Management's Discussion and Analysis (PDF)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Independent Statistics & Analysis U.S. Energy Information Administration

Independent Statistics & Analysis September 2020 U.S. Energy Information eia Administration Short- Term Energy Outlook (STEO) Forecast highlights Globalliquidfuels The SeptemberShort- TermEnergy Outlook (STEO) remainssubject to heightenedlevels of uncertaintybecausemitigationand reopeningefforts relatedto the 2019 novel coronavirusdisease ( COVID- 19) continueto evolve. Reducedeconomicactivity related to the COVID- 19 pandemichas caused changes in energydemandand supply patternsin 2020.This STEOassumes U.S. grossdomesticproductdeclinedby 4.6% in the first half of 2020fromthe same period a year ago and will rise beginninginthe third quarterof 2020, with year-over-year growthof 3.1% in 2021.The U.S. macroeconomic assumptionsinthis outlookare based onforecasts by IHS Markit. Brentcrude oilspot prices averaged$45 per barrel ( b ) in August, up $2/ b from the average inJuly. Brent prices in Augustwere up $26/ b from the multiyearlow monthly average price in April.The increaseinoil prices has occurred EIA estimatesglobal oil marketshave shifted from global liquidfuelsinventoriesbuildingat a rate of 7.2 million barrels per day (b/ d ) in the second quarterto drawingat a rate of 3.7 millionb/ d inthe third quarter. expects inventorydraws in the fourth quarterof 3.1million b/d before marketsbecome relativelybalancedin 2021, withforecast drawsof0.3 million b/ d. Despiteexpectedinventorydraws inthe comingmonths, EIA expects high inventory levels and surplus crude oil productioncapacitywill limit upward pressureon oil prices. EIA forecastsmonthlyBrent spot priceswill average $ 44 / b duringthe fourth quarter of 2020 and riseto an average of $49/ b in 2021as oil marketsbecome more balanced. EIA estimatesthat globalconsumptionof petroleumand liquid fuels averaged94.3 millionb/ d in August . Liquid fuels consumptionwas down 8.2 millionb/ d from August 2019, butit was up from an averageof 85.1 million b/ d duringthe second quarterof 2020 and 93.3 millionb/ d in July. -

Athabasca Oil Corporation Takes Further Actions in Response to The

FOR IMMEDIATE RELEASE ‐ April 2, 2020 Athabasca Oil Corporation Takes Further Actions in Response to the Current Environment CALGARY – Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”) is taking further immediate actions in response to the significant decline in global oil prices to bolster balance sheet strength and corporate resiliency. Shut‐in of Hangingstone Asset Due to the significant decline in oil prices combined with the economic uncertainty associated to the ongoing COVID crisis, Athabasca has decided to suspend the Hangingstone SAGD operation. This suspension was initiated on April 2, 2020 and will involve shutting in the well pairs, halting steam injection to the reservoir, and taking measures to preserve the processing facility and pipelines in a safe manner so that it could be re‐started at a future date when the economy has recovered. The Hangingstone asset has an operating break‐even of approximately US$37.50 Western Canadian Select and this action is expected to significantly improve corporate resiliency in the current environment. As part of this action, Athabasca is reducing its corporate staff count by 15%. Hangingstone was Athabasca’s first operated oil sands project that began construction in 2013 and was commissioned in 2015. The Company would like to thank all staff that have worked hard over the years to bring this asset on stream. It is unfortunate that made‐in‐Alberta assets like Hangingstone cannot continue operations under current prices. Revised 2020 Guidance Annual corporate guidance is 30,000 – 31,500 boe/d and reflects a ~2,500 boe/d reduction related to the shut‐in. -

U.S.-Canada Cross- Border Petroleum Trade

U.S.-Canada Cross- Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits March 2021 Submitted to: American Petroleum Institute 200 Massachusetts Ave NW Suite 1100, Washington, DC 20001 Submitted by: Kevin DeCorla-Souza ICF Resources L.L.C. 9300 Lee Hwy Fairfax, VA 22031 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits This report was commissioned by the American Petroleum Institute (API) 2 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits Table of Contents I. Executive Summary ...................................................................................................... 4 II. Introduction ................................................................................................................... 6 III. Overview of U.S.-Canada Petroleum Trade ................................................................. 7 U.S.-Canada Petroleum Trade Volumes Have Surged ........................................................... 7 Petroleum Is a Major Component of Total U.S.-Canada Bilateral Trade ................................. 8 IV. North American Oil Production and Refining Markets Integration ...........................10 U.S.-Canada Oil Trade Reduces North American Dependence on Overseas Crude Oil Imports ..................................................................................................................................10 Cross-Border Pipelines Facilitate U.S.-Canada Oil Market Integration...................................14 -

Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook (2016 – 2036)

Study No. 159 September 2016 CANADIAN CANADIAN CRUDE OIL AND NATURAL GAS ENERGY PRODUCTION AND SUPPLY COSTS OUTLOOK RESEARCH INSTITUTE (2016 – 2036) Canadian Energy Research Institute | Relevant • Independent • Objective CANADIAN CRUDE OIL AND NATURAL GAS PRODUCTION AND SUPPLY COSTS OUTLOOK (2016 – 2036) Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook (2016 – 2036) Authors: Laura Johnson Paul Kralovic* Andrei Romaniuk ISBN 1-927037-43-0 Copyright © Canadian Energy Research Institute, 2016 Sections of this study may be reproduced in magazines and newspapers with acknowledgement to the Canadian Energy Research Institute September 2016 Printed in Canada Front photo courtesy of istockphoto.com Acknowledgements: The authors of this report would like to extend their thanks and sincere gratitude to all CERI staff involved in the production and editing of the material, including but not limited to Allan Fogwill, Dinara Millington and Megan Murphy. *Paul Kralovic is Director, Frontline Economics Inc. ABOUT THE CANADIAN ENERGY RESEARCH INSTITUTE The Canadian Energy Research Institute is an independent, not-for-profit research establishment created through a partnership of industry, academia, and government in 1975. Our mission is to provide relevant, independent, objective economic research in energy and environmental issues to benefit business, government, academia and the public. We strive to build bridges between scholarship and policy, combining the insights of scientific research, economic analysis, and practical experience. For more information about CERI, visit www.ceri.ca CANADIAN ENERGY RESEARCH INSTITUTE 150, 3512 – 33 Street NW Calgary, Alberta T2L 2A6 Email: [email protected] Phone: 403-282-1231 Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook iii (2016 – 2036) Table of Contents LIST OF FIGURES ............................................................................................................ -

Oil Price Forecasting Using Crack Spread Futures and Oil Exchange Traded Funds

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Choi, Hankyeung; Leatham, David J.; Sukcharoen, Kunlapath Article Oil price forecasting using crack spread futures and oil exchange traded funds Contemporary Economics Provided in Cooperation with: University of Finance and Management, Warsaw Suggested Citation: Choi, Hankyeung; Leatham, David J.; Sukcharoen, Kunlapath (2015) : Oil price forecasting using crack spread futures and oil exchange traded funds, Contemporary Economics, ISSN 2084-0845, Vizja Press & IT, Warsaw, Vol. 9, Iss. 1, pp. 29-44, http://dx.doi.org/10.5709/ce.1897-9254.158 This Version is available at: http://hdl.handle.net/10419/141896 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu 29 Primary submission: 16.09.2014 | Final acceptance: 26.09.2014 Oil Price Forecasting Using Crack Spread Futures and Oil Exchange Traded Funds Hankyeung Choi1, David J. -

Chicap-Crude-List-7-15-2020.Pdf

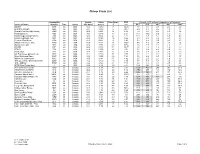

Chicap Crude List Commodity Gravity Sulfur Pour Point RVP Viscosity (cST) at listed temperature in Fahrenheit Crude Oil Name Identifier Type Origin °API @60°F mass% °F psi 40°F 50°F 68°F 86°F 104°F Bakken BAK sw USA 42.5 0.080 -71 10.21 4.1 3.6 2.9 2.5 2.0 Grand Mesa Light GML sw USA 48.7 0.060 5 10.67 2.9 2.7 2.2 1.9 1.6 Grand Mesa Sweet@Cushing GMS sw USA 40.2 0.206 32 8.26 7.2 6.0 4.6 3.6 3.0 Mississippi Lime MSL sw USA 34.3 0.519 -11 6.27 16.1 13.2 9.6 7.2 6 Niobrara @Cushing Pony PL NIB sw USA 37.5 0.402 27 8.11 11.1 8.8 6.7 5.1 4.0 Niobrara @Saddlehorn SSC sw USA 43.2 0.144 -38 9.55 5.3 4.5 3.5 2.8 2.3 Permian Sour Blend PRM sw USA 41.9 0.281 -6 8.03 5.1 4.4 3.5 2.8 2.3 Saddlehorn Intermediate SHM sw USA 42.5 0.137 21 10.67 5.6 4.9 3.8 3.1 2.6 Saddlehorn Light SHL sw USA 48.4 0.058 -33 10.54 2.8 2.5 2.1 1.8 1.6 SCOOP SCP sw USA 54.4 0.015 -71 10.77 2.0 1.8 1.6 1.4 1.2 STACK STK sw USA 41.9 0.079 -22 9.71 7.1 6.4 4.9 4.0 3.2 Stack Light STL sw USA 47.4 0.022 5 8.17 3.6 3.3 2.7 2.3 2.0 US High Sweet @Clearbrook UHC sw USA 42.1 0.120 -71 9.78 4.7 4.1 3.2 2.6 2.2 West Oklahoma Sweet WOS sw USA 49.0 0.025 -38 7.84 3.1 2.8 2.3 1.9 1.7 Whitecliffs Condensate WCC sw USA 48.5 0.141 -71 8.82 2.5 2.5 2.1 1.9 1.6 WTI @Cushing - Domestic Sweet DSW sw USA 41.2 0.400 -38 7.69 6.7 5.7 4.4 3.5 2.8 WTI - Midland WTM sw USA 43.6 0.163 -11 7.13 5.3 4.5 3.4 2.7 2.3 WTS (West Texas Sour) C so USA 32.9 1.64 -23 5.67 18.0 14.3 9.9 7.2 5.5 Access Western Blend AWB H Canada 21.6 3.79 -46 6.67 672 457 248 145 91.0 Albian Heavy Synthetic AHS H Canada 20.0 -

2018 ANNUAL INFORMATION FORM Suncor Energy Inc

11FEB201917213713 ANNUAL INFORMATION FORM Dated February 28, 2019 Suncor Energy Inc. 19FEB201920364295 ANNUAL INFORMATION FORM DATED FEBRUARY 28, 2019 TABLE OF CONTENTS 1 Advisories 2 Glossary of Terms and Abbreviations 2 Common Industry Terms 4 Common Abbreviations 4 Conversion Table 5 Corporate Structure 5 Name, Address and Incorporation 5 Intercorporate Relationships 6 General Development of the Business 6 Overview 7 Three-Year History 10 Narrative Description of Suncor’s Businesses 10 Oil Sands 15 Exploration and Production 19 Refining and Marketing 23 Other Suncor Businesses 24 Suncor Employees 24 Ethics, Social and Environmental Policies 26 Statement of Reserves Data and Other Oil and Gas Information 28 Oil and Gas Reserves Tables and Notes 33 Future Net Revenues Tables and Notes 39 Additional Information Relating to Reserves Data 51 Industry Conditions 58 Risk Factors 68 Dividends 69 Description of Capital Structure 71 Market for Securities 72 Directors and Executive Officers 78 Audit Committee Information 80 Legal Proceedings and Regulatory Actions 80 Interests of Management and Others in Material Transactions 80 Transfer Agent and Registrar 80 Material Contracts 80 Interests of Experts 81 Disclosure Pursuant to the Requirements of the NYSE 81 Additional Information 82 Advisory – Forward-Looking Information and Non-GAAP Financial Measures Schedules A-1 SCHEDULE ‘‘A’’ – AUDIT COMMITTEE MANDATE B-1 SCHEDULE ‘‘B’’ – SUNCOR ENERGY INC. POLICY AND PROCEDURES FOR PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES C-1 SCHEDULE ‘‘C’’ – FORM 51-101F2 REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR D-1 SCHEDULE ‘‘D’’ – FORM 51-101F2 REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR E-1 SCHEDULE ‘‘E’’ – FORM 51-101F3 REPORT OF MANAGEMENT AND DIRECTORS ON RESERVES DATA AND OTHER INFORMATION ADVISORIES In this Annual Information Form (AIF), references to ‘‘Suncor’’ each year in the two-year period ended December 31, 2018. -

