2017 FINAL Trifold-Medical Capital Brochure Reva V2 HR

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Philadelphia Investment Trends Report

Venture impact Technology investment in the Greater Philadelphia region Trends and highlights, January 2008 to June 2013 Innovation, investment and opportunity On behalf of EY, Ben Franklin Technology Partners of Southeastern Pennsylvania and the Greater Philadelphia Alliance for Capital and Technologies (PACT), we are pleased to present this review 421 companies of technology investment trends and highlights in the Greater Philadelphia region. $4.1 billion The technology investment community in the Greater Philadelphia region includes a wide variety of funding sources supporting a diverse array of companies and industry sectors. In this report, Total investment since we’ve analyzed more than a thousand investment rounds and January 2008 exits that occurred in the Philadelphia region since 2008 – including investments from venture capital fi rms (VCs), angel investors (Angels), corporate/strategic investors, seed funds, accelerators and other sources of funding. As shown in this report, 2012 reversed a post-recession slowdown in venture funding in Greater Philadelphia, and to date, 2013 has brought a welcome increase in the amount of new funds available at regional investment fi rms. These are positive signs for our region’s technology companies, as are the increasing number of exits via IPO and acquisition, which serve as further validation of the investment opportunities created by our region’s growing technology sector. We encourage you to explore this report, and we hope that it will provide useful insights into the current state of -

RESI Boston Program Guide 09-26-2017 Digital

SEPTEMBER 26 , 2017 BOSTON, MA Early stage investors, fundraising CEOs, scientist-entrepreneurs, strategic partners, and service providers now have an opportunity to Make a Compelling Connection ONSITE GUIDE LIFE SCIENCE NATION Connecting Products, Services & Capital #RESIBOS17 | RESIConference.com | Boston Marriott Copley Place FLOOR PLAN Therapeutics Track 2 Investor Track 3 & track4 Track 1 Device, Panels Workshops & Diagnostic & HCIT Asia Investor Panels Panels Ad-Hoc Meeting Area Breakfast & Lunch DINING 29 25 30 26 31 27 32 28 33 29 34 30 35 Breakfast / LunchBreakfast BUFFETS 37 28 24 27 23 26 22 25 21 24 20 23 19 22 exhibit hall 40 15 13 16 14 17 15 18 16 19 17 20 18 21 39 INNOVATION 14 12 13 11 12 10 11 9 10 8 9 7 8 EXHIBITORS CHALLENGE 36 38 FINALISTS 1 1 2 2 3 3 4 4 5 5 6 6 7 Partnering Check-in PARTNERING Forum Lunch BUFFETS Breakfast / Breakfast RESTROOM cocktail reception REGISTRATION content Welcome to RESI - - - - - - - - - - - - - - - 2 RESI Agenda - - - - - - - - - - - - - - - - - - 3 BOSTON RESI Innovation Challenge - - - - - - - 5 Exhibiting Companies - - - - - - - - - - 12 Track 1: Therapeutics Investor Panels - - - - - - - - - - - - - - - 19 Track 2: Device, Diagnostic, & HCIT Investor Panels - - - - 29 Track 3: Entrepreneur Workshops - - - - - - - - - - - - - - - - - - 38 Track 4: Asia-North America Workshop & Panels - - - - - - 41 Track 5: Partnering Forum - - - - - - - - - - - - - - - - - - - - - - - - 45 Sponsors & Media Partners - - - - - - - - - - - - - - - - - - - - - - - 46 1 welcome to resi On behalf of Life Science Nation (LSN) and our title sponsors WuXi AppTec and Johnson & Johnson Innovation JLABS, I would like to thank you for joining us at RESI Boston. LSN is very happy to welcome you all to Boston, the city where it all began, for our 14th RESI event. -

