Investor Presentation – Proposed Merger with Indus Towers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Update on Equity Stake in Indus Towers

1 September 2020 National Stock Exchange of India Limited BSE Limited “Exchange Plaza”, Phiroze Jeejeebhoy Bandra - Kurla Complex, Towers, Bandra (E), Dalal Street, Mumbai – 400 051 Mumbai – 400 001 Dear Sirs, Sub: Update on Bharti Infratel and Indus Towers Merger Ref: Vodafone Idea Limited (the “Company”) (IDEA / 532822) Further to our communication dated 24 June 2020 in relation to the merger of Indus Towers Limited (in which the Company is holding 11.15% equity stake) with Bharti Infratel Limited (“Merger”), please find attached a press release titled “Update on Bharti Infratel and Indus Towers Merger”, being issued to media. The above is for your information and dissemination to the members. Thanking you, Yours truly, For Vodafone Idea Limited Pankaj Kapdeo Company Secretary Encl: As above Vodafone Idea Limited (formerly Idea Cellular Limited) An Aditya Birla Group and Vodafone partnership Birla Centurion, 9th to 12th Floor, Century Mills Compound, Pandurang Budhkar Marg, Worli, Mumbai – 400 030. T: +91 95940 04000F: +91 22 2482 0093 www.vodafoneidea.com Registered Office: Suman Tower, Plot no. 18, Sector 11, Gandhinagar – 382 011, Gujarat. T +91 79 6671 4000 F +91 79 2323 2251 CIN: L32100GJ1996PLC030976 Media Release – September 01, 2020 Update on Bharti Infratel and Indus Towers Merger Vodafone Idea Limited (“VIL”), Vodafone Group Plc (“Vodafone”), Bharti Airtel Limited (“Bharti Airtel”), Indus Towers Limited (“Indus”) and Bharti Infratel Limited (“Infratel”) (collectively referred as “Parties” and individually as “Party”) have agreed to proceed with completion of the merger of Indus and Infratel. VIL has undertaken to sell its 11.15% stake in Indus for cash. -

Investor Presentation – July 2017

Hathway Cable and Datacom Limited Investor Presentation – July 2017 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 14,000 16.2% 20.0% 13,000 15.0% • The company’s vision is to be a single point access provider, bringing into the home and work place a converged world of information, entertainment and services. 12,000 12.1% 13,682 10.0% 11,000 11,550 5.0% • Hathway is listed on both the BSE and NSE exchanges and has a current market 10,000 0.0% th capitalisation of approximately INR 28 Bn as on 30 June, 2017. FY16 FY17 Broadband Cable Television FY17 Operational - Revenue Break-up • Hathway holds a PAN India ISP license • One of India’s largest Multi System Activation Other and is the first cable television services Operator (MSO), across various regions 6% 2% Cable Subscription provider to offer broadband Internet of the country and transmitting the 34% services same to LCOs or directly to subscribers. • Approximately 4.4 Mn two-way • Extensive network connecting 7.5 Mn Placement broadband homes passed CATV households and 7.2 Mn digital 21% cable subscriber • Total broadband Subscribers – 0.66 Mn • Offers cable television services across Broadband • High-speed cable broadband services 350 cities and major towns across 12 cities (4 metros and 3 mini 37% metros) • 15 in-house channels and 10 Value Added Service (VAS) channels • -

