The Economic Security of Business Transactions. Management In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Archaeology of the Prussian Crusade

Downloaded by [University of Wisconsin - Madison] at 05:00 18 January 2017 THE ARCHAEOLOGY OF THE PRUSSIAN CRUSADE The Archaeology of the Prussian Crusade explores the archaeology and material culture of the Crusade against the Prussian tribes in the thirteenth century, and the subsequent society created by the Teutonic Order that lasted into the six- teenth century. It provides the first synthesis of the material culture of a unique crusading society created in the south-eastern Baltic region over the course of the thirteenth century. It encompasses the full range of archaeological data, from standing buildings through to artefacts and ecofacts, integrated with writ- ten and artistic sources. The work is sub-divided into broadly chronological themes, beginning with a historical outline, exploring the settlements, castles, towns and landscapes of the Teutonic Order’s theocratic state and concluding with the role of the reconstructed and ruined monuments of medieval Prussia in the modern world in the context of modern Polish culture. This is the first work on the archaeology of medieval Prussia in any lan- guage, and is intended as a comprehensive introduction to a period and area of growing interest. This book represents an important contribution to promot- ing international awareness of the cultural heritage of the Baltic region, which has been rapidly increasing over the last few decades. Aleksander Pluskowski is a lecturer in Medieval Archaeology at the University of Reading. Downloaded by [University of Wisconsin - Madison] at 05:00 -

Bydgoskie Kamienice Z Okresu Międzywojennego // the Inter-War

ROCZNIKI HUMANISTYCZNE TomLV,zeszyt4 − 2007 AGNIESZKA WYSOCKA BYDGOSKIE KAMIENICE Z OKRESU MIE˛DZYWOJENNEGO Okres od połowy XIX wieku az˙do I wojny s´wiatowej był decyduj ˛acy dla procesu przekształcania sie˛Bydgoszczy w nowoczesne miasto. W tym czasie małomiasteczkowa zabudowa złoz˙ona z parterowych lub pie˛trowych domów, przekrytych wysokimi dachami, zmieniona została na mniej lub bardziej okazałe kamienice czynszowe. Lokalni architekci i mistrzowie budowlani wzorowali sie˛na tendencjach panuj˛acych w tym czasie w architekturze nie- mieckiej, zwłaszcza berlin´skiej. Kiedy w styczniu 1920 r. Bydgoszcz na powrót znalazła sie˛w granicach pan´stwa polskiego, charakter i klimat miasta tworzyła architektura z przełomu XIX i XX wieku. Nie znaczy to jednak, z˙e budynki z lat mie˛dzywojennych nie odcisne˛ły na tkance urbanistycznej miasta swojego pie˛tna. Skala nowych przedsie˛wzie˛c´ podejmowanych w tym czasie nie miała na pewno rozmachu Gdyni czy Warszawy, ale w swojej niewielkiej skali zasługuje na uwage˛. Ze spektrum zjawisk architektonicznych na potrze- by tego artykułu zostały wybrane zagadnienia dotycz ˛ace kamienic czynszo- wych. LATA DWUDZIESTE XX WIEKU Nowa architektura musiała albo wykorzystywac´ puste parcele w obre˛bie juz˙zabudowanych ulic, albo zajmowac´nowe przestrzenie poza centrum mias- ta, na terenie wł ˛aczonych w granice Bydgoszczy w 1920 r. przedmies´c´. Urz ˛ad Budownictwa bydgoskiego Magistratu z funduszy miejskich na gruntach nale- z˙˛acych do miasta wzniósł kilka interesuj ˛acych domów wielomieszkaniowych. Dr AGNIESZKA WYSOCKA − dokumentalista w Wojewódzkim Os´rodku Kultury w Bydgosz- czy; e-mail: [email protected] 34 AGNIESZKA WYSOCKA Projektantem wszystkich był inz˙ynier architekt Bogdan Raczkowski1. Na ich przykładzie moz˙na przes´ledzic´, jak kon´czyła sie˛ jedna epoka – historyzm, a otwierała druga – funkcjonalizm. -

Brownfield Analysis of Bydgoszcz and Solec

ANAL YSIS OF CURRENT SITUATION OF BROWNFIELDS IN BYDGOSZCZ-TORUŃ FUNCTIONAL URBAN AREA „Zachem” Chemical Plant in Bydgoszcz City Version 1 Factory of railway sleepers preservation in Solec Kujawski town 12-2016 Table of Contents 1. General characterization of Bydgoszcz – Toruń Functional Urban Area.................................... 4 2. Detailed assessment of former “Zachem” Chemical Plant in Bydgoszcz City .......................... 17 (authors: Mariusz Czop PhD E., Dorota Pietrucin PhD E.) 2.1. Historical background of a production in a chemical plant ................................................... 17 2.2. Environmental status description and critical aspects .......................................................... 18 2.2.1. Geological structure ...................................................................................................... 18 2.2.2. Groundwater quality and its impact on superficial water ............................................ 21 2.2.3. Soil quality ..................................................................................................................... 25 2.2.4. Air quality ...................................................................................................................... 28 2.2.5. Natural heritage ............................................................................................................ 29 2.2.6. Land consumption ......................................................................................................... 30 2.3. Socio-economic status -

