CDP Climate Change Questionnaire 2020 Respondent

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oil Refining in Mexico and Prospects for the Energy Reform

Articles Oil refining in Mexico and prospects for the Energy Reform Daniel Romo1 1National Polytechnic Institute, Mexico. E-mail address: [email protected] Abstract: This paper analyzes the conditions facing the oil refining industry in Mexico and the factors that shaped its overhaul in the context of the 2013 Energy Reform. To do so, the paper examines the main challenges that refining companies must tackle to stay in the market, evaluating the specific cases of the United States and Canada. Similarly, it offers a diagnosis of refining in Mexico, identifying its principal determinants in order to, finally, analyze its prospects, considering the role of private initiatives in the open market, as well as Petróleos Mexicanos (Pemex), as a placeholder in those areas where private enterprises do not participate. Key Words: Oil, refining, Energy Reform, global market, energy consumption, investment Date received: February 26, 2016 Date accepted: July 11, 2016 INTRODUCTION At the end of 2013, the refining market was one of stark contrasts. On the one hand, the supply of heavy products in the domestic market proved adequate, with excessive volumes of fuel oil. On the other, the gas and diesel oil demand could not be met with production by Petróleos Mexicanos (Pemex). The possibility to expand the infrastructure was jeopardized, as the new refinery project in Tula, Hidalgo was put on hold and the plan was made to retrofit the units in Tula, Salamanca, and Salina Cruz. This situation constrained Pemex's supply capacity in subsequent years and made the country reliant on imports to supply the domestic market. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Integrating Into Our Strategy

INTEGRATING CLIMATE INTO OUR STRATEGY • 03 MAY 2017 Integrating Climate Into Our Strategy INTEGRATING CLIMATE INTO OUR STRATEGY • 03 CONTENTS Foreword by Patrick Pouyanné, Chairman and Chief Executive Officer, Total 05 Three Questions for Patricia Barbizet, Lead Independent Director of Total 09 _____________ SHAPING TOMORROW’S ENERGY Interview with Fatih Birol, Executive Director of the International Energy Agency 11 The 2°C Objective: Challenges Ahead for Every Form of Energy 12 Carbon Pricing, the Key to Achieving the 2°C Scenario 14 Interview with Erik Solheim, Executive Director of UN Environment 15 Oil and Gas Companies Join Forces 16 Interview with Bill Gates, Breakthrough Energy Ventures 18 _____________ TAKING ACTION TODAY Integrating Climate into Our Strategy 20 An Ambition Consistent with the 2°C Scenario 22 Greenhouse Gas Emissions Down 23% Since 2010 23 Natural Gas, the Key Energy Resource for Fast Climate Action 24 Switching to Natural Gas from Coal for Power Generation 26 Investigating and Strictly Limiting Methane Emissions 27 Providing Affordable Natural Gas 28 CCUS, Critical to Carbon Neutrality 29 A Resilient Portfolio 30 Low-Carbon Businesses to Become the Responsible Energy Major 32 Acquisitions That Exemplify Our Low-Carbon Strategy 33 Accelerating the Solar Energy Transition 34 Affordable, Reliable and Clean Energy 35 Saft, Offering Industrial Solutions to the Climate Change Challenge 36 The La Mède Biorefinery, a Responsible Transformation 37 Energy Efficiency: Optimizing Energy Consumption 38 _____________ FOCUS ON TRANSPORTATION Offering a Balanced Response to New Challenges 40 Our Initiatives 42 ______________ OUR FIGURES 45 04 • INTEGRATING CLIMATE INTO OUR STRATEGY Total at a Glance More than 98,109 4 million employees customers served in our at January 31, 2017 service stations each day after the sale of Atotech A Global Energy Leader No. -

