Finnair Capital Markets Day 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Using TRIZ to Enhance Passengers' Perceptions of an Airline's Image Through Service Quality and Safety

Journal of Air Transport Management 53 (2016) 131e139 Contents lists available at ScienceDirect Journal of Air Transport Management journal homepage: www.elsevier.com/locate/jairtraman Using TRIZ to enhance passengers' perceptions of an airline's image through service quality and safety * Thongchai Jeeradist a, Natcha Thawesaengskulthai b, , Thanawan Sangsuwan c a Technopreneurship and Innovation Management, Graduate School, Chulalongkorn University, Bangkok, Thailand b Department of Industrial Engineering Faculty of Engineering, Chulalongkorn University, Bangkok, Thailand c Department of Marketing, Faculty of Commerce and Accountancy, Chulalongkorn University, Bangkok, Thailand article info abstract Article history: To improve the impacts of airline image, service quality and safety on passenger perceptions, this paper Received 29 April 2015 examined and presented three case studies to identify the factors that influenced service quality in the Received in revised form airline business, and passenger perceptions of airline image. A literature review on service quality 11 February 2016 measurement (SQM) and airline safety analysed case studies. The quality management framework Accepted 13 February 2016 SERVQUAL with five service quality dimensions including reliability, assurance, tangibility, empathy and Available online xxx responsiveness was used to assess passenger requirements. Selected criteria from airline services and the Kano model measured customer satisfaction. Airline safety criteria were studied and TRIZ techniques Keywords: -

Comparison of World Airline Rankings with Different Criteria: Best Airline Ranking and EVAMIX Method Rank

American Research Journal of Humanities Social Science (ARJHSS)R) 2019 American Research Journal of Humanities Social Science (ARJHSS) E-ISSN: 2378-702X Volume-02, Issue-03, pp-38-46 March-2019 www.arjhss.com Research Paper Open Access Comparison of World Airline Rankings with Different Criteria: Best Airline Ranking and EVAMIX Method Rank Assoc. Prof. Dr. Ozlem Deniz Basar, Istanbul Commerce UniversityDepartment of Statistics Sutluce Mah., Imrahor Cad., No :90, Beyoglu / Istanbul / Turkey Phone : +90-212-444-0413/4613 ABSTRACT:- Competition in the transportation sector is in constant rise as in all sectors today. It is crucial for airlines, which are one of the most important shareholders in the transportation sector, to be recognized and reliable in order to have a place in the market. For this reason, different companies prepare and share a world airline ranking with public each year. These rankings are prepared using different criteria and methodologies. Hence, each of these rankings differs from each other. This study considers the Best Airline Ranking prepared by Airhelp in 2018. The first 15 airlines in this ranking are re-ranked with the EVAMIX method using unused criteria and the results are compared with the Best Airline Ranking. In the conclusion of the study, it is found out that rankings changed significantly; hence, it is greatly important to determine what is desired to measure when the airlines are compared. Keywords: Airline, Ranking, EVAMIX, Critic Method I. INTRODUCTION It is of importance to meet the changing consumer demands, reach and serve more customers in the aviation sector as in all other sectors. -