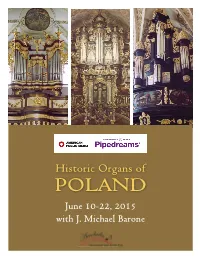

POLAND June 10-22, 2015 with J

Historic Organs of POLAND June 10-22, 2015 with J. Michael Barone www.americanpublicmedia.org www.pipedreams.org National broadcasts of Pipedreams are made possible with funding from Mr. & Mrs. Wesley C. Dudley, grants from Walter McCarthy, Clara Ueland, and the Greystone Foundation and the Art and Martha Kaemmer Fund of the HRK Foundation, by the contributions of listeners to Ameri- can Public Media stations nationwide, and by the thirty-two member organizations of the Associated Pipe Organ Builders of America, APOBA, representing the designers and creators of pipe organs heard throughout the country and around the world, with information at www.apoba.com. See and hear Pipedreams on the Internet 24-7 at www.pipedreams.org. A complete booklet pdf with the tour itinerary can be accessed online at www.pipedreams.org/tour Table of Contents Welcome Letter Page 2 Bios of Hosts and Organists Page 3-6 Polish History Page 7-9 Historical Background of Polish Organs Page 10-22 Alphabetical List of Organ Builders Page 23-26 Polish Organ Composers Page 27-29 Discography Page 30-32 Organ Observations Page 33-35 Tour Itinerary Page 36-39 Organ Sites Page 40-114 Rooming List Page 115 Traveler Bios Page 116-118 Hotel List Page 119-120 Map Inside Back Cover Thanks to the following people for their valuable assistance in creating this tour: Michał Markuszewski in Warsaw, Valerie Bartl, Janelle Ekstrom, Cynthia Jorgenson, Janet Tollund, and Tom Witt of Accolades International Tours for the Arts in Minneapolis. In addition to site specific websites, we gratefully acknowledge the following sources for this booklet: Polskie Wirtualne Centrum Organowe: www.organy.art.pl PAGE 22 HISTORICALORGANTOUR OBSERVATIONS DISCOGRAPHYBACKGROUNDWELCOME ITINERARYHOSTS Welcome Letter from Michael.. -

Indeks Do Znicza Index to ZNICZ

Indeks do ZNICZa Autorka Ewa Karpinska-Gierat, Bethlehem, Connecticut, USA Edytor, opracowanie komputerowe, wydawca Eva Ziem-Boykin, Language Bridges Opublikowany 24 lipca 2010 w setną rocznicę Harcerstwa ---------------------------------------------------------------------------------------------------------- Index to ZNICZ Author Ewa Karpinska-Gierat, Bethlehem, Connecticut, USA Editor, typesetting, publisher Eva Ziem-Boykin, Language Bridges, Colorado Published on July 24, 2010 - the 100th anniversary of Polish Scouting 2010.7.17 1 Wstep do INDEKSU ZNICZa Prasa towarzyszy ruchowi harcerskiemu od zarania jego dziej¶ow.Niezale_znieod tego czy s»ato czasopisma centralne, wydawane przez wÃladze,czy te_z¶srodowiskowe, speÃlniaj»awa_zn»a rol»e.Informacje w nich zawarte s»apodstawowym, cz»estojedynym, zr¶odÃlem danych histo- rycznych, poniewa_zarchiwa harcerskie s»aniekompletne, b»ad¶znie zachowaÃly si»ezupeÃlnie. Uwagi te dotycz»azwÃlaszczaHarcerstwa dziaÃlaj»acegopoza Krajem. Polski ruch skautowy czyli Harcerstwo obchodzi w 2010 swoje stulecie. W Ameryce rozpoczaÃlsi»eju_zw 1912 r., gdy StanisÃlaw KoÃlodziejczyk zaÃlo_zyÃlw St. Louis, MO (Missouri) (oddziaÃl sokoÃlo-skautowy w oparciu o wzory lwowskiego \SokoÃla". Tw¶orcaHarcerstwa w Polsce Andrzej MaÃlkowski redagowaÃl w 1916 r. rubryk»eskautow»aw czasopi¶smie\Sok¶ol Polski" w Pittsburgu. Na pocz»atkulat dwudziestych w Bu®alo, NY ukazywaÃla si»esz- palta po¶swi»econaruchowi skautowemu w tygodniku polskim \Telegram", animowana przez Leonarda Gabryelewicza. Pod koniec lat 20-tych ponownie pojawia si»ew pi¶smie\Sok¶ol Polski" dziaÃl harcerski redagowany przez MieczysÃlawa Wasilewskiego. Od pocz»atkulat 30-tych w Chicago, IL wychodziÃlo pismo \Harcerz Z.N.P." (Zwi»azekNarodowy Polski). Tak_ze odbyÃlo si»ekilka instruktorskich wypraw harcerskich z Polski do Stan¶owZjednoc- zonych i Kanady o_zywiaj»acruch harcerski. Po wojnie nowe o¶srodki harcerskie w Ameryce wydawaÃly swoje organy prasowe takie jak: \Czuj Duch. -

