AMP Capital Corporate Bond Quarterly Investment Option Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021

1H21 INVESTOR MATERIALS 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. CONTENTS 1H21 RESULTS PRESENTATION 3 ABOUT BOQ 30 1H21 RESULTS 34 PORTFOLIO QUALITY 38 CAPITAL, FUNDING & LIQUIDITY 45 DIVISIONAL RESULTS 52 ECONOMIC ASSUMPTIONS 56 Bank of Queensland Limited 2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. AGENDA INTRODUCTION Cherie Bell, General Manager Investor Relations RESULTS OVERVIEW George Frazis, Managing Director and CEO FINANCIAL DETAIL AND PORTFOLIO QUALITY Ewen Stafford, Chief Financial Officer and Chief Operating Officer SUMMARY & OUTLOOK George Frazis, Managing Director and CEO Q&A George Frazis, Managing Director and CEO Ewen Stafford, Chief Financial Officer and Chief Operating Officer Bank of Queensland Limited 2021 Half Year Results Presentation 4 RESULTS OVERVIEW GEORGE FRAZIS MANAGING DIRECTOR AND CEO 1H21 OVERVIEW 1. Statutory profit growth of 66%, cash net profit up 9%, and EPS growth of 3%1, reflecting strong growth whilst managing margin, costs and lower impairments 2. Good business momentum, with strong housing loan growth of 1.6x system and improved NIM to 1.95% 3. Delivering on the strategic transformation, over the last three halves, with go live of the first phase of the retail digital banking platform, and acquisition of ME Bank announced 4. Asset quality remains sound, reflected by loan impairment expense to GLAs reducing to 10bps and arrears reducing over the half. Prudent provision levels maintained 5. Capital strength to support business growth and transformation investment with CET1 of 10.03% 6. -

Aurizon Operation’S Submission to the Western Australia Treasury Department Issues Paper Table of Contents

Review of the Western Australian Rail Access Regime 17 November 2017 Aurizon Operation’s submission to the Western Australia Treasury Department Issues Paper Table of Contents Executive Summary .................................................................................................................. 4 Aurizon Operations in Western Australia .................................................................................. 5 Improving the effectiveness of the Western Australian Rail Access Regime ............................. 6 Aurizon submissions to the WA Access Code Review ......................................................... 7 Aurizon’s experience with the Code ..................................................................................... 7 Lessons from the CBH negotiations..................................................................................... 8 Areas for improvement ........................................................................................................ 9 Balance of power in access negotiations .................................................................................. 9 Reform Option 1. Make the non-discrimination requirements mandatory for all access negotiations whether executed inside or outside of the Code. ................................. 9 Reform Option 2. Part 5 instruments apply regardless of whether or not an access agreement is negotiated inside or outside of the Code .......................................... 11 Reform Option 3. Allow a negotiation which commences -

Half Year Results 2021 Investor Presentation

NAB 2021 HALF YEAR RESULTS INDEX This presentation is general background information about NAB. It is intended to be used by a professional analyst audience and is not intended to be relied upon as financial advice. Refer to page 116 for legal disclaimer. Financial information in this presentation is based on cash earnings, which is not a statutory financial measure. Refer to page 114 for definition of cash earnings and reconciliation to statutory net profit. Overview 3 1H21 Financials 16 Additional Information 32 Divisional Performances 32 Technology & Operations Update 49 Long Term: A Sustainable Approach 52 Australian Business Lending 59 Australian Housing Lending 63 Other Australian Products 70 Group Asset Quality 73 Capital & Funding 90 Economics 103 Other Information 111 OVERVIEW ROSS McEWAN Group Chief Executive Officer KEY MESSAGES Financial results reflect improving economy Risks remain – strength and stability continue to be a priority Executing our strategy with discipline and focus Building momentum, with more to do Well positioned to support a business-led recovery 4 SOUND FINANCIAL RESULTS METRIC 1H21 2H20 1H21 V 2H20 Statutory net profit ($m) 3,208 1,246 Large CONTINUING OPERATIONS (EX LARGE NOTABLE ITEMS 1) Cash earnings 2 ($m) 3,343 2,258 48.1% Underlying profit ($m) 4,576 4,952 (7.6%) Cash ROE 11.1% 7.7% 3.4% Diluted Cash EPS (cents) 96.9 67.3 44.0% Dividend (cents) 60 30 100% Cash payout ratio 3 59.1% 42.7% 16.4% (1) For a full breakdown of large notable items in 2H20 refer to Section 4, Note 3 of the 2021 Half Year Results Announcement. -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Invocare Limited and Subsidiaries Appendix 4D (Rule 4.2A) Half Year Report for the Half Year Ended 30 June 2021

