Belåningssatser Pr 12.08.2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Candidates Nominated to the Board of Directors in Gjensidige Forsikring ASA

Office translation for information purpose only Appendix 18 Candidates nominated to the Board of Directors in Gjensidige Forsikring ASA Per Andersen Born in 1947, lives in Oslo Occupation/position: Managing Director, Det norske myntverket AS Education/background: Chartered engineer and Master of Science in Business and Economics, officer’s training school, Director of Marketing and Sales and other positions with IBM, CEO of Gjensidige, CEO of Posten Norge and Managing Director of ErgoGroup, senior consultant to the CEO of Posten Norge, CEO of Lindorff. Trond Vegard Andersen Born in 1960, lives in Fredrikstad Occupation/position: Managing Director of Fredrikstad Energi AS Education/background: Certified public accountant and Master of Science in Business and Economics from the Norwegian School of Business Economics and Administration (NHH) Offices for Gjensidige: Member of owner committee in East Norway Organisational experience: Chairman of the Board for all FEAS subsidiaries, board member for Værste AS (regional development in Fredrikstad) Hans-Erik Folke Andersson Born in 1950, Swedish, lives in Djursholm Occupation/position: Consultant, former Managing Director of insurance company Skandia, Nordic Director for Marsh & McLennan and Executive Director of Mercantile & General Re Education/background: Statistics, economy, business law and administration from Stockholm University Offices for Gjensidige: Board member since 2008 Organisational experience: Chairman of the Board of Semcon AB, Erik Penser Bankaktiebolag and Canvisa AB and a board member of Cision AB. Per Engebreth Askildsrud Born in 1950, lives in Jevnaker Occupation/position: Lawyer, own practice Education/background: Law Offices for Gjensidige: Chairman of the owner committee Laila S. Dahlen Born in 1968, lives in Oslo Occupation/position: Currently at home on maternity leave. -

View Annual Report

ANNUAL REPORT 2015 www.bakkafrost.com Faroese Company Registration No.: 1724 TABLE OF CONTENTS Table of Contents Chairman’s Statement 4 Statement by the Management and the Board of Directors 6 Key Figures 10 Bakkafrost’s History 12 Group Structure 16 Operation Sites 20 Main Events 22 Operational Review 24 Financial Review 28 Operational Risk and Risk Management 38 Financial Risk and Risk Management 42 Outlook 44 Business Review 46 Business Objectives and Strategy 62 BAKKAFROST 2 ANNUAL REPORT 2015 TABLE OF CONTENTS Operation 64 Health, Safety and the Environment 68 Shareholder Information 70 Directors’ Profiles 72 Group Management’s Profiles 76 Other Managers’ Profiles 78 Corporate Governance 80 Statement by the Management and the Board of Directors on the Annual Report 81 Independent Auditor’s Report 82 Bakkafrost Group Consolidated Financial Statements 84 Table of Contents – Bakkafrost Group 85 P/F Bakkafrost – Financial Statements 133 Table of Contents – P/F Bakkafrost 134 Glossary 147 BAKKAFROST 3 ANNUAL REPORT 2015 CHARIMAN’S STATEMENT Chairman’s Statement Bakkafrost has in recent years grown into one of the largest companies in the Faroe Islands. Our aim to run Bakkafrost responsibly and sustainably is important to our entire stakeholders, i.e. employees, shareholders and society. Bakkafrost has a growth strategy of creating sustainable values and not just short-term gains. This strategy demands daily awareness of opportunities and threats to our operations from both the board, the management and the employees. RÚNI M. HANSEN Chairman of the Board 810 million (DKK) The result after tax for 2015 BAKKAFROST 4 ANNUAL REPORT 2015 CHARIMAN’S STATEMENT March 2015 marked the five years’ milestone since Bakka- commence production in 2016, and our processing opera- frost was listed on Oslo Stock Exchange. -

