Consolidated Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consolidated-Annual-Report-2009

2009 Consolidated annual report Key Figures Balance Sheet (in millions of Euros) 2009 2008 Change in per cent Assets 41,225 41,578 -0.8% Financial assets 14,543 14,367 +1.2% Receivables from customers 21,066 20,697 +1.8% Payables to customers 22,674 22,585 +0.4% Issued securities at cost 3,343 3,703 -9.7% Eligible own funds 2,826 2,180 +29.6% Income Statement (in millions of Euros) 2009 2008 Change in per cent Net interest income 564.3 652.5 -13.5% Net fee and commission income 154.8 143.9 +7.6% Gains and losses on assets and liabilities adjusted for minority interest 1) 138.9 -406.3 – Administrative expenses -517.3 -617.4 +16.2% Provisions and impairment losses -236.7 -281.4 +15.9% Profit (loss) before tax adjusted for minority interest 1) 45.5 -614.6 – Key figures 2009 2008 Tier I capital ratio 10.0% 6.6% Own funds ratio 13.6% 9.8% Cost:income ratio 2) 67.3% 174.4% Resources, as of 31.12. 2009 2008 Workforce (in full-time equivalents) 4,954 5,351 Bank branches 153 166 Post office branches 1,230 1,298 Rating 2009 2008 Moody’s rating 3) Baa1 Baa1 1) Under IFRS, the item Gains and losses on financial assets and liabilities also includes the valuation of securities whose risk is borne by minority shareholders. These securities are subject to substantial fair value fluctuations. In order to improve the comparability of the results, the valuation results attributable to minority shareholders have been excluded in the figures presented on this page. -

European Npls - FY18 an Overview of the Non-Performing Loan Market

An Acuris Company Year-End 2018 European NPLs - FY18 An overview of the non-performing loan market Alessia Pirolo Head of NPL Coverage, Debtwire +44 (0) 20 3741 1399 [email protected] Amy Finch Data Journalist, Debtwire +44 (0) 20 3741 1187 [email protected] European NPLs – FY18 An Acuris Company Overview: A Record Year for NPL sales 3-7 Trends by Country Italy 8-13 Spain 14-17 New Entries: Portugal, Greece and Cyprus 18-24 UK and Ireland 25-28 Germany 29-30 Index List of closed deals 31-40 Criteria 41 Authors and contact details 42 2 European NPLs – FY18 An Acuris Company A Record Year for NPL sales The European non-performing loan (NPL) market reached its peak in 2018 with disposal totalling EUR 205.1bn in gross book value (GBV). Debtwire NPL Database tracked 142 transactions. The year just closed has been by far a record, compared with EUR 144bn in 2017 and EUR 107bn in 2016, according to data from Deloitte. The last quarter of 2018 saw a particularly intense pace of activity, given that at the end of the third quarter closed deals totalled EUR 125bn. The most active country was Italy, which totalled half of the total volume of NPL sales. In 2018, 64 NPL sales with a gross book value (GBV) of EUR 103.6bn were tracked in the country, almost half of which were via securitisations within the government’s Garanzia sulla Cartolarizzazione delle Sofferenze (GACS) scheme, which now has only until 6 March 2019 to run. Spain has started to see a slowdown of sales, but still completed a massive EUR 43.2bn in 27 deals. -

Albertsons Companies, Inc. Form DEF 14A Filed 2021-06-24

SECURITIES AND EXCHANGE COMMISSION FORM DEF 14A Definitive proxy statements Filing Date: 2021-06-24 | Period of Report: 2021-08-05 SEC Accession No. 0001140361-21-022208 (HTML Version on secdatabase.com) FILER Albertsons Companies, Inc. Mailing Address Business Address 250 PARKCENTER BLVD. 250 PARKCENTER BLVD. CIK:1646972| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 0227 BOISE ID 83706 BOISE ID 83706 Type: DEF 14A | Act: 34 | File No.: 001-39350 | Film No.: 211043788 208-395-6200 SIC: 5411 Grocery stores Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document TABLE OF CONTENTS UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to Rule 14a-12 Albertsons Companies, Inc. (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ Fee paid previously with preliminary materials. -

