2 Halvårsrapport 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

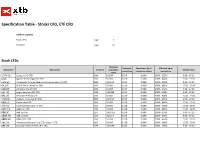

Specification Table - Stocks CFD, ETF CFD

Specification Table - Stocks CFD, ETF CFD Table of contents Stock CFDs page 1 ETF CFDs page 61 Stock CFDs Minimum Minimum Commission (% of XTB mark-up on Instrument Description Currency transaction Trading Hours commission transaction value) commission value 1COV.DE Covestro AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 A.US Agilent Technologies Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 A3M.ES Atresmedia Corp de Medios de Comunicacion SA CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AA.US* CLOSE ONLY / Alcoa Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAD.DE Amadeus Fire AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAL.UK Anglo American PLC CFD GBP 100 GBP 8 EUR 0.08% 100% - 200% 9:00 - 17:30 AAL.US American Airlines CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AALB.NL Aalberts Industries NV CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAN.US Aaron's Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAP.US Advance Auto Parts Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAPL.US Apple Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 ABB.SE ABB Ltd CFD SEK 1000 SEK 8 EUR 0.08% 100% - 430% 9:00 - 17:25 ABBN.CH ABB Ltd CFD CHF 150 CHF 8 EUR 0.08% 100% - 375% 9:00 - 17:20 ABBV.US Abbvie Inc. -

Plain Language in the Norwegian Financial Services

Plain Language Association International’s 11th conference Improving Customer Relationships September 21-23, 2017 University of Graz, Austria hosted by Klarsprache.at Copyright of this presentation belongs to the presenter www.plainlanguagenetwork.org Plain Language in the Norwegian financial sector Graz, 22nd September 2017 Gry Nergård, Consumer Policy Director www.finansnorge.no Introduction • Gry Nergård • Lawyer • Consumer Policy Director, Finance Norway • Former Norwegian Consumer Ombudsman www.finansnorge.no 3 Our members: • Finance Norway is the industry • Savings banks organisation for the financial • Commercial banks industry in Norway. • Life insurers • We represent about 240 financial • Non-life insurers companies with around 50,000 • Savings bank foundations employees. • Mortgage companies • Financial conglomerates • Other financial companies www.finansnorge.no Changes in the retirement pension system www.finansnorge.no The P-word www.finansnorge.no What is difficult? • Summer 2016: questionaire to 1000 consumers • Confirmed: • Economical terms are incomprehensible to most people. • In plain language: they are totaly not understandable! www.finansnorge.no Finance Norway’s Plain Language Project Main goals • Better information to consumers about retirement pension • Better choices – better pensions • Reduce capasity and costs in costumer relations • Better language culture in the companies • Reputation and trust www.finansnorge.no Working methode • Steering group • Working grpup • Bilateral cooperation between each company -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe SMID Cap 19 August 2021 Tradable Plus Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.72 UNITED Bureau Veritas S.A. 0.42 FRANCE Gjensidige Forsikring ASA 0.17 NORWAY KINGDOM Campari 0.31 ITALY Gn Store Nordic 0.53 DENMARK AAK 0.18 SWEDEN Carl Zeiss Meditec 0.33 GERMANY Halma 0.66 UNITED Aalberts NV 0.24 NETHERLANDS Castellum 0.32 SWEDEN KINGDOM ABN AMRO Bank NV 0.23 NETHERLANDS Centrica 0.2 UNITED Hargreaves Lansdown 0.39 UNITED Acciona S.A. 0.16 SPAIN KINGDOM KINGDOM Accor 0.32 FRANCE Chr. Hansen Holding A/S 0.43 DENMARK Hays 0.16 UNITED ACS Actividades Cons y Serv 0.3 SPAIN Clariant 0.21 SWITZERLAND KINGDOM Adecco Group AG 0.49 SWITZERLAND Coca-Cola HBC AG 0.33 UNITED HeidelbergCement AG 0.6 GERMANY Adevinta 0.21 NORWAY KINGDOM HelloFresh SE 0.67 GERMANY Admiral Group 0.43 UNITED Cofinimmo 0.21 BELGIUM Helvetia Holding AG 0.18 SWITZERLAND KINGDOM Commerzbank 0.35 GERMANY Hikma Pharmaceuticals 0.27 UNITED Aedifica 0.22 BELGIUM ConvaTec Group 0.25 UNITED KINGDOM Aegon NV 0.34 NETHERLANDS KINGDOM Hiscox 0.18 UNITED KINGDOM Aeroports de Paris 0.17 FRANCE Countryside Properties 0.16 UNITED Holmen AB 0.2 SWEDEN Ageas 0.46 BELGIUM KINGDOM Homeserve 0.17 UNITED Aker BP ASA 0.16 NORWAY Covestro AG 0.54 GERMANY KINGDOM Alfa Laval 0.52 SWEDEN Covivio 0.2 FRANCE Howden Joinery Group 0.3 UNITED Alstom 0.7 FRANCE Croda International 0.64 UNITED KINGDOM KINGDOM Alten 0.18 -

