Jpmorgan Trust I Form NPORT-P Filed 2021-05-26

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3Rd Quarter Holdings

Calvert VP Russell 2000® Small Cap Index Portfolio September 30, 2020 Schedule of Investments (Unaudited) Common Stocks — 95.2% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,130 $ 226,398 Modine Manufacturing Co.(1) 4,047 25,294 AAR Corp. 2,929 $ 55,065 Motorcar Parts of America, Inc.(1) 1,400 21,784 Aerojet Rocketdyne Holdings, Inc.(1) 6,371 254,139 Standard Motor Products, Inc. 1,855 82,826 AeroVironment, Inc.(1) 1,860 111,619 Stoneridge, Inc.(1) 2,174 39,936 Astronics Corp.(1) 2,153 16,621 Tenneco, Inc., Class A(1)(2) 4,240 29,426 Cubic Corp. 2,731 158,862 Visteon Corp.(1) 2,454 169,866 Ducommun, Inc.(1) 914 30,089 VOXX International Corp.(1) 1,752 13,473 Kaman Corp. 2,432 94,775 Workhorse Group, Inc.(1)(2) 8,033 203,074 Kratos Defense & Security Solutions, Inc.(1) 10,345 199,452 XPEL, Inc.(1) 1,474 38,442 (1) Maxar Technologies, Inc. 5,309 132,406 $2,100,455 Moog, Inc., Class A 2,535 161,049 Automobiles — 0.1% National Presto Industries, Inc. 420 34,381 PAE, Inc.(1) 5,218 44,353 Winnebago Industries, Inc. 2,733 $ 141,214 Park Aerospace Corp. 1,804 19,700 $ 141,214 Parsons Corp.(1) 1,992 66,812 Banks — 6.8% Triumph Group, Inc. 4,259 27,726 (1) Vectrus, Inc. 987 37,506 1st Constitution Bancorp 623 $ 7,414 $ 1,444,555 1st Source Corp. 1,262 38,920 Air Freight & Logistics — 0.4% ACNB Corp. -

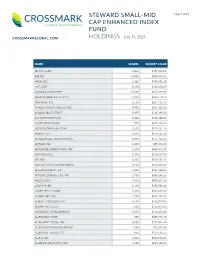

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

Healthcare Market Monitor

Mergers & Acquisitions Capital Raise Strategic Advisory Healthcare Market Monitor Q1 2021 CTIVITY Q1 2021 M&A A Mergers & Acquisitions Capital Raise Strategic Advisory Highlights Total M&A Volume: Q1 2020 vs. Q1 2021 ▪ In Q1 2021, total Healthcare M&A volume was up 65.1% compared to Q1 2020. 600 515 M&A Volume ▪ The eHealth segment continues to be an attractive space with total deal 500 volume increasing by 44 transactions in Q1 2021 over Q1 2020. Physician Medical Groups also experienced a large increase in volume largely due to 400 private equity buyers or their sponsored companies targeting small 312 Notable physician groups. 300 Transactions ▪ Much of the increase in total Q1 2021 volume could be attributed to the roll- 200 out of COVID-19 vaccines and the uncertainty around presidential election subsiding. 100 Public Indexes ▪ Additionally, aggregate deal value among the segments was up 340.5% over - Q1 2020, reaching $56.8B in Q1 2021. Q1 2020 Q1 2021 M&A Volume by Segment: Q1 2020 vs. Q1 2021 HCA Overview 120 Q1 2020 110 102 95 100 Q1 2021 94 Services 77 80 58 60 49 40 35 Experience 25 28 26 18 20 17 16 17 20 20 10 4 6 0 Behavioral eHealth Home Health / Hospitals Labs / Managed Care Other Services Physician Post-acute Senior / Assisted Contact Us Health Care Hospice Diagnostics Medical Groups Care/Rehab Living Source: CapitalIQ, Healthcare M&A News 2 ELECT OTABLE CTIVITY S , N M&A A Mergers & Acquisitions Capital Raise Strategic Advisory $ in millions Announce Transaction Date Category Target Acquirer/Investor Short Description Value Mar-21 Senior / Assisted Living All Assets of Henry Ford Village, Inc. -

