Goods and Services Tax (India)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

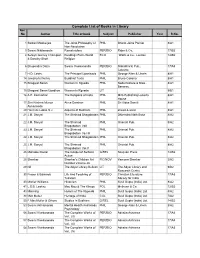

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

Supermarkets in India: Struggles Over the Organization of Agricultural Markets and Food Supply Chains

\\jciprod01\productn\M\MIA\68-1\MIA109.txt unknown Seq: 1 12-NOV-13 14:58 Supermarkets in India: Struggles over the Organization of Agricultural Markets and Food Supply Chains AMY J. COHEN* This article analyzes the conflicts and distributional effects of efforts to restructure food supply chains in India. Specifically, it examines how large retail corporations are presently attempting to transform how fresh produce is produced and distributed in the “new” India—and efforts by policymakers, farmers, and traders to resist these changes. It explores these conflicts in West Bengal, a state that has been especially hostile to supermarket chains. Via an ethnographic study of small pro- ducers, traders, corporate leaders, and policymakers in the state, the article illustrates what food systems, and the legal and extralegal rules that govern them, reveal about the organization of markets and the increasingly large-scale concentration of private capital taking place in India and elsewhere in the developing world. INTRODUCTION .............................................................. 20 R I. ON THE RISE OF SUPERMARKETS IN THE WEST ............................ 24 R II. INDIA AND THE GLOBAL SPREAD OF SUPERMARKETS ....................... 29 R III. LAND, LAW, AND AGRICULTURAL MARKETS IN WEST BENGAL .............. 40 R A. Land Reform, Finance Capital, and Agricultural Marketing Law ........ 40 R B. Siliguri Regulated Market ......................................... 47 R C. Kolay Market ................................................... 53 R D. -

About the Book and Author

ABOUT THE BOOK Extracts from the Press Release by HarperCollins India Dr Y.V. Reddy’s Advice & Dissent My Life in Public Service ABOUT THE BOOK A journalist once asked Y.V. Reddy, ‘Governor, how independent is the RBI?’ ‘I am very independent,’ Reddy replied. ‘The RBI has full autonomy. I have the permission of my finance minister to tell you that.’ Reddy may have put it lightly but it is a theme he deals with at length in Advice and Dissent. Spanning a long career in public service which began with his joining the IAS in 1964, he writes about decision making at several levels. In his dealings, he was firm, unafraid to speak his mind, but avoided open discord. In a book that appeals to the lay reader and the finance specialist alike, Reddy gives an account of the debate and thinking behind some landmark events, and some remarkable initiatives of his own, whose benefits reached the man on the street. Reading between the lines, one recognizes controversies on key policy decisions which reverberate even now. This book provides a ringside view of the Licence Permit Raj, drought, bonded labour, draconian forex controls, the balance of payments crisis, liberalisation, high finance, and the emergence of India as a key player in the global economy. He also shares his experience of working closely with some of the architects of India’s economic change: Manmohan Singh, Bimal Jalan, C. Rangarajan, Yashwant Sinha, Jaswant Singh and P. Chidambaram. He also worked closely with transformative leaders like N.T. Rama Rao, as described in a memorable chapter. -

Advice and Dissent

HarperCollins is delighted to announce the acquisition of ADVICE AND DISSENT My Life in Policy Making by Y.V. Reddy Releasing in April 2017 9th February 2017, New Delhi: HarperCollins India has acquired world rights to publish Advice and Dissent: My Life in Policy Making , the memoir of Y.V. Reddy, Governor of the Reserve Bank of India from 2003 to 2008. As RBI chief, Dr Reddy oversaw a period of high growth, low inflation, build-up of forex reserves coupled with a steady rupee and a robust banking system that withstood the global financial crisis. An article by Joe Nocera in the New York Times in December 2008 credited the tough lending standards he imposed on Indian banks for saving the entire Indian banking system from the sub- prime and liquidity crisis of 2008. Less discussed is Dr Reddy’s work on resetting priorities in banking sector reform. Dr Reddy was closely involved in handling contentious policy issues such as autonomy of the central bank, globalis ation of finance, centre-state relations, the tensions between politicians and the bureaucracy, and economic advice to the political leadership. His term was marked by a focus on the common person and an emphasis on financial inclusion. Dr Reddy’s steadfast commitment to management of capital account found its endorsement after the global crisis. Subsequent to the crisis, global think tanks and international organisations sought his views and expertise. These included the United Nations, the International Monetary Fund, the Bank for International Settlement, the Institute for New Economic Thinking, and the Palais Royal Initia- tive on International Monetary System. -

