Conveyancing and the Law of Real Property

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Real Estate Marketplace Glossary: How to Talk the Talk

Federal Trade Commission ftc.gov The Real Estate Marketplace Glossary: How to Talk the Talk Buying a home can be exciting. It also can be somewhat daunting, even if you’ve done it before. You will deal with mortgage options, credit reports, loan applications, contracts, points, appraisals, change orders, inspections, warranties, walk-throughs, settlement sheets, escrow accounts, recording fees, insurance, taxes...the list goes on. No doubt you will hear and see words and terms you’ve never heard before. Just what do they all mean? The Federal Trade Commission, the agency that promotes competition and protects consumers, has prepared this glossary to help you better understand the terms commonly used in the real estate and mortgage marketplace. A Annual Percentage Rate (APR): The cost of Appraisal: A professional analysis used a loan or other financing as an annual rate. to estimate the value of the property. This The APR includes the interest rate, points, includes examples of sales of similar prop- broker fees and certain other credit charges erties. a borrower is required to pay. Appraiser: A professional who conducts an Annuity: An amount paid yearly or at other analysis of the property, including examples regular intervals, often at a guaranteed of sales of similar properties in order to de- minimum amount. Also, a type of insurance velop an estimate of the value of the prop- policy in which the policy holder makes erty. The analysis is called an “appraisal.” payments for a fixed period or until a stated age, and then receives annuity payments Appreciation: An increase in the market from the insurance company. -

Supplementary Conveyancing Questionnaire

Supplementary Conveyancing Questionnaire (To be completed if you have answered YES to 9d) Should you have insufficient space to answer any questions, please continue on your own HEADED notepaper Please note that this questionnaire forms part of your proposal for professional indemnity insurance and you are reminded of the importance of the notes and declaration on the proposal, which also applies to this questionnaire. LLP 682 - Jul 12 Important note regarding the completion of this proposal form. 1. Disclosure Any “material fact” must be disclosed to insurers - A “material fact” is any information which may influence the judgement of a prudent insurer in deciding whether to accept the risk and if so, on what terms. Any “material change” must be disclosed to insurers. - A “material change” is any material fact which arises on renewal or during the currency of the policy that has not previously been disclosed as a material fact. Examples of material changes to material facts include: • Fraud on the part of any of the Partners and Employees • A change in the composition of the firm's practice • Mergers and Acquisitions with other firms • Conversion to a Limited Liability Partnership If you are unsure whether a fact or change is material or not, you should disclose it. Failure to provide all “material facts” and/or notify all “material changes” may cause the contract of insurance to be void from inception i.e. your insurers will return the premium and there will be no cover for any claims made under the policy. 2. Presentation This proposal form must be completed by an authorised individual or principal of the firm. -

The Myth of Strict Foreclosure

THE MYTH OF STRICT FORECLOSURE SHmLDON TEFF* YTHS in the field of mortgages are many and striking. One of the most striking is the assumption of American students that the English chancellor left the mortgagor virtually unprotected from his mortgagee. It is not diffitult to find the reasons for this assump- tion. In the colonial period of the country the Court of Chancery was in great disrepute., Time has removed much of the prejudice against doctrines of the chancellor, but in the field of mortgages the prejudice has continued. First, the English system of mortgages seems very primitive to American students. The struggle of junior mortgages to obtain the status of legal charges has confirmed the tradition that the English system of mortgages was very slow in developing, and the hocus-pocus of the long-term lease by which, under the 1925 legislation,2 the second mortgage emerged as a legal charge tended to confirm the prejudice. Surely under a system so primitive mortgagors could not have been adequately protected! The second reason for the prejudice is based upon the history of the American law of mortgages. For more than a century the trend of the American law has been toward greater protection for the debtor. Judges and legislators have joined in the effort to improve the position of the mortgagor and yet, as the d6bicle of the last decade shows, the present American system leaves the mortgagor without adequate protection. The position of mortgagors who did not have the benefit of the century's improvements must have been miserable indeed. -

