The Government and the RBI Srinivasa Raghavan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

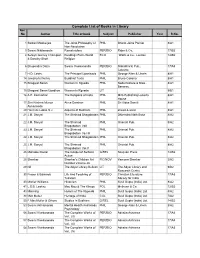

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

Rakesh Mohan: State of the Indian Economy

Rakesh Mohan: State of the Indian economy Inaugural address by Dr Rakesh Mohan, Deputy Governor of the Reserve Bank of India, at the 2nd Annual Indian Securities Infrastructure & Operations Forum 2006, Mumbai, 7 November 2006. * * * It is my great pleasure to be here at the 2nd Annual Indian Securities Infrastructure & Operations Forum 2006. The recent growth momentum of the Indian economy is leading to renewed interest in India’s growth prospects. As the mid-year review of the annual policy is just over I thought instead of giving just a run-down of the current state of the Indian economy let me put the current trends into a broader perspective - both with respect to the longer term trend and as well as the global scenario. Thus, I will proceed as follows: • In order to draw appropriate perspectives for the future of the Indian economy, I will first present an overview of India’s economic progress over the past three decades. • Given the growing integration of the Indian economy with the rest of the world, I will then discuss the prospects of the global economy. • This will be followed by an assessment of the current economic situation in India. • Finally, I will discuss some of the issues necessary to accelerate the current growth momentum. I. Overview of longer-term trends Growth, savings and investment Following the initiation of structural reforms in the early 1990s, the Indian economy has grown at an annual average rate of over 6 per cent per annum. While the 1980s had also witnessed high growth (5.8 per cent per annum), this growth was associated with widening macroeconomic imbalances – growing fiscal deficits, growing current account deficits, falling international reserves and higher inflation – culminating in the balance of payments crisis of 1990-91. -

Daily Updated Current Affairs–08.03.2019 to 10.03.2019

DAILY UPDATED CURRENT AFFAIRS–08.03.2019 TO 10.03.2019 NATIONAL The Supreme Court's Constitution Bench has referred the Ram Janmabhoomi-Babri Masjid dispute case for court-appointed and monitored mediation for a "permanent solution". Supreme Court has appointed a 3 member panel of mediators. Former apex court judge Justice (retd) F M Kallifulla will head the panel of mediators in the case. Other members of the panel of mediators include spiritual guru Shri Shri Ravi Shankar and senior advocate Sriram Panchu. The Court directs that the panel of mediators will file a progress report of the mediation proceedings within four weeks and the process should be completed within eight weeks. President Ram Nath Kovind launched the Pulse Polio programme for 2019 By administering polio drops to children on the eve of the National Immunization Day (10th March) at the Rashtrapati Bhawan. More than 17 crore children of less than five years across the country will be given polio drops as part of the drive to sustain polio eradication from the country. The Mizoram Cabinet approved the proposed Mizoram Liquor Prohibition Bill,2019. Liquor was prohibited in the state from 1997 till January 2015 with the Mizoram Liquor Total Prohibition Act in force. The previous Congress government had allowed opening of wine shops in the state from March 2015. Railways Minister Piyush Goyal announced that all mountain railways in India will now have glass- enclosed coaches. Vista dome coaches have large windows on the sides and glass panels on the roof to provide better viewing experience. Oil Minister Dharmendra Pradhan announced that 7 crore LPG connections have been distributed within the last 34 months under the Pradhan Mantri Ujjwala Yojana (PMUY). -

