Suburban Gentrification: Understanding the Determinants of Single-Family Residential Redevelopment, a Case Study of the Inner-Ring Suburbs of Chicago, IL, 2000-2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Title: Suburban Verticalisation in London: Regeneration, Intra-Urban

Title: Suburban Verticalisation in London: regeneration, intra-urban inequality and social harm Abstract: With the rapid and large scaled expansion of new developments of high rise flats, London’s outer boroughs are seeing a suburban growth not seen since the 1930s. The objective of this mass verticalization are similar to the suburbanisation that occurred in the inter-war period in aiming to provide housing to a growing urban population. However behind the demographic imperative, other economic, socio-cultural and political processes come into play as they did in the past. Considering spatial, social and material transformations, the paper is concerned with a combination of factors, actors, structures and processes in this initial analysis of the new vertical suburbs of London. With this combined perspective, the analysis contributes to critical debates in criminology that are expanding to issues of social harm and social exclusion in the capitalist city. In this paper, I interrogate the fact that an increase of the housing stock only partially addresses the housing crisis in London as the problem of the provision of social housing is becoming increasingly limited under tight budget constraints and a financial structure that relies on and facilitates the involvement of the private sector in the delivery and management of housing. I also question the promises of regeneration solutions through new-build gentrification which have proved ineffective in other urban contexts and should be examined further in the context of London suburbs where the scale of construction is unprecedented and comes to exacerbate inequalities that have long been overlooked when the focus has been on inner boroughs and their gentrification. -

Slum Clearance in Havana in an Age of Revolution, 1930-65

SLEEPING ON THE ASHES: SLUM CLEARANCE IN HAVANA IN AN AGE OF REVOLUTION, 1930-65 by Jesse Lewis Horst Bachelor of Arts, St. Olaf College, 2006 Master of Arts, University of Pittsburgh, 2012 Submitted to the Graduate Faculty of The Kenneth P. Dietrich School of Arts and Sciences in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Pittsburgh 2016 UNIVERSITY OF PITTSBURGH DIETRICH SCHOOL OF ARTS & SCIENCES This dissertation was presented by Jesse Horst It was defended on July 28, 2016 and approved by Scott Morgenstern, Associate Professor, Department of Political Science Edward Muller, Professor, Department of History Lara Putnam, Professor and Chair, Department of History Co-Chair: George Reid Andrews, Distinguished Professor, Department of History Co-Chair: Alejandro de la Fuente, Robert Woods Bliss Professor of Latin American History and Economics, Department of History, Harvard University ii Copyright © by Jesse Horst 2016 iii SLEEPING ON THE ASHES: SLUM CLEARANCE IN HAVANA IN AN AGE OF REVOLUTION, 1930-65 Jesse Horst, M.A., PhD University of Pittsburgh, 2016 This dissertation examines the relationship between poor, informally housed communities and the state in Havana, Cuba, from 1930 to 1965, before and after the first socialist revolution in the Western Hemisphere. It challenges the notion of a “great divide” between Republic and Revolution by tracing contentious interactions between technocrats, politicians, and financial elites on one hand, and mobilized, mostly-Afro-descended tenants and shantytown residents on the other hand. The dynamics of housing inequality in Havana not only reflected existing socio- racial hierarchies but also produced and reconfigured them in ways that have not been systematically researched. -

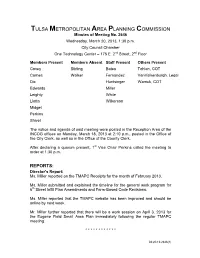

TULSA METROPOLITAN AREA PLANNING COMMISSION Minutes of Meeting No

TULSA METROPOLITAN AREA PLANNING COMMISSION Minutes of Meeting No. 2646 Wednesday, March 20, 2013, 1:30 p.m. City Council Chamber One Technology Center – 175 E. 2nd Street, 2nd Floor Members Present Members Absent Staff Present Others Present Covey Stirling Bates Tohlen, COT Carnes Walker Fernandez VanValkenburgh, Legal Dix Huntsinger Warrick, COT Edwards Miller Leighty White Liotta Wilkerson Midget Perkins Shivel The notice and agenda of said meeting were posted in the Reception Area of the INCOG offices on Monday, March 18, 2013 at 2:10 p.m., posted in the Office of the City Clerk, as well as in the Office of the County Clerk. After declaring a quorum present, 1st Vice Chair Perkins called the meeting to order at 1:30 p.m. REPORTS: Director’s Report: Ms. Miller reported on the TMAPC Receipts for the month of February 2013. Ms. Miller submitted and explained the timeline for the general work program for 6th Street Infill Plan Amendments and Form-Based Code Revisions. Ms. Miller reported that the TMAPC website has been improved and should be online by next week. Mr. Miller further reported that there will be a work session on April 3, 2013 for the Eugene Field Small Area Plan immediately following the regular TMAPC meeting. * * * * * * * * * * * * 03:20:13:2646(1) CONSENT AGENDA All matters under "Consent" are considered by the Planning Commission to be routine and will be enacted by one motion. Any Planning Commission member may, however, remove an item by request. 1. LS-20582 (Lot-Split) (CD 3) – Location: Northwest corner of East Apache Street and North Florence Avenue (Continued from 3/6/2013) 1. -

Managing Metropolitan Growth: Reflections on the Twin Cities Experience

_____________________________________________________________________________________________ MANAGING METROPOLITAN GROWTH: REFLECTIONS ON THE TWIN CITIES EXPERIENCE Ted Mondale and William Fulton A Case Study Prepared for: The Brookings Institution Center on Urban and Metropolitan Policy © September 2003 _____________________________________________________________________________________________ MANAGING METROPOLITAN GROWTH: REFLECTIONS ON THE TWIN CITIES EXPERIENCE BY TED MONDALE AND WILLIAM FULTON1 I. INTRODUCTION: MANAGING METROPOLITAN GROWTH PRAGMATICALLY Many debates about whether and how to manage urban growth on a metropolitan or regional level focus on the extremes of laissez-faire capitalism and command-and-control government regulation. This paper proposes an alternative, or "third way," of managing metropolitan growth, one that seeks to steer in between the two extremes, focusing on a pragmatic approach that acknowledges both the market and government policy. Laissez-faire advocates argue that we should leave growth to the markets. If the core cities fail, it is because people don’t want to live, shop, or work there anymore. If the first ring suburbs decline, it is because their day has passed. If exurban areas begin to choke on large-lot, septic- driven subdivisions, it is because that is the lifestyle that people individually prefer. Government policy should be used to accommodate these preferences rather than seek to shape any particular regional growth pattern. Advocates on the other side call for a strong regulatory approach. Their view is that regional and state governments should use their power to engineer precisely where and how local communities should grow for the common good. Among other things, this approach calls for the creation of a strong—even heavy-handed—regional boundary that restricts urban growth to particular geographical areas. -

GAO-04-758 Metropolitan Statistical Areas

United States General Accounting Office Report to the Subcommittee on GAO Technology, Information Policy, Intergovernmental Relations and the Census, Committee on Government Reform, House of Representatives June 2004 METROPOLITAN STATISTICAL AREAS New Standards and Their Impact on Selected Federal Programs a GAO-04-758 June 2004 METROPOLITAN STATISTICAL AREAS New Standards and Their Impact on Highlights of GAO-04-758, a report to the Selected Federal Programs Subcommittee on Technology, Information Policy, Intergovernmental Relations and the Census, Committee on Government Reform, House of Representatives For the past 50 years, the federal The new standards for federal statistical recognition of metropolitan areas government has had a metropolitan issued by OMB in 2000 differ from the 1990 standards in many ways. One of the area program designed to provide a most notable differences is the introduction of a new designation for less nationally consistent set of populated areas—micropolitan statistical areas. These are areas comprised of a standards for collecting, tabulating, central county or counties with at least one urban cluster of at least 10,000 but and publishing federal statistics for geographic areas in the United fewer than 50,000 people, plus adjacent outlying counties if commuting criteria States and Puerto Rico. Before is met. each decennial census, the Office of Management and Budget (OMB) The 2000 standards and the latest population update have resulted in five reviews the standards to ensure counties being dropped from metropolitan statistical areas, while another their continued usefulness and 41counties that had been a part of a metropolitan statistical area have had their relevance and, if warranted, revises statistical status changed and are now components of micropolitan statistical them. -

Cultivating (A) Sustainability Capital: Urban Agriculture, Eco-Gentrification, and the Uneven Valorization of Social Reproduction

Portland State University PDXScholar Urban Studies and Planning Faculty Nohad A. Toulan School of Urban Studies and Publications and Presentations Planning 2-2017 Cultivating (a) Sustainability Capital: Urban Agriculture, Eco-Gentrification, and the Uneven Valorization of Social Reproduction Nathan McClintock Portland State University, [email protected] Follow this and additional works at: https://pdxscholar.library.pdx.edu/usp_fac Part of the Food Security Commons, and the Urban Studies and Planning Commons Let us know how access to this document benefits ou.y Citation Details McClintock, Nathan, "Cultivating (a) Sustainability Capital: Urban Agriculture, Eco-Gentrification, and the Uneven Valorization of Social Reproduction" (2017). Urban Studies and Planning Faculty Publications and Presentations. 168. https://pdxscholar.library.pdx.edu/usp_fac/168 This Post-Print is brought to you for free and open access. It has been accepted for inclusion in Urban Studies and Planning Faculty Publications and Presentations by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. POST-PRINT VERSION Forthcoming, Annals of the American Association of Geographers 2018 Special Issue: Social Justice in the City Accepted 9 February 2017 Cultivating (a) sustainability capital: Urban agriculture, eco-gentrification, and the uneven valorization of social reproduction Nathan McClintock Toulan School of Urban Studies and Planning, Portland State University ! [email protected] Abstract. Urban agriculture (UA), for many activists and scholars, plays a prominent role in food justice struggles in cities throughout the Global North, a site of conflict between use and exchange values, and rallying point for progressive claims to the right to the city. -

Urbanistica N. 146 April-June 2011

Urbanistica n. 146 April-June 2011 Distribution by www.planum.net Index and english translation of the articles Paolo Avarello The plan is dead, long live the plan edited by Gianfranco Gorelli Urban regeneration: fundamental strategy of the new structural Plan of Prato Paolo Maria Vannucchi The ‘factory town’: a problematic reality Michela Brachi, Pamela Bracciotti, Massimo Fabbri The project (pre)view Riccardo Pecorario The path from structure Plan to urban design edited by Carla Ferrari A structural plan for a ‘City of the wine’: the Ps of the Municipality of Bomporto Projects and implementation Raffaella Radoccia Co-planning Pto in the Val Pescara Mariangela Virno Temporal policies in the Abruzzo Region Stefano Stabilini, Roberto Zedda Chronographic analysis of the Urban systems. The case of Pescara edited by Simone Ombuen The geographical digital information in the planning ‘knowledge frameworks’ Simone Ombuen The european implementation of the Inspire directive and the Plan4all project Flavio Camerata, Simone Ombuen, Interoperability and spatial planners: a proposal for a land use Franco Vico ‘data model’ Flavio Camerata, Simone Ombuen What is a land use data model? Giuseppe De Marco Interoperability and metadata catalogues Stefano Magaudda Relationships among regional planning laws, ‘knowledge fra- meworks’ and Territorial information systems in Italy Gaia Caramellino Towards a national Plan. Shaping cuban planning during the fifties Profiles and practices Rosario Pavia Waterfrontstory Carlos Smaniotto Costa, Monica Bocci Brasilia, the city of the future is 50 years old. The urban design and the challenges of the Brazilian national capital Michele Talia To research of one impossible balance Antonella Radicchi On the sonic image of the city Marco Barbieri Urban grapes. -

