IIFL MULTICAP PMS (Portfolio Management Service) All Data Are As on July 31, 2021 and Denominated in INR

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2012-13 Awards & Recognitions

Annual Report 2012-13 Awards & Recognitions SRF’s Chemicals Business wins Deming Prize The Chemicals Business of SRF won the coveted Deming Prize during the year. Roop Salotra, President & CEO, Chemicals Business received the medal and certificate from Hiromasa Yonekura, Chairman, Deming Prize Committee, at a ceremony held in Tokyo on November 14, 2012. Deming Prize is awarded by the Union of Japanese Scientists and Engineers (JUSE). Key Milestones…….2012-13 The Packaging Films Business bagged the Best SEZ Award within the ‘EPCES Export Award’ instituted by the Export Promotion Council for the 6th consecutive year SRF set up the firstHot Laminated Facility in the country to be able to expand its product range for Laminated Fabrics and compete at the higher end of the market SRF’s Coated Fabrics Business added new products such as Pagodas, Double Sided Striped Awnings and Lacquered Tarpaulins (printable) SRF’s Fluorochemicals Business introduced two new products – trichloroethylene and perchloroethylene SRF’s Chemical Technology Group filed7 new process patents as intellectual property of the company taking the total number to 29 SRF’s Engineering Plastics Business introduced Halogen free environmental friendly products for electrical segment and also made a significant headway in the international market SRF Foundation was conferred with the reputed 12th Businessworld FICCI CSR Award 2011-12 for its Kidsmart Early Learning Programme under the category of ‘Exemplary Innovation Promoting CSR’ Contents Chairman’s Message 02 Company Information 04 Corporate Overview Notice 06 Directors’ Report 10 Management Discussion and Analysis 20 Corporate Governance Report 28 Management Reports Standalone Financial Statements 40 Consolidated Financial Statements 87 Financial Statements Annual Report 2012-13 Chairman’s Message Dear shareholders, Let me begin by sharing with you some good news. -

BENCHMARK: Nifty Midcap

EMERGING LEADERS EQUITY FUND The objective of this fund is to generate capital appreciation in the long term through investments predominantly in mid cap stocks BENCHMARK: Nifty Midcap 100 Fund Performance as on 31st August 2021 Fund Benchmark 80% 73.7% 70.3% DATE OF INCEPTION 70% 60% TH 26 FEBRUARY 2018 50% 40% 35.9% 34.6% 30% 24.5% 22.1% 20% 15.4% 13.4% 12.6% 10.7% 10% 2.6% 2.2% 0% TOTAL Inception 3 yrs 2 yrs 1 yr 6 M 1 M 0% - 40% 100.0% 224.9 Emerging Leaders Equity Fund benchmark is Nifty Midcap 100 Money Market Actual AUM^ IN Modified Duration of Debt and Money Market: 0.00 years Allocation Rs. Crore Instruments and Past performance is not indicative of future performance Others 60% - 100% The SFIN for Emerging Leaders Equity Fund is ULIF02020/12/17EMLEDEQFND136 The Benchmark of the fund has been changed from Nifty Midcap 50 to Nifty Midcap 1.1% 2.6 Equity and Equity ^Assets Under Management 100 with effect from 1st January 2021. The Benchmark performance given above for Actual AUM^ IN Related Instruments Allocation Rs. Crore all tenures is as per Nifty Midcap 100. 98.9% 235.9 NAV as on 31st August 2021: Rs. 15.5667 Actual AUM^ IN Allocation Rs. Crore TOP 10 HOLDING AS ON 31ST AUGUST 2021 % Equity 98.9 SRF Limited 2.3 Shriram Transport Finance Company Limited 2.1 Cholamandalam Investment and Finance Company Limited 2.1 TOP 10 INDUSTRY SECTOR EXPOSURE (%) Crompton Greaves Consumer Electricals Limited 2.0 37.9 40 Laurus Labs Ltd 2.0 35 AU Small Finance Bank Limited 2.0 Bharat Forge Limited 2.0 30 Mphasis Limited 1.9 25 Mindtree Limited -

Infosys Annual Report 2011-12 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