The Supervisory Board of Gjensidige Forsikring ASA

The Supervisory Board of Gjensidige Forsikring ASA Name Office Born Lives in Occupation/position Education/background Organisational experience Bjørn Iversen Member 1948 Reinsvoll Farmer Degree in agricultural economics, Head of the Oppland county branch of the the Agricultural University of Norwegian Farmers' Union 1986–1989, Norway in 1972. Landbrukets head of the Norwegian Farmers' Union sentralforbund 1972–1974, Norges 1991–1997, chair of the supervisory board Kjøtt- og Fleskesentral 1974–1981, of Hed-Opp 1985–89, chair/member of the state secretary in the Ministry of board of several companies. Agriculture 1989–1990. Chair of the Supervisory Board and Chair of the Nomination Committee of Gjensidige Forsikring ASA. Hilde Myrberg Member 1957 Oslo MBA Insead, law degree. Deputy chair of the board of Petoro AS, member of the board of CGGVeritas SA, deputy member of Stålhammar Pro Logo AS, member of the nomination committee of Det Norske ASA, member of the nomination committee of NBT AS. Randi Dille Member 1962 Namsos Self-employed, and Economics subjects. Case Chair of the boards of Namsskogan general manager of officer/executive officer in the Familiepark, Nesset fiskemottak and Namdal Bomveiselskap, agricultural department of the Namdal Skogselskap, member of the board Namsos County Governor of Nord- of several other companies. Sits on Nord- Industribyggeselskap and Trøndelag, national recruitment Trøndelag County Council and the municipal Nordisk Reinskinn project manager for the council/municipal executive board of Compagnie DA. Norwegian Fur Breeders' Namsos municipality. Association, own company NTN AS from 1999. Benedikte Bettina Member 1963 Krokkleiva Company secretary and Law degree from the University of Deputy member of the corporate assembly Bjørn (Danish) advocate for Statoil ASA. -

Gjensidige Bank Investor Presentation Q1 2017

Gjensidige Bank Investor Presentation Q1 2017 4. May 2017 Disclaimer The information contained herein has been prepared by and is the sole responsibility of Gjensidige Bank ASA and Gjensidige Bank Boligkreditt AS (“the Company”). Such information is confidential and is being provided to you solely for your information and may not be reproduced, retransmitted, further distributed to any other person or published, in whole or in part, for any purpose. Failure to comply with this restriction may constitute a violation of applicable securities laws. The information and opinions presented herein are based on general information gathered at the time of writing and are therefore subject to change without notice. While the Company relies on information obtained from sources believed to be reliable but does not guarantee its accuracy or completeness. These materials contain statements about future events and expectations that are forward-looking statements. Any statement in these materials that is not a statement of historical fact including, without limitation, those regarding the Company’s financial position, business strategy, plans and objectives of management for future operations is a forward-looking statement that involves known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which the Company will operate in the future. The Company assumes no obligations to update the forward-looking statements contained herein to reflect actual results, changes in assumptions or changes in factors affecting these statements. -

2626667.Pdf (1.837Mb)

BI Norwegian Business School - campus Oslo GRA 19703 Master Thesis Thesis Master of Science Evaluating the Predictive Power of Leading Indicators Used by Analysts to Predict the Stock Return for Norwegian Listed Companies Navn: Amanda Marit Ackerman Myhre Hadi Khaddaj Start: 15.01.2020 09.00 Finish: 01.09.2020 12.00 GRA 19703 0981324 0983760 Evaluating the Predictive Power of Leading Indicators Used by Analysts to Predict the Stock Return for Norwegian Listed Companies Supervisor: Ignacio Garcia de Olalla Lopez Programme: Master of Science in Business with Major in Accounting and Business Control Abstract This paper studies the predictive power of leading indicators used by interviewed analysts to predict the monthly excess stock returns for some of the most influential Norwegian companies listed on the Oslo Stock Exchange. The thesis primarily seeks to evaluate whether a multiple factor forecast model or a forecast combination model incorporating additional explanatory variables have the ability to outperform a five common factor (FCF) benchmark forecast model containing common factors for the Norwegian stock market. The in-sample and out-of- sample forecasting results indicate that a multiple factor forecast model fails to outperform the FCF benchmark model. Interestingly, a forecast combination model with additional explanatory variables for the Norwegian market is expected to outperform the FCF benchmark forecast model. GRA 19703 0981324 0983760 Acknowledgements This thesis was written as the final piece of assessment after five years at BI Norwegian Business School and marks the completion of the Master of Science in Business program. We would like to thank our supervisor Ignacio Garcia de Olalla Lopez for his help and guidance through this process. -

