Condominium Ownership of Real Property

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Real Estate Marketplace Glossary: How to Talk the Talk

Federal Trade Commission ftc.gov The Real Estate Marketplace Glossary: How to Talk the Talk Buying a home can be exciting. It also can be somewhat daunting, even if you’ve done it before. You will deal with mortgage options, credit reports, loan applications, contracts, points, appraisals, change orders, inspections, warranties, walk-throughs, settlement sheets, escrow accounts, recording fees, insurance, taxes...the list goes on. No doubt you will hear and see words and terms you’ve never heard before. Just what do they all mean? The Federal Trade Commission, the agency that promotes competition and protects consumers, has prepared this glossary to help you better understand the terms commonly used in the real estate and mortgage marketplace. A Annual Percentage Rate (APR): The cost of Appraisal: A professional analysis used a loan or other financing as an annual rate. to estimate the value of the property. This The APR includes the interest rate, points, includes examples of sales of similar prop- broker fees and certain other credit charges erties. a borrower is required to pay. Appraiser: A professional who conducts an Annuity: An amount paid yearly or at other analysis of the property, including examples regular intervals, often at a guaranteed of sales of similar properties in order to de- minimum amount. Also, a type of insurance velop an estimate of the value of the prop- policy in which the policy holder makes erty. The analysis is called an “appraisal.” payments for a fixed period or until a stated age, and then receives annuity payments Appreciation: An increase in the market from the insurance company. -

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised Or Amended in 2005)

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised or Amended in 2005) drafted by the NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS and by it APPROVED AND RECOMMENDED FOR ENACTMENT IN ALL THE STATES at its ANNUAL CONFERENCE MEETING IN ITS ONE-HUNDRED-AND-THIRTEENTH YEAR PORTLAND, OREGON JULY 30-AUGUST 6, 2004 WITH PREFATORY NOTE AND COMMENTS Copyright ©2004 By NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS April 2005 ABOUT NCCUSL The National Conference of Commissioners on Uniform State Laws (NCCUSL), now in its 114th year, provides states with non-partisan, well-conceived and well-drafted legislation that brings clarity and stability to critical areas of state statutory law. Conference members must be lawyers, qualified to practice law. They are practicing lawyers, judges, legislators and legislative staff and law professors, who have been appointed by state governments as well as the District of Columbia, Puerto Rico and the U.S. Virgin Islands to research, draft and promote enactment of uniform state laws in areas of state law where uniformity is desirable and practical. • NCCUSL strengthens the federal system by providing rules and procedures that are consistent from state to state but that also reflect the diverse experience of the states. • NCCUSL statutes are representative of state experience, because the organization is made up of representatives from each state, appointed by state government. • NCCUSL keeps state law up-to-date by addressing important and timely legal issues. • NCCUSL’s efforts reduce the need for individuals and businesses to deal with different laws as they move and do business in different states. -

Deed Recording

DEED RECORDING Deeds are important legal documents. The Onondaga County Clerk’s Office strongly recommends consulting an attorney regarding the preparation and filing/recording of any legal document. OUR OFFICE IS PROHIBITED BY LAW FROM PROVIDING ANY LEGAL ADVCE. THE ACCEPTANCE OF AN INSTRUMENT FOR RECORDING IN NO WAY IMPLIES AN ENDORSEMENT OR LEGAL SUFFICIENCY OR A GUARANTEE OF TITLE. IF YOU CHOOSE TO ACT AS YOUR OWN ATTORNEY YOU ARE SOLELY RESPONSIBLE FOR LEGAL COMPLIANCE AND ANY IMPLICATIONS THEREOF. To find a local attorney who specializes in real estate, contact the Onondaga County Bar Association Lawyer Referral Serve at 315.471.2690. Their website is located at https://www.onbar.org/ Our office does not supply forms. To purchase a New York State specific deed form, you may visit the Blumberg Legal Forms website at: https://www.blumberg.com/forms/ All deed filings must be accompanied by both an RP-5217 and TP 584 All recording in Onondaga County require a legal description for the subject property. ADDITIONAL RECORDING FEE EFFECTIVE MARCH 11, 2020 Effective March 11, 2020 there will be a $10 fee added to all residential deed recordings. On January 11, 2020 Governor Cuomo signed into law an amendment to Real Property Law Section 291 that requires County Clerks to notify the owner(s) of record of residential real property when a document is recorded affecting said residential property. The law also allows a reasonable fee to be assessed for said notices. The NYS Association of County Clerks, in order to provide uniformity throughout NYS, has determined that $10 is a reasonable fee per document. -