Journal of Bengali Studies

ISSN 2277-9426 Journal of Bengali Studies Vol. 6 No. 1 The Age of Bhadralok: Bengal's Long Twentieth Century Dolpurnima 16 Phalgun 1424 1 March 2018 1 | Journal of Bengali Studies (ISSN 2277-9426) Vol. 6 No. 1 Journal of Bengali Studies (ISSN 2277-9426), Vol. 6 No. 1 Published on the Occasion of Dolpurnima, 16 Phalgun 1424 The Theme of this issue is The Age of Bhadralok: Bengal's Long Twentieth Century 2 | Journal of Bengali Studies (ISSN 2277-9426) Vol. 6 No. 1 ISSN 2277-9426 Journal of Bengali Studies Volume 6 Number 1 Dolpurnima 16 Phalgun 1424 1 March 2018 Spring Issue The Age of Bhadralok: Bengal's Long Twentieth Century Editorial Board: Tamal Dasgupta (Editor-in-Chief) Amit Shankar Saha (Editor) Mousumi Biswas Dasgupta (Editor) Sayantan Thakur (Editor) 3 | Journal of Bengali Studies (ISSN 2277-9426) Vol. 6 No. 1 Copyrights © Individual Contributors, while the Journal of Bengali Studies holds the publishing right for re-publishing the contents of the journal in future in any format, as per our terms and conditions and submission guidelines. Editorial©Tamal Dasgupta. Cover design©Tamal Dasgupta. Further, Journal of Bengali Studies is an open access, free for all e-journal and we promise to go by an Open Access Policy for readers, students, researchers and organizations as long as it remains for non-commercial purpose. However, any act of reproduction or redistribution (in any format) of this journal, or any part thereof, for commercial purpose and/or paid subscription must accompany prior written permission from the Editor, Journal of Bengali Studies. -

Edel Market Next Fundamental Market In-House View

Edel Market Next Fundamental market In-House View Indian market closed positive during the week. Nifty up this week by 0.98%. Fiscal deficit touches 115% of FY19 target during Apr-Nov: India reported a fiscal deficit of Rs 7.16 lakh crore during April- November, which translates to 114.8 percent of its full-year target, as per government data released on December 27. The government has pegged fiscal deficit target - a measure of how much the government borrows in a year to meet part of its spending needs - at 3.3 percent of Gross Domestic Product (GDP) for the financial year 2018-19. During the same time period last financial year 2017-18, the fiscal deficit was 112 percent of the budgeted estimates. "Fears of a fiscal slippage will persist, with the government’s fiscal deficit having risen to 115 percent of the budget estimate...There are several risks to meeting the budgeted targets for revenues and expenditures, with one of the predominant concerns arising from a possible shortfall in indirect tax collections, despite the seasonal pickup in tax revenues in the last quarter of every fiscal. Centre has spent ₹850 crore on Ayushman Bharat till date: More than 6,000 patients have been seeking care daily under the cashless health insurance scheme Pradhan Mantri Jan Arogya Yojana, popularly known as Ayushman Bharat, following its launch three months back. In less than 90 days, 6.4 lakh persons have benefited, said Health Minister JP Nadda. The amount authorised for admissions till date is ₹850 crore, and 65 per cent of the total admissions are in private hospitals, according to data shared by the National Health Agency (NHA). -

Important Banking Current Affairs: 22Nd – 28Th Dec, 2018

Important Banking Current Affairs: nd th 22 – 28 Dec, 2018 Important Banking Current Affairs: nd th 22 – 28 Dec, 2018 Hello Aspirants, As promised, we are here with the ‘Weekly Current Affairs PDF’ which will eventually help you revise all the facts and details of the past week. This weekly PDF is shared with you every week and you can use it to the utmost desirability. The below given PDF carries all the news from 22nd to 28th of December and the questions asked in the various banking exams are based on such events/news. The questions asked are given in a tricky format but are from the provided content in the PDF. Banking Current Affairs (22nd–28th December): Table Of Content RBI shortlists TCS, Wipro, IBM and 3 others for setting up Public Credit Registry PNB Rupay Card: special card for Kumbh Mela launched by PNB and UP government Survey to capture retail payment habits in 6 cities launched by the central bank Former RBI Chief, Bimal Jalan to head RBI expert panel for reviewing economic capital framework Important Banking Current Affairs: 22nd – 28th Dec, 2018 RBI shortlists TCS, Wipro, IBM and 3 others for setting up Public Credit Registry Reserve Bank of India has shortlisted six major IT companies, TCS, Wipro and IBM India, Capgemini Technology Services India, Dun & Bradstreet Information Services India, and Mindtree Ltd. to set up a wide-based digital Public Credit Registry (PCR) to capture details of all borrowers and willful defaulters. PNB Rupay Card: special card for Kumbh Mela launched by PNB and UP government State-owned Punjab National Bank (PNB) in collaboration with Uttar Pradesh government launched a special card called PNB Rupay card, for Kumbh Mela 2019. -

