Podravka Group Business Results for 1-12 2020 Period

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trading Summary First Quarter of 2017

Trading Summary First quarter of 2017 Zagreb, April 2017. This publication was prepared and published by the Zagreb Stock Exchange Inc., Ivana Lučića 2a/22, Zagreb (hereinafter: Exchange). The publication is intended to provide information to the public and shall not be deemed to constitute an offer or invitation to buy or advice on trade or investment in financial instruments or opinion on the terms of the purchase or sale of any financial instrument mentioned therein whether favourable or not, nor should it be relied on as a substitute for own judgement or assessment by any user of this publication. The Exchange waives responsibility and liability for any damage which might arise out of the use of information contained therein. Further use of information available in this publication is permitted by the Exchange provided that the source is cited. Copyright © 2017. Zagreb Stock Exchange Zagreb Ivana Lučića 2a/22 All rights reserved. Content: 1 TRADING .................................................................................................................................. 1 1.1 COMPARISION WITH PREVIOUS QUARTER .............................................................................................................. 1 1.2 COMPARISON WITH PREVIOUS YEAR ..................................................................................................................... 2 1.3 MONTHLY TRADING OVERVIEW ........................................................................................................................... 4 -

Pregled Trgovine

Trading Summary First half of 2017 Zagreb, July 2017. This publication was prepared and published by the Zagreb Stock Exchange Inc., Ivana Lučića 2a/22, Zagreb (hereinafter: Exchange). The publication is intended to provide information to the public and shall not be deemed to constitute an offer or invitation to buy or advice on trade or investment in financial instruments or opinion on the terms of the purchase or sale of any financial instrument mentioned therein whether favourable or not, nor should it be relied on as a substitute for own judgement or assessment by any user of this publication. The Exchange waives responsibility and liability for any damage which might arise out of the use of information contained therein. Further use of information available in this publication is permitted by the Exchange provided that the source is cited. Copyright © 2017. Zagreb Stock Exchange Zagreb Ivana Lučića 2a/22 All rights reserved. Content: 1 TRADING......................................................................................................................... 1 1.1 COMPARISION WITH PREVIOUS HALF .......................................................................................... 1 1.2 COMPARISON WITH PREVIOUS YEAR ........................................................................................... 2 1.3 MONTHLY TRADING OVERVIEW ................................................................................................. 3 1.4 INDICES ............................................................................................................................... -

CEE Investment Opportunities: Slovenia & Croatia Investor

CEE investment opportunities: Slovenia & Croatia Investor Day Site visits Monday, 23 May 2016 Slovenia: Krka & Gorenje Timetable: 08:00– 17:15 Krka is among the top generic pharmaceutical companies in the world. Its business is the production and sale of prescription pharmaceuticals, non- prescription products and animal health products. 08:00 Departure from Hotel International (Zagreb) 10:00 Krka tour Gorenje is one of the leading European home 11:00 Departure from Krka appliance manufacturers with a history 13:00 Lunch break spanning more than 60 years. Home 14:00 Gorenje tour appliances under global brands Gorenje and 15:00 Departure from Gorenje Asko and six regional brands (Atag, Pelgrim, Upo, Mora, Etna and Körting) elevate the 17:15 Arrival at Hotel International (Zagreb) quality of life of users in 90 countries worldwide. Croatia: Podravka, Ledo & Atlantic Grupa Timetable: 08:00 – 16:45 Podravka produces the well-known Vegeta, as well as thousands of other products in its diverse catalogue. T h e Podravka brands are recognisable and a favourite in both Croatian and foreign markets. 08:00 Departure from Hotel International (Zagreb) 10:00 Podravka tour Ledo is the largest Croatian producer of 11:00 Departure from Podravka industrial-scale ice cream and the largest 13:00 Lunch break distributor of frozen foods. 14:00 Ledo tour Atlantic Grupa is one of the most dynamic 15:00 Departure from Ledo business systems in the region, with a 15:30 Atlantic Grupa tour significant portion of its business activities in 16:30 Departure from Atlantic Grupa the EU. 16:45 Arrival at Hotel International (Zagreb) For further details, please contact your WOOD sales representative or Karolina Drach-Kowalczyk at [email protected] . -