Title Matters Affecting Parties in Possession: By

TITLE MATTERS AFFECTING PARTIES IN POSSESSION: ADVERSE POSSESSION, AFTER-ACQUIRED TITLE, & THE RULE AGAINST PERPETUITIES BY DONALD G. SINEX SCOTT C. PETRY SUSAN A. STANTON TABLE OF CONTENTS INTRODUCTION…………………………………………………………………………….. 1 I. ADVERSE POSSESSION…….……………………………………………………………. 1 1. Adverse Possession………...………………...……………………………………….......... 2 2. Identifying Issues in Record Title…………………………………………………………. 3 a. Historical Changes in Metes and Bounds…………………………………………… 4 b. Adverse Possession of Minerals……………………………………………………… 4 c. Adverse Possession in Cotenancy, Landlord-Tenant, & Grantor-Grantee Situations………………………………………………………………………….…...... 5 d. Distinguishing Coholders from Cotenants………………………………………….. 6 3. Adverse Possession Requirement………………………………………………………… 7 4. Other Issues………………………………………...……………………………………….. 9 II. AFTER ACQUIRED TITLE………………………….…………………………………………. 10 1. The Doctrine………………..……... ……………………………………………………….. 10 2. Bases Used by Courts in Applying the Doctrine…………………………………........... 11 3. Conveyance Instruments that an Examiner is Likely to Encounter…………………… 12 a. Deeds of Trust and Liens……………………………………………………………... 12 b. Oil & Gas Leases and Limitations……………………………………………………. 14 c. Public Lands……………………………………………………………………………. 15 d. Title Acquired in Trust………………………………………………………………… 16 e. Quitclaims and Limitations…………………………………………………………… 16 4. Effect on Notice and Purchasers………………………………………………………….. 18 a. Subsequent Purchaser…………………………………………………………………. 19 b. Protections……………………………………...………………………………………. 19 c. Duty to Search…………………………………………………………………………. -

July 2007 Real Property Question 6

July 2007 Real Property Question 6 MEE Question 6 Owen owned vacant land (Whiteacre) in State B located 500 yards from a lake and bordered by vacant land owned by others. Owen, who lived 50 miles from Whiteacre, used Whiteacre for cutting firewood and for parking his car when he used the lake. Twenty years ago, Owen delivered to Abe a deed that read in its entirety: Owen hereby conveys to the grantee by a general warranty deed that parcel of vacant land in State B known as Whiteacre. Owen signed the deed immediately below the quoted language and his signature was notarized. The deed was never recorded. For the next eleven years, Abe seasonally planted vegetables on Whiteacre, cut timber on it, parked vehicles there when he and his family used the nearby lake for recreation, and gave permission to friends to park their cars and recreational vehicles there. He also paid the real property taxes due on the land, although the tax bills were actually sent to Owen because title had not been registered in Abe’s name on the assessor’s books. Abe did not build any structure on Whiteacre, fence it, or post no-trespassing signs. Nine years ago, Abe moved to State C. Since that time, he has neither used Whiteacre nor given others permission to use Whiteacre, and to all outward appearances the land has appeared unoccupied. Last year, Owen died intestate leaving his daughter, Doris, as his sole heir. After Owen’s death, Doris conveyed Whiteacre by a valid deed to Buyer, who paid fair market value for Whiteacre. -

Virginia Real Property Electronic Recording Standard

SEC505-00.1 Effective Date: May 1, 2007 December 8, 2016 COMMONWEALTH OF VIRGINIA Information Technology Resource Management Standard VIRGINIA REAL PROPERTY ELECTRONIC RECORDING STANDARD Virginia Information Technologies Agency (VITA) i Virginia Real Property Electronic Recording Standard SEC505-00.1 Effective Date: May 1, 2007 December 8, 2016 PUBLICATION VERSION CONTROL ITRM Publication Version Control: It is the user's responsibility to ensure they have the latest version of the ITRM publication. Questions should be directed to the Associate Director Manager for Policy, Practice and Enterprise Architecture (PPA) (EA) at VITA’s Relationship Management Governance (RMG) Strategic Management Services (SMS). SMS EA will issue a Change Notice Alert, post it on the VITA Web site, and provide an email announcement to the Circuit Court Clerks, as well as other parties PPA EA considers to be interested in the change. This chart contains a history of this ITRM publication’s revisions. Version Date Purpose of Revision Original 05/01/2007 Base Document This administrative update is necessitated by changes in the Code of 00.1 12/08/2017 Virginia and organizational changes in VITA. No substantive changes were made to this document. ii Virginia Real Property Electronic Recording Standard SEC505-00.1 Effective Date: May 1, 2007 December 8, 2016 PREFACE real estate settlement process for the benefit of citizens of the Commonwealth and users of the electronic Publication Designation filing system. SEC505-00.1 Sections 55-66.3 through 55-66.5 and 55-66.8 through Subject 55-66.15: This Standard for the electronic acceptance and recordation for the release of mortgage, rescinding Virginia Real Property Electronic Recording Standard erroneously recorded certificates of satisfaction, requirements on secured creditors, and the form and Effective Date effect of satisfaction facilitates real estate transactions May 1, 2007 December 8, 2016 in the Commonwealth. -