Nuclear Hvac

NUCLEAR HVAC ENGIE Axima, your key partner ENGIE Axima your local partner for engineering, procurement, construction and operation maintenance of your nuclear HVAC projects. Gravelines With a network of GravelinesDunkerque Lille Boulogne-sur-Mer Dunkerque Lille Boulogne-sur-MerPenly St-Omer Dieppe Chooz Cherbourg Penly St-Omer Amiens Paluel Dieppe Chooz FlamanvilleCherbourg Amiens Compiègne Cattenom officies Paluel Rouen Flamanville Compiègne Cattenom Phalsbourg Engineering Procurement Construction Rouen PARIS Saint-Brieuc Caen Reims Metz ENGIE_axima RÉFÉRENCES COULEUR Brest Phalsbourg Haguenau • Design of HVAC & air treatment systems, • Qualification of the equipment (either • Installation of HVAC systems in in France ChartresPARIS Nogent/Seine gradient_MONO_WHITE Saint-Brieuc MontaubanCaen Reims Metz 22/10/2015 Brest Nancy HaguenauSTRASBOURG Landivisiau de Bretagne LeChartres Mans Nogent/Seine Troyes 24, rue Salomon de Rothschild - 92288 Suresnes - FRANCE of process fluids, process vacuum, and by analysis or testing). coordination with other work packages. Montauban Tél. : +33 (0)1 57 32 87 00 / Fax : +33 (0)1 57 32 87 87 Quimper Web : www.carrenoir.com WHITE cooling systems, including the preparation Landivisiau de BretagneRennesLe Mans Orléans Troyes Nancy Epinal STRASBOURGColmar Lorient Chaumont • Long-term partnership with reputable • Testing, commissioning, acceptance, Quimper Angers Fessenheim of the technical specifications for the VannesRennes St-LaurentOrléans Epinal MulhouseColmar suppliers for the procurement of all operation -

Shell QRA Q2 2021

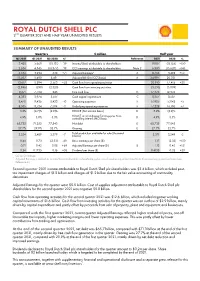

ROYAL DUTCH SHELL PLC 2ND QUARTER 2021 AND HALF YEAR UNAUDITED RESULTS SUMMARY OF UNAUDITED RESULTS Quarters $ million Half year Q2 2021 Q1 2021 Q2 2020 %¹ Reference 2021 2020 % 3,428 5,660 (18,131) -39 Income/(loss) attributable to shareholders 9,087 (18,155) +150 2,634 4,345 (18,377) -39 CCS earnings attributable to shareholders Note 2 6,980 (15,620) +145 5,534 3,234 638 +71 Adjusted Earnings² A 8,768 3,498 +151 13,507 11,490 8,491 Adjusted EBITDA (CCS basis) A 24,997 20,031 12,617 8,294 2,563 +52 Cash flow from operating activities 20,910 17,415 +20 (2,946) (590) (2,320) Cash flow from investing activities (3,535) (5,039) 9,671 7,704 243 Free cash flow G 17,375 12,376 4,383 3,974 3,617 Cash capital expenditure C 8,357 8,587 8,470 9,436 8,423 -10 Operating expenses F 17,905 17,042 +5 8,505 8,724 7,504 -3 Underlying operating expenses F 17,228 16,105 +7 3.2% (4.7)% (2.9)% ROACE (Net income basis) D 3.2% (2.9)% ROACE on an Adjusted Earnings plus Non- 4.9% 3.0% 5.3% controlling interest (NCI) basis D 4.9% 5.3% 65,735 71,252 77,843 Net debt E 65,735 77,843 27.7% 29.9% 32.7% Gearing E 27.7% 32.7% Total production available for sale (thousand 3,254 3,489 3,379 -7 boe/d) 3,371 3,549 -5 0.44 0.73 (2.33) -40 Basic earnings per share ($) 1.17 (2.33) +150 0.71 0.42 0.08 +69 Adjusted Earnings per share ($) B 1.13 0.45 +151 0.24 0.1735 0.16 +38 Dividend per share ($) 0.4135 0.32 +29 1. -