Healthcare Disruptive Technologies & Innovations

22 March 2020 Equity Research Americas | United States Healthcare Technology 3rd Healthcare Disruptive Technologies & Innovations (HCDT&I) Virtual Day Recap Healthcare Technology & Distribution | Management Meeting Last week, we hosted our 3rd Healthcare Disruptive Technologies & Innovations (HCDT&I) day Research Analysts virtually. Presenters included executives from Altruista Health, Buoy Health, Livongo, Quartet Health, Somatus, Welltok, Iora Health, and Heal. We also hosted sessions with Will Brady, the Jailendra Singh Chief of Staff to HHS Deputy Secretary, and Dr. Sylvia Romm, Atlantic Health System’s CIO. 212 325 8121 [email protected] Technology Playing a Critical Role in Dealing with the COVID-19 Pandemic. Dealing with the COVID-19 pandemic was a key discussion topic at our HCDT&I day. Jermaine Brown Artificial Intelligence (AI) focused companies, such as Buoy Health, released a COVID-19 212 325 8125 screening tool that took the CDC guidelines and layered them on top of the AI. Companies [email protected] such as Livongo and Somatus serve chronic care populations, which are most vulnerable to Adam Heussner the coronavirus. Their role and solutions in these circumstances vary from helping members 212 325 4727 manage stress/anxiety to sharing a detailed picture of member’s underlying conditions with [email protected] the appropriate provider to best inform the treatment (if needed). Livongo has not seen any disruption to date in sales activity. Quartet Health, which serves individuals with mental health conditions, is focused on the rapid acceleration of digital care options to help its members deal with fear and anxiety related to the pandemic. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

You're Nourishing Young Minds!

SUMMER 2017 You’re Nourishing Young Minds! THE QUARTERLY NEWSLETTER OF IN THIS ISSUE: You Ensure Children PAGE 3PAGE 7 Your Gifts Feed Hardworking Have Access to Good Kids at the Easley Families Have Help, Nutrition! Community Center Thanks to You OUR MISSION TO FEED HUNGRY PEOPLE AND WORK TO SOLVE HUNGER ISSUES IN OUR COMMUNITY Letter BOARD OF DIRECTORS Jeffrey D. Warne from the Board Chair Jonathan Flack President & CEO Board Vice Chair Ann J. Pruitt Thank You for Helping Children Board Secretary Grow and Thrive John West Board Treasurer Dear Friend, Scott Turner Past Board Chair hildren across Middle eliminate the risk that they is making a difference for Tennessee have been fall behind academically hungry students on page MEMBERS Csquirming with when they return to school. 8 of this special summer Greg Allen excitement about the end edition of Table Topics. Scott Bowers of the school year. With That’s why we recently Brian Bowman two months to play in the launched our 2017 Hunger Your gifts are revealed in David Bradley Dr. Jim Burton sunshine and enjoy being Free Summer campaign — the lives of the children, Melissa Eads a kid, many boys and girls to ensure local students parents and teachers who Andy Flatt across our communities who are at an increased risk have expressed just how Lucia Folk will be celebrating summer of hunger have access to the much your generosity Fletcher Foster vacation. nutritious food they need means to them. David Fox to thrive this summer and Amy Johnston-Little But summer doesn’t seem beyond. -

Semi-Annual Market Review

Semi-Annual Market Review HEALTH IT & HEALTH INFORMATION SERVICES JULY 2020 www.hgp.com TABLE OF CONTENTS 1 Health IT Executive Summary 3 2 Private Equity Survey 5 3 Health IT Market Trends 10 4 Health IT M&A (Including Buyout) 13 5 Health IT Capital Raises (Non-Buyout) 18 6 Healthcare Capital Markets 19 7 Macroeconomics 23 8 Health IT Headlines 25 9 About Healthcare Growth Partners 28 10 HGP Transaction Experience 29 11 Appendix A – M&A Highlights 32 12 Appendix B – Buyout Highlights 35 13 Appendix C – Investment Highlights 37 Copyright© 2020 Healthcare Growth Partners 2 EXECUTIVE SUMMARY 1 COVID-19 has quickly and permanently changed the way business is conducted around the world. Health IT was no exception, as providers rapidly shifted to virtual care delivery models enabled by new CMS rules and technology that equips the American healthcare system with maximum flexibility to respond to the COVID-19 pandemic. Together, these innovations accelerated the transformational shift to “hospitals without walls”. While the Health IT and broader Healthcare industry have undoubtedly received renewed attention during this public health crisis and will experience a long- term lift, we have also observed a slowdown in the pace of transaction activity, albeit a more measured slowdown when compared to that of other industries. The underlying sentiment for Health IT is as strong as ever, as evident in our Private Equity Survey (beginning page 5). The following six measures of Health IT activity during the first half of 2020 reflect the challenges of the lockdown but overall reflect how Health IT continues to receive high investor interest due to overwhelmingly strong fundamentals during this tough economic environment. -