Infosys Annual Report 2011-12 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2012 OR Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from __________ to __________ OR Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of event requiring this shell company report________ Commission File Number 000-25383 INFOSYS LIMITED (Exact name of Registrant as specified in its charter) Not Applicable (Translation of Registrant’s name into English) Bangalore, Karnataka, India (Jurisdiction of incorporation or organization) Electronics City, Hosur Road, Bangalore, Karnataka, India 560 100. +91-80-2852-0261 (Address of principal executive offices) V. Balakrishnan, Member of the Board and Chief Financial Officer, +91-80-2852-0261, [email protected] Electronics City, Hosur Road, Bangalore, Karnataka, India 560 100. (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act : Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares each represented by one NASDAQ Global Select Market Equity Share, par value `5 per share Securities registered or to be registered pursuant to Section 12(g) of the Act : None. -

Kotak Funds: India Midcap Fund

Kotak Funds: India Midcap Fund Strictly confidential : For the use of institutional investors only. FACTSHEET Data as on 31/12/2019 Investment Objecve Kotak Funds: India Midcap Fund ("Fund") aims to achieve long term capital appreciaon by primarily invesng at least two thirds of its total assets in equity and equity linked securies of mid capitalizaon companies registered in India or deriving a significant poron of their business from India. Fund Details Key Information Structure UCITS V compliant SICAV Fund Size USD 1970.41 mn* Share class Class J Acc* Fund Nav USD 16.68 ISIN code LU0675383409 Inception Date: Bloomberg code KIMDCLJ LX Equity Fund 25-05-2010 Kotak India Mid Cap Fund Class J (Acc) USD 31-07-2014 Investment manager Kotak Mahindra Asset Management (Singapore) Pte. Ltd *Fund size mentioned is for Kotak Funds: India Midcap Fund as a whole. Domicile Luxembourg Performance Snapshot (% Change) Reference Currency USD Duration Fund Index (NIFTY Midcap 100) Alpha Dealing and Valuation Daily 1 Month 0.63 -0.28 0.91 Administration and Depository Services HSBC France, Luxembourg Branch 3 Months 5.23 5.95 -0.73 Management Company FundRock Management Company 6 Months 0.45 -6.36 6.80 S.A. 1 Year 2.88 -6.48 9.36 Management Fee 1.0% of the Net Asset Value 3 Years 8.99 4.26 4.72 Other fees As set out in the Prospectus 5 Years 7.36 3.71 3.65 Subscription Charge Up to 5.00% YTD 2.88 -6.48 9.36 *Share Class J available for institutional investors only. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) o Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR x Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2007 OR o Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 OR o Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the Transition period from __________ to __________ Commission File Number 000-25383 INFOSYS TECHNOLOGIES LIMITED (Exact name of Registrant as specified in its charter) Not Applicable (Translation of Registrant’s name into English) Bangalore, Karnataka, India (Jurisdiction of incorporation or organization) Electronics City, Hosur Road, Bangalore, Karnataka, India 560 100. +91-80-2852-0261 (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares each represented by one Equity Nasdaq Global Select Market Share, par value Rs. 5 per share Securities registered pursuant to Section 12(g) of the Act: None. (Title of class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: Not Applicable (Title of class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: 571,209,862 Equity Shares Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Revision in Market Lot of Derivative Contracts on Individual Stocks

Department : FUTURES & OPTIONS Download Ref No: NSE/FAOP/45895 Date : September 30, 2020 Circular Ref. No: 87/2020 All Members, Revision in Market Lot of Derivative Contracts on Individual Stocks In pursuance of SEBI guidelines for periodic revision of lot sizes for derivatives contracts specified in the SEBI circular CIR/MRD/DP/14/2015 dated July 13, 2015, the market lots of derivatives contracts shall be revised as follows: Sr. Underlying whose Derivative Count of Annexure No Effective date contract size shall be Underlying Number October 30, 2020 (for Nov 1 Revised Downwards 15 1 2020 & later expiries) 2 Revised Upwards 12 October 30, 2020 (for Jan 2 2021 & later expiries) 3 Unchanged 108 - 3 Revised Downwards but new October 30, 2020 (for Jan 4 lot size is not a multiple of old 1 4 2021 & later expiries) lot size To avoid operational complexities, in case of Annexure 2 and 4 above, following will be applicable: 1. Only the far month contract i.e. January 2021 expiry contracts will be revised for market lots. Contracts with maturity of November 2020 and December 2020 would continue to have the existing market lots. All subsequent contracts (i.e. January 2021 expiry and beyond) will have revised market lots. 2. The day spread order book will not be available for the combination contract of Dec 2020 – Jan 2021 expiry. For the purpose of the computation, the average of the closing price of the underlying has been taken for one month period of September 1st – September 30th 2020. This circular shall come into effect from October 30, 2020. -

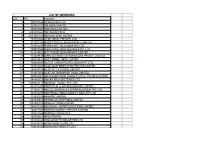

List of Importers S.N

LIST OF IMPORTERS S.N. IEC Importer 1 888015356 20 MICRONS LTD. 2 793012112 3M INDIA LIMITED 3 388038047 ABB INDIA LIMITED. 4 3892000662 ABI SNOWATECH 5 2503001335 ABIRAMI SOAP WORKS 6 799008966 ACER INDIA (PRIVATE) LTD 7 713020253 ADVICS SOUTH INDIA PRIVATE LIMITED 8 711002207 AGRIPLAST TECH INDIA PVT LTD 9 799008966 AGRITRADE INDIA SERVICES PVT LTD 10 312019882 AGT FOODS INDIA PRIVATE LIMITED 11 712023836 AISIN AUTOMOTIVE KARNATAKA PRIVATE LIMITED 12 288002822 AKZO NOBEL INDIA LIMITED 13 799009091 ALCON LABORATORIES (INDIA) PVT LTD., 14 503082058 ALOK MASTERBATCHES PRIVATE LIMITED 15 288007735 ALSTOM T & D INDIA LIMITED 16 711017956 ALSTOM TRANSPORT INDIA LIMITED 17 497016061 AMALGAMATIONS VALEO CLUTCH PRIVATE LIMITED 18 988006723 AMARA RAJA BATTERIES LTD 19 3306001414 AMAZON WOOD PVT. LTD. 20 488016207 AMBATTUR CLOTHING PRIVATE LIMITED 21 311009174 AMCOL MINERALS & MATERIALS INDIA PVT LTD 22 407034293 AMPHENOL OMNICONNECT INDIA PVT LTD 23 415900018 ANANDA VIKATAN 24 907000657 APARNA ENTERPRISES LIMITED 25 1088000720 APOLLO TYRES LIMITED 26 988001292 AQUAMALL WATER SOLUTIONS LIMITED 27 402017986 ARISTON AGENCY PRIVATE LIMITED 28 300022964 ARKEMA CHEMICALS 29 300062401 ARMSTRONG 30 588169340 ARO GRANITE INDUSTRIES LTD 31 588130311 ASAHI INDIA GLASS LTD 32 798014911 ASHIRVAD PIPES PVT LTD 33 488014336 ASHOK LEYLAND LIMITED 34 388010789 ASIAN PAINTS LTD 35 412001951 ASIAN TRADING COMPANY 36 796005532 AT & S INDIA PRIVATE LIMITED 37 707010462 ATS ELGI LIMITED 38 2588000011 AUROBINDO PHARMA LIMITED 39 507039807 AUTOLIV INDIA PVT. LTD. 40 903006499 AVANTI FEEDS LTD. 41 497016753 BASF CATALYSTS INDIA PVT LTD., 42 388007257 BASF INDIA LIMITED 43 288012101 BATA INDIA LIMITED 44 596004729 BECTON DICKINSON INDIA PRIVATE LIMITED 45 788013441 BEML LIMITED, 46 388167084 BENNETT COLEMAN & CO LTD 47 288019539 BERGER PAINTS INDIA LIMITED 48 788001027 BHARAT ELECTRONICS LTD. -

Aegon Life Indepth May 2021.Pdf

MAY 2021 IN-DEPTH INVESTMENT BULLETIN OF AEGON LIFE INSURANCE COMPANY LTD AEGON, toh tension gone. INDEX Description Page No. Enhanced Equity Fund 6 Accelerator Fund 7 Pension Enhanced Equity Fund 8 Pension Index Fund 9 Group Equity Fund 10 Blue Chip Equity Fund 11 Opportunity Fund 12 Debt Fund 14 Pension Debt Fund 15 Secure Fund 16 Pension Secure Fund 17 Conservative Fund 18 Balanced Fund 20 Pension Balanced Fund 22 Stable Fund 24 NAVPF Fund 26 Indepth | May 2021 | 2 Commentary on the Indian Securities Market for April 2021 Nifty (down 0.4%) was largely flat in April post a flattish march. The covid situation has worsened in the month of April in India leading to different levels of lockdowns in various states. The vaccination program for the age group of 18-44 years has been allowed from 1 st May. However, vaccination availability is a concern in the short term and may lead to some delays. The dollar index corrected after three months of up move. It was down 2.09% and closed at 91.28 level. Despite the fall in Dollar index, the rupee was weak and depreciated by 97 paise to close at 74.08 level. Brent Crude gained almost 6% after one month of correction and ended at 67.25 level. Gold was up by 3.6% after three months of correction. Foreign institutional investors (FIIs) investment turned negative after six month of positive inflows. They sold about $1.3 bn worth of equity in April. Domestic institutional investors (DIIs) investment continued to be positive for a second month in a row. -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

