy to force Rudd's hand early, at least two weeks before he was prepared to go, Gillard was able to crush him in the Labor caucus ballot 71 to 31 votes. Although there was a strong element of voting against Rudd rather than for Gillard in the ballot, it saw off Rudd's chances for this parliamentary term at least and gave Labor a chance to regather its thoughts and try to redeem a seemingly hopeless position. Gillard set out her intentions, addressing the public: "I can assure you that this political drama is over and now you are back at centre stage where you should properly be and you will be the focus of all of our efforts." On the issue of reshuffling her ministry and whether she would be punishing Rudd supporters, Gillard declared: "My focus will be on having a team based on merit and the ability to take the fight up on behalf of Labor to our conservative opponents. -

Ministerial Careers and Accountability in the Australian Commonwealth Government / Edited by Keith Dowding and Chris Lewis

AND MINISTERIAL CAREERS ACCOUNTABILITYIN THE AUSTRALIAN COMMONWEALTH GOVERNMENT AND MINISTERIAL CAREERS ACCOUNTABILITYIN THE AUSTRALIAN COMMONWEALTH GOVERNMENT Edited by Keith Dowding and Chris Lewis Published by ANU E Press The Australian National University Canberra ACT 0200, Australia Email: [email protected] This title is also available online at http://epress.anu.edu.au National Library of Australia Cataloguing-in-Publication entry Title: Ministerial careers and accountability in the Australian Commonwealth government / edited by Keith Dowding and Chris Lewis. ISBN: 9781922144003 (pbk.) 9781922144010 (ebook) Series: ANZSOG series Notes: Includes bibliographical references. Subjects: Politicians--Australia. Politicians--Australia--Ethical behavior. Political ethics--Australia. Politicians--Australia--Public opinion. Australia--Politics and government. Australia--Politics and government--Public opinion. Other Authors/Contributors: Dowding, Keith M. Lewis, Chris. Dewey Number: 324.220994 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the publisher. Cover design and layout by ANU E Press Printed by Griffin Press This edition © 2012 ANU E Press Contents 1. Hiring, Firing, Roles and Responsibilities. 1 Keith Dowding and Chris Lewis 2. Ministers as Ministries and the Logic of their Collective Action . 15 John Wanna 3. Predicting Cabinet Ministers: A psychological approach ..... 35 Michael Dalvean 4. Democratic Ambivalence? Ministerial attitudes to party and parliamentary scrutiny ........................... 67 James Walter 5. Ministerial Accountability to Parliament ................ 95 Phil Larkin 6. The Pattern of Forced Exits from the Ministry ........... 115 Keith Dowding, Chris Lewis and Adam Packer 7. Ministers and Scandals ......................... -

Local Adaptation Pathways Program Forum Report

Local Adaptation Pathways Program Forum Report ‘from risk to action’ Looking Backward: Evaluation Looking Forward: Implementation June 2011 Report prepared by: ICLEI – Local Governments for Sustainability by: Martin Brennan, Wayne Wescott and Hazen Cleary ICLEI – Local Governments for Sustainability ICLEI – Local Governments for Sustainability (ICLEI) is an international association of local governments and national and regional local government organisations that have made a commitment to sustainable development. More than 1200 cities, towns, counties and their associations worldwide comprise ICLEI’s membership. ICLEI Oceania ICLEI Oceania is the secretariat for the Oceania region. Its Melbourne head office is hosted by the City of Melbourne and which was established in 1999. ICLEI Oceania’s focus is to work predominantly with local governments in Australia and New Zealand. The Oceania office has been active in the Asia region with work undertaken on climate change action in support of local government in Indonesia, China, Korea and Taiwan. ICLEI Oceania undertakes collaborative work with Federal and State government departments and agencies, where that work builds the capacity of local governments to achieve sustainable communities, and supports those departments and agencies to progress their sustainable outcomes in partnership with the local government sector. We acknowledge the contribution of the Department of Climate Change and Energy Efficiency: Colin Steele Sharon Larkin Cate Coddington Huong Vu Funded by the Australian Government -

Resisting Howard's Industrial Relations

RESISTING HOWARD’S INDUSTRIAL RELATIONS ‘REFORMS’: AN ASSESSMENT OF ACTU STRATEGY Tom Bramble ‘We are facing the fight of our lives. The trade union movement will be judged on how effectively we meet this challenge’ (AMWU National Secretary, Doug Cameron, May 2005). Howard’s planned industrial relations (IR) legislation confronts Australian unions with their worst nightmare. This is obviously the case for rank and file members who face a savage attack on their conditions, but the legislation is also terrifying for the union bureaucracy. Since Federation, Australian capitalism has operated on the basis of mediating class conflict at the workplace through arbitration and conciliation. This did not mean that class conflict was absent, or that the arbitration system was not itself a weapon in this conflict, only that at the base of any such conflict was a recognition by employers and the state of the legitimacy of the union bureaucracy in the industrial relations process. With its WorkChoices legislation, the Howard government has signalled an onslaught on this entire system and, with it, the central role of union officials in the system of structured class relationships. The purpose of this article is to provide a critical assessment of the strategy drawn up by the ACTU to resist WorkChoices. Although there are differences of emphasis within their ranks, the ACTU executive and office bearers have pursued a strategy with five main components. First, to convince employers that they are wrong to break from the system that has served them well for a century. Second, to lobby the ALP at state and federal levels. -

