Building a Targeting System for Bangladesh Based on Proxy Means Testing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

12. FORMULATION of the URBAN TRANSPORT MASTER PLAN Development of the RSTP Urban Transportation Master Plan (1) Methodology

The Project on The Revision and Updating of the Strategic Transport Plan for Dhaka (RSTP) Final Report 12. FORMULATION OF THE URBAN TRANSPORT MASTER PLAN Development of the RSTP Urban Transportation Master Plan (1) Methodology The development of the RSTP Urban Transportation Master Plan adopted the following methodology (see Figure 12.1): (i) Elaborate the master plan network through a screen line analysis by comparing the network capacity and future demand. (ii) Identify necessary projects to meet future demand at the same time avoiding excessive capacity. (iii) Conducts economic evaluation of each project to give priority on projects with higher economic return. (iv) Conduct preliminary environmental assessment of every project and consider countermeasures against environmental problems, if any. (v) Make a final prioritization of all physical projects by examining their respective characteristics from different perspectives. (vi) Classify the projects into three categories, namely short-, medium- and long-term projects, by considering the financial constraints. (vii) Prepare an action plan for short-term projects together with “soft” measures. Mid-term Project Source: RSTP Study Team Figure 12.1 Development Procedure for the Master Plan 12-1 The Project on The Revision and Updating of the Strategic Transport Plan for Dhaka (RSTP) Final Report (2) Output of the Transportation Network Plan The RSTP urban transportation network plan was developed based on a review and a modification of the STP network plan. The main points of the modification or adoption of the STP network master plan are as follows: i. Harmonization with future urban structure, land-use plan and development of network plan. -

Connecting Bangladesh: Economic Corridor Network

Connecting Bangladesh: Economic Corridor Network Economic corridors are anchored on transport corridors, and international experience suggests that the higher the level of connectivity within and across countries, the higher the level of economic growth. In this paper, a new set of corridors is being proposed for Bangladesh—a nine-corridor comprehensive integrated multimodal economic corridor network resembling the London Tube map. This paper presents the initial results of the research undertaken as an early step of that development effort. It recommends an integrated approach to developing economic corridors in Bangladesh that would provide a strong economic foundation for the construction of world-class infrastructure that, in turn, could support the growth of local enterprises and attract foreign investment. About the Asian Development Bank COnnecTING BANGLADESH: ADB’s vision is an Asia and Pacific region free of poverty. Its mission is to help its developing member countries reduce poverty and improve the quality of life of their people. Despite the region’s many successes, it remains home to a large share of the world’s poor. ADB is committed to reducing poverty through inclusive economic growth, environmentally sustainable growth, and regional integration. ECONOMIC CORRIDOR Based in Manila, ADB is owned by 67 members, including 48 from the region. Its main instruments for helping its developing member countries are policy dialogue, loans, equity investments, guarantees, grants, NETWORK and technical assistance. Mohuiddin Alamgir -