Integrating Infill Planning in California's General

Integrating Infill Planning in California’s General Plans: A Policy Roadmap Based on Best-Practice Communities September 2014 Center for Law, Energy & the Environment (CLEE)1 University of California Berkeley School of Law 1 This report was researched and authored by Christopher Williams, Research Fellow at the Center for Law, Energy and the Environment (CLEE) at the University of California, Berkeley School of Law. Ethan Elkind, Associate Director of Climate Change and Business Program at CLEE, served as project director. Additional contributions came from Terry Watt, AICP, of Terrell Watt Planning Consultant, and Chris Calfee, Senior Counsel; Seth Litchney, General Plan Guidelines Project Manager; and Holly Roberson, Land Use Council at the California Governor’s Office of Planning and Research (OPR), among other stakeholder reviewers. 1 Contents Introduction .................................................................................................................................................. 4 1 Land Use Element ................................................................................................................................. 5 1.1 Find and prioritize infill types most appropriate to your community .......................................... 5 1.2 Make an inclusive list of potential infill parcels, including brownfields ....................................... 9 1.3 Apply simplified mixed-use zoning designations in infill priority areas ...................................... 10 1.4 Influence design choices to -

Urban Renewal Plan City of Manitou Springs, Colorado

Manitou Springs East Corridor Urban Renewal Plan City of Manitou Springs, Colorado November 2006 Prepared for: Manitou Springs City Council G:\East Manitou Springs UR Plan1 revised .doc 1 Manitou Springs East Corridor Urban Renewal Plan City of Manitou Springs, Colorado November 2006 Table of Contents Page Section 1.0: Preface and Background 3 Section 2.0: Qualifying Conditions 7 Section 3.0: Relationship to Comprehensive Plan 9 Section 4.0: Land Use Plan and Plan Objectives 10 Section 5.0: Project Implementation 14 Section 6.0: Project Financing 17 Section 7.0: Changes & Minor Variations from Adopted Plan 20 Section 8.0: Severability 21 Attachments Pending Attachment 1: Manitou Springs East Corridor Conditions Survey Findings Attachment 2: El Paso County Financial Impact Report G:\East Manitou Springs UR Plan1 revised .doc 2 MANITOU SPRINGS EAST CORRIDOR URBAN RENEWAL PLAN City of Manitou Springs, Colorado November 2006 Prepared for: Manitou Springs City Council 1.0 Preface and Background 1.1 Preface This East Manitou Springs Urban Renewal Plan (the “Plan” or the “Urban Renewal Plan”) has been prepared for the Manitou Springs City Council. It will be carried out by the Manitou Springs Urban Renewal Authority, (the “Authority”) pursuant to the provisions of the Urban Renewal Law of the State of Colorado, Part 1 of Article 25 of Title 31, Colorado Revised Statutes, 1973, as amended (the “Act”). The administration of this project and the enforcement of this Plan, including the preparation and execution of any documents implementing it, shall be performed by the Authority. 1.2 Description of Urban Renewal Area According to the Act, the jurisdictional boundaries of the Authority are the same as the boundaries of the municipality. -

An Economist's Perspective on Urban Sprawl, Part 1, Defining Excessive

An Economist’s Perspective on Urban Sprawl, Part 1 An Economist’s Perspective on Urban Sprawl, Part 1 Defining Excessive Decentralization in California and Other Western States California Senate Office of Research January 2002 (Revised) An Economist’s Perspective on Urban Sprawl, Part 1 An Economist’s Perspective on Urban Sprawl, Part I Defining Excessive Decentralization in California and Other Western States Prepared by Robert W. Wassmer Professor Graduate Program in Public Policy and Administration California State University Visiting Consultant California Senate Office of Research Support for this work came from the California Institute for County Government, Capital Regional Institute and Valley Vision, Lincoln Institute of Land Policy, and the California State University Faculty Research Fellows in association with the California Senate Office of Research. The views expressed in this paper are those of the author. Senate Office of Research Elisabeth Kersten, Director Edited by Rebecca LaVally and formatted by Lynne Stewart January 2002 (Revised) 2 An Economist’s Perspective on Urban Sprawl, Part 1 Table of Contents Executive Summary..................................................................................... 4 What is Sprawl? ........................................................................................... 5 Findings ........................................................................................................ 5 Conclusions.................................................................................................. -