Australian Science Minister Demoted Outgoing Kim Carr Hailed As “One of the Best”

NATURE | NEWS Australian science minister demoted Outgoing Kim Carr hailed as “one of the best”. Cheryl Jones 19 December 2011 Australian Prime Minister Julia Gillard took Australian science leaders by surprise last week when she demoted her Science Minister, Kim Carr, to a non-cabinet position. Carr has held the cabinet-level Innovation, Industry, Science and Research portfolio since Labor came to power in late 2007, and held, among others, the post of shadow science and research minister during the party's long period in opposition. He has now been given the Manufacturing and Defence Materiel portfolios in a move seen by some commentators as a power play by the prime minister as she struggles to hold on to leadership of the minority Labor government. Gillard deposed former prime minister Kevin Rudd shortly before a national election last year, and speculation abounds that the revamped ministry is designed to fortify her against a possible challenge from him. Just how Carr's demotion would figure in this scenario is unclear. He is not giving media interviews about the reshuffle. Science and research, including the government science agencies and university research, have been added to the tertiary education portfolio under Senator Chris Evans. The innovation and industry portfolios, meanwhile, have been added to the responsibilities of the climate-change minister, Greg Combet. Popular presence Australia’s science-policy experts acknowledge Carr’s performance in the cabinet. He was successful in winning funds for his portfolio. He also reformed the R&D tax incentive programme to stimulate research and development in small- and medium- sized companies, and moved to rejuvenate Australia’s ailing space programme. -

Second Minister for Defence Calls on Australian Defence Minister

Second Minister for Defence Calls on Australian Defence Minister 23 Nov 2009 Minister for Education and Second Minister for Defence Ng Eng Hen discussing regional security issues with Minister for Defence Senator John Faulkner at Parliament House, Canberra, Australia. Minister for Education and Second Minister for Defence Ng Eng Hen called on Australian Minister for Defence Senator John Faulkner in Canberra this morning. During their meeting, the two leaders discussed regional security issues of mutual concern, and reaffirmed the strong and broad-based bilateral defence relations between Singapore and Australia. Dr Ng, who is on an official visit to Australia from 22 to 25 November 2009, also called on Australian Deputy Prime Minister and Minister for Education Julia Gillard and Shadow Minister for Defence Senator David Johnston, and met with Minister for Defence Personnel, Material and Science Greg Combet. Tomorrow, Dr Ng will visit Singapore Armed Forces (SAF) troops participating in the annual Exercise Wallaby at the Shoalwater Bay Training Area (SWBTA) in Queensland, Australia. He will observe an integrated livefiring exercise involving major air and land platforms such as the Apache attack helicopters, Pegasus lightweight howitzers and Leopard 2A4 Main 1 Battle Tanks. Some 3,900 SAF personnel are taking part in this year's exercise, which is being conducted from 16 October to 29 November 2009. Dr Ng's visit to Australia is part of the regular ministerial exchanges between Singapore and Australia and underscores the close bilateral defence ties between the two countries. The SAF and the Australian Defence Force also interact extensively through bilateral and multilateral training exercises, visits, professional exchanges and military courses. -

The Rudd Government Australian Commonwealth Administration 2007–2010

The Rudd Government Australian Commonwealth Administration 2007–2010 The Rudd Government Australian Commonwealth Administration 2007–2010 Edited by Chris Aulich and Mark Evans Published by ANU E Press The Australian National University Canberra ACT 0200, Australia Email: [email protected] This title is also available online at: http://epress.anu.edu.au/rudd_citation.html National Library of Australia Cataloguing-in-Publication entry Title: The Rudd government : Australian Commonwealth administration 2007 - 2010 / edited by Chris Aulich and Mark Evans. ISBN: 9781921862069 (pbk.) 9781921862076 (eBook) Notes: Includes bibliographical references. Subjects: Rudd, Kevin, 1957---Political and social views. Australian Labor Party. Public administration--Australia. Australia--Politics and government--2001- Other Authors/Contributors: Aulich, Chris, 1947- Evans, Mark Dr. Dewey Number: 324.29407 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the publisher. Cover design by ANU E Press Illustrations by David Pope, The Canberra Times Printed by Griffin Press Funding for this monograph series has been provided by the Australia and New Zealand School of Government Research Program. This edition © 2010 ANU E Press Contents Acknowledgments . vii Contributors . ix Part I. Introduction 1 . It was the best of times; it was the worst of times . 3 Chris Aulich 2 . Issues and agendas for the term . 17 John Wanna Part II. The Institutions of Government 3 . The Australian Public Service: new agendas and reform . 35 John Halligan 4 . Continuity and change in the outer public sector . -