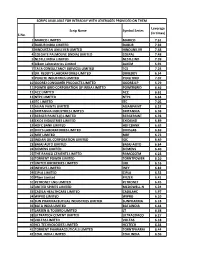

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

List of Shortlisted Applicants for Expert Panel - BML Munjal Awards 2019 (In Alphabetical Order)

List of Shortlisted Applicants for Expert Panel - BML Munjal Awards 2019 (in alphabetical order) Category : Public Sector Undertaking / Co-operative S.No. Organisation Name 1 Bihar State Cooperative Milk Producers' Federation Limited (COMPFED) 2 Goa Shipyard Limited 3 Hindustan Shipyard Limited 4 Indian Railway Catering & Tourism Corporation Limited 5 National Mineral Development Corporation Limited (NMDC) 6 ONGC Mangalore Petrochemicals Limited 7 Rashtriya Ispat Nigam Limited (RINL) 8 Small Industries Development Bank of India 9 Southern Power Distribution Company of A.P Limited (APSPDCL) Category : Private Manufacturing S.No. Organisation Name 1 Anand Automotive Private Limited 2 Aurobindo Pharma Limited 3 Bharat Aluminium Company Limited 4 Biocon 5 Bosch Limited 6 Daikin Airconditioning India Private Limited 7 Dr Reddy's Laboratories Limited For updates please follow: www.bmlmunjalawards.com 1 | P a g e S.No. Organisation Name 8 Electrosteel Castings Limited 9 Exide Industries Limited 10 Godrej & Boyce Manufacturing Company Limited 11 Hindustan Unilever Limited 12 Hindustan Zinc Limited 13 Jindal Power Limited 14 JK Cement Limited 15 JK Paper Limited 16 Lava International Limited 17 Nestlé India Limited 18 Otis Elevator Company (India) Limited 19 Rane (Group) Limited 20 Schneider Electric Limited 21 Siemens Limited 22 SKI Carbon Black (India) Private Limited 23 SRF Limited 24 Vedanta Limited (Jharsuguda) 25 Zydus Cadila Healthcare Limited Category : Private Services S.No. Organisation Name 1 Aravind Eye Care Systems 2 Ashiana Housing -

Annual Report for FY 2019-20

CREATING VALUE THE SRF WAY ANNUAL REPORT 2019-20 WHAT’S INSIDE 01 02 06 Company Message from Notice Information the Chairman 19 62 69 Management Discussion Corporate Governance Board’s Report Report & Analysis 88 100 190 Business Responsibility Standalone Consolidated Report Financials Financials COMPANY INFORMATION Auditors Bankers Registered Office M/s B S R & Co. LLP, • ICICI Bank (CIN: L18101DL1970PLC005197) Chartered Accountants • State Bank of India Unit Nos. 236 & 237, 2nd Floor, • Standard Chartered Bank DLF Galleria, Mayur Place, President & CFO • Citibank NA Noida Link Road, Mayur Vihar Phase I Extension, Rahul Jain • DBS Bank India Limited • HDFC Bank Delhi, India - 110 091 • Kotak Mahindra Bank Tel: +91-11- 49482870 Vice President • HSBC (Corporate Compliance) & • Axis Bank Corporate Office Company Secretary • Yes Bank Block - C, Sector - 45, Rajat Lakhanpal • MUFG Bank Limited Gurugram - 122 003, • Sumitomo Mitsui Banking Haryana, India Corporation Email: [email protected] • Mizuho Bank Limited www.srf.com • IDFC Bank • BNP Paribas Annual Report 2019-20 MESSAGE FROM THE CHAIRMAN Dear Shareholders, robust multi-business entity, which As I sit down to pen my message for holds us in good stead. Strategic the Annual Report FY 2019-20 at a innovations across businesses, desk in my home, I am reminded of a backed by strong R&D team have quote by one of India’s most revered helped the company effectively face poets, Rabindranath Tagore, “You can’t such external uncertainties. cross the sea merely by standing and staring at the water.” Staying resilient Coming to our specific Businesses, I and agile in difficult situations is the would like to talk about some of the only way we can respond efficaciously milestones achieved by each of our and adapt to changing times swiftly.