ENGIE Inaugurates a Platform Designed to Test Renewable Technologies in Singapore, Thus Accelerating Its Strategy Towards a Carbon-Neutral Economy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ishares Core EURO STOXX 50 UCITS

iShares Core EURO STOXX 50 UCITS ETF EXW1 (DE) August Factsheet Performance, Portfolio Breakdowns, Net Asset information as at: 31-Aug-2021 All other data as at: 07-Sep-2021 Investors should read the Key Investor Information Document and Prospectus prior to investing. Capital at risk. All financial investments involve an element of risk. Therefore, the value The Fund seeks to track the performance of an index composed of 50 of the largest companies in of your investment and the income from it will the Eurozone. vary and your initial investment amount cannot be guaranteed. KEY BENEFITS KEY FACTS 1 Exposure to the 50 largest companies from developed Eurozone countries Asset Class Equity Fund Base Currency EUR 2 Direct investment into blue-chip companies representative of leaders in the Eurozone Share Class Currency EUR Fund Launch Date 27-Dec-2000 3 Exposure to regional and large market capitalisation companies Share Class Launch Date 27-Dec-2000 Benchmark EURO STOXX® 50 Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. ISIN DE0005933956 This means the Fund is more sensitive to any localised economic, market, political or regulatory Total Expense Ratio 0.10% Distribution Type Up to 4x per year events. The value of equities and equity-related securities can be affected by daily stock market Domicile Germany movements. Other influential factors include political, economic news, company earnings and Methodology Replicated significant corporate events. Counterparty Risk: The insolvency of any institutions providing Product Structure Physical services such as safekeeping of assets or acting as counterparty to derivatives or other Rebalance Frequency Quarterly instruments, may expose the Fund to financial loss. -

First Name Last Name Title Doug Abbott Melt/Cast Electrical Super

First Name Last Name Title Doug Abbott Melt/Cast Electrical Super Charles Abbott #1 Mill Superintendent Wilson Abbott Project Manager Mohamed Abdelshafy Quality Mgr Keizo Abe General Manager Takeshi Abe Markus Abel Senior Expert Steelmaking Steve Abernathy Sunday Abraham Principal Research Enginee Mark Abraham Staff Mohamed Abumosaed Operation Mgr John Accurso Process Engineer Gesser Achim Steven Acker Jason Adair Melting Shift Supervisor Michael Adam Chris Adams Danny Adams Melt Shop Caster Foreman Jeffrey Adams Director of Safety Marlon Adams General Supervisor, Furnac Tony Adams Technical Sales Manager Sam Adams Chris Addison Larry Addkison Michael Adducci District Sales Manager Giovanni Adduci Mark Ader General Sales Manager Allan Adkins Marketing and Sales Manager Tim Adler West Regional Sales Manager Mikael Adolfsson Kuldeep Agarwal Anwar Aglan Cesar Agostino MOHAMED MAZEEM AHAMED IMRAN Frank Ahrenhold Director Steelmaking Federico Ahualli Operations Director Rajiv Ahuja President / CEO David Ahwesh Hiroshi Aida Tomoyuki Aizawa Lal Ajwani Sales Manager Canada Steve Aker Operations Mgr Andy Akers Liam Akins Satoru Akutsu Faishl Alahmadi Specialist Constantno Alarcon Head of Sales Department Ali Jaber Al-Athba Manager Cem Alaybeyoglu Denis Albayrak Mohammed Al-Bedour Vice President Robert Albert Principal Engineer Robert Albert Project Manager William Alder Maher Al-Dojayli Engineering Specialist Sammuel Aleixo Student James Alesia Safety Coordinator Bradley Alexander Unit Manager R.D. Alexander General Manager Tony Alexander Gianluca Aliotta Yassin Alkazaz YUSUF alkhatib MANAGER William Allan Principal Jason Allen lloyd allen Chris Allen Guarding Technician Mike Allen Sr Sales Manager Jean Allen Marcus Allhands Tony Allor Mike Allor Michael Almeraz Michael Almli Eric Almquist Engineer/Sales Ann Almstedt Vice President Niklas Almstedt President Majed AlRashedi Manager Saad Alshammary Sr. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Nuclear Hvac