Quarterly Report, Q1 2020

Q1 2020 Quarterly Report: WilderHill Clean Energy Index®, March 31, 2020 The Clean Energy Index® (ECO) began 1st Quarter 2020 around 70 and it ended Q1 near 56, down -20%; but there was more to this Q1. A remarkable, volatile, exhilarating, frightening, roller coaster Q1 first had gone up sharply +30%, over 90 in mid-February, then crashed latter Q1 to below 50. Intra-day moves were abrupt: in a few hours March 24, ECO sprang up +15%. Or seen longer since 2017, when the ECO Index® was 38, last 3 years it’s risen some +55%. An independent tracking fund at start of 2017 was about 18.5, start of 2018 was about 25.5, start of 2019 was about 21.5, start of 2020 around 34 and at end of Q1 fell to around 27. ECO passively captures an emerging highly volatile theme; it thusly can & does at times also ‘drop like a rock’ – as was amply proven for instance Q1 2020. Big gains have occurred here – as well too as bigger declines. Plus we offer a mere observation: it’s counter-intuitive perhaps yet ECO’s theme has now spiked up at times in Bush II & Trump Presidencies - though neither greatly promoted green energy. Meanwhile drops were seen 8 years of an Obama Presidency that favored this sector (yet 2008-2016 was a bit singular as China undertook to enter and gain major market share in clean energy, a goal that since came to fruition). Look back last 5 years at Benchmark ECO Index®, live since 2004 & 1st for climate solutions, and it’s near nil, negligibly up a few percent. -

Arctic Norwegian Equities Monthly Report July 2020

Arctic Norwegian Equities Monthly Report July 2020 FUND COMMENTS Arctic Norwegian Equities gave 3.4% return in July (I-class) versus 4% for the OSEFX benchmark index. Year to date the fund has returned -14.3% compared to -10.1% for the OSEFX. Since inception the fund has returned 120.7% versus 100.2% for the benchmark index. In July many of the largest companies on the Oslo Stock Exchange an- nounced results for the 2nd quarter. Several companies delivered above market expectations. Of note is DNB which rose near 10 percent on the day of reporting, driven by lower loan losses and higher other income. A number of companies also announced positive profit warmings, including B2 Holding, XXL, Atea and Europris. In July positive attribution for the Fund versus the benchmark index came from overweights in Atea and Crayon, and underweight in Mowi. Atea announced positive results for the 2nd quarter. Revenues were up by 12 percent from Q2 last year, and the company’s operating profit and bottom line were 50 percent higher than market expec- tations. Atea has further strengthened its competitive position in the Nordics, with a marked share in excess of 20 percent. Crayon also rose in July, partly due to strong software sales for Atea. Crayon is a large global partner of Microsoft. Microsoft announced 2nd quarter results which exceeded market expectations on the top- and bottom line. Shares in salmon farming declined in July, partly due to weak salmon price development. Demand for air transport to China has been reduced after discovery of coronavirus on a salmon cutting board in Beijing. -

