United Airlines / United Express Reciprocal Jumpseat

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Air Travel Consumer Report

U.S. Department of Transportation Air Travel Consumer Report A Product Of The OFFICE OF AVIATION ENFORCEMENT AND PROCEEDINGS Aviation Consumer Protection Division Issued: May 2006 1 Flight Delays March 2006 12 Months Ending March 2006 1 Mishandled Baggage March 2006 January-March 2006 1 st Oversales 1 Quarter 2006 2 Consumer Complaints March 2006 (Includes Disability and January-March 2006 Discrimination Complaints) Customer Service Reports to the Dept. of Homeland Security3 March 2006 Airline Animal Incident Reports4 March 2006 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov/ 2 Data compiled by the Aviation Consumer Protection Division. Website: http://airconsumer.ost.dot.gov/ 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Aviation Consumer Protection Division TABLE OF CONTENTS Section Page Section Page Introduction ......................…2 Flight Delays Mishandled Baggage Explanation ......................…3 Explanation ....................…..25 Table 1 ......................…4 Ranking--Month ....................…..26 Overall Percentage of Reported Flight Ranking--YTD ..................…....27 Operations Arriving On Time, by Carrier Table 1A ......................…5 Oversales Overall Percentage of Reported Flight Explanation ....................…..28 Operations Arriving On Time and Carrier Rank, Ranking--Quarter ..................…....29 by Month, Quarter, and Data Base to Date Table 2 ......................…6 Consumer Complaints -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 0-14719 SKYWEST, INC. Incorporated under the Laws of Utah 87-0292166 (IRS Employer ID No.) 444 South River Road St. George, Utah 84790 (435) 634-3000 Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol(s) Name of Each Exchange on which Registered Common Stock, No Par Value SKYW The Nasdaq Global Select Market Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

Skywest, Inc. Announces Second Quarter 2020 Results

NEWS RELEASE CONTACT: Investor Relations Corporate Communications 435.634.3200 435.634.3553 [email protected] [email protected] SkyWest, Inc. Announces Second Quarter 2020 Results Second Quarter Results • Net loss of $26 million, pre-tax loss of $33 million, or $0.51 loss per share • SkyWest took delivery of 21 used E175 aircraft under a previously-announced agreement with United Airlines • SkyWest took delivery of two new E175 aircraft and three used E175 aircraft under a previously-announced agreement with Delta Air Lines ST. GEORGE, UTAH, July 30, 2020 -- SkyWest, Inc. (NASDAQ: SKYW) (“SkyWest”) today reported financial and operating results for Q2 2020, including net loss of $26 million, or $0.51 per share, compared to net income of $88 million, or $1.71 per diluted share, for Q2 2019. The primary factor in SkyWest’s lower results in Q2 2020 compared to Q2 2019 was reduced flight schedules and lower demand resulting from the COVID-19 pandemic. Commenting on the results, Chip Childs, Chief Executive Officer of SkyWest, said, “COVID-19 continues to cause unprecedented disruption across the airline industry. The safety and well- being of our people and passengers remains our main focus. Maintaining strong liquidity and working collaboratively with our partners are our other priorities. I want to thank our 14,000 employees for their dedication to our passengers, each other and our mission during this pandemic.” Financial Results Revenue was $350 million in Q2 2020, down from $744 million in Q2 2019, due to the COVID- 1 19 pandemic that caused a significant reduction in the number of scheduled flights SkyWest operated under its flying contracts compared to the same period last year. -