Atlantic Grupa Case Study

ATLANTIC GRUPA UNLOCKS WAREHOUSE PRODUCTIVITY GAINS WITH HONEYWELL VOICE. Case Study STOJAN PAŠALIĆ, SUPPLY CHAIN DEVELOPMENT MANAGER, ATLANTIC GRUPA: “By analyzing our picking processes, we were able to calculate for the first time exactly how much time was taken up by picking, moving around the warehouse and other activities.” OVERVIEW Headquartered in Zagreb, Croatia, Atlantic Grupa is one of the largest fast-moving consumer goods (FMCG) producers and distributors in Southeast Europe. Founded in 1991, the company operates in eight countries and exports products — both its own and other brands — to more than 40 markets around the globe. Steady acquisitions, combined with a well-earned reputation for quality goods and excellent service, have resulted in solid year-over-year growth for the company. To keep pace with demand, Atlantic Grupa sought a voice-directed, order-picking solution that would boost productivity and reduce errors in its distribution operations. Atlantic Grupa ultimately invested in Honeywell Voice for its built-in integration flexibility, pick-up-and-go capabilities and superior data insights. BACKGROUND Atlantic Grupa was experiencing growing pains. Order volumes solution for order picking at its warehouses in Zagreb and Split. By were rising by roughly 10 percent per year, requiring that freeing the eyes and hands of its pickers, Atlantic Grupa aimed to employees complete between 350,000 to 400,000 picks per streamline processes, boost productivity, and reduce error rates. month. While permanent staff increases were not a long-term Within short order of implementing Honeywell Voice, Atlantic option, training temporary employees to address peak season Grupa achieved its goals. -

Winter in Prague Tuesday 5 December to Friday 8 December 2017

emerging europe conference Winter in Prague Tuesday 5 December to Friday 8 December 2017 Our 2017 event held over 4 informative and jam-packed days, will continue the success of the previous five years and host almost 3,000 investor meetings, with over 160 companies representing 17 countries, covering multiple sectors. For more information please contact your WOOD sales representative: WOOD & Company Save Warsaw +48 222 22 1530 the Date! Prague +420 222 096 452 conferences 2017 London +44 20 3530 0611 [email protected] Participating companies in 2016 - by country Participating companies in 2016 - by sector Austria Hungary Romania Turkey Consumer Financials Healthcare TMT Atrium ANY Banca Transilvania Anadolu Efes Aegean Airlines Alior Bank Georgia Healthcare Group Asseco Poland AT&S Budapest Stock Exchange Bucharest Stock Exchange Arcelik AmRest Alpha Bank Krka AT&S CA Immobilien Magyar Telekom Conpet Bizim Toptan Anadolu Efes Athex Group (Hellenic Exchanges) Lokman Hekim CME Conwert MOL Group Electrica Cimsa Arcelik Banca Transilvania Cyfrowy Polsat S.A. Erste Bank OTP Bank Fondul Proprietatea Coca-Cola Icecek Astarta Bank Millennium Industrials Luxoft Immofinanz Wizz Air Hidroelectrica Dogan Holding Atlantic Grupa BGEO Aeroflot Magyar Telekom PORR Nuclearelectrica Dogus Otomotiv Bizim Toptan Bank Zachodni WBK Cimsa O2 Czech Republic RHI Kazakhstan OMV Petrom Ford Otosan CCC Bucharest Stock Exchange Ciech Orange Polska Uniqa Insurance Group Steppe Cement Romgaz Garanti Coca-Cola Icecek Budapest Stock Exchange Dogus Otomotiv OTE Vienna -

Download Pdf (7.2

CONTENTS SUMMARY OF KEY FINANCIAL INDICATORS ............................................................................................. 1 LETTER OF THE PRESIDENT OF THE MANAGEMENT BOARD TO SHAREHOLDERS .............................. 2 CORPORATE PROFILE OF ATLANTIC GRUPA ........................................................................................... 4 ABOUT THE COMPANY ........................................................................................................................... 4 COMPANY HISTORY ................................................................................................................................ 4 ORGANISATIONAL STRUCTURE ............................................................................................................ 8 OWNERSHIP STRUCTURE .....................................................................................................................10 CORPORATE MANAGEMENT OF ATLANTIC GRUPA ................................................................................12 CORPORATE MANAGEMENT .................................................................................................................14 GENERAL ASSEMBLY ............................................................................................................................14 SUPERVISORY BOARD OF ATLANTIC GRUPA .....................................................................................14 SUPERVISORY BOARD COMMITTEES ..................................................................................................17 -