Renewable Hydrogen, Made Cost Competitive

SPECIAL FEATURE – HYDROGEN ENERGY Renewable hydrogen, made cost competitive An interview with Jon André Løkke, CEO of Nel ASA, by Joanna Sampson magine a time before petroleum and electricity – horse- drawn carriages dominated the highways and byways and candles provided artificial lighting. The world was I transformed by fossil solutions in just a few centuries. But we are currently being faced with the side effects of utilising fossil energy – climate change and pollution. The obvious solution to these problems is exchanging fossil fuels with new renewable energies like solar, wind, and wave power. According to one company in Norway, it’s time for another global transformation. This time, it will be transformed by hydrogen, the simplest and most abundant element in the universe. In 1940, Nel undertook the world’s largest water Nel ASA has a vision of empowering generations with clean electrolysis installation at Rjukan, Norway, with a total 3 energy forever. To achieve this, CEO Jon André Løkke hydrogen production capacity exceeding 30,000Nm /hour believes hydrogen, along with renewable energy, must from hydropower. play a main role in the biggest energy transition since the Just over a decade later, in 1953, Nel started up a second discovery of oil. large-scale hydro-powered electrolyser plant for supplying Three quarters of the sun is made from hydrogen, providing hydrogen to ammonia production in Glomfjord, Norway. us with all the clean energy we need for at least another And in 1959 the company completely redesigned the five billion years. Realising that we have unlimited access electrolyser unit, forming the basis for today’s atmospheric to the sun raises an interesting question though: how do we electrolyser. -

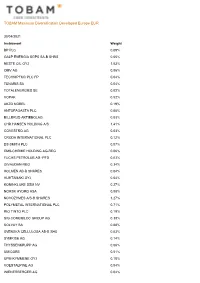

TOBAM Maximum Diversification Developed Europe EUR

TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight BP PLC 0.09% GALP ENERGIA SGPS SA-B SHRS 0.05% NESTE OIL OYJ 1.03% OMV AG 0.06% TECHNIPFMC PLC FP 0.04% TENARIS SA 0.04% TOTALENERGIES SE 0.02% VOPAK 0.52% AKZO NOBEL 0.19% ANTOFAGASTA PLC 0.05% BILLERUD AKTIEBOLAG 0.03% CHR HANSEN HOLDING A/S 1.41% COVESTRO AG 0.03% CRODA INTERNATIONAL PLC 0.12% DS SMITH PLC 0.07% EMS-CHEMIE HOLDING AG-REG 0.06% FUCHS PETROLUB AG -PFD 0.03% GIVAUDAN-REG 0.34% HOLMEN AB-B SHARES 0.04% HUHTAMAKI OYJ 0.04% KONINKLIJKE DSM NV 0.27% NORSK HYDRO ASA 0.08% NOVOZYMES A/S-B SHARES 1.27% POLYMETAL INTERNATIONAL PLC 0.71% RIO TINTO PLC 0.19% SIG COMBIBLOC GROUP AG 0.38% SOLVAY SA 0.08% SVENSKA CELLULOSA AB-B SHS 0.03% SYMRISE AG 0.14% THYSSENKRUPP AG 0.06% UMICORE 0.51% UPM-KYMMENE OYJ 0.18% VOESTALPINE AG 0.04% WIENERBERGER AG 0.04% TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight YARA INTERNATIONAL ASA 0.08% A P MOLLER - MAERSK A/S - A 0.06% A P MOLLER - MAERSK A/S - B 0.08% ACS ACTIVIDADES CONS Y SERV 0.07% ADDTECH AB-B SHARES 0.03% ADP 0.04% AENA SA 0.11% ALSTOM 0.17% ANDRITZ AG 0.03% ATLANTIA SPA 0.08% BELIMO HOLDING AG-REG 0.04% BUCHER INDUSTRIES AG-REG 0.04% BUNZL PLC 0.10% DEUTSCHE LUFTHANSA-REG 0.05% DIPLOMA PLC 0.04% DSV PANALPINA A/S 0.45% EASYJET PLC 0.20% ELIS SA 0.03% EPIROC AB-A 0.10% EPIROC AB-B 0.06% FERROVIAL SA 0.05% FLUGHAFEN ZURICH AG-REG 0.03% GEA GROUP AG 0.06% GEBERIT AG-REG 0.21% HAYS PLC 0.03% HOMESERVE PLC 0.04% HOWDEN JOINERY GROUP PLC 0.06% IMCD GROUP NV 0.07% IMI PLC 0.05% -