Annual Report 2015-2016 Research Themes

Annual Report 2015-2016 Research Themes The research themes of the initiative are explored through public lectures, seminars, conferences, films, research projects, and outreach.� The Initiative currently conducts research on the following themes: 1 Indian Urbanization: Governance, Politics and Political Economy 2 Economic Inequalities and Change 3 Pluralism and Diversities 4 Democracy Above: Engaged audience at Student Fellowship Presentation Front Cover: Chhatrapati Shivaji Terminus at Sunset. Mumbai, India. Image: Paul Prescot 1 OP Jindal Distinguished Lecture Series To promote a serious discussion of politics, economics, social and cultural change in modern India, Sajjan and Sangita Jindal have endowed, in perpetuity, the OP Jindal Distinguished Lectures by major scholars and public figures.� Fall 2015 MONTEK SINGH AHLUWALIA and also in books. He co-authored Re-distribution In October 2015, Montek Singh Ahluwalia with Growth: An Approach to Policy (1975). He delivered the OP Jindal Distinguished Lectures. also wrote, “Reforming the Global Financial Ahluwalia has served as a high-level government Architecture”, which was published in 2004 as official in India, as well as with the IMF and the Economic paper No.41 by the Commonwealth World Bank. He has been a key figure in India’s Secretariat, London. Ahluwalia is an honorary economic reforms since the mid-1980s. Most fellow of Magdalen College, Oxford and a member recently, Ahluwalia was Deputy Chairman of the of the Governing Council of the Global Green Planning Commission from July 2004 till May Growth Institute, a new international organization 2014. In addition to this Cabinet level position, based in South Korea. He is a member of the Ahluwalia was a Special Invitee to the Cabinet Alpbach-Laxenburg Group established by the and several Cabinet Committees. -

Raghuram Rajan

EXECUTIVE BRIEFINGS POLITICS AND ECONOMY: RAGHURAM RAJAN Adit Jain, IMA India June 2016 A fine innings India’s economy is precariously perched. Its current account deficit has crossed 5% of GDP. Fiscal imprudence over successive years has led to high deficits, which in turn have created sticky retail inflation in the 10-12% range. Foreign exchange reserves are down to USD 280 billion and both industrial output and investment have shrunk. Adding to the misery has been a rude shock dealt by the United States Federal Reserve through an announcement that it proposes to taper its bond buying programme. The ensuing taper tantrum is leading investors to dump emerging market assets fearing the end of cheap money. Consequently, the Rupee has come under a bear hammering shedding around a quarter of its value. Liquidity is tight and analysts are worried about external solvency and a balance of payments crisis. Adding to all of this is a threat, most serious, of a sovereign downgrade by rating agencies. All this happened in the autumn of 2013 when an academic from the University of Chicago was brought in to assume charge as Governor of India’s Reserve Bank. In a few months from now, Raghuram Rajan will complete his three-year term in office. The disquiet within the markets is whether he will get a second term. As this note will argue, he richly deserves it. It is within the bounds of tradition that central bank Governors in India are given extensions and usually serve for two terms. Very few have not done so. -

About the Book and Author

ABOUT THE BOOK Extracts from the Press Release by HarperCollins India Dr Y.V. Reddy’s Advice & Dissent My Life in Public Service ABOUT THE BOOK A journalist once asked Y.V. Reddy, ‘Governor, how independent is the RBI?’ ‘I am very independent,’ Reddy replied. ‘The RBI has full autonomy. I have the permission of my finance minister to tell you that.’ Reddy may have put it lightly but it is a theme he deals with at length in Advice and Dissent. Spanning a long career in public service which began with his joining the IAS in 1964, he writes about decision making at several levels. In his dealings, he was firm, unafraid to speak his mind, but avoided open discord. In a book that appeals to the lay reader and the finance specialist alike, Reddy gives an account of the debate and thinking behind some landmark events, and some remarkable initiatives of his own, whose benefits reached the man on the street. Reading between the lines, one recognizes controversies on key policy decisions which reverberate even now. This book provides a ringside view of the Licence Permit Raj, drought, bonded labour, draconian forex controls, the balance of payments crisis, liberalisation, high finance, and the emergence of India as a key player in the global economy. He also shares his experience of working closely with some of the architects of India’s economic change: Manmohan Singh, Bimal Jalan, C. Rangarajan, Yashwant Sinha, Jaswant Singh and P. Chidambaram. He also worked closely with transformative leaders like N.T. Rama Rao, as described in a memorable chapter. -