APR 2009 Stats Rpts

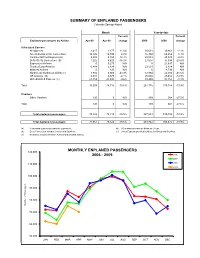

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

2012 Investor Day Setting the Scene Transform 2015

2012 Investor Day Setting the scene Transform 2015 Setting targets Net debt January 2012 Cost reduction Implementing immediate measures Capacity 2012 and beyond Capex Cost reduction Securing structural cost reductions New labor agreements From 2013 Industrial projects Initiating a new revenue dynamic From 2013 2012 Investor Day 3 Transform 2015: end 2014 objectives Reduction in net debt: €2bn Reduction in unit costs*:10% Renegotiation of collective agreements Limited capacity growth Medium-haul restructuring Investment plan revised down Cargo turnaround Cost-saving measures Improvement in long-haul and maintenance profitability * Unit cost per EASK ex fuel 2012 Investor Day 4 Our overarching target: deleveraging the balance sheet 6.5 6.1 6.1 5.6 € billions 4.4 4.4 4.5 3.8 Net debt 2.7 March March March March March Dec Dec Dec Dec Dec Dec Dec Dec 2005 2006 2007 2008 2009 2009 2010 2011 2012 2013 2014 2015 2016 Net debt/ 2.6 0.9 4.8 <2 EBITDA 3.0 3.0 2.7 2.2 1.6 1.7 1.3 EBITDA 0.4 (last twelve months) March March March March March Dec Dec Dec Dec Dec Dec Dec Dec 2005 2006 2007 2008 2009 2009 2010 2011 2012 2013 2014 2015 2016 2012 Investor Day 5 Improvement in operating cash flows the primary source of net debt reduction Capex adjusted to cash generation Limit sale and lease-back operations Less than €100m per year planned for 2013, 2014 and beyond Focus on cost reduction rather than asset disposals Hedging operation on 1/3 of remaining Amadeus stake (7.5%) within framework of our risk management strategy 2012 Investor Day 6 -

Airline Quarterly Financial Review

AIRLINE QUARTERLY FINANCIAL REVIEW FOURTH QUARTER 2019 PASSENGER NATIONALS DEPARTMENT OF TRANSPORTATION OFFICE OF AVIATION ANALYSIS: COMPETITION AND POLICY ANALYIS DIVISION Table of Contents INTRODUCTION ........................................................................................................................................................................................................................... 2 SYSTEM PASSENGER NATIONALS ................................................................................................................................................................................................ 3 Chart 1. Operating Profit and Net Income (Loss) for the Quarter .................................................................................................................................. 4 Chart 2. Operating Profit and Net Income (Loss) for the Year Ended ............................................................................................................................ 4 Chart 3. Operating Profit (Loss) by Quarter ................................................................................................................................................................... 5 Chart 4. Net Income (Loss) by Quarter .......................................................................................................................................................................... 5 Chart 5. Operating Profit (Loss) Year Ended by Quarter ............................................................................................................................................... -

New Expanded Joint Venture

Press Release The Power of Choice for Cargo Customers as Air France-KLM, Delta and Virgin Atlantic launch trans-Atlantic Joint Venture AMSTERDAM/PARIS, ATLANTA and LONDON: February 3rd, 2020 – Air France-KLM Cargo, Delta Air Lines Cargo and Virgin Atlantic Cargo are promising cargo customers more connections, greater shipment routing flexibility, improved trucking options, aligned services and innovative digital solutions with the launch of their expanded trans-Atlantic Joint Venture (JV). The new partnership, which represents 23% of total trans-Atlantic cargo capacity or more than 600,000 tonnes annually, will enable the airlines to offer the best-ever customer experience, and a combined network of up to 341 peak daily trans-Atlantic services – a choice of 110 nonstop routes with onward connections to 238 cities in North America, 98 in Continental Europe and 16 in the U.K. More choice and convenience for customers Customers will be able to leverage an enhanced network built around the airlines’ hubs in Amsterdam, Atlanta, Boston, Detroit, London Heathrow, Los Angeles, Minneapolis, New York-JFK, Paris, Seattle and Salt Lake City. It creates convenient nonstop or one-stop connections to every corner of North America, Europe and the U.K., giving customers the added confidence of delivery schedules being met by a wide choice of options. The expanded JV enables greater co-operation between the airlines, focused on delivering world class customer service and reliability on both sides of the Atlantic achieved through co-located facilities, joint trucking options as well as seamless bookings and connected service recovery. The airlines already co-locate at warehouses in key U.S., U.K. -

MAR 2009 Stats Rpts

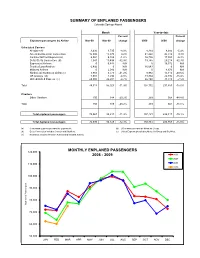

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Air Travel Consumer Report

Air Travel Consumer Report A Product Of THE OFFICE OF AVIATION CONSUMER PROTECTION Issued: August 2021 Flight Delays1 June 2021 January - June 2021 Mishandled Baggage, Wheelchairs, and Scooters 1 June 2021 January -June 2021 Oversales1 2nd Quarter 2021 Consumer Complaints2 June 2021 (Includes Disability and January - June 2021 Discrimination Complaints) Airline Animal Incident Reports4 June 2021 Customer Service Reports to 3 the Dept. of Homeland Security June 2021 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov 2 Data compiled by the Office of Aviation Consumer Protection. Website: http://www.transportation.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Office of Aviation Consumer Protection. TABLE OF CONTENTS Section Page Section Page Flight Delays Flight Delays (continued) Introduction 3 Table 8 35 Explanation 4 List of Regularly Scheduled Domestic Flights with Tarmac Delays Over 3 Hours, By Marketing/Operating Carrier Branded Codeshare Partners 5 Table 8A Table 1 6 List of Regularly Scheduled International Flights with 36 Overall Percentage of Reported Flight Tarmac Delays Over 4 Hours, By Marketing/Operating Carrier Operations Arriving On-Time, by Reporting Marketing Carrier Appendix 37 Table 1A 7 Mishandled Baggage Overall Percentage of Reported Flight Ranking- by Marketing Carrier (Monthly) 39 Operations Arriving On-Time, by Reporting Operating Carrier Ranking- by Marketing Carrier (YTD) 40 Table 1B 8 -

Pinnacle Airlines, Inc. CRJ200 124 CRJ900 16

Forward-Looking Statement The use of words, such as “may”, “might”, “will”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “intends”, “future”, “potential” or “continue”, the negative of these terms and other comparable terminology are intended to identify forward-looking statements. These statements are only predictions based on our current expectations and projections about future events. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In this regard, you should specifically consider the numerous risks outlined in our registration statement in the section entitled, “Risk Factors.” 1 Phil Trenary President and CEO 2 About Pinnacle Airlines Corp. Holding company with two operating subsidiaries: Pinnacle Airlines, Inc. and Colgan Air, Inc. Regional Airline Partnerships with Continental Airlines, Delta Air Lines, Northwest Airlines, United Airlines and US Airways Over 5,000 Employees Current fleet of 138 CRJ200 and 2 CRJ900 next generation regional jets, 42 Saab 340B and 7 Beech 1900D turboprop aircraft 14 additional CRJ900s on order for delivery by February 2009 15 Q-400 next generation turboprops on order. Deliveries start in December 2007, completed by June 30, 2008. 3 Guiding Principles – Pinnacle Airlines Never Compromise Safety Respect for All Pinnacle People We recognize safety as our highest We recognize the value of all People. priority in all aspects of the Airline. We will train our People in the areas of diversity and leadership, giving them the Commitment to Communications tools necessary to ensure relationships We will communicate timely and effectively any are based on the principle of mutual respect. -