Small Business Incubator Certification Program Annual Report 2020

Small Business Incubator Certification Program 2020 Annual Report Incubator Certification Program Overview Business incubators nurture the development of Oklahoma Business Incubator entrepreneurial companies, helping them survive Association and grow during the startup period, when they The Oklahoma Business Incubator Association are most vulnerable. These programs provide their (OkBIA) was formed more than 20 years ago. The client companies with business support services purpose of the OkBIA is to provide information, and resources tailored to young firms. The most networking, guidance and assistance to incubator common goals of incubation programs are creating operators, as well as to work with the Legislature jobs in a community, enhancing a community’s to promote and benefit business incubators and entrepreneurial climate, retaining businesses in a tenants. community, building or accelerating growth in a local industry, and diversifying local economies. Oklahoma Business Incubators Incubators vary in the way they deliver their In 1988, the Oklahoma Legislature passed the services, in their organizational structure and in Oklahoma Small Business Incubators Incentives the types of clients they serve. As they are highly Act. The Act enables the tenants of a certified adaptable, incubators have differing goals, including incubator facility to be exempt from state tax liability diversifying rural economies, providing employment on income earned as a result of occupancy for up for and increasing wealth of depressed inner cities, to five years. In 2001, the legislature amended the and transferring technology from universities and act to extend the tenant’s tax exemption from five major corporations. Incubator clients are often at to 10 years. The exemption remains in effect after the forefront of developing new and innovative the tenant has graduated from an incubator. -

The Gender Gap in Startup Catalyst Organizations

University of California, Hastings College of the Law UC Hastings Scholarship Repository Faculty Scholarship 2017 The Gender Gap in Startup Catalyst Organizations: Bridging the Divide between Narrative and Reality Alice Armitage UC Hastings College of the Law, [email protected] Robin Feldman UC Hastings College of the Law, [email protected] Follow this and additional works at: https://repository.uchastings.edu/faculty_scholarship Recommended Citation Alice Armitage and Robin Feldman, The Gender Gap in Startup Catalyst Organizations: Bridging the Divide between Narrative and Reality, 95 Or. L. Rev. 313 (2017). Available at: https://repository.uchastings.edu/faculty_scholarship/1591 This Article is brought to you for free and open access by UC Hastings Scholarship Repository. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of UC Hastings Scholarship Repository. For more information, please contact [email protected]. OREGON 2017 VOLUME 95 LAW NUMBER 2 REVIEW Articles ROBIN FELDMAN,* ALICE ARMITAGEt & CONNIE WANGT The Gender Gap in Startup Catalyst Organizations: Bridging the Divide Between Narrative and Reality I. The Catalyst Phenomenon: Function and Typology..............314 A. Co-Working Spaces.........................315 B. Incubators................................ 317 C. Accelerators ........................ ...... 318 II. The Gender Gap in Entrepreneurship and Technology..........320 III. Research Design and Methodology ................. 323 IV. Results ........................... ............... 326 *Harry & Lillian Hastings Professor and Director of the Institute for Innovation Law, University of California, Hastings College of the Law. t Associate Professor of Law and Director of the Startup Legal Garage, University of California, Hastings College of the Law. I Research Fellow at the Institute for Innovation Law, University of California, Hastings College of the Law. -

A Framework for a Public-Private Partnership to Increase The

A national laboratory of the U.S. Department of Energy Office of Energy Efficiency & Renewable Energy National Renewable Energy Laboratory Innovation for Our Energy Future Enhancing Commercial Technical Report NREL/TP-110-40463 Outcomes from R&D May 2007 A Framework for a Public–Private Partnership to Increase the Yield of Federally Funded R&D Investments and Promote Economic Development L.M. Murphy Manager, Enterprise Development Programs National Renewable Energy Laboratory P. Jerde Executive Director Robert H. and Beverly A. Deming Center for Entrepreneurship, Leeds School of Business University of Colorado, Boulder L. Rutherford Venture Partner Vista Ventures R. Barone 2008 MS/MBA Candidate Department of Environmental Studies and Leeds School of Business University of Colorado, Boulder NREL is operated by Midwest Research Institute ● Battelle Contract No. DE-AC36-99-GO10337 Enhancing Commercial Technical Report NREL/TP-110-40463 Outcomes from R&D May 2007 A Framework for a Public–Private Partnership to Increase the Yield of Federally Funded R&D Investments and Promote Economic Development L.M. Murphy Manager, Enterprise Development Programs National Renewable Energy Laboratory P. Jerde Executive Director Robert H. and Beverly A. Deming Center for Entrepreneurship, Leeds School of Business University of Colorado, Boulder L. Rutherford Venture Partner Vista Ventures R. Barone 2008 MS/MBA Candidate Department of Environmental Studies and Leeds School of Business University of Colorado, Boulder Prepared under Task No. 1100.1000 National Renewable Energy Laboratory 1617 Cole Boulevard, Golden, Colorado 80401-3393 303-275-3000 • www.nrel.gov Operated for the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy by Midwest Research Institute • Battelle Contract No. -

Overview of Cleveland's Health Care Industry and Bioenterprise Initiative

Overview of Cleveland’s Health Care Industry and BioEnterprise Initiative November 14, 2007 1 Overview • Regional Health Care Base: 2002 • Transformation: Role of State • BioEnterprise and Entrepreneurship • Lessons Learned 2 Cleveland Health Care Base Nationally-recognized leaders in clinical care and research … • > $450 Million in annual research • Numerous nationally-distinctive programs including: • Cardiovascular • Cancer • Neurology • Orthopedics • Surgery • Pediatrics • Medical imaging • Biomedical engineering • Stem cells & tissue engineering • Advanced materials • Molecular diagnostics • Anti-infectives • Prions • Destination for innovation and care 3 Cleveland Health Care Base … a broad industry base… • ~500 health care Biopharma- companies in region ceutical 16% • Five >$1 billion companies Device/ or divisions Equipment Other 68% • Over 20,000 employees 6% Health Care Services/IT 10% 4 Weak Commercialization …However, few companies were attracting growth equity CLEVELAND AREA CLEVELAND AREA HEALTH CARE VENTURE INVESTMENT HEALTH CARE VENTURE INVESTMENT $ Millions Companies Financed 6 33 5 8 2 01 02 0 0 0 001 2 2 2 20 5 Source: Dow Jones Venture Wire; Venture Source; BioEnterprise Broad Effort Required • Community- People wide effort Pipeline • Collaboration Growth Clinical • Connectedness … regionally Capital and nationally 6 2002: Commitment to Growth • Private • Renewed focus on entrepreneurs and innovation • Technology transfer culture capabilities significantly enhanced • Investment firms and professional services • Public -

Analytical Report 'Analytical Study of the Success Factors Russian High

Analytical studyStatement of ofthe problem. Limitations and Assumptions the success factors Russian high-tech companies in Singapore Contents Statement of the problem. Limitations and Assumptions 3 Introduction 3 Goal of the study 4 Assumptions and Limitations 5 Disclaimer 6 Objectives of the study 6 Description of the research methodology 7 Framework 7 Questionnaire Design 9 Data Processing 14 The selection and characterization of respondent companies 14 The results of the study and comparative data 16 Failed Companies 27 Conclusion 27 The structure of the business ecosystem in Singapore 29 Government 31 Specific organisational features of small and medium enterprises in Singapore 34 Government Agencies 38 Entrepreneurship Stimuli 39 Entrepreneurship Assistance 44 Entrepreneurship Incentives 46 Features of the national business 52 A few general facts 58 A few random recommendations 59 Cooperation of Republic of Singapore and Russian Federation 62 Conclusions and recommendations 70 Appendix 1: Questionnaire 77 Appendix 2: Aggregated Survey Results 83 Appendix 3: Government Links 83 Appendix 4: Russian Organisations and Communities in Singapore 85 Appendix 5. List of references 86 2 Statement of the problem. Limitations and Assumptions Statement of the problem. Limitations and Assumptions Introduction Most people do not quite realize the dynamics of economic development of Singapore and importance of this small island’s city-sate for the global economy. Singapore, which is in the running to be the world’s fastest- growing economy, is the nation with the most business-friendly regulation, according to the World Bank’s 2013 Doing Business Reporti. In 2012, World Bank ranked Singapore the first in terms of ease of doing business, trading across the borders and the second in terms of protecting investors, in Economy Ranking. -

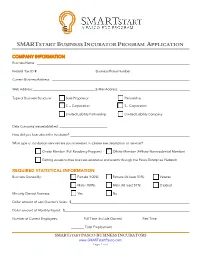

Smartstart Business Incubator Program Application

SMARTSTART BUSINESS INCUBATOR PROGRAM APPLICATION COMPANY INFORMATION Business Name: Federal Tax ID #: Business Phone Number: Current Business Address: Web Address: E-Mail Address: Type of Business Structure: Sole Proprietor Partnership C – Corporation S - Corporation Limited Liability Partnership Limited Liability Company Date Company was established: How did you hear about the Incubator? What type of incubation services are you interested in (please see description of service)?: Onsite Member (Full Residency Program) Offsite Member (Affiliate Nonresidential Member) Getting access to free business assistance and events through the Pasco Enterprise Network REQUIRED STATISTICAL INFORMATION Business Owned By: Female (100%) Female (At least 51%) Veteran Male (100%) Male (At least 51%) Disabled Minority Owned Business: Yes No Dollar amount of Last Quarter’s Sales: $ Dollar amount of Monthly Payroll: $ Number of Current Employees: Full Time (Include Owners) Part Time Total Employment SMARTSTART PASCO BUSINESS INCUBATORS www.SMARTstartPasco.com Page 1 of 6 SMARTSTART BUSINESS INCUBATOR PROGRAM APPLICATION BUSINESS RELATIONSHIPS Commercial Bank (Company name and contact): Phone #: Location: Legal Representation (Company name and contact): Phone #: Location: Accountant (Company name and contact): Phone #: Location: Insurance Provider (Company name and contact): Phone #: Location: OWNERSHIP INFORMATION (Use separate sheet to list additional owners) Owner’s Name #1: Title: Address: Phone #: Social Security Number: % of Ownership: Personal Annual -

Clarity on Mergers and Acquisitions

Clarity on Mergers & Acquisitions Swiss deal flows hit record high January 2019 16 2018 activity and 2019 outlook An industry-by-industry look at last year’s deals and what you might expect over the next 12 months. 22 Private Equity and the Swiss economy SECA’s General Secretary shares his insights into how Private Equity makes the Swiss economy stronger. 76 Detailed 2018 transaction list View the M&A deals that involved a Swiss buyer, seller or target. 28 4 12 6 18 10 Clarity on Mergers & Acquisitions CONTENT Clarity on Mergers & Acquisitions EDITORIAL CHAPTER II 3 Switzerland’s M&A activity 34 Industry Sector Pages sets a new record 36 Chemicals 40 Commodities CHAPTER I 44 Consumer Markets Overview 48 Financial Services 52 Industrial Markets 12 Media headlines 56 Pharmaceuticals & Life Sciences 60 Power & Utilities 14 Summary 64 Private Equity 68 Real Estate 72 Technology, Media & Telecommunications Focus Topic: Private Equity CHAPTER III 22 What is it and how does it work? 76 List of Swiss M&A 26 The changing legal and regulatory framework for Private Equity in Switzerland transactions in 2018 30 Interview with Maurice Pedergnana, SECA: CHAPTER IV The national economy is healthier thanks to private equity 110 Tombstones 116 PINBOARD 117 CONTACT & IMPRINT 1 2 Clarity on Mergers & Acquisitions EDITORIAL Switzerland’s M&A activity sets a new record activity. In fact, acquisitions by Private Equity houses once more exceeded exits, in a further sign of the growing importance of this community on the M&A landscape. A considerable amount of the M&A activity observed last year is due to changing consumer behaviors and rapid advances in technology – not least i4.0, the ’fourth industrial revolution’ that is upon us thanks to developments in artificial intelligence. -

Bryan Stevenson

ABOUT DEFY COLORADO Defy Ventures Colorado harnesses the talents of currently and formerly incarcerated men and women, redirecting them toward legal business ventures and careers. We support Entrepreneurs in Training (EITs) from incarceration through reentry into the community, providing entrepreneurship, employment, and personal development training and improving well-being. Defy Colorado builds an authentic, supportive community between EITs and executive volunteers as they experience their shared humanity. Our “blended learning” model combines video-based training with in-person facilitation, mentoring, and events and has the ability to scale globally and to empower the most under-served populations. Each of us is more than the worst thing we’ve ever done. — Bryan Stevenson Defy offers intensive entrepreneurship development, executive mentoring, business pitch showcases, access to financial investment, and startup incubation. Online instructors include influencers — such as Randy Komisar (Partner, Kleiner Perkins Caufield & Byers), Duncan Niederauer (former CEO, New York Stock Exchange), Stanley Tucker (CEO and Founder, Meridian Management Group), Steve Madden (Founder and former CEO of Steve Madden, Ltd.) Seth Godin (marketing guru), professors from Harvard Business School and Stanford Business School, and former EITs — who believe in second-chance entrepreneurs. IMPACT SAMPLE COURSES • 5,200+ EITs enrolled nationally • Employment Coaching Series (both pre- and post-release) • “Insights into Ideation” • 7.2% recidivism rate • “Fear -

HEALTHCARE INDUSTRY ASSOCIATION (HCIA) RESUME BOOK Columbia Healthcare and Pharmaceutical Management Program