InvoCare Limited and subsidiaries Appendix 4D (rule 4.2A) Half year report For the half year ended 30 June 2021 INVOCARE LIMITED Appendix 4D Results for announcement to the market (All comparisons to half year ended 30 June 2020) Jun 2021 Up/(down) Movement $’000 $’000 % Revenue from continuing operations 260,855 30,531 13.3 Operating earnings after income tax attributable to ordinary equity holders of InvoCare Limited* 20,552 8,987 77.7 Net profit from ordinary activities after income tax attributable to ordinary equity holders of InvoCare Limited 43,856 61,861 343.6 Net profit after income tax attributable to ordinary equity holders of InvoCare Limited 43,856 61,861 343.6 * This is non-IFRS financial information and is reconciled to statutory profit in the Financial Report (Refer to Directors’ report in the Half Year Financial Report attached). Dividend information Franked Amount per amount per Franking share share credit cents cents % 2021 Interim dividend 9.5 9.5 100 Dividend dates For 2021 interim dividend to be paid, the dividend dates are as follows. Record date 3 September 2021 Payment date 7 October 2021 The Company’s Dividend Reinvestment Plan (DRP) will operate for the 2021 interim dividend by acquiring shares on market at no discount. Shares will be transferred to participants in accordance with the DRP Rules. The last time for the receipt of an election notice to participate in the DRP is 5:00pm on 6 September 2021. Eligible shareholders may lodge their DRP elections electronically by logging onto InvoCare’s share registry, Link Market Services, via their website at https://investorcentre.linkmarketservices.com.au and clicking on the link to Investor Login. -

Stepping up with Spark

STEPPING UP COLLABORATION WITH SPARK “Skype for Business is improving the way we work within Westpac – it’s amazing to see how collaboration and teamwork has skyrocketed with the ability to share and create digitally.” Richard Jarrett, Head of IT Foundation & Frontline Experience, Westpac Behind the Business RAPID ROLL-OUT OF SKYPE FOR BUSINESS Accelerating Westpac NZ’s digital transformation. To be recognised as one of the world’s great “It will mean we can collaborate more effectively, be About Westpac NZ service companies, Westpac NZ has been looking more productive and offer more to our customers.” at ways to cut down process and speed up the time • Founded in 1861 it takes to make decisions for its customers. “With almost 5,000 staff spread across offices and branches throughout New Zealand, it’s a large project Over the last few years, Westpac has focused on • 4,900 employees and one that is supporting a cultural shift in the way leveraging digital technology to do this. Partnering Westpac works.” with Spark for a Skype for Business deployment is its • 620 ATMs latest move that’s helping the bank to find new and Benefiting from rapid deployment • 1.35 million customers smarter ways of doing business. Keen to roll out Skype for Business as quickly as “Skype for Business is going to equip our people possible and with minimal risk, Westpac turned to with the latest unified communication and video long-standing technology partners and Microsoft conferencing tools,” says Head of IT Foundation “Collaborating will be a experts, Spark, to do this. -

Full Year Results Presentation

Dominic D Smith Senior Vice President & Company Secretary Aurizon Holdings Limited ABN 14 146 335 622 T +61 7 3019 9000 F +61 7 3019 2188 E [email protected] W aurizon.com.au Level 17, 175 Eagle Street Brisbane QLD 4000 GPO Box 456 Brisbane QLD 4001 ASX Market Announcements ASX Limited 20 Bridge Street Sydney NSW 2000 19 August 2013 BY ELECTRONIC LODGEMENT Aurizon – Full year results presentation Please find attached for immediate release to the market the Company’s full year results presentation. The presentation will be delivered to an analyst and investor briefing which will commence at 10.30am (AEST). This briefing will be web-cast and accessible via the following link: http://www.media-server.com/m/p/pwt9z573. Yours faithfully Dominic D Smith SVP & Company Secretary FY2013 Results Presentation Lance Hockridge – Managing Director & CEO Keith Neate – EVP & CFO 19 August 2013 Important notice No Reliance on this document This document was prepared by Aurizon Holdings Limited (ACN 146 335 622) (referred to as ―Aurizon‖ which includes its related bodies corporate). Whilst Aurizon has endeavoured to ensure the accuracy of the information contained in this document at the date of publication, it may contain information that has not been independently verified. Aurizon makes no representation or warranty as to the accuracy, completeness or reliability of any of the information contained in this document. Document is a summary only This document contains information in a summary form only and does not purport to be complete and is qualified in its entirety by, and should be read in conjunction with, all of the information which Aurizon files with the Australian Securities Exchange. -