Transit-Oriented Development and Joint Development in the United States: a Literature Review

Transit Cooperative Research Program Sponsored by the Federal Transit Administration RESEARCH RESULTS DIGEST October 2002—Number 52 Subject Area: VI Public Transit Responsible Senior Program Officer: Gwen Chisholm Transit-Oriented Development and Joint Development in the United States: A Literature Review This digest summarizes the literature review of TCRP Project H-27, “Transit-Oriented Development: State of the Practice and Future Benefits.” This digest provides definitions of transit-oriented development (TOD) and transit joint development (TJD), describes the institutional issues related to TOD and TJD, and provides examples of the impacts and benefits of TOD and TJD. References and an annotated bibliography are included. This digest was written by Robert Cervero, Christopher Ferrell, and Steven Murphy, from the Institute of Urban and Regional Development, University of California, Berkeley. CONTENTS IV.2 Supportive Public Policies: Finance and Tax Policies, 46 I INTRODUCTION, 2 IV.3 Supportive Public Policies: Land-Based I.1 Defining Transit-Oriented Development, 5 Initiatives, 54 I.2 Defining Transit Joint Development, 7 IV.4 Supportive Public Policies: Zoning and I.3 Literature Review, 9 Regulations, 57 IV.5 Supportive Public Policies: Complementary II INSTITUTIONAL ISSUES, 10 Infrastructure, 61 II.1 The Need for Collaboration, 10 IV.6 Supportive Public Policies: Procedural and II.2 Collaboration and Partnerships, 12 Programmatic Approaches, 61 II.3 Community Outreach, 12 IV.7 Use of Value Capture, 66 II.4 Government Roles, 14 -

25 Great Ideas of New Urbanism

25 Great Ideas of New Urbanism 1 Cover photo: Lancaster Boulevard in Lancaster, California. Source: City of Lancaster. Photo by Tamara Leigh Photography. Street design by Moule & Polyzoides. 25 GREAT IDEAS OF NEW URBANISM Author: Robert Steuteville, CNU Senior Dyer, Victor Dover, Hank Dittmar, Brian Communications Advisor and Public Square Falk, Tom Low, Paul Crabtree, Dan Burden, editor Wesley Marshall, Dhiru Thadani, Howard Blackson, Elizabeth Moule, Emily Talen, CNU staff contributors: Benjamin Crowther, Andres Duany, Sandy Sorlien, Norman Program Fellow; Mallory Baches, Program Garrick, Marcy McInelly, Shelley Poticha, Coordinator; Moira Albanese, Program Christopher Coes, Jennifer Hurley, Bill Assistant; Luke Miller, Project Assistant; Lisa Lennertz, Susan Henderson, David Dixon, Schamess, Communications Manager Doug Farr, Jessica Millman, Daniel Solomon, Murphy Antoine, Peter Park, Patrick Kennedy The 25 great idea interviews were published as articles on Public Square: A CNU The Congress for the New Urbanism (CNU) Journal, and edited for this book. See www. helps create vibrant and walkable cities, towns, cnu.org/publicsquare/category/great-ideas and neighborhoods where people have diverse choices for how they live, work, shop, and get Interviewees: Elizabeth Plater-Zyberk, Jeff around. People want to live in well-designed Speck, Dan Parolek, Karen Parolek, Paddy places that are unique and authentic. CNU’s Steinschneider, Donald Shoup, Jeffrey Tumlin, mission is to help build those places. John Anderson, Eric Kronberg, Marianne Cusato, Bruce Tolar, Charles Marohn, Joe Public Square: A CNU Journal is a Minicozzi, Mike Lydon, Tony Garcia, Seth publication dedicated to illuminating and Harry, Robert Gibbs, Ellen Dunham-Jones, cultivating best practices in urbanism in the Galina Tachieva, Stefanos Polyzoides, John US and beyond.