James Hardie Industries NV

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 November 19, 2004 1-15240 (Commission File Number) JAMES HARDIE INDUSTRIES N.V. (Exact name of Registrant as specified in its charter) 4th Level, Atrium, unit 04-07 Strawinskylaan 3077 1077 ZX Amsterdam, The Netherlands (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F..X.... Form 40-F......... Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Not Applicable Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Not Applicable Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ..... No ..X... (If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not Applicable TABLE OF CONTENTS Safe Harbor Statement 3 Exhibit Index 4 Signatures 5 EXHIBIT 99.1 2 Table of Contents Safe Harbor Statement The exhibit attached to this Form 6-K contains forward-looking statements. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “should,” “aim” and similar expressions are Intended to identify forward-looking statements but are not the exclusive means of identifying such statements. -

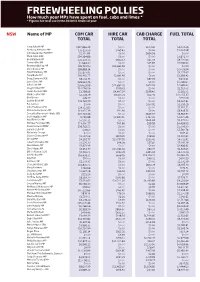

Freewheeling Pollies How Much Your Mps Have Spent on Fuel, Cabs and Limos * * Figures for Total Use in the 2010/11 Financial Year

FREEWHEELING POLLIES How much your MPs have spent on fuel, cabs and limos * * Figures for total use in the 2010/11 financial year NSW Name of MP COM CAR HIRE CAR CAB CHARGE FUEL TOTAL TOTAL TOTAL TOTAL Tony Abbott MP $217,866.39 $0.00 $103.42 $4,559.36 Anthony Albanese MP $35,123.59 $265.43 $0.00 $1,394.98 John Alexander OAM MP $2,110.84 $0.00 $694.56 $0.00 Mark Arbib SEN $34,164.86 $0.00 $0.00 $2,806.77 Bob Baldwin MP $23,132.73 $942.53 $65.59 $9,731.63 Sharon Bird MP $1,964.30 $0.00 $25.83 $3,596.90 Bronwyn Bishop MP $26,723.90 $33,665.56 $0.00 $0.00 Chris Bowen MP $38,883.14 $0.00 $0.00 $2,059.94 David Bradbury MP $15,877.95 $0.00 $0.00 $4,275.67 Tony Burke MP $40,360.77 $2,691.97 $0.00 $2,358.42 Doug Cameron SEN $8,014.75 $0.00 $87.29 $404.41 Jason Clare MP $28,324.76 $0.00 $0.00 $1,298.60 John Cobb MP $26,629.98 $11,887.29 $674.93 $4,682.20 Greg Combet MP $14,596.56 $749.41 $0.00 $1,519.02 Helen Coonan SEN $1,798.96 $4,407.54 $199.40 $1,182.71 Mark Coulton MP $2,358.79 $8,175.71 $62.06 $12,255.37 Bob Debus $49.77 $0.00 $0.00 $550.09 Justine Elliot MP $21,762.79 $0.00 $0.00 $4,207.81 Pat Farmer $0.00 $0.00 $177.91 $1,258.29 John Faulkner SEN $14,717.83 $0.00 $0.00 $2,350.51 Mr Laurie Ferguson MP $14,055.39 $90.91 $0.00 $3,419.75 Concetta Fierravanti-Wells SEN $20,722.46 $0.00 $649.97 $3,912.97 Joel Fitzgibbon MP 9,792.88 $7,847.45 $367.41 $2,675.46 Paul Fletcher MP $7,590.31 $0.00 $464.68 $2,475.50 Michael Forshaw SEN $13,490.77 $95.86 $98.99 $4,428.99 Peter Garrett AM MP $39,762.55 $0.00 $0.00 $1,009.30 Joanna Gash MP $78.60 $0.00 -

Selling Workchoices: the Campaign for Industrial Relations Reform

CASE PROGRAM 2009-84.1 Selling WorkChoices: the campaign for industrial relations reform In 2005 the Howard Government planned to institute major changes to Australia’s industrial relations system. The contentious legislation, better known as WorkChoices, was anticipated by the Australian Council of Trade Unions (ACTU)1 which launched a pre-emptive advertising campaign opposing it. This prompted the Government to bring its own advertisements forward amid claims that the $55 million campaign was a misuse of public money to fund political propaganda. Problems with the law and an imminent election in 2007 led the government to launch another advertising campaign but it too was beset by controversy. Howard’s IR plan After a successful election campaign, the Liberal-National Coalition assumed government in 1996 and Prime Minister John Howard made reorganising Australia’s industrial relations (IR) system a key priority, although the Government had not secured control of Senate.2 Less than a year later, the Workplace Relations Act 1996 was passed into law, replacing the Industrial Relations Act 1988. The Act heralded a number of significant changes including the expansion of enterprise bargaining agreements which had been introduced by the previous government. This allowed a group of employees to negotiate pay and conditions directly with their employer This case was written by Marinella Padula, Australia and New Zealand School of Government for Peter Thompson as a basis for class discussion rather than to illustrate either effective or ineffective handling of a managerial situation. Cases are not necessarily intended as a complete account of the events described. While every reasonable effort has been made to ensure accuracy at the time of publication, subsequent developments may mean that certain details have since changed.