Hungary: Early Illiberalism Adopter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preventing the Spread of Violent Nationalism

ODUMUNC 2019 Issue Brief UN Security Council Addressing the Spread of Violent Nationalism ODU Model United Nations Society Introduction on international cooperation but differentiation, deliberately choosing conflict over consensus. The rising global appeal of nationalism is a The difficulty comes because of the great public challenge to the ability of the United Nations to appeal of nationalism. Emphasizing the solve problems. When Member States choose uniqueness and superiority of each nation, polices based on national superiority instead of nationalism often is the easiest way to unite the global cooperation, the UN loses the consensus largest number of people in a country’s borders. it requires to act effectively. Yet a growing It has enormous appeal to rising leaders in number of leaders find the political rewards of democracies especially, but also can be useful enhancing nationalism hard to resist. With for leaders of authoritarian governments, stronger nationalism comes a not just less ability seeking a way to enhance the legitimacy of their to solve international problems, but greater risk power. In every case, nationalism often is the of conflict and war. For the UN Security easiest way to strengthen a government, to win Council, coping with the rise of nationalism may elections and unify an electoral majority of the be essential to remaining relevant and effective. people. But it is possible? Nationalism has the advantage of unifying most The nationalism problem raises s fundamental or many of the people in a territory, making difficulties for the UN. The United Nations is them willing to sacrifice together on behalf of based on conflicting principles. -

The Political Context of Eu Accession in Hungary

European Programme November 2002 THE POLITICAL CONTEXT OF EU ACCESSION IN HUNGARY Agnes Batory Introduction For the second time since the adoption of the Maastricht Treaty – seen by many as a watershed in the history of European integration – the European Union (EU) is set to expand. Unlike in 1995, when the group joining the Union consisted of wealthy, established liberal democracies, ten of the current applicants are post-communist countries which recently completed, or are still in various stages of completing, democratic transitions and large-scale economic reconstruction. It is envisaged that the candidates furthest ahead will become members in time for their citizens to participate in the next elections to the European Parliament due in June 2004. The challenge the absorption of the central and east European countries represents for the Union has triggered a need for internal institutional reform and new thinking among the policy-makers of the existing member states. However, despite the imminence of the ‘changeover’ to a considerably larger and more heterogeneous Union, the domestic profiles of the accession countries have remained relatively little known from the west European perspective. In particular, the implications of enlargement in terms of the attitudes and preferences of the new (or soon to be) players are still, to a great extent, unclear. How will they view their rights and obligations as EU members? How committed will they be to the implementation of the acquis communautaire? In what way will they fill formal rules with practical content? BRIEFING PAPER 2 THE POLITICAL CONTEXT OF EU ACCESSION IN HUNGARY Naturally, the answers to these questions can only government under the premiership of Miklós Németh be tentative at this stage. -