Third Supplement 2019

Third Supplement dated 20 December 2019 to the Base Prospectus dated 18 March 2019 as supplemented by the First Supplement dated 5 June 2019, and the Second Supplement dated 19 August 2019 This document constitutes a supplement (the "Third Supplement") for the purposes of Article 13 of the Luxembourg Law on Prospectuses (as defined below) in connection with Article 46 para. 3 of Regulation (EU) 2017/1129 to two base prospectuses: (i) the base prospectus of BAWAG Group AG in respect of non-equity securities within the meaning of Article 22 (6) no.(4) of the Commission Regulation (EC) No. 809/2004 of 29 April 2004, as amended, ("Non-Equity Securities") and (ii) the base prospectus of BAWAG P.S.K. Bank für Arbeit und Wirtschaft und Österreichische Postsparkasse Aktiengesellschaft in respect of Non-Equity Securities (together, the "Debt Issuance Programme Prospectus" or the "Base Prospectus"). This Third Supplement is supplemental to, and should be read in conjunction with the Debt Issuance Programme Prospectus dated 18 March 2019, as supplemented by the First Supplement dated 5 June 2019 (the "First Supplement") and the Second Supplement dated 19 August 2019 (the "Second Supplement"). BAWAG Group AG BAWAG P.S.K. Bank für Arbeit und Wirtschaft und Österreichische Postsparkasse Aktiengesellschaft Vienna, Republic of Austria Vienna, Republic of Austria – Issuer – – Issuer – EUR 10,000,000,000 Debt Issuance Programme (the "Programme") The Issuers have requested the Commission de Surveillance du Secteur Financier of the Grand Duchy of Luxembourg -

Federated Hermes Investment Funds Public Limited Company

Federated Hermes Investment Funds Public Limited Company (An umbrella investment company with variable capital and having segregated liability between its Sub-Funds incorporated with limited liability in Ireland) Interim Report and Unaudited Financial Statements For the financial period ended 30 June 2020 Company Registration Number: 463628 Federated Hermes Investment Funds Public Limited Company Contents Management and Administration ������������������������������������������������������������������������������������������������������������������������������� 3 Manager Information ������������������������������������������������������������������������������������������������������������������������������������������������� 4 Investment Manager’s Report ����������������������������������������������������������������������������������������������������������������������������������� 6 Unaudited Portfolio Statements ������������������������������������������������������������������������������������������������������������������������������� 41 Unaudited Balance Sheet �������������������������������������������������������������������������������������������������������������������������������������� 191 Unaudited Income Statement �������������������������������������������������������������������������������������������������������������������������������� 201 Unaudited Statement of Changes in Net Assets Attributable to Holders of Redeemable Participating Shares ���� 210 Unaudited Cash Flow Statement ��������������������������������������������������������������������������������������������������������������������������� -

UNITED CHURCH of CHRIST, INC. SCHEDULE of INVESTMENTS March 31, 2021 Unaudited - for Information Purposes Only

THE PENSION BOARDS - UNITED CHURCH OF CHRIST, INC. SCHEDULE OF INVESTMENTS March 31, 2021 Unaudited - for information purposes only. SUMMARY OF INVESTMENTS COST VALUE STABLE VALUE INVESTMENTS Short-Term Investments $ 32,253,645 $ 32,253,645 Synthetic Guaranteed Investment Contracts Liquidity Strategy 22,775,770 22,775,770 Total Return Strategy 113,816,896 113,816,896 TOTAL STABLE VALUE INVESTMENTS $ 168,846,312 $ 168,846,312 SHORT-TERM INVESTMENTS Short-term Investments $ 99,844,082 $ 99,844,082 TOTAL SHORT-TERM INVESTMENTS $ 99,844,082 $ 99,844,082 FIXED-INCOME INVESTMENTS Bonds $ 1,100,460,107 $ 1,102,627,965 Bond funds 127,197,863 136,853,018 Asset-backed & Mortgage-backed Securities 252,260,633 255,492,647 TOTAL FIXED-INCOME INVESTMENTS $ 1,479,918,603 $ 1,494,973,630 EQUITY INVESTMENTS Common stocks and equivalents $ 948,021,079 $ 1,367,282,966 Equity funds 295,450,197 366,566,153 TOTAL EQUITY INVESTMENTS $ 1,243,471,276 $ 1,733,849,120 OTHER INVESTMENTS Hedge funds $ 92,035,561 $ 122,358,507 Real assets 107,927,936 98,977,251 Participation in the United Church Funds, Inc. 34,869,973 45,987,425 TOTAL OTHER INVESTMENTS $ 234,833,470 $ 267,323,183 TOTAL INVESTMENTS $ 3,226,913,743 $ 3,764,836,327 PRINCIPAL INTEREST DESCRIPTION SERIES MATURITY COST VALUE AMOUNT RATE % SHORT-TERM INVESTMENTS MFB NI Treasury Money Market Fund $ 32,253,645 $ 32,253,645 TOTAL SHORT-TERM INVESTMENT $ 32,253,645 $ 32,253,645 SYNTHETIC GUARANTEED INVESTMENT CONTRACTS- LIQUIDITY STRATEGY: Asset-Backed Securities 801,908 AEP Texas Inc. -