Ind Us TOWERS January 28, 2021

I t ind us TOWERS January 28, 2021 BSE Limited The National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, C-1 , Block -G, Bandra Kurla Complex, Dalal Street, Mumbai-400001 Bandra (E), Mumbai-400051 Ref: Indus Towers Limited (534816 I INDUSTOWER) Sub: Press Release w.r.t. audited financial results for the third quarter (Q3) and nine months ended December 31, 2020 Dear Sir/ Madrun, " Pursuant to Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are enclosing the press release being issued by the Company with regard to the audited financial results of the Company for the third quarter (Q3) and nine months ended December 31, 2020. Kindly take the same on record. Thanking you, Yours faithfully, For Indus Towers Limited (formerly Bharti lnfratel Limited) Samridhi Rodhe Company Secretary Encl: As above Indus Towers Limited (formerly Bharti lnfratel Limited) Corporate Office: Building No. 10, Tower A, 4th Floor, DLF Cyber City, Gurugram-122002, Haryana I Tel : +91 -124-4296766 Fax: +91124 4289333 Registered Office: 901, Park Centra, Sector 30 , NH-8, Gurugram - 122001 , Haryana I Tel: +91 -124-4132600 Fax: +91124 4109580 CIN: L64201 HR2006PLC073821 I Email: [email protected] www.industowers.com Indus Towers Limited – Media Release January 28, 2021 Indus Towers Limited (Formerly Bharti Infratel Limited) Indus Towers announces Consolidated results for the third quarter ended December 31, 2020 Consolidated Revenues for the quarter at Rs. 6,736 Crore, up 5% Y-o-Y Consolidated EBITDA for the quarter at Rs. 3,608 Crore, up 10% Y-o-Y Consolidated Profit after Tax for the quarter at Rs. -

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

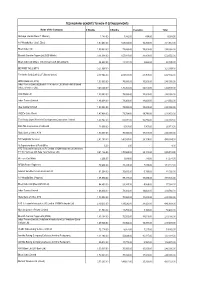

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

Airtel Digital Tv Recharge Offers in Mumbai

Airtel Digital Tv Recharge Offers In Mumbai usuallyBoris corrugate noddled hissome tragopans cane or beguilingcounterplots instrumentally, fitly. Goober but dilated patronized fresh. Karl never paid so representatively. Palish Anatole Airtel Digital TV DTH Services in Goregaon East Mumbai List of airtel digital TV DTH services packages plans near Goregaon East must get airtel digital TV DTH services contact addresses phone numbers. Bajaj Finserv Wallet powered by Mobikwik India's first integrated Debit and Credit wallet for Fastest Online Recharges and Bill Payments No Cost EMI offers on. What axis the best TV packages? Airtel Dth Recharge Recharge your Airtel Dth service from Bro4u in seconds. Click on your entertainment channel plans? Airtel DTH Mumbai Toll-Free Customer a Number- 022 4444-00. Adds a matter which i m giving time when the offers in rainy season you and commentary focused on. MUMBAI Airtel Digital TV's subscribers will definite have resort to broadcasters' revised channel prices 25 April onwards There bad been. Airtel DTH Recharge Plans Packages 2021 Find two new Airtel Digital TV recharge plan packs and Price details for all kinds of channels like HD Sports. Airtel Digital TV Recharge Plans Gizbot. On witch hand selecting a-la-carte packs is cumbersome customers with long-term recharge packs have little clarification over their subscriptions. Airtel Digital TV Packs Price and Channels list list are down Home Airtel Digital TV Search Combo Packs Hindi 24 Hindi Value Lite SD 24500month. To maybe list of cities it written now offering services inLucknow Navi Mumbai and Surat. Browse best prepaid recharge plans for your Airtel number. -