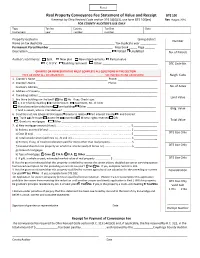

Real Property Conveyance Fee Statement of Value and Receipt

Real Property Conveyance Fee Statement of Value and Receipt DTE 100 If exempt by Ohio Revised Code section 319.54(G)(3), use form DTE 100(ex) Rev 1/14 FOR COUNTY AUDITOR’S USE ONLY Type Tax list County Tax Dist Date Instrument year number number Property located in ____________________________________________________________ taxing district Number Name on tax duplicate ____________________________________________ Tax duplicate year __________ Permanent Parcel Number _______________________________________ Map book _____ Page ______ Description ___________________________________________________ Platted Unplatted No. of Parcels Auditor’s comments: Split New plat New improvements Partial value C.A.U.V. Building removed Other __________________________________ DTE Code No. GRANTEE OR REPRESENTATIVE MUST COMPLETE ALL QUESTIONS IN THIS SECTION TYPE OR PRINT ALL INFORMATION SEE INSTRUCTIONS ON REVERSE Neigh. Code 1. Grantor’s Name _________________________________________________ Phone: ___________________________ 2. Grantee’s Name _________________________________________________ Phone: ___________________________ Grantee’s Address__________________________________________________________________________________ No. of Acres 3. Address of Property ________________________________________________________________________________ 4. Tax billing address _________________________________________________________________________________ Land Value 5. Are there buildings on the land? Yes No If yes, Check type: 1, 2 or 3 family dwelling Condominium -

Usufruct Study Guide

Article 562 ± 578 1. Define usufruct. Usufruct is a real right by virtue of which a person is given the right to enjoy the property of another with the obligation of preserving its form and substance, unless the title constituting it or the law provides otherwise. 2. What are the three fundamental Rights Appertaining to Ownership? Ownership consists of three fundamental rights, to wit: - jus disponende (right to dispose) - jus utendi (right to use) - jus fruendi (right to the fruits) 3. Of the above-mentioned fundamental rights, what consists usufruct and naked ownership? The combination of the jus utendi and jus fruendi is called usufruct. The remaining right jus disponendi is really the essence of what is termed ³naked ownership´. 4. What right is transferred to the usufructuary and what right is remained with the owner? In a usufruct, only the jus utendi and jus fruendi over the property is transferred to the usufructuary. The owner of the property maintains the jus disponendi or the power to alienate, encumber, transform, and even destroy the same. (Hemedes vs. CA, 316 SCRA 347 1999). 5. What are the formulae with respect to full ownership, usufruct, and naked ownership? The following are the formulae: - Full Ownership equals Naked Ownership plus Usufruct - Naked Ownership equals Full Ownership minus Usufruct - Usufruct equals Full Ownership minus Naked Ownership 6. What are the characteristics or elements of usufruct? The following are the characteristics or elements of usufruct: ESSENTIAL CHARACTERISTICS: those without which it can not be termed usufruct: (a) It is REAL RIGHT (whether registered in the Registry of Property or not). -

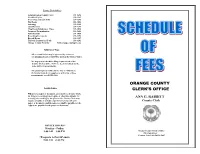

Schedule of Fees (PDF)

County Clerk Offices Administration/County Clerk 291-2690 Certified Copies 291-3287 Court Papers/Court Calls 291-3286 File Room 291-3086 Indexing 291-3285 Land Records 291-3287 Map Room/Subdivision Maps 291-3084 Passports/Naturalization 291-2698 Pistol Permits 291-3060 Recording Documents 291-3292 Record Room 291-3287 Uniform Commercial Code 291-3292 Orange County Web Site www.orangecountygov.com Subdivision Maps After a subdivision map is approved by a town or city planning board, it MUST be filed in the Clerk’s Office. We urge you to check the filing requirements of the County Clerk’s Office that have been mandated by the state and local governments. The planning board office in the city or town where the land is located can supply you with a list of these requirements, or call 291-3084. ORANGE COUNTY Legible Copies CLERK’S OFFICE Whenever a paper or document, presented to a County Clerk for filing or recording is not legible or otherwise suitable for ANN G. RABBITT scanning or recording by the process, the County Clerk may require a legible or suitable copy thereof along with such County Clerk paper or document, and the same fees shall be payable for the copy as are payable for the paper or document. OFFICE HOURS * Monday – Friday 9:00 AM – 5:00 PM Orange County Clerk’s Office 255 Main Street Goshen, New York 10924-1697 *Passports & Pistol Permits 9:00 AM – 4:30 PM ASSIGNMENT OF MORTGAGE*, To Record 45.00 MECHANICS LIEN, To File 15.00 Plus Per Page 5.00 Affidavit of Service (35 Days) 5.00 Plus Each Additional Mortgage 3.00 Discharge by Payment into Court 3.00 1st Asst. -