Columbus Regional Airport Authority

COLUMBUS REGIONAL AIRPORT AUTHORITY - PORT COLUMBUS INTERNATIONAL AIRPORT TRAFFIC REPORT June 2014 7/22/2014 Airline Enplaned Passengers Deplaned Passengers Enplaned Air Mail Deplaned Air Mail Enplaned Air Freight Deplaned Air Freight Landings Landed Weight Air Canada Express - Regional 2,377 2,278 - - - - 81 2,745,900 Air Canada Express Totals 2,377 2,278 - - - - 81 2,745,900 AirTran 5,506 4,759 - - - - 59 6,136,000 AirTran Totals 5,506 4,759 - - - - 59 6,136,000 American 21,754 22,200 - - - 306 174 22,210,000 Envoy Air** 22,559 22,530 - - 2 ,027 2 ,873 527 27,043,010 American Totals 44,313 44,730 - - 2,027 3,179 701 49,253,010 Delta 38,216 36,970 29,594 34,196 25,984 36,845 278 38,899,500 Delta Connection - ExpressJet 2,888 2,292 - - - - 55 3,709,300 Delta Connection - Chautauqua 15,614 14,959 - - 640 - 374 15,913,326 Delta Connection - Endeavor 4 ,777 4,943 - - - - 96 5,776,500 Delta Connection - GoJet 874 748 - - 33 - 21 1,407,000 Delta Connection - Shuttle America 6,440 7,877 - - 367 - 143 10,536,277 Delta Connection - SkyWest 198 142 - - - - 4 188,000 Delta Totals 69,007 67,931 29,594 34,196 27,024 36,845 971 76,429,903 Southwest 97,554 96,784 218,777 315,938 830 103,146,000 Southwest Totals 97,554 96,784 - - 218,777 315,938 830 103,146,000 United 3 ,411 3,370 13,718 6 ,423 1 ,294 8 ,738 30 3,990,274 United Express - ExpressJet 13,185 13,319 - - - - 303 13,256,765 United Express - Mesa 27 32 - - - - 1 67,000 United Express - Republic 4,790 5,133 - - - - 88 5,456,000 United Express - Shuttle America 9,825 9,076 - - - - 151 10,919,112 -

Automated Flight Statistics Report For

DENVER INTERNATIONAL AIRPORT TOTAL OPERATIONS AND TRAFFIC March 2014 March YEAR TO DATE % of % of % Grand % Grand Incr./ Incr./ Total Incr./ Incr./ Total 2014 2013 Decr. Decr. 2014 2014 2013 Decr. Decr. 2014 OPERATIONS (1) Air Carrier 36,129 35,883 246 0.7% 74.2% 99,808 101,345 (1,537) -1.5% 73.5% Air Taxi 12,187 13,754 (1,567) -11.4% 25.0% 34,884 38,400 (3,516) -9.2% 25.7% General Aviation 340 318 22 6.9% 0.7% 997 993 4 0.4% 0.7% Military 15 1 14 1400.0% 0.0% 18 23 (5) -21.7% 0.0% TOTAL 48,671 49,956 (1,285) -2.6% 100.0% 135,707 140,761 (5,054) -3.6% 100.0% PASSENGERS (2) International (3) Inbound 68,615 58,114 10,501 18.1% 176,572 144,140 32,432 22.5% Outbound 70,381 56,433 13,948 24.7% 174,705 137,789 36,916 26.8% TOTAL 138,996 114,547 24,449 21.3% 3.1% 351,277 281,929 69,348 24.6% 2.8% International/Pre-cleared Inbound 42,848 36,668 6,180 16.9% 121,892 102,711 19,181 18.7% Outbound 48,016 39,505 8,511 21.5% 132,548 108,136 24,412 22.6% TOTAL 90,864 76,173 14,691 19.3% 2.0% 254,440 210,847 43,593 20.7% 2.1% Majors (4) Inbound 1,698,200 1,685,003 13,197 0.8% 4,675,948 4,662,021 13,927 0.3% Outbound 1,743,844 1,713,061 30,783 1.8% 4,724,572 4,700,122 24,450 0.5% TOTAL 3,442,044 3,398,064 43,980 1.3% 75.7% 9,400,520 9,362,143 38,377 0.4% 75.9% National (5) Inbound 50,888 52,095 (1,207) -2.3% 139,237 127,899 11,338 8.9% Outbound 52,409 52,888 (479) -0.9% 139,959 127,940 12,019 9.4% TOTAL 103,297 104,983 (1,686) -1.6% 2.3% 279,196 255,839 23,357 9.1% 2.3% Regionals (6) Inbound 382,759 380,328 2,431 0.6% 1,046,306 1,028,865 17,441 1.7% Outbound