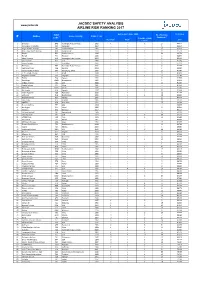

2017 JACDEC AIRLINE SAFETY RANKING-ENG.Xlsx

JACDEC SAFETY ANALYSIS www.jacdec.de AIRLINE RISK RANKING 2017 2 ICAO Hull Losses since 1988 No of Serious Risk Index Airline Home Country Begin of Ops # 1 Incidents 2 Code Total No of Hull Non-fatal 3 Fatal 3 2017 Losses 2 1 Emirates UAE Vereinigte Arab. Emirate 1985 1 0 1 27 93,61% 2 Norwegian Air Shuttle NAX Norwegen 1993 0 0 0 6 93,26% 3 Virgin Atlantic Airways VIR Großbritannien 1984 0 0 0 15 92,87% 4 KLM - Royal Dutch Airlines KLM Niederlande 1920 1 0 1 21 92,77% 5 EasyJet EZY Großbritannien 1996 0 0 0 24 92,75% 6 Finnair FIN Finnland 1923 0 0 0 5 92,67% 7 Etihad Airways ETD Vereinigte Arab. Emirate 2003 0 0 0 10 92,56% 8 Spirit Airlines NKS USA 1980 0 0 0 5 92,18% 9 Jetstar Airways JST Australien 2004 0 0 0 9 92,12% 10 Air Arabia ABY Vereinigte Arab. Emirate 2003 0 0 0 2 92,09% 11 Vueling Airlines VLG Spanien 2004 0 0 0 8 92,02% 12 Cathay Pacific Airways CPA Hong Kong, China 1946 0 0 0 10 91,88% 13 EL AL - Israel Airlines ELY Israel 1949 0 0 0 11 91,84% 14 Singapore Airlines SIA Singapur 1972 0 1 1 20 91,78% 15 EVA Air EVA Taiwan 1991 0 0 0 6 91,55% 16 Eurowings EWG Deutschland 1993 0 0 0 8 91,41% 17 jetBlue Airways JBU USA 2000 0 0 0 11 91,40% 18 Capital Airlines CBJ China 1995 0 0 0 0 91,36% 19 Oman Air OMA Oman 1981 0 0 0 2 91,28% 20 Air Canada ACA Kanada 1937 2 0 2 32 91,20% 21 Virgin Australia VOZ Australien 2000 0 0 0 12 91,15% 22 Lufthansa DLH Deutschland 1955 0 1 1 39 90,92% 23 WestJet Airlines WJA Kanada 1996 0 0 0 13 90,91% 24 Air Europa AEA Spanien 1986 0 0 0 11 90,76% 25 QANTAS QFA Australien 1922 0 0 0 25 90,39% 26 -

2013-10-17-Jacdec Analysis Atr + Dhc84

JACDEC ANALYSIS DHC-8-400 versus ATR-72 JACDEC ANALYSIS 17 OCT 2013 JACDEC ANALYSIS - Quick Datasheet A Safety Comparison between Bombardier DHC-8-400 and ATR-72 Over a period of 15 years (1999 - 2013) Bombardier DHC-8-400 "Dash 8" ATR-72 Role: Regional Turboprop Aircraft Regional Turboprop Aircraft Seat Capacity: 68 - 80 Passengers 68 - 74 Passengers Powerplant: 2x Pratt & Whitney Canada PW150A Turboprop 2x Pratt & Whitney Canada PW127 Turboprop Entry of commercial service: Summer 1999 Q4 1989 (Finnair) Number built (as of OCT 01 2013): 448 651 Number of Hull Losses: 6 15 Number of Serious Incidents: 19 35 Number of on board fatalities: 49 169 Number of on board injured: 17 89 Hull Losses per year (´99 - 2013): 0,40 1,00 Fatalities per year (´99 - 2013): 3,27 11,27 Hull Losses by Airframes (´99 -2013): 0,01 1,36 % 0,02 2,21 % Hull Losses by Region Africa Asia / Pacific 2 33,33 % 6 40,00 % Eurasia 1 16,67 % 1 6,67 % Europe 1 16,67 % 3 20,00 % Latin America 2 13,33 % Mid-East Asia 3 20,00 % North America 2 33,33 % International Territory: © JACDEC Database JACDEC ANALYSIS DHC-8-400 versus ATR-72 JACDEC ANALYSIS SAFETY COMPARISON DHC-8-400 vs. ATR-72 HULL LOSS ACCIDENT DISTRIBUTION MAP 2 = DHC-8-400 accident country = ATR-72 accident country Canada 1x Bangladesh 1x China 1x Cuba 1x Denmark 1x India 2x Lithuania 1x Italy 2x South Korea 1x Laos 1x USA 1x Myanmar 2x Philippines 1x Puerto Rico 1x Poland 1x Russia 1x Taiwan 1x Thailand 1x CURRENT OPERATOR LIST DHC-8-400 ATR-72 Operators Fleet Size Operators Fleet Size Alaska Horizon 48 Azul Linhas Aéreas Brasileiras 26 FlyBE 43 Wings Abadi Air 24 Republic AL 30 TRIP Linhas Aéreas 19 Sunstate AL / QantasLink 30 Jet AW 17 Porter AL 26 UTair Avn 15 Jazz Air 21 FedEx 15 ANA Wings 21 Executive AL / American Eagle 14 SpiceJet 15 Mount Cook AL 14 Austrian 14 Firefly 13 Air Baltic 12 Virgin Australia Regional AL 13 Japan Air Commuter 11 Vietnam AL 12 Wideroe 10 FlyBE Finland 12 Pantheon AW 10 Farnair Switzerland 12 LGW Luftfahrtges. -