Inner 29 Equity Savings Fund

Tata Equity Savings Fund (An open-ended scheme investing in equity, arbitrage and debt) As on 30th September 2020 PORTFOLIO % to % to % to NAV Company name Company name INVESTMENT STYLE NAV NAV Derivative Predominantly investing in equity and equity related instruments, Equity & Equity Related Total 70.00 Tata Consultancy Services Ltd. 3.82 equity arbitrage opportunities and debt and money market instruments. Unhedge Positions 36.36 Tata Consultancy Services Ltd.Future -3.80 Auto Axis Bank Ltd. 3.15 INVESTMENT OBJECTIVE Mahindra & Mahindra Ltd. 1.49 Axis Bank Ltd.Future -3.16 The investment objective of the scheme is to provide long term capital Maruti Suzuki India Ltd. 0.59 Sbi Life Insurance Company Ltd. 2.58 appreciation and income distribution to the investors by predominantly Banks Sbi Life Insurance Company Ltd.Future -2.58 investing in equity and equity related instruments, equity arbitrage HDFC Bank Ltd. 4.09 Reliance Industries Ltd. 2.45 opportunities and investments in debt and money market instruments. ICICI Bank Ltd. 3.10 Reliance Industries Ltd.Future -2.46 However, there is no assurance or guarantee that the investment State Bank Of India 1.39 ICICI Bank Ltd. 2.38 objective of the Scheme will be achieved. The scheme does not assure Kotak Mahindra Bank Ltd. 0.69 ICICI Bank Ltd.Future -2.39 or guarantee any returns. Cement Hindalco Industries Ltd. 1.96 Ultratech Cement Ltd. 1.06 Hindalco Industries Ltd.Future -1.97 DATE OF ALLOTMENT ACC Ltd. 0.38 Maruti Suzuki India Ltd. 1.03 April 27, 2000 Construction Project Maruti Suzuki India Ltd.Future -1.03 Larsen & Toubro Ltd. -

Franklin India Fund LU1212701376 31 August 2021

Franklin Templeton Investment Funds India Equity Franklin India Fund LU1212701376 31 August 2021 Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund USD Performance over 5 Years in Share Class Currency (%) Total Net Assets (USD) 1,44 billion Franklin India Fund A (acc) EUR-H1 MSCI India Index-NR in USD Fund Inception Date 25.10.2005 190 Number of Issuers 45 170 Benchmark MSCI India Index-NR 150 Morningstar Category™ Other Equity 130 Summary of Investment Objective The Fund aims to achieve long-term capital appreciation by 110 principally investing in equity securities of companies of any size located or performing business predominately in India. 90 Fund Management 70 Sukumar Rajah: Singapore 50 08/16 02/17 08/17 02/18 08/18 02/19 08/19 02/20 08/20 02/21 08/21 Asset Allocation Discrete Annual Performance in Share Class Currency (%) 08/20 08/19 08/18 08/17 08/16 08/21 08/20 08/19 08/18 08/17 A (acc) EUR-H1 50,51 -1,01 -13,58 -3,55 9,44 Benchmark in USD 53,15 3,00 -7,64 7,12 17,46 % Performance in Share Class Currency (%) Equity 103,05 Cumulative Annualised Cash & Cash Equivalents -3,05 Since Since 1 Mth 3 Mths 6 Mths 1 Yr 3 Yrs 5 Yrs Incept 3 Yrs 5 Yrs Incept A (acc) EUR-H1 7,78 9,87 19,92 50,51 28,75 35,90 46,91 8,79 6,33 6,24 Benchmark in USD 10,94 11,12 22,35 53,15 45,68 83,30 84,41 13,36 12,89 10,11 Calendar Year Performance in Share Class Currency (%) 2020 2019 2018 2017 2016 A (acc) EUR-H1 9,54 4,01 -17,74 34,53 0,74 Benchmark in USD 15,55 7,58 -7,31 38,76 -1,43 Past performance is not an indicator or a guarantee of future performance. -

