REPORT On15th ISQ ANNUAL CONFERENCE 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2012-13 Awards & Recognitions

Annual Report 2012-13 Awards & Recognitions SRF’s Chemicals Business wins Deming Prize The Chemicals Business of SRF won the coveted Deming Prize during the year. Roop Salotra, President & CEO, Chemicals Business received the medal and certificate from Hiromasa Yonekura, Chairman, Deming Prize Committee, at a ceremony held in Tokyo on November 14, 2012. Deming Prize is awarded by the Union of Japanese Scientists and Engineers (JUSE). Key Milestones…….2012-13 The Packaging Films Business bagged the Best SEZ Award within the ‘EPCES Export Award’ instituted by the Export Promotion Council for the 6th consecutive year SRF set up the firstHot Laminated Facility in the country to be able to expand its product range for Laminated Fabrics and compete at the higher end of the market SRF’s Coated Fabrics Business added new products such as Pagodas, Double Sided Striped Awnings and Lacquered Tarpaulins (printable) SRF’s Fluorochemicals Business introduced two new products – trichloroethylene and perchloroethylene SRF’s Chemical Technology Group filed7 new process patents as intellectual property of the company taking the total number to 29 SRF’s Engineering Plastics Business introduced Halogen free environmental friendly products for electrical segment and also made a significant headway in the international market SRF Foundation was conferred with the reputed 12th Businessworld FICCI CSR Award 2011-12 for its Kidsmart Early Learning Programme under the category of ‘Exemplary Innovation Promoting CSR’ Contents Chairman’s Message 02 Company Information 04 Corporate Overview Notice 06 Directors’ Report 10 Management Discussion and Analysis 20 Corporate Governance Report 28 Management Reports Standalone Financial Statements 40 Consolidated Financial Statements 87 Financial Statements Annual Report 2012-13 Chairman’s Message Dear shareholders, Let me begin by sharing with you some good news. -

Update on Equity Stake in Indus Towers

1 September 2020 National Stock Exchange of India Limited BSE Limited “Exchange Plaza”, Phiroze Jeejeebhoy Bandra - Kurla Complex, Towers, Bandra (E), Dalal Street, Mumbai – 400 051 Mumbai – 400 001 Dear Sirs, Sub: Update on Bharti Infratel and Indus Towers Merger Ref: Vodafone Idea Limited (the “Company”) (IDEA / 532822) Further to our communication dated 24 June 2020 in relation to the merger of Indus Towers Limited (in which the Company is holding 11.15% equity stake) with Bharti Infratel Limited (“Merger”), please find attached a press release titled “Update on Bharti Infratel and Indus Towers Merger”, being issued to media. The above is for your information and dissemination to the members. Thanking you, Yours truly, For Vodafone Idea Limited Pankaj Kapdeo Company Secretary Encl: As above Vodafone Idea Limited (formerly Idea Cellular Limited) An Aditya Birla Group and Vodafone partnership Birla Centurion, 9th to 12th Floor, Century Mills Compound, Pandurang Budhkar Marg, Worli, Mumbai – 400 030. T: +91 95940 04000F: +91 22 2482 0093 www.vodafoneidea.com Registered Office: Suman Tower, Plot no. 18, Sector 11, Gandhinagar – 382 011, Gujarat. T +91 79 6671 4000 F +91 79 2323 2251 CIN: L32100GJ1996PLC030976 Media Release – September 01, 2020 Update on Bharti Infratel and Indus Towers Merger Vodafone Idea Limited (“VIL”), Vodafone Group Plc (“Vodafone”), Bharti Airtel Limited (“Bharti Airtel”), Indus Towers Limited (“Indus”) and Bharti Infratel Limited (“Infratel”) (collectively referred as “Parties” and individually as “Party”) have agreed to proceed with completion of the merger of Indus and Infratel. VIL has undertaken to sell its 11.15% stake in Indus for cash. -