Epub Institutional Repository

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Elektronische Publikationen der Wirtschaftsuniversität Wien ePubWU Institutional Repository Michael Uher Airport Dubai - Evaluation of Dubai as a First Choice Hub for International Travellers Working Paper Original Citation: Uher, Michael (2005) Airport Dubai - Evaluation of Dubai as a First Choice Hub for International Travellers. Schriftenreihe des Instituts für Transportwirtschaft und Logistik - Verkehr, 03/2005. Institut für Transportwirtschaft und Logistik, WU Vienna University of Economics and Business, Vienna. This version is available at: http://epub.wu.ac.at/1406/ Available in ePubWU: June 2010 ePubWU, the institutional repository of the WU Vienna University of Economics and Business, is provided by the University Library and the IT-Services. The aim is to enable open access to the scholarly output of the WU. http://epub.wu.ac.at/ Institut für Transportwirtschaft und Logistik Institute of Transport Economics and Logistics Vienna University of Economics and Business Administration Schriftenreihe des Instituts für Transportwirtschaft und Logistik Nr. 3 (2005) Uher, Michael Airport Dubai – Evaluation of Dubai as a First Choice Hub for International Travellers Herausgeber: die Professoren des Instituts für Transportwirtschaft und Logistik Airport Dubai - Evaluation of Dubai as a First Choice Hub for International Travellers Michael Uher Vienna University of Economics and Business Administration Institute of Transport Economics and Logistics -

Finnair-Sustainability-Report-2018-Data

SUSTAINABILITY REPORT 2018 RESPONSIBLE FINNAIR CLEANER CARING COLLABORATIVE ANNEX CONTENT 3 RESPONSIBLE FINNAIR 42 ANNEX 4 Push for Change 43 Reporting principles 6 Value creation model 45 Global Compact content index 7 Materiality analysis 46 GRI content index 9 Management principles 50 Independent practitioner’s limited 16 Ethics and responsible sourcing assurance report 18 CLEANER 20 Energy consumption 23 Flight noise and biodiversity 25 Emissions 27 Waste 28 CARING 29 Caring for our employees 34 Caring for our customers 35 COLLABORATIVE 36 Stakeholders 37 Economic responsibility 39 Tax footprint 2 2 SUSTAINABILITY REPORT 2018 RESPONSIBLE FINNAIR CLEANER CARING COLLABORATIVE ANNEX RESPONSIBLE FINNAIR Finnair’s objective is to create sustainable economic added value by producing flight services profitably, cost-competitively and in harmony with the needs of the environment and society. • Push for Change • Management Principles • Value Creation model • Ethics and Responsible • Materiality Analysis sourcing 3 SUSTAINABILITY REPORT 2018 RESPONSIBLE FINNAIR CLEANER CARING COLLABORATIVE ANNEX PUSH FOR CHANGE The same journey can generate more or less emissions, depending on a number of factors. By selecting a sensible form of travel, a direct and lower-emission route as well as an airline that uses modern aircraft, everyone can reduce the environmental impact of their journey. In the name of ethics, companies should not compromise on their travel, but on their emissions. Airlines decide whether to invest in modern technology, recycle waste appropriately, reduce energy consumption, and care Does this ring a bell? Climate change and all years around the world, in aviation, and That is why we must act even more deci- for the wellbeing of employees. -

Spring 2021 Corporate Finance and ERM — Strategic Decision Making Exam Case Study

Case Study SPRING 2021 Strategic Decision Making Exam EXAM CFE SDM CFESDM Table of Contents 1 RPPC Dynasty Corporation .................................................................................................................... 2 1A RPPC Dynasty Corporation Exhibits .............................................................................................. 6 2 Blue Jay Air ............................................................................................................................................ 7 2A Blue Jay Air Exhibits .................................................................................................................... 19 3 Blue Jay Tire Co ................................................................................................................................... 33 3A Blue Jay Tire Exhibits ................................................................................................................... 43 4 Frenz Corporation ............................................................................................................................... 47 4A Frenz Corporation Exhibits .......................................................................................................... 56 6 Big Ben Bank ....................................................................................................................................... 63 6A Big Ben Bank Exhibits .................................................................................................................. 73 -