HEALTHCARE INDUSTRY ASSOCIATION (HCIA) RESUME BOOK Columbia Healthcare and Pharmaceutical Management Program CLASS OF 2017 CLASS OF 2018 CONTENTS 2017 RESUMES 11 ROBERT MORIN 20 SONYA NANDA JT MUNCH JAY NICHOLAS 3 LISA AULT RICHARD MURPHEY LIZ NYLUND JULIE BAILEY BORMAN ELISA 12 SAM NELSON 21 PATIENCE OLANITORI ADAM NORRIS MILICA PAVLOVIC 4 WILLIAM CAMPBELL COURTNEY PITTENGER ALLISON PERRIN GUIDO CASTAGNOLA CECE CHEN 13 VARNA RAMAN 22 PRAMOD PRASAD MORGAN SHATTUCK DARPITA PUROHIT 5 JAMES CHEUNG STEPH SHAW FENG QIAN BIRCE CIRAVOGLU EVAN COHEN 14 XIN (TONY) SHU 23 DIVYA RAJ ALEXANDER APARNA RAMAKRISHNAN 6 ELIZABETH COLONNA VON FALENHAUSEN ISOBEL ROSENTHAL CHRISTIAN DUNNE PHILONG DUONG 24 MEREDITH SHIELDS 2018 RESUMES JASON ZE SU 7 LEV ELDEMIR KEITH TABIN PAWEL FEDEJKO 14 YAPRAK BARAN 25 JEFFERSON TAYLOR EMILY GARVIN 15 JAMES BEALL ANGELA WANG DIANA BERKOVITS 8 RACHEL HAN MALLORY WEST CAROLYN HEISLER TRAVIS BOWDEN 26 ELLEN YANG QIAN HU 16 JESSICA CHO THORSON ZACH 9 SCOTT JOHNSON JOSEPH COSENTINO HILLARY KAPLAN KATIE DEAN VICTORIA LAI 17 ADAM ESCALANTE 10 SHREYAS LAKSHMINARAYAN MATTHEW FOXMAN JOSEPHINE LINTHORST ANDREW GOTTESDIENER JAMIE MEYERSON 18 STEPHANIE HU NAMWON JUNG JESSICA KIM 19 CHASE KNIGHT MOLLY MAGNUSON ALEX MARGOLIS HCIA AT COLUMBIA BUSINESS SCHOOL The Healthcare Industry Association (HCIA) is committed to expanding opportunities outside of the classroom for Columbia Business School students to learn about the many segments of the healthcare industry. Working in close collaboration with the Healthcare and Pharmaceutical Management Program, HCIA organizes a variety of activities throughout the year. It offers members the opportunity to increase their knowledge of the healthcare industry, expand their professional networks, learn about diverse career paths, and secure internships, full-time opportunities, and in-semester projects. -

Guidelines for Creating a Business Incubator Slesarev M.A., Professor at the Department of Management, Marketing and Foreign Economic Affairs, MGIMO

Guidelines for creating a business incubator Slesarev M.A., Professor at the Department of Management, Marketing and Foreign Economic Affairs, MGIMO 1. Concept of a business incubator and its types Business incubator — an organization that aims is to support new small en- terprises and entrepreneurs who, due to lack of financial resources, lack of experi- ence and (or) qualifications, are not able to implement their projects outside the busi- ness incubator. According to the international classification, business incubators are divided into university and non-university (traditional) models. Traditional services of a business incubator services: provision of a working space equipped with furniture, computers, communi- cations and office equipment, on preferential rental terms; provision of common areas (meeting rooms, rooms for meetings and trainings, kitchen space, etc.); provision of paid, preferential or free basic services, such as secretarial ser- vices, administration, accounting and management accounting, Internet ac- cess; project expertise, assistance in writing a business plan; consulting services on various aspects of business activity; involvement of external specialists and mentors, professional development and training services (thematic seminars and trainings); services for the protection and valuation of intellectual property, licensing and certification of innovative products; assistance in obtaining bank loans, providing guarantees for banks, attracting venture funds and business angels; “Packaging” of projects for investors: design and preparation of presentation materials, organization of exhibitions and presentations (pitches) of projects and other services. According to the methodology of the MGIMO Innovation and Business Incu- bation Development Fund (FIBI), the general characteristics of a business incubator should include the area, number of staff, as well as industry specialization and the specificities of client work (for example, participation in the authorized capital).