Bus Station of Suburban Transport in Bydgoszcz

BUS STATION OF SUBURBAN TRANSPORT IN BYDGOSZCZ * Market, A few streets – This is the whole city. Everywhere is very close ... Literally two steps. Ryszard Marek Groński 1. INTRODUCTION n Bydgoszcz, as in other Polish cities, the development of public transport falls on the second half of the nineteenth century and is associated with the industrial prosperity of the city, which determined its territorial development. The first means of transport were omnibuses and horse trams, which left for Bydgoszcz in 1888. Along with the construction of the municipal power plant, electric trams started running, which in 1896 began to transport passengers on the routes of Bydgoszcz. Invention of the internal combustion engine led Ito the emergence of a new means of communication - the bus. This type of transport did not require a rigid technical infrastructure, hence its range was wid- er than the existing means of transport.Wheel transport was initially based on trucks converted into buses, bought back from the army after the end of World War I. Such buses served commuter transport from Fordon, Koronowo and Szubin. The city bus appeared in Bydgoszcz only in 19361. It was connected with the necessity to generate an area in the city constituting a transfer point, well com- municated with public urban public transport. The influx of people to the city and its increased mobility associated with locating industry on the outskirts of the city, new residential buildings, as well as accidents of suburban buses led the munici- pality to reserve in the urban structure the area that together with a special de- velopment carried out the functions of the bus station. -

Mapa Rysunkowa-Bci.Pdf

30 49 29 54 36 53 20 45 52 31 4 34 39 46 6 24 41 5 37 13 21 2 10 18 48 15 7 11 27 32 16 42 35 1 43 38 14 47 22 44 33 58 26 51 55 50 9 17 25 57 8 40 23 56 3 28 19 12 18. południk długości geograficznej wschodniej przecina płytę Starego Rynku. Tym samym centrum Bydgoszczy za Miejskie Centrum Kultury umiejscowione jest w gmachu przy ulicy Marcinkowskiego. Autorem projektu secesyjnej kamienicy z początku XX Rzeka Brda wpływa na rozwój miasta od początku jego istnienia. To właśnie nad nią zloka- 1 sprawą jednej wspólnej współrzędnej geograficznej połączone jest m.in. z takimi miastami jak Sztokholm czy Cape Town. 21 wieku był Fritz Weidner. Obecnie jest to miejsce spotkań towarzyskich, koncertów, pokazów filmowych oraz szeroko rozumianych wydarzeń kultu- 45 lizowane są najbardziej atrakcyjne dla turystów miejsca – Wyspa Młyńska z Wenecją, spichrze, Miejsce upamiętniające ciekawostkę geograficzną, w postaci niewielkiego pomnika, znajduje się na Wyspie Młyńskiej. ralnych. Ponadto MCK opiekuje się Galerią Wspólną, Muszlą Koncertową w parku im. W. Witosa oraz Zespołem Pałacowo-Parkowym w Ostromecku. Opera Nova, Katedra czy Poczta Główna. Brda to również jeden z najpiękniejszych w kraju szla- Line of longitude 18th meridian east passes through the Old Market. Thus, Bydgoszcz is on the same line of Municipal Centre of Culture is located on Marcinkowski Street in a secession style building from the beginning of the 20th century designed ków kajakowych – 238-kilometrowa rzeka przepływa przez malownicze Bory Tucholskie. Trasa longitude as Stockholm and Cape Town. -