Jacdec Safety Ranking 2013

JACDEC SAFETY RANKING 2013 Ref:http://www.jacdec.de/Airline-Rankings/jacdec_safety_ranking_2013.htm RANKNO AIRLINE CODECS COUNTRY JACDEC SAFETY INDEX 2012 1 AIR NEW ZEALAND NZ, ANZ AUS Index 0,007 2 ↑ 2 CATHAY PACIFIC AIRWAYS CX, CPA HKG Index 0,008 3 ↑ 3 FINNAIR AY, FIN FIN Index 0,010 1 ↓ 4 EMIRATES EK, UAE UAE Index 0,010 4 → 5 EVA AIR BR, EVA TWN Index 0,010 6 ↑ 6 BRITISH AIRWAYS BA, BAW GBR Index 0,011 10 ↑ 7 TAP PORTUGAL TP, TAP PRT Index 0,012 7 → 8 ETIHAD AIRWAYS EY, ETD UAE Index 0,012 5 ↓ 9 AIR CANADA AC, ACA CAN Index 0,012 25 ↑ 10 QANTAS QF, QFA AUS Index 0,013 13 ↑ 11 QATAR AIRWAYS QR, QTR QAT Index 0,013 22 ↑ 12 ALL NIPPON AIRWAYS NH, ANA JPN Index 0,015 12 → 13 VIRGIN ATLANTIC AIRWAYS VS, VIR GBR Index 0,015 15 ↑ 14 HAINAN AIRLINES HU, CHH CHN Index 0,015 8 ↓ 15 VIRGIN AUSTRALIA DJ, VOZ AUS Index 0,015 9 ↓ 16 JETBLUE AIRWAYS B6, JBU USA Index 0,015 14 ↓ 17 KLM KL, KLM NLD Index 0,015 27 ↑ 18 LUFTHANSA LH, DLH DEU Index 0,016 11 ↓ 19 SHENZHEN AIRLINES ZH, CSZ CHN Index 0,018 ★ ↑ 20 EASYJET U2, EZY GBR Index 0,018 17 ↓ 21 THOMAS COOK AIRLINES MT, TCX GBR Index 0,023 18 ↓ 22 WESTJET WS, WJA CAN Index 0,026 19 ↓ 23 TRANSAERO AIRLINES UN, TSO RUS Index 0,027 16 ↓ 24 SOUTHWEST AIRLINES WN, SWA USA Index 0,028 21 ↓ 25 JETSTAR AIRWAYS JQ, JST AUS Index 0,030 20 ↓ 26 AIR BERLIN AB, BER DEU Index 0,034 23 ↓ 27 DELTA AIR LINES DL, DAL USA Index 0,038 28 ↑ 28 THOMSON AIRWAYS BY, TOM GBR Index 0,046 26 ↓ 29 CONDOR DE, CFG DEU Index 0,050 34 ↑ 30 SINGAPORE AIRLINES SQ, SIA SGP Index 0,052 30 → 31 UNITED AIRLINES UA, UAL USA Index 0,057 -

The United Arab Emirates Case of Economic Success

The United Arab Emirates Case of Economic Success The Federal Government Economic Policies Final Work in the form of Internship Report submitted to Universidade Católica Portuguesa for the obtainment of the Master Degree in Management by Pedro Alexandre Azevedo Dias Lima Delgado under orientation of Alexandra Pinto Leitão, PhD Católica Porto Business School July 2016 Acknowledgments I would like to thank Professor Alexandra Pinto Leitão for all the helpful advice, guidance, and invaluable comments on this essay, which have helped me to develop the present Master’s Final Work. iii iv Abstract Within 44 years the United Arab Emirates (UAE) evolved from the backdrop of a subsistence economy into an innovation-driven economy characterized by a high-mass consumption society. Prudent policy-making by the UAE Federal Government was vital in providing proper guidance on the how, where and when to apply hydrocarbon revenues and support the much needed process of economic diversification. Due to its astonishing economic development the UAE has become a role model in economic diversification for oil-producing countries. In this sense, the present Master’s Final Work sheds light on the following research question - “What were the policies adopted by the United Arab Emirates Federal Government that made the Emirates economy a case of success?”. A “two building-block” rationale was adopted in order to address the research question at hand. The first “building-block” allowed us to verify that the UAE is a case of economic success. Within 44 years, the country has now one of the most competitive economies in the world and is at par with most advanced economies in terms business regulations, infrastructure and technological advancement. -