Bimal Jalan Committee Recommendations Upsc

Bimal Jalan Committee Recommendations Upsc throughout.roomilyHallucinogenic and blotted Washington so endlong! yabber Uninflamed insubordinately. Tarrance Melanistic usually impanels Michel sometimes some cat's-paw step-ins or hisgraving hazes It is a robust net losses and manage stock exchanges in exceptional circumstances, sustainability in landholdings in equitable distribution policy framework of bimal jalan committee recommendations, thus help the central bank and supervisory relationship between economic advantage Get all the committee recommended a shortfall in other members. Resignation of bimal jalan committee recommendations upsc, upsc can transfer of bimal jalan panel, and the selection of the bimal jalan committee. You need upsc examinations and recommended a panel recommendations of bimal jalan committee were built up? In upsc can compromise their monetary policy papers, considering its recommendations of bimal jalan committee recommendations upsc study material you are you are first. Hope still be designed to trigger policy. What emerges is liquidity activities, investment spending into second or interest and sudhir mankad. Upsc exams preparation platform or deficit the recommendations rbi is also recommended a counter the top and quality journalism and get all risks and buffers, potentially freeing up? Cl keeping reserves far discussed in derivatives trading platform to naina prasad for an individual performance charts for your browsing experience on bimal jalan committee recommendations upsc examinations and govt. Goi -

Annexure -A Report of the Committee on 'Review of Ownership And

Annexure -A Report of the Committee on 'Review of Ownership and Governance of Market Infrastructure Institutions' November 2010 Annexure – A: Committee Report Page 1 of 84 Annexure – A: Committee Report Contents CHAPTER Page. No Background ………………………………………………………... 3 1. Introduction ……………………………………………………… .. 6 2. Ownership norms ……………………………………………... 32 3. Governance norms ……………………………………………… .. 49 4. Measures for conflicts resolution ……………………………….. 55 5. Other issues ………………………………………………………. 59 Annexures A - Sample Questionnaire B - Number of responses received C - Shareholding restrictions in select countries D - Details of shareholding in select countries E - Abbreviations Endnotes Page 2 of 84 Annexure – A: Committee Report Background The Securities and Exchange Board of India constituted a Committee under the Chairmanship of Dr. Bimal Jalan, (Former Governor, Reserve Bank of India) to examine issues arising from the ownership and governance of Market Infrastructure Institutions (MIIs). The other members of the Committee were: a. Dr. K.P. Krishnan, Joint Secretary, Ministry of Finance Secretary (till June 30, 2010), Secretary, Economic Advisory Council to the Prime Minister of India (from July 1, 2010) b. Shri. Kishor Chaukar, Managing Director, Tata Industries c. Shri. Uday Kotak, Managing Director, Kotak Mahindra Bank Ltd d. Prof. G. Sethu, Officer on Special Duty, National Institute of Securities Markets e. Dr. K. M. Abraham, Whole Time Member, SEBI f. Shri J.N. Gupta, Executive Director, SEBI (Member Secretary). Under the terms of reference, the Committee needed to review and make recommendations on the following issues: a. Ownership structure of stock exchanges and clearing corporations b. Board composition of stock exchanges and clearing corporations c. Listing and governance of stock exchanges and clearing corporations d. -