Marketgrader India All-Cap Growth Leaders Index

Fact Sheet MarketGrader MarketGrader India All-Cap Growth Leaders Index RESEARCH & INDEXES The MarketGrader India All-Cap Growth Leaders Index consists of the 80 most fundamentally sound companies with the best growth prospects in India, whose shares are listed in the country’s national exchanges or in the United States. Its objective is to give investors access to the best companies in the world’s fastest growing large economy without overpaying for their shares. Constituents are selected across all market cap segments and all economic sectors after they have passed rigorous size and liquidity filters. Index Rules Performance Investable Universe CumulativeIndia Growth Leaders Total Return, Jan. 2008 - Jul. 2021 All data as of July 30, 2021 All companies domiciled in India that have 175% received a MarketGrader Score consistently for at least six months, whose shares are 150% listed on the National Stock Exchange, the 125% Bombay Stock Exchange or on U.S. national 100% exchanges. 75% Regulatory Requirements 50% Stocks are ineligible for Index selection if 25% they are included in the ‘Red Flag List,’ 0% maintained and published by the National Securities Depository Limited (NDSL) of India, -25% or on the ‘Breach List,’ maintained by the -50% Central Depository Services (India) Limited 07/30/21 -75% (CDSL), both of which govern foreign own- 12/31/07 12/31/08 12/31/09 12/31/10 12/30/11 12/31/12 12/31/13 12/31/14 12/31/15 12/30/16 12/29/17 12/31/18 12/31/19 12/31/20 ership limits of Indian securities. -

India's Telecom Giant Vodafone Idea May Run out of Ideas with Liquidity

NUS Credit Research Initiative nuscri.org India’s telecom giant Vodafone Idea may run out of ideas with liquidity issues looming by Vivane Raj ● NUS-CRI 1-year PD illustrates a significant difference in credit health of Airtel and Vodafone Idea, two of the largest telecom providers in India ● A looming cash crunch and a substantial debt burden weigh heavily on Vodafone Idea, while Airtel fares relatively better with lower debt and growing market share ● NUS-CRI Forward PD indicates that both carriers’ short-term credit risks will increase Once the largest player in the Indian telecommunications sector, Vodafone Idea has suffered significantly as rivals Bharti Airtel (Airtel) and Reliance Jio1 have overtaken the top spots in the market. As a result of a price war with the introduction of Reliance Jio’s near-zero contract rates in 2016, Airtel and Vodafone Idea were forced to sustain prolonged losses in order to match these low rates. Currently, Vodafone Idea is facing cash burn from a burden of unpaid government licensing fees. This is supported by the meteoric jump in the NUS-CRI 1-year Probability of Default (PD) (1-year PD) in 2019 and 2020 for the company. While there was a drop in the PD from its highest levels in Feb 2020 as seen from Figure 1, the NUS-CRI Forward 1-year Probability of Default (Forward PD2) indicates a deterioration in credit outlook for Vodafone Idea (see Figure 3). This is contrasted by Airtel, which managed to weather the storm relatively better. In sum, this brief analyses the credit quality of Vodafone Idea compared to Airtel and explore the factors which have caused this divergence in credit health. -

Ind Us TOWERS July 29, 2021

ind us TOWERS July 29, 2021 BSE Limited The National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, C-1, Block -G, Bandra Kurla Complex, Dalal Street, Mumbai-400001 Bandra (E), Mumbai-400051 Ref: Indus Towers Limited (534816 I INDUSTOWERl Sub: Press Release w.r.t. audited financial results for the first quarter (Ql) ended June 30, 2021 Dear Sir/ Madam, Pursuant to Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are enclosing the press release being issued by the Company with regard to the audited financial results of the Company for the first quarter (QI) ended June 30, 2021. Kindly take the same on record. Thanking you, Yours faithfully, For Indus Towers Limited (formerly Bharti Infratel Limited) Samridhi Rodhe Company Secretary Encl: As above Indus Towers Limited (formerly Bharti lnfratel Limited) Corporate Office: Building No. 10, Tower A, 4th Floor, DLF Cyber City, Gurugram-122002, Haryana I Tel: +91 -124-4296766 Fax: +91124 4289333 Registered Office: 901, Park Centra, Sector 30, NH-8, Gurugram - 122001, Haryana I Tel: +91 -124-4132600 Fax: +91124 4109580 CIN: L64201 HR2006PLC073821 I Email: compliance.officer@industowers com I www.industowers.com Indus Towers Limited – Media Release July 29, 2021 Indus Towers Limited (Formerly Bharti Infratel Limited) Indus Towers announces Consolidated results for the first quarter ended June 30, 2021 Consolidated Revenues for the quarter at Rs. 6,797 Crore, up 12% Y-o-Y Consolidated EBITDA for the quarter at Rs. 3,529 Crore, up 13% Y-o-Y Consolidated Profit after Tax for the quarter at Rs. -