The Supervisory Board of Gjensidige Forsikring ASA

The Supervisory Board of Gjensidige Forsikring ASA Name Office Born Address Occupation/position Education/background Organisational experience Bjørn Iversen Member 1948 Reinsvoll Farmer Agricultural economics, Agricultural Head of Oppland county branch of the Norwegian University of Norway in 1972. Landbrukets Farmers' Union 1986-1989, head of the Norwegian sentralforbund 1972-1974, Norges Kjøtt- og Farmers' Union 1991-1997, chair of the supervisory Fleskesentral 1974-1981, state secretary in board of Hed-Opp 1985-89, chair/member of the board the Ministry of Agriculture 1989-1990 of several companies. Chair of the Supervisory Board and Chair of the Nomination Committee of Gjensidige Forsikring ASA. Hilde Myrberg Member 1957 Oslo Senior Vice President MBA Insead, law degree. Chair of the board of Orkla Asia Holding AS, deputy Corporate Governance, chair of the board of Petoro AS, member of the board of Orkla ASA Renewable Energy Corporation ASA, deputy board member of Stålhammar Pro Logo AS, deputy chair of the board of Chr. Salvesen & Chr Thams's Communications Aktieselskap, member of the boards of Industriinvesteringer AS and CGGVeritas SA. Randi Dille Member 1962 Namsos Self-employed, and Economies subjects. Case officer/executive Chair of the boards of Namsskogan Familiepark, Nesset general manager of officer in the agricultural department of the fiskemottak and Namdal Skogselskap, member of the Namdal Bomveiselskap, County Governor of Nord-Trøndelag, boards of several other companies. Sits on Nord- Namsos national recruitment project manager for Trøndelag County Council and the municipal Industribyggeselskap and the Norwegian Fur Breeders' Association, council/municipal executive board of Namsos Nordisk Reinskinn own company NTN AS from 1999. -

Disclosure of Assignments and Mandates the Overview Shows A

Disclosure of assignments and mandates The overview shows a list of issuers of financial instruments where Arctic Securities AS has prepared or distributed research reports, where Arctic Securities AS has rendered publicly known investment banking services in the previous 12 months. Such services include general financial services, assistance in connection with an IPO, share placement or market making. Arctic has received compensation for investment banking services from the companies on the list in the previous 12 months. • Africa Energy Corporation • Aker ASA • Aker Biomarine AS • American Shipping Company ASA • American Tankers Inc • Atlantic Sapphire ASA • B2Holding ASA • Belships ASA • BerGenBio ASA • Borgestad ASA • Bulk Industrier AS • Cherry AB • Color Group AS • Compactor Fastigheter AB • Corem Property Group AB • Crayon Group Holding ASA • Cxense ASA • DNB ASA • DOF Subsea • Flex LNG Ltd • Frigaard Property Group AS • Gentian Diagnostics AS • Golar LNG Partners • Golden Ocean Group Ltd • Gjensidige Forsikring ASA • Heimstaden AB • Helgeland Sparebank • Ice Group Scandinavia Holdings AS • Icelandic Salmon • Kahoot! AS • Kalera AS • Kongsberg Gruppen ASA • Magseis ASA • Maxfastigheter i Sverige AB • Multiconsult ASA • NEL ASA • Nordic American Tankers Ltd. • Northern Drilling Ltd. • Northern Ocean Ltd. • North Investment Group AB • Norwegian Air Shuttle ASA • Norwegian Energy Company ASA • Norwegian Property ASA • NRC Group ASA • Ocean Yield ASA • Odfjell SE • Otovo AS • Polight AS • Quantafuel ASA • REC Silicon ASA • Saferoad Holding ASA • Samhällsfastighetsbolaget I Norden AB • Schibsted ASA • Scorpio Bulkers Inc. • Seadrill Ltd • Self Storage Group ASA • SFL Corporation Ltd • Shelf Drilling Ltd. • Solstad Offshore ASA • Solon Eiendom ASA • Sparebank1 Nord-Norge • Sparebanken Telemark • Sparebankstiftelsen Buskerud Vestfold • Sparebankstiftelsen Helgeland • Sparebankstiftelsen Jevnaker Lunner Nittedal • Sparebankstiftelsen Nøtterøy Tønsberg • Vaccibody AS • Volue AS . -