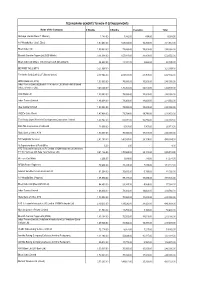

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

BENCHMARK: Nifty Midcap

EMERGING LEADERS EQUITY FUND The objective of this fund is to generate capital appreciation in the long term through investments predominantly in mid cap stocks BENCHMARK: Nifty Midcap 100 Fund Performance as on 31st August 2021 Fund Benchmark 80% 73.7% 70.3% DATE OF INCEPTION 70% 60% TH 26 FEBRUARY 2018 50% 40% 35.9% 34.6% 30% 24.5% 22.1% 20% 15.4% 13.4% 12.6% 10.7% 10% 2.6% 2.2% 0% TOTAL Inception 3 yrs 2 yrs 1 yr 6 M 1 M 0% - 40% 100.0% 224.9 Emerging Leaders Equity Fund benchmark is Nifty Midcap 100 Money Market Actual AUM^ IN Modified Duration of Debt and Money Market: 0.00 years Allocation Rs. Crore Instruments and Past performance is not indicative of future performance Others 60% - 100% The SFIN for Emerging Leaders Equity Fund is ULIF02020/12/17EMLEDEQFND136 The Benchmark of the fund has been changed from Nifty Midcap 50 to Nifty Midcap 1.1% 2.6 Equity and Equity ^Assets Under Management 100 with effect from 1st January 2021. The Benchmark performance given above for Actual AUM^ IN Related Instruments Allocation Rs. Crore all tenures is as per Nifty Midcap 100. 98.9% 235.9 NAV as on 31st August 2021: Rs. 15.5667 Actual AUM^ IN Allocation Rs. Crore TOP 10 HOLDING AS ON 31ST AUGUST 2021 % Equity 98.9 SRF Limited 2.3 Shriram Transport Finance Company Limited 2.1 Cholamandalam Investment and Finance Company Limited 2.1 TOP 10 INDUSTRY SECTOR EXPOSURE (%) Crompton Greaves Consumer Electricals Limited 2.0 37.9 40 Laurus Labs Ltd 2.0 35 AU Small Finance Bank Limited 2.0 Bharat Forge Limited 2.0 30 Mphasis Limited 1.9 25 Mindtree Limited -

IIFL MULTICAP PMS (Portfolio Management Service) All Data Are As on July 31, 2021 and Denominated in INR

IIFL MULTICAP PMS (Portfolio Management Service) All data are as on July 31, 2021 and denominated in INR Investment Objective: The objective of the investment approach is to generate long term capital appreciation for investors from a portfolio of equity and equity related securities. The investment strategy is to invest in a portfolio following the SCDV framework (Secular, Cyclical, Defensives, Value Trap) wherein it invests a large proportion of the portfolio in high quality Secular growth ompanies which are long term compounding stories. Rest of the portfolio is invested across quality Cyclicals and Defensives while avoiding Value traps. Portfolio construction across these three quadrants enables us to enhance diversification even with limited number of stocks. Description of types of securities: Listed equity and liquid schemes of mutual funds Basis of selection of such types of securities as part of the investment approach: SCDV Framework along with internal (financial analysis, corporate governance checks, risk reward valuation) and external analysis (conferences, investor presentations, management interaction, primary visits across supply chain) Allocation of portfolio across types of securities: • Equity Investment – up to 100% of corpus • Liquid schemes of Mutual funds and other securities as per discretion of Portfolio Manager Benchmark: S&P BSE 200 TR Index is the benchmark of the strategy as it is a broad-based index and its composition broadly represents the strategy’s investment universe Investment Time Horizon: Recommended -

Marketgrader India All-Cap Growth Leaders Index

Fact Sheet MarketGrader MarketGrader India All-Cap Growth Leaders Index RESEARCH & INDEXES The MarketGrader India All-Cap Growth Leaders Index consists of the 80 most fundamentally sound companies with the best growth prospects in India, whose shares are listed in the country’s national exchanges or in the United States. Its objective is to give investors access to the best companies in the world’s fastest growing large economy without overpaying for their shares. Constituents are selected across all market cap segments and all economic sectors after they have passed rigorous size and liquidity filters. Index Rules Performance Investable Universe CumulativeIndia Growth Leaders Total Return, Jan. 2008 - Jul. 2021 All data as of July 30, 2021 All companies domiciled in India that have 175% received a MarketGrader Score consistently for at least six months, whose shares are 150% listed on the National Stock Exchange, the 125% Bombay Stock Exchange or on U.S. national 100% exchanges. 75% Regulatory Requirements 50% Stocks are ineligible for Index selection if 25% they are included in the ‘Red Flag List,’ 0% maintained and published by the National Securities Depository Limited (NDSL) of India, -25% or on the ‘Breach List,’ maintained by the -50% Central Depository Services (India) Limited 07/30/21 -75% (CDSL), both of which govern foreign own- 12/31/07 12/31/08 12/31/09 12/31/10 12/30/11 12/31/12 12/31/13 12/31/14 12/31/15 12/30/16 12/29/17 12/31/18 12/31/19 12/31/20 ership limits of Indian securities. -

Infosys Annual Report 2011-12 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