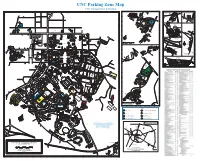

UNC Parking Zone Map UNC Transportation & Parking

UNC Parking Zone Map UNC Transportation & Parking Q R S T U V W X Y Z A B C D E F G H I J K L M N O P 26 **UNC LEASES SPACE CAROLINA . ROAD IN THESE BUILDINGS 21 21 MT HOMESTEAD NORTH LAND MGMT. PINEY OPERATIONS CTR. VD. (NC OFFICE HORACE WILLIAMS AIRPORT VD., HILL , JR. BL “RR” 41 1 1 Resident 41 CommuterRR Lot R12 UNC VD AND CHAPEL (XEROX) TE 40 MLK BL A PRINTING RIVE EXTENSION MLK BL ESTES D SERVICES TIN LUTHER KING TERST PLANT N O I AHEC T EHS HOMESTEAD ROAD MAR HANGER VD. 86) O I-40 STORAGE T R11 TH (SEE OTHER MAPS) 22 22 O 720, 725, & 730 MLK, JR. BL R1 T PHYSICAL NOR NORTH STREET ENVRNMEN HL .3 MILES TO TH. & SAFETY ESTES DRIVE 42 COMMUTER LOT T. 42 ER NC86 ELECTRICAL DISTRICENTBUTION OPERATIONS SURPLUS WA REHOUSE N1 ST GENERAL OREROOM 2 23 23 2 R1 CHAPEL HILL ES MLK JR. BOULE NORTH R1 ARKING ARD ILITI R1 / R2OVERFLOW ZONEP V VICES C R A F SHOPS GY SE EY 43 RN 43 ENERBUILDING CONSTRUCTION PRITCHARD STREET R1 NC 86 CHURCH STREET . HO , JR. BOULE ES F R1 / V STREET SER L BUILDING VICE ARD A ST ATIO GI EET N TR AIRPOR R2 S T DRIVE IN LUTHER KING BRANCH T L MAR HIL TH WEST ROSEMARY STREET EAST ROSEMARY STREET L R ACILITIES DRIVE F A NO 24 STUDRT 24 TH COLUMBI IO CHAPE R ADMINIST OFF R NO BUILDINGICE ATIVE R10 1700 N9 MLK 208 WEST 3 N10 FRANKLIN ST. -

Grand Trunk Road Improvement Project

NATIONALHIGHWAYS AUTHORITY OFINDIA NotMm Trmk ROL" in Mncit inba (bp( M&%p&uryon) Public Disclosure Authorized Grand Trunk Road Improvement Project Environmentl Management Plan Package IVA t \' ~~N4rChzT">k Rouh5G E432 C -, Volume 10 Public Disclosure Authorized Northws Tnk Read r- 1I O iCeftury 'a , ,¢,,-t4 (G.T. Road) ;-Robad 1`44twofit S t s. / Public Disclosure Authorized l ; /h-r r' d (2007aA.d.) Propoead TrUOl4NU Mpoi -~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~- Public Disclosure Authorized / ~~FIL1E GOPY i ; _~ ss Siouth Asia Pvt. 'Ltd.- -- _ AQVS WJ 99 ........-----------..-.... .Nd SaN.VaNv 1nuinoLLsoH 5 S.C LI 99.................................... I................................................................... NION3 1 4 VICv 1, S9... --- --- ------- ------ '-'-'S3UUiOnW.S NOIUV9 ZVCL' pg.....................-........ I.......-..............----.--.-----.....-''........ ONIUM d0N'33 1 19 .-.--.--..-- ---- --- ----- --- - - W3O803NI3j B'£V' I 85'9 ',.. ,..... .------- '-'''-'-(DNWILLlH9 VHV NIELN~3o)WOUM flS0ISC 8 £ I 99. .............................-.....................-----..-..............................nS NOM Y3ON03 L£ i, -- 'oSM .S---- SMIDISI 9~£ I .ZSilO ~~~~3soo~~~~~00dI~~~~~ dYwvc1 SC £ I 19 ... s~3juINmB~ Z£C 1 Z9., . I........"I,,'-",.. - - - ........- b1V'-'sMS-flre VCV i, .- _ _ - OM-J.N3VE14IN WJN3V4NOAEN3 U0 SNLVOIO CII 94..n-------------------------- SIN3V31N33N*f~VN3 1VldAj -- Z. [K[ s., ... .. ...... .. ... .-......- ......... sno100W dN Zs -................................................................- ONMON -

Resettlement Plan (Draft)