Doprinos Analize Financijskih Izvještaja Poslovnoj Analizi Poduzeća

Doprinos analize financijskih izvještaja poslovnoj analizi poduzeća Pleš, Ivan Master's thesis / Diplomski rad 2019 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: University of Zagreb, Faculty of Economics and Business / Sveučilište u Zagrebu, Ekonomski fakultet Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:148:795581 Rights / Prava: Attribution-NonCommercial-ShareAlike 4.0 International Download date / Datum preuzimanja: 2021-09-27 Repository / Repozitorij: REPEFZG - Digital Repository - Faculty of Economcs & Business Zagreb Sveučilište u Zagrebu Ekonomski fakultet Analiza i poslovno planiranje DOPRINOS ANALIZE FINANCIJSKIH IZVJEŠTAJA POSLOVNOJ ANALIZI PODUZEĆA Diplomski rad Ivan Pleš Zagreb, svibanj, 2019. Sveučilište u Zagrebu Ekonomski fakultet Zagreb Analiza i poslovno planiranje DOPRINOS ANALIZE FINANCIJSKIH IZVJEŠTAJA POSLOVNOJ ANALIZI PODUZEĆA THE CONTRIBUTION OF ANALYSIS OF FINANCIAL REPORTS TO BUSINESS ANALYSIS OF COMPANY Diplomski rad Ivan Pleš Broj indeksa autora: 0067514821 Mentor: Prof.dr.sc. Ivana Mamić Sačer Zagreb, svibanj, 2019. _____________________________ Ime i prezime studenta/ice IZJAVA O AKADEMSKOJ ČESTITOSTI Izjavljujem i svojim potpisom potvrđujem da je ____________________________________ (vrsta rada) isključivo rezultat mog vlastitog rada koji se temelji na mojim istraživanjima i oslanja se na objavljenu literaturu, a što pokazuju korištene bilješke i bibliografija. Izjavljujem da nijedan dio rada nije napisan na nedozvoljen način, odnosno da je prepisan iz necitiranog rada, te da nijedan dio rada ne krši bilo čija autorska prava. Izjavljujem, također, da nijedan dio rada nije iskorišten za bilo koji drugi rad u bilo kojoj drugoj visokoškolskoj, znanstvenoj ili obrazovnoj ustanovi. Student/ica: U Zagrebu,_____________ ______________________ (potpis) SAŽETAK U prvom dijelu rada teorijski je objašnjena poslovna analiza poduzeća, odnosno analiza strategija, analiza industrije te analiza financijskih izvještaja. -

ABC 09 Alphabet of Good Fun

Atlantic Grupa Newsletter No. 13, July 2009 Quarterly issue ABC 09 Alphabet of Good Fun The General Assembly of Atlantic Grupa Held The Consumer Health Care Division in the Kosovian market Tomislav Matusinović appointed Berlin in colours a Member of the Neva in a new of Multipower Management Board modern building NEWS Neva in a new modern Desert for Monta building in Rakitje Ten years ago, the hand manufacture of sandwi- ches with only six em- ployees entered the Atlantic’s family. Prior to that, the former san- dwich “ZagrepËanec” could have been purcha- sed only in several loca- tions in Zagreb and its surroundings, around a hundred sandwiches were produced daily and their expiry period was only two days. Atlantic recognised the potential which this sandwich, due to its general recognisability and high daily consumption, could have in domestic and regional markets. Therefore, in 1999 major investments were ini- tiated that included a systematic development of the pro- Neva’s new building duction plant, necessary equipment for the production and distribution of sandwiches throughout Croatia, em- Production facilities for the manufacture of cosmeti- constructed in line with the latest industrial standar- ployment of professional and motivated personnel, all re- cs and personal care products within Neva will soon ds and, naturally, with a good tradition of manufactu- sulting in a creation of a new product category in Croatia become a neighbour to their sister company Fidifarm ring processes in line with internationally recognised (sandwiches with prolonged freshness and duration, wi- in Rakitje. The newly built plant, which construction standards. -