The Spectre of Weakening Prices

Oil & gas macro outlook The spectre of weakening prices 16 August 2010 Crude oil and refined product markets are in significant surplus currently which sets the scene for some near-term weakness in prices. A lacklustre price trend Analysts Peter J Dupont 020 3077 5700 is also expected to extend into 2011 reflecting the likely persistence of well Neil Shah 020 3077 5715 supplied markets and historically high inventories. Weak fundamentals relate to Ian McLelland 020 3077 5700 OPEC and non-OPEC supply additions and an increasingly lacklustre economic Elaine Reynolds 020 3077 5700 [email protected] backdrop. For institutional enquiries please contact: Alex Gunz 020 3077 5746 Crude oil supply/demand outlook Gareth Jones 020 3077 5704 [email protected] The upward trend in US and OECD inventories over the past year or more points to a crude oil market in surplus. Inventories are now close to 20-year and at least WTI vs Brent 12-year highs respectively. For 2010 we look for a supply surplus of at least 90 0.5mmb/d and approximate balance in 2011. 70 50 Crude oil prices $ barrel per 30 Light crude oil prices have trended broadly flat since the end of the third quarter of 2009. Prices firmed in the month to early August 2010 with West Texas Jul/09 Jul/10 Apr/09 Apr/10 Jan/10 Jan/09 Oct/09 Intermediate (WTI) hitting a recent high of $82.6/barrel. Subsequently, prices have Brent WTI AIM Oil & Gas Index come under significant pressure taking WTI down to $78.4/barrel on August 11, 7000 reflecting rising inventories and bearish US and China macroeconomic news. -

Crudemonitor.Ca Western Canadian Select (WCS)

CrudeMonitor.ca - Canadian Crude Quality Monitoring Program Page 1 of 2 crudemonitor.ca Home Monthly Reports Tools Library Industry Resources Contact Us Western Canadian Select (WCS) What is Western Canadian Select crude? Western Canadian Select is a Hardisty based blend Canada of conventional and oilsands production managed by Liberia Canadian Natural Resources, Cenovus Energy, Manilol Suncor Energy, and Talisman Energy. Argus has sti. launched daily volume-weighted average price ibia Saskalchewan Edmon-i t indexes for Western Canadian Select (WCS) and will publish this index in the daily Argus Crude and Argus Americas Crude publications. Calgary Winnipt Map data ©2013 Google Most Recent Sample Comments: Light Ends Summary Last 6 Samples WCS-807, Sep 17, 2013 Most Property 6 Month 1 Year 5 Year Recent The September 17th sample of Western Canadian ( vol% ) Average Average Average Select contained slightly elevated density, Sample sulphur, MCR, BTEX and C7 x C10 concentrations, C3- 0.04 0.05 0.06 0.06 while butanes and pentanes were slightly Butanes 1.04 1.68 1.82 2.02 decreased. Simulated distillation results indicate Pentanes 3.56 4.76 4.87 4.44 an increase in the residue fraction. Hexanes 3.86 4.10 4.21 3.94 Monthly Reports Heptanes 3.70 3.00 2.96 2.82 Octanes 3.08 2.27 2.14 2.12 Basic Analysis Nonanes 2.36 1.72 1.57 1.50 Decanes 1.27 0.89 0.82 0.72 Most 6 Month 1 Year 5 Year Property Recent Average Average Average Sample BTEX H Density (kg/m3) 934.5 929.6 928.3 929.2 Most 6 Gravity (oAPI) 19.8 20.6 20.8 20.7 Property 1 Year 5 Year Recent Month 0 (vol%) Average Average Sulphur ( wt o) 3.71 3.53 3.51 3.52 Sample Average MCR (wt%) 10.20 10.02 9.84 9.71 Benzene 0.18 0.17 0.18 0.16 Sediment (ppmw) 305 302 296 329 Toluene 0.41 0.33 0.32 0.30 TAN (mgKOH/g) 0.94 0.91 0.93 0.94 • Ethyl Benzene 0.09 0.07 0.06 0.06 Salt (ptb) 28.0 30.9 46.4 Xyl enes 0.45 0.33 0.30 0.29 Nickel (mg/L) 62.7 60.7 59.0 Vanadium (mg/L) 147.0 143.7 141.8 Olefins (wt%) ND ND Distillation *ND indicates a tested value below the instrument threshold. -

Volatility Dynamics and Seasonality in Energy Prices: Implications for Crack-Spread Price Risk