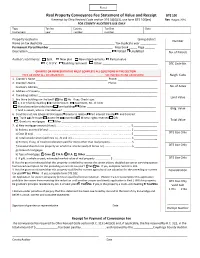

Real Property Conveyance Fee Statement of Value and Receipt

Real Property Conveyance Fee Statement of Value and Receipt DTE 100 If exempt by Ohio Revised Code section 319.54(G)(3), use form DTE 100(ex) Rev 1/14 FOR COUNTY AUDITOR’S USE ONLY Type Tax list County Tax Dist Date Instrument year number number Property located in ____________________________________________________________ taxing district Number Name on tax duplicate ____________________________________________ Tax duplicate year __________ Permanent Parcel Number _______________________________________ Map book _____ Page ______ Description ___________________________________________________ Platted Unplatted No. of Parcels Auditor’s comments: Split New plat New improvements Partial value C.A.U.V. Building removed Other __________________________________ DTE Code No. GRANTEE OR REPRESENTATIVE MUST COMPLETE ALL QUESTIONS IN THIS SECTION TYPE OR PRINT ALL INFORMATION SEE INSTRUCTIONS ON REVERSE Neigh. Code 1. Grantor’s Name _________________________________________________ Phone: ___________________________ 2. Grantee’s Name _________________________________________________ Phone: ___________________________ Grantee’s Address__________________________________________________________________________________ No. of Acres 3. Address of Property ________________________________________________________________________________ 4. Tax billing address _________________________________________________________________________________ Land Value 5. Are there buildings on the land? Yes No If yes, Check type: 1, 2 or 3 family dwelling Condominium -

1 Preventing Homelessness

PREVENTING HOMELESSNESS STATEMENT OF BEST PRACTICE IN JOINT WORKING BETWEEN RENFREWSHIRE COUNCIL AND HOUSING ASSOCIATIONS (RSLs), PRIVATE LANDLORDS AND CREDITORS IN THE RENFREWSHIRE AREA. EVICTION PROTOCOL 1. INTRODUCTION This Statement of Best Practice aims to ensure that prevention of homelessness and dealing with evictions takes place in a non-discriminatory way and that appropriate support is available to all tenants/legal occupiers on an individual basis. The agreement relies on effective partnership working, built upon honesty, integrity, confidentiality and a willingness by all parties to prevent eviction and resultant homelessness. 2. BACKGROUND The prevention of homelessness, whatever the cause, is a key strategic aim of Renfrewshire Council. Section 11 of the Homelessness etc. (Scotland) Act 2003 places a duty on all Registered Social Landlords/private sector landlords* and creditors to notify the local authority of any repossession proceedings. The duty under Section 11 becomes a statutory requirement on 1st April 2009 (* Since April 2006 all private landlords letting property in Scotland have also had a duty to register with the Council.) This Statement of Best Practice sets out arrangements for the implementation of Section 11 to ensure that all tenants and legal occupants of dwellings in Renfrewshire have access to services which can provide advice and assistance in preventing homelessness occurring as a result of eviction or repossession due to rent or mortgage arrears, or other management grounds. As part of an ongoing restructure of homelessness services in Renfrewshire, a Prevention Team has been established. Within this team there are Homeless Prevention Officers who have a dedicated role to assist households threatened with homelessness. -

Real & Personal Property

CHAPTER 5 Real Property and Personal Property CHRIS MARES (Appleton, Wsconsn) hen you describe property in legal terms, there are two types of property. The two types of property Ware known as real property and personal property. Real property is generally described as land and buildings. These are things that are immovable. You are not able to just pick them up and take them with you as you travel. The definition of real property includes the land, improvements on the land, the surface, whatever is beneath the surface, and the area above the surface. Improvements are such things as buildings, houses, and structures. These are more permanent things. The surface includes landscape, shrubs, trees, and plantings. Whatever is beneath the surface includes the soil, along with any minerals, oil, gas, and gold that may be in the soil. The area above the surface is the air and sky above the land. In short, the definition of real property includes the earth, sky, and the structures upon the land. In addition, real property includes ownership or rights you may have for easements and right-of-ways. This may be for a driveway shared between you and your neighbor. It may be the right to travel over a part of another person’s land to get to your property. Another example may be where you and your neighbor share a well to provide water to each of your individual homes. Your real property has a formal title which represents and reflects your ownership of the real property. The title ownership may be in the form of a warranty deed, quit claim deed, title insurance policy, or an abstract of title. -

Violations of Zoning Ordinances, the Covenant Against Encumbrances, and Marketability of Title: How Purchasers Can Be Better Protected