Resettlement Plan (Draft) Document Stage: Draft Project Number: 45203-006 August 2016 Bangladesh: Natural Gas Infrastructure and Efficiency Improvement Project Prepared by Gas Transmission Company Limited (GTCL), company under the Bangladesh Oil, Gas and Minerals Corporation (Petrobangla) of the Government of Bangladesh for the Asian Development Bank CURRENCY EQUIVALENTS (as of August 2016) Currency unit – Taka (Tk) Tk1.00 = $0.01277 $1.00 = Tk78 NOTE (i) The fiscal year of the Government of Bangladesh and its agencies ends on 30 June. (ii) In this report, "$" refers to US dollars. Weights and Measures 1 ha – 2.47 acre 1 ha – 10,000 sq.m 1 acre – 100 decimal Abbreviations AB Acquiring Body AC Assistant Commissioner (Land) ADB Asian Development Bank ADC Additional Deputy Commissioner AH Affected household AP Affected person APD Additional Project Director BBS Bangladesh Bureau of Statistics BGFCL Bangladesh Gas Fields Company Limited BFD Bangladesh Forest Department CBE Commercial and Business Enterprise CCL Cash Compensation under Law CEGIS Center for Environmental and Geographic Information Services CEO Chief Executive Officer CLARP Consolidated Land Acquisition and Resettlement Plan CMP Current Market Price CPR Common Property Resources CROW Construction Right-of-Way CSC Construction Supervision Consultant DAE Department of Agriculture Extension DC Deputy Commissioner DCI Direct Calorie Intake DoF Department of Fisheries EA Executing Agency EC Entitlement Card EP Entitled Person ERD Economic Relations Division ESDU Environment and Social -

Factors Influencing Farmers' Awareness on Environmental Hazards Caused by Rice Monoculture

J. Bangladesh Agril. Univ. 2(1): 55-62,2004 . ISSN 1810-3030 Factors influencing farmers' awareness on environmental hazards caused by rice monoculture A.H. Chowdhury Lecturer, Department of Agricultural Extension Education, BAU, Mymensingh Abstract This purposive study was undertaken to examine the factors associated with farmers' awareness on environmental hazards caused by rice monoculture and ascertain the factors contribute to their awareness. Char ishardia village of Mymensingh sadar upazila and Tulatuli village of Sonagazi upazila, Feni were purposively selected as traditional and progressive village respectively. Data were collected from the randomly selected sample e.g. 96 farmers 48 form each village using a pre-tested structured interview schedule during March and July 2003. About half (54percent) of the respondents had high awareness on environmental hazards of rice monoculture compared to 30 percent low awareness. Farmers of progressive village had more average level of education, family size, training exposure, knowledge of diversified crop cultivation, cosmopoliteness, extension media contact, and innovativeness than those of traditional village. Out of ten selected characteristics, level of education, knowledge of diversified crop cultivation, cosmopoliteness and innovativeness were positively related with the awareness while family size was negatively related. Three factors namely knowledge of diversified crop cultivation, family size and level of education contributed significantly to the farmers' awareness considering both the villages while innovativeness together _with the former two factors mentioned contributed to the awareness considering progressive village. On the other hand, only two factors such as knowledge of diversified"crop cultivation and level of education contributed in predicting awareness of the farmers of traditional village. -

Natural Gas Infrastructure and Efficiency Improvement Project: Component 2

External Social Safeguard Monitoring First Progress Report Project No. 45203-006 Semestral Report December 2018 Bangladesh: Natural Gas Infrastructure and Efficiency Improvement Project (Component 2 – Chittagong-Bakhrabad Gas Transmission Pipeline) Prepared by Md. Abdus Samad for the Gas Transmission Company Limited, Government of Bangladesh and the Asian Development Bank. This social safeguard monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. Gas Transmission Company Limited (A Company of Petrobangla) Government of the People’s Republic of Bangladesh Ministry of Power, Energy & Mineral Resources Energy & Mineral Resources Division External Monitoring Expert Services to carry out the External Monitoring & Evaluation (M&E) and reporting of the Implementation of Resettlement Action Plan (RAP) under the “Construction of Chattogram-Feni-Bakhrabad Gas Transmission Parallel Pipeline Project” 1st Progress Report December, 2018 Submitted to 1. Mr. Yoojung Jang- Social Development Specialist 2. Mr. Hong Wei Zhang- Senior Finance Specialist Asian Development Bank For Construction of Chittagong-Feni-Bakhrabad Gas Transmission Parallel Pipeline Project Ref: Contract No. GTCL- SD3 Dated 9th August, 2018 between Gas Transmission Company Limited (GTCL) and Md. Abdus Samad, the Individual Consultant ( External Monitoring Expert) for the implementation of Resettlement Action Plan (RAP) under “Construction of Chattogram-Feni-Bakhrabad Gas Transmission Parallel Pipeline Project” Submitted by Md. -

Strategic Urban Transport Master Plan (P155253)

