ETF Risk Report: DON Wisdomtree Midcap Dividend Gray Swan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sponsorship Prospectus

June 27 – July 1, 2016 • The Mirage, Las Vegas SPONSORSHIP PROSPECTUS “Not only is it a great show and a great environment to be in but this show more so than the any other shows that we attend directly represent the heart of our business and that is customer service, customer engagement, and call center technologies.” -Shane Chuvalas, Technical Sales Consultant, Interactive Intelligence 2016 CCW Diamond Sponsor 2 www.callcenterweek.com Corporate Practitioners and Solution Providers both consider CCW the MUST ATTEND event brand WHY? • Neutral Voice – We are vendor agnostic & holistic – serving everyone from start-ups to large scale solution providers and decision-makers that are simple looking for the best ideas to optimize and expand their operations. • Dedicated Content Focus – Continual research throughout the year to uncover the best stories, told by the top leaders. This is our day job. • ROI Centric – We are a business and recognize that everyone who steps who invests in CCW whether you are a delegate attendee or a sponsor must see an ROI. We focus on preparation, innovate ways to optimize the experience and focus on the details. • The Trusted Place Where Business Gets Done - Our end-users come to shop for vendors. Our vendors are prepared to scale and personalize. 3 www.callcenterweek.com “One thing I thought that was just great today is the attendance in the expo hall… It was just packed all day today. And I think that demonstrate just how interested the attendees are in the newer technologies and some of the processes that can -

FA14 Fair Guide PRINT

JOB & Internship FAIR FAIR GUIDE Day of the Fair: • Download or access the “U of Iowa Career Fair Plus” app - save organizations to your “favorites”! • Write down questions to ask representatives from your targeted organizations. • Stop by the Student Hospitality Hub to print extra copies of your resume or practice your elevator speech. • Bring your Student ID for check in. • Allow yourself time to visit with organizations, you may need a break to refresh and then return to the fair! • Use the Career Fair app or map to identify locations of your targeted organizations. Speaking with Employers at the Fair • Visit your targeted companies/organizations rst. Gather business cards. • Pick up materials from each employer you visit. • Tell the representatives about yourself, speak about your skills and how they t with the organization. • Ask the representative your prepared questions. • Leave your resume if paper copies are accepted. They may ask you to apply online/hireahawk.com • Visit with additional employers as time permits. Take the opportunity to learn about the variety of opportunities that exist. After the Fair • Write thank you notes/emails to each representative you spoke with. • Continue your research of organizations. • Attend career seminars or meet with Career Advisors at the Pomerantz Career Center. NEW THIS YEAR JOBS INTERNSHIPS TOURS GRAD SCHOOLS #hirehawks Individuals with disabilities are encouraged to attend all University of Iowa-sponsored events. 100 Pomerantz Center, Suite C310 If you are a person with a disability who requires an accommodation in order to participate in (319) 335-1023 this event, please contact the Pomerantz Career Center in advance at (319) 335-1023. -

Corporate Ghg Inventorying and Target Setting Self-Assessment: V1.0

APPENDIX Corporate GHG Inventorying and Target Setting Self - Assessment : V1.0 Development and Methodology April 2020 APPENDIX: CORPORATE GHG INVENTORYING AND TARGET SETTING SELF-ASSESSMENT: V1.0 Purpose of this Self-Assessment and How it Can Lead to Action Companies are often in a stronger position to improve their greenhouse gas (GHG) management efforts once they understand their relative performance compared to their peers. In response to stakeholder interest, this self-assessment is designed to help companies estimate, at a high level, how their GHG inventorying and target-setting approaches compare to large peer companies representing different industry sectors. Once companies estimate how their key GHG measurement and target-setting efforts compare to their peers, they can evaluate, in greater detail, how other companies approach GHG inventorying and target setting. Helping companies locate their GHG management efforts within the broader market may spur competition, garner internal support for widening the scope of their GHG inventories or setting more aggressive GHG reduction targets, and prioritize resources to implement GHG reduction activities. • Entry-level: For companies beginning to address their GHG emissions, this resource aims to help them identify which inventorying and target-setting actions reflect common business practices today and provide them with a roadmap for developing their own inventories and setting targets. • Intermediate: For companies further along their sustainability journey, this self- assessment can validate more advanced inventorying and target-setting behaviors that position them to deepen GHG emission reductions. • Advanced: For leading companies, this resource can also validate their efforts and encourage them to explore implementing more cutting edge GHG management efforts, eventually pushing such innovations into the mainstream and sharing practices with others. -

Alphabetical Index of Active Clients

PART III ALPHABETICAL INDEX OF REPRESENTED ENTITIES AND THEIR GOVERNMENTAL AFFAIRS AGENTS BY REGISTRATION NUMBER FOR THE FOURTH QUARTER OF 2009 Represented Entity Name Registration Number 180-Turning Lives Around 1458 1868 Public Affairs LLC 1054 1868 Public Affairs/WalMart 1533 21st Century Frontier Group Inc 337 3000 Oceanfront LLC 1534 346 Ridgefield Management LLC 939 4 Connections LLC 1691 431 Corp 721 650 Union Boulevard LLC 1234 7-Eleven Inc 433 92 Now 1607 AAA Clubs of NJ 1781 AAA Mid-Atlantic 1542 AARP NJ 1222 Abba/Clemente LLC 1786 Abbott Laboratories Inc 1479 ABC Bail Bonds 721 Academy Bus LLC 1603 ACCENTURE LLP 1720 Access NJ 721 ACCESS NJ 1380 ACE III, LLC/Steel Pier 433 ACLU of New Jersey 1618 ACRA Turf Club LLC 173 ACS Government Solutions 1817 ACS State & Local Solutions 1538 ACS State & Local Solutions 1578 Action Carting Environmental Services 1741 ** New Represented Entity included during this quarter Page 1 of 79 PART III ALPHABETICAL INDEX OF REPRESENTED ENTITIES AND THEIR GOVERNMENTAL AFFAIRS AGENTS BY REGISTRATION NUMBER FOR THE FOURTH QUARTER OF 2009 Represented Entity Name Registration Number Administaff Inc 1319 ADP Claims Services Group 1000 Advance Realty Group 365 Advanced Drainage Systems Inc 365 Advanced Drainage Systems Inc 1697 Advanced Drainage Systems Inc 1745 Aes/Red Oak 463 Aetna 1720 Aetna Health Inc 1832 Aetna Inc 754 Aetna Life & Casualty 26 AFLAC 1769 Agate Construction 1587 Agile Technologies LLC 1618 AIA NJ 433 AIA-NJ Central Section 433 AIG American General - US Life Insurance Co 1224 Air Bag -

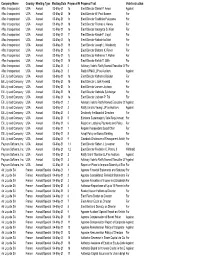

Weekly Market Recap February 8, 2021

Weekly Market Recap February 8, 2021 Price Price Returns Index Close Week YTD S&P 500 Index 3,887 4.6% 3.5% Dow Jones Industrial Average 31,148 3.9% 1.8% NASDAQ 13,856 6.0% 7.5% Russell 2000 Index 2,233 7.7% 13.1% MSCI EAFE Index 2,166 2.0% 0.8% 10-yr Treasury Yield 1.17% 0.1% 0.2% Oil WTI ($/bbl) $56.98 9.3% 17.6% Bonds* $116.71 -0.5% -1.0% Source: Bloomberg, FactSet *Bonds represented by the iShares U.S. Aggregate Bond ETF Last Week: U.S. Equity Market • U.S. large cap equities (S&P 500® Index) rose +4.6% (the best week since November), as fiscal stimulus expectations increased with Democrats focused on using budget reconciliation to provide another large COVID-19 relief package (~$1.9 trillion). The Federal Reserve pushed back against premature tapering and stressed the need to look past an expected spike in inflation this spring. According to FactSet, with just under 60% of S&P 500 companies reporting 4Q20 earnings to date, 81% of those companies beat expectations, ahead of the 75% one-year and 74% five-year averages. Treasuries were mostly weaker, as the curve steepened and the 2/10 spread reached its widest level since 2017. Gold lost -2.0%, while Oil (WTI) rose +9.3%. • S&P 500 Index sector returns: o Energy (+8.3%) outperformed, as oil (WTI) rose +9.3%. o Communication services (+7.3%) rose, with strength from Alphabet (+14.3%) on an earnings beat, Twitter (+12.4%), Activision Blizzard (+11.7%) on earnings, and Disney (+7.7%). -

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2010 Parent Company names is provided here as a reference for facilities filing their RY 2011 reports using paper forms. For RY2011, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3M CO 4-D CORROSION CONTROL SPECIALISTS INC 50% DAIRY FARMERS OF AMERICA 50% PRAIRIE FARM 88TH REGIONAL SUPPORT COMMAND A & A MANUFACTURING CO INC A & A READY MIX INC A & E INC A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT -

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2011 Parent Company names is provided here as a reference for facilities filing their RY 2012 reports using paper forms. For RY 2012, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3F CHIMICA AMERICAS INC 3G MERMET CORP 3M CO 5N PLUS INC A & A MANUFACTURING CO INC A & A READY MIX INC A & E CUSTOM TRUCK A & E INC A FINKL & SONS CO A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT & SON INC A TO Z DRYING -

2013 ANNUAL REPORT on BOARD Chad Pregracke | Founder & President from the BENCH Living Lands & Waters Dear Supporter, Curtis Lundy | Chairman a WORD Hard Work

2013 ANNUAL REPORT On BOARD Chad Pregracke | Founder & President from the BENCH Living Lands & Waters Dear Supporter, Curtis Lundy | Chairman A WORD Hard work. True impact. Recognition. Rewards. Transformative. Retired Vice President & CFO, When I joined the Living Lands & Waters (LL&W) board thirteen THE National Bank Fun. Those are just a few ways to describe our 2013. years ago, they did not have a balance sheet that balanced. Tom Rowe | Vice Chairman Not even close. LL&W had a houseboat, living quarters for Retired President, With your support, we conducted 148 events and hauled Serv-A-Lite Products, Inc. Chad and crew, which floated — most of the time, not always. over 341,000 pounds of trash from America’s river banks Terry Becker | Treasurer LL&W had vibrancy, a bite’em in the butt tenacity for hard and waterways in the last year. We expanded our education President, work and results, and crazy creativity, all of which got the program with 49 workshops that included 1,297 participating Riverway Foundation organization through the early days. These qualities have not teachers and students. Through community outreach events, Leigh Ann Baird | Secretary diminished through the years. They have been strengthened thousands of adults and kids heard the LL&W mission. VP, Strategic Planning & Sustainability, by a talented and longer serving crew and office staff, a Ingram Barge Company sophisticated, dedicated board, a greatly broadened financial Because of the commitment and passion of people like you, the Jeff Becker support base, an expanded scope that involves attracting water is cleaner, river banks are safer, kids are more aware of VP North America Grain, thousands of volunteers for tree planting and education of their responsibilities to our environment and teachers are better Archer Daniels Midland Company youth, in addition to river cleanups. -

Why the Quad Cities

WHY THE QUAD CITIES.... There’s never been a better time to Make It Here in the Quad Cities region Minneapolis Madison Milwaukee Detroit IOWA Chicago Des Moines Omaha M i s s i s s i ILLINOIS p p Indianapolis i R Kansas City i ve Cincinnati r St. Louis 300 miles Louisville (482.8 km) 500 miles (804.6 km) 563.823.2655 QuadCitiesFirst.com Representative Employers in the Quad Cities Region Company Employees Industry Deere & Company 7240 Agricultural Innovation Rock Island Arsenal 6163 Defense Manufacturing Genesis Health System 5173 Healthcare Hy-Vee 4568 Grocery UnityPoint Health - Trinity 3954 Healthcare HNI Corporation 3200 Office Furniture Manufacturing Walmart 2821 Warehouse Clubs and Supercenters Arconic 2500 Aerospace and Defense Aluminum Tyson Fresh Meats 2400 Food Processing Kraft Heinz 1600 Food Processing Isle Casino Hotel Bettendorf 1250 Casino, Hotel, Entertainment Tri-City Electric Co. 1200 Electrical Contractor West Liberty Foods 1200 Food Processing XPAC 1000 Supply Chain Management and Logistics Kent Corporation 950 Food Processing Mercy Medical Center 950 Healthcare MidAmerican Energy Company 845 Utility/Energy Delivery Exelon Nuclear - Quad Cities Generating Station 800 Utility/Energy Delivery Cobham Mission Systems 750 Defense and Aerospace Manufacturing Nestle Purina PetCare Company 685 Pet Food Maker Custom-Pak Inc. 675 Durable Good Manufacturing Alorica 650 Global Customer Service Von Maur 640 Retail Headquarters & Distribution Center United Parcel Service 640 International & Domestic Package Shipping Great Dane Trailers 600 Truck Trailer Manufacturing Archer Daniels Midland (ADM) 600 Food Processing Group O 526 Third Party Logistics Sears Manufacturing 520 Durable Good Manufacturing Source: Bi-State Regional Commission, Infogroup, Reference USA Gov, and individual employers, January 2019. -

ETF Risk Report: SPDV Buyer Beware: Every ETF Holds the Full Risk of Its Underlying Equities Disclosures in the Best Interest of Investors