VIOLATIONS OF ZONING ORDINANCES, THE COVENANT AGAINST ENCUMBRANCES, AND MARKETABILITY OF TITLE: HOW PURCHASERS CAN BE BETTER PROTECTED Jessica P. Wilde∗ I. INTRODUCTION Zoning ordinances function as an exercise of the government’s general police power, sustaining the enjoyment, health, and safety of the public. They are important in order to maintain property values and protect a neighborhood’s quality and environment.1 Zoning ordinances prevent people from using their property in a way that would make a neighborhood less enjoyable.2 State statutes often provide civil and criminal penalties for failing to comply with zoning ordinances.3 Noncompliance with existing ordinances may be of concern to a buyer who buys a parcel of land ∗ J.D. candidate, Touro Law Center, May 2007; B.S., Brigham Young University, May 2004. 1 See ROBERT H. NELSON, ZONING AND PROPERTY RIGHTS: AN ANALYSIS OF THE AMERICAN SYSTEM OF LAND USE REGULATION 11-12 (1977). 2 Id. They are often enacted for safety purposes; for example, a zoning ordinance prevents commercial use in a residential neighborhood or may require a permit or certificate of occupancy before a building is occupied. In addition, a zoning ordinance may be in the form of a building code, requiring that the building maintain certain requirements for fire code purposes. Ordinances serve an array of important functions in order to maintain the value and enjoyment of a neighborhood, as well as facilitate the safety and health of the public. 3 Adam Forman, Comment, What You Can’t See Can Hurt You: Do Latent Violations of a Restrictive Land Use Ordinance, Existing Upon Conveyance, Constitute a Breach of the Covenant Against Encumbrances? 64 ALB. -

Property and Conveyancing William Schwartz

Annual Survey of Massachusetts Law Volume 1973 Article 4 1-1-1973 Chapter 1: Property and Conveyancing William Schwartz Follow this and additional works at: http://lawdigitalcommons.bc.edu/asml Part of the Property Law and Real Estate Commons Recommended Citation Schwartz, William (1973) "Chapter 1: Property and Conveyancing," Annual Survey of Massachusetts aL w: Vol. 1973, Article 4. Schwartz: Chapter 1: Property and Conveyancing CHAPTER 1 Property and Conveyancing WILLIAM SCHWARTZ• §1.1. Abolition of the doctrine of worthier title. Sections 33A and 83B of chapter 184 have been added to the General Laws.1 These statutes abolish the doctrine of worthier title. In order to comprehend the impact of these statutes it is necessary to understand both of the common law branches of this rule-testamentary worthier title and inter vivos worthier title. Since these statutes may not affect prior conveyances or devises, such an understanding of the common law branches remains essential. At common law, if land was devised, and a devisee was given an estate of the same quantity and quality as he would have taken if the devise had been stricken out of the will, he was deemed to take the inter est by descent and not by devise.2 This is known as the Doctrine of Testamentary Worthier Title. A variety of reasons have been suggested for the rule, including the desire on the part of medieval lords to preserve the valuable incidents of tenure.8 For example: 0 owns Blackacre in fee simple absolute. 0 devises it to A. At O's death, A is O's heir. -

Rio Arriba County Planning & Zoning Department

Bernadette Gonzales GIS Mapping Specialist Rio Arriba County Planning & Zoning Department Margaret Archuleta Map Review Specialist EXEMPTION AFFIDAVIT To claim an exemption from the requirements of the Rio Arriba County Subdivision Ordinance, you must complete this form, sign it before a notary public and submit it together with legible copies of all required documents to the County Planning and Zoning Reviewer, 1122 Industrial Park, Espanola, NM, 87532. Be sure to check all exemptions, which apply and attach legible copies of all supporting documents. I, ___________________________, claim an exemption from the requirements of the New Mexico Subdivision Act and the Rio Arriba County Subdivision Regulations for the following reason(s). I certify that this transaction involves: ___ THIRTY-FIVE ACRE EXEMPTION: The sale, lease or other conveyance of any parcel that is thirty-five (35) acres or larger in size within any twelve (12) month period, provided that the land has been used primarily and continuously for agricultural purposes, in accordance with & 7-36-20 NMSA 1978, for the preceding three (3) years. Attach existing, recorded plat showing size and location of parcel and remainder property. ____ COURT ORDER EXEMPTION: The division of land created by court order, where the court order creates no more than one lot/parcel per party. Attach copy of court order and conveyancing document to said party or parties ____ GRAZING OR FARMING EXEMPTION: The division of land for grazing or farming activities provided that the land continues to be used for grazing or farming activities. Attach copy of proposed conveyancing documents and documents restricting future use to grazing or farming activities. -

