Mesa Air Group, Inc. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Air Travel Consumer Report

U.S. Department of Transportation Air Travel Consumer Report A Product Of The OFFICE OF AVIATION ENFORCEMENT AND PROCEEDINGS Aviation Consumer Protection Division Issued: May 2006 1 Flight Delays March 2006 12 Months Ending March 2006 1 Mishandled Baggage March 2006 January-March 2006 1 st Oversales 1 Quarter 2006 2 Consumer Complaints March 2006 (Includes Disability and January-March 2006 Discrimination Complaints) Customer Service Reports to the Dept. of Homeland Security3 March 2006 Airline Animal Incident Reports4 March 2006 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov/ 2 Data compiled by the Aviation Consumer Protection Division. Website: http://airconsumer.ost.dot.gov/ 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Aviation Consumer Protection Division TABLE OF CONTENTS Section Page Section Page Introduction ......................…2 Flight Delays Mishandled Baggage Explanation ......................…3 Explanation ....................…..25 Table 1 ......................…4 Ranking--Month ....................…..26 Overall Percentage of Reported Flight Ranking--YTD ..................…....27 Operations Arriving On Time, by Carrier Table 1A ......................…5 Oversales Overall Percentage of Reported Flight Explanation ....................…..28 Operations Arriving On Time and Carrier Rank, Ranking--Quarter ..................…....29 by Month, Quarter, and Data Base to Date Table 2 ......................…6 Consumer Complaints -

ABX Holdings, Inc. 145 Hunter Drive, Wilmington, Ohio 45177

ABX Holdings, Inc. 145 Hunter Drive, Wilmington, Ohio 45177 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 13, 2008 Notice is hereby given that the 2008 annual meeting of the stockholders of ABX Holdings, Inc., a Delaware corporation (the “Company”), has been called and will be held on May 13, 2008, at 11:00 a.m., local time, at the Roberts Convention Centre, 188 Roberts Road, Wilmington, Ohio, for the following purposes: 1. To elect two directors to the Board of Directors each for a term of three years. 2. To consider and vote on a proposal to amend the Company’s Certificate of Incorporation to change the name of the Company from ABX Holdings, Inc. to “Air Transport Services Group, Inc.” 3. To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for fiscal year 2008. 4. To consider and vote on a stockholder proposal. 5. To attend to such other business as may properly come before the meeting and any adjournments thereof. The foregoing matters are described in more detail in the Proxy Statement that is attached to this notice. At the meeting, we will also report on the Company’s 2007 business results and other matters of interest to stockholders. Only holders of record, as of the close of business on March 17, 2008, of shares of common stock of the Company will be entitled to notice of and to vote at the meeting and any adjournments thereof. By Order of the Board of Directors Wilmington, Ohio W. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

APR 2009 Stats Rpts

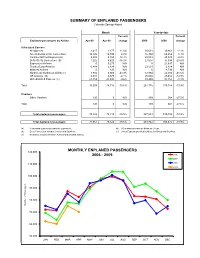

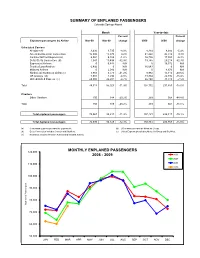

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

MAR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Appendix C Informal Complaints to DOT by New Entrant Airlines About Unfair Exclusionary Practices March 1993 to May 1999

9310-08 App C 10/12/99 13:40 Page 171 Appendix C Informal Complaints to DOT by New Entrant Airlines About Unfair Exclusionary Practices March 1993 to May 1999 UNFAIR PRICING AND CAPACITY RESPONSES 1. Date Raised: May 1999 Complaining Party: AccessAir Complained Against: Northwest Airlines Description: AccessAir, a new airline headquartered in Des Moines, Iowa, began service in the New York–LaGuardia and Los Angeles to Mo- line/Quad Cities/Peoria, Illinois, markets. Northwest offers connecting service in these markets. AccessAir alleged that Northwest was offering fares in these markets that were substantially below Northwest’s costs. 171 9310-08 App C 10/12/99 13:40 Page 172 172 ENTRY AND COMPETITION IN THE U.S. AIRLINE INDUSTRY 2. Date Raised: March 1999 Complaining Party: AccessAir Complained Against: Delta, Northwest, and TWA Description: AccessAir was a new entrant air carrier, headquartered in Des Moines, Iowa. In February 1999, AccessAir began service to New York–LaGuardia and Los Angeles from Des Moines, Iowa, and Moline/ Quad Cities/Peoria, Illinois. AccessAir offered direct service (nonstop or single-plane) between these points, while competitors generally offered connecting service. In the Des Moines/Moline–Los Angeles market, Ac- cessAir offered an introductory roundtrip fare of $198 during the first month of operation and then planned to raise the fare to $298 after March 5, 1999. AccessAir pointed out that its lowest fare of $298 was substantially below the major airlines’ normal 14- to 21-day advance pur- chase fares of $380 to $480 per roundtrip and was less than half of the major airlines’ normal 7-day advance purchase fare of $680. -