Conveyancing and the Law of Real Property

September 2014 - ISSUE 19 Conveyancing and The Law of Real Property The questions may be asked what is Conveyancing and why is Property Rules and his first act must be to undertake an inves‐ it attached to the Law of Real Property. tigation into the title of the Vendor’s property. This search which must be conducted in the Register of Deeds and should When dealing with the Law of Real Property there are two involve a period of time of thirty years or longer in the case fundamental points which must be understood‐‐‐ where the date of the Vendor’s Deed is older than thirty years. (i) You acquire knowledge of the rights and liabilities attached to the interests of the owner in the land and The Cause List search is undertaken in the Supreme Court Registry and the purpose of which is to ascertain whether (ii) The foundation of the Rules of Conveyancing. there are any liens pending against the Vendor in the Su‐ preme Court Register. If there are pending liens, they must be It is not easy to distinguish accurately between Real Property settled by the Vendor before he is able to sell the property. and Conveyancing. It is said that Real Property deals with the rights and liabilities of land owners. Conveyancing on the The original documents of title must be produced by the Ven‐ other hand is the art of creating and transferring rights in land dor and delivered to the attorney for review. I the Vendor is and thus the Rules of Conveyancing and the Law of Real Prop‐ unable to produce the same and the attorney has found the erty cannot be distinguished as separate subjects though re‐ title to be good and marketable, then the Vendor must sign lated closely but should be distinguished as two parts of one and swear an Affidavit of Loss in respect of such lost or mis‐ subject of land law. -

Real & Personal Property

CHAPTER 5 Real Property and Personal Property CHRIS MARES (Appleton, Wsconsn) hen you describe property in legal terms, there are two types of property. The two types of property Ware known as real property and personal property. Real property is generally described as land and buildings. These are things that are immovable. You are not able to just pick them up and take them with you as you travel. The definition of real property includes the land, improvements on the land, the surface, whatever is beneath the surface, and the area above the surface. Improvements are such things as buildings, houses, and structures. These are more permanent things. The surface includes landscape, shrubs, trees, and plantings. Whatever is beneath the surface includes the soil, along with any minerals, oil, gas, and gold that may be in the soil. The area above the surface is the air and sky above the land. In short, the definition of real property includes the earth, sky, and the structures upon the land. In addition, real property includes ownership or rights you may have for easements and right-of-ways. This may be for a driveway shared between you and your neighbor. It may be the right to travel over a part of another person’s land to get to your property. Another example may be where you and your neighbor share a well to provide water to each of your individual homes. Your real property has a formal title which represents and reflects your ownership of the real property. The title ownership may be in the form of a warranty deed, quit claim deed, title insurance policy, or an abstract of title. -

Recording Deeds in Lake County

Recording Deeds in Lake County Deeds for properties located in Lake County should be recorded in the Lake County Recorder of Deeds Office. Deeds are accepted for recording in person or by mail. Once recorded, the document will be assigned a document number, scanned, and entered into a Grantor/Grantee index. The original document will be returned to the party named on the document. After recording, land records are available for public viewing. As always, it is suggested that you consult legal & accounting professionals to fully understand the legal & tax implications of recording any property deed changes. If there is anything that our staff can do to help make this process easier for you, please let us know. 18 N County St – 6th Floor Waukegan, IL 60085-4358 Phone: (847) 377-2575 Fax: (847) 984-5860 Email: [email protected] Website: www.lakecountyil.gov/recorder Recording Requirements: 1. Deeds must be dated, signed & notarized. 2. Parties involved must be named. 3. Grantee's (buyer) address must be listed. 4. Deeds require a complete legal description. 5. Metes & bounds legal descriptions require a Plat Act affidavit. 6. Deeds require the name & address of the Preparer. 7. Deeds require “Mail to” information (name & address) - this is where the recorded document must be returned, after it has been recorded. 8. Taxpayer name & address for tax bills must be listed. 9. All deeds require either a completed Illinois PTAX- 203 form or a signed & dated exemption statement. 10. Local municipal transfer tax stamps must be obtained at the local municipality prior to being submitted to the Recorder of Deeds Office.