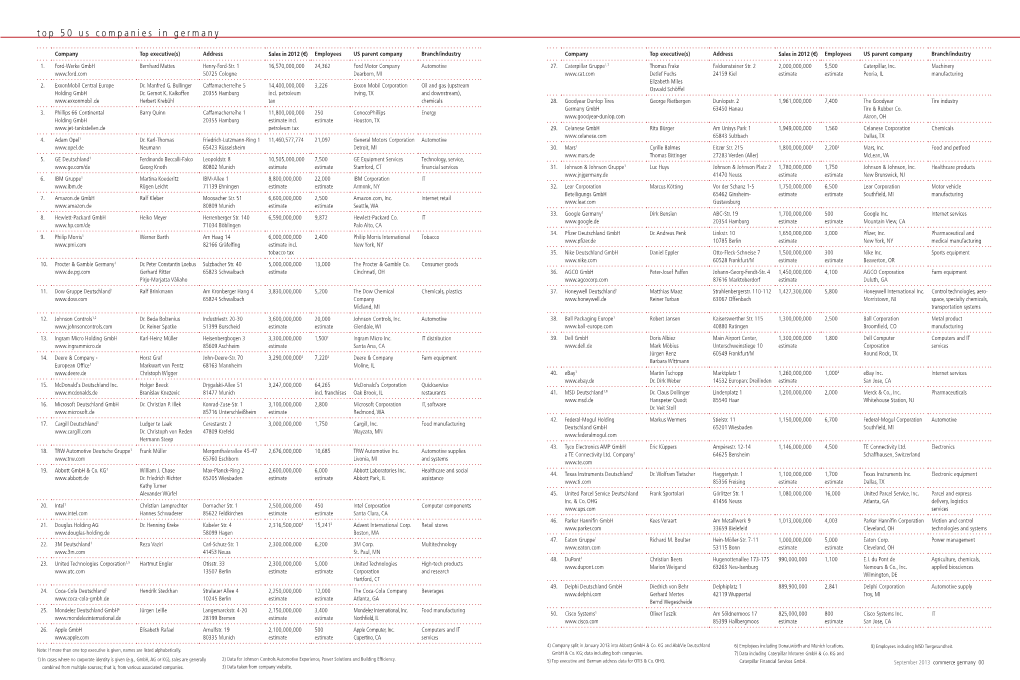

Top 50 Us Companies in Germany

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kion Group Ag 2016 [Pdf, 1.4

A NEW ERA This annual report is available in German and English. Only the content of the German version is authoritative. KION GROUP AG, Wiesbaden STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2016 € Notes 31/12/2016 31/12/2015 A. Non-Current Assets (3) Property, plant and equipment 145,428.39 216,259.58 Investments in affiliated companies 4,474,412,891.16 2,005,932,650.00 4,474,558,319.55 2,006,148,909.58 B. Current Assets I. Receivables and other assets (4) 1. Receivables from affiliated companies 965,752,435.23 243,601,512.08 2. Receivables from related companies 174,664.14 0.00 3. Other assets 8,119,209.80 5,205,087.06 974,046,309.17 248,806,599.14 II. Credit balances with banks 56,715,095.93 12,203.61 Total assets 5,505,319,724.65 2,254,967,712.33 € Notes 31/12/2016 31/12/2015 A. Equity (5) I. Subscribed capital 108,790,000.00 98,900,000.00 Treasury shares -164,486.00 -160,050.00 Issued capital 108,625,514.00 98,739,950.00 II. Capital reserves 2,465,553,486.47 2,015,727,529.03 III. Retained earnings 139,053,326.98 9,903,326.98 IV. Distributable profit 129,236,004.00 76,100,000.00 2,842,468,331.45 2,200,470,806.01 B. Provisions 1. Retirement benefit obligation (6) 20,319,088.00 13,515,388.00 2. Tax provisions 4,138,079.75 54.49 3. -