The State Ownership Report 2019

The State Ownership Report 2019 Contents The Minister’s introduction 7 Category Goal of the highest possible Scope and key figures 8 return over time and where Key issues for the State as owner 16 the State no longer has a How the State exercises its ownership 22 A sustainable portfolio for 1 rationale for its ownership long-term value creation 34 Ambita AS 42 Baneservice AS 43 Entra ASA 44 Flytoget AS 45 Giek kredittforsikring AS 46 Mesta AS 47 Category Goal of the highest possible return over time and where the State has a special 2 rationale for its ownership Aker Kværner Holding AS 50 Argentum Fondsinvesteringer AS 51 DNB ASA 52 Eksportfinans Norway ASA 53 Electronic chart centre AS 54 Equinor ASA 55 Investinor AS 56 Kommunalbanken AS 57 Kongsberg Gruppen ASA 58 Mantena AS 59 Nammo AS 60 Norsk Hydro ASA 61 Nysnø Klimainvesteringer AS 62 Posten Norge AS 63 Statkraft SF 64 Telenor ASA 65 Vygruppen AS 66 Yara International ASA 67 Category Goal of the most efficient possible attainment of 3 public policy goals Andøya Space Center AS 70 Simula Research Laboratory AS 104 Avinor AS 71 Siva – Selskapet for Industrivekst SF 105 Bane Nor SF 72 Space Norway AS 106 Bjørnøen AS 73 Statnett SF 107 Carte Blanche AS 74 Statskog SF 108 Den Nationale Scene 75 Staur gård AS 109 Andøya Space Center AS 76 Store Norske Spitsbergen Kulkompani AS 110 Den Norske Opera & Ballett AS 76 Talent Norge AS 111 Avinor AS 77 Trøndelag Teater AS 112 Eksportkreditt Norge AS 77 Universitetssenteret på Svalbard AS 113 Enova 78 Vinmonopolet AS 114 Entur AS 79 Fiskeri- og -

Regulatory Reform in Norway

Regulatory Reform in Norway MARKETISATION OF GOVERNMENT SERVICES – STATE-OWNED ENTERPRISES © OECD (2003). All rights reserved. 1 ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Pursuant to Article 1 of the Convention signed in Paris on 14th December 1960, and which came into force on 30th September 1961, the Organisation for Economic Co-operation and Development (OECD) shall promote policies designed: • to achieve the highest sustainable economic growth and employment and a rising standard of living in Member countries, while maintaining financial stability, and thus to contribute to the development of the world economy; • to contribute to sound economic expansion in Member as well as non-member countries in the process of economic development; and • to contribute to the expansion of world trade on a multilateral, non-discriminatory basis in accordance with international obligations. The original Member countries of the OECD are Austria, Belgium, Canada, Denmark, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. The following countries became Members subsequently through accession at the dates indicated hereafter: Japan (28th April 1964), Finland (28th January 1969), Australia (7th June 1971), New Zealand (29th May 1973), Mexico (18th May 1994), the Czech Republic (21st December 1995), Hungary (7th May 1996), Poland (22nd November 1996), Korea (12th December 1996) and the Slovak Republic (14th December 2000). The Commission of the European Communities takes part in the work of the OECD (Article 13 of the OECD Convention). © OECD 2003 Permission to reproduce a portion of this work for non-commercial purposes or classroom use should be obtained through the Centre français d’exploitation du droit de copie (CFC), 20, rue des Grands-Augustins, 75006 Paris, France, tel. -