Infosys Annual Report 2011-12 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2012 OR Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from __________ to __________ OR Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of event requiring this shell company report________ Commission File Number 000-25383 INFOSYS LIMITED (Exact name of Registrant as specified in its charter) Not Applicable (Translation of Registrant’s name into English) Bangalore, Karnataka, India (Jurisdiction of incorporation or organization) Electronics City, Hosur Road, Bangalore, Karnataka, India 560 100. +91-80-2852-0261 (Address of principal executive offices) V. Balakrishnan, Member of the Board and Chief Financial Officer, +91-80-2852-0261, [email protected] Electronics City, Hosur Road, Bangalore, Karnataka, India 560 100. (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act : Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares each represented by one NASDAQ Global Select Market Equity Share, par value `5 per share Securities registered or to be registered pursuant to Section 12(g) of the Act : None. -

Kotak Funds: India Midcap Fund

Kotak Funds: India Midcap Fund Strictly confidential : For the use of institutional investors only. FACTSHEET Data as on 31/12/2019 Investment Objecve Kotak Funds: India Midcap Fund ("Fund") aims to achieve long term capital appreciaon by primarily invesng at least two thirds of its total assets in equity and equity linked securies of mid capitalizaon companies registered in India or deriving a significant poron of their business from India. Fund Details Key Information Structure UCITS V compliant SICAV Fund Size USD 1970.41 mn* Share class Class J Acc* Fund Nav USD 16.68 ISIN code LU0675383409 Inception Date: Bloomberg code KIMDCLJ LX Equity Fund 25-05-2010 Kotak India Mid Cap Fund Class J (Acc) USD 31-07-2014 Investment manager Kotak Mahindra Asset Management (Singapore) Pte. Ltd *Fund size mentioned is for Kotak Funds: India Midcap Fund as a whole. Domicile Luxembourg Performance Snapshot (% Change) Reference Currency USD Duration Fund Index (NIFTY Midcap 100) Alpha Dealing and Valuation Daily 1 Month 0.63 -0.28 0.91 Administration and Depository Services HSBC France, Luxembourg Branch 3 Months 5.23 5.95 -0.73 Management Company FundRock Management Company 6 Months 0.45 -6.36 6.80 S.A. 1 Year 2.88 -6.48 9.36 Management Fee 1.0% of the Net Asset Value 3 Years 8.99 4.26 4.72 Other fees As set out in the Prospectus 5 Years 7.36 3.71 3.65 Subscription Charge Up to 5.00% YTD 2.88 -6.48 9.36 *Share Class J available for institutional investors only. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) o Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR x Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2007 OR o Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 OR o Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the Transition period from __________ to __________ Commission File Number 000-25383 INFOSYS TECHNOLOGIES LIMITED (Exact name of Registrant as specified in its charter) Not Applicable (Translation of Registrant’s name into English) Bangalore, Karnataka, India (Jurisdiction of incorporation or organization) Electronics City, Hosur Road, Bangalore, Karnataka, India 560 100. +91-80-2852-0261 (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares each represented by one Equity Nasdaq Global Select Market Share, par value Rs. 5 per share Securities registered pursuant to Section 12(g) of the Act: None. (Title of class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: Not Applicable (Title of class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: 571,209,862 Equity Shares Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Ind Us TOWERS July 29, 2021

ind us TOWERS July 29, 2021 BSE Limited The National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, C-1, Block -G, Bandra Kurla Complex, Dalal Street, Mumbai-400001 Bandra (E), Mumbai-400051 Ref: Indus Towers Limited (534816 I INDUSTOWERl Sub: Press Release w.r.t. audited financial results for the first quarter (Ql) ended June 30, 2021 Dear Sir/ Madam, Pursuant to Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are enclosing the press release being issued by the Company with regard to the audited financial results of the Company for the first quarter (QI) ended June 30, 2021. Kindly take the same on record. Thanking you, Yours faithfully, For Indus Towers Limited (formerly Bharti Infratel Limited) Samridhi Rodhe Company Secretary Encl: As above Indus Towers Limited (formerly Bharti lnfratel Limited) Corporate Office: Building No. 10, Tower A, 4th Floor, DLF Cyber City, Gurugram-122002, Haryana I Tel: +91 -124-4296766 Fax: +91124 4289333 Registered Office: 901, Park Centra, Sector 30, NH-8, Gurugram - 122001, Haryana I Tel: +91 -124-4132600 Fax: +91124 4109580 CIN: L64201 HR2006PLC073821 I Email: compliance.officer@industowers com I www.industowers.com Indus Towers Limited – Media Release July 29, 2021 Indus Towers Limited (Formerly Bharti Infratel Limited) Indus Towers announces Consolidated results for the first quarter ended June 30, 2021 Consolidated Revenues for the quarter at Rs. 6,797 Crore, up 12% Y-o-Y Consolidated EBITDA for the quarter at Rs. 3,529 Crore, up 13% Y-o-Y Consolidated Profit after Tax for the quarter at Rs. -

Revision in Market Lot of Derivative Contracts on Individual Stocks

Department : FUTURES & OPTIONS Download Ref No: NSE/FAOP/45895 Date : September 30, 2020 Circular Ref. No: 87/2020 All Members, Revision in Market Lot of Derivative Contracts on Individual Stocks In pursuance of SEBI guidelines for periodic revision of lot sizes for derivatives contracts specified in the SEBI circular CIR/MRD/DP/14/2015 dated July 13, 2015, the market lots of derivatives contracts shall be revised as follows: Sr. Underlying whose Derivative Count of Annexure No Effective date contract size shall be Underlying Number October 30, 2020 (for Nov 1 Revised Downwards 15 1 2020 & later expiries) 2 Revised Upwards 12 October 30, 2020 (for Jan 2 2021 & later expiries) 3 Unchanged 108 - 3 Revised Downwards but new October 30, 2020 (for Jan 4 lot size is not a multiple of old 1 4 2021 & later expiries) lot size To avoid operational complexities, in case of Annexure 2 and 4 above, following will be applicable: 1. Only the far month contract i.e. January 2021 expiry contracts will be revised for market lots. Contracts with maturity of November 2020 and December 2020 would continue to have the existing market lots. All subsequent contracts (i.e. January 2021 expiry and beyond) will have revised market lots. 2. The day spread order book will not be available for the combination contract of Dec 2020 – Jan 2021 expiry. For the purpose of the computation, the average of the closing price of the underlying has been taken for one month period of September 1st – September 30th 2020. This circular shall come into effect from October 30, 2020. -

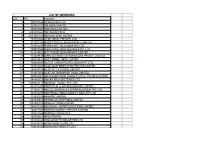

List of Importers S.N

LIST OF IMPORTERS S.N. IEC Importer 1 888015356 20 MICRONS LTD. 2 793012112 3M INDIA LIMITED 3 388038047 ABB INDIA LIMITED. 4 3892000662 ABI SNOWATECH 5 2503001335 ABIRAMI SOAP WORKS 6 799008966 ACER INDIA (PRIVATE) LTD 7 713020253 ADVICS SOUTH INDIA PRIVATE LIMITED 8 711002207 AGRIPLAST TECH INDIA PVT LTD 9 799008966 AGRITRADE INDIA SERVICES PVT LTD 10 312019882 AGT FOODS INDIA PRIVATE LIMITED 11 712023836 AISIN AUTOMOTIVE KARNATAKA PRIVATE LIMITED 12 288002822 AKZO NOBEL INDIA LIMITED 13 799009091 ALCON LABORATORIES (INDIA) PVT LTD., 14 503082058 ALOK MASTERBATCHES PRIVATE LIMITED 15 288007735 ALSTOM T & D INDIA LIMITED 16 711017956 ALSTOM TRANSPORT INDIA LIMITED 17 497016061 AMALGAMATIONS VALEO CLUTCH PRIVATE LIMITED 18 988006723 AMARA RAJA BATTERIES LTD 19 3306001414 AMAZON WOOD PVT. LTD. 20 488016207 AMBATTUR CLOTHING PRIVATE LIMITED 21 311009174 AMCOL MINERALS & MATERIALS INDIA PVT LTD 22 407034293 AMPHENOL OMNICONNECT INDIA PVT LTD 23 415900018 ANANDA VIKATAN 24 907000657 APARNA ENTERPRISES LIMITED 25 1088000720 APOLLO TYRES LIMITED 26 988001292 AQUAMALL WATER SOLUTIONS LIMITED 27 402017986 ARISTON AGENCY PRIVATE LIMITED 28 300022964 ARKEMA CHEMICALS 29 300062401 ARMSTRONG 30 588169340 ARO GRANITE INDUSTRIES LTD 31 588130311 ASAHI INDIA GLASS LTD 32 798014911 ASHIRVAD PIPES PVT LTD 33 488014336 ASHOK LEYLAND LIMITED 34 388010789 ASIAN PAINTS LTD 35 412001951 ASIAN TRADING COMPANY 36 796005532 AT & S INDIA PRIVATE LIMITED 37 707010462 ATS ELGI LIMITED 38 2588000011 AUROBINDO PHARMA LIMITED 39 507039807 AUTOLIV INDIA PVT. LTD. 40 903006499 AVANTI FEEDS LTD. 41 497016753 BASF CATALYSTS INDIA PVT LTD., 42 388007257 BASF INDIA LIMITED 43 288012101 BATA INDIA LIMITED 44 596004729 BECTON DICKINSON INDIA PRIVATE LIMITED 45 788013441 BEML LIMITED, 46 388167084 BENNETT COLEMAN & CO LTD 47 288019539 BERGER PAINTS INDIA LIMITED 48 788001027 BHARAT ELECTRONICS LTD.