Financial Report Kirk Beauty One Gmbh Th As at September 30 2015

Financial Report Kirk Beauty One GmbH th as at September 30 2015 Financial Report – Important Notice | 1 Content Important Notice .............................................................................................. 2 Disclosure Regarding Forward-Looking Statements ........................................... 3 Risk Factors ...................................................................................................... 5 Management’s Discussion and Analysis of Financial Condition and Results of Operations ..................................................................................................... 34 Business ......................................................................................................... 60 Management ................................................................................................. 91 Description of Certain Financing Arrangements .............................................. 93 Certain Definitions ......................................................................................... 98 Unaudited Pro Forma Financial Information ................................................. 101 Consolidated Financial Statements ................................................................ F-1 Consolidated Statement of Comprehensive Income F-2 Consolidated Balance Sheet F-4 Statement of Changes in Group Equity F-6 Consolidated Cash Flow Statement F-8 Segment Reporting F-9 Notes to the Consolidated Financial Statements F-11 The consolidated statements have been prepared in millions -

The Inventory of the Michael Douglas Collection #1839

The Inventory of the Michael Douglas Collection #1839 Howard Gotlieb Archival Research Center Douglas, Michael #1839 3/31/16, 4/7/16 Preliminary Listing I. Wardrobe. A. Costumes. Box 1-2 1. “The American President.” Box 3-8 2. “Behind the Candelabra.” Box 9 3. “Disclosure.” 4. “A Perfect Murder.” 5. “Romancing The Stone.” Box 9-14 6. “The Game.” Box 15-20 7. “The In-Laws.” Box 21-25 8. “It Runs In The Family.” Box 26 9. “Jewel Of The Nile.” Box 27-32 10. “Traffic.” Box 33-37 11. “Wonder Boys.” Box 38 12. “Wall Street.” B. Hanging Costumes. Pkg. 1-2 1. “The American President.” Pkg. 3-35 2. “Behind the Candelabra.” Pkg. 36-57 3. “The Game.” Pkg. 58-78 4. “The In-Laws.” Pkg. 79-116 5. “It Runs In The Family.” Pkg. 117 6. “Wall Street.” Box 39-56 C. Personal. Pkg. 118-124 D. Hanging Personal. II. Printed Materials. A. Files. Box 57-88 1. Clippings (not on their spreadsheets). Box 88 2. General. B. Blueprints/Maps. C. Internet printouts. D. Postcards. Box 89-91 E. Magazines. Box 92-94 F. Programs. Box 95 G. Newspapers. Box 95-96 H. Reviews. Box 96 I. Clippings. J. Booklets. K. Pamphlets. L. Fliers. Box 97 M. Posters. Pkg. 125-141 N. Oversized posters. Douglas, Michael (3/31/16, 4/7/16) Page 1 of 46 III. Film and Video. Box 98-131 A. VHS. Box 131 B. 8 mm cassettes. C. Mini-DVs. Box 132 D. DV-Cams. Box 133 E. DVDs. Box 134 F. -

BW Confidential Team At

www.bwconfidential.com The inside view on the international beauty industry March 5 - April 1, 2015 #108 CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL Comment Inside The buzz 2 Version X News roundup he number of new fragrance launches continues to rise Netwatch 6 Tand stood at 1,620 in 2014, according to the latest edition of fragrance guide Fragrances of the World 2015 Social media monitor by industry expert Michael Edwards. However, the pace of new introductions slowed somewhat last year. In women’s Interview 7 fragrance, the number of launches in 2014 dropped to Gebr Heinemann purchasing & 925 compared with 968 in 2013. The niche category, logistics executive director Kay Spanger which is fast becoming saturated, also saw a slight decline in launches with 448 new products in 2014, against 540 Insight 9 in 2013. European perfumeries But the number of flankers continues to rise—a total of 275 were introduced last year— as brands looked to capitalize on existing ranges rather than take the risk of introducing a Store visit 13 completely new franchise. Yves Rocher, France While most bemoan the number of launches, the newness factor is unlikely to go away. No matter what the industry, from mobile phones to tablets, consumers are looking for the latest new thing. The only difference is that in many other sectors the latest product often boasts a new technological feature or interesting update, while in fragrance, consumers will be offered a lighter or more intense version of a scent that came out a year earlier. The question is whether version x of a well-known scent is compelling enough for consumers to part with their cash and make a purchase. -