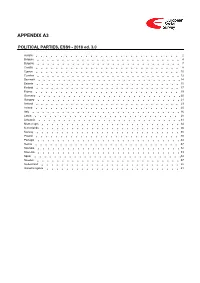

ESS9 Appendix A3 Political Parties Ed

APPENDIX A3 POLITICAL PARTIES, ESS9 - 2018 ed. 3.0 Austria 2 Belgium 4 Bulgaria 7 Croatia 8 Cyprus 10 Czechia 12 Denmark 14 Estonia 15 Finland 17 France 19 Germany 20 Hungary 21 Iceland 23 Ireland 25 Italy 26 Latvia 28 Lithuania 31 Montenegro 34 Netherlands 36 Norway 38 Poland 40 Portugal 44 Serbia 47 Slovakia 52 Slovenia 53 Spain 54 Sweden 57 Switzerland 58 United Kingdom 61 Version Notes, ESS9 Appendix A3 POLITICAL PARTIES ESS9 edition 3.0 (published 10.12.20): Changes from previous edition: Additional countries: Denmark, Iceland. ESS9 edition 2.0 (published 15.06.20): Changes from previous edition: Additional countries: Croatia, Latvia, Lithuania, Montenegro, Portugal, Slovakia, Spain, Sweden. Austria 1. Political parties Language used in data file: German Year of last election: 2017 Official party names, English 1. Sozialdemokratische Partei Österreichs (SPÖ) - Social Democratic Party of Austria - 26.9 % names/translation, and size in last 2. Österreichische Volkspartei (ÖVP) - Austrian People's Party - 31.5 % election: 3. Freiheitliche Partei Österreichs (FPÖ) - Freedom Party of Austria - 26.0 % 4. Liste Peter Pilz (PILZ) - PILZ - 4.4 % 5. Die Grünen – Die Grüne Alternative (Grüne) - The Greens – The Green Alternative - 3.8 % 6. Kommunistische Partei Österreichs (KPÖ) - Communist Party of Austria - 0.8 % 7. NEOS – Das Neue Österreich und Liberales Forum (NEOS) - NEOS – The New Austria and Liberal Forum - 5.3 % 8. G!LT - Verein zur Förderung der Offenen Demokratie (GILT) - My Vote Counts! - 1.0 % Description of political parties listed 1. The Social Democratic Party (Sozialdemokratische Partei Österreichs, or SPÖ) is a social above democratic/center-left political party that was founded in 1888 as the Social Democratic Worker's Party (Sozialdemokratische Arbeiterpartei, or SDAP), when Victor Adler managed to unite the various opposing factions. -

Political Conflict, Social Inequality and Electoral Cleavages in Central-Eastern Europe, 1990-2018

World Inequality Lab – Working Paper N° 2020/25 Political conflict, social inequality and electoral cleavages in Central-Eastern Europe, 1990-2018 Attila Lindner Filip Novokmet Thomas Piketty Tomasz Zawisza November 2020 Political conflict, social inequality and electoral cleavages in Central-Eastern Europe, 1990-20181 Attila Lindner, Filip Novokmet, Thomas Piketty, Tomasz Zawisza Abstract This paper analyses the electoral cleavages in three Central European countries countries—the Czech Republic, Hungary and Poland—since the fall of communism until today. In all three countries, the left has seen a prolonged decline in support. On the other hand, the “populist” parties increased their support and recently attained power in each country. We relate this to specific trajectories of post-communist transition. Former communist parties in Hungary and Poland transformed themselves into social- democratic parties. These parties' pro-market policies prevented them from establishing themselves predominantly among a lower-income electorate. Meanwhile, the liberal right in the Czech Republic and Poland became representative of both high-income and high-educated voters. This has opened up space for populist parties and influenced their character, assuming more ‘nativist’ outlook in Poland and Hungary and more ‘centrist’ in the Czech Republic. 1 We are grateful to Anna Becker for the outstanding research assistance, to Gábor Tóka for his help with obtaining survey data on Hungary and to Lukáš Linek for helping with obtaining the data of the 2017 Czech elections. We would also like to thank Ferenc Szűcs who provided invaluable insights. 1 1. Introduction The legacy of the communist regime and the rapid transition from a central planning economy to a market-based economy had a profound impact on the access to economic opportunities, challenged social identities and shaped party politics in all Central European countries. -

Elections As Opinion Polls

Slovak Studies Program, University of Pittsburgh votruba “at” pitt “dot” edu http://www.pitt.edu/~votruba American Association for the Advancement of Slavic Studies National Convention, Seattle, WA, November 1997 Session 6, Friday, 11/21/1997, 5:45 pm - 7:45 pm Panel 8-02 The Anomalies of Slovak Electoral Politics in Central European Perspective Elections as O pinion Polls : A Comparison of the Voting Patterns in Post-Communist Central Europe and Slovakia Introduction to the roundtable Martin Votruba Only this Monday, several prominent opposition leaders and former activists of the Vel- vet Revolution in Slovakia commemorated the 8th anniversary of its beginning. Ladislav Chudík, a well respected actor and Slovakia’s first post-communist Minister of Culture, told some 15,000 people gathered where the mass demonstrations started in Bratislava that the way Slovakia was living now was the result of how Slovakia voted, and the way it’ll vote next year will determine the way it will live in the future. In the given context, he vas voicing Slovak opposition’s complaints about the ruling party, the Movement for a Democratic Slovakia (HZDS1), often seen as personified in its leader and Prime Minis- ter Vladimír Mečiar. The opposition criticizes the ruling coalition for a number of un- democratic acts and finds itself incapable of passing bills in Parliament and influencing the cabinet’s policies. The West shares the opposition’s concerns about Slovakia’s gov- ernment and turned Slovakia down for early membership in NATO. Ladislav Chudík’s words reflected the view generally held by Slovak opposition poli- ticians and often expressed not only by the Western media, the media in its former fed- eral partner, the Czech Republic, as well as in Slovakia, but also by Slovakia’s opposi- tion intellectuals and scholars. -

Elections and Fears in the European Periphery: Populism and Euroscepticism1

Elections and Fears in the European Periphery: Populism and Euroscepticism1 Daniel Smilov Elections in many EU member states are being decided on the basis of wide-spread fears. Successful parties and candidates are normally those, who best express and probably even fan such fears. As a result, the political mainstream is under significant pressure: more and more voters distrust pro- European, supra-national, progressive type of politics which relies on the coordination among a plurality of equal actors. Instead, there is a tendency to support more clear-cut chains of command and authority, expedience, narrowly defined national interests. This, I argue, is the platform of what could be called ‘populism of fear’ – a specific type of ideology, which becomes more and more successful as a tool for voter mobilization. Recent events – the crisis in the Eurozone, the refugee crisis and the terrorist acts are only going to amplify this tendency. Daniel Smilov is Associate Professor at the Political Science Department, University of Sofia, and Programme Director at the Centre for Liberal Strategies, Sofia. He is also Recurrent Visiting Professor of Comparative Constitutional Law at the Central European University, Budapest. Smilov holds doctorates from the University of Oxford (DPhil, 2003) and the Central European University, Budapest (SJD, 1999). He has published extensively on the topics of populism and constitutionalism in Eastern Europe, and comparative party and campaign finance. Smilov is a regular commentator on Bulgarian political developments in the Bulgarian press and in the international media. ‘The Rise of Populism’ has become an umbrella concept used to explain political developments in a striking variety of contexts.2 The brand ‘populists’ is associated with political actors as diverse as the Tea Party in the US, Berlusconi and his associates in Italy, the UKIP in the UK, Fidesz in Hungary, Smer in Slovakia, PiS in Poland, and the former tzar of Bulgaria Simeon Sax Cobburg Gotha and his body guard/successor Boyko Borissov. -

Main Right Party Responses to Radical Populist and Extremist Party Positioning in Central Europe

Main Right Party Responses to Radical Populist and Extremist Party Positioning in Central Europe. Paper prepared for the ECPR Joint Sessions Workshop, Salamanca Spain April 10-15, 2014 Reinhard Heinisch, Kristina Hauser [email protected], [email protected] University of Salzburg Austria Abstract: Drawing on data from the Chapel Hill Expert Survey and case profiles, the paper traces the interaction between main right parties and (radical) right party competitors, to determine, whether the former adopt dismissive, accommodationist-convergent, accommodationist-cooperative, or, adversarial responses. Assuming that main right parties are forced to respond strategically to right party competitors, we examine in this the role of the dominant cleavage structure (socioeconomic or socio-cultural), the initial position of the main right party, the cost/pressure associated with changing a long-established position, the issue dimension involved (economic vs. exclusivist), and decision of cooperating with parties with more complementary or more compatible positions. Drawing on the literature, we argue that regime legacies and the role of the EU accession process on party realignment have structured party competition such that contestation occurs primarily over socioeconomic or socio-cultural issues. In the latter case, we expect main right parties to move to the right either to converge on positions of a far-right competitor or to prevent challenges from the right. If contestation is centered on the economic issue dimension, we assume main right parties be more constrained in their ability to accommodate right party competitors and rather engage in cooperation to form a right or center-right bloc to compete with a center-left bloc. -

