2012 Stratus 10-K R223

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2Nd Street District Austin, Texas 78701

FOR LEASE 2ND STREET DISTRICT AUSTIN, TEXAS 78701 www.cbre.com/ucr FOR LEASE | 2ND STREET DISTRICT | AUSTIN, TEXAS 78701 PROPERTY INFO + The 2ND Street District is made up of the best shopping, dining and entertainment in Austin. + Heavy foot traffic during the week and on weekends. + Over 450 apartments immediately in the district, and within 1/4 mile from multiple condominiums and the two highest grossing hotels in the city, The JW Marriott and The W Hotel. + Tenants in the district include Austin City Limits Live at the Moody Theater, Violet Crown Cinema, Urban Outfitters, Jo’s Coffee, La Condesa, Milk & Honey, Lamberts, Austin Java, and many more. GROSS LEASABLE AREA + 144,137 SF AVAILABLE SPACE + 1,200 SF - 5,059 SF RATES | NNN + Please call for rates. www.cbre.com/ucr FOR LEASE | 2ND STREET DISTRICT | AUSTIN, TEXAS 78701 3RD STREE T BALLET AUSTIN BALLET Popbar AMLI on 2ND DEN Leasing Office At Lease AVAILABLE 1/1/18 Starbucks 5,059 S.F. Which Wich? Cathy’s Cleaners Peli Peli Royal Blue Grocery Daily Juice Finley’s Barber Shop Finley’s Barber Shop Con’ Olio G Con’ Olio U Austin Proper Sales Office A 2ND Street W Austin Away Spa D AMLI on 2ND District Office L A A AMLI DOWNTOWN W Austin Bar Chi V L A PUBLIC PARKING LACQUER U BLOCK 21 PUBLIC PARKING C BLOCK 22 P 110 PUBLIC PARKS | 34 STREET PARKS BLOCK 20 A E P 412 PUBLIC PARKS | 7 STREET PARKS $ 326 PUBLIC PARKS | 34 STREET PARKS Hacienda v P Trace AMLI Downtown Leasing Office PRIZE Authentic Smiles At Lease 3TEN Urban Outfitters Violet Crown Cinema LOFT Austin City Limits La Condesa & Malverde Crú Estilo ModCloth Taverna Taverna Circus Upstairs Upstairs Austin City Limits Live at the Moody Theatre Rocket Electrics Jo’s Hot Coffee Bonobos C Austin MacWorks Alimentari 28 Numero $ Design Within Reach O v L ORA Public Art 2ND STREE T D League ofEtcetera, Rebels etc. -

AVAILABILITY REPORT Properties & Land for Lease Or Sale

RETAIL FOR SALE OFFICE FOR LEASE RETAIL FOR LEASE OFFICE FOR SALE SUBLEASE SPACE INDUSTRIAL FOR LEASE INDUSTRIAL FOR SALE LAND FOR SALE AVAILABILITY REPORT Properties & Land for Lease or Sale April 2021 Austin, TX 5TH + TILLERY FEATURES AVAILABILITY PARKING RATE CONTACT 3:1,000 Matt Frizzell Class A building • 3 stories with abundant natural light • Decks Kevin Granger with panoramic views • 600 KW array of solar panels • Direct 182,716 RSF Surface $38.00 entry to suites • Automatic doors allowing for touchless entry to property APRIL 2021 | LISTING REPORT OFFICE SPACE for Lease PROPERTY AVAILABILITY RATE FEATURES CONTACT • Central location with easy access to TECH 3443 Highway 183 and entrances/exits on the 3443 Ed Bluestein Blvd. frontage road Austin, TX 78721 • Valet and reserved parking Melissa Totten Lease Call Broker • On-site building management Mark Greiner 327,278 RSF for Rate • State-of-the-art-fitness center with Property Flyer lockers and showers Charlie Hill • On-site healthcare services, yoga studio, bike path and bike storage NE • Direct access to Walnut Creek Bike Trail 5TH + TILLERY 618 Tillery St. Austin, TX 78702 • Class A building $40.00 NNN • 3:1,000 parking ratio Lease Matt Frizzell • 3 stories with tons of natural light ±182,716 RSF 2021 Est. OpEx Property Flyer $17.50 • Decks with panoramic views Kevin Granger • 600 KW array of solar panels Visit Website EAST UPLANDS CORP CENTER I & II UPLANDS I Lease 5301 Southwest Pkwy. • 4:1,000 SF parking; expandable to Austin, TX 78735 UPLANDS I 5.5/1,000 as needed 23,956 SF UPLANDS II Matt Frizzell Call Broker (Avail. -