Annual Report 2014–15 © 2015 National Council of Applied Economic Research

National Council of Applied Economic Research Annual Report Annual Report 2014–15 2014–15 National Council of Applied Economic Research Annual Report 2014–15 © 2015 National Council of Applied Economic Research August 2015 Published by Dr Anil K. Sharma Secretary & Head Operations and Senior Fellow National Council of Applied Economic Research Parisila Bhawan, 11 Indraprastha Estate New Delhi 110 002 Telephone: +91-11-2337-9861 to 3 Fax: +91-11-2337-0164 Email: [email protected] www.ncaer.org Compiled by Jagbir Singh Punia Coordinator, Publications Unit ii | NCAER Annual Report 2014-15 NCAER | Quality . Relevance . Impact The National Council of Applied Economic Research, or NCAER as it is more commonly known, is India’s oldest and largest independent, non-profit, economic policy research institute. It is also one of a handful of think tanks globally that combine rigorous analysis and policy outreach with deep data collection capabilities, especially for household surveys. NCAER’s work falls into four thematic NCAER’s roots lie in Prime Minister areas: Nehru’s early vision of a newly- independent India needing independent • Growth, macroeconomics, trade, institutions as sounding boards for international finance, and economic the government and the private sector. policy; Remarkably for its time, NCAER was • The investment climate, industry, started in 1956 as a public-private domestic finance, infrastructure, labour, partnership, both catering to and funded and urban; by government and industry. NCAER’s • Agriculture, natural resource first Governing Body included the entire management, and the environment; and Cabinet of economics ministers and • Poverty, human development, equity, the leading lights of the private sector, gender, and consumer behaviour. -

Advice and Dissent

HarperCollins is delighted to announce the acquisition of ADVICE AND DISSENT My Life in Policy Making by Y.V. Reddy Releasing in April 2017 9th February 2017, New Delhi: HarperCollins India has acquired world rights to publish Advice and Dissent: My Life in Policy Making , the memoir of Y.V. Reddy, Governor of the Reserve Bank of India from 2003 to 2008. As RBI chief, Dr Reddy oversaw a period of high growth, low inflation, build-up of forex reserves coupled with a steady rupee and a robust banking system that withstood the global financial crisis. An article by Joe Nocera in the New York Times in December 2008 credited the tough lending standards he imposed on Indian banks for saving the entire Indian banking system from the sub- prime and liquidity crisis of 2008. Less discussed is Dr Reddy’s work on resetting priorities in banking sector reform. Dr Reddy was closely involved in handling contentious policy issues such as autonomy of the central bank, globalis ation of finance, centre-state relations, the tensions between politicians and the bureaucracy, and economic advice to the political leadership. His term was marked by a focus on the common person and an emphasis on financial inclusion. Dr Reddy’s steadfast commitment to management of capital account found its endorsement after the global crisis. Subsequent to the crisis, global think tanks and international organisations sought his views and expertise. These included the United Nations, the International Monetary Fund, the Bank for International Settlement, the Institute for New Economic Thinking, and the Palais Royal Initia- tive on International Monetary System. -