NUCLEAR HVAC ENGIE Axima, your key partner ENGIE Axima your local partner for engineering, procurement, construction and operation maintenance of your nuclear HVAC projects. Gravelines With a network of GravelinesDunkerque Lille Boulogne-sur-Mer Dunkerque Lille Boulogne-sur-MerPenly St-Omer Dieppe Chooz Cherbourg Penly St-Omer Amiens Paluel Dieppe Chooz FlamanvilleCherbourg Amiens Compiègne Cattenom officies Paluel Rouen Flamanville Compiègne Cattenom Phalsbourg Engineering Procurement Construction Rouen PARIS Saint-Brieuc Caen Reims Metz ENGIE_axima RÉFÉRENCES COULEUR Brest Phalsbourg Haguenau • Design of HVAC & air treatment systems, • Qualification of the equipment (either • Installation of HVAC systems in in France ChartresPARIS Nogent/Seine gradient_MONO_WHITE Saint-Brieuc MontaubanCaen Reims Metz 22/10/2015 Brest Nancy HaguenauSTRASBOURG Landivisiau de Bretagne LeChartres Mans Nogent/Seine Troyes 24, rue Salomon de Rothschild - 92288 Suresnes - FRANCE of process fluids, process vacuum, and by analysis or testing). coordination with other work packages. Montauban Tél. : +33 (0)1 57 32 87 00 / Fax : +33 (0)1 57 32 87 87 Quimper Web : www.carrenoir.com WHITE cooling systems, including the preparation Landivisiau de BretagneRennesLe Mans Orléans Troyes Nancy Epinal STRASBOURGColmar Lorient Chaumont • Long-term partnership with reputable • Testing, commissioning, acceptance, Quimper Angers Fessenheim of the technical specifications for the VannesRennes St-LaurentOrléans Epinal MulhouseColmar suppliers for the procurement of all operation -

Schneider Electric Sustainability Report

Schneider Sustainability Report 2017 – 2018 A clear vision for the future sdreport.se.com sdreport.se.comsdrsdsdrdrepepoepoportrt.rtt..ssese.ee..comccooomm • 1 CONTENTS 3 • INTRODUCTION: OUR MISSION The digital transformation of energy management and automation is our mission. As our CEO, Jean-Pascal Tricoire says, “When it comes to climate change, I’m neither an optimist nor a pessimist. I’m an activist.” 9 • SUSTAINABLE SOLUTIONS We believe meaningful action is the only path to a sustainable world. Discover how we use EcoStruxure™ innovation and open collaboration to create effi cient, eff ective, green solutions for our customers. 17 • OUR CUSTOMERS Across buildings, data centers, industry, and infrastructure, we’re equipping the world with connected solutions that increase operational and energy effi ciency — and make sustainability a reality. See the results. 22 • OUR PEOPLE It takes great people to power our sustainability eff orts and our company. We off er a learning-focused, inclusive workplace that fosters innovation and fuels professional development. Learn more about our shared, meaningful purpose. 28 • OUTREACH AND INITIATIVES Today, 1.1 billion people lack access to electricity. As we work to reduce the energy gap and address fuel poverty, we must do so responsibly. Learn how we’re innovating to solve this energy paradox. 36 • COMPANY PERFORMANCE We launched more than 100 new products, continued to optimize our portfolio, and delivered growth for shareholders. See how Schneider Electric performed in 2017. 44 • LOOKING AHEAD We’re taking proactive steps toward co-creating a sustainable future with immediate and short- and long-term sustainability targets. See what’s next. -

The Royal Institution for the Advancement

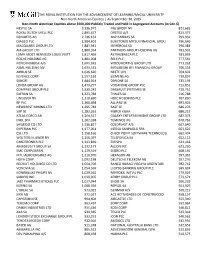

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Non-North American Equities │ As September 30, 2019 Non-North American Equities above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) NESTLE SA 3,136,972 ING GROEP NV 822,665 ROYAL DUTCH SHELL PLC 2,895,677 ORSTED A/S 813,377 NOVARTIS AG 2,736,152 BNP PARIBAS SA 799,331 DIAGEO PLC 1,984,601 SUMITOMO MITSUI FINANCIAL GROU 796,646 MACQUARIE GROUP LTD 1,881,942 IBERDROLA SA 796,483 AIA GROUP LTD 1,880,954 PARTNERS GROUP HOLDING AG 781,932 LVMH MOET HENNESSY LOUIS VUITT 1,817,469 ASTRAZENECA PLC 781,059 ROCHE HOLDING AG 1,801,008 RELX PLC 777,561 NOVO NORDISK A/S 1,695,931 WOOLWORTHS GROUP LTD 771,262 ASML HOLDING NV 1,633,531 MITSUBISHI UFJ FINANCIAL GROUP 766,553 AIRBUS SE 1,626,620 NESTE OYJ 764,602 KEYENCE CORP 1,557,193 SIEMENS AG 739,857 SANOFI 1,484,014 DANONE SA 733,193 LONZA GROUP AG 1,479,277 VODAFONE GROUP PLC 723,852 COMPASS GROUP PLC 1,339,242 DASSAULT SYSTEMES SE 720,751 SAFRAN SA 1,323,784 THALES SA 716,788 UNILEVER NV 1,319,690 HSBC HOLDINGS PLC 707,830 BP PLC 1,300,498 ALLIANZ SE 693,905 NEWCREST MINING LTD 1,295,783 BASF SE 686,276 SAP SE 1,283,261 MERCK KGAA 686,219 ATLAS COPCO AB 1,264,517 GALAXY ENTERTAINMENT GROUP LTD 683,373 ENEL SPA 1,262,338 TEMENOS AG 670,763 SHISEIDO CO LTD 1,236,827 COLOPLAST A/S 667,640 EXPERIAN PLC 1,177,061 INTESA SANPAOLO SPA 663,622 CSL LTD 1,158,166 CHECK POINT SOFTWARE TECHNOLOG 662,404 WOLTERS KLUWER NV 1,156,397 TELEFONICA SA 652,113 CARDTRONICS PLC 1,143,839 ENI SPA 641,418 AMADEUS IT GROUP SA -

CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3)

ENVIRONMENT CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3) GRI Standards : 402-1: Energy 305-1, 305-2, 305-3,305-4, 305-5: Emissions EXECUTIVE SUMMARY Sanofi has committed to limit the impacts linked to its activities on the environment. One of the major challenges of the Sanofi Planet Mobilization program consists in reducing its Greenhouse Gas (GHG) emissions: • direct emissions related to Scope 1 and 2 (industrial, R&D and tertiary sites, including the medical representative’s fleet) • indirect emissions related to scope 3, associated with the value chain activities (transportation and distribution, purchased goods and services, waste generation, etc.) Carbon Footprint Factsheet 1 Published in April 2021 TABLE OF CONTENTS 1. BACKGROUND ............................................................................................................ 3 2. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 1 & 2 ................................ 3 2.1. Dashboard: objectives and progress ...................................................................... 3 2.2. Key figures ................................................................................................................. 3 2.3. Highlights ................................................................................................................... 4 3. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 3 ....................................... 6 3.1. Context ....................................................................................................................... 6 3.2. Key -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

Common Stocks — 104.5%

Eaton Vance Tax-Advantaged Global Dividend Income Fund January 31, 2021 PORTFOLIO OF INVESTMENTS (Unaudited) Common Stocks — 104.5% Security Shares Value Aerospace & Defense — 0.8% Safran S.A.(1) 98,721 $ 12,409,977 $ 12,409,977 Banks — 6.7% Bank of New York Mellon Corp. (The) 518,654 $ 20,657,989 Citigroup, Inc. 301,884 17,506,253 HDFC Bank, Ltd.(1) 512,073 9,775,702 ING Groep NV(1) 1,676,061 14,902,461 Japan Post Bank Co., Ltd. 445,438 3,851,696 Mitsubishi UFJ Financial Group, Inc. 2,506,237 11,317,609 Mizuho Financial Group, Inc. 292,522 3,856,120 Sumitomo Mitsui Financial Group, Inc. 186,747 5,801,916 Wells Fargo & Co. 341,979 10,218,332 $ 97,888,078 Beverages — 1.0% Diageo PLC 378,117 $ 15,180,328 $ 15,180,328 Biotechnology — 1.2% CSL, Ltd. 82,845 $ 17,175,550 $ 17,175,550 Building Products — 0.9% Assa Abloy AB, Class B 509,607 $ 12,603,485 $ 12,603,485 Chemicals — 0.7% Sika AG 38,393 $ 10,447,185 $ 10,447,185 Construction & Engineering — 0.0% Abengoa S.A., Class A(1)(2) 311,491 $ 0 Abengoa S.A., Class B(1)(2) 3,220,895 0 $0 Construction Materials — 0.9% CRH PLC 332,889 $ 13,660,033 $ 13,660,033 Consumer Finance — 0.6% Capital One Financial Corp. 79,722 $ 8,311,816 $ 8,311,816 1 Security Shares Value Diversified Financial Services — 2.5% Berkshire Hathaway, Inc., Class B(1) 101,853 $ 23,209,243 ORIX Corp. -

Ethics Charter • ENGIE

Ethics charter 2 INTRODUCTION – ISABELLE KOCHER, CEO A SUSTAINABLE COMPANY IS AN ETHICAL COMPANY ENGIE is a global benchmark player in the energy sector. Responsible growth is central to the Group’s areas of activity (low-carbon electricity generation, networks, customer solutions), which positions itself as a pioneer to address the main challenges of the new energy landscape: reducing and adapting to climate change, access to sustainable energy and reasonable use of resources. To meet these challenges we need a trustworthy and reliable relationship with all our stakeholders: trust of consumers and industrialists, of the public authorities and civil society, of our partners, suppliers, and our customers. Building and preserving this trust is based on two requirements: that of appropriation and uncompromising respect for our values by every Group employee; and that of our own responsibility in the decisions we take or the projects in which we become involved. This daily requirement shapes our identity around a simple and strong conviction: a sustainable company is an ethical company. ENGIE ETHICS CHARTER 3 This ethical ambition, shared by all, requires This Ethics charter, along with the Practical guide every individual to ethics, is the foundation to be exemplary for all of the referentials, internal policies and codes of conduct adopted by We have a very clear policy: zero tolerance, particularly regarding fraud and corruption, the Group, and which each and complete commitment to compliance with and every one of us must ethical rules - those of the countries in which promote and protect, we operate and those we set for ourselves. This requires every employee to take seriously whatever our position their role in building and protecting the Group’s in the hierarchy, our entity, reputation, by acting in full compliance with the or our geographical sphere applicable laws and our values and ethical principles, in all of our activities. -

ANNUAL REPORT 2019 Danone

ANNUAL REPORT 2019 Danone Accelerating the FOOD revolution TOGETHER Celebrating ‘ONE PERSON, BUSiNESS-LED 100 YEARS ONE VOiCE, ONE SHARE’ COALITiONS of pioneering healthy 100,000 employees for inclusive growth innovation co-owning our future & biodiversity Contents #1 Danone in 2019 4 11 Danone Empowering employees at a gIance to co-own our vision 12 2019 Celebrating 100 years of pioneering Key milestones healthy innovation together 8 13 Interview with our Chairman and CEO, Collective action Emmanuel Faber, for greater impact by Danone employees & transformational change 10 Progressing towards our 2030 Goals #2 Performance Creating sustainable & profitable value for all 15 22 3 questions to Essential Dairy Cécile Cabanis, CFO & Plant-Based 1 24 #3 Health & Nutrition Waters performance 2 18 Specialized Nutrition Collaborative Environmental performance innovation 20 Building a healthier Social performance & sustainable food system together 29 34 Boosting Co-creating innovation the future of food 30 3 Growing with purpose A people-powered company 32 Biodiversity: from farm to fork For more information: danone.com/integrated- annual-report-2019 3 Danone at a glance OUR MISSION: ‘BRINGING HEALTH THROUGH FOOD A GLOBAL LEADER WITH A UNIQUE HEALTH-FOCUSED TO AS MANY PEOPLE AS POSSIBLE’ PORTFOLIO IN FOOD AND BEVERAGES LEADING POSITIONS (1) STRONG PROGRESS ON PROFITABLE GROWTH IN 2019 #1 #1 #2 €25.3 bn 15.21% €3.85 €2.10 Sales Recurring operating Recurring earnings Dividend per share WORLDWiDE EUROPE WORLDWiDE margin per share (EPS) payable in -

Order 1 Purchase 2 Sale

Form to be sent to: ORDER 1 BNP Paribas Securities Services Grands Moulins de Pantin – Issuers Services Shareholders Relations SCHNEIDER ELECTRIC 9, rue du Débarcadère 2 93761 PANTIN CEDEX PURCHASE SALE FAX: 01 55 77 34 17 - +33 1 55 77 34 17 Confirmation of the order dated 3 / / made by phone 1 DD/MM/YYYY I the undersigned, Mr / Mrs / Ms Last name First name(s) (For legal persons: name of signatory) (For legal persons: first name of signatory) (strike out as appropriate) Company name SIREN (For legal persons) Date and place of at Phone birth (DD/MM/YYYY) mandatory) Shareholder number (account number) Residing at Town Post code Country Tax address give irrevocable instructions to BNP Paribas Securities Services to transmit the following order: 4 Stock ISIN Code Number of shares (in words) (in figures) 1 Type of order At market price Limit order at EUR (show the maximum purchase price or minimum sale price) Validity of order (maximum end of month): Documents to be supplied: • For a sale order 5 a Bank Account identity (RIB), Postal Account identity (RIP), Savings Account identity (RICE) or IBAN number for payment by transfer of the proceeds of the sale of shares, after deduction of brokerage fees, taxes and commissions. • For payment to an account using an IBAN / BIC code, please specify the payment currency in which the account is held: ……………………………… By signing this document, I declare that I have previously signed a dealing services agreement and taken note of the Terms and Conditions of BNP Paribas Securities Services, an extract of which is shown on the reverse, which I accept unreservedly.