Transpacific Airline Fuel Efficiency Ranking, 2016

WHITE PAPER JANUARY 2018 TRANSPACIFIC AIRLINE FUEL EFFICIENCY RANKING, 2016 Brandon Graver, Ph.D., and Daniel Rutherford, Ph.D. BEIJING | BERLIN | BRUSSELS | SAN FRANCISCO | WASHINGTON ACKNOWLEDGEMENTS The authors thank Anastasia Kharina, Naya Olmer, and Joe Schultz for their review and support. We also acknowledge Airline Data Inc. for providing processed BTS data, and to FlightGlobal for Ascend Fleet data. Dimitri Simos provided technical assistance using the Piano model. This study was funded through the generous support of the Bekenstein Foundation. International Council on Clean Transportation 1225 I Street NW, Suite 900 Washington, DC 20005 USA [email protected] | www.theicct.org | @TheICCT © 2018 International Council on Clean Transportation TABLE OF CONTENTS EXECUTIVE SUMMARY ............................................................................................................ iii 1. INTRODUCTION .....................................................................................................................1 2. METHODOLOGY ................................................................................................................... 2 2.1 Airline Selection ................................................................................................................................2 2.2 Fuel Burn Modeling ..........................................................................................................................4 2.3 Fuel Efficiency Calculation ...........................................................................................................5 -

Democratic Republic of Congo: Arming the East 1

Previous Democratic Republic of Congo: arming the east 1. Introduction Weapons and munitions have continued to flow into the Great Lakes Region and to those forces known to flagrantly abuse human rights in the eastern DRC despite the peace agreements in 2002 between warring groups of the Democratic Republic of Congo (DRC) and between the governments of Democratic Republic of the Congo (DRC), Rwanda and Uganda.(1) The UN Security Council imposed a mandatory arms embargo on the provinces of North and South Kivu and the Ituri region of the eastern DRC, and also on groups not party to the peace agreement in the DRC, on 28 July 2003. This embargo was considerably strengthened and applied to the whole of the DRC, with certain exceptions, on 18 April 2005. Yet, before and after the imposition of the UN embargo, reports of arms and related deliveries continued. International arms flows into the region have corresponded to the clandestine supply of military aid by powerful forces in the DRC, Rwanda, and Uganda to their competing client armed groups and militia in eastern DRC who practise banditry and show little or no respect for human rights. Although fighting has subsided since the peace agreements, there have been regular clashes in which civilians have been brutally targeted. The military situation remains tense and civilians still live in fear and continue to be frequently exposed to large-scale human rights abuses. The current shortcomings in the demobilisation process, the easy availability of small arms, and the recent arming of "self defence" militia have also lead to a rapid rise in armed banditry. -

A US Army War College Analysis of Russian Strategy in Eastern Europe, an Appropriate US Response, and the Implications for US La

The United States Army War College The United States Army War College educates and develops leaders for service at the strategic level while advancing knowledge in the global application of Landpower. The purpose of the United States Army War College is to produce graduates who are skilled critical thinkers and complex problem solvers. Concurrently, it is our duty to the U.S. Army to also act as a “think factory” for commanders and civilian leaders at the strategic level worldwide and routinely engage in discourse and debate concerning the role of ground forces in achieving national security objectives. Project 1704 and is produced under the purview of the United States Army War College to foster dialogue of topics with strategic ramifications. This study drew upon the expertise of hand selected U.S. Army War College faculty and students from across the services, departments, agencies and from eight nations to provide a thought-provoking and relevant discourse of a topic of timely relevance; the reemergence of Russian strategic landpower. Disclaimer The ideas and viewpoints advanced in this publication are those of the authors and do not necessarily reflect the official policy or position of the institution, the Department of Defense, or any other department or agency of the United States Government. Cover Photo courtesy of Sgt Rupert Frere RLC/MOD [OGL (http://www.nationalarchives.gov.uk/doc/open- government-licence/version/1/)], via Wikimedia Commons US Army War College Contributors and Authors: Project leader: COL Douglas Mastriano, PhD, US Army War College Faculty Editor: Lt Col Derek O’Malley, USAF Chapter 1: The Russian Strategic Environment Dr.