Real Property Conveyance Fee

Real Property Conveyance Fee tate law establishes a mandatory conveyance fee that is exempt from federal income taxation, when on the transfer of real property. The fee is calculated the transfer is without consideration and furthers the Sbased on a percentage of the property value that is agency’s charitable or public purpose. transferred. In addition to the mandatory fee, all but one • when property is sold to provide or release security county levies a permissive real property transfer fee. The for a debt, or for delinquent taxes, or pursuant to a revenue from both the mandatory fee and the permissive court order. fee is deposited in the general fund of the county in which • when a corporation transfers property to a stock the property is located - no revenue goes to the state. In holder in exchange for their shares during a corporate 2013, the latest year for which data is available, convey reorganization or dissolution. ance fees generated approximately $108.7 million in rev • when property is transferred by lease, unless the enues to counties: $34.0 million from mandatory fees and lease is for a term of years renewable forever. $74.7 million from permissive fees. • to a grantee other than a dealer, solely for the pur pose of, and as a step in, the prompt sale to others. Taxpayer • to sales or transfers to or from a person when no (Ohio Revised Code 319.202 and 322.06) money or other valuable and tangible consideration The real property conveyance fee is paid by persons readily convertible into money is paid or is to be paid who make sales of real estate or used manufactured for the realty, and the transaction is not a gift. -

Condominium Ownership of Real Property

CHAPTER 47-04.1 CONDOMINIUM OWNERSHIP OF REAL PROPERTY 47-04.1-01. Definitions. In this chapter, unless context otherwise requires: 1. "Common areas" means the entire project excepting all units therein granted or reserved. 2. "Condominium" is an estate in real property consisting of an undivided interest or interests in common in a portion of a parcel of real property together with a separate interest or interests in space in a structure, on such real property. 3. "Interest" means the fractional or percentage interest or interests ascribed to each unit by the declaration provided for in section 47-04.1-03. 4. "Limited common areas" means those elements designed for use by the owners of one or more but less than all of the units included in the project. 5. "Project" means the entire parcel of real property divided, or to be divided into condominiums, including all structures thereon. 6. "To divide" real property means to divide the ownership thereof by conveying one or more condominiums therein but less than the whole thereof. 7. "Unit" means the elements of a condominium which are not owned in common with the owners of other condominiums in the project. 47-04.1-02. Recording of declaration to submit property to a project. When the sole owner or all the owners, or the sole lessee or all of the lessees of a lease desire to submit a parcel of real property to a project established by this chapter, a declaration to that effect shall be executed and acknowledged by the sole owner or lessee or all of such owners or lessees and shall be recorded in the office of the recorder of the county in which such property lies. -

41.01.01 Real Property

41.01.01 Real Property Revised September 21, 2021 Next Scheduled Review: September 21, 2026 Click to view Revision History. Regulation Summary This regulation provides uniform guidance for the acquisition, disposition, lease and license of real property and delegates authority to the chief executive officers (CEO) or designees of The Texas A&M University System (system). Definitions Click to view Definitions. Regulation 1. GENERAL PROVISIONS 1.1 System Real Estate Office. Except as otherwise provided in this regulation, all activities involving the acquisition, disposition, lease and license of a surface estate, except those activities and operations commonly associated with easements and right-of-ways, will be consolidated in the System Real Estate Office (SREO) and coordinated with the appropriate member or members. 1.2 System Energy Resource Office. Except as otherwise provided in this regulation, all activities involving the acquisition, disposition and lease of a mineral estate, and those activities commonly associated with easements and right-of-ways of a surface estate, will be consolidated in the System Energy Resource Office (SERO) and coordinated with the appropriate member or members. 1.3 Intrasystem Assignment of Real Property. Subject to any legal requirements or donor restrictions, real property used primarily for member purposes will be assigned to the using member for maintenance, operation and management purposes. Real property may be reassigned by the chancellor based on the primary use or proposed use of the property. The reassignment will be evidenced by a form prepared by SREO, signed by the chancellor and maintained by SREO. 1.4 Maintenance of Inventory and Records.