CROBEX® and Crobextr® CROBEX10® and Crobex10tr

September 8th, 2020 CROBEX® and CROBEXtr® ISIN Trading Issuer Free float Number of Weighting code factor listed shares factor 1 HRADPLRA0006 ADPL AD PLASTIK d.d. 70% 4.199.584 1,00000000 2 HRADRSPA0009 ADRS2 ADRIS GRUPA d.d. 95% 6.784.100 0,36528752 3 HRARNTRA0004 ARNT Arena Hospitality Group dd 50% 5.128.721 1,00000000 4 HRATGRRA0003 ATGR ATLANTIC GRUPA d.d. 45% 3.334.300 0,48953990 5 HRATPLRA0008 ATPL ATLANTSKA PLOVIDBA d.d. 85% 1.395.520 1,00000000 6 HRDDJHRA0007 DDJH ĐURO ĐAKOVIC GRUPA d.d. 50% 10.153.230 1,00000000 7 HRDLKVRA0006 DLKV Dalekovod, d.d. 40% 24.719.305 1,00000000 8 HRERNTRA0000 ERNT ERICSSON NIKOLA TESLA d.d. 55% 1.331.650 0,98709462 9 HRHT00RA0005 HT HT d.d. 45% 80.766.229 0,15037086 10 HRIGH0RA0006 IGH INSTITUT IGH d.d. 50% 613.709 1,00000000 11 HRINGRRA0001 INGR INGRA d.d. 95% 13.545.200 1,00000000 12 HRKOEIRA0009 KOEI KONČAR d.d. 100% 2.572.119 0,59493974 13 HRKRASRA0008 KRAS KRAŠ d.d. 12% 1.498.621 1,00000000 14 HROPTERA0001 OPTE OT-OPTIMA TELEKOM d.d. 40% 69.443.264 1,00000000 15 HRPODRRA0004 PODR PODRAVKA d.d. 85% 7.120.003 0,35950401 16 HRRIVPRA0000 RIVP Valamar Riviera d.d. 55% 126.027.542 0,55422898 17 HRSAPNRA0007 SAPN Saponia d.d. 13% 658.564 1,00000000 18 HRTPNGRA0000 TPNG TANKERSKA NEXT GENERATION 50% 8.733.345 1,00000000 19 HRZABARA0009 ZABA Zagrebačka banka d.d. 4% 320.241.955 1,00000000 CROBEX10® and CROBEX10tr® ISIN Trading Issuer Free float Number of Weighting code factor listed shares factor 1 HRADPLRA0006 ADPL AD PLASTIK d.d. -

PROSPEKT Atlantic Grupa D.D. HRK 115 Milijuna Obveznica Kamatna Stopa 5,750%, Dospijeće 2011

PROSPEKT Atlantic Grupa d.d. HRK 115 milijuna obveznica Kamatna stopa 5,750%, dospijeće 2011. Cijena izdanja 99,979% Obveznice Atlantic Grupe d.d. bit će izdane 6. prosinca 2006. (“Datum izdanja”) u ukupnom iznosu od HRK 115.000.000,00, u nematerijaliziranom obliku, na ime i u denominaciji od HRK 1, kamatne stope 5,750% godišnje, te dospijeća 6. prosinca 2011. Kamata će se obračunavati po fiksnoj godišnjoj stopi od 5,750% od i uključujući Datum izdanja. Kamata će se isplaćivati dva puta godišnje u jednakim iznosima. Obveznice će 6. prosinca 2006. biti uvrštene u Usluge Depozitorija i Usluge Prijeboja i Namire Središnje depozitarne agencije d.d., Heinzelova 62a, Zagreb, (“SDA”). Obveznice nose ISIN oznaku HRATGRO11CA5. Obveznice će 8. prosinca 2006. biti uvrštene u prvu kotaciju (Službeno tržište) Zagrebačke burze d.d., Ksaver 200, Zagreb, (“Zagrebačka burza”), pod oznakom ATGR-O-11CA. Zajednički Agenti i Pokrovitelji izdanja Raiffeisenbank Austria d.d. Zagrebačka banka d.d. Zajednički Agenti izdanja zaduženi za uvrštenje Obveznica u prvu kotaciju (Službeno tržište) Zagrebačke burze Raiffeisenbank Austria d.d. Zagrebačka banka d.d. Datum ovog Prospekta je 6. prosinca 2006. 1 ATLANTIC GRUPA d.d. (“Atlantic” ili “Atlantic Grupa” ili “Grupa” ili “Izdavatelj”) prihvaća odgovornost za sadržaj ovog Prospekta. Prema vlastitom uvjerenju, svim saznanjima i podacima kojima Atlantic raspolaže, podaci iz ovog Prospekta čine cjelovit i istinit prikaz imovine, obveza, gubitaka i dobitaka, financijskog položaja i poslovanja Atlantica, kao i prava i obveza sadržanih u Obveznicama Atlantica. Prema najboljem saznanju Atlantica, nijedna bitna činjenica koja bi mogla utjecati na potpunost i istinitost ovog Prospekta nije izostavljena. -