Membership List; Russell 2000 Index

Russell US Indexes Membership list Russell 2000® Index Company Ticker Company Ticker 1-800-FLOWERS.COM CL A FLWS AFC GAMMA AFCG 1LIFE HEALTHCARE ONEM AFFIMED N.V. AFMD 1ST SOURCE SRCE AGEAGLE AERIAL SYSTEMS UAVS 22ND CENTURY GROUP INC. XXII AGENUS AGEN 2U TWOU AGILITI AGTI 3-D SYSTEMS DDD AGILYSYS AGYS 4D MOLECULAR THERAPEUTICS FDMT AGIOS PHARMACEUTICALS AGIO 89BIO ETNB AGREE REALTY ADC 8X8 EGHT AIR TRANSPORT SERVICES GROUP ATSG 9 METERS BIOPHARMA INC NMTR AKEBIA THERAPEUTICS AKBA 908 DEVICES MASS AKERO THERAPEUTICS AKRO A10 NETWORKS ATEN AKOUOS AKUS AAON INC AAON AKOUSTIS TECHNOLOGIES INC AKTS AAR CORP AIR AKOYA BIOSCIENCES AKYA ABERCROMBIE & FITCH A ANF ALAMO GROUP ALG ABM INDUSTRIES INC ABM ALARM.COM HOLDINGS ALRM ACACIA RESEARCH - ACACIA TECHNOLOGIES ACTG ALBANY INTERNATIONAL A AIN ACADEMY SPORTS AND OUTDOORS ASO ALBIREO PHARMA ALBO ACADIA PHARMACEUTICALS ACAD ALDEYRA THERAPEUTICS ALDX ACADIA REALTY AKR ALECTOR ALEC ACCEL ENTERTAINMENT (A) ACEL ALERUS FINANCIAL CORP. ALRS ACCELERATE DIAGNOSTICS AXDX ALEXANDER & BALDWIN INC. ALEX ACCO BRANDS ACCO ALEXANDERS INC ALX ACCOLADE ACCD ALIGNMENT HEALTHCARE ALHC ACCRETIVE HEALTH RCM ALIGOS THERAPEUTICS ALGS ACCURAY ARAY ALKAMI TECHNOLOGY ALKT ACI WORLDWIDE ACIW ALKERMES PLC ALKS ACLARIS THERAPEUTICS ACRS ALLAKOS ALLK ACUSHNET HOLDINGS GOLF ALLEGHENY TECHNOLOGIES ATI ACUTUS MEDICAL AFIB ALLEGIANCE BANCSHARES ABTX ADAPTHEALTH AHCO ALLEGIANT TRAVEL ALGT ADDUS HOMECARE ADUS ALLETE ALE ADICET BIO INC ACET ALLIED MOTION TECHNOLOGIES AMOT ADIENT PLC ADNT ALLOGENE THERAPEUTICS ALLO ADTALEM GLOBAL EDUCATION -

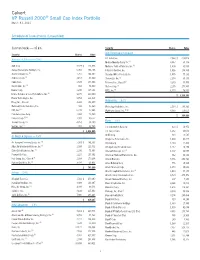

Calvert VP Russell 2000 Small Cap Index Portfolio

Calvert VP Russell 2000® Small Cap Index Portfolio March 31, 2021 Schedule of Investments (Unaudited) Common Stocks — 95.6% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,064 $ 273,026 Modine Manufacturing Co.(1) 4,047 59,774 AAR Corp. 2,929 $ 121,993 Motorcar Parts of America, Inc.(1) 1,400 31,500 Aerojet Rocketdyne Holdings, Inc. 6,050 284,108 Patrick Industries, Inc. 1,816 154,360 AeroVironment, Inc.(1) 1,761 204,382 Standard Motor Products, Inc. 1,855 77,131 Astronics Corp.(1) 2,153 38,840 Stoneridge, Inc.(1) 2,174 69,155 Cubic Corp. 2,599 193,808 Tenneco, Inc., Class A(1) 4,240 45,453 Ducommun, Inc.(1) 914 54,840 Visteon Corp.(1) 2,255 274,997 Kaman Corp. 2,245 115,146 XPEL, Inc.(1) 1,474 76,545 (1) Kratos Defense & Security Solutions, Inc. 9,875 269,390 $ 3,264,343 Maxar Technologies, Inc. 5,852 221,323 Automobiles — 0.1% Moog, Inc., Class A 2,368 196,899 National Presto Industries, Inc. 420 42,869 Winnebago Industries, Inc. 2,534 $ 194,383 PAE, Inc.(1) 5,218 47,066 Workhorse Group, Inc.(1)(2) 8,033 110,615 Park Aerospace Corp. 1,804 23,849 $ 304,998 Parsons Corp.(1)(2) 1,992 80,557 Banks — 8.3% Triumph Group, Inc. 4,259 78,280 (1) Vectrus, Inc. 987 52,745 1st Constitution Bancorp 623 $ 10,971 $ 2,026,095 1st Source Corp. 1,262 60,046 Air Freight & Logistics — 0.3% ACNB Corp. -