Research & Publications

ISSN 2320 –2114 Research & Publications Annual Report 2019–2020 Research and Publications Team Prof. Jishnu Hazra Chairperson, Research and Publications Members of Research and Publications Committee Prof. Jishnu Hazra Prof. Mukta Kulkarni Prof. Pulak Ghosh Prof. Chetan Subramanian Prof. Prithwiraj Mukherjee Prof. Abhinav Anand Prof. Gopal Das Research and Publications Team Nirmala Manoj Project Executive Chitralekha A D Copy Editor I Strategy (S) RESEARCH AND PUBLICATIONS ANNUAL REPORT 2020 (April 2019 – March 2020) Strategy (S) Strategy 1 Contents Preface 3 Research Output 4 IIMB Cases at Harvard Business Publishing (HBP) 6 Leading Journal Publications 8 Awards, Honours, and Achievements 10 Area-wise Publications and Research Output I Strategy (S) 11 II Economics and Social Sciences (ESS) 35 III Finance and Accounting (F&A) 60 IV Marketing (M) 78 V Organisational Behaviour & Human Resource Management 87 (OB&HRM) VI Productions and Operations Management (P&OM) 106 VII Decision Sciences (DS) 119 VIII Information Systems (IS) 134 IX Centre for Public Policy (CPP) 139 X Entrepreneurship 158 XI Centre for Corporate and Governance and Citizenship (CCGC) 164 XII Data Centre and Analytics Lab (DCAL) 166 XIII Supply Chain Management Centre (SCMC) 175 XIV Centre for Teaching and Learning (CTL) 181 XV Israel Centre (IC) 183 XVI India Japan Study Centre (IJSC) 187 XVII IIMB Research Seminar Series 189 Contents Author Index 196 2 Preface IMB’s vision and mission entail thought leadership, innovation and I excellence in education. The faculty at IIMB engages in original academic research and in developing case studies to expand the frontiers of knowledge and evolve tools for an enriching classroom experience. -

India Policy Forum July 12–13, 2016

Programme, Authors, Chairs, Discussant and IPF Panel Members India Policy Forum July 12–13, 2016 NCAER | National Council of Applied Economic Research 11 IP Estate, New Delhi 110002 Tel: +91-11-23379861–63, www.ncaer.org NCAER | Quality . Relevance . Impact NCAER is celebrating its 60th Anniversary in 2016-17 Tuesday, July 12, 2016 Seminar Hall, 1st Floor, India International Centre, New Wing, New Delhi 8:30 am Registration, coffee and light breakfast 9:00–9:30 am Introduction and welcome Shekhar Shah, NCAER Keynote Remarks Amitabh Kant, CEO, NITI Aayog 9:30–11:00 am The Indian Household Savings Landscape [Paper] [Presentation] Cristian Badarinza, National University of Singapore Vimal Balasubramaniam & Tarun Ramadorai, Saïd Business School, Oxford & NCAER Chair Barry Bosworth, Brookings Institution Discussants Rajnish Mehra, University of Luxembourg, NCAER & NBER [Presentation] Nirvikar Singh, University of California, Santa Cruz & NCAER [Presentation] 11:00–11:30 am Tea 11:30 am–1:00 pm Measuring India’s GDP growth: Unpacking the Analytics & Data Issues behind a Controversy that Refuses to Go Away [Paper] [Presentation] R Nagaraj, Indira Gandhi Institute of Development Research T N Srinivasan, Yale University Chair Indira Rajaraman, Member, 13th Finance Commission Discussants Pronab Sen, Former Chairman, National Statistical Commission & Chief Statistician, Govt. of India; India Growth Centre B N Goldar, Institute of Economic Growth [Presentation] 1:00–2:00 pm Lunch 2:00–3:30 pm Early Childhood Development in India: Assessment & Policy -