ESG 100 Oslo Stock Exchange Report

ESG 100 - THE OSLO An analysis of how the 100 largest STOCKcompanies on the Oslo Stock Exchange report on ESG EXCHANGE 2020 ESG 100 Glossary SUSTAINABILITY THE UN SUSTAINABLE DEVELOPMENT GOALS The concept was introduced in 1987 when the The 2030 Agenda for Sustainable Development, Brundtland Commission defined sustainable adopted by all UN Member States in 2015, sets out development as resource utilisation that meets the 17 sustainable development goals (SDGs). The goals needs of the present without compromising the ability embrace both developing and industrialised of future generations to meet their own needs. countries and have been broadly endorsed by the Corporate sustainability entails managing a business in business community. a manner that ensures that decisions made today regarding economic, environmental, and social CORPORATE SOCIAL RESPONSIBILITY (CSR) conditions will also work in the future. To engage in CSR means that, in the normal course of business, a company is operating in ways that ESG enhance society and the environment, instead of ESG is an acronym for environmental, social and contributing negatively to them. CSR is often used governance factors. CO2 emissions and energy synonymously with sustainability. consumption are examples of environmental factors, human rights and labour conditions are examples of CORPORATE COMMUNITY ENGAGEMENT (CCE) social factors, and compliance with laws and internal This term refers to the activities that a company company control mechanisms are examples of undertakes to enhance its relationships with, and governance factors. contribute to the well-being of, the communities in which it has a presence or impact. CCE often SUSTAINABLE FINANCE involves contributions to charitable organisations, Sustainable finance involves assessing ESG factors in culture and sports, or support for volunteer work. -

Annual Report 2019 .Pdf 18MB

Annual Report Statkraft AS 2019 CONTENT 3 Introduction 3 Statkraft at a glance 6 The Board of Directors 7 The Corporate Management 8 Letter from the CEO 9 Report from the Board of Directors 12 Strategy – Powering a green future 16 Financial performance 20 Segments 25 Risk management 29 Sustainability 31 Sustainability management 33 Statkraft’s contribution 35 Social disclosures 41 Environmental disclosures 45 Economic disclosures 49 Corporate Governance 59 Statements 59 Group Financial Statements 59 Financial Statements 64 Notes 129 Statkraft AS Financial Statements 129 Financial Statements 133 Notes 150 Auditor’s Statement 155 Sustainability Statement 170 Auditor’s Statement 176 Declaration from the Board of Directors and CEO 177 Key figures and Alternative Performance Measures Statkraft is a leading renewable energy company with activities on three continents within hydro, wind and solar. Through our market activities and production assets we create value for our owner, our customers and the societies we operate in. Statkraft at a glance USA Statkraft has 4.000 employees Peru Brazil in 16 countries Chile Europe’s largest producer of renewable energy EBIT underlying Net profit Cash flow from operations 17.6 11.3 12.0 NOK BILLION NOK BILLION NOK BILLION ROACE Net interest-bearing debt Dividend paid in 2019 16.3 16.0 8.5 PER CENT NOK BILLION NOK BILLION Norway Sweden The Netherlands United Kingdom Ireland Germany France Spain Nepal Albania Turkey India Power generated in 2019 Share renewable energy Investments in 2019 61 93 7.4 TWH PER CENT NOK BILLION Standard & Poor's Fitch Ratings' long-term rating long-term rating A- BBB+ 59% Norway 27% Europe 14% Outside Europe 5 ANNUAL REPORT 2019 | STATKRAFT AS 6 The Board of Directors From the left: Vilde Eriksen Bjerknes, Mikael Lundin, Ingelise Arntsen, Asbjørn Sevlejordet, Thorhild Widvey, Peter Mellbye, Bengt Ekenstierna, Hilde Drønen and Thorbjørn Holøs Thorhild Widvey Peter Mellbye Hilde Drønen Born 1956, Norwegian Born 1949, Norwegian Born 1961, Norwegian Chair of the board, member since 2016. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only.