BAWAG P.S.K. Investor Factsheet

BAWAG P.S.K. Investor Factsheet Key data Company overview Financial Position (€ bn) 2011 2012 Chg. BAWAG P.S.K. … Total assets 41.1 41.3 +0.5% … is one of Austria’s largest banking institutions with 1.6m customers relying on a well-known strong brand Customer deposits 22.0 22.0 -0.1% Customer loans 23.2 22.3 -4.1% … is the most Austrian full-service universal bank (>75% of loans granted to customers in Austria) Risk-weighted assets 23.2 20.6 -11.2% … operates the largest centrally managed distribution network in Austria with extended opening hours Income Statement (€ m) 2011 2012 Chg. The bank was founded in 1883 by the Emperor Franz Joseph I as „k.k.Postsparcassen-Amt“ Core revenues 853.8 792.1 -7.2% 2005: Merger of BAWAG and Österreichische Postsparkasse (P.S.K.) to “BAWAG P.S.K.” Operating income 923.7 931.8 +0.9% Operating expenses -592.9 -604.5 -2.0% The bank is owned by the controlling shareholder Cerberus Capital Management L.P. (~52%) and the significant minority shareholder GoldenTree Asset Management LP (~39%). Austrian co-investors include Österreichische Risk costs -154.8 -150.1 +3.0% Post AG, Generali Holding Vienna AG and Wüstenrot Wohnungswirtschaft reg.Gen.m.b.H. Profit after tax1) 147.5 153.2 +3.9% Net profit 122.5 107.3 -12.4% Strategic cornerstones Key strengths & market positions Key Indicators (%) 2011 2012 Chg. CET I capital ratio2) 7.8 11.0 - Retail: integrated multi-channel strategy – intuitive Largest centrally managed distribution network in Own funds ratio 12.3 13.8 - banking – innovative “box” concept, unique access to Austria: >500 cutting-edge branches in cooperation Cost-income ratio1) 64.2 64.9 - customers, further expansion of direct channels with Austrian Post Diversified Corporate & International Business – Comprehensive multi-channel approach Resources 2011 2012 Chg. -

Second Supplement Dated 17 August 2021 to the Base Prospectus Dated 12 March 2021

Second Supplement dated 17 August 2021 to the Base Prospectus dated 12 March 2021 This second supplement (the “Second Supplement”) constitutes a supplement within the meaning of Art. 23 of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (the “Prospectus Regulation”) relating to two base prospectuses: (i) the base prospectus of BAWAG Group AG (“BAWAG”, together with its consolidated subsidiaries, including BAWAG P.S.K. (as defined herein) “BAWAG Group”) in respect of non-equity securities within the meaning of Article 2 point (c) of the Prospectus Regulation (“Non-Equity Securities”) and (ii) the base prospectus of BAWAG P.S.K. Bank für Arbeit und Wirtschaft und Österreichische Postsparkasse Aktiengesellschaft (“BAWAG P.S.K.”, together with its consolidated subsidiaries, “BAWAG P.S.K. Group” and BAWAG and BAWAG P.S.K. the “Issuers” and each an “Issuer”) in respect of Non-Equity Securities (the “Original Prospectus”), as supplemented by the first supplement dated 30 April 2021 (the “First Supplement” and together with the Original Prospectus, the “Debt Issuance Programme Prospectus” or the “Base Prospectus”). BAWAG Group AG BAWAG P.S.K. Bank für Arbeit und Wirtschaft und Österreichische Postsparkasse Aktiengesellschaft Vienna, Republic of Austria Vienna, Republic of Austria – Issuer – – Issuer – EUR 10,000,000,000 Debt Issuance Programme (the “Programme”) The Issuers have requested the Commission de Surveillance du Secteur Financier of the Grand Duchy of Luxembourg (the “CSSF”) in its capacity as -