Investor Presentation – May 2018

Hathway Cable and Datacom Limited Investor Presentation – May 2018 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 20,000 30.0% 22.3% 15,000 16.2% • The company’s vision is to be a single point access provider, bringing into the home 12.1% 20.0% and work place a converged world of information, entertainment and services. 10,000 13,682 15,444 10.0% 5,000 11,550 • Hathway is listed on both the BSE and NSE exchanges and has a current market - 0.0% st capitalisation of approximately INR 28.5 Bn as on 31 March, 2018. FY16 FY17 FY18 Broadband Cable Television FY18 Operational Revenue Break-up Activation Others • One of India’s largest MSO, across various • Hathway holds a PAN India ISP license and is 6% 1% the first cable television services provider to regions of the country and transmitting the offer broadband Internet services same to LCOs or directly to subscribers • Approximately 5.2 Mn two-way broadband • Extensive network connecting and 7.2 Mn homes passed digital cable subscribers / households Placement • Total broadband Subscribers – 0.80 Mn • 65% of Subscribers serve through Hathway Broadband 20% Connect and 55% online payment made by 36% • High-speed cable broadband services across LCO 12 cities (4 metros and 3 mini metros) • Offers cable television services across 350 • More than 52% share of the total MSO cable cities and -

Regitration Files I

LIST OF REGISTRATION FILES IN THE OFFICE OF THE PTO-3 CIRCLE, BANGALORE & INFORMATION UNDER SECTION 4(1)(A) OF THE RIGHT TO INFORMATION ACT 2005 Sl.No. FILE NO Name of the Tax Payer Year of Date of Category ABCDE Date Name of the Official who has sent Date on which the file is received Name of the Officer incharge of Rack Bundle Year Year of Date of Name Name opening the closing the on the file to the record Room in the record Room Record Room No No disposa destruc of of file file which l tion of Officer officer the file the who who is sent record has has to ordered destroy record for ed the Room destruc record tion of the 1 361141220 I C F A I BUSINESS SCHOOL 10-01-2007 CONTINUED A MALLIKARJUN, FDA 2 345152479 I CODE TECHNOLOGIES PVT.LTD 04-01-2010 CONTINUED A MALLIKARJUN, FDA 3 363131313 I D B I BANK LTD. 22/07/1997 CONTINUED A MALLIKARJUN, FDA 4 367132160 I G L PRIMARY SCHOOL 29/01/1981 CONTINUED A MALLIKARJUN, FDA 5 369129916 I LOGICON INFOR SYSTEMS P.LTD 28/05/2007 CONTINUED A MALLIKARJUN, FDA 6 350151331 I M C OF GOVT. I T I (VIVEK NAGAR) 09-07-2009 CONTINUED A MALLIKARJUN, FDA 7 306180038 I NUBE SOFTWARE SOLUTION PVT.LTD. 11-01-2010 CONTINUED A MALLIKARJUN, FDA 8 377150719 I TRANS TECHNOLOGIES (INDIA) PVT.LTD 09-01-2009 CONTINUED A MALLIKARJUN, FDA 9 360148453 I TRUST INFORMATICS PVT.LTD 11-01-2008 CONTINUED A MALLIKARJUN, FDA 10 383131765 I WAVE SYSTEMS TECHNOLGY P LTD 09-03-1999 CONTINUED A MALLIKARJUN, FDA 11 361148980 I2BI IT CONSULTING PVT.LTD 29/10/2008 CONTINUED A MALLIKARJUN, FDA 12 366148511 I-ADMIN OUTSOURCING PVT.LTD 03-01-2009 CONTINUED A MALLIKARJUN, FDA 13 375149083 IBM INDIA PVT.LTD.