The Royal Institution for the Advancement

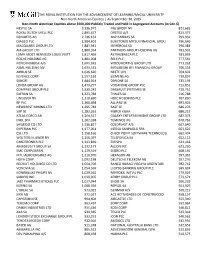

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Non-North American Equities │ As September 30, 2019 Non-North American Equities above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) NESTLE SA 3,136,972 ING GROEP NV 822,665 ROYAL DUTCH SHELL PLC 2,895,677 ORSTED A/S 813,377 NOVARTIS AG 2,736,152 BNP PARIBAS SA 799,331 DIAGEO PLC 1,984,601 SUMITOMO MITSUI FINANCIAL GROU 796,646 MACQUARIE GROUP LTD 1,881,942 IBERDROLA SA 796,483 AIA GROUP LTD 1,880,954 PARTNERS GROUP HOLDING AG 781,932 LVMH MOET HENNESSY LOUIS VUITT 1,817,469 ASTRAZENECA PLC 781,059 ROCHE HOLDING AG 1,801,008 RELX PLC 777,561 NOVO NORDISK A/S 1,695,931 WOOLWORTHS GROUP LTD 771,262 ASML HOLDING NV 1,633,531 MITSUBISHI UFJ FINANCIAL GROUP 766,553 AIRBUS SE 1,626,620 NESTE OYJ 764,602 KEYENCE CORP 1,557,193 SIEMENS AG 739,857 SANOFI 1,484,014 DANONE SA 733,193 LONZA GROUP AG 1,479,277 VODAFONE GROUP PLC 723,852 COMPASS GROUP PLC 1,339,242 DASSAULT SYSTEMES SE 720,751 SAFRAN SA 1,323,784 THALES SA 716,788 UNILEVER NV 1,319,690 HSBC HOLDINGS PLC 707,830 BP PLC 1,300,498 ALLIANZ SE 693,905 NEWCREST MINING LTD 1,295,783 BASF SE 686,276 SAP SE 1,283,261 MERCK KGAA 686,219 ATLAS COPCO AB 1,264,517 GALAXY ENTERTAINMENT GROUP LTD 683,373 ENEL SPA 1,262,338 TEMENOS AG 670,763 SHISEIDO CO LTD 1,236,827 COLOPLAST A/S 667,640 EXPERIAN PLC 1,177,061 INTESA SANPAOLO SPA 663,622 CSL LTD 1,158,166 CHECK POINT SOFTWARE TECHNOLOG 662,404 WOLTERS KLUWER NV 1,156,397 TELEFONICA SA 652,113 CARDTRONICS PLC 1,143,839 ENI SPA 641,418 AMADEUS IT GROUP SA -

CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3)

ENVIRONMENT CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3) GRI Standards : 402-1: Energy 305-1, 305-2, 305-3,305-4, 305-5: Emissions EXECUTIVE SUMMARY Sanofi has committed to limit the impacts linked to its activities on the environment. One of the major challenges of the Sanofi Planet Mobilization program consists in reducing its Greenhouse Gas (GHG) emissions: • direct emissions related to Scope 1 and 2 (industrial, R&D and tertiary sites, including the medical representative’s fleet) • indirect emissions related to scope 3, associated with the value chain activities (transportation and distribution, purchased goods and services, waste generation, etc.) Carbon Footprint Factsheet 1 Published in April 2021 TABLE OF CONTENTS 1. BACKGROUND ............................................................................................................ 3 2. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 1 & 2 ................................ 3 2.1. Dashboard: objectives and progress ...................................................................... 3 2.2. Key figures ................................................................................................................. 3 2.3. Highlights ................................................................................................................... 4 3. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 3 ....................................... 6 3.1. Context ....................................................................................................................... 6 3.2. Key -