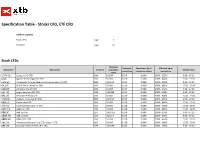

Specification Table - Stocks CFD, ETF CFD

Specification Table - Stocks CFD, ETF CFD Table of contents Stock CFDs page 1 ETF CFDs page 61 Stock CFDs Minimum Minimum Commission (% of XTB mark-up on Instrument Description Currency transaction Trading Hours commission transaction value) commission value 1COV.DE Covestro AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 A.US Agilent Technologies Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 A3M.ES Atresmedia Corp de Medios de Comunicacion SA CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AA.US* CLOSE ONLY / Alcoa Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAD.DE Amadeus Fire AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAL.UK Anglo American PLC CFD GBP 100 GBP 8 EUR 0.08% 100% - 200% 9:00 - 17:30 AAL.US American Airlines CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AALB.NL Aalberts Industries NV CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAN.US Aaron's Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAP.US Advance Auto Parts Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAPL.US Apple Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 ABB.SE ABB Ltd CFD SEK 1000 SEK 8 EUR 0.08% 100% - 430% 9:00 - 17:25 ABBN.CH ABB Ltd CFD CHF 150 CHF 8 EUR 0.08% 100% - 375% 9:00 - 17:20 ABBV.US Abbvie Inc. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe SMID Cap 19 August 2021 Tradable Plus Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.72 UNITED Bureau Veritas S.A. 0.42 FRANCE Gjensidige Forsikring ASA 0.17 NORWAY KINGDOM Campari 0.31 ITALY Gn Store Nordic 0.53 DENMARK AAK 0.18 SWEDEN Carl Zeiss Meditec 0.33 GERMANY Halma 0.66 UNITED Aalberts NV 0.24 NETHERLANDS Castellum 0.32 SWEDEN KINGDOM ABN AMRO Bank NV 0.23 NETHERLANDS Centrica 0.2 UNITED Hargreaves Lansdown 0.39 UNITED Acciona S.A. 0.16 SPAIN KINGDOM KINGDOM Accor 0.32 FRANCE Chr. Hansen Holding A/S 0.43 DENMARK Hays 0.16 UNITED ACS Actividades Cons y Serv 0.3 SPAIN Clariant 0.21 SWITZERLAND KINGDOM Adecco Group AG 0.49 SWITZERLAND Coca-Cola HBC AG 0.33 UNITED HeidelbergCement AG 0.6 GERMANY Adevinta 0.21 NORWAY KINGDOM HelloFresh SE 0.67 GERMANY Admiral Group 0.43 UNITED Cofinimmo 0.21 BELGIUM Helvetia Holding AG 0.18 SWITZERLAND KINGDOM Commerzbank 0.35 GERMANY Hikma Pharmaceuticals 0.27 UNITED Aedifica 0.22 BELGIUM ConvaTec Group 0.25 UNITED KINGDOM Aegon NV 0.34 NETHERLANDS KINGDOM Hiscox 0.18 UNITED KINGDOM Aeroports de Paris 0.17 FRANCE Countryside Properties 0.16 UNITED Holmen AB 0.2 SWEDEN Ageas 0.46 BELGIUM KINGDOM Homeserve 0.17 UNITED Aker BP ASA 0.16 NORWAY Covestro AG 0.54 GERMANY KINGDOM Alfa Laval 0.52 SWEDEN Covivio 0.2 FRANCE Howden Joinery Group 0.3 UNITED Alstom 0.7 FRANCE Croda International 0.64 UNITED KINGDOM KINGDOM Alten 0.18 -