Public Disclosure Authorized Chittagong Strategic Urban Transport Master Plan (P155253) Public Disclosure Authorized Strategic Urban Transport Master Plan 24 November, 2018 Public Disclosure Authorized Prepared by: Prepared for: e.Gen Consultants Ltd., Bangladesh Public Disclosure Authorized in association with Integrated Transport Planning Ltd, United Kingdom Table of Contents 1. Introduction .................................................................................................................... 1 1.1 Study area ................................................................................................................................... 1 1.2 Reports produced ...................................................................................................................... 3 1.3 Data collection ........................................................................................................................... 3 1.4 Layout of this document .......................................................................................................... 4 2. Urban development ..................................................................................................... 6 2.1 Urban structure.......................................................................................................................... 6 2.2 Employment ............................................................................................................................. 10 2.3 Future growth ......................................................................................................................... -

Land Resource Appraisal of Bangladesh for Agricultural

BGD/81/035 Technical Report 3 Volume II LAND RESOURCES APPRAISAL OF BANGLADESH FOR AGRICULTURAL DEVELOPMENT REPORT 3 LAND RESOURCES DATA BASE VOLUME II SOIL, LANDFORM AND HYDROLOGICAL DATA BASE A /UNITED NATIONS DEVELOPMENT PROGRAMME FAo FOOD AND AGRICULTURE ORGANIZATION vJ OF THE UNITED NATIONS BGD/81/035 Technical Report 3 Volume II LAND RESOURCES APPRAISAL OF BANGLADESH FOR AGRICULTURALDEVELOPMENT REPORT 3 LAND RESOURCES DATA BASE VOLUME II SOIL, LANDFORM AND HYDROLOGICAL DATA BASE Report prepared for the Government of the People's Republic of Bangladesh by the Food and Agriculture Organization of the United Nations acting as executing agency for the United Nations Development Programme based on the work of H. Brammer Agricultural Development Adviser J. Antoine Data Base Management Expert and A.H. Kassam and H.T. van Velthuizen Land Resources and Agricultural Consultants UNITED NATIONS DEVELOPMENT PROGRAMME FOOD AND AGRICULTURE ORGANIZATION OF THE UNITED NATIONS Rome, 1988 The designations employed and the presentation of material in this publication do not imply the expression of any opinion whatsoever on the part of the Food and AgricultureOrganization of the United Nations concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. All rights reserved. No part of this publication may be reproduced, stored ina retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopyingor otherwise, without the prior perrnission of (he copyright owner. Applications for such permission,with a statement of the purpose and extent of the reproduction, should be addressedto the Director, Publications Division, Food and Agriculture Organization of the United Nations, Viadelle Terme di Caracarla, 00100 Home, Italy. -

Bangladesh Agron

Bangladesh Agron. J. 2015, 18(1): 89-98 GROWTH, YIELD AND QUALITY OF WHEAT VARITIES AS AFFECTED BY DIFFERENT LEVELS OF NITROGEN H. Mondal1, S. Mazumder2, S. K. Roy3, T. A. Mujahidi4 and S. K. Paul5 1Department of Agronomy, Sher-e-Bangla Agricultural University, Dhaka-1207, Bangladesh 2Sher-e-Bangla Nagar Adorsha Mohila College, Dhaka-1207, Bangladesh, 3Department of Genetics and Plant Breeding, Sher-e-Bangla Agricultural University, Dhaka-1207, Bangladesh 4Plant Breeding Division, Bangladesh Agricultural Research Institute, Joydebpur, Gazipur-1701, Bangladesh 5Agronomy Division, Bangladesh Agricultural Research Institute, Joydebpur, Gazipur-1701, Bangladesh. E-mail: [email protected] Key Words: Wheat variety, Nitrogen, Protein, Grain quality Abstract A field experiment was conducted at the experimental field of Sher-e-Bangla Agricultural University, Dhaka, Bangladesh during November 2012 to March 2013 to evaluate the response of three (3) wheat varieties viz., BARI Gom23, BARI Gom24 and BARI Gom25 under four levels of nitrogen fertilizer i.e, 75, 100, 125 and 150 kg N ha-1. The experiment was laid out in Randomized Complete Block Design (RCBD) with three replications. Results showed that plant height, number of leaves plant-1, leaf length and dry matter content were significantly affected due to varieties and/or nitrogen levels. Grains ear-1, number of fertile grains plant-1, 1000-grain weight, grain yield and harvest index were also significantly influenced by varieties and/or nitrogen levels. The value of all parameters studied in this experiment increased with increasing nitrogen levels up to 125 kg N ha-1 and thereafter decreased with fertilizer increasing level. Combination results showed that BARI Gom-24 with application of 125 kg N ha-1 gave the maximum grain yield (4.71 t ha-1), harvest index (49.37 %) and protein content (10.88%). -