Ikonotheka 2015/25

IKONOTHEKA IKONO THEKA 25 25 2015 www.wuw.pl Ikonotheka 25 grzb 11.indd 3 5/12/16 7:49 AM IKONO THEKA 25 tyt_Ikonotheka_25.indd 1 2/2/16 2:50 PM Photo: Maria Poprzęcka Essays in Honour of Professor Wiesław Juszczak THE JOURNAL FOUNDED BY JAN BIAŁOSTOCKI (1921–1988) EDITED BY Gabriela Świtek GUEST EDITOR Ryszard Kasperowicz EDITORIAL BOARD Barbara Arciszewska (University of Warsaw), Sergiusz Michalski (Universität Tübingen), Andrzej Pieńkos (University of Warsaw), Antoni Ziemba (University of Warsaw) EDITORIAL SECRETARY Dariusz Żyto PROOFREADING Colin Phillips et al. EDITING Bogusława Jurkevich Institute of Art History of University of Warsaw 00-927 Warszawa, Krakowskie Przedmieście 26/28 phone: +48 (22) 552 04 06, fax: +48 (22) 552 04 07 e-mail: [email protected] www.ikonotheka.ihs.uw.edu.pl It is the authors’ responsibility to obtain appropriate permission for the reproduction of any copyrighted material, including images © Copyright by Wydawnictwa Uniwersytetu Warszawskiego, Warszawa 2015 Wydawnictwa Uniwersytetu Warszawskiego 00-497 Warszawa, ul. Nowy Świat 4 http://www.wuw.pl; e-mail: [email protected] Dział Handlowy WUW: phone: +48 22 55 31 333 e-mail: [email protected] www.wuw.pl ISSN 0860-5769 Layout: Dariusz Górski Tabula gratulatoria JAKUB ADAMSKI (Warszawa) BARBARA ARCISZEWSKA (Warszawa) WOJCIECH BAŁUS (Kraków) ZBIGNIEW BANIA (Łódź) ANNA I WALDEMAR BARANIEWSCY (Warszawa) ZBIGNIEW BENEDYKTOWICZ (Warszawa) ANDRZEJ BETLEJ (Kraków) HUBERT BILEWICZ (Gdańsk) MARIUSZ BRYL (Poznań) TADEUSZ CEGIELSKI (Warszawa) JULIUSZ A. CHROŚCICKI -

9(81) Warszawa, 24 Lutego - 2 Marca 2013 R

R. 69(81) Warszawa, 24 lutego - 2 marca 2013 r. Nr 9 Poz. 6255 - 6914 WYKAZ DZIAŁÓW UKD 0 DZIAŁ OGÓLNY (Naukoznawstwo. Bibliografia. Informa- 622 Górnictwo cja. Bibliotekarstwo. Bibliologia) 629 Technika środków transportu. Technika astronautyczna 0/9(03) Encyklopedie i leksykony o treści ogólnej 63 Rolnictwo 004 Informatyka 630/635 Leśnictwo. Ogólne zagadnienia rolnictwa. Uprawa ro- 005 Zarządzanie. Biurowość ślin 1 FILOZOFIA 636/639 Zootechnika. Weterynaria. Produkty zwierzęce. Ło- 159.9 Psychologia wiectwo. Rybołówstwo 2 RELIGIA. TEOLOGIA 64 Gospodarstwo domowe. Gastronomia. Hotelarstwo 272 Kościół rzymskokatolicki 654+656 Telekomunikacja i telemechanika. Transport. Poczta 3 NAUKI SPOŁECZNE. PRAWO. ADMINISTRACJA 655+659 Działalność wydawnicza. Reklama. Środki maso- 30 Metodologia nauk społecznych. Polityka społeczna. Proble- wego przekazu matyka płci. Socjografia 657 Rachunkowość. Księgowość 311+314 Statystyka. Demografia 658 Organizacja przedsiębiorstw. Organizacja i technika han- 316 Socjologia dlu 32 Nauki polityczne. Polityka 66/68 Przemysł. Rzemiosło. Mechanika precyzyjna 33 Nauki ekonomiczne 69 Przemysł budowlany. Rzemiosło budowlane. Materiały bu- 331 Praca dowlane 336 Finanse. Podatki 7 SZTUKA. ROZRYWKI. SPORT 338/339 Gospodarka. Handel 71 Planowanie przestrzenne. Urbanistyka 338.48 Turystyka 72 Architektura 34+351/354 Prawo. Administracja publiczna. Gospodarka ko- 73/76 Rzeźba. Rysunek. Malarstwo. Grafika. Rzemiosło arty- munalna styczne 355/359 Nauka i sztuka wojenna. Siły zbrojne 77 Fotografia i procesy pokrewne 364/368 Opieka społeczna. Ubezpieczenia. Konsumeryzm 78 Muzyka 37 Oświata. Wychowanie. Szkolnictwo 791/792 Film. Teatr 39 Etnografia. Zwyczaje i obyczaje. Folklor 793/794 Rozrywki towarzyskie. Zabawy. Gry 5 MATEMATYKA. NAUKI PRZYRODNICZE 796/799 Sport 502/504 Nauka o środowisku. Ochrona i zagrożenie środowi- 8 JĘZYKOZNAWSTWO. NAUKA O LITERATURZE. LITERA- ska TURA PIĘKNA 51 Matematyka 80/81 Językoznawstwo.