Proxy Voting Report 1 January 2020 to 30 June 2020 Australia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021

1H21 INVESTOR MATERIALS 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. CONTENTS 1H21 RESULTS PRESENTATION 3 ABOUT BOQ 30 1H21 RESULTS 34 PORTFOLIO QUALITY 38 CAPITAL, FUNDING & LIQUIDITY 45 DIVISIONAL RESULTS 52 ECONOMIC ASSUMPTIONS 56 Bank of Queensland Limited 2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. AGENDA INTRODUCTION Cherie Bell, General Manager Investor Relations RESULTS OVERVIEW George Frazis, Managing Director and CEO FINANCIAL DETAIL AND PORTFOLIO QUALITY Ewen Stafford, Chief Financial Officer and Chief Operating Officer SUMMARY & OUTLOOK George Frazis, Managing Director and CEO Q&A George Frazis, Managing Director and CEO Ewen Stafford, Chief Financial Officer and Chief Operating Officer Bank of Queensland Limited 2021 Half Year Results Presentation 4 RESULTS OVERVIEW GEORGE FRAZIS MANAGING DIRECTOR AND CEO 1H21 OVERVIEW 1. Statutory profit growth of 66%, cash net profit up 9%, and EPS growth of 3%1, reflecting strong growth whilst managing margin, costs and lower impairments 2. Good business momentum, with strong housing loan growth of 1.6x system and improved NIM to 1.95% 3. Delivering on the strategic transformation, over the last three halves, with go live of the first phase of the retail digital banking platform, and acquisition of ME Bank announced 4. Asset quality remains sound, reflected by loan impairment expense to GLAs reducing to 10bps and arrears reducing over the half. Prudent provision levels maintained 5. Capital strength to support business growth and transformation investment with CET1 of 10.03% 6. -

Fund Profile

Janus Henderson Tactical Income Fund With a focus on delivering a stable return profile and capital preservation, Janus Henderson’s highly experienced Australian Fixed Interest Team have the flexibility to actively change asset allocations in order to take full advantage of the interest rate cycle and credit environments. FUND Objective Stage 3: Implementation Implement the strategy by investing in a range of The Janus Henderson Tactical Income Fund cash, fixed interest and higher yielding securities. (“Fund”) seeks to achieve a total return By investing in the Fund, the following key after fees that exceeds the total return of the investment decisions are managed by the Team: Bloomberg AusBond Bank Bill Index and PROFILE Bloomberg AusBond Composite 0+ Yr Index • Interest rates: Determine when to hold longer (equally weighted) (“Benchmark”), by investing dated fixed rate assets (e.g. government bonds in a diversified portfolio of predominantly are typically cheap when interest rates peak in Australian income producing assets. an economic cycle) and when to hold shorter dated floating rate exposure. About the Fund • Sectors: Consider the right proportion of The Fund is an integrated and diversified fixed government securities versus non- interest solution, designed to make tactical government securities, dependent on the investment decisions between cash, longer adequacy of compensation to investors for duration fixed interest securities and higher the additional risk. yielding securities, throughout every step of the investment cycle. • Securities: Determine which non-government securities have stable to improving credit Investment philosophy quality. Of these securities, understand which offer an appropriate return for the The Fund is designed to leverage the considerable underlying risk. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Specialist Australian Small Companies Quarterly Investment Option Update

Specialist Australian Small Companies Quarterly Investment Option Update 31 December 2020 Aim and Strategy Sector Allocation % To provide a total return (income and capital growth) Consumer Discretionary 21.97 after costs and before tax, above the performance Materials 17.24 benchmark, the S&P/ASX Small Ordinaries Industrials 14.87 Accumulation Index, on a rolling three-year basis. The Health Care 9.90 portfolio invests in small companies listed on the Information Technology 8.64 Australian Securities Exchange (ASX). For this Financials 6.06 portfolio small companies are considered to be those Communication Services 5.61 outside the top 100 listed companies (by market Consumer Staples 5.50 value). Up to 20% of the portfolio may be invested in Real Estate 5.37 unlisted companies that the investment manager Cash 2.80 believes are likely to be listed in the next 12 months, or Energy 2.05 in companies between the top 50 and 100 listed on the ASX. Top Holdings % City Chic Collective Ltd 2.49 Investment Option Performance Lynas Rare Earths Ltd 2.43 To view the latest investment performances for each Eagers Automotive Ltd 2.07 product, please visit www.amp.com.au/performance Integral Diagnostics Ltd 2.04 Marley Spoon AG 1.89 Investment Option Overview Technology One Ltd 1.85 Investment category Australian Shares Pilbara Minerals Ltd 1.84 Suggested minimum investment Seven Group Holdings Ltd 1.83 7 years timeframe Ingenia Communities Group 1.78 Relative risk rating Very High Auckland International Airport 1.75 Investment style Active Manager style Multi-manager Asset Allocation Benchmark (%) Australian Shares 100 Cash 0 Actual Allocation % International Shares 11.61 Australian Shares 82.23 Listed Property and Infrastructure 3.36 Cash 2.80 Fund Performance The Fund posted a very strong positive absolute return and outperformed its benchmark over the December quarter. -