Specialist Australian Small Companies Quarterly Investment Option Update

Specialist Australian Small Companies Quarterly Investment Option Update 31 December 2020 Aim and Strategy Sector Allocation % To provide a total return (income and capital growth) Consumer Discretionary 21.97 after costs and before tax, above the performance Materials 17.24 benchmark, the S&P/ASX Small Ordinaries Industrials 14.87 Accumulation Index, on a rolling three-year basis. The Health Care 9.90 portfolio invests in small companies listed on the Information Technology 8.64 Australian Securities Exchange (ASX). For this Financials 6.06 portfolio small companies are considered to be those Communication Services 5.61 outside the top 100 listed companies (by market Consumer Staples 5.50 value). Up to 20% of the portfolio may be invested in Real Estate 5.37 unlisted companies that the investment manager Cash 2.80 believes are likely to be listed in the next 12 months, or Energy 2.05 in companies between the top 50 and 100 listed on the ASX. Top Holdings % City Chic Collective Ltd 2.49 Investment Option Performance Lynas Rare Earths Ltd 2.43 To view the latest investment performances for each Eagers Automotive Ltd 2.07 product, please visit www.amp.com.au/performance Integral Diagnostics Ltd 2.04 Marley Spoon AG 1.89 Investment Option Overview Technology One Ltd 1.85 Investment category Australian Shares Pilbara Minerals Ltd 1.84 Suggested minimum investment Seven Group Holdings Ltd 1.83 7 years timeframe Ingenia Communities Group 1.78 Relative risk rating Very High Auckland International Airport 1.75 Investment style Active Manager style Multi-manager Asset Allocation Benchmark (%) Australian Shares 100 Cash 0 Actual Allocation % International Shares 11.61 Australian Shares 82.23 Listed Property and Infrastructure 3.36 Cash 2.80 Fund Performance The Fund posted a very strong positive absolute return and outperformed its benchmark over the December quarter. -

Some Common Service Providers Listing New Westpac Account

Some Common Service Providers Listing Here is a list of some common companies where you may have payments coming from or going to your old bank account. Westpac has prepared this listing of contact details based on information from third party websites, on 8 October 2010. If you have completed a Switch form, Westpac will pass on your new account details to the companies concerned. However, to ensure all your regular payments are redirected to your new Westpac account, please contact the companies you have arrangements with to let them know of your new Westpac account details or linked Westpac Debit MasterCard® card details. This will ensure all your regular payments are re-directed to your new Westpac account. New Westpac account: BSB – . Account number. Health Insurance Other Financial Institutions HBA 131 243 www.hba.com.au American Express www.americanexpress.com.au/ 1300 732 235 australia/ HBF 133 423 www.hbf.com.au ANZ 13 13 14 www.anz.com.au HCF 13 13 34 www.hcf.com.au Bank of Queensland www.boq.com.au MBF 131 137 www.mbf.com.au 1300 55 72 72 Medibank Private 132 331 www.medibank.com.au BankSA 13 13 76 www.banksa.com.au NIB 13 14 63 www.nib.com.au Bankwest 13 17 18 www.bankwest.com.au Commonwealth Bank www.commbank.com.au General & Car Insurance 13 2221 AAMI 13 22 44 www.aami.com.au NAB 13 22 65 www.nab.com.au Allianz 132 664 www.allianz.com.au St.George Bank 13 33 30 www.stgeorge.com.au Personal Banking CGU 13 15 32 www.cgu.com.au Citibank 13 24 84 www.citibank.com.au GIO 13 10 10 www.gio.com.au ING Direct 133 464 www.ingdirect.com.au -

Of the Corporations Act, AMP Limited Advises Its Current Interest in Shares of AMP Ltd