Conceptual Master Plans for the Brackenridge Tract Project Report

Conceptual Master Plans for the Brackenridge Tract PROJECT REPORT - APPENDICES VOLUME 3 APPENDIX D. Market Analysis D1. MARKET ANALYSIS REPORT THE UNIVERSITY OF TEXAS SYSTEM: Brackenridge Tract Project Report Appendix AUSTIN, TEXAS Project Report University of Texas System Conceptual Master Plan for Development of the Brackenridge Tract Prepared for Cooper, Robertson, and Partners New York, NY Submitted by Economics Research Associates and Capital Market Research 14 October 2008 (revised September 25, 2009) ERA Project No. 17848 1101 Connecticut Avenue, NW Suite 750 Washington, DC 20036 202.496.9870 FAX 202.496.9877 www.econres.com Los Angeles San Francisco San Diego Chicago Washington DC London New York Table of Contents I. Introduction and Project Overview .............................................................................. 5 Executive Summary ................................................................................................................. 5 II. Housing Market Analysis.............................................................................................. 7 Austin Apartment Market Overview......................................................................................... 7 Austin Apartment Demand Overview....................................................................................... 2 Central Market Area Apartment Market Conditions.................................................................. 4 Central Market Area Multifamily Demand Forecast.................................................................. -

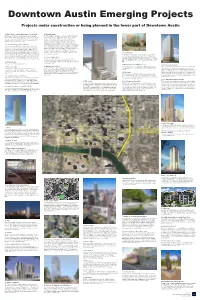

Downtown Austin Emerging Projects October 28, 2009

Downtown Austin Emerging Projects October 28, 2009 Under Construction Commercial C43 Block 21 / W Austin Hotel and Residences Completion: early 2011 Construction began in May 2008 on this block north of Austin City Hall that will be transformed into a 36-floor high-rise featuring a 250 Contact: Belinda D. Wells room luxury W Hotel, 159 luxury condominiums, and a 2,200-seat Stratus Properties "Austin City Limits" venue. The project will cost $260 million and 512-478-5788 encompass 780,000 square feet. www.block21residences.com C57 1300 Guadalupe Completion: Early 2010 This is the conversion of a three-story office building constructed in 1964 into a modern Class A office building with an additional floor Contact: and a rooftop terrace with views of the Capitol. Thirteenth & Guadalupe, LLC http://www.aquilacommercial.com/properties/view /1300-Guadalupe Residential R2.1 Gables Park Plaza, 1st Phase Completion: Early 2010 This primarily residential project (294 apartments and 185 condominiums) will include 22,000 s.f. of retail and 11,000 s.f. of Contact: Will Withers office and a 5,000 s.f. restaurant. Gables Residential 512-502-6000 http://www.gables.com/ R24 The Fondren Building (La Vista on Lavaca) Completion: Early 2010 Construction of this mixed-use building restarted early this year. The project will have a first floor restaurant, a 3-floor Executive Business Contact: Mac Pike Center, and 66 office and condo units (700 s.f. to 2,000 s.f.) on the The Sutton Company top floors. 512-478-8300 http://www.lavistaonlavaca.com/ R50 The Austonian Completion: June 2010 On September 17, 2009 this $200 million mixed-use tower at the northwest corner of Second Street and Congress Avenue topped out. -

Hyde Park: an Early Suburban Development in Austin, Texas (1891- 1941)

HYDE PARK: AN EARLY SUBURBAN DEVELOPMENT IN AUSTIN, TEXAS (1891- 1941) Hyde Park, one of the most desirable neighborhoods of modern Austin, is nearing the hundredth anniversary of its founding. The legacy of its settlement and growth remind us of the important role Hyde Park has played in the history of Austin; a role which can be better understood and evaluated following a discussion of the city's development. Austin has served as Texas' seat of government since shortly after the city's founding in 1838. The city was established as the result of an internal struggle among the leaders of the newly formed Republic of Texas, which gained independence from Mexico in 1836. Many believed Houston or some other established town should be selected as the capital of Texas. Intense competition and rivalry developed for that designation and the attendant financial and political opportunities it would provide. As a compromise, founding fathers decided that the creation of an entirely new community was the most appropriate solution. As president of the Republic, Mirabeau B. Lamer selected Waterloo, small dispersed settlement on the Colorado River, as the new capital of Texas. Edwin Waller surveyed the townsite, including a grandly sited capitol square atop a hill that terminated a broad thoroughfare (Congress Avenue) extending from the river. Named in honor of Stephen F. Austin, the town became reality as the first lots were sold on August 1, 1839. Despite the isolated location near the frontier, the designation fueled the new capital's growth and its population increased to 856 by 1840. Numerous government offices opened providing the foundation for the local economy. -