Statoil Business Update

Statoil US Onshore Jefferies Global Energy Conference, November 2014 Torstein Hole, Senior Vice President US Onshore competitively positioned 2013 Eagle Ford Operator 2012 Marcellus Operator Williston Bakken 2011 Stamford Bakken Operator Marcellus 2010 Eagle Ford Austin Eagle Ford Houston 2008 Marcellus 1987 Oil trading, New York Statoil Office Statoil Asset 2 Premium portfolio in core plays Bakken • ~ 275 000 net acres, Light tight oil • Concentrated liquids drilling • Production ~ 55 kboepd Eagle Ford • ~ 60 000 net acres, Liquids rich • Liquids ramp-up • Production ~34 koepd Marcellus • ~ 600 000 net acres, Gas • Production ~130 kboepd 3 Shale revolution: just the end of the beginning • Entering mature phase – companies with sustainable, responsible development approach will be the winners • Statoil is taking long term view. Portfolio robust under current and forecast price assumptions. • Continuous, purposeful improvement is key − Technology/engineering − Constant attention to costs 4 Statoil taking operations to the next level • Ensuring our operating model is fit for Onshore Operations • Doing our part to maintain the company’s capex commitments • Leading the way to reduce flaring in Bakken • Not just reducing costs – increasing free cash flow 5 The application of technology Continuous focus on cost, Fast-track identification, Prioritised development of efficiency and optimisation of development & implementation of potential game-changing operations short-term technology upsides technologies SHORT TERM – MEDIUM – LONG TERM • Stage -

Ethics Charter • ENGIE

Ethics charter 2 INTRODUCTION – ISABELLE KOCHER, CEO A SUSTAINABLE COMPANY IS AN ETHICAL COMPANY ENGIE is a global benchmark player in the energy sector. Responsible growth is central to the Group’s areas of activity (low-carbon electricity generation, networks, customer solutions), which positions itself as a pioneer to address the main challenges of the new energy landscape: reducing and adapting to climate change, access to sustainable energy and reasonable use of resources. To meet these challenges we need a trustworthy and reliable relationship with all our stakeholders: trust of consumers and industrialists, of the public authorities and civil society, of our partners, suppliers, and our customers. Building and preserving this trust is based on two requirements: that of appropriation and uncompromising respect for our values by every Group employee; and that of our own responsibility in the decisions we take or the projects in which we become involved. This daily requirement shapes our identity around a simple and strong conviction: a sustainable company is an ethical company. ENGIE ETHICS CHARTER 3 This ethical ambition, shared by all, requires This Ethics charter, along with the Practical guide every individual to ethics, is the foundation to be exemplary for all of the referentials, internal policies and codes of conduct adopted by We have a very clear policy: zero tolerance, particularly regarding fraud and corruption, the Group, and which each and complete commitment to compliance with and every one of us must ethical rules - those of the countries in which promote and protect, we operate and those we set for ourselves. This requires every employee to take seriously whatever our position their role in building and protecting the Group’s in the hierarchy, our entity, reputation, by acting in full compliance with the or our geographical sphere applicable laws and our values and ethical principles, in all of our activities. -