Company Secretary AMP Limited ABN: 49 079 354 519 33 Alfred Street Sydney NSW 2000 Australia GPO Box 4134 Sydney NSW 2001 Australia Email: [email protected] Web: amp.com.au Telephone: (02) 9257 5000 Facsimile: (02) 9257 7178 19-August-2021 Manager ASX Market Announcements Australian Securities Exchange Level 4, 20 Bridge Street Sydney NSW 2000 Notice Pursuant to Corporations Act Sub-section 259C(2) Exemption Dear Sir/Madam, Pursuant to an exemption under Sub-section 259C(2) of the Corporations Act, AMP Limited advises its current interest in shares of AMP Ltd. Marissa Bendyk Company Secretary, AMP Limited AMP Ltd ABN 49 079 354 519 Corporations Act 2001 Subsection 259C(2) Exemption To: AMP Ltd ACN/ARSN: 079 354 519 Shareholder: AMP Limited (ACN 079 354 519) and its related bodies corporate. Notice Date: 18-Aug-2021 1. Previous Notice Particulars of the shareholders' previous notice under sub-section 259C(2) exemption was given on: The previous notice was given to the company on: 05-Aug-2021 The previous notice was dated: 04-Aug-2021 2. Previous and present voting power The total number and percentage of shares in each class of voting shares in the company to which the shareholder has an interest in or derivative exposure to, when last required and when now required to give notice, are: Previous Notice Present Notice Class of securities Persons' votes Voting Power Persons' votes Voting Power Ordinary Share 53,430,902 1.64% 53,595,691 1.64% 3. Change in interest and derivative exposure Particulars of each change in, or change in the nature of, the interests of the substantial holder in, or derivative exposure to voting shares since the shareholder was last required to give a notice are: See Annexure 'A' 4. -

2019 Voting Record As at 30 June 2019

2019 Voting Record as at 30 June 2019 Solaris Core Australian Equity Fund Solaris High Alpha Australian Equity Fund Solaris Core Australian Equity Fund (Total Return) Stock Company Name Meeting Date Item Resolutions Solaris Resolution Management/ Decision Type Shareholder Proposal MQG Macquarie Group Limited 26/07/2018 2a Elect Peter H Warne as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 2b Elect Gordon M Cairns as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 2c Elect Glenn R Stevens as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 3 Approve the Remuneration Report For Ordinary Management MQG Macquarie Group Limited 26/07/2018 4 Approve Participation of Nicholas Moore in the Macquarie Group Employee Retained Equity Plan For Ordinary Management MQG Macquarie Group Limited 26/07/2018 5 Approve Issuance of Macquarie Group Capital Notes For Ordinary Management JHX James Hardie Industries plc 10/08/2018 1 Accept Financial Statements and Statutory Reports For Ordinary Management JHX James Hardie Industries plc 10/08/2018 2 Approve the Remuneration Report For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3a Elect Persio Lisboa as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3b Elect Andrea Gisle Joosen as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3c Elect Michael Hammes as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3d Elect Alison Littley as Director -

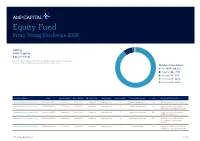

Equity Fund Proxy Voting Disclosure 2020

Equity Fund Proxy Voting Disclosure 2020 Voting AMP Capital Equity Fund Note: The below disclosures refer to Australian listed securities only and do not include foreign listed securities held in the portfolio. Number of resolutions: n For 1077 - 90.2% n Against 88 - 7.3% n Abstain 18 - 1.5% n Unvoted 8 – 0.7% n Unvoted 3 – 0.3% Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 1 Capital Management For Ratify Placement of Securities Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 2 Capital Management For Approve Issue of Securities (Executive chair Bill Beament) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 3 Capital Management For Approve Issue of Securities (NED Mary Hackett) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 4 Capital Management For Approve Issue of Securities (Former NED Christopher Rowe) Northern Star Resources Ltd AU000000NST8 1/22/2020 1/20/2020 Ordinary Management 5 Board Related For Approve Financial Assistance (Kalgoorlie Lake View Pty Ltd) AMP Capital Equity Fund 1 of 58 Company Name ISIN Meeting Date Record Date Meeting Type Proponent Proposal No. Type of Proposal Vote Proposal Description Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 1 Audit/Financials For Accounts and Reports Virgin Money UK Plc. AU0000064966 1/29/2020 1/24/2020 Annual Management 2 Compensation For Remuneration Policy (Binding) Virgin Money UK Plc.