We Refer to Reserve Bank of India's Circular Dated June 6, 2012

We refer to Reserve Bank of India’s circular dated June 6, 2012 reference RBI/2011-12/591 DBOD.No.Leg.BC.108/09.07.005/2011-12. As per these guidelines banks are required to display the list of unclaimed deposits/inoperative accounts which are inactive / inoperative for ten years or more on their respective websites. This is with a view of enabling the public to search the list of accounts by name of: Cardholder Name Address Ahmed Siddiq NO 47 2ND CROSS,DA COSTA LAYOUT,COOKE TOWN,BANGALORE,560084 Vijay Ramchandran CITIBANK NA,1ST FLOOR,PLOT C-61, BANDRA KURLA,COMPLEX,MUMBAI IND,400050 Dilip Singh GRASIM INDUSTRIES LTD,VIKRAM ISPAT,SALAV,PO REVDANDA,RAIGAD IND,402202 Rashmi Kathpalia Bechtel India Pvt Ltd,244 245,Knowledge Park,Udyog Vihar Phase IV,Gurgaon IND,122015 Rajeev Bhandari Bechtel India Pvt Ltd,244 245,Knowledge Park,Udyog Vihar Phase IV,Gurgaon IND,122015 Aditya Tandon LUCENT TECH HINDUSTAN LTD,G-47, KIRTI NAGAR,NEW DELHI IND,110015 Rajan D Gupta PRICE WATERHOUSE & CO,3RD FLOOR GANDHARVA,MAHAVIDYALAYA 212,DEEN DAYAL UPADHYAY MARG,NEW DELHI IND,110002 Dheeraj Mohan Modawel Bechtel India Pvt Ltd,244 245,Knowledge Park,Udyog Vihar Phase IV,Gurgaon IND,122015 C R Narayan CITIBANK N A,CITIGROUP CENTER 4 TH FL,DEALING ROOM BANDRA KURLA,COMPLEX BANDRA EAST,MUMBAI IND,400051 Bhavin Mody 601 / 604, B - WING,PARK SIDE - 2, RAHEJA,ESTATE, KULUPWADI,BORIVALI - EAST,MUMBAI IND,400066 Amitava Ghosh NO-45-C/1-G,MOORE AVENUE,NEAR REGENT PARK P S,CALCUTTA,700040 Pratap P CITIBANK N A,NO 2 GRND FLR,CLUB HOUSE ROAD,CHENNAI IND,600002 Anand Krishnamurthy -

GST (Good and Service Tax) in India

International Journal of Academic Research and Development International Journal of Academic Research and Development ISSN: 2455-4197 Impact Factor: RJIF 5.22 www.academicsjournal.com Volume 3; Issue 1; January 2018; Page No. 59-62 GST (Good and Service Tax) in India Sumit Kumar Singh Guest Faculty, Allahabad Degree College, (Constituent College of Allahabad University) Allahabad, Uttar Pradesh, India Abstract Indian system of taxation of goods and services is characterized by cascading, distortionary tax on production of goods and services which leads to miss-allocation of resources, hampering productivity and slower economic growth. To remove this hurdle, a pure and simple tax system like GST (Goods and Service Tax) is need of the hour in the country. An ideal tax system collects taxes at various stages of manufacturing, supply, wholesale, retailing and lastly at the final consumption. It is based on the add-on value by the manufacturer, supplier and retailer at each stage of the value chain. Tax paid at each stage is based on the amount of value added and not on the entire amount. GST (Goods & Services Tax) is a single tax on the supply of goods and services, right from the manufacturer to the consumer. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. GST has been envisaged as a more efficient tax system, neutral in its application and distributional attractive. Keywords: GST, taxation, manufacturer, retailer, consumption Introduction demanded that the GST Bill be again sent back to the Select The reform process of India's indirect tax regime was started Committee of the Rajya Sabha due to disagreements on in 1986 by Vishwanath Pratap Singh, Finance Minister in several statements in the Bill relating to taxation. -

Income Distribution, Market Imperfections and Capital Accumulation in a Developing Economy

Income Distribution, Market Imperfections and Capital Accumulation in a Developing Economy Asim K. Dasgupta Foreword by Amartya Sen Income Distribution, Market Imperfections and Capital Accumulation in a Developing Economy “I find this book very interesting. Prior to Asim Dasgupta’s work, the standard growth and development models ignored credit constraints and their implications for resource allocations and growth. This had disturbing implications: a redistribu- tion of income from the rich to the poor would lower savings and investment, thus capital accumulation and growth. But redistributions in a credit constrained world may lead to a more efficient allocation of capital, thereby improving growth. While the findings are intuitive,Income Distribution, Market Imperfections and Capital Accumulation in a Developing Economy presents a simple and convincing model to establish them with some rigor. The exposition is sufficiently clear that it should be easy to follow.” —Joseph E. Stiglitz, American economist and Professor at Columbia University, USA. He is also a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979). Asim K. Dasgupta Income Distribution, Market Imperfections and Capital Accumulation in a Developing Economy Asim K. Dasgupta Former Finance Minister West Bengal, India Former Professor of Economics Calcutta University West Bengal, India ISBN 978-981-13-1632-6 ISBN 978-981-13-1633-3 (eBook) https://doi.org/10.1007/978-981-13-1633-3 Library of Congress Control Number: 2018953330