Of the Corporations Act, AMP Limited Advises Its Current Interest in Shares of AMP Ltd

Company Secretary AMP Limited ABN: 49 079 354 519 33 Alfred Street Sydney NSW 2000 Australia GPO Box 4134 Sydney NSW 2001 Australia Email: [email protected] Web: amp.com.au Telephone: (02) 9257 5000 Facsimile: (02) 9257 7178 19-August-2021 Manager ASX Market Announcements Australian Securities Exchange Level 4, 20 Bridge Street Sydney NSW 2000 Notice Pursuant to Corporations Act Sub-section 259C(2) Exemption Dear Sir/Madam, Pursuant to an exemption under Sub-section 259C(2) of the Corporations Act, AMP Limited advises its current interest in shares of AMP Ltd. Marissa Bendyk Company Secretary, AMP Limited AMP Ltd ABN 49 079 354 519 Corporations Act 2001 Subsection 259C(2) Exemption To: AMP Ltd ACN/ARSN: 079 354 519 Shareholder: AMP Limited (ACN 079 354 519) and its related bodies corporate. Notice Date: 18-Aug-2021 1. Previous Notice Particulars of the shareholders' previous notice under sub-section 259C(2) exemption was given on: The previous notice was given to the company on: 05-Aug-2021 The previous notice was dated: 04-Aug-2021 2. Previous and present voting power The total number and percentage of shares in each class of voting shares in the company to which the shareholder has an interest in or derivative exposure to, when last required and when now required to give notice, are: Previous Notice Present Notice Class of securities Persons' votes Voting Power Persons' votes Voting Power Ordinary Share 53,430,902 1.64% 53,595,691 1.64% 3. Change in interest and derivative exposure Particulars of each change in, or change in the nature of, the interests of the substantial holder in, or derivative exposure to voting shares since the shareholder was last required to give a notice are: See Annexure 'A' 4. -

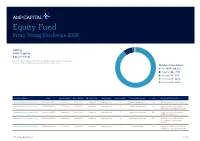

Equity Fund Proxy Voting Disclosure 2020

Equity Fund Proxy Voting Disclosure 2020 Voting AMP Capital Equity Fund Note: The below disclosures refer to Australian listed securities only and do not include foreign listed securities held in the portfolio. Number of resolutions: n For 1077 - 90.2% n Against 88 - 7.3% n Abstain 18 - 1.5% n Unvoted 8 – 0.7% n Unvoted 3 – 0.3% Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 1 Capital Management For Ratify Placement of Securities Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 2 Capital Management For Approve Issue of Securities (Executive chair Bill Beament) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 3 Capital Management For Approve Issue of Securities (NED Mary Hackett) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 4 Capital Management For Approve Issue of Securities (Former NED Christopher Rowe) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 5 Board Related For Approve Financial Assistance (Kalgoorlie Lake View Pty Ltd) AMP Capital Equity Fund 1 of 58 Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 1 Audit/Financials For Accounts and Reports Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 2 Compensation For Remuneration Policy (Binding) Virgin Money UK Plc. -

June 2017 Investment Update

Investment update As at 30 June 2017 Snapshot Pre-tax net tangible assets Gross assets $1.06 $42.0m Fully franked Performance dividend yield (p.a. since January 2008) wilsonassetmanagement.com.au 5.0% 12.6% ABN 49 126 420 719 WAM Active Limited Market overview ASX code WAA The S&P/ASX All Ordinaries Accumulation Index closed up 0.3% for the Listed Jan 2008 month, to finish the financial year up 13.1%, the best year for the market Gross assets $42.0m since 2014. The sectors that drove the advance during FY2017 were Market cap $42.7m materials (+20.6%), utilities (+14.7%), banks (+11.9%) and healthcare Share price (WAA) $1.10 (+11.8%). Option price (WAAO) $0.015 NTA before tax $1.06 Global equity markets ended the month down as central banks Shares on issue 38,802,828 foreshadowed the end of easy monetary policy. The US Federal Reserve Options on issue 31,680,247 raised interest rates for the third consecutive time to between 1% to 1.25% Annualised fully franked 5.5c in response to improving confidence in the US economy. interim dividend (FY2017) Fully franked dividend yield 5.0% In Australia, the unemployment rate fell to a lower than expected 5.5% from 5.7% the previous month, the lowest level since February 2013. The political Investment objectives attack on banks continued with the South Australian Government • Deliver shareholders a regular income announcing it would introduce a bank tax in addition to the Federal stream via fully franked dividends Government’s levy. -