4 MB Apr 2019 Downtown Austin Retail

Final Report Downtown Austin Retail Market Strategy For The Downtown Austin Alliance and the City of Austin Submitted by Economics Research Associates April 2005 ERA Project No. 15373 1101 Connecticut Avenue, NW Suite 750 Washington, DC 20036 202.496.9870 FAX 202.496.9877 www.econres.com Los Angeles San Francisco San Diego Chicago Washington DC London New York Executive Summary Introduction Methodology Economic Overview Task 1: Infrastructure Inventory Task 2: Retail Inventory Summary of Retail Supply Competitive Context Shoppers Behaviors Survey Customer Base Survey Task 3: Retail Demand Analysis Task 4: Market Strategy Summary of Best Practices Case Studies Downtown Austin Retail Panel Downtown Austin Retail Strategy Task 5 – Barriers to Entry and Recommended Implementation Strategy Implementation Recommendations APPENDICES: Infrastructure Inventory - Black & Vernooy Downtown Retail Demand Survey – Selected Findings, M. Crane & Associates, June 2004 International Downtown Association Broker/Developer Panel Report Case Studies – Downtown Retail Incentives Best Practices IDA Survey of Retail Incentives 1101 Connecticut Avenue, NW Suite 750 Washington, DC 20036 202.496.9870 FAX 202.496.9877 www.econres.com Los Angeles San Francisco San Diego Chicago Washington DC London New York General & Limiting Conditions Every reasonable effort has been made to ensure that the data utilized in this study reflect the most accurate and timely information possible. This study is based on estimates, assumptions and other information developed by ERA from its independent research effort, general knowledge of the market and the industry, and consultations with the Downtown Austin Alliance and its representatives. No responsibility is assumed for inaccuracies in reporting by the DAA, its agent and representatives or any other data source used in preparing or presenting this study. -

Projects Under Construction Or Being Planned in the Lower Part of Downtown Austin

Downtown Austin Emerging Projects Projects under construction or being planned in the lower part of Downtown Austin 1. Fifth & Baylor (Austin Market District, West Block) 15. Republic Square Work began recently on an 80,000-square-foot retail and office The City of Austin is working in collaboration with the Downtown building on the southwest quadrant of the intersection, just in front Austin Alliance, the Austin Parks Foundation, the US General of an apartment project being built by Phoenix Properties. About Services Administration (GSA) and a variety of downtown 30,000 square feet there will be for retail use, including West Elm, stakeholders to transform this historic square into a beautiful with the balance going to office tenants. green place buzzing with people and activity. This initiative brings together private and public resources to create physical 2. Lance Armstrong Crosstown Bikeway improvements and programs that attract, engage, and reflect Austin’s diverse community. This project is now being done in coordination This project, named for seven-time Tour de France winner and with the development of a new Federal Courthouse on the block cancer survivor Lance Armstrong, will provide a continuous bike just to the west of the square. The Austin City Council has agreed route for over 6 miles, beginning at Levander Loop at US 183, to close the one-block section of San Antonio Street between following 5th Street, passing through downtown along 4th and 3rd the Square and the courthouse site, and efforts are beginning to streets, and terminating near Deep Eddy pool just west of Mopac. -