Realizing Potential

REALIZING POTENTIAL GLOBAL HIGHLIGHTS REVIEW 2013/14 CONTENTS 01 Introduction HOW WE PERFORMED 02 Our year in numbers 04 Message from our partners 06 Business review 08 Sector focus: Business and Financial Services 09 Case studies: InverCap Holdings and Vantiv 10 Sector focus: Healthcare 11 Case studies: American Heart of Poland (AHP) and Mediq 12 Sector focus: Industrial 13 Case studies: Ocensa and Oxea 14 Sector focus: Retail, Consumer and Leisure 15 Case studies: The Coffee Bean & Tea Leaf and DOUGLAS Holding 16 Sector focus: Technology, Media and Telecoms (TMT) 17 Case studies: KMD and P2 Energy Solutions 18 Portfolio company listing 19 Advent investing in communities: CARE Hospitals ABOUT US 20 Advent at a glance 22 Environment, social and governance 24 The partnership 25 Advent offices Important Notice All data supplied is as of March 31, 2014 unless otherwise stated. Figures with a $ are in US dollars. NOT AN OFFER These materials are not an offer to sell any securities or a solicitation of an offer to buy any securities. Any offer or solicitation relating to the securities of one or more investment funds (the “Advent Funds”) managed or advised by Advent International Corporation (“Advent International”) may only be made by delivery of a Private Placement Memorandum of such Advent Fund and only where permitted by law. PAST PERFORMANCE Past performance is not indicative of future performance, and there can be no assurance that the Advent Funds will achieve comparable results in the future. PROJECTIONS AND FUTURE PERFORMANCE These materials may include information about prior performance and projections of anticipated future performance or results of one or more Advent Funds (including, without limitation, one or more investments made by the Advent Funds) and other forward-looking statements. -

České Dráhy V Commission

6.8.2018 EN Official Journal of the European Union C 276/41 2. Dismisses the action as to the remainder; 3. Orders each party to bear its own costs. (1) OJ C 314, 29.8.2016. Judgment of the General Court of 26 June 2018 — Sicignano v EUIPO — IN.PRO.DI (GiCapri ‘a giacchett’e capri’) (Case T-619/16) (1) (EU trade mark — Opposition proceedings — Application for EU figurative mark GiCapri ‘a giacchett’e capri’ — Earlier EU figurative mark CAPRI — Relative ground for refusal — Likelihood of confusion — Article 8(1)(b) of Regulation (EC) No 207/2009 (now Article 8(1)(b) of Regulation (EU) 2017/1001)) (2018/C 276/68) Language of the case: Italian Parties Applicant: Pasquale Sicignano (Santa Maria la Carità, Italy) (represented by: A. Masetti Zannini de Concina, M. Bucarelli and G. Petrocchi, lawyers) Defendant: European Union Intellectual Property Office (EUIPO) (represented by: L. Rampini and J. Crespo Carillo, acting as Agents) Other party to the proceedings before the Board of Appeal of EUIPO: Inghirami Produzione Distribuzione SpA (IN.PRO.DI) (Milan, Italy) Re: Action brought against the decision of the Fifth Board of Appeal of EUIPO of 2 June 2016 (Case R 806/2015-5), relating to opposition proceedings between IN.PRO.DI and Mr Sicignano. Operative part of the judgment The Court: 1. Dismisses the action; 2. Orders Mr Pasquale Sicignano to pay the costs. (1) OJ C 392, 24.10.2016. Judgment of the General Court of 20 June 2018 — České dráhy v Commission (Case T-621/16) (1) (Competition — Administrative procedure — Decision ordering an inspection — Inspection ordered on the basis of information obtained from a separate inspection — Proportionality — Obligation to state reasons — Right to respect for private life — Rights of defence) (2018/C 276/69) Language of the case: Czech Parties Applicant: České dráhy a.s. -