ETF Risk Report: SPDV Buyer beware: Every ETF holds the full risk of its underlying equities Disclosures in the best interest of investors AAM S&P 500 High Dividend Value ETF Gray Swan Event Risks exist for every equity held by SPDV. Gray swan events include accounting fraud, management failures, failed internal controls, M&A problems, restatements, etc. These risks occur infrequently, but Gray Swan Event Factor for SPDV 1.17% consistently for all equities. Equities account for 87.77% of SPDV’s assets. Most investors ignore these risks until after they are disclosed; whereupon a stock’s price drops precipitously. Just as insurance companies can predict likely costs for a ETF's Governance Risk Statement: "The Fund is not actively managed, and its sub- driver’s future car accidents based on the driver’s history, adviser would not sell shares of an equity security due to current or projected we predict the likely cost (price drop) for SPDV following underperformance of a security, industry, or sector, unless that security is removed gray swan disclosures within its holdings. The expected from the Index or the selling of shares of that security is otherwise required upon a price decrease across the SPDV equity portfolio is 1.17%. reconstitution or rebalancing of the Index." However, individual equity risks vary signicantly. This report helps investors know their risk exposure. Inception Date: 11/28/2020 Year-to-Date Return: 18.59% The AAM S&P 500 High Dividend Value ETF seeks current cash ow and capital growth by tracking the investment Net Assets: $31.9m 1-Year Return: 66.02% results of the S&P 500 Dividend and Free Cash Flow Yield Index, an equal-weighted index composed of 55 Price: $28.98 3-Year Return: 7.85% attractively-valued stocks of large-cap U.S. -

Placement in Employment and Job Types

Approximately 9 months after graduation, alumni who graduated in '14-'15 or '15-'16 held these jobs: Title Company Location Company Type Field Greater Chicago Account Coordinator Creative Group, Inc. Area Account Coordinator Creative Group, Inc Chicago, IL Deerfield, IL, Privately owned medium or large Business Management, Account Coordinator NCH Marketing Services United States business Accounting, or Finance Account Exectutive Cannon Solutions America Chicago, IL Accountant Umpqua Feather Merchants Louisville, CO Rock Island, IL, Privately owned medium or large Combination of IT programing Actuarial Student Illinois Casualty Company USA business and Mathematical Analysis Admissions Counselor Western Illinois University Macomb, IL Americorps Member City Year Chicago Chicago, IL Minnetonka, Application Support Analyst Epicor Software Minnesota Yorkville High Assistant Choir Director Yorkville CUSD School Assistant Event Designer Zilli Hospitality Group Waukesha, WI Assistant Men's Soccer Augustana College Rock Island, IL Assistant to the GIS Specialist P/T GIS Elmhurst Assistant Volleyball Coach Augustana College Rock Island, IL Greater Omaha Audit Assistant Deloitte Area Taylor Ridge, IL, Business Management, Audit associate Bohnsack & Frommelt LLP USA Small business Accounting, or Finance Schaumburg, IL, Privately owned medium or large Business Management, Audit Associate RSM Mcgladrey US business Accounting, or Finance Audit Intern Deloitte Chicago, IL Dallas/Fort Audit Intern Deloitte Worth Area Behavioral Health Social Services or -

AP2 Maj 2021.Xlsx

Company Name Country Meeting Type Meeting Date Proposal NuProposal Text Vote Instruction Aflac Incorporated USA Annual 03-May-21 1a Elect Director Daniel P. Amos Against Aflac Incorporated USA Annual 03-May-21 1b Elect Director W. Paul Bowers For Aflac Incorporated USA Annual 03-May-21 1c Elect Director Toshihiko Fukuzawa For Aflac Incorporated USA Annual 03-May-21 1d Elect Director Thomas J. Kenny For Aflac Incorporated USA Annual 03-May-21 1e Elect Director Georgette D. Kiser For Aflac Incorporated USA Annual 03-May-21 1f Elect Director Karole F. Lloyd For Aflac Incorporated USA Annual 03-May-21 1g Elect Director Nobuchika Mori For Aflac Incorporated USA Annual 03-May-21 1h Elect Director Joseph L. Moskowitz For Aflac Incorporated USA Annual 03-May-21 1i Elect Director Barbara K. Rimer For Aflac Incorporated USA Annual 03-May-21 1j Elect Director Katherine T. Rohrer For Aflac Incorporated USA Annual 03-May-21 1k Elect Director Melvin T. Stith For Aflac Incorporated USA Annual 03-May-21 2 Advisory Vote to Ratify Named Executive OffFor Aflac Incorporated USA Annual 03-May-21 3 Ratify KPMG LLP as Auditors Against Eli Lilly and Company USA Annual 03-May-21 1a Elect Director Katherine Baicker For Eli Lilly and Company USA Annual 03-May-21 1b Elect Director J. Erik Fyrwald For Eli Lilly and Company USA Annual 03-May-21 1c Elect Director Jamere Jackson For Eli Lilly and Company USA Annual 03-May-21 1d Elect Director Gabrielle Sulzberger For Eli Lilly and Company USA Annual 03-May-21 1e Elect Director Jackson P.