Northwest Austin

Spring :: 1Q 2013 Austin Publication Date: April 2013 Office Market Overview The Austin Office Market Overview is a quarterly publication prepared by Transwestern Austin for our clients. If you would like receive copies of this publication on a quarterly basis, please contact any of our senior team members below, or send an email request to [email protected]. Transwestern Austin 901 South MoPac Expressway Building 4, Suite 250 Austin, Texas 78746 512.328.5600 www.transwestern.net/austin Transwestern Austin Kevin Roberts, President | Southwest (713) 270.3347 [email protected] Robert Gaston, Executive Vice President | Central Texas (512) 314.3554 [email protected] Becky Doolin, CPA, Senior Vice President | Financial Services (512) 314.3575 [email protected] Agency Leasing and Tenant Advisory Mike Brown, Senior Vice President (512) 314.3552 [email protected] Britt Reed, Senior Vice President (512) 314.3577 [email protected] Greg Johnson, Vice President (512) 314.3570 [email protected] Luke Wheeler, Vice President (512) 314.3553 [email protected] Brandon Lester, Associate Vice President (512) 314.3576 [email protected] Will Stewart, Senior Associate (512) 314.3574 [email protected] Central Texas Multifamily Services Jeff Rogers, Managing Director (512) 314.5207 [email protected] Chris Stutzman, Managing Director (512) 314.5203 [email protected] Development Services Ty Puckett, Executive Vice -

Download Austin File Alphabetic List

Austin File Alphabetic List 13th Floor Elevators--See: BIOGRAPHY FILE - Roky Erickson M9300 16 S0300 1800 Restaurant & Bar R3800 (E) 1880s P7300 1886 Room H3200 (8) 1938 Radio Script P1400 (12) 1977 Bond Issue P7100 (3) 1980-1989 P8660 2-J's R3800 (T) 23rd Street Artists Market P1400 (39) 26 Doors S2300 (21) 311 Club S0300 (102) 35th & Jefferson Retail/Office Center B6824 (5) 35th Street Festival C1900 (15) 3M Corporation M0900 (41) 5 AM Studio M9385 (52) 501 Studios M8460 (75) 5604 Manor N1875 (14) 612 West R3800 (S) 64 Beds H2010 (2) 8 ½ Souvenirs M9300 (E) A Bon Chat, Bon Rat I1200 (16) "A Nostalgic Evening at the Grand Ole Driskill" H3200 (4) "A Traditional San Jacinto Day Celebration" L2710 (29s) A-Perm-O-Green Lawn Company G0800 (3) A. Mozart Fest M9383 (7) A.C.O.R.N. N1900 (26) AAA Bonding Company C9200 (2) Aaron's B5070 (5) Abattoir M8640 (2) Abbey Wedding Chapel, The (in general folder) W2300 (1) Abbott Laboratories Corporation M0900 (11) Abendmusik M9380 (9) Aber-Schultz Auto Supply Company A9910 (26) Abernathy Furniture Company F5000 (16) Ablanedo, Ralph 1978 M8900 (41) Abortion F0520 (1) Academy for Educational Development E0600 (2) Academy Surplus D1100 (24) Accent Gallery A6400 (105) Accent Travel T7900 (6) ACCESS (Austin Collaborative of Cultural & Educational Sites & Schools) P8200 (83) Ace Custom Tailors C5230 (22) Achievement Scores P8200 (15) Achilles Grocery G4200 (91) Ackermann, Frieda and Hans W5700 (5) Acme Life Insurance Company I1150 (2) Acquisitions L2710 (29a) Acquisitions L2710 (29r) Act Against Violence Community -

CBRE | 100 Congress Ave. | Suite 500 Austin, TX 78701 | Eat

CBRE | 100 Congress Ave. | Suite 500 Austin, TX 78701 | www.cbre.com/austin EAT. SHOP. LIVE. AVAILABILITY 1,183 SF - 2,345 SF CENTRAL BUSINESS DISTRICT AT YOUR DOORSTEP 3-5 MINUTE WALK • 360 Condominiums • Jo's Coffee • ACL Live @ Moody Theater • La Condesa • Ann Taylor Loft • Lamberts • Ashton • Lavaca Street Bar & Grill • Austin City Hall • Luxe Apothetique • Austin Java • Malaga Tapas & Bar • Austin Proper Hotel • Mama Fu’s (coming soon) • Mellow Johnny’s • Austin Public Library • Mercury • Ballet Austin • Milk & Honey Day Spa • Bar Chi • The Monarch • Bess Bistro • NorthShore (coming soon) • Blu Dot • RIDE Indoor Cycling • Bob’s Steak & Chophouse • Royal Blue Grocery • The Bonneville • Second Bar & Kitchen • Bonobos • Starbucks • Café Medici • Sullivan’s Steakhouse • Cantina Laredo • Taverna Austin • Cedar Street Courtyard • III Forks • Cru Wine Bar • Thundercloud Subs • Delish Bakery • Trace • Design Within Reach • Urban Outfitters • Eliza Page • Violet Crown Cinema • Flor • The W Hotel • Francesca’s • Wee • Hotel Zaza (coming soon) • Wells Fargo Bank • Juan Pelota Cafe • Which Wich 8+ MINUTE WALK • Alamo Drafthouse • Iron Works • Annie’s • JW Marriott • Anthropologie • La Traviata • Austin Convention Center • Luke’s Locker • Austin American-Statesman • Maiko Sushi Bat Observation Center • Manuel's • Arro • Max’s Wine Dive • Barre 3 • Moonshine Patio Bar & Grill • Benji’s Cantina • Osteria Pronto • Brooks Brothers • Paramount Theater • Burger Bar • Parkside • By George • Patagonia 60+ 6,500 7,500 125+ 43m + • Capital Grille • Perry’s -