BAWAG Group Half-Year Financial Report 2020

HALF-YEAR FINANCIAL REPORT AS OF 30 June 2020 1 BAWAG GROUP HALF-YEAR FINANCIAL REPORT AS OF 30.6.2020 KEY FIGURES Profit or loss statement Q2 Q2 Jan-Jun Jan-Jun Change (%) Change (%) (in € million) 2020 2019 2020 2019 Net interest income 227.8 220.6 3.3 447.7 435.1 2.9 Net fee and commission income 55.8 70.0 (20.3) 127.7 142.6 (10.4) Core revenues 283.6 290.6 (2.4) 575.4 577.7 (0.4) Other income1) 0.6 22.4 (97.3) 4.4 33.6 (86.9) Operating income 284.2 313.0 (9.2) 579.8 611.3 (5.2) Operating expenses (124.7) (136.0) (8.3) (249.6) (262.3) (4.8) Pre-provision profit 159.5 177.0 (9.9) 330.2 349.0 (5.4) Regulatory charges (2.5) (2.9) (13.8) (38.8) (37.1) 4.6 Total risk costs (74.6) (15.3) >100 (129.6) (27.2) >100 Profit before tax 80.8 160.0 (49.5) 161.3 287.1 (43.8) Income taxes (19.3) (38.3) (49.6) (38.6) (68.5) (43.6) Net profit 61.2 121.7 (49.7) 122.3 218.6 (44.1) Q2 Q2 Jan-Jun Jan-Jun Change (%) Change (%) Share data 2020 2019 2020 2019 Pre-tax earnings per share (in €)2) 0.92 1.62 (43.4) 1.83 2.90 (37.0) After-tax earnings per share (in €)2) 0.70 1.23 (43.3) 1.39 2.21 (37.1) Book value per share (in €) 38.28 36.23 5.7 38.28 36.23 5.7 Tangible book value per share (in €) 31.96 30.45 4.9 31.96 30.45 4.9 Shares outstanding at the end of the 87,937,130 98,794,893 (11.0) 87,937,130 98,794,893 (11.0) period Performance ratios Q2 Q2 Jan-Jun Jan-Jun Change (pts) Change (pts) (figures annualized) 2020 2019 2020 2019 Return on common equity3) 7.4% 13.7% (6.3) 7.3% 12.5% (5.2) Return on tangible common equity3) 8.9% 16.2% (7.3) 8.8% 14.6% (5.8) -

Corporate Structuresof of Independent Independent – Continued Insurance Adjusters, Adjusters Inc

NEW YORK PENNSYLVANIANEW YORK New York Association of Independent Adjusters, Inc. PennsylvaniaNew York Association AssociationCorporate of of Independent Independent Structures Insurance Adjusters, Adjusters Inc. 1111 Route 110, Suite 320, Farmingdale, NY 11735 1111 Route 110,110 Suite Homeland 320, Farmingdale, Avenue NY 11735 E-Mail: [email protected] section presents an alphabetical listing of insurance groups, displaying their organizational structure. Companies in italics are non-insurance entities. The effective date of this listing is as of July 2, 2018. E-Mail:Baltimore, [email protected] MD 21212 www.nyadjusters.org www.nyadjusters.orgTel.: 410-206-3155 AMB# COMPANY DOMICILEFax %: OWN 215-540-4408AMB# COMPANY DOMICILE % OWN 051956 ACCC HOLDING CORPORATION Email: [email protected] AES CORPORATION 012156 ACCC Insurance Company TX www.paiia.com100.00 075701 AES Global Insurance Company VT 100.00 PRESIDENT 058302 ACCEPTANCEPRESIDENT INSURANCE VICECOS INC PRESIDENT 058700 AETNA INC. VICE PRESIDENT Margaret A. Reilly 002681 Acceptance Insurance Company Kimberly LabellNE 100.00 051208 Aetna International Inc CT 100.00 Margaret A. Reilly PRESIDENT033722 Aetna Global Benefits (BM) Ltd Kimberly BermudaLabell 100.00 033652 ACCIDENT INS CO, INC. HC, INC. 033335 Spinnaker Topco Limited Bermuda 100.00 012674 Accident Insurance Company Inc NM Brian100.00 Miller WEST REGIONAL VP 033336 Spinnaker Bidco Limited United Kingdom 100.00 058304 ACMATVICE CORPORATION PRESIDENT 033337 Aetna Holdco (UK) LimitedEXECUTIVEWEST REGIONAL SECRETARYUnited Kingdom VP 100.00 050756 ACSTAR Holdings Inc William R. WestfieldDE 100.00 078652 Aetna Insurance Co Ltd United Kingdom 100.00 010607 ACSTARDavid Insurance Musante Company IL 100.00 091442 Aetna Health Ins Co Europe DAC WilliamNorman R. -