Financial Statements 2019 Kion Group Ag

DIGITALISATION ENERGY AUTOMATION SHAPING INNOVATION THE FUTURE FINANCIAL STATEMENTS 2019 KION GROUP AG PERFORMANCE This annual report is available in German and English. Only the content of the German version is authoritative. KION GROUP AG, Frankfurt am Main _________________________________________________________________________________ Statement of financial position as at 31 December 2019 Assets € thousand Notes 31.12.2019 31.12.2018 A. Non-current assets [3] I. Intangible assets 1 1 II. Property, plant and equipment 2,834 3,317 III. Financial assets 4,231,227 4,231,227 4,234,061 4,234,544 B. Current assets I. Receivables and other assets [4] 1. Receivables from affiliated companies 3,389,008 3,303,674 2. Receivables from other long-term investees and investors 190 227 3. Other assets 16,537 17,745 3,405,734 3,321,646 II. Cash on hand and credit balances with banks 40,651 18,323 C. Deferred charges 11 0 Total Assets 7,680,457 7,574,514 KION GROUP AG, Frankfurt am Main _________________________________________________________________________________ Statement of financial position as at 31 December 2019 Equity and liabilities € thousand Notes 31.12.2019 31.12.2018 A. Equity [5] I. Subscribed capital 118,090 118,090 Treasury shares -131 -166 Issued capital 117,959 117,924 II. Capital reserves 3,058,841 3,057,214 III. Other revenue reserves 498,303 494,803 IV. Distributable profit 153,522 141,669 3,828,626 3,811,611 B. Provisions 1. Retirement benefit obligation [6] 47,366 39,328 2. Tax provisions 44,319 23,217 3. Other provisions [7] 33,375 22,885 125,060 85,430 C. -

April 2018 M&A and Investment Summary

April 2018 M&A and Investment Summary Table of Contents 1 Overview of Monthly M&A and Investment Activity 3 2 Monthly M&A and Investment Activity by Industry Segment 9 3 Additional Monthly M&A and Investment Activity Data 41 4 About Petsky Prunier 55 Securities offered through Petsky Prunier Securities, LLC, member of FINRA. This M&A and Investment Summary has been prepared by and is being distributed in the United States by Petsky Prunier, a broker dealer registered with the U.S. SEC and a member of FINRA. 2 | M&A and Investment Summary April 2018 M&A and Investment Summary for All Segments Transaction Distribution ▪ A total of 657 deals were announced in April 2018, of which 310 were worth $35.5 billion in aggregate reported value • April was the most active month of the past 36 months, highlighted by record activity in the Business & IT Services and Agency & Marketing Services segments ▪ Software was the most active segment with 224 deals announced— 132 of these transactions reported $15.6 billion in value ▪ Digital Media/Commerce was also active with 133 transactions, 79 of which were worth a reported $7.7 billion ▪ Strategic buyers announced 322 deals (48 reported $9.0 billion in value) ▪ VC/Growth Capital investors announced 298 transactions (255 reported $16.0 billion in value) ▪ Private Equity investors announced 40 deals during the month (seven reported $10.4 billion in value) April 2018 BUYER/INVESTOR BREAKDOWN Transactions Reported Value Strategic Buyout Venture/Growth Capital # % $MM % # $MM # $MM # $MM Software 224 34% $15,602.9 44% 73 $4,751.5 11 $5,398.1 140 $5,453.3 Digital Media/Commerce 133 20% 7,626.0 22% 49 465.6 5 1,196.7 79 5,963.7 Business Services 99 15% 4,433.8 13% 69 571.1 16 3,764.3 14 98.3 Marketing Technology 88 13% 2,288.4 6% 37 989.9 4 - 47 1,298.5 Agency & Marketing Services 45 7% 295.8 1% 41 295.8 2 - 2 - Traditional Media 31 5% 839.9 2% 27 542.9 0 - 4 297.0 *Note, transactions valued at $6 billion or more have been excluded from totals to limit comparative distortions. -