The EPP's Orbán Compromise Is Not a Solution—But It Can Be a First Step

Transatlantic Take Photo: J.S. Photographer The EPP’s Orbán Compromise Is Not a Solution—but it Can Be a First Step By Daniel Hegedüs The growing conflict within the European People’s Party (EPP) over what to do with Viktor Orbán’s Fidesz party, which governs Hungary and has become the conservative party group’s enfant terrible, has been temporarily solved by a surprising compromise. Threatened with expulsion or suspension, as proposed by 13 EPP member parties, Orbán submitted himself to the latter under the condition that it was framed as a voluntary move by Fidesz. This suits both sides. It helps Hungary’s prime minister save face at home and in Europe. It also brings to the EPP political relief in its European Parliament elections campaign, which was suffering from association with Orbán’s actions. However, this development is not the win for him that he would like to spin. For the first time, he has been stood up to and he had to back down from his threat to leave the EPP if sanctioned. At the same time, it shows to the European party groups, the EU, and member-states that autocratizing governments respond to pressure, not to coddling. After tolerating the EU’s first competitive authoritarian regime for nine years, the EPP finally took the first step against it. The suspension is only a compromise; nevertheless, future scrutiny and treatment of Fidesz will provide the EPP with an opportunity to demonstrate its commitment to defending European democratic values. Direct Implications with the conditions set by the EPP leadership, which The suspension deprives Fidesz of its voting rights include the Hungarian government obeying of rule in the EPP organs and of its right to propose of law and keeping Central European University in candidates for party positions, as well as stopping Budapest. -

Nations in Transit 2018 Contents

Confronting Illiberalism NATIONS IN TRANSIT 2018 CONTENTS Nations in Transit 2018: Confronting Illiberalism 1 The Challenge at the Core of Europe 5 Smearing the Messenger 8 The Twilight of Putinism 10 Nations in Transit 2018 Map 12 Informal Power: The Men behind the Curtains 14 Macedonia: Freeing the Captured State 15 Uzbekistan: The First, Meager, Shoots of Spring 17 Overview of Score Changes 19 Nations in Transit 2018 Scores 20 Methodology 22 Category and Democracy Scores 23 Democracy Score History by Region 24 RESEArch AND EDITORIAL TEAM ON THE COVER Nate Schenkkan is project director of Nations in Transit. Senior re- Serbians protest against Prime Minister Aleksandar Vučić’s searcher Zselyke Csaky and research associate Nathan Stormont presidential win in Belgrade in April 2017. contributed to this booklet. MILOS MISKOV/Anadolu Agency/Getty Images 2 Nations in Transit 2018 Confronting Illiberalism by Nate Schenkkan Contempt for independent institutions and open discussion has become entrenched from Central Europe to Eurasia. Time is running out for the EU and the United States to confront the antidemocratic backlash. In 2017, illiberalism established itself as the new nor- “Illiberalism” is not a derogatory code word for “pol- mal in the region that stretches from Central Europe icies we disagree with.” It is an ideological stance through Eurasia. In Central Europe, governments that rejects the necessity of independent institu- that disdain independent institutions and seek to tions as checks on the government and dismisses fuse the ruling party with the state are no longer the idea of legitimate disagreement in the public exceptional. The bulldozing of the judiciary in Poland sphere. -

MARPOR Full Dataset 2013B: 2011-2013 Updates and Changes

MARPOR Full Dataset 2013b: 2011-2013 Updates and Changes MARPOR Full Dataset 2013b: December 2013 Version whole election Australia 2010; Germany 2013; Greece 2004; Italy 2013; Lithuania 2012; Norway 2005; South Korea 2012; Switzerland 2007. whole election Mexico 2003. – replacing estimates new data new single parties Hungary 2002 SZDSZ Alliance of Free Democrats (86422). general party spelling and correct wording of all labels checked and revised if appropriate. changes partyname spelling and correct wording of all English party names checked and revised if appropriate. parfam made constant over time for all parties. Parfam was coded inconsistently in a few cases mostly due to change from CMP to MARPOR and did not reflect real changes in party family affiliation. changes coderyear set to 998 if the data is an estimate (progtype = 3) or if we are missing the data completely (progtype = 99). manual set to 998 if the data is an estimate (progtype = 3) or if we are missing the data completely (progtype = 99). testresult set to 998 if the data is an estimate (progtype = 3) or if we are missing the data completely (progtype = 99). on the coder manual corrected for a few cases. level on the UK 1992 totseats corrected. election level Croatia 2000 totseats, pervote and absseat corrected/recalculated and voteest changed to 1 where appropriate. corrections on the party Austrian Freedom Party parfam changed to national. level for all 42420 (Austria) elections VMRO-DPMNE 89710 parfam changed to Christian democratic. (Macedonia) on the party Christian Social People’s per1013 changed to zero, quasi-sentences in this category recoded to per101. -