Care Bangladesh Shouhardo Iii Program

CARE BANGLADESH SHOUHARDO III PROGRAM Monitoring and Evaluation Plan September 6th 2016 Awardee Name: CARE Country: Bangladesh Award No.: AID-FFP-A-15-00009 Contents 1 SHOUHARDO III Program Overview ............................................................................................... 1 1.1 Program Overview .......................................................................................................................... 1 1.2 Context .............................................................................................................................................. 2 2 SHOUHARDO III Monitoring and Evaluation System .................................................................... 2 2.1 Objectives and Strategy of the M&E System .............................................................................. 3 3 SHOUHARDO III’s Theory of Change PROGRAM DESIGN ....................................................... 4 3.1 Theory of Change ............................................................................................................................ 4 3.1.1 Review of SHOUHARDO III ToC ....................................................................................... 5 3.2 SHOUHARDO III Logical Framework ........................................................................................ 5 3.2.1 Monitoring & Management of Log Frame indicators ....................................................... 9 3.3 SHOUHARDO III Performance Indicators Tracking Table (IPTT) .................................. -

A"" ASL\ '-L I~'S'l'l1'ul'e of N.Chu1logy

nl.!:i. SPATJ8.l! DJ_~JTJ~}B\LTION 91":': ~HYSICAL !,:!,C!!,_.t:J'))'.S iN _._-----BANGLADESH. Ii\" ~ID. [1,\IIi\lHJDI_~ $Ji!h'1ll'T~;n 1:9 J~HB.!!..IWAU'j'MENTOF UR'!}ANbNH l!l-;..qJ.9_N...!~l, !'LANNi!>!!!: 1..N P..f.IJ.TIAI. ~1!LFlLMEN'I' 010' 'l'IIE !1!m!JJill'c!~l':N"l'S !':..o.R'l'IlIl. POST @~I1:PA"I:E_UlJ'LOM~ LN_ ---------UIiBAN ._----II.EGlONAL- !l-"\_~GI,,l.j)FSH Ijl\:rVERS ITY OF ENG I NEERING AND 1'ECHNOLOG \' ,1Jl!,\i;A A"" ASL\_'-l I~'S'l'l1'Ul'E OF n.cHU1LOGY. BANGlWl{. "1'11.,\11,:,;,1) AW;lJST, 19f19 711.24 1969 SFATIAL DISTRIBUTION OF PHYSICAL BAH . FACILITIES IN BANGLADESH A Projeet Report b, MD. BAHAUDDIN 111I1I111~llllllllllilllllllll WT62191!i • 'Approved as to style and cOlltents b, .j; PO y !.j.;~~.- (Dr. darwarJalien) AssiStant Professor chairman Departmell.t of Urban and (Supervisor) Regional Planning I BUET. Dhaka Bead Department or Urban and Member Regional Planning BUET. Dhaka •, , Member \ .nd November1989 ) .. , ACKNOWLEDGEMENT The author wishes to express his deepest gratitude to his advisor Dr. Sarwar Jahan, Assistant Professor, Department of Urban and Regional Planning, Bangladesh University of Engineering and Technology, for his continuous encouragement, guidance and advice throughout the research work. The author is deeply indebted to professor Mir Shahidul Islam, Head of the Department of Urban and regional planning for his invalu- able advice, encouragement and constructive comments. The author is also grateful to Mr. Ajmal H. Ahmed, Associate Professor, Department of Urban & regional planning, BUET, for his constructive comments as a member of the examination committee.