ANGEBOTSUNTERLAGE Freiwilliges Öffentliches Übernahmeangebot

Pflichtveröffentlichung gemäß §§ 34, 14 Abs. 2 und 3 des deutschen Wertpapiererwerbs- und Übernahmegesetzes (WpÜG) Aktionäre der DOUGLAS HOLDING AG insbesondere mit Wohnsitz, Sitz oder gewöhnlichem Aufenthalt außerhalb der Bundesrepublik Deutschland sollten die „ALLGEMEINEN INFORMATIONEN UND INFOR- MATIONEN FÜR AKTIONÄRE INSBESONDERE MIT WOHNSITZ, SITZ ODER GEWÖHNLICHEM AUFENTHALT AUSSERHALB DER BUNDESREPUBLIK DEUTSCHLAND“ in Abschnitt 1 sowie „WICHTIGE HINWEISE FÜR US-AKTIONÄRE“ in Abschnitt 21 dieser Angebotsunterlage besonders beach- ten. A N G E B O T S U N T E R L A G E Freiwilliges öffentliches Übernahmeangebot (Barangebot) der Beauty Holding Three AG Beim Strohhause 27 20097 Hamburg Deutschland an die Aktionäre der DOUGLAS HOLDING AG Kabeler Straße 4 58099 Hagen Deutschland zum Erwerb aller auf den Inhaber lautenden Stückaktien an der DOUGLAS HOLDING AG zum Preis von EUR 38,00 je Aktie Annahmefrist: 31. Oktober 2012 bis 4. Dezember 2012, 24:00 Uhr (Ortszeit Frankfurt am Main) / 18:00 Uhr (Ortszeit New York) Douglas-Aktien: ISIN DE0006099005 Zum Verkauf eingereichte Douglas-Aktien: ISIN DE000A1RFM86 Nachträglich zum Verkauf eingereichte Douglas-Aktien: ISIN DE000A1RFM94 INHALTSVERZEICHNIS 1. ALLGEMEINE INFORMATIONEN UND INFORMATIONEN FÜR AKTIONÄRE INSBESONDERE MIT WOHNSITZ, SITZ ODER GEWÖHNLICHEM AUFENTHALT AUSSERHALB DER BUNDESREPUBLIK DEUTSCHLAND ............................................... 1 1.1 Rechtsgrundlagen – Durchführung des freiwilligen Angebots nach den Vorschriften des deutschen Wertpapiererwerbs- und Übernahmegesetzes -

Success-Story GK/Retail Bei Parfümerie Douglas

Success Story GK/Retail für Douglas Die Herausforderung Die GK/Retail Suite ist die ganzheitliche Lösung der GK SOFTWARE AG für den Store mit all seinen Wechselbeziehungen innerhalb von Filialunter - _Eine einheitliche Lösung für 1.000 Douglas-Par- nehmen. Mit mehr als 140.000 Installationen in über 30 Ländern ist GK/ fümerien in 18 Ländern Retail die marktführende Java-Lösung in Europa. Die modularen Lösungen _Senkung der TCO durch Reduzierung von War- der GK/Retail Suite ermöglichen den kompletten Filialbetrieb vom POS tung und Support über Backoffice, mobile Geräte, Workflow bis hin zur Zentrale und inte- _Fiskalisierung (Hardware/Software) grieren effizient alle Subsysteme im Store. Führende Einzelhändler, wie _Abbildung der Douglas-Card-Funktionalitäten Coop (Schweiz), EDEKA, Galeria Kaufhof, Lidl, Netto Marken-Discount, Tchi- _Anbindung eines externen CRM-Systems bo, Telekom-Shops oder Jysk Nordic vertrauen seit Jahren auf die Lösun- _Integration von Lufthansa Miles & More gen der GK SOFTWARE AG, wenn es darum geht, ihre Filialprozesse auf _Abbildung unterschiedlicher Rabattaktionen in den verschiedenen Ländern höchstem Niveau zu steuern. _24-Stunden-Betriebskonzept Parfümerie Douglas, ein Mitglied der Douglas Holding, entschied sich _EFT-Anbindung 2005 auf Lösungen aus der GK/Retail Suite zu setzen, um sein europäi- sches Filialnetz mit einer einheitlichen Filiallösung neu auszurichten. Die Die Lösung Einführung von GK/Retail bei Douglas Parfümerie International gehört zu den größten europaweiten POS-Projekten. _GK/Retail POS Touch (nativ 1024x768) mit GUI im firmeneigenen Corporate Design Das Projekt wurde mit meh- _GK/Retail Backoffice reren Awards ausgezeich- _GK/Retail StoreWeaver-Komponenten für Anbin- net: dung CRM-System, Lufthansa Miles & More Best In-Store Solution Best International Solution _GK/Retail Storemanager für Parametrisierung 2008 2009 und Monitoring Douglas macht das Leben schöner Europas Parfümerie Nr. -