Quarterly Report, Q1 2020

Q1 2020 Quarterly Report: WilderHill Clean Energy Index®, March 31, 2020 The Clean Energy Index® (ECO) began 1st Quarter 2020 around 70 and it ended Q1 near 56, down -20%; but there was more to this Q1. A remarkable, volatile, exhilarating, frightening, roller coaster Q1 first had gone up sharply +30%, over 90 in mid-February, then crashed latter Q1 to below 50. Intra-day moves were abrupt: in a few hours March 24, ECO sprang up +15%. Or seen longer since 2017, when the ECO Index® was 38, last 3 years it’s risen some +55%. An independent tracking fund at start of 2017 was about 18.5, start of 2018 was about 25.5, start of 2019 was about 21.5, start of 2020 around 34 and at end of Q1 fell to around 27. ECO passively captures an emerging highly volatile theme; it thusly can & does at times also ‘drop like a rock’ – as was amply proven for instance Q1 2020. Big gains have occurred here – as well too as bigger declines. Plus we offer a mere observation: it’s counter-intuitive perhaps yet ECO’s theme has now spiked up at times in Bush II & Trump Presidencies - though neither greatly promoted green energy. Meanwhile drops were seen 8 years of an Obama Presidency that favored this sector (yet 2008-2016 was a bit singular as China undertook to enter and gain major market share in clean energy, a goal that since came to fruition). Look back last 5 years at Benchmark ECO Index®, live since 2004 & 1st for climate solutions, and it’s near nil, negligibly up a few percent. -

Arctic Norwegian Equities Monthly Report July 2020

Arctic Norwegian Equities Monthly Report July 2020 FUND COMMENTS Arctic Norwegian Equities gave 3.4% return in July (I-class) versus 4% for the OSEFX benchmark index. Year to date the fund has returned -14.3% compared to -10.1% for the OSEFX. Since inception the fund has returned 120.7% versus 100.2% for the benchmark index. In July many of the largest companies on the Oslo Stock Exchange an- nounced results for the 2nd quarter. Several companies delivered above market expectations. Of note is DNB which rose near 10 percent on the day of reporting, driven by lower loan losses and higher other income. A number of companies also announced positive profit warmings, including B2 Holding, XXL, Atea and Europris. In July positive attribution for the Fund versus the benchmark index came from overweights in Atea and Crayon, and underweight in Mowi. Atea announced positive results for the 2nd quarter. Revenues were up by 12 percent from Q2 last year, and the company’s operating profit and bottom line were 50 percent higher than market expec- tations. Atea has further strengthened its competitive position in the Nordics, with a marked share in excess of 20 percent. Crayon also rose in July, partly due to strong software sales for Atea. Crayon is a large global partner of Microsoft. Microsoft announced 2nd quarter results which exceeded market expectations on the top- and bottom line. Shares in salmon farming declined in July, partly due to weak salmon price development. Demand for air transport to China has been reduced after discovery of coronavirus on a salmon cutting board in Beijing. -

Renewable Hydrogen, Made Cost Competitive

SPECIAL FEATURE – HYDROGEN ENERGY Renewable hydrogen, made cost competitive An interview with Jon André Løkke, CEO of Nel ASA, by Joanna Sampson magine a time before petroleum and electricity – horse- drawn carriages dominated the highways and byways and candles provided artificial lighting. The world was I transformed by fossil solutions in just a few centuries. But we are currently being faced with the side effects of utilising fossil energy – climate change and pollution. The obvious solution to these problems is exchanging fossil fuels with new renewable energies like solar, wind, and wave power. According to one company in Norway, it’s time for another global transformation. This time, it will be transformed by hydrogen, the simplest and most abundant element in the universe. In 1940, Nel undertook the world’s largest water Nel ASA has a vision of empowering generations with clean electrolysis installation at Rjukan, Norway, with a total 3 energy forever. To achieve this, CEO Jon André Løkke hydrogen production capacity exceeding 30,000Nm /hour believes hydrogen, along with renewable energy, must from hydropower. play a main role in the biggest energy transition since the Just over a decade later, in 1953, Nel started up a second discovery of oil. large-scale hydro-powered electrolyser plant for supplying Three quarters of the sun is made from hydrogen, providing hydrogen to ammonia production in Glomfjord, Norway. us with all the clean energy we need for at least another And in 1959 the company completely redesigned the five billion years. Realising that we have unlimited access electrolyser unit, forming the basis for today’s atmospheric to the sun raises an interesting question though: how do we electrolyser.