In This Issue... Plus

Volume 18 No. 2 February 2009 12 in this issue... 6 Vibrant Gujarat 8 India Inc. at Davos 12 15th Partnership Summit 22 3rd Sustainability Summit 8 31 Defence Industry Seminar plus... n India Rubber Expo 2009 n The Power of Cause & Effect n India’s Tryst with Corporate Governance 22 n India & the World n Regional Round Up n And all our regular features We welcome your feedback and suggestions. Do write to us at 31 [email protected] Edited, printed and published by Director General, CII on behalf of Confederation of Indian Industry from The Mantosh Sondhi Centre, 23, Institutional Area, Lodi Road, New Delhi-110003 Tel: 91-11-24629994-7 Fax: 91-11-24626149 Email: [email protected] Website: www.cii.in Printed at Aegean Offset Printers F-17 Mayapuri Industrial Area, Phase II, New Delhi-110064 Registration No. 34541/79 JOURNAL OF THE Confederation OF INDIAN INDUSTRY 2 | February 2009 Communiqué Padma Vibhushan award winner Ashok S Ganguly Member, Prime Minister’s Council on Trade & Industry, Member India USA CEO Council, Member, Investment Commission, and Member, National Knowledge Commission Padma Bhushan award winners Shekhar Gupta A M Naik Sam Pitroda C K Prahalad Editor-in-Chief, Indian Chairman and Chairman, National Paul and Ruth McCracken Express Newspapers Managing Director, Knowledge Commission Distinguished University (Mumbai) Ltd. Larsen & Toubro Professor of Strategy Padma Shri award winner R K Krishnakumar Director, Tata Sons, Chairman, Tata Coffee & Asian Coffee, and Vice-Chairman, Tata Tea & Indian Hotels Communiqué February 2009 | 5 newsmaker event 4th Biennial Global Narendra Modi, Chief Minister, Gujarat, Mukesh Ambani, Chairman, Investors’ Summit 2009 Reliance Industries, Ratan Tata, Chairman, Tata Group, K V Kamath, President, CII, and Raila Amolo Odinga, Prime Minister, Kenya ibrant Gujarat, the 4th biennial Global Investors’ and Mr Ajit Gulabchand, Chairman & Managing Director, Summit 2009 brought together business leaders, Hindustan Construction Company Ltd, among several investors, corporations, thought leaders, policy other dignitaries. -

Outcome Document

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF ECONOMIC AFFAIRS (ECONOMIC DIVISION) OUTCOME DOCUMENT DELHI ECONOMICS CONCLAVE 2013, International Conference on “The Agenda for the Next Five Years” Held at Hyatt Regency, New Delhi December 11-12, 2013 MINISTRY OF FINANCE DEPARTMENT OF ECONOMIC AFFAIRS “The Agenda for the Next Five Years” Venue: Hotel Hyatt Regency, Ring Road, New Delhi. Plenary Day-1: December 11, 2013 (Wednesday) 09.00 – 10.00 AM Registration 10.00 – 10.45 AM Inaugural Session Welcome Address : Dr. Arvind Mayaram, Secretary, Economic Affairs, GoI Inaugural Address : Shri P. Chidambaram, Finance Minister, GoI Vote of Thanks : Dr. H.A.C. Prasad, Senior Economic Adviser, DEA, MOF 10.45 – 11.45 AM Opening Plenary Lecture Session -1 Chair: Dr. C. Rangarajan, Chairman, Economic Advisory Council to the Prime Minister Plenary Lecture: Dr. Raghuram G. Rajan, Governor RBI Topic: “Financial Sector Reforms”. 11.45 AM-12.00 Noon Tea 12.00 Noon – 1.15 PM Plenary Session – 1 Theme Global Economic Development – Past, present and lessons for future Chair: Dr. Montek Singh Ahluwalia, Deputy Chairman, Planning Commission, GOI Panelists: Prof. Nathan Nunn, Harvard University Prof. Romain Wacziarg, UCLA Anderson School of Management Dr. K.L Prasad, Adviser, DEA, MOF Dr. Arvinder Sachdeva , Adviser, DEA, MOF 1.15– 2.15 PM Lunch 2.15– 3.30 PM Plenary Session– 2 Theme: Trade, Finance and Reforms Chair Dr. Bimal Jalan, former Governor, RBI Panelists Prof. Shang-Jin Wei, Columbia Business School Prof. Renato Baumann, IPEA, Brazil Ms. Naina Lal Kidwai, Chairperson, FICCI & Group General Manager and Country Head (India), HSBC Ltd Mr.