6. Information About the Board Directors Whose Appointment Is Proposed to the Annual Shareholders' Meeting

ADC_VA_V7 05/04/2018 15:56 Page18 Information about the Board directors whose ratification, re-appointment or appointment is proposed to the Shareholders' Meeting INFORMATION ON THE BOARD DIRECTORS Ratification of the co-opting Anne-Marie Idrac Expertise and professional experience Anne- Marie Idrac graduated from the Paris Institute of Political Studies (Institut d’Études Politiques), the National School of Administration (École Nationale d’Administration) and the Institute of Higher Learning in National Defense (Institut des Hautes Etudes de Défense Nationale). She has spent most of her career working in the fields of the environment, housing, urban development and transport. She was chief executive office at the Public Development Agency of Cergy-Pontoise, director of land transportation at the Ministry of Equipment and Transport and subsequently Secretary of State for Transport. She occupied the positions of Chair and CEO of the RATP (Paris Public Transport Authority) from 2002 to 2006, and Chair and CEO of the SNCF (French State Railways) from 2006 to 2008. She was a Member of Parliament from 1997 to Independent director 2002, and Secretary of State for Foreign Trade from 2008 to 2010. Anne-Marie Idrac is currently board Born July 27, 1951 director of companies. First appointed as a Board Other directorships and offices Directorships and offices held in the last five director: years and having expired November 2, 2017 French companies Expiration date of current — President of Aéroport de Toulouse- Blagnac French company term of office: Supervisory Board (this function will expire in — Member of the Supervisory Board of Vallourec (1) 2021 Shareholders’ Meeting May 2018); until 2015. -

Corporate Governance Germany

WWW.ICGG.BIZ issue 02/2012 INSIGHT corporate governance germany Essential: Information, Analysis and Opinion for Investment Professionals, Advisers and Academics CONTENTS 02 COMPANIES 15 CAMPUS Douglas out of the stock market? High pensions for DAX board members 03 BUHLMANN’S CORNER 17 HARTmuT VENNEN AND MARKUS WEIK 06 ACTIONS CORNER Compliance must be lived 08 AGM DATES 19 CAPITAL NEWS Buying & Selling in January 09 POLITICS GCGC wants independent supervisory board 19 DIRECTORS´ DEALINGS members 20 INSIGHT SHAREHOLDFER ID 11 REINHARD EYRING AND 38 INVESTORS INFORMATION PHILIP CAVAILLÉS Your IR contacts in the Prime Bearer and registered shares in the light of 42 READING SUGGESTIONS the 2012 company-law amendment 42 EVENTS DIARY 14 PEOPLE 43 INDEXES OF COMPANIES Enders becomes EADS CEO AND PERSONS 01 INSIGHT corporate Governance Germany companies Douglas to go private? The Douglas retail group (Douglas perfumeries, be known in mid January. There were so far no Thalia bookstores, Christ jewellers and Hussel binding offers, however, nor is the structure or sweetshops) is according to the will of the foun- financing of any acquisition clarified. The deal ding family Kreke to be rebuilt and streamlined. is still in the concept phase, signalled CEO and The Krekes, who hold about 12.62 percent of the founder’s son Henning Kreke. If it were possible, shares in the trade group, have announced that to- however, to buy Douglas completely through a gether with the allied Oetker family (25.81 percent financial investor, the company, undervalued in of the Douglas shares), they wish to raise their sta- Kreke’s eyes, could sooner or later be taken off ke in the company.