Volatility Dynamics and Seasonality in Energy Prices: Implications for Crack-Spread Price Risk Hiroaki Suenaga* and Aaron Smith** We examine the volatility dynamics of three major petroleum commod- ities traded on the NYMEX: crude oil, unleaded gasoline, and heating oil. Using the partially overlapping time-series (POTS) framework of Smith (2005), we model jointly all futures contracts with delivery dates up to a year into the future and extract information from these prices about the persistence of market shocks. The model depicts highly nonlinear volatility dynamics that are consistent with the observed seasonality in demand and storage of the three commodities. Spe- cifically, volatility of the three commodity prices exhibits time-to-delivery effects and substantial seasonality, yet their patterns vary systematically by contract delivery month. The conditional variance and correlation across the three com- modities also vary over time. High price volatility of near-delivery contracts and their low correlation with concurrently traded distant contracts imply high short- horizon price risk for an unhedged position in the calendar or crack spread. Price risk at the one-year horizon is much lower than short-horizon risk in all seasons and for all positions, but it is still substantial in magnitude for crack-spread positions. Crack-spread hedgers ignore nearby high-season price risk at their peril, but they would also be remiss to ignore the long horizon. 1. INTRODUCTION Demand for motor gasoline in the United States peaks in the summer driving season, whereas demand for heating oil peaks in winter. Because these two refined petroleum products are imperfect substitutes in the production pro- The Energy Journal, Vol. -

WCS Houston: a New Price Signal for Heavy Crude at the US Gulf Coast

Argus White Paper: WCS Houston: A new price signal for heavy crude at the US Gulf coast Growing Canadian heavy crude output and new pipeline Array of Argus US Gulf coast markers connections to the US Gulf coast have created the first active pipeline spot market for heavy sour crude at the US Gulf 0 coast. Canadian heavy Western Canadian Select (WCS) now LLS trades regularly on a spot basis at multiple terminals in the 1 Houston area. The US Gulf market has searched for years WTI for a representative and market-based price benchmark to Houston Mars reflect the value of heavy crude at the coast. But robust and 2 ASCI transparent spot markets never developed around inbound cargoes of Mexican, Venezuelan, Colombian and other heavy sulphur percent sours. Now WCS Houston is ready to fill that gap. 3 Maya The better benchmark WCS For years, the small volumes of Canadian heavy crude arriving 4 at the US Gulf coast traded with reference to medium sour 15 20 25 30 35 40 45 Mars, ASCI, or to Mexico’s heavy Maya. In this way, the API gravity industry attempted to relate the price of heavy Canadian crude to prevailing market value. But Mars is much lighter and Maya and WCS Houston: Discounts to LLS, $/bl lower in sulphur content than Canadian heavy crude, making it an imperfect match (see graph at top right). -4 Maya, though similar in quality to WCS, is not a market but a -7 price set by a government formula based 40pc on the price of West Texas Sour (WTS) crude at Midland, Texas, hundreds of -10 miles from the Gulf coast. -

2020-03-24 the Oilsands in a Carbon-Constrained Canada FINAL

The oilsands in a carbon- constrained Canada The collision course between overall emissions and national climate commitments Benjamin Israel Jan Gorski, Nina Lothian, Chris Severson-Baker, Nikki Way February 2020 updated March 2020 Photo: Kris Krüg, CC BY-NC-ND 2.0 The oilsands in a carbon- constrained Canada The collision course between overall emissions and national climate commitments Benjamin Israel Jan Gorski, Nina Lothian, Chris Severson-Baker and Nikki Way February 2020 updated March 2020 Production management: Michelle Bartleman Editors: Michelle Bartleman, Roberta Franchuk, ISBN 1-897390-44-0 Sarah MacWhirter Contributors: Nichole Dusyk, Simon Dyer, The Pembina Institute Duncan Kenyon, Morrigan Simpson-Marran 219 19 Street NW Calgary, AB ©2020 The Pembina Institute Canada T2N 2H9 All rights reserved. Permission is granted to Phone: 403-269-3344 reproduce all or part of this publication for non- commercial purposes, as long as you cite the Additional copies of this publication may be source. downloaded from the Pembina Institute website, www.pembina.org. Recommended citation: Israel, Benjamin. The oilsands in a carbon-constrained Canada. The Pembina Institute, 2020. Pembina Institute The oilsands in a carbon-constrained Canada | ii About the Pembina Institute The Pembina Institute is a national non-partisan think tank that advocates for strong, effective policies to support Canada’s clean energy transition. We employ multi-faceted and highly collaborative approaches to change. Producing credible, evidence-based research and analysis, we consult directly with organizations to design and implement clean energy solutions, and convene diverse sets of stakeholders to identify and move toward common solutions. ————————————————— pembina.org ————————————————— twitter.com/pembina facebook.com/pembina.institute Donate to the Pembina Institute Together, we can lead Canada's transition to clean energy.