Naturally DIFFERENT Learn About Our Corporate Values Grand Kafa Winning Team in Basketball at ABCD: Nikola Kero, Rok Žerjal, Vinko Matiê, Darko Burëul, Karlo Greguriê

Atlantic Grupa Newsletter I No 19 I December 2011 I Quarterly issue Naturally DIFFERENT Learn about our corporate values ABCD: Nikola Kero, Rok Žerjal, Vinko MatiÊ, Darko BurËul, Karlo GreguriÊ in basketball at Grand kafa winning team Cockta in Apatovac, Argeta, Multipower in Rogaška Cedevita and Cockta amongst the TOP 10 w w Revenue and operating profitability growth EWS N In the first nine months of 2011, Atlantic Grupa reported sales of HRK 3.45 billion, two times higher compared to the same period last year and 4% higher compared to the proforma consolidated sales in the first nine months of 2010. The operating profit before deprecia- the Sports and Functional Food Divi- guidance” says Emil Tedeschi, Presi- tion and amortisation, without one-off sionwith 18.3% higher sales and the dent and CEO of Atlantic Grupa. impacts, was HRK 394 million, while Pharma Division with the respective After integrating Droga Kolinska the net profit excluding one-off ef- 12.5 % growth. into Atlantic Grupa, the share of re- fects was HRK 32.5 million. The key “We are satisfied with our perform- gional markets in total sales reached sales growth drivers, along with the ance shown by doubled sales figures 79.8%. During the first nine months acquisition of Droga Kolinska, were resulting from the acquisition of Droga the share of Croatian market in total Kolinska and with organic growth of sales was 29%, followed by the mar- sales and operating profits on the pro- kets of Serbia with 24.6%, Slovenia forma consolidated basis compared to 12%, Bosnia & Herzegovina 8.2% the previous year. -

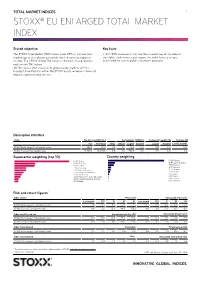

Stoxx® Eu Enlarged Total Market Index

TOTAL MARKET INDICES 1 STOXX® EU ENLARGED TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX EU Enlarged Total Market Index 266.7 121.0 0.6 0.1 10.3 0.0 8.5 0.0 N/A STOXX Europe Total Market Index 12,763.5 10,020.5 9.5 2.6 250.9 0.0 2.5 0.0 3.0 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX EU Enlarged Total Market Index 1.2 -3.4 6.4 0.1 1.7 14.7 -4.9 6.3 0.0 0.3 STOXX Europe Total Market Index 0.4 2.0 18.3 44.5 55.2 4.8 2.9 17.9 12.7 8.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX EU Enlarged Total Market Index 15.1 15.0 16.3 23.2 25.3 -0.1 -0.4 0.4 0.0 -0.0 STOXX Europe Total Market Index 11.0 11.1 11.5 20.0 21.6 -0.9 0.3 1.3 0.6 0.4 Index to benchmark Correlation Tracking error (%) STOXX EU Enlarged Total Market Index 0.7 0.7 0.7 0.8 0.9 10.3 10.7 11.9 12.3 12.7 Index to benchmark Beta Annualized information ratio STOXX EU Enlarged Total Market Index 1.0 0.9 1.0 1.0 1.0 0.8 -0.8 -0.8 -1.0 -0.6 1 For information on data calculation, please refer to STOXX calculation reference guide.