What's New in Austin?

- WHAT’S NEW IN AUSTIN? Whether it’s a friendly vibe, a creative culture, or an active community, there’s something special about Austin, the Live Music Capital of the World®. As the city’s popularity as a travel destination grows, so does the demand for entertainment, new attractions and distinct accommodations. Please access our online Press Resources for more information on specific industries and interests. For information about upcoming hotels projects and meetings and conventions, please reference the Hotel Updates page and the Austin Convention Calendar page. Here’s what’s new or upcoming in the city: FLIGHTS In summer 2016, Condor Airlines will be flying between Austin-Bergstrom International Airport (AUS) and Frankfurt International Airport (FRA). The seasonal flights are scheduled to operate on Mondays and Thursdays from June 27, 2016 through September 1, 2016. Austin is the third addition to Condor’s network in the United States within one year after launching nonstop service between Providence (PVD) and Portland (PDX) to Frankfurt, Germany this summer. ATTRACTIONS X Games Austin, Texas, the Live Music Capital of the World®, was selected to host one of six stops on the Global X Games circuit for the next four years beginning 2014, to be hosted at Circuit of the Americas. X Games Austin gained a 4-day attendance of 160,000 spectators and an all-time total of 5,069,115 attendees in 2015, making it the most attended X Games since 2004. Moto X Flat Track, Moto X Quarter Pipe and Big Air Doubles also debuted at the 2015 games. -

Taylor Downtown Historic District 10/26/2005

(Oct. 1990) United States Department of the Interior ^^p 1 5 t-*^"-^ 11^3 National Park Service NATIONAL REGISTER OF HISTORIC PLACES REGISTRATION FORM I. NAME OF PROPERTY HISTORIC NAME: Taylor Downtown Historic District OTHER NAME/SITE NUMBER: N/A 2. LOCATION STREET & NUMBER: Roughly bounded by Fifth Street, Washburn, First Street, and Vance Street. CITY OR TOWN: Taylor VICINITY: N/A NOT FOR PUBLICATION: N/A STATE:Texas CODE: TX COUNTY: Williamson CODE: 491 ZIP CODE: 76574 1. STATE/FEDERAL AGENCY CERTIFICATION As the designated authority under the National Historic Preservation Act, as amended, I hereby certify that this (jc_nomination) ( request for determination of eligibilit)') meets the documentation standards for registering properties in the National Register of Historic Places and meets the procedural and professional requirements set forth in 36 CFR Part 60. In my opinion, the property {_x_ meets) ( _ does not meet) the National Register criteria. 1 recommend that this propejiy1)e considered significant ( _ nationally) ( _ statewide) ( x locally). ( See continuation sheet for additional comments.) A-\ Signature fffcertifying official Date State Historic Preservation Officer. Texas Historical Commission State or Federal agency and bureau In my opinion, the property meets does not meet the National Register criteria. { See continuation sheet for additional comments.) Signature of commenting or other official Date State or Federal agency and bureau 4. NATIONAL PARK SERVICE CERTIFICATION entered in the National Register i ALo-^^^A '/'^^ \^QCIlj/X_. [D ' ZC> ' (7) _ See continuation sheet, determined eligible for the National Register _ See continuation sheet determined not eligible for the National Register removed from the National Register other (explain): USDI/NPS NRHP Registration Form Taylor Downtown Historic District, Taylor, Williamson County, Texas Page 2 5.