Pinnacle Airlines, Inc. CRJ200 124 CRJ900 16

Forward-Looking Statement The use of words, such as “may”, “might”, “will”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “intends”, “future”, “potential” or “continue”, the negative of these terms and other comparable terminology are intended to identify forward-looking statements. These statements are only predictions based on our current expectations and projections about future events. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In this regard, you should specifically consider the numerous risks outlined in our registration statement in the section entitled, “Risk Factors.” 1 Phil Trenary President and CEO 2 About Pinnacle Airlines Corp. Holding company with two operating subsidiaries: Pinnacle Airlines, Inc. and Colgan Air, Inc. Regional Airline Partnerships with Continental Airlines, Delta Air Lines, Northwest Airlines, United Airlines and US Airways Over 5,000 Employees Current fleet of 138 CRJ200 and 2 CRJ900 next generation regional jets, 42 Saab 340B and 7 Beech 1900D turboprop aircraft 14 additional CRJ900s on order for delivery by February 2009 15 Q-400 next generation turboprops on order. Deliveries start in December 2007, completed by June 30, 2008. 3 Guiding Principles – Pinnacle Airlines Never Compromise Safety Respect for All Pinnacle People We recognize safety as our highest We recognize the value of all People. priority in all aspects of the Airline. We will train our People in the areas of diversity and leadership, giving them the Commitment to Communications tools necessary to ensure relationships We will communicate timely and effectively any are based on the principle of mutual respect. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

REPUBLIC AIRWAYS HOLDINGS INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ___________________________________ FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ______________ TO _____________ COMMISSION FILE NUMBER: 000-49697 REPUBLIC AIRWAYS HOLDINGS INC. (Exact name of registrant as specified in its charter) DELAWARE 06-1449146 (State or other jurisdiction of (I.R.S. Employer Identification Number) incorporation or organization) 8909 Purdue Road, Suite 300, Indianapolis, Indiana 46268 (Address of principal executive offices) (Zip Code) (317) 484-6000 (Registrant’s telephone number, including area code) _____________________________ Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $.001 per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

United Airlines / United Express Reciprocal Jumpseat

Updated July 22, 2020 United Airlines / United Express Reciprocal Jumpseat Frequently Asked Questions What’s changing? Starting June 1, 2020, jumpseat-qualified United (UA) and United Express (UAX) employees in Dispatch, Flight Operations and Inflight Services will be able to electronically self-list for a qualifying jumpseat in employeeRES. UAX carriers include: Air Wisconsin, CommutAir, ExpressJet, GoJet, Mesa Airlines, Republic Airlines, and *SkyWest Airlines (*Flight Operations and Dispatch only). • UA employees will be able self-list for UAX flights within the 50 United States and can continue to self-list for mainline UA flights worldwide. • UAX employees will be able to self-list for UA/UAX flights operating only within the 50 United States. employeeRES will verify jumpseat eligibility and priority during the listing process, which will be reflected in Aero, the system used by customer service representatives (CSRs) at airports, after check in. What’s not changing? UA and UAX employees from Dispatch, Flight Operations and Inflight Services and UA Inflight- qualified management will still be able to list for a jumpseat at the gate with a CSR. Employees with controlled jumpseat privileges, including maintenance groups and select management employees, cannot self-list in employeeRES or with a gate CSR, and must follow established processes to receive authorization for a jumpseat. Why are we making this change? Being able to self-list in employeeRES frees up time for CSRs at gates allowing them more time to complete critical tasks before departure and focus on delivering caring service to our customers. Improved automation in Aero also allows CSRs working the gates to accurately see flight deck and cabin jumpseat availability.