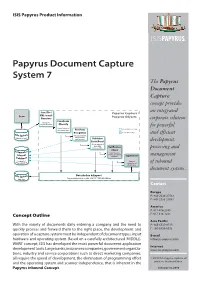

Papyrus Document Capture System 7 the Papyrus Document Capture Concept Provides

ISIS Papyrus Product Information ISISPAPYRUSTM Papyrus Document Capture System 7 The Papyrus Document Capture concept provides Scan-/File-/ Papyrus Capture / an integrated Scan XML-/e-mail- Papyrus Objects Receiver corporate solution FreeForm Images to object structure Classify for powerful Classication of automated processing document type FreeForm Recognition manual processing and efficient Recognixe index data, header and invoices Validation Batch/Detail development, Check extracted data with process rules Verification processing and Client Correction reco results, document management validation Supervisor Special correction of of inbound documents document systems. Data Archiv & Export Export validated data as XML, CSV, TXT / TIFF, JPG, PDF le Contact Europe P: +43-2236-27551 F: +43-2236-21081 America P: 817-416-2345 Concept Outline F: 817-416-1223 Asia Pacific With the variety of documents daily entering a company and the need to P: +65-6339-8719 quickly process and forward them to the right place, the development and F: +65-6336-6933 operation of a capture system must be independent of document types, input E-mail hardware and operating system. Based on a carefully architectured ‘MIDDLE- [email protected] WARE’ concept, ISIS has developed the most powerful document application Internet development tools. Large banks, insurances companies, government organiza- www.isis-papyrus.com tions, industry and service corporations such as direct marketing companies, all require the speed of development, the elimination of programming effort -

Beleggingen Ultimo 4E Kwartaal 2020

Beleggingen ultimo 4e kwartaal 2020 Onderstaande lijst betreft de directe beleggingen van Bpf Zoetwaren per 31 december 2020. Aandelen 3i Group Plc AMERISAFE, Inc. Banco de Sabadell SA 3M Co. AmerisourceBergen Corp. Banco Santander SA A.P. Møller-Mærsk A/S Amgen, Inc. Bank of Montreal Aarons, Inc. Analog Devices, Inc. Bank of Nova Scotia ABB Ltd. Andritz AG Barclays Plc Abbott Laboratories Anglo American Plc Barnes Group Inc AbbVie, Inc. Anheuser-Busch InBev SA Barrick Gold Corp. ABN AMRO Group NV ANSYS, Inc. BAWAG Group AG Acadia Healthcare Co., Inc. Anthem, Inc. Baxter International, Inc. Accenture Plc Apple, Inc. Bayerische Motoren Werke AG ACI Worldwide, Inc. Applied Industrial Technologies, BCE, Inc. ACS Actividades de Construccion y Inc. Bechtle AG Servicios SA Applied Materials, Inc. Bed Bath & Beyond, Inc. Activision Blizzard, Inc. Applus Services SA Benchmark Electronics, Inc. Adecco SA Arrow Electronics, Inc. Berkeley Group Holdings Plc Admiral Group Plc Asahi Glass Co., Ltd. Berkshire Hathaway, Inc. Adobe Systems, Inc. ASM International NV Best Buy Co., Inc. Advance Auto Parts, Inc. ASML Holding NV BHP Billiton Ltd. Adyen NV Assicurazioni Generali SpA BHP Billiton Plc AEGON NV Assurant, Inc. Biogen, Inc. Aflac, Inc. Assured Guaranty Ltd. Bio-Rad Laboratories, Inc. ageas SA/NV Astellas Pharma, Inc. BioTelemetry, Inc. Agilent Technologies, Inc. AstraZeneca Plc Blackbaud, Inc. AGL Energy Ltd. ASX Ltd. BNP Paribas SA Akamai Technologies, Inc. AT&T, Inc. Boise Cascade Co. Akzo Nobel NV Atlas Copco AB Boliden AB Alcoa, Inc. ATOS SE Booz Allen Hamilton Holding Corp. Alexion Pharmaceuticals, Inc. Aurizon Holdings Ltd. BorgWarner, Inc. Alika SRL AusNet Services Ltd.