ANNUAL REPORT 2019 Danone

ANNUAL REPORT 2019 Danone Accelerating the FOOD revolution TOGETHER Celebrating ‘ONE PERSON, BUSiNESS-LED 100 YEARS ONE VOiCE, ONE SHARE’ COALITiONS of pioneering healthy 100,000 employees for inclusive growth innovation co-owning our future & biodiversity Contents #1 Danone in 2019 4 11 Danone Empowering employees at a gIance to co-own our vision 12 2019 Celebrating 100 years of pioneering Key milestones healthy innovation together 8 13 Interview with our Chairman and CEO, Collective action Emmanuel Faber, for greater impact by Danone employees & transformational change 10 Progressing towards our 2030 Goals #2 Performance Creating sustainable & profitable value for all 15 22 3 questions to Essential Dairy Cécile Cabanis, CFO & Plant-Based 1 24 #3 Health & Nutrition Waters performance 2 18 Specialized Nutrition Collaborative Environmental performance innovation 20 Building a healthier Social performance & sustainable food system together 29 34 Boosting Co-creating innovation the future of food 30 3 Growing with purpose A people-powered company 32 Biodiversity: from farm to fork For more information: danone.com/integrated- annual-report-2019 3 Danone at a glance OUR MISSION: ‘BRINGING HEALTH THROUGH FOOD A GLOBAL LEADER WITH A UNIQUE HEALTH-FOCUSED TO AS MANY PEOPLE AS POSSIBLE’ PORTFOLIO IN FOOD AND BEVERAGES LEADING POSITIONS (1) STRONG PROGRESS ON PROFITABLE GROWTH IN 2019 #1 #1 #2 €25.3 bn 15.21% €3.85 €2.10 Sales Recurring operating Recurring earnings Dividend per share WORLDWiDE EUROPE WORLDWiDE margin per share (EPS) payable in -

Integrated Reporting in France: a Failure of Reducing the Information Asymmetries About Sustainability Elisabeth Albertini

Integrated reporting in France: a failure of reducing the information asymmetries about sustainability Elisabeth Albertini To cite this version: Elisabeth Albertini. Integrated reporting in France: a failure of reducing the information asymmetries about sustainability. Sustainability Accounting, Management and Policy Journal, Emerald, 2018. hal-02148574 HAL Id: hal-02148574 https://hal.archives-ouvertes.fr/hal-02148574 Submitted on 5 Jun 2019 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Integrated reporting in France: a failure of reducing the information asymmetries about sustainability Elisabeth Albertini Abstract Purpose: This paper aims to determine how integrated reporting (IR) can effectively report on multiple capitals that, when taken together, should create value in a sustainable way, with the objective of reducing information asymmetry. Design/methodology/approach: To answer this research question, a qualitative content analysis was conducted of the IR disclosed by the French companies in the period 2013 –16. Findings: The study reveals that information asymmetry is not reduced since companies mention only some capitals as inputs to their value creation process while almost entirely excluding natural capital. Moreover, companies disclose only positive information, mainly about their financial capital, without mentioning any destruction of capital, especially natural capital. -

Saputo Dairy Australia Commences Large-Scale Renewable Electricity Agreement with ENGIE

Media Release Saputo Dairy Australia commences large-scale renewable electricity agreement with ENGIE (Melbourne, 7 April 2021) – Saputo Dairy Australia (SDA), the operating subsidiary of Saputo Inc. in Australia, is issuing this media release to announce that SDA has commenced a 10 year long-term, large-scale renewable power purchase agreement (PPA) with ENGIE, a global leader in renewable energy. Within two years, this transformational program will ramp up to offset 46% of SDA’s electricity with renewables through ENGIE’s Australian renewable energy generation portfolio. In 2020, Saputo Inc., one of the top 10 dairy processors in the world, pledged to accelerate its global efforts to safeguard the environment and committed clear targets to achieve sustainable progress, including actively sourcing renewables. SDA’s long-term commitment to renewable electricity is a big step towards Saputo achieving its promise to reduce its global greenhouse gas intensity by 20% by 2025. This renewable initiative will be on track to reduce SDA’s carbon dioxide emissions by more than 61,000 tonnes in 2023 - equal to taking more than 13,000 cars off the road and reducing Saputo’s global CO2 footprint by 5.7% (against the FY2020 baseline). SDA’s 10-year renewable PPA with ENGIE commenced on 1 April, following a two-year intensive program with energy and sustainability advisor, Schneider Electric. Partnering with ENGIE is an important step in sourcing clean renewable electricity to reduce SDA’s environmental footprint and play our part as a sustainable dairy manufacturer. ENGIE welcomed the deal with SDA. “We’re delighted to be delivering a long-term renewable solution that will help Saputo Dairy Australia achieve their sustainability goals,” said Andrew Hyland, ENGIE’s Executive General Manager of Energy Management.