Nashville, Tennessee 615-743-3140 [email protected] Www

Nashville, Tennessee 615-743-3140 [email protected] www.healthcarecouncil.com ANNUAL REPORT 2018–2019 NASHVILLE HEALTH CARE COUNCIL To inspire global collaboration to improve PURPOSE health care by serving as a catalyst for leadership STATEMENT and innovation. 2018 NASHVILLE HEALTH CARE COUNCIL 2019 BOARD OF DIRECTORS R. Milton Johnson Doug French Jeff Pate CHAIRMAN Managing Director Principal/Chief Development Officer Former Chairman and CEO Santé Ventures PYA HCA Samuel N. Hazen Keith Payet Robert A. Frist Jr. President and CEO CEO VICE CHAIRMAN HCA United Healthcare Co-founder, CEO, President and Chairman Christopher A. Holden C. Wright Pinson, M.D. HealthStream, Inc President and CEO IMMEDIATE PAST CHAIRMAN Envision Healthcare CEO Tim Adams Vanderbilt Health System President and CEO Kell Holland Saint Thomas Health Former Head of Corporate Risk Martin S. Rash and Broking Former Chairman and CEO Lucinda (Cindy) M. Baier Willis Towers Watson RCCH HealthCare Partners President and CEO Brookdale Senior Living Tom Hooper Patrick Ryan Managing Director CEO William (Bill) Carpenter JLL Press Ganey Associates, Inc. Former Chairman and CEO LifePoint Health Joey A. Jacobs Saurabh Sinha Former Chairman and CEO Co-founder, President and CEO Beth Chase Acadia Healthcare emids Technologies Senior Managing Director Ankura Consulting Group A.J. Kazimi Dee Anna Smith CEO CEO Neil de Crescenzo Cumberland Pharmaceuticals Sarah Cannon President and CEO Change Healthcare Paul Kusserow Jerry Taylor President and CEO Partner Bob Fisher Amedisys Burr & Forman, LLP President Belmont University Lynn Massingale, M.D. Claire Tucker Executive Chairman CEO and President Stephen F. Flatt TEAMHealth CapStar Bank CEO National HealthCare Corporation Wes Pass Edna Willingham Chief Strategy Officer Former President, TN Health Plan Mary S. -

PORTFOLIO HOLDINGS AS at JULY 31, 2019 Issuer Security Currency

PORTFOLIO HOLDINGS AS AT JULY 31, 2019 Issuer Security Currency Sector Maturity Current Yield (%) Acadia Healthcare Co Inc ACADIA HEALTHCARE 1L TL-B4 3/18 USD Health Care 16/02/2023 4.82 Acosta Inc ACOSTA 1L TL-B1 USD Business Equip & Services 26/09/2021 15.96 Prime Security Services Borrower Llc ADT PRIME SECURITY 1L TL-B USD Business Equip & Services 02/05/2022 5.08 Advantage Sales & Marketing Inc ADVANTAGE SALES & MARKETING 1L TL USD Business Equip & Services 25/07/2021 6.03 Advantage Sales & Marketing Inc ADVANTAGE SALES & MARKETING 2L TL USD Business Equip & Services 25/07/2022 11.03 Agiliti Health Inc AGILITI DD 1L TL-B (10/18) USD Health Care 04/01/2026 5.43 Global Medical Response Inc (Delaware) AIR MEDICAL 1L TL-B1 (02/18) USD Health Care 28/04/2022 5.75 Akorn Inc AKORN INC 1L TL-B USD Health Care 16/04/2021 10.18 Albea Beauty Holdings Sa ALBEA 1L TL-B EUR (3/18) EUR Containers & Glass 12/04/2024 3.28 Albertsons ALBERTSONS 1L TL-B5 USD Food & Drug Retailers 21/12/2022 5.30 Alixpartners Llp ALIX PARTNERS 1L TL-B USD Business Equip & Services 04/04/2024 5.07 Dlg Acquisitions Ltd ALL3MEDIA 1L TL-B EUR 5/19 EUR Broadcast Radio & Tv 23/05/2026 3.73 Altice Financing Sa ALTICE FINANCING SA RegS USD Cable TV 15/02/2023 6.42 SFR Group ALTICE FRANCE 1L TL-B13 (7/18) USD Cable TV 14/08/2026 6.36 Csc Holdings Llc ALTICE USA 1L TL-B 10/18 USD Cable TV 10/01/2026 4.59 Csc Holdings Llc ALTICE USA 1L TL-B 3/17 USD Cable TV 17/07/2025 4.59 Amc Entertainment Holdings Inc AMC ENTERTAINMENT 1L TL-B 3/19 USD Leisure 14/03/2026 5.23 Anta International