Codebook: Government Composition, 1960-2019

Codebook: Government Composition, 1960-2019 Codebook: SUPPLEMENT TO THE COMPARATIVE POLITICAL DATA SET – GOVERNMENT COMPOSITION 1960-2019 Klaus Armingeon, Sarah Engler and Lucas Leemann The Supplement to the Comparative Political Data Set provides detailed information on party composition, reshuffles, duration, reason for termination and on the type of government for 36 democratic OECD and/or EU-member countries. The data begins in 1959 for the 23 countries formerly included in the CPDS I, respectively, in 1966 for Malta, in 1976 for Cyprus, in 1990 for Bulgaria, Czech Republic, Hungary, Romania and Slovakia, in 1991 for Poland, in 1992 for Estonia and Lithuania, in 1993 for Latvia and Slovenia and in 2000 for Croatia. In order to obtain information on both the change of ideological composition and the following gap between the new an old cabinet, the supplement contains alternative data for the year 1959. The government variables in the main Comparative Political Data Set are based upon the data presented in this supplement. When using data from this data set, please quote both the data set and, where appropriate, the original source. Please quote this data set as: Klaus Armingeon, Sarah Engler and Lucas Leemann. 2021. Supplement to the Comparative Political Data Set – Government Composition 1960-2019. Zurich: Institute of Political Science, University of Zurich. These (former) assistants have made major contributions to the dataset, without which CPDS would not exist. In chronological and descending order: Angela Odermatt, Virginia Wenger, Fiona Wiedemeier, Christian Isler, Laura Knöpfel, Sarah Engler, David Weisstanner, Panajotis Potolidis, Marlène Gerber, Philipp Leimgruber, Michelle Beyeler, and Sarah Menegal. -

North Macedonia Political Briefing: Macedonian Debates on the New European Commission Anastas Vangeli

ISSN: 2560-1601 Vol. 22, No. 1 (MK) Oct 2019 North Macedonia political briefing: Macedonian Debates on the New European Commission Anastas Vangeli 1052 Budapest Petőfi Sándor utca 11. +36 1 5858 690 Kiadó: Kína-KKE Intézet Nonprofit Kft. [email protected] Szerkesztésért felelős személy: Chen Xin Kiadásért felelős személy: Huang Ping china-cee.eu 2017/01 Macedonian Debates on the New European Commission Introduction As an aspiring candidate for membership in the European Union (EU), the Republic of North Macedonia (hereinafter Macedonia) paid close attention to the formation of the new European Commission (EC) for the period 2019-2024. A significant part of the debates on the new Commission were shaped by the discourse in the mainstream European media – focusing on the negotiations and bargaining between the top leaders on who gets which position, while also discussing the key challenges for the forthcoming commission – the projected exit of the United Kingdom from the EU being the most burning one. At the same time, Macedonian media paid significant attention to the issue of EU enlargement, and in particular, the attitude of the new Commission towards the EU membership candidacy of Macedonia, as well as the appointment of a new Commissioner in charge for enlargement negotiations. Once it turned out that the Directorate General (DG) dealing with enlargement would be assigned to a Hungarian official from the ranks of Fidesz, the discussions on the new Commission and its enlargement agenda became more politicized – as the future of the relations between Macedonia and Hungary remain a big unknown in the aftermath of the escape of the former Prime Minister Nikola Gruevski to Budapest, where he has been granted political asylum.