JH Inv Funds Series I OEIC AR 05 2021.Indd

ANNUAL REPORT & ACCOUNTS For the year ended 31 May 2021 Janus Henderson Investment Funds Series I Janus Henderson Investment Funds Series I A Who are Janus Henderson Investors? Global Strength 14% 13% £309.6B 55% 45% 31% 42% Assets under Over 340 More than 2,000 25 Over 4,300 management Investment professionals employees Offi ces worldwide companies met by investment teams in 2020 North America EMEA & LatAm Asia Pacifi c Source: Janus Henderson Investors, Staff and assets under management (AUM) data as at 30 June 2021. AUM data excludes Exchange-Traded Note (ETN) assets. Who we are Janus Henderson Investors (‘Janus Henderson’) is a global asset manager off ering a full suite of actively managed investment products across asset classes. As a company, we believe the notion of ‘connecting’ is powerful – it has shaped our evolution and our world today. At Janus Henderson, we seek to benefi t clients through the connections we make. Connections enable strong relationships based on trust and insight aswell as the fl ow of ideas among our investment teams and our engagement with companies. These connections are central to our values, to what active management stands for and to the long-term outperformance we seek to deliver. Our commitment to active management off ers clients the opportunity to outperform passive strategies over the course of market cycles. Through times of both market calm and growing uncertainty, our managers apply their experience weighing risk versus reward potential – seeking to ensure clients are on the right side of change. Why Janus Henderson Investors At Janus Henderson, we believe in linking our world-class investment teams and experienced global distribution professionals with our clients around the world. -

AMP17367 Reviewvis 27.Indd

2013 shareholder review Dividends Dividend cents per share The fi nal dividend of Final dividend 11.5 cents per share will Interim dividend be paid on 10 April 2014. The fi nal dividend will be 30 30 70% franked and brings 30 29 the total dividend for 2013 25 16 15 to 23 cents per share. 14 23 The payout ratio for the 20 12.5 full 2013 dividend is 80% 11.5 of the 2013 underlying profi t, which is at the 15 15 top of AMP’s target payout 10 14 range of 70–80% of 12.5 underlying profi t. 11.5 0 2009 2010 2011 2012 2013 Annual general meeting AMP’s 2014 annual general meeting (AGM) will be held at 10.00am (AEST) on Thursday 8 May 2014 at the Savoy Ballroom, Grand Hyatt Melbourne, 123 Collins Street, Melbourne, Australia. Full details of the 2014 AGM, including the notice of meeting and a link to the live webcast, are available at amp.com.au/agm. AMP 2013 annual report The full AMP 2013 annual report, including the complete fi nancial report, can be found at amp.com.au/2013annualreport. AMP Limited ABN 49 079 354 519. Unless otherwise specified, all amounts are in Australian dollars. Information in the review is current as at 3 March 2014. AMP was founded on a simple yet bold idea – that every individual should have the power and ability to control his or her life. For more than 160 years, we’ve dedicated ourselves to making this possible. And while we’ve grown and changed over the decades, one thing has remained the same – our unwavering sense of purpose to help people own tomorrow. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 04 December 2020 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 13.48 -3.02 2.04 -24.57 -5.73 13.14 21.69 66.61 - - ABC Adelaide Brighton 3.23 2.22 3.19 -2.46 -0.08 -18.14 -17.52 -1.18 4.55 98 ABP Abacus Property Grp 3.15 -0.63 6.42 21.82 -10.83 4.23 -3.52 6.74 8.37 69 AFI Australian Foundat 7.22 -0.82 8.41 17.95 9.38 13.38 9.55 8.04 7.01 75 AGL AGL Energy Limited 13.52 -1.46 5.54 -20.24 -27.72 -9.15 -12.47 1.87 3.88 102 AIA Auckland Internation 7.32 -0.41 8.77 11.76 -12.65 5.08 9.74 10.98 18.12 22 ALD Ampol Limited 30.77 0.46 21.00 9.73 -8.08 8.66 -1.78 0.93 10.77 56 ALL Aristocrat Leisure 31.84 -3.74 3.67 17.51 -3.91 17.25 14.09 28.04 29.23 7 ALQ ALS Limited 9.52 -2.36 -0.98 31.69 7.40 14.26 14.25 21.73 5.54 90 ALU Altium Limited 35.72 2.09 -5.53 -1.48 2.44 24.33 41.36 50.26 71.58 1 ALX Atlas Arteria 6.48 -1.22 8.91 -2.66 -11.90 3.02 5.85 12.80 18.17 21 AMC Amcor PLC 15.34 -0.84 0.16 3.68 8.49 11.97 3.36 6.80 13.24 39 AMP AMP Limited 1.72 -1.15 3.30 2.84 0.04 -12.32 -25.31 -14.07 -2.03 121 ANN Ansell Limited 35.68 -5.06 -14.07 0.81 26.57 27.11 14.59 12.75 11.78 48 ANZ ANZ Banking Grp Ltd 23.30 0.91 22.54 24.41 -1.20 -1.64 -1.47 2.25 5.11 94 APA APA Group 10.18 -3.69 -6.86 -9.84 -0.47 13.21 7.59 8.16 14.00 36 APE AP Eagers Limited 13.25 -0.53 14.13 81.51 37.33 41.67 21.54 5.80 20.09 20 APT Afterpay Touch 94